Noticias del mercado

-

22:19

U.S. stocks closed

U.S. stocks tumbled to start 2016, as a rout in Chinese equities renewed concern that an economic slowdown there will damp global growth.

Investors returning to the market after the New Year holiday faced a worldwide selloff sparked by weak factory data in China, while a reading that showed the fastest contraction in U.S. manufacturing in six years bolstered anxiety that slowing growth in the world's second-largest economy is spreading. A flareup in tension between Saudi Arabia and Iran added to the unease.

The Standard & Poor's 500 Index fell 1.5 percent to 2,012.98 at 4 p.m. in New York, after sliding as much as 2.7 percent, for its worst start to a year since 2001.

Trading was halted in China after a 7 percent drop in the CSI 300 Index of large-capitalization companies listed in Shanghai and Shenzhen amid deteriorating manufacturing data. Chinese policy makers, who went to unprecedented lengths to prop up stock prices during a summer rout, are trying to prevent financial-market volatility from weighing on economy set to grow at its weakest annual pace since 1990.

S&P Dow Jones Indices data indicate the first day of trading has no predictive power for the rest of the year. The index ends the year in the same direction it takes on the opening day 50.6 percent of the time, the data show. The first month of the year has proved more telling -- the gauge's return in January determines its direction for the year 72.4 percent of the time.

After scaling new peaks and enduring its worst selloff in four years, the main U.S. equity index ended 2015 0.7 percent lower. Investor sentiment wavered last year between optimism that the economy was strong enough to handle higher borrowing costs and concern that China's slowdown will hurt global growth, which exacerbated weakness in commodity prices and raw-material stocks.

The beginning of 2015 was also rocky, with the benchmark index dropping 2.7 percent in its first three sessions, followed by a two-day, 3 percent rally before eventually finishing January down 3.1 percent.

Meanwhile, investment strategies premised on buying shares based on their momentum just posted the best year since 2007, which isn't great news for bulls. Past instances when momentum stocks -- defined as the ones showing the biggest gains in the last six to 12 months -- won have occurred closer to the end of rallies than the beginning, signaling indiscriminate buying at a time when more traditional share drivers such as earnings growth are starting to wane.

-

21:01

DJIA 17028.96 -396.07 -2.27%, NASDAQ 4873.12 -134.29 -2.68%, S&P 500 1999.06 -44.88 -2.20%

-

20:21

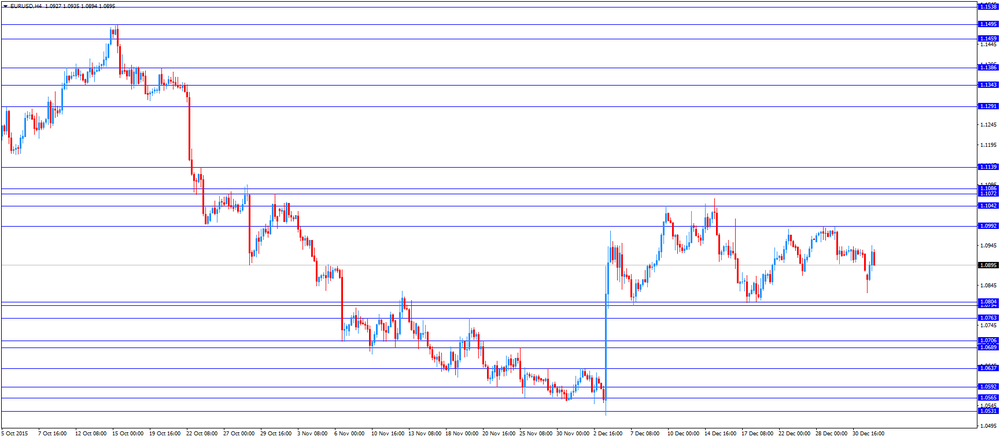

American focus: the US dollar strengthened against the major currencies

The US dollar strengthened against the major currencies against the background of falling global stock markets, weak economic data in China and rising tensions in the Middle East.

Weaker-than-expected data on the manufacturing sector in China, as well as the fall in the yuan decline in stock indices provoked China by 7% and activated mechanism stop trading. The Chinese currency fell to its lowest in nearly five years, the level against the US dollar, and there are no signs that the Chinese authorities intend to do anything to strengthen the national currency, as was the case in recent months.

The continued weakening of the Chinese economy, especially the slowdown in the manufacturing sector, undermines prospects for global demand for commodities. This increases the pressure on emerging economies whose budgets depend on selling commodities.

The decline of the yuan puts trade partners of China in a disadvantageous position, and increases expectations of what other countries will have to implement the weakening of their currencies.

The US Federal Reserve this year, may take place three to five interest rate hikes if economic data remain strong. On Monday in the CNBC interview the president of the Federal Reserve of San Francisco's John Williams.

In the event that the US economy will maintain growth in the range of 2% -2.25%, and inflation will accelerate slightly this year, "I think that the rise in interest rates from 3 to 5 times is justified, at least so it seems at at the moment, "Williams said.

"The data suggest that it makes sense to gradually raise interest rates", - he added.

According Uilms, the US economy is "in very good condition," and he believes that the impetus to the growth observed in 2015, may continue in 2016. Consumer spending and companies are moving "good path", while net exports provided a "significant negative impact", he said.

Williams, however, has warned that the economy will continue to need support from the Fed.

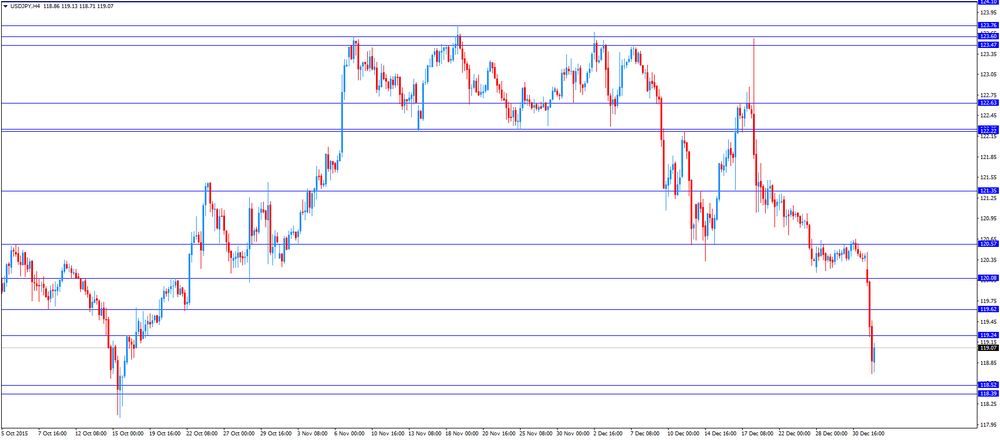

The Japanese yen has strengthened by more than 150 points against the dollar, dropping below Y119.00, as tensions in the Middle East and weak economic data from China have increased demand for yen as a safe haven. As it became known, the index of business activity in the manufacturing sector of China Caixin in December was 48.2 points, 49.0 points lower than expected and the previous value of 48.6. January 1 China published official data on business activity in December. In the manufacturing sector, the index was at the level of 49.7, which is slightly below the forecast of 49.8 and above the previous value of 49.6. The index of non-manufacturing sector was 54.4 against 53.6 in November. Many experts expect that the growth of the Chinese economy in the next 5 years is unlikely to exceed 6.5%.

