Noticias del mercado

-

17:42

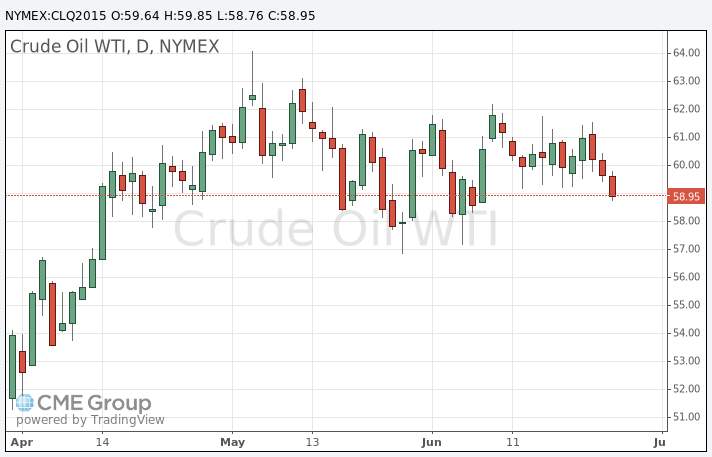

Oil prices traded lower on concerns over global oil glut

Oil prices traded lower on concerns over global oil glut. Debt talks between Athens and its creditors also remained in focus.

Athens yesterday failed to reach agreement with its creditors, and it is a step closer to a possible default now. Next round of debt talks is scheduled to be tomorrow.

If a deal is not reached at Saturday's meeting, officials are expected to start preparing a "Plan B" to protect the Eurozone from damaging other countries in the Eurozone.

Analysts said that a Greek default could lead to a decline in demand for oil.

Investors expect the results of talks on the Iranian nuclear program. It is likely that talks will continue as there are doubts that all issues can be resolved before June 30.

Investors are also awaiting the release of the number of the U.S. oil rigs later in the day. Oil production in the U.S. remains at high level despite the falling number of oil rigs.

WTI crude oil for August delivery decreased to $58.76 a barrel on the New York Mercantile Exchange.

Brent crude oil for August rose to $62.85 a barrel on ICE Futures Europe.

-

17:25

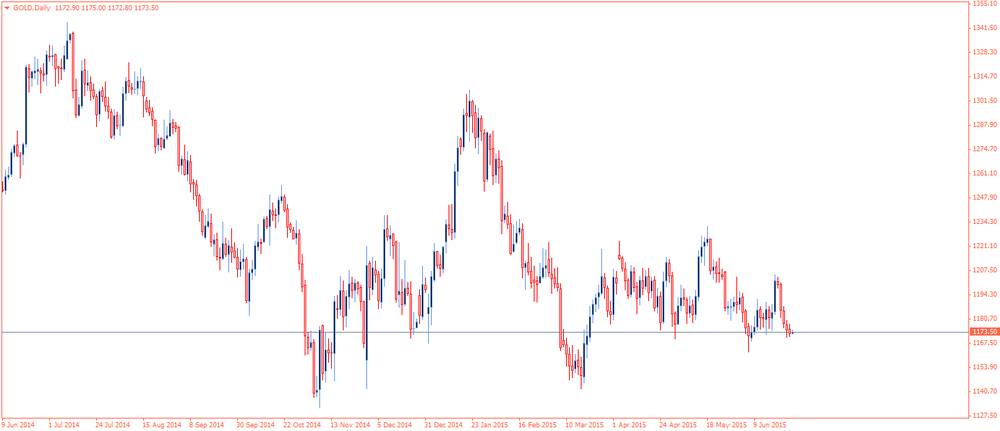

Gold price traded lower ahead of the Eurogroup’s meeting on Saturday

Gold price traded lower ahead of the Eurogroup's meeting on Saturday. If a deal is not reached at Saturday's meeting, officials are expected to start preparing a "Plan B" to protect the Eurozone from damaging other countries in the Eurozone.

German Chancellor Angela Merkel said on Friday that the Eurogroup's meeting on Saturday would be decisive for finding a deal for Greece.

The Guardian reported on Friday that the Greek government rejected a five-month extension to its bailout deal.

According to a European official, Greece's lenders offers a financial aid of €15.5 billion in four instalments by the end of November if Greece implements economic reforms. Greece would receive the first instalment of €1.8 billion by Tuesday.

European Commission President Jean-Claude Juncker said on Friday that he was optimistic a deal with Greece could be reached.

A stronger U.S. dollar also weighed on gold price. The greenback rose against other major currencies on the better-than-expected final Reuters/Michigan Consumer Sentiment Index. The index increased to 96.7 in June from 90.7 in May, beating the preliminary estimate of 94.6.

Holdings of the t gold ETF, SPDR Gold Shares, climbed 6.9 tonnes on Thursday. It was the biggest one-day rise since Febuary 2.

August futures for gold on the COMEX today fell to 1167.10 dollars per ounce.

-

09:02

Oil: prices are demonstrating modest gains

West Texas Intermediate futures for August delivery started this session with a decline, but later on it managed to advance slightly to $59.74 (+0.07%). Meanwhile Brent crude for August advanced to $63.46 (+0.41%) a barrel. Market participants are waiting for results of Greece's negotiations with its partners and talks between Iran and six world powers. Both issues have a deadline on June 30.

Meanwhile U.S. crude was supported by a 0.9% surge in consumer spending in May (the best result in six years) and weighed by recent data, which showed a build-up in U.S. gasoline stockpiles.

-

08:59

Gold is slightly higher as invests await news on Greece

Gold is currently at $1,173.10 (+0.11%) an ounce, heading for the biggest weekly drop since March. This week's loss is currently at 2.2%, still held back by prospects of Greek default amid absence of a deal between the country and its international lenders. Negotiations will resume on Saturday (the fifth meeting this week).

At the same time expectations that the Federal Reserve plans to raise interest rates this year, increasing the opportunity cost of holding non-yielding precious metal, have weighed on gold this year.

-

00:31

Commodities. Daily history for Jun 25’2015:

(raw materials / closing price /% change)

Oil 59.64 -0.10%

Gold 1,172.60 +0.07%

-