Noticias del mercado

-

21:00

S&P 500 2,099.35 -2.96 -0.14 %, NASDAQ 5,072.92 -39.27 -0.77 %, Dow 17,931.54 +41.18 +0.23 %

-

18:26

Wall Street: Major U.S. stock-indexes mixed

Major U.S. stock-indexes mixed on Friday. Investors were encouraged by signals of a possible deal between Greece and its creditors that could help the country avert a debt default. Euro zone partners offered to release billions in frozen aid in a last-minute push to win Greece's acceptance for a cash-for-reform deal. Greece failed to clinch a deal with its international creditors on Thursday. Investors also await the annual tweaks to the makeup of Russell stock indexes that may produce a rush of transactions worth over $40 billion in the final moments of trading on Friday.

Most all Dow stocks trading in positive area (23 of 30). Top looser - Intel Corporation (INTC, -2.83%). Top gainer - NIKE, Inc. (NKE, +4.22).

S&P index sectors mixed. Top gainer - Financial (+0,3%). Top looser - Technology (-0.7%).

At the moment:

Dow 17880.00 +68.00 +0.38%

S&P 500 2095.25 +1.25 +0.06%

Nasdaq 100 4488.00 -21.25 -0.47%

10-year yield 2.47% +0.07

Oil 59.45 -0.25 -0.42%

Gold 1172.30 +0.50 +0.04%

-

18:16

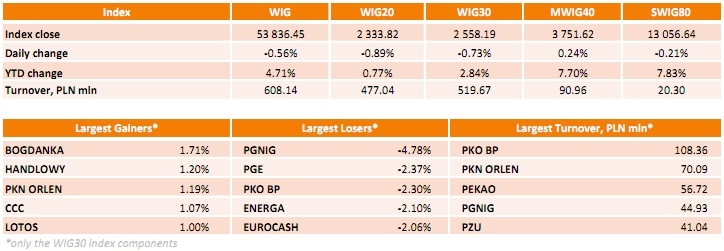

WSE: Session Results

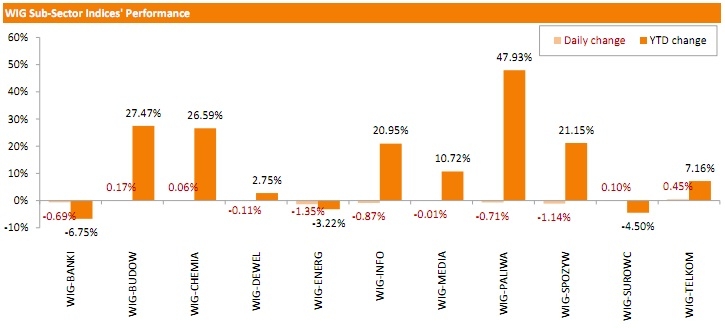

Polish equity market retreated on Friday, with the broad market measure, the WIG Index, sliding 0.56%.Sector-wise, utilities (-1.35%) fared the worst, while telecommunication sector (+0.45%) was the strongest group.

The large-cap stocks' measure, the WIG30 Index, fell 0.73%. Within the Index components, PGNIG (WSE: PGN) was the sharpest decliner, losing 4.78% on prospects of gas price cuts. Other major laggards included PGE (WSE: PGE), PKO BP (WSE: PKO) and ENERGA (WSE: ENG), dropping a respective 2.37%, 2.3% and 2.1%. On the other side of the ledger, BOGDANKA (WSE: LWB) added 1.71% and became the session best performer, followed by HANDLOWY (WSE: BHW) and PKN ORLEN (WSE: PKN), which gained 1.2% and 1.19% respectively.

-

18:00

European stocks closed: FTSE 100 6,753.7 -54.12 -0.79 %, CAC 40 5,059.17 +17.46 +0.35 %, DAX 11,492.43 +19.30 +0.17 %

-

18:00

European stocks close: stocks closed mixed on hopes for a deal between Greece and its creditors

Stock indices closed mixed on hopes for a deal between Greece and its creditors. Athens yesterday failed to reach agreement with its creditors, and it is a step closer to a possible default now. Next round of debt talks is scheduled to be tomorrow.