Also today, it was published data on business activity in Japan. They showed that the index of business activity in the manufacturing sector of the Nikkei in Japan in December was 52.6 points, reaching a 20-month high, slightly above the previous value of 52.5.

The euro earlier rose significantly against the dollar, reaching a maximum of 30 of December. Investors pay attention to data on business activity in Germany and the euro zone. The Markit Economics said that the growth of business activity in the manufacturing sector in Germany accelerated slightly in December, surpassing in this assessment experts. According to data seasonally adjusted final manufacturing PMI rose to 53.2 points in December, compared to 52.9 points in November. The latter value was the highest in four months. Experts predicted an increase to 53.0 points. Also, Markit Economics said that the growth rate of new orders accelerated to a four-month high, helped by increased domestic and foreign demand. In response to the increase in new orders, the company increased production volumes in December.

Another report showed that manufacturing PMI for the euro zone rose to 53.2 in December from 52.8 in November. The latter value was the highest since April 2014. It is also the first time that all eight surveyed countries, including Greece, recorded growth in activity. Manufacturers again reported a decline in selling prices, and that means inflation is unlikely to quickly reach the target level.

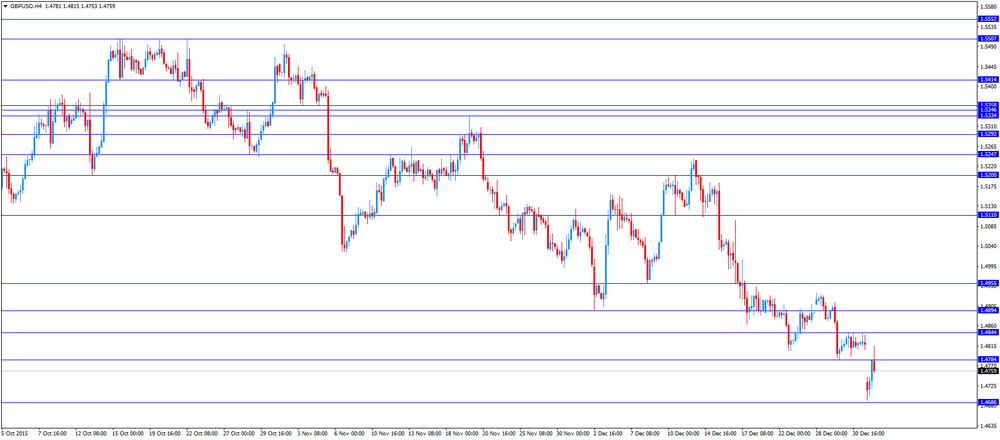

Pound previously significantly rose against the dollar, briefly rising above the level of $ 1.4800. Today it became known that manufacturing activity in the UK deteriorated moderately in December, which was mainly caused by the slowdown in new orders to a five-month low. According to the data, purchasing managers' index for the manufacturing sector fell in December to 51.9 points against 52.5 points in November. The latter value was the lowest in three months. Analysts had expected the index to rise to 52.8 points. "UK manufacturing sector finished 2015 on a disappointing note. The pace of growth slowed from recent highs, which was recorded in October, and again went to the neutral mark of 50 points," - said Rob Dobson, senior economist at Markit. Despite the improvement in the second and third quarters, the latest data suggest that industrial production for 2015 as a whole may be below the level of 2014 "

Another report showed that UK consumer lending increased in November at the fastest pace in almost a decade, and the country's banks have approved a greater number of mortgage loans than expected. The Bank of England said that net lending to consumers rose in November by 8.3 percent per annum, specifying the maximum rate since February 2006. Experts say such a change could cause concern in the Central Bank on the relevance of lending standards. In monetary terms, lending rose to 1.476 billion. Pounds, compared with the previous month, exceeding the forecasts of economists polled by Reuters.

-

18:13

WSE: Session Results

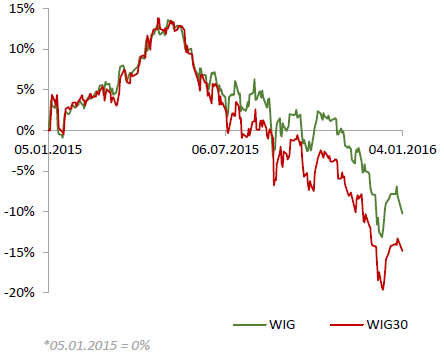

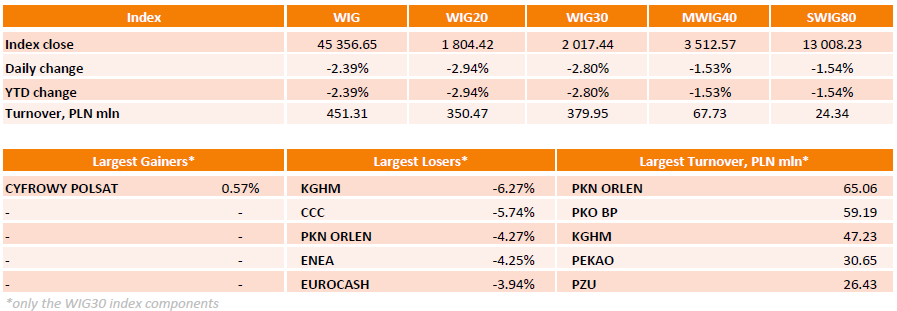

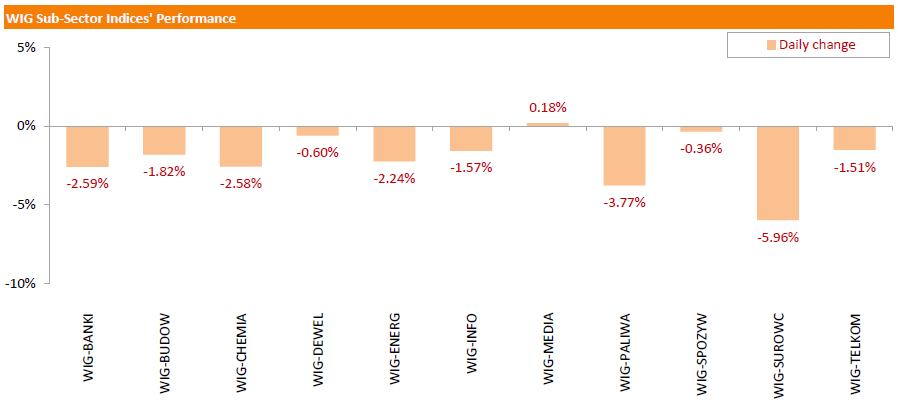

Polish equity market closed lower on the first trading day of 2016. The broad market measure, the WIG Index, posted a 2.39% decline. Almost all sectors in the WIG produced losses. Media sector (+0.18%) was the only exception. At the same time, materials (-5.96%) and oil and gas sector (-3.77%) posed the worst results.

