Noticias del mercado

-

23:30

Australia: AIG Services Index, December 46.3

-

22:37

U.S. stocks closed

U.S. stocks closed little changed after China's move to stabilize its financial markets left investors to focus on the prospects for global growth amid renewed selling in crude oil and weaker-than-expected auto sales.

Stocks in China rose Tuesday in volatile trading, stabilizing after weaker factory data from the world's second-largest economy sparked a worldwide selloff on Monday. State-backed funds were said to intervene after yesterday's 7 percent plunge in the CSI 300 Index of large-capitalization companies listed in Shanghai and Shenzhen wiped out $590 billion of market value. European equities also climbed after a 2.5 percent rout on Monday.

Even as yesterday ranked as the sixth-worst start to a year for the S&P 500 since 1932, the move is less surprising when compared with how the gauge usually fares. The index has moved an average 1.1 percent in either direction on opening day, compared with an average daily move of 0.77 percent on all other days.

Following Monday's rout, investors stuck with what worked last year. Health-care and consumer staples shares, two of 2015's best performers, were among the leaders. Technology shares slipped the most under Apple's drag. Seven of the S&P 500's 10 main industries were higher, with phone companies posting the strongest advance.

Sentiment has turned more cautious on stocks amid the Federal Reserve's first interest-rate increase since 2006, and forecasts for little to no growth in corporate earnings before the spring. Strategists at Citigroup Inc. cut their view on U.S. equities to underweight Tuesday, saying that while they're not especially bearish, they see better opportunities in Europe and Japan. "After outperforming for six consecutive years, maybe U.S. equities are due a breather," the firm wrote in a note.

Fed officials expect the pace of future rate increases to be gradual, though they have stressed that the path depends on progress in economic data. A report Monday showed the fastest contraction in U.S. manufacturing in six years, adding to worries that weakness in China's economy is spreading. Investors will look for further clues this week in data on services industry growth, factory activity, employment and minutes from the Fed's December meeting.

-

22:01

U.S.: Total Vehicle Sales, mln, December 17.34 (forecast 18.1)

-

21:00

DJIA 17143.67 -5.27 -0.03%, NASDAQ 4896.35 -6.74 -0.14%, S&P 500 2016.36 3.70 0.18%

-

20:21

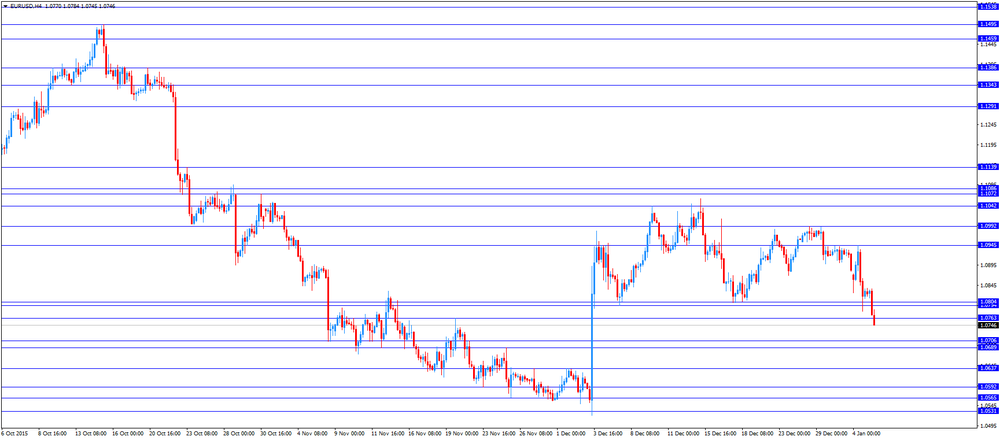

American focus: the US dollar strengthened against the major currencies

The dollar generally holds gains against the other major currencies, as disappointing euro zone inflation data, concerns about the growth of the Chinese economy and the growing tension in the Middle East eroded risk sentiment of the market.