If a deal is not reached at Saturday's meeting, officials are expected to start preparing a "Plan B" to protect the Eurozone from damaging other countries in the Eurozone.

German Chancellor Angela Merkel said on Friday that the Eurogroup's meeting on Saturday would be decisive for finding a deal for Greece.

The Guardian reported on Friday that the Greek government rejected a five-month extension to its bailout deal.

According to a European official, Greece's lenders offers a financial aid of €15.5 billion in four instalments by the end of November if Greece implements economic reforms. Greece would receive the first instalment of €1.8 billion by Tuesday.

European Commission President Jean-Claude Juncker said on Friday that he was optimistic a deal with Greece could be reached.

Meanwhile, the economic data from the Eurozone was mixed. M3 money supply rose 5.0% in May from last year, missing expectations for a 5.4% gain, after a 5.3 % increase in April.

Loans to the private sector in the Eurozone climbed 0.5% in May from the last year, after a flat reading in April.

German import prices declined by 0.8% in May from last year, after a 0.6% fall in April. Import prices decline since January 2013.

German export prices climbed 1.4% year-on-year in May, after a 1.6% increase in April.

French consumer confidence index remained unchanged at 94 in June, beating expectation for a decline to 93.

The Italian consumer confidence index climbed to 109.5 in June from 106.0 in May. The increase was driven by rises in economic and personal financial expectations subindices.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,753.7 -54.12 -0.79 %

DAX 11,492.43 +19.30 +0.17 %

CAC 40 5,059.17 +17.46 +0.35 %

-

17:15

European Commission President Jean-Claude Juncker is optimistic a deal with Greece could be reached

European Commission President Jean-Claude Juncker said on Friday that he was optimistic a deal with Greece could be reached.

"Tomorrow is a crucial day not only for Greece but also for the euro area as a whole. I am quite optimistic but not over optimistic," he said.

-

17:04

Greek government rejects a five-month extension to its bailout programme

The Guardian reported on Friday that the Greek government rejected a five-month extension to its bailout deal.

According to a European official, Greece's lenders offers a financial aid of €15.5 billion in four instalments by the end of November if Greece implements economic reforms. Greece would receive the first instalment of €1.8 billion by Tuesday.

-

16:31

Thomson Reuters/University of Michigan final consumer sentiment index increases to 96.7 in June

The Thomson Reuters/University of Michigan final consumer sentiment index increased to 96.7 in June from 90.7 in May, beating the preliminary estimate of 94.6.

"Consumers voiced in the first half of 2015 the largest and most sustained increase in economic optimism since 2004. Consumer spending will remain the driving force of economic growth in 2015," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin.

He adds that consumer spending could rise 3.0% in 2015.

The current economic conditions index soared to 108.9 in June from 100.8 in May.

The index of consumer expectations rose to 87.8 from 84.2.

-

15:41

U.S. Stocks open: Dow +0.25%, Nasdaq -0.30%, S&P -0.07%

-

15:28

Greece’s lenders offers a financial aid of €15.5 billion

According to a European official, Greece's lenders offers a financial aid of €15.5 billion in four instalments by the end of November if Greece implements economic reforms. Greece would receive the first instalment of €1.8 billion by Tuesday.

The financial help would contain €8.7 billion from the European Financial Stability Facility, €3.5 billion from the International Monetary Fund and €3.3 billion euros in central-bank profits on bond purchases.

-

15:27

Before the bell: S&P futures +0.17%, NASDAQ futures +0.08%

U.S. stock-index futures were little changed as Greek debt talks continue and Nike Inc. gained after posting better- than-estimated earnings.

Global markets:

Nikkei 20,706.15 -65.25 -0.31%

Hang Seng 26,663.87 -481.88 -1.78%

Shanghai Composite 4,193.64 -334.14 -7.38%

FTSE 6,769.8 -38.02 -0.56%

CAC 5,071.91 +30.20 +0.60%

DAX 11,479.16 +6.03 +0.05%

Crude oil $59.17 (-0.84%)

Gold $1172.40 (+0.05%)

-

15:15

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Chevron Corp

CVX

98.36

+0.02%

7.2K

Apple Inc.

AAPL

127.55

+0.04%

134.3K

Ford Motor Co.