The large-cap stocks' measure, the WIG30 Index, fell by 2.80%. Media group CYFROWY POLSAT (WSE: CPS) was the sole advancer among the index's components. The stock gained 0.57%. At the same time, copper producer KGHM (WSE: KGH) was the index's sharpest decliner, slumping 6.27% on news that the company may need to run asset impairment tests due to continued low commodities prices. It was followed by footwear retailer CCC (WSE: CCC), tumbling 5.74% on reported weak sales results for December. Other most prominent losers were oil refiner PKN ORLEN (WSE: PKN), genco ENEA (WSE: ENA) and FMCG wholesaler EUROCASH (WSE: EUR), plunging by 4.27%, 4.25% and 3.94% respectively.

-

18:12

San Francisco Fed President John Williams expects the Fed to raise its interest rate three to five times this year

San Francisco Fed President John Williams said in an interview with CNBC on Monday that he expects the Fed to raise its interest rate three to five times this year.

He also said that he expects the U.S. economy to grow about 2% to 2.25% and inflation to increase toward the Fed's 2% target.

Williams noted that he was not concerned about the weak economic data from China.

-

18:00

European stocks close: stocks closed lower on the weaker-than-expected Chinese manufacturing data

Stock indices traded lower on the weaker-than-expected Chinese Markit/Caixin manufacturing purchasing managers'

Stock indices closed lower on the weaker-than-expected Chinese Markit/Caixin manufacturing purchasing managers' index (PMI). The Chinese Markit/Caixin manufacturing PMI declined to 48.2 in December from 48.6 in November, missing expectations for a reading of 49.0. Production fell in December, partly driven by a further drop in total new work. Companies continued to shed their staff.

Meanwhile, the economic data from Eurozone was mixed. Destatis released its consumer price data for Germany on Monday. German preliminary consumer price index decreased 0.1% in December, missing expectations for a 0.2% rise, after a 0.1% increase in November.

On a yearly basis, German preliminary consumer price index declined to 0.3% in December from 0.4% in November, missing expectations for a rise to 0.6%.

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's final manufacturing purchasing managers' index (PMI) rose to 53.2 in December from 52.8 in November, up from the preliminary reading of 53.1.

Production and employment grew in all countries.

"The end of 2015 saw the Eurozone manufacturing recovery gain further traction, with rates of expansion in production and new orders over the final quarter besting those of quarter three. The sector is therefore likely to make a meaningful positive contribution to the euro GDP numbers for quarter four," Rob Dobson, Senior Economist at Markit said.

Germany's final manufacturing purchasing managers' index (PMI) climbed to 53.2 in December from 52.9 in November, up from the preliminary reading of 53.0.

The index was driven by a rise in production and new orders. New export orders showed the strongest rise in nearly two years.

France's final manufacturing purchasing managers' index (PMI) rose to 51.4 in December from 50.6 in November, down from the preliminary reading of 51.6. It was the highest level since March 2014.

The index was driven by a rise in output and new orders.

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Monday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. declined to 51.9 in December from 52.5 in November. November's figure was revised down from 52.7.

A reading above 50 indicates expansion.

The decline was driven by a slower pace of the growth in output and new orders.

"The UK manufacturing sector ended 2015 on a disappointing note, with its rate of growth slowing further from October's recent high back down towards the stagnation mark. This suggests that industry will make, at best, only a marginal positive contribution to broader economic growth in the final quarter of the year," Markit's Senior Economist Rob Dobson said.

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Monday. The number of mortgages approvals in the U.K. was up to 70,410 in November from 69,867 in October, exceeding expectations for an increase to 70,400. October's figure was revised up from 69,630.

Consumer credit in the U.K. rose by £1.476 billion in November, after a £1.207 billion gain in October. October's figure was revised down from £1.178 billion.

Net lending to individuals in the U.K. increased by £5.35 billion in November, after a £4.8 billion gain in October.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,093.43 -148.89 -2.39 %

DAX 10,283.44 -459.57 -4.28 %

CAC 40 4,522.45 -114.61 -2.47 %

-

18:00

European stocks closed: FTSE 6080.49 -161.83 -2.59%, DAX 10277.55 -465.46 -4.33%, CAC 40 4518.59 -118.47 -2.55%

-

17:48

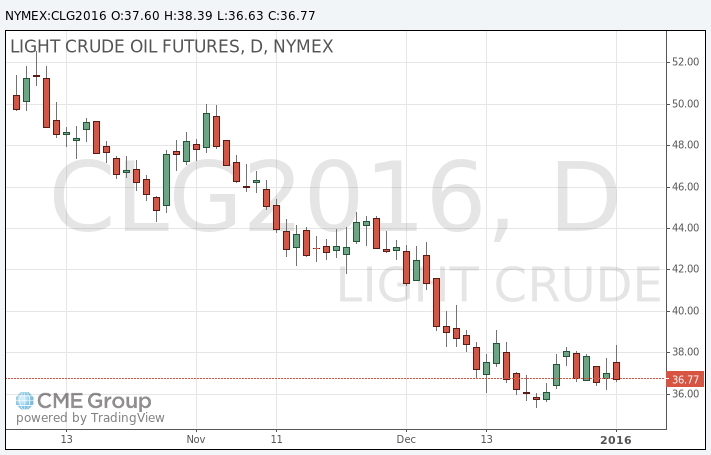

Oil prices traded mixed

WTI crude fell on Genscape data after a significant increase earlier. Oil prices climbed on concerns over the situation in the Middle East. The Saudi Arabian government said on Sunday that it had broken off diplomatic ties with Iran. The government has given Iranian diplomats two days to leave Saudi Arabia.

Bahrain and Sudan joined Saudi Arabia and cut ties with Iran.

The United Arab Emirates said that it would downgrade its diplomatic team in Iran.

The situation escalated after Saudi Arabia executed a Shia Muslim cleric.

The research group Genscape said on Monday that crude inventories at the Cushing, Oklahoma declined last week.

WTI crude oil for February delivery declined to $36.63 a barrel on the New York Mercantile Exchange.

Brent crude oil for February climbed to $38.55 a barrel on ICE Futures Europe.

-

17:41

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock indexes tumbled about 2,5% on Monday - the first trading day of the year - after weak Chinese economic data reignited fears of a global slowdown. Mainland Chinese shares fell 7%, triggering a new circuit breaker that prompted a trading halt, after surveys showed factory activity in the world's second largest economy shrank sharply in December.

All Dow stocks in negative area (19 of 30). Top looser - Cisco Systems, Inc. (CSCO, -4,49%).

All S&P sectors also in negative area. Top looser - Services (-3.0%).