The euro declined significantly against the dollar, updating the yesterday's low. The pressure on the currency has the expectation of publication of inflation data for the euro area. After the publication of this report, the euro continued to fall, as the figures fell short of forecasts. Recall the preliminary data provided by the Statistical Office, Eurostat, showed that consumer prices in the euro zone rose in December by 0.2%, as in the previous month. Experts expect that the prices will increase by 0.4%. Meanwhile, core consumer price index, which does not take into account the extremely volatile components, rose last month by 0.9%, confirming analysts' forecasts. Recall that in November this indicator also increased by 0.9%. The report also stated that the price of food, alcohol and tobacco recorded the largest increase in December - at the level of + 1.2% versus + 1.5% in November. Meanwhile, prices of services increased by 1.1% after increasing by 1.2%. The cost of non-energy goods increased by 0.3%, as in November. Energy prices fell 5.9%, after declining by 7.3%.

Small influenced statistics for Germany. The Federal Labor Agency said that the seasonally adjusted number of unemployed decreased by 14 000, amounting to 2.757 million at the same time. People. Economists had expected the index to fall in 7000, after declining by 14,000 in November (revised from -13,000). Meanwhile, the unemployment rate remained at 6.3 per cent (the lowest value since the time of reference of the statistics, namely from January 1992). The latter value is in line with expectations.

Demand for the safe haven yen-preserved after Monday was published statistics on China, where the index of business activity in the manufacturing sector Caixin fell this month to a level of 48.2 from the previous value of 48.6 in December, with expectations of growth to 48 9.

This minimum value of the index in September, lower than 50, which is the boundary between the deceleration and growth.

Markets are also worried about the growing tension in the Middle East, once in response to the execution of the well-known Shia preacher in Tehran was defeated Saudi embassy.

The pound fell against the dollar, despite the publication of good data on business activity. Experts note that the attitude to risk is now the main driver of movements of the pair, as the US calendar is almost empty.

Earlier today, a report by Markit Economics and CIPS showed that the growth rate of activity in the UK construction industry has accelerated markedly in December after the November reached a seven-month low. According to the index of purchasing managers in the construction sector rose in December to 57.8 points compared to 55.3 points in November. Analysts had expected the index to increase to only 56.0 points. The Markit Economics said that the growth rate of commercial and residential construction rebounded in December after falling to its lowest level since mid-2013 in November. Civil engineering, however, declined, albeit only slightly. It is worth emphasizing the reduction in this sector was recorded for the first time since April 2015. In addition, studies have shown that more than half of the companies expect a rise in business activity during 2016 and only 7 percent predict a decrease.