F

15.45

+0.06%

5.2K

Tesla Motors, Inc., NASDAQ

TSLA

269.00

+0.08%

7.2K

Wal-Mart Stores Inc

WMT

71.96

+0.14%

1.5K

Starbucks Corporation, NASDAQ

SBUX

54.15

+0.15%

0.2K

Facebook, Inc.

FB

88.13

+0.17%

102.3K

JPMorgan Chase and Co

JPM

68.80

+0.22%

2.3K

Goldman Sachs

GS

213.30

+0.23%

1.6K

Citigroup Inc., NYSE

C

56.32

+0.23%

7.1K

Google Inc.

GOOG

536.54

+0.24%

0.2K

Walt Disney Co

DIS

114.76

+0.27%

4.6K

Amazon.com Inc., NASDAQ

AMZN

441.30

+0.27%

0.2K

Johnson & Johnson

JNJ

99.40

+0.28%

0.1K

AT&T Inc

T

36.30

+0.33%

69.8K

Verizon Communications Inc

VZ

47.64

+0.42%

4.0K

Procter & Gamble Co

PG

79.76

+0.47%

1.2K

Yandex N.V., NASDAQ

YNDX

15.98

+0.50%

0.1K

UnitedHealth Group Inc

UNH

123.00

+0.55%

1.7K

The Coca-Cola Co

KO

40.27

+0.62%

10.1K

Nike

NKE

108.72

+3.33%

93.3K

General Electric Co

GE

27.04

0.00%

11.5K

Barrick Gold Corporation, NYSE

ABX

10.99

0.00%

6.6K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.74

0.00%

10.7K

McDonald's Corp

MCD

95.69

-0.10%

0.2K

Exxon Mobil Corp

XOM

83.81

-0.14%

3.7K

Cisco Systems Inc

CSCO

28.35

-0.17%

0.2K

ALCOA INC.

AA

11.55

-0.17%

1.9K

Microsoft Corp

MSFT

45.56

-0.20%

25.5K

Yahoo! Inc., NASDAQ

YHOO

40.93

-0.33%

7.5K

Twitter, Inc., NYSE

TWTR

35.05

-0.34%

1.3K

Caterpillar Inc

CAT

86.40

-0.37%

4.4K

Visa

V

68.31

-0.45%

0.5K

Hewlett-Packard Co.

HPQ

30.99

-0.70%

1.8K

Intel Corp

INTC

31.50

-1.53%

84.5K

-

15:10

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Facebook (FB) initiated at Buy at Mizuho, target $104

Amazon (AMZN) initiated at Buy at Mizuho, arget $498

eBay (EBAY) initiated at Neutral at Mizuho, target $65

Yahoo! (YHOO) initiated at Buy at Mizuho, target $51

NIKE (NKE) reiterated at Hold at Canaccord Genuity, target raised from $96 to $104

NIKE (NKE) reiterated at Mkt Perform at FBR Capital, target raised from $100 to $109

NIKE (NKE) reiterated at Market Perform at Telsey Advisory Group, target raised from $109 to $115

NIKE (NKE) reiterated at Buy at Nomura, target raised from $110 to $125

NIKE (NKE) reiterated at Buy at Jefferies, target raised from $120 to $122

Intel (INTC) reiterated at Buy at Jefferies, target lowered from $48 to $45

-

15:03

New Zealand's trade surplus climbs to NZ$350 million in May

Statistics New Zealand released its trade data on late Thursday. New Zealand's trade surplus climbed to NZ$350 million in May from NZ$183 million in April. April's figure was revised up from a surplus of NZ$123 million.

Analysts had expected a deficit of NZ$100 million.

Exports fell 4.7% in May, driven by a 28% decline in milk powder, butter and cheese, while imports dropped 7.0%, driven a fall in crude oil and capital goods.

-

14:41

Japan's national consumer price index (CPI) falls to an annual rate of 0.5% in May

Japan's Ministry of Internal Affairs and Communications released its inflation data late Thursday. Japan's national consumer price index (CPI) fell to an annual rate of 0.5% in May from 0.6% in April. Japan's national CPI excluding fresh food declined to an annual rate of 0.1% in May from 0.3% in April, beating expectations for a flat reading.