At the moment:

Dow 16889.00 -452.00 -2.61%

S&P 500 1985.25 -50.25 -2.47%

Nasdaq 100 4445.00 -142.75 -3.11%

Oil 36.57 -0.47 -1.27%

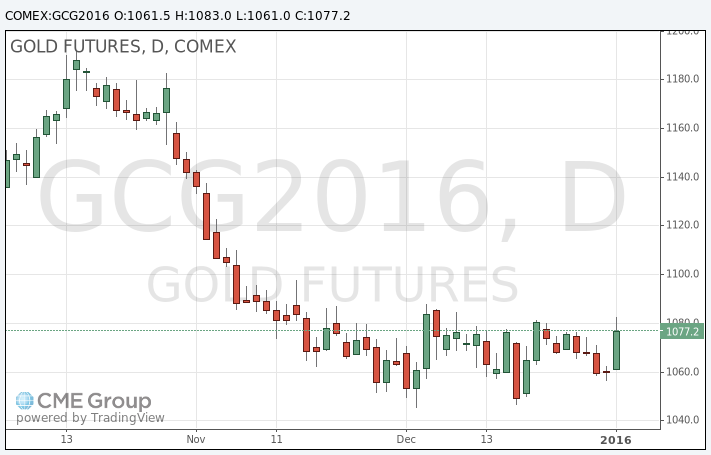

Gold 1075.10 +14.90 +1.41%

U.S. 10yr 2.21 -0.06

-

17:22

Gold rises more than 1.5%

Gold price rose on concerns over the situation in the Middle East. The Saudi Arabian government said on Sunday that it had broken off diplomatic ties with Iran. The government has given Iranian diplomats two days to leave Saudi Arabia.

Bahrain and Sudan joined Saudi Arabia and cut ties with Iran.

The United Arab Emirates said that it would downgrade its diplomatic team in Iran.

The situation escalated after Saudi Arabia executed a Shia Muslim cleric.

Gold was also supported by the weaker-than-expected U.S. manufacturing data. The Institute for Supply Management released its manufacturing purchasing managers' index for the U.S. on Monday. The index declined to 48.2 in December from 48.6 in November, missing expectations for a rise to 49.0. It was the lowest level since June 2009.

A reading above 50 indicates expansion, below indicates contraction.

The decline was partly driven by a fall in employment. The employment index dropped to 48.1 in December from 51.3 in November.

February futures for gold on the COMEX today rose to 1083.00 dollars per ounce.

-

17:15

Canadian manufacturing PMI declines to 47.5 in December

Royal Bank of Canada (RBC), the Supply Chain Management Association (SCMA) and Markit Economics released their RBC Canadian manufacturing PMI on Monday. The index declined to 47.5 in December from 48.6 in November. It was the lowest level since October 2010.

The decline was driven by falls in output volumes and new business.

"Business conditions in the Canadian manufacturing sector fell at a survey-record pace in December as weaker domestic demand and ongoing uncertainty in the energy sector continues to take its toll," RBC senior vice-president and chief economist, Craig Wright, said.

-

16:35

Construction spending in the U.S. drops 0.4% in November

The U.S. Commerce Department released construction spending data on Monday. Construction spending in the U.S. declined 0.4% in November, missing expectations for a 0.5% gain, after a 0.3% increase in October. It was the biggest decline since June 2014.

October's figure was revised down from a 1.0% rise.

The data from January 2005 through October 2015 was revised by the U.S. government.

The drop was mainly driven by a fall in non-residential construction, which was down 0.8% in November.

Spending on private residential construction climbed 0.2% in November.

Spending on private construction decreased 0.2% in November, while public construction spending slid 1.0%.

-

16:13

ISM manufacturing purchasing managers’ index falls to 48.2 in December, the lowest level since June 2009

The Institute for Supply Management released its manufacturing purchasing managers' index for the U.S. on Monday. The index declined to 48.2 in December from 48.6 in November, missing expectations for a rise to 49.0. It was the lowest level since June 2009.

A reading above 50 indicates expansion, below indicates contraction.

The decline was partly driven by a fall in employment. The employment index dropped to 48.1 in December from 51.3 in November.

The production index increased to 49.8 in December from 49.2 in November.

The new orders index rose to 49.2 in December from 48.9 in November.

The price index was down to 33.5 in December from 35.5 in November.

-

16:00

U.S.: ISM Manufacturing, December 48.2 (forecast 49)

-

16:00

U.S.: Construction Spending, m/m, November -0.4% (forecast 0.5%)

-

15:53

U.S. final manufacturing purchasing managers' index (PMI) declines to 51.2 in December, the lowest level since October 2012

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the U.S. on Monday. The U.S. final manufacturing purchasing managers' index (PMI) decreased to 51.2 in December from 52.8 in November, down from the previous estimate of 51.3. It was the lowest level since October 2012.

A reading above 50 indicates expansion in economic activity.

The index was driven by a slower pace of growth in output and new business, while input costs fell.

"The strong dollar is hurting exporters as well as hitting domestic sales as firms compete against inflows of cheap imports. Low oil prices are meanwhile hitting demand for goods and machinery from the energy sector. There are signs that consumers are becoming more cautious in relation to spending as interest rates lift off their historic lows, and overseas demand remains in the doldrums. All of these factors look set to continue to hurt manufacturers, and even intensify, in coming months," Markit's Chief Economist Chris Williamson said.

-

15:45

U.S.: Manufacturing PMI, December 51.2 (forecast 51.3)

-

15:33

U.S. Stocks open: Dow -1.81%, Nasdaq -2.22%, S&P -1.58%

-

15:25

Before the bell: S&P futures -1.82%, NASDAQ futures -2.15%

U.S. stock-index futures declined.

Global Stocks:

Nikkei 18,450.98 -582.73 -3.06%

Hang Seng 21,327.12 -587.28 -2.68%

Shanghai Composite 3,296.54 -242.64 -6.86%

FTSE 6,100.18 -142.14 -2.28%

CAC 4,529.98 -107.08 -2.31%

DAX 10,304.38 -438.63 -4.08%

Crude oil $37.64 (+1.62%)

Gold $1076.50 (+1.54%)

-

15:12

Saudi Arabia cuts diplomatic ties with Iran

The Saudi Arabian government said on Sunday that it had broken off diplomatic ties with Iran. The government has given Iranian diplomats two days to leave Saudi Arabia.

Bahrain and Sudan joined Saudi Arabia and cut ties with Iran.

The United Arab Emirates said that it would downgrade its diplomatic team in Iran.

The situation escalated after Saudi Arabia executed a Shia Muslim cleric.

-

15:04

Italy’s manufacturing PMI rises to 55.6 in December, the highest level since March 2011

Markit Economics released its manufacturing purchasing managers' index (PMI) for Italy on Monday. Italy's manufacturing purchasing managers' index (PMI) climbed to 55.6 in December from 54.9 in November. It was the highest level since March 2011.

The increase was driven by rises in output, new orders and employment.

"A weak euro, recovering domestic demand and falling global commodity prices have provided the necessary tailwinds to get things moving. The goods-producing sector has solid momentum heading into the New Year, with new order growth accelerating and companies taking on new staff to cope with rising production requirements," Markit economist Phil Smith said.

-

15:01

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Barrick Gold Corporation, NYSE

ABX

7.61

3.12%

44.9K

Exxon Mobil Corp

XOM

77.48

-0.60%

30.6K

Chevron Corp

CVX

89.30

-0.73%

1.2K

McDonald's Corp

MCD

117.26

-0.74%

44.1K

Deere & Company, NYSE

DE

75.62

-0.85%

48.2K

Verizon Communications Inc

VZ

45.81

-0.89%

13.6K

AT&T Inc

T

34.09

-0.93%

69.4K

International Paper Company

IP

37.34

-0.95%

35.3K

Merck & Co Inc

MRK

52.29

-1.00%

67.3K

General Motors Company, NYSE

GM

33.66

-1.03%

91.1K

United Technologies Corp

UTX

95.00

-1.11%

0.2K

ALTRIA GROUP INC.

