Noticias del mercado

-

17:48

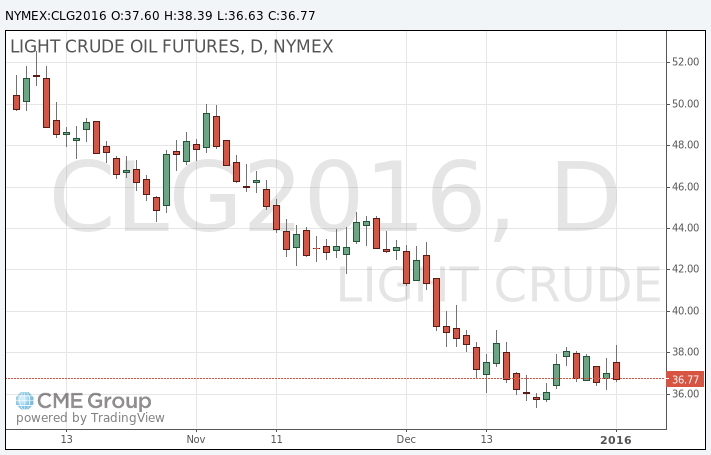

Oil prices traded mixed

WTI crude fell on Genscape data after a significant increase earlier. Oil prices climbed on concerns over the situation in the Middle East. The Saudi Arabian government said on Sunday that it had broken off diplomatic ties with Iran. The government has given Iranian diplomats two days to leave Saudi Arabia.

Bahrain and Sudan joined Saudi Arabia and cut ties with Iran.

The United Arab Emirates said that it would downgrade its diplomatic team in Iran.

The situation escalated after Saudi Arabia executed a Shia Muslim cleric.

The research group Genscape said on Monday that crude inventories at the Cushing, Oklahoma declined last week.

WTI crude oil for February delivery declined to $36.63 a barrel on the New York Mercantile Exchange.

Brent crude oil for February climbed to $38.55 a barrel on ICE Futures Europe.

-

17:22

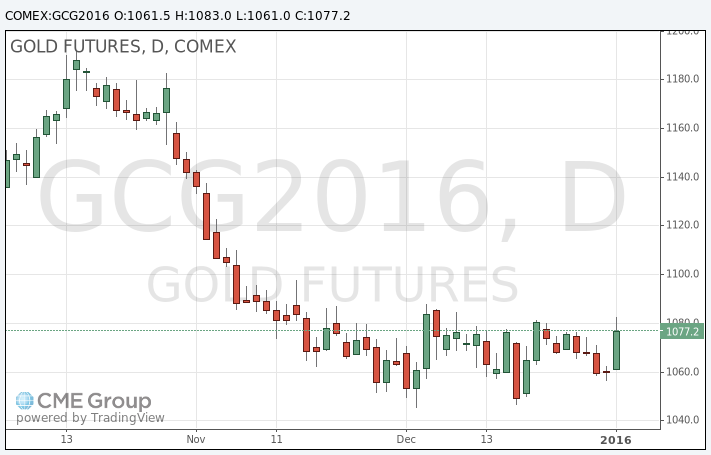

Gold rises more than 1.5%

Gold price rose on concerns over the situation in the Middle East. The Saudi Arabian government said on Sunday that it had broken off diplomatic ties with Iran. The government has given Iranian diplomats two days to leave Saudi Arabia.

Bahrain and Sudan joined Saudi Arabia and cut ties with Iran.

The United Arab Emirates said that it would downgrade its diplomatic team in Iran.

The situation escalated after Saudi Arabia executed a Shia Muslim cleric.

Gold was also supported by the weaker-than-expected U.S. manufacturing data. The Institute for Supply Management released its manufacturing purchasing managers' index for the U.S. on Monday. The index declined to 48.2 in December from 48.6 in November, missing expectations for a rise to 49.0. It was the lowest level since June 2009.

A reading above 50 indicates expansion, below indicates contraction.

The decline was partly driven by a fall in employment. The employment index dropped to 48.1 in December from 51.3 in November.

February futures for gold on the COMEX today rose to 1083.00 dollars per ounce.