Household spending in Japan jumped at annual rate of 4.8% in May, exceeding forecasts of a 3.4% increase, after a 1.3% fall in April.

Japan's unemployment rate remained unchanged at 3.3% in May, in line with expectations.

-

12:00

European stock markets mid session: stocks traded lower on the uncertainty over the debt talks between Greece and its creditors

Stock indices traded mixed on the uncertainty over the debt talks between Greece and its creditors. Athens yesterday failed to reach agreement with its creditors, and it is a step closer to a possible default now. Next round of debt talks is scheduled to be tomorrow.

If a deal is not reached at Saturday's meeting, officials are expected to start preparing a "Plan B" to protect the Eurozone from damaging other countries in the Eurozone.

German Chancellor Angela Merkel said on Friday that the Eurogroup's meeting on Saturday would be decisive for finding a deal for Greece.

Athens have to repay €1.6 billion IMF loans by June 30.

Meanwhile, the economic data from the Eurozone was mixed. M3 money supply rose 5.0% in May from last year, missing expectations for a 5.4% gain, after a 5.3 % increase in April.

Loans to the private sector in the Eurozone climbed 0.5% in May from the last year, after a flat reading in April.

German import prices declined by 0.8% in May from last year, after a 0.6% fall in April. Import prices decline since January 2013.

German export prices climbed 1.4% year-on-year in May, after a 1.6% increase in April.

French consumer confidence index remained unchanged at 94 in June, beating expectation for a decline to 93.

The Italian consumer confidence index climbed to 109.5 in June from 106.0 in May. The increase was driven by rises in economic and personal financial expectations subindices.

Current figures:

Name Price Change Change %

FTSE 100 6,747.15 -60.67 -0.89 %

DAX 11,422.07 -51.06 -0.45 %

CAC 40 5,026.11 -15.60 -0.31 %

-

11:44

Italian consumer confidence index climbs to 109.5 in June

The Italian statistical office ISTAT released its consumer confidence index for Italy on Friday. The Italian consumer confidence index climbed to 109.5 in June from 106.0 in May. May's figure was revised up from 105.7.

The increase was driven by rises in economic and personal financial expectations subindices.

-

11:37

German import prices decline 0.8% in May

Destatis released its import prices data for Germany on Friday. German import prices declined by 0.8% in May from last year, after a 0.6% fall in April.

Import prices decline since January 2013.

On a monthly base, import prices decreased 0.2% in May, after a 0.6% rise in April.

On a monthly base, import prices excluding crude oil and mineral oil products climbed by 2.4% in May.

Export prices climbed 1.4% year-on-year in May, after a 1.6% increase in April.

On a monthly base, export prices were down 0.2% in May, after a 0.3% rise in April.

-

11:24

French consumer confidence index remains unchanged at 94 in June

French statistical office INSEE released its consumer confidence index for France on Friday. French consumer confidence index remained unchanged at 94 in June, beating expectation for a decline to 93. May's figure was revised from 93.

The index of the outlook on consumers' saving capacity remained unchanged at -7 in June.

The index of households' assessment of their financial situation in the past twelve months remained flat in June.

The index of the outlook on consumers' financial situation rose to -12 in June from -13 in May.

The index of the outlook on unemployment rising in coming months fell to 55 in June from 57 in the previous month.

The index for current inflation expectations climbed to -55 in June.

-

11:12

M3 money supply in the Eurozone rises 5.0% in May from last year

The European Central Bank (ECB) released its M3 money supply figures on Friday. M3 money supply rose 5.0% in May from last year, missing expectations for a 5.4% gain, after a 5.3 % increase in April.

During three months to May, M3 money supply rose to 5.0% from 4.7% in the February to April period.

The lending for house purchase jumped 1.4% year-on-year in May.

Loans to the private sector in the Eurozone climbed 0.5% in May from the last year, after a flat reading in April.

-

10:51

Bank of Spain upgrades its economic growth forecast for 2015 for Spain

The Bank of Spain Governor Luis Maria Linde said on Wednesday that the Bank of Spain upgraded its economic growth forecast for 2015 for Spain. The Spanish economy is expected to expand at 3.1% in 2015, up from the previous forecast of 2.8%. The economic growth forecast was upgraded as domestic demand gathers momentum.