MO

57.56

-1.12%

15.9K

Procter & Gamble Co

PG

78.50

-1.15%

1.4K

Johnson & Johnson

JNJ

101.47

-1.22%

27.7K

International Business Machines Co...

IBM

135.85

-1.29%

10.5K

Pfizer Inc

PFE

31.86

-1.30%

10.3K

Wal-Mart Stores Inc

WMT

60.50

-1.31%

16.6K

Ford Motor Co.

F

13.90

-1.35%

281.1K

The Coca-Cola Co

KO

42.35

-1.42%

22.9K

Intel Corp

INTC

33.95

-1.45%

17.2K

UnitedHealth Group Inc

UNH

115.90

-1.48%

20.9K

Hewlett-Packard Co.

HPQ

11.66

-1.52%

3.4K

Google Inc.

GOOG

747.00

-1.57%

1.9K

Home Depot Inc

HD

130.15

-1.59%

0.8K

Walt Disney Co

DIS

103.35

-1.65%

12.3K

E. I. du Pont de Nemours and Co

DD

65.50

-1.65%

0.3K

Microsoft Corp

MSFT

54.55

-1.68%

101.1K

Cisco Systems Inc

CSCO

26.48

-1.73%

146.1K

3M Co

MMM

148.00

-1.75%

0.1K

Nike

NKE

61.38

-1.79%

43.3K

FedEx Corporation, NYSE

FDX

146.29

-1.81%

0.4K

AMERICAN INTERNATIONAL GROUP

AIG

60.85

-1.81%

34.7K

Goldman Sachs

GS

176.90

-1.85%

1.3K

Starbucks Corporation, NASDAQ

SBUX

58.91

-1.87%

17.2K

Visa

V

76.05

-1.93%

9.1K

Boeing Co

BA

141.72

-1.98%

0.2K

JPMorgan Chase and Co

JPM

64.28

-2.00%

2.2K

Caterpillar Inc

CAT

66.55

-2.07%

6.3K

General Electric Co

GE

30.50

-2.09%

57.3K

American Express Co

AXP

68.06

-2.14%

0.7K

Apple Inc.

AAPL

102.83

-2.31%

390.8K

Amazon.com Inc., NASDAQ

AMZN

659.00

-2.50%

48.1K

Facebook, Inc.

FB

102.00

-2.54%

243.3K

Twitter, Inc., NYSE

TWTR

22.51

-2.72%

108.9K

ALCOA INC.

AA

9.60

-2.74%

107.5K

Citigroup Inc., NYSE

C

50.31

-2.78%

14.9K

Yandex N.V., NASDAQ

YNDX

15.22

-3.18%

24.4K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

6.54

-3.40%

31.6K

Yahoo! Inc., NASDAQ

YHOO

32.10

-3.49%

0.9K

Tesla Motors, Inc., NASDAQ

TSLA

230.00

-4.17%

52.3K

-

14:50

Greece’s final manufacturing PMI climbs to 50.2 in December

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Greece on Monday. Greece's manufacturing purchasing managers' index (PMI) climbed to 50.2 in December from 48.1 in November.

The index was driven by a rise in production.

"The improvement in business conditions was propped up by a modest expansion in output, something manufacturers have not experienced during 2015. The increase in workforce numbers, albeit fractional, has also helped to resuscitate the sector," Markit economist Samuel Agass said.

-

14:50

Option expiries for today's 10:00 ET NY cut

USDJPY 120.00 (USD 205m) 121.00 (192m) 121.20-25 (480m)

EURUSD 1.0800 (EUR 1.1bln) 1.0850-60 (800m) 1.0890-1.0910 (857m)

GBPUSD 1.5000 (GBP 468m)

USDCHF 0.9905 (USD 300m)

AUDUSD 0.7110 (AUD 300m) 0.7150 (605m)

AUDJPY 89.95 (AUD 377m)

-

14:48

Upgrades and downgrades before the market open

Upgrades:

McDonald's (MCD) upgraded to Buy at Nomura

Deere (DE) upgraded to Neutral from Sell at UBS

Downgrades:

Amazon (AMZN) downgraded to Neutral from Buy at Monness Crespi & Hard

Other:

-

14:40

Spain’s manufacturing PMI declines to 53.0 in December

Markit Economics released its manufacturing purchasing managers' index (PMI) for Spain on Monday. Spain's manufacturing purchasing managers' index (PMI) declined to 53.0 in December from 53.1 in November.

The index was driven by a faster pace of production growth and new orders, while input costs continued to decline.

"The latest Spanish manufacturing PMI data signalled a solid end to 2015 for the sector as growth rates for output and new orders continued to accelerate following a brief slowdown around the end of Q3," a senior economist at Markit Andrew Harker said.

-

14:27

German consumer price inflation decreases 0.1% in December

Destatis released its consumer price data for Germany on Monday. German preliminary consumer price index decreased 0.1% in December, missing expectations for a 0.2% rise, after a 0.1% increase in November.

On a yearly basis, German preliminary consumer price index declined to 0.3% in December from 0.4% in November, missing expectations for a rise to 0.6%.

The annual increase was mainly driven by a rise in services prices, which were up 1.2% year-on-year in December.

Goods prices dropped 0.6% year-on-year in December, driven by a decline in energy prices. Energy prices slid 6.5% year-on-year in December.

-

14:22

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the release of the positive economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:35 Japan Manufacturing PMI (Finally) December 52.6 52.5 52.6

01:45 China Markit/Caixin Manufacturing PMI December 48.6 49 48.2

08:30 Switzerland Manufacturing PMI December 49.7 52.1

08:50 France Manufacturing PMI (Finally) December 50.6 51.6 51.4

08:55 Germany Manufacturing PMI (Finally) December 52.9 53 53.2

09:00 Eurozone Manufacturing PMI (Finally) December 52.8 53.1 53.2

09:30 United Kingdom Consumer credit, mln November 1207 Revised From 1178 1476

09:30 United Kingdom Net Lending to Individuals, bln November 4.8 5.35

09:30 United Kingdom Mortgage Approvals November 69.87 Revised From 69.63 70.4 70.41

09:30 United Kingdom Purchasing Manager Index Manufacturing December 52.5 Revised From 52.7 51.9

13:00 Germany CPI, m/m (Preliminary) December 0.1% 0.2% -0.1%

13:00 Germany CPI, y/y (Preliminary) December 0.4% 0.6% 0.3%

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. The final manufacturing purchasing managers' index is expected to decline to 51.3 in December from 52.8 in November.

The ISM manufacturing purchasing managers' index is expected to rise to 49.0 in December from 48.6 in November.

The euro traded mixed against the U.S. dollar after the release of the positive economic data from the Eurozone. Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's final manufacturing purchasing managers' index (PMI) rose to 53.2 in December from 52.8 in November, up from the preliminary reading of 53.1.