-

16:13

ISM manufacturing purchasing managers’ index falls to 48.2 in December, the lowest level since June 2009

The Institute for Supply Management released its manufacturing purchasing managers' index for the U.S. on Monday. The index declined to 48.2 in December from 48.6 in November, missing expectations for a rise to 49.0. It was the lowest level since June 2009.

A reading above 50 indicates expansion, below indicates contraction.

The decline was partly driven by a fall in employment. The employment index dropped to 48.1 in December from 51.3 in November.

The production index increased to 49.8 in December from 49.2 in November.

The new orders index rose to 49.2 in December from 48.9 in November.

The price index was down to 33.5 in December from 35.5 in November.

-

15:53

U.S. final manufacturing purchasing managers' index (PMI) declines to 51.2 in December, the lowest level since October 2012

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the U.S. on Monday. The U.S. final manufacturing purchasing managers' index (PMI) decreased to 51.2 in December from 52.8 in November, down from the previous estimate of 51.3. It was the lowest level since October 2012.

A reading above 50 indicates expansion in economic activity.

The index was driven by a slower pace of growth in output and new business, while input costs fell.

"The strong dollar is hurting exporters as well as hitting domestic sales as firms compete against inflows of cheap imports. Low oil prices are meanwhile hitting demand for goods and machinery from the energy sector. There are signs that consumers are becoming more cautious in relation to spending as interest rates lift off their historic lows, and overseas demand remains in the doldrums. All of these factors look set to continue to hurt manufacturers, and even intensify, in coming months," Markit's Chief Economist Chris Williamson said.

-

15:12

Saudi Arabia cuts diplomatic ties with Iran

The Saudi Arabian government said on Sunday that it had broken off diplomatic ties with Iran. The government has given Iranian diplomats two days to leave Saudi Arabia.

Bahrain and Sudan joined Saudi Arabia and cut ties with Iran.

The United Arab Emirates said that it would downgrade its diplomatic team in Iran.

The situation escalated after Saudi Arabia executed a Shia Muslim cleric.

-

10:40

Chinese Markit/Caixin manufacturing PMI declines to 48.2 in December

The Chinese Markit/Caixin manufacturing PMI declined to 48.2 in December from 48.6 in November, missing expectations for a reading of 49.0.

Production fell in December, partly driven by a further drop in total new work. Companies continued to shed their staff.

"The Caixin China General Manufacturing PMI for December is 48.2, down 0.4 points from the reading for November. This shows that the forces driving an economic recovery have encountered obstacles and the economy is facing a greater risk of weakening. More fluctuations in global markets are expected now that the U.S. Federal Reserve has started raising interest rates," Dr. He Fan, Chief Economist at Caixin Insight Group, said.

-

10:21

First oil exports from the U.S. after the 40-year ban was lifted

The U.S. oil company ConocoPhillips sold the U.S. light crude oil to the Swiss trading company Vitol. It was the first U.S. crude oil shipment exported from the U.S. after the 40-year ban was lifted in December.

-

06:59

Oil prices rose on geopolitical tensions

West Texas Intermediate futures for February delivery rose to $37.80 (+2.05%), while Brent crude advanced to $38.19 (+2.44%) after Saudi Arabia cut diplomatic relations with Iran in response to an attack of its embassy in Tehran. Recently Saudi Arabia executed Iranian citizens, who were accused of attacking public places in Saudi Arabia.

Both Saudi Arabia and Iran are major oil producers and these tensions raise concerns over stability of supplies, however the persistent global supply glut and recent weak economic data from China (world's second-biggest consumer of oil) limit bullish expectations.

-

06:53

Gold edged up

Gold climbed to $1,064.80 (+0.43%) amid demand for safe-haven assets after Saudi Arabia cut diplomatic relations with Iran and gave Iranian diplomats 48 hours to leave the country in response to an attack of its embassy in Tehran. Recently Saudi Arabia executed Iranian citizens, who were accused of attacking public places in Saudi Arabia.

Investors traditionally turn to gold at times of crisis and geopolitical tensions, but such gains are normally short-lived.

-

00:33

Commodities. Daily history for Dec 31’2015:

(raw materials / closing price /% change)

Oil 37.07 +0.08%

Gold 1,060.50 +0.03%

-