The Spanish economy is expected to grow 2.7% in 2016.

According to Linde, the economy probably expand at 1% in the second quarter. Inflation in Spain is expected to be above zero by the end of the year.

"The forecasts for what remains of the year and for next point to the maintenance of elevated dynamism, clearly superior to that of the majority of our partners in the euro area," the Bank of Spain governor said.

-

10:38

Average weekly earnings of Canadian non-farm payroll employees increases 2.5% in April

Statistics Canada released its average weekly earnings data of Canadian non-farm payroll employees on Thursday. Average weekly earnings of Canadian non-farm payroll employees increased 2.5% in April year-on-year.

Weekly earnings rose C$955.37 in April from C$931.94 a year earlier.

Employees in Canada worked an average 33.1 hours per week in April, up from 32.9 hours last year.

Total non-farm employment climbed by 16,400 in April.

-

10:27

German Bundesbank President Jens Weidmann criticizes the continued provision of Emergency Liquidity Assistance (ELA) to Greek banks

German Bundesbank President Jens Weidmann criticized in Frankfurt on Thursday the continued provision of Emergency Liquidity Assistance (ELA) to Greek banks.

"When banks without access to the markets buy debt of a sovereign which is likewise locked out of the market, taking recourse to ELA raises serious monetary-financing concerns. The Eurosystem must not provide bridge financing to Greece even in anticipation of later disbursements," he said.

Weidmann noted that Greek banks that receive ELA should be urged to "do their utmost to improve their liquidity situation and be prevented from worsening it further by rolling over illiquid T-bills of their sovereign".

ELA now stands at nearly €89 billion.

-

10:14

Marine Le Pen, a frontrunner in France's 2017 presidential election: a Greek exit from the Eurozone is inevitable

Marine Le Pen, a frontrunner in France's 2017 presidential election, said in an interview on Tuesday that a Greek exit from the Eurozone is inevitable. France will follow Greece, she added.

"We've won a few months' respite but the problem will come back. Today we're talking about Grexit, tomorrow it will be Brexit, and the day after tomorrow it will be Frexit," Le Pen said.

-

08:56

Global Stocks: equities declined in both Asia and the U.S.

U.S. stocks advanced at the beginning of Thursday's session amid upbeat economic data, including personal spending, which rose by 0.9% in May vs 0.7% expected. This was the best performance of the index in six years. At the same time jobless claims remained low. However after a while considerations that strong performance of the U.S. economy would persuade central bank's policymakers to start raising rates weighed on equities, leading them lower.

The Dow Jones industrial average fell by 75.71 points, or 0.42%, to 17,890.36. The Standard & Poor's 500 fell by 6.27 points, or 0.30%, to 2,102.31. The Nasdaq Composite fell by 10.22 points, or 0.20%, to close at 5,112.19.

In Asia Hong Kong Hang Seng fell by 1.48%, or 402.29 points, to 26,743.46. China Shanghai Composite Index dropped 4.60%, or 208.21 points, to 4,319.57. Meanwhile the Nikkei declined by 0.16%, or 33.38 points, to 20,738.02.

Asian stocks fell amid absence of Greece's deal. At the same time some analysts say that Shanghai Composite is experiencing correction, not simply declines. There are also concerns that a bubble is building up in China's stock market.

-

04:03

Nikkei 225 20,666.6 -104.80 -0.50%, Hang Seng 26,853.57 -292.18 -1.08%, Shanghai Composite 4,526.92 -0.86 -0.02%

-

00:30

Stocks. Daily history for Jun 25’2015:

(index / closing price / change items /% change)

Hang Seng 27,145.75 -259.22 -0.95 %

S&P/ASX 200 5,632.72 -54.05 -0.95 %

Shanghai Composite 4,528.86 -161.29 -3.44 %

Topix 1,670.91 -8.98 -0.53 %

FTSE 100 6,807.82 -36.98 -0.54 %

CAC 40 5,041.71 -3.64 -0.07 %

Xetra DAX 11,473.13 +1.87 +0.02 %

S&P 500 2,102.31 -6.27 -0.30 %

NASDAQ Composite 5,112.19 -10.22 -0.20 %

Dow Jones 17,890.36 -75.71 -0.42 %

-