Production and employment grew in all countries.

"The end of 2015 saw the Eurozone manufacturing recovery gain further traction, with rates of expansion in production and new orders over the final quarter besting those of quarter three. The sector is therefore likely to make a meaningful positive contribution to the euro GDP numbers for quarter four," Rob Dobson, Senior Economist at Markit said.

Germany's final manufacturing purchasing managers' index (PMI) climbed to 53.2 in December from 52.9 in November, up from the preliminary reading of 53.0.

The index was driven by a rise in production and new orders. New export orders showed the strongest rise in nearly two years.

France's final manufacturing purchasing managers' index (PMI) rose to 51.4 in December from 50.6 in November, down from the preliminary reading of 51.6. It was the highest level since March 2014.

The index was driven by a rise in output and new orders.

The British pound traded higher against the U.S. dollar after the release of the mixed economic data from the U.K. Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Monday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. declined to 51.9 in December from 52.5 in November. November's figure was revised down from 52.7.

A reading above 50 indicates expansion.

The decline was driven by a slower pace of the growth in output and new orders.

"The UK manufacturing sector ended 2015 on a disappointing note, with its rate of growth slowing further from October's recent high back down towards the stagnation mark. This suggests that industry will make, at best, only a marginal positive contribution to broader economic growth in the final quarter of the year," Markit's Senior Economist Rob Dobson said.

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Monday. The number of mortgages approvals in the U.K. was up to 70,410 in November from 69,867 in October, exceeding expectations for an increase to 70,400. October's figure was revised up from 69,630.

Consumer credit in the U.K. rose by £1.476 billion in November, after a £1.207 billion gain in October. October's figure was revised down from £1.178 billion.

Net lending to individuals in the U.K. increased by £5.35 billion in November, after a £4.8 billion gain in October.

The Swiss franc traded lower against the U.S. dollar. Credit Suisse and procure.ch released their manufacturing purchasing managers' index (PMI) for Switzerland on Monday. The manufacturing purchasing managers' index in Switzerland climbed to 52.1 in December from 49.7 in November.

A reading above 50 indicates contraction.

The increase was largely driven by a rise in production. The production increased to 57.6 in December from 49.5 In November.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair rose to $1.4815

USD/JPY: the currency pair decreased to Y118.69

The most important news that are expected (GMT0):

14:45 U.S. Manufacturing PMI(Finally) December 52.8 51.3

15:00 U.S. Construction Spending, m/m November 1% 0.5%

15:00 U.S. ISM Manufacturing December 48.6 49

-

14:00

Germany: CPI, m/m, December -0.1% (forecast 0.2%)

-

14:00

Germany: CPI, y/y , December 0.3% (forecast 0.6%)

-

13:44

Orders

EUR/USD

Offers 1.0950 1.0965 1.0985 1.1000 1.1025-30 1.1050 1.1080 1.1100

Bids 1.0900 1.0880-85 1.0850 1.0825-30 1.0800 1.0780-85 1.0750

GBP/USD

Offers 1.4780 1.4800 1.4820-25 1.4840 1.4865 1.4885 1.4900

Bids 1.4720-25 1.4700 1.4680-85 1.4665 1.4650 1.4630 1.4600

EUR/GBP

Offers 0.7420 0.7435 0.7450 0.7475-80 0.7500 0.7530 0.7550

Bids 0.7380-85 0.7355-60 0.7320 0.7300 0.7275-80 0.7250

EUR/JPY

Offers 131.00 132.00 132.50 132.80 133.00

Bids 129.50 129.00

USD/JPY

Offers 119.25 119.50 119.80 120.00 120.20-25 120.50 120.75 121.00

Bids 119.00 118.85 118.65 118.50 118.30 118.00 117.80-85 117.50

AUD/USD

Offers 0.7225-30 0.7250 0.7280 0.7300 0.7320 0.7350

Bids 0.7200 0.7180-85 0.7150 0.7120-25 0.7100

-

12:04

European stock markets mid session: stocks traded lower on the weaker-than-expected Chinese manufacturing data

Stock indices traded lower on the weaker-than-expected Chinese Markit/Caixin manufacturing purchasing managers' index (PMI). The Chinese Markit/Caixin manufacturing PMI declined to 48.2 in December from 48.6 in November, missing expectations for a reading of 49.0. Production fell in December, partly driven by a further drop in total new work. Companies continued to shed their staff.

Meanwhile, the economic data from Eurozone was positive. Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's final manufacturing purchasing managers' index (PMI) rose to 53.2 in December from 52.8 in November, up from the preliminary reading of 53.1.

Production and employment grew in all countries.

"The end of 2015 saw the Eurozone manufacturing recovery gain further traction, with rates of expansion in production and new orders over the final quarter besting those of quarter three. The sector is therefore likely to make a meaningful positive contribution to the euro GDP numbers for quarter four," Rob Dobson, Senior Economist at Markit said.

Germany's final manufacturing purchasing managers' index (PMI) climbed to 53.2 in December from 52.9 in November, up from the preliminary reading of 53.0.

The index was driven by a rise in production and new orders. New export orders showed the strongest rise in nearly two years.

France's final manufacturing purchasing managers' index (PMI) rose to 51.4 in December from 50.6 in November, down from the preliminary reading of 51.6. It was the highest level since March 2014.

The index was driven by a rise in output and new orders.

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Monday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. declined to 51.9 in December from 52.5 in November. November's figure was revised down from 52.7.

A reading above 50 indicates expansion.

The decline was driven by a slower pace of the growth in output and new orders.

"The UK manufacturing sector ended 2015 on a disappointing note, with its rate of growth slowing further from October's recent high back down towards the stagnation mark. This suggests that industry will make, at best, only a marginal positive contribution to broader economic growth in the final quarter of the year," Markit's Senior Economist Rob Dobson said.

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Monday. The number of mortgages approvals in the U.K. was up to 70,410 in November from 69,867 in October, exceeding expectations for an increase to 70,400. October's figure was revised up from 69,630.

Consumer credit in the U.K. rose by £1.476 billion in November, after a £1.207 billion gain in October. October's figure was revised down from £1.178 billion.

Net lending to individuals in the U.K. increased by £5.35 billion in November, after a £4.8 billion gain in October.

Current figures:

Name Price Change Change %

FTSE 100 6,103.76 -138.56 -2.22 %

DAX 10,342.67 -400.34 -3.73 %

CAC 40 4,523 -114.06 -2.46 %

-

11:45

Swiss manufacturing PMI climbs to 52.1 in December

Credit Suisse and procure.ch released their manufacturing purchasing managers' index (PMI) for Switzerland on Monday. The manufacturing purchasing managers' index in Switzerland climbed to 52.1 in December from 49.7 in November.

A reading above 50 indicates contraction.

The increase was largely driven by a rise in production. The production increased to 57.6 in December from 49.5 In November.

Purchase prices decreased to 36.8 in December from 38.4 in November, while the backlog of orders sub-index fell to 51.4 from 51.5.

Employment rose to 44.7 in December from 43.9 in November.

-

11:38

Number of mortgages approvals in the U.K. rises to 70,410 in November

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Monday. The number of mortgages approvals in the U.K. was up to 70,410 in November from 69,867 in October, exceeding expectations for an increase to 70,400. October's figure was revised up from 69,630.