-

18:27

WSE: Session Results

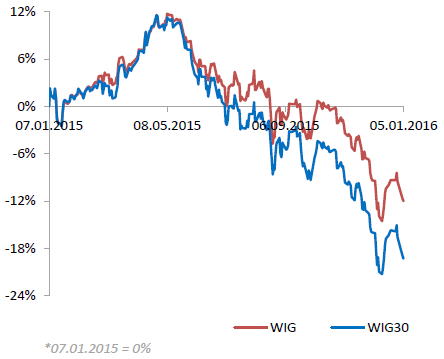

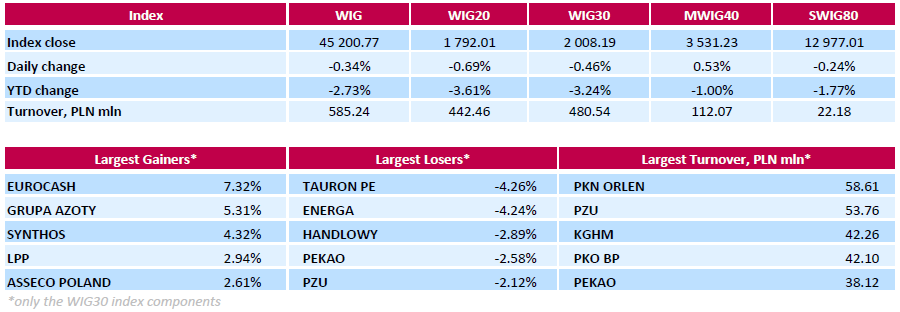

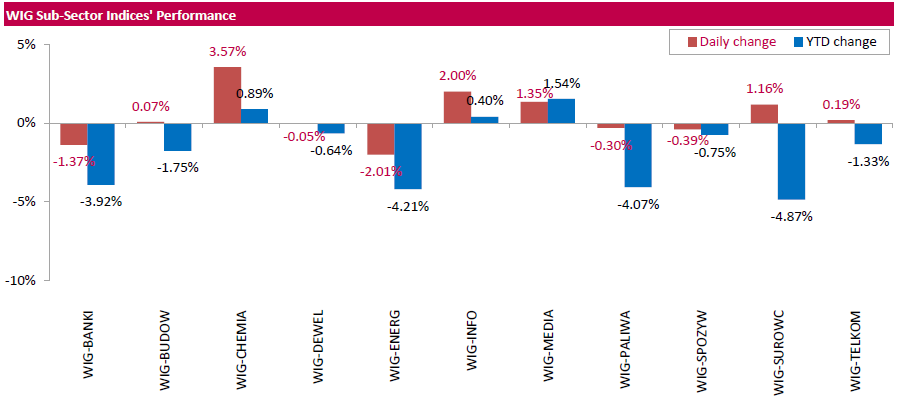

Polish equity market closed lower on Tuesday. The broad measure, the WIG index, lost 0.34%. Sector performance within the WIG Index was mixed. Chemicals sector (+3.57%) was best performer, while utilities (-2.01%) recorded the worst result.

The large-cap benchmark, the WIG30 Index, fell by 0.46%. Within the index components, gencos TAURON PE (WSE: TPE) and ENERGA (WSE: ENG) were the weakest performers, tumbling by 4.26% and 4.24% respectively. Other major losers included financial sector names HANDLOWY (WSE: BHW), PEKAO (WSE: PEO) and PZU (WSE: PZU), slumping 2.89%, 2.58% and 2.12% respectively. On the other side of the ledger, FMCG wholesaler EUROCASH (WSE: EUR) led the advancers, climbing by 7.32% after two consecutive sessions of declines. It was followed by chemical producers GRUPA AZOTY (WSE: ATT) and SYNTHOS (WSE: SNS), jumping by 5.31% and 4.32% respectively.

The Warsaw Stock Exchange will be closed on Wednesday, Jan. 6, due to celebration of Epiphany or Three Kings' Day (Święto Trzech Króli) in Poland.

-

18:00

European stocks close: stocks closed higher despite concerns over the slowdown in the Chinese economy

Stock indices traded higher despite concerns over the slowdown in the Chinese economy.

Meanwhile, the economic data from Eurozone was mixed. Eurostat released its consumer price inflation data for the Eurozone on Tuesday. The preliminary consumer price inflation in the Eurozone remained unchanged at an annual rate of 0.2% in December, missing expectations for a rise to 0.4%.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco remained unchanged at an annual rate of 0.9% in December, in line with expectations.

Food, alcohol and tobacco prices were up 1.2% in December, non-energy industrial goods prices gained 0.5%, and services prices climbed 1.1%, while energy prices dropped 5.9%.

The Federal Labour Agency released its unemployment figures for Germany on Tuesday. The number of unemployed people in Germany fell by 14,000 in December, exceeding expectations for a 7,000 decline, after a 14,000 decrease in November. November's figure was revised up from a 13,000 decline.

The unemployment rate remained unchanged at 6.3% in December, in line with expectations.

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. rose to 57.8 in December from 55.3 in November, exceeding expectations for an increase to 56.0.

A reading above 50 indicates expansion in the construction sector.

The index was driven by a rise in commercial construction.

