Noticias del mercado

-

17:43

WTI crude oil price continues to decline on yesterday’s U.S. crude oil inventories data

WTI crude oil price continues to decline on yesterday's U.S. crude oil inventories data. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories declined by 4.9 million barrels to 463 million in the week to June 19. It was the eight consecutive weekly decline.

Analysts had expected a decline of 1.8 million barrels.

U.S. oil production increased to 9.6 million barrels a day from 9.59 million barrels a day.

Investors speculate that oil supply may increase if a deal can be reached over Iran's nuclear programme.

WTI crude oil for August delivery decreased to $59.43 a barrel on the New York Mercantile Exchange.

Brent crude oil for August rose to $63.34 a barrel on ICE Futures Europe.

-

17:24

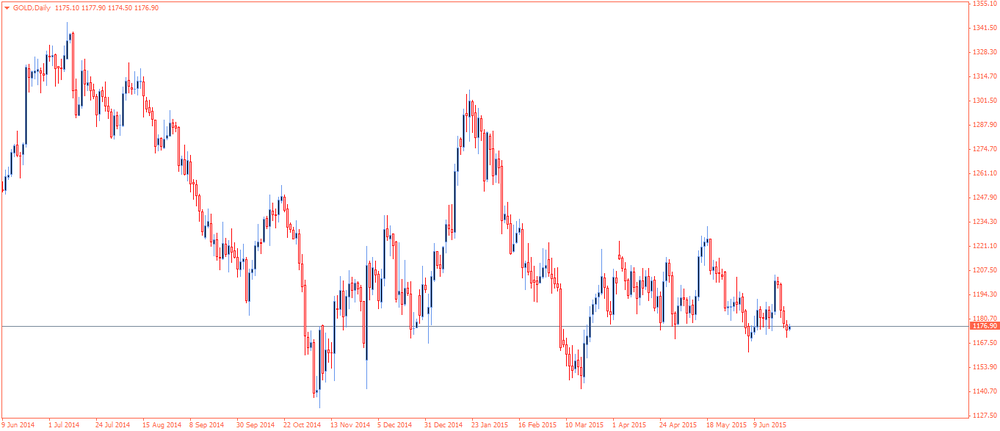

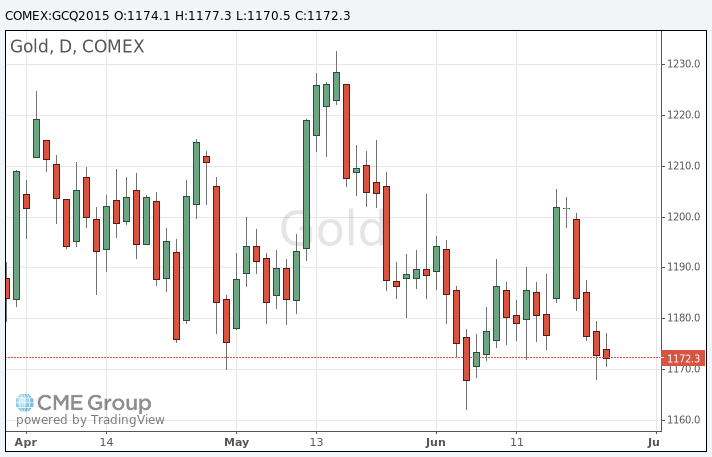

Gold price traded lower on the better-than-expected U.S. personal spending

Gold price traded lower on the better-than-expected U.S. personal spending. Personal spending jumped 0.9% in May, exceeding expectations for 0.7% gain, after a 0.1% increase in April. It was the biggest increase since August 2009.

Consumer spending makes more than two-thirds of U.S. economic activity.

Personal income increased 0.5% in May, in line with expectations, after a 0.5% rise in April. April's figure was revised up from a 0.4% gain.

On a yearly basis, the PCE price index excluding food and index increased 1.2% in May, beating expectations for a 0.8% gain, after a 1.3% rise in April. It was the smallest rise since February 2014.

The PCE index is below the Fed's 2% inflation target. The PCE index is the Fed's preferred measure of inflation.

The number of initial jobless claims in the week ending June 20 in the U.S. increased by 3,000 to 271,000 from 268,000 in the previous week. T the previous week's figure was revised down from 267,000. Analysts had expected the number of initial jobless claims to be 272,000.

Debt talks between Athens and its creditors remained in focus. Eurogroup's meeting ended without a deal today. Next Eurogroup's meeting is scheduled to be on Saturday.

European Commission President Jean-Claude Juncker said on Thursday that officials will "work until the last minute, second, millisecond so that the euro project does not crash".

August futures for gold on the COMEX today fell to 1170.50 dollars per ounce.

-

09:02

Oil: digesting U.S. crude inventories data

West Texas Intermediate futures for August delivery slid to $60.13 (-0.23%), while Brent crude for August slightly declined to $63.44 (-0.08%) a barrel amid mixed data from the U.S. Energy Information Administration.

On one hand U.S. commercial crude-oil supplies in the week ended June 19 fell more than analysts had expected (-4.9 million barrels vs -1.8 million barrels expected). This was the eighth straight decline. On the other hand stockpiles remained above average levels. U.S. gasoline stocks climbed 680,000 barrels to 218.49 million and weighed on crude prices, which had initially advanced amid the greater-than-expected drop in supplies. Earlier analysts expected a decline in gasoline stockpiles.

-

08:59

Gold is slightly higher amid ongoing concerns over Greece

Gold is currently at $1,176.40 (+0.30%) an ounce. The safe-haven metal advanced after optimism about Greek deal contracted as creditors handed Greece's officials a revised set of proposals.

Physical demand in Asia is weak partly due to seasonal factors and further declines in prices will be needed to revive it.

In an attempt to give China more influence over the pricing of the precious metal, the Shanghai Gold Exchange plans to launch a yuan-denominated gold fix by the end of 2015. "The aim is to provide a more diversified benchmark pricing to the industry," Shen Gang, vice president of the Shanghai Gold Exchange, said.

-

00:31

Commodities. Daily history for Jun 24’2015:

(raw materials / closing price /% change)

Oil 60.22 -0.08%

Gold 1,174.50 +0.14%

-