Consumer credit in the U.K. rose by £1.476 billion in November, after a £1.207 billion gain in October. October's figure was revised down from £1.178 billion.

Net lending to individuals in the U.K. increased by £5.35 billion in November, after a £4.8 billion gain in October.

-

11:29

Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. drops to 51.9 in December

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Monday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. declined to 51.9 in December from 52.5 in November. November's figure was revised down from 52.7.

A reading above 50 indicates expansion.

The decline was driven by a slower pace of the growth in output and new orders.

"The UK manufacturing sector ended 2015 on a disappointing note, with its rate of growth slowing further from October's recent high back down towards the stagnation mark. This suggests that industry will make, at best, only a marginal positive contribution to broader economic growth in the final quarter of the year," Markit's Senior Economist Rob Dobson said.

-

11:24

France’s final manufacturing PMI increases to 51.4 in December

Markit Economics released its final manufacturing purchasing managers' index (PMI) for France on Monday. France's final manufacturing purchasing managers' index (PMI) rose to 51.4 in December from 50.6 in November, down from the preliminary reading of 51.6. It was the highest level since March 2014.

The index was driven by a rise in output and new orders.

"The French manufacturing sector maintained its recent modest growth momentum at the end of 2015, with the headline PMI climbing to its highest level since early-2014. Falling commodity prices gave manufacturers scope to cut their output charges further, which they will hope will support continued growth in new orders early in the New Year," Markit Senior Economist Jack Kennedy said.

-

11:07

Germany’s final manufacturing PMI rises to 53.2 in December

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Germany on Monday. Germany's final manufacturing purchasing managers' index (PMI) climbed to 53.2 in December from 52.9 in November, up from the preliminary reading of 53.0.

The index was driven by a rise in production and new orders. New export orders showed the strongest rise in nearly two years.

"Reflective of the trend observed throughout 2015, the Germany Manufacturing PMI posted above the nochange mark of 50.0 in December, thereby signalling sustained growth in the sector. New order intakes continued to grow at a healthy rate, with demand for consumer goods particularly strong and exports showing the largest monthly rise since February 2014," Markit economist Oliver Kolodseike said.

-

10:48

Eurozone’s final manufacturing PMI rises to 53.2 in December

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's final manufacturing purchasing managers' index (PMI) rose to 53.2 in December from 52.8 in November, up from the preliminary reading of 53.1.

Production and employment grew in all countries.

"The end of 2015 saw the Eurozone manufacturing recovery gain further traction, with rates of expansion in production and new orders over the final quarter besting those of quarter three. The sector is therefore likely to make a meaningful positive contribution to the euro GDP numbers for quarter four," Rob Dobson, Senior Economist at Markit said.

-

10:40

Chinese Markit/Caixin manufacturing PMI declines to 48.2 in December

The Chinese Markit/Caixin manufacturing PMI declined to 48.2 in December from 48.6 in November, missing expectations for a reading of 49.0.

Production fell in December, partly driven by a further drop in total new work. Companies continued to shed their staff.

"The Caixin China General Manufacturing PMI for December is 48.2, down 0.4 points from the reading for November. This shows that the forces driving an economic recovery have encountered obstacles and the economy is facing a greater risk of weakening. More fluctuations in global markets are expected now that the U.S. Federal Reserve has started raising interest rates," Dr. He Fan, Chief Economist at Caixin Insight Group, said.

-

10:32

United Kingdom: Net Lending to Individuals, bln, November 5.35

-

10:30

United Kingdom: Consumer credit, mln, November 1476

-

10:30

United Kingdom: Purchasing Manager Index Manufacturing , December 51.9

-

10:30

United Kingdom: Mortgage Approvals, November 70.41 (forecast 70.4)

-

10:21

First oil exports from the U.S. after the 40-year ban was lifted

The U.S. oil company ConocoPhillips sold the U.S. light crude oil to the Swiss trading company Vitol. It was the first U.S. crude oil shipment exported from the U.S. after the 40-year ban was lifted in December.

-

10:18

Option expiries for today's 10:00 ET NY cut

USD/JPY 120.00 (USD 205m) 121.00 (192m) 121.20-25 (480m)

EUR/USD 1.0800 (EUR 1.1bln) 1.0850-60 (800m) 1.0890-1.0910 (857m)

GBP/USD 1.5000 (GBP 468m)

USD/CHF 0.9905 (USD 300m)

AUD/USD 0.7110 (AUD 300m) 0.7150 (605m)

AUD/JPY 89.95 (AUD 377m)

-

10:11

Final Markit/Nikkei manufacturing purchasing managers' index for Japan remains unchanged at 52.6 in December

The final Markit/Nikkei manufacturing Purchasing Managers' Index (PMI) for Japan remained unchanged at 52.6 in December, up from the preliminary reading of 52.5.

A reading above 50 indicates expansion, a reading below 50 indicates contraction of activity.

The index was driven by a rise in new orders and output.

"Manufacturing conditions continued to improve at a marked rate in December, contributing to the strongest PMI quarterly average seen since Q1 in 2014. This suggests that the official GDP figure for Q4 2015 will signal some growth. As a result of sharp expansions in both manufacturing production and new orders, employment and buying activity increased further," economist at Markit, Amy Brownbill, said.

-

10:00

Eurozone: Manufacturing PMI, December 53.2 (forecast 53.1)

-

09:55

Germany: Manufacturing PMI, December 53.2 (forecast 53)

-

09:50

France: Manufacturing PMI, December 51.4 (forecast 51.6)

-

09:30

Switzerland: Manufacturing PMI, December 52.1

-

07:41

Foreign exchange market. Asian session: the U.S. dollar declined

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:35 Japan Manufacturing PMI (Finally) December 52.6 52.5 52.6

01:45 China Markit/Caixin Manufacturing PMI December 48.6 49 48.2

The U.S. dollar fell to a ten-month low against the yen as tensions in the Middle East and weak economic data from China increased demand for this safe-haven currency. Risk sentiment declined after Saudi Arabia cut diplomatic ties with Iran on Sunday.

The Australian dollar fell amid disappointing data from Australia's major trading partner China and weaker-than-expected domestic data. The index of activity in Australia's manufacturing sector from AiG declined to 51.9 points in December from 52.5 reported previously. The index remained above 50, which suggests expansion.

The Markit/Caixin Manufacturing PMI for China declined to 48.2 in December from 48.6 in the previous month falling further into contraction territory. Economists had expected a reading of 49.0. Many experts don't expect China's economic growth to exceed 6.5% in 2016.