"UK construction companies finished 2015 in a positive fashion, as overall output growth recovered from November's seven-month low. Commercial building was the main engine of growth, with this area of activity expanding at the strongest pace since autumn 2014. There was also a rebound in house building activity in December, but momentum was still much softer than the post-crisis highs achieved during 2014," Senior Economist at Markit, Tim Moore, said.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,137.24 +43.81 +0.72 %

DAX 10,310.1 +26.66 +0.26 %

CAC 40 4,537.63 +15.18 +0.34 %

-

18:00

European stocks closed: FTSE 6137.24 43.81 0.72%, DAX 10310.10 26.66 0.26%, CAC 40 4537.63 15.18 0.34%

-

17:39

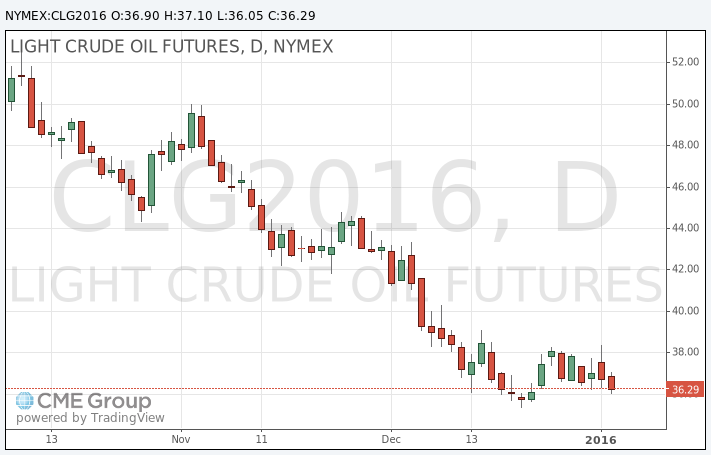

Oil prices decline on concerns over the global oil oversupply

Oil prices decline on concerns over the global oil oversupply. Oil producing countries do not want to reduce their oil output.

The weak Chinese manufacturing data also weighed on oil prices. The Chinese Markit/Caixin manufacturing PMI declined to 48.2 in December from 48.6 in November, missing expectations for a reading of 49.0. Production fell in December, partly driven by a further drop in total new work. Companies continued to shed their staff.

WTI crude oil for February delivery declined to $36.05 a barrel on the New York Mercantile Exchange.

Brent crude oil for February fell to $36.61 a barrel on ICE Futures Europe.

-

17:34

Gold continues to rise

Gold price rose on concerns over the slowdown in the Chinese economy and over the situation in the Middle East. Saudi Arabia, Bahrain and Sudan had broken off diplomatic ties with Iran.

Kuwait said that it would recall its ambassador from Iran.

The situation escalated after Saudi Arabia executed a Shia Muslim cleric.

The Chinese Markit/Caixin manufacturing PMI declined to 48.2 in December from 48.6 in November, missing expectations for a reading of 49.0. Production fell in December, partly driven by a further drop in total new work. Companies continued to shed their staff.

February futures for gold on the COMEX today rose to 1081.50 dollars per ounce.

-

17:22

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock indexes higher on Tuesday as investors recovered from a bruising selloff on the first trading day of the year. Stock markets plunged on Monday after weak Chinese economic data rekindled fears of a global slowdown, prompting a near-$20 billion injection by the People's Bank of China to stabilize its markets. U.S. stocks closed sharply lower on Monday, with the Dow making its worst start to a year since 2008. Weak U.S. factory data also added to the worries.

Most of Dow stocks in positive area (18 of 30). Top looser - American Express Company (AXP, -2,23%). Top gainer - Wal-Mart Stores Inc. (WMT, +1.87%).

Almost all S&P sectors also in positive area. Top looser - Basic Materials (-0,7%). Top gainer - Conglomerates (+1,2%).

At the moment:

Dow 17037.00 -48.00 -0.28%

S&P 500 2006.50 -2.50 -0.12%

Nasdaq 100 