EUR/USD: the pair rose to $1.0890 in Asian trade

USD/JPY: the pair fell to Y119.44

GBP/USD: the pair traded within $1.4692-1.4744

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 Switzerland Manufacturing PMI December 49.7

08:50 France Manufacturing PMI (Finally) December 50.6 51.6

08:55 Germany Manufacturing PMI (Finally) December 52.9 53

09:00 Eurozone Manufacturing PMI (Finally) December 52.8 53.1

09:30 United Kingdom Consumer credit, mln November 1178

09:30 United Kingdom Net Lending to Individuals, bln November 4.8

09:30 United Kingdom Mortgage Approvals November 69.63 70.4

09:30 United Kingdom Purchasing Manager Index Manufacturing December 52.7

13:00 Germany CPI, m/m (Preliminary) December 0.1% 0.2%

13:00 Germany CPI, y/y (Preliminary) December 0.4% 0.6%

14:45 U.S. Manufacturing PMI (Finally) December 52.8 51.3

15:00 U.S. Construction Spending, m/m November 1% 0.5%

15:00 U.S. ISM Manufacturing December 48.6 49

-

07:07

Options levels on monday, January 1, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0986 (2482)

$1.0956 (5549)

$1.0915 (2628)

Price at time of writing this review: $1.0893

Support levels (open interest**, contracts):

$1.0830 (3769)

$1.0804 (2957)

$1.0771 (6314)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 55583 contracts, with the maximum number of contracts with strike price $1,1100 (7255);

- Overall open interest on the PUT options with the expiration date January, 8 is 73664 contracts, with the maximum number of contracts with strike price $1,0450 (8017);

- The ratio of PUT/CALL was 1.33 versus 1.30 from the previous trading day according to data from December, 31

GBP/USD

Resistance levels (open interest**, contracts)

$1.5001 (477)

$1.4902 (290)

$1.4804 (378)

Price at time of writing this review: $1.4735

Support levels (open interest**, contracts):

$1.4695 (1439)

$1.4598 (802)

$1.4499 (207)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 20099 contracts, with the maximum number of contracts with strike price $1,5100 (2879);

- Overall open interest on the PUT options with the expiration date January, 8 is 19893 contracts, with the maximum number of contracts with strike price $1,5100 (3084);

- The ratio of PUT/CALL was 0.99 versus 0.97 from the previous trading day according to data from December, 31

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:59

Oil prices rose on geopolitical tensions

West Texas Intermediate futures for February delivery rose to $37.80 (+2.05%), while Brent crude advanced to $38.19 (+2.44%) after Saudi Arabia cut diplomatic relations with Iran in response to an attack of its embassy in Tehran. Recently Saudi Arabia executed Iranian citizens, who were accused of attacking public places in Saudi Arabia.

Both Saudi Arabia and Iran are major oil producers and these tensions raise concerns over stability of supplies, however the persistent global supply glut and recent weak economic data from China (world's second-biggest consumer of oil) limit bullish expectations.

-

06:53

Gold edged up

Gold climbed to $1,064.80 (+0.43%) amid demand for safe-haven assets after Saudi Arabia cut diplomatic relations with Iran and gave Iranian diplomats 48 hours to leave the country in response to an attack of its embassy in Tehran. Recently Saudi Arabia executed Iranian citizens, who were accused of attacking public places in Saudi Arabia.

Investors traditionally turn to gold at times of crisis and geopolitical tensions, but such gains are normally short-lived.

-

06:42

Global Stocks: U.S. stock indices declined on the last session of 2015

U.S. stock indices declined on the last session of 2015 on Thursday.

The Dow Jones Industrial Average fell 178.84 points, or 1.02%, to 17,425.03 (-2.23% over the year). The S&P 500 lost 19.42 points, or 0.94%, to 2,043.94 (-0.73% over the year; its energy sector lost more than 20% in 2015 although it was the only sector, which gained on Thursday). The Nasdaq Composite declined 58.43 points, or 1.15%, to 5,007.41(more than +5.5% over the year).

U.S. stocks were mostly tracking oil in the last two trading weeks of 2015 as uncertainty over Federal Reserve's rates cleared out.

This morning in Asia Hong Kong Hang Seng fell 2.53%, or 554.35, to 21,360.05. China Shanghai Composite Index dropped 4.76%, or 168.39, to 3,370.80. The Nikkei plunged 2.89, or 550.62, to 18,483.09.

Asian stock indices fell amid tensions between Iran and Saudi Arabia and weak economic data from China. On Sunday Saudi Arabia cut diplomatic relations with Tehran.

The Markit/Caixin Manufacturing PMI for China declined to 48.2 in December from 48.6 in the previous month falling further into contraction territory. Economists had expected a reading of 49.0. Many experts don't expect China's economic growth to exceed 6.5% in 2016.

-

03:04

Nikkei 225 18,855.28 -178.43 -0.94 %, Hang Seng 21,600.13 -314.27 -1.43%, Shanghai Composite 3,531.18 -8.01 -0.23 %

-

02:45

China: Markit/Caixin Manufacturing PMI, December 48.2 (forecast 49)

-

02:35

Japan: Manufacturing PMI, December 52.6 (forecast 52.5)

-

00:33

Commodities. Daily history for Dec 31’2015:

(raw materials / closing price /% change)

Oil 37.07 +0.08%

Gold 1,060.50 +0.03%

-

00:33

Stocks. Daily history for Sep Dec 31’2015:

(index / closing price / change items /% change)

Nikkei 225 19,033.71 +51.48 +0.27 %

Hang Seng 21,914.4 +32.25 +0.15 %

Shanghai Composite 3,539.6 -33.28 -0.93 %

FTSE 100 6,242.32 -31.73 -0.51 %

CAC 40 4,637.06 -40.08 -0.86 %

Xetra DAX 10,743.01 -117.13 -1.08 %

S&P 500 2,043.94 -19.42 -0.94 %

NASDAQ Composite 5,007.41 -58.43 -1.15 %

Dow Jones 17,425.03 -178.84 -1.02 %

-

00:32

Currencies. Daily history for Dec 31 ’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0882 -0,45%

GBP/USD $1,4818 +0,03%

USD/CHF Chf0,9942 +0,57%

USD/JPY Y120,41 -0,08%

EUR/JPY Y131,03 -0,53%

GBP/JPY Y178,42 -0,07%

AUD/USD $0,7307 +0,31%

NZD/USD $0,6840 +0,01%

USD/CAD C$1,3858 -0,14%

-

00:18

Schedule for today, Monday, Jan 4’2016:

(time / country / index / period / previous value / forecast)

01:35 Japan Manufacturing PMI (Finally) December 52.6 52.5

01:45 China Markit/Caixin Manufacturing PMI December 48.6 49

08:30 Switzerland Manufacturing PMI December 49.7

08:50 France Manufacturing PMI (Finally) December 50.6 51.6

08:55 Germany Manufacturing PMI (Finally) December 52.9 53

09:00 Eurozone Manufacturing PMI (Finally) December 52.8 53.1

09:30 United Kingdom Consumer credit, mln November 1178

09:30 United Kingdom Net Lending to Individuals, bln November 4.8

09:30 United Kingdom Mortgage Approvals November 69.63 70.4

09:30 United Kingdom Purchasing Manager Index Manufacturing December 52.7

13:00 Germany CPI, m/m (Preliminary) December 0.1% 0.2%

13:00 Germany CPI, y/y (Preliminary) December 0.4% 0.6%

14:45 U.S. Manufacturing PMI (Finally) December 52.8 51.3

15:00 U.S. Construction Spending, m/m November 1% 0.5%

15:00 U.S. ISM Manufacturing December 48.6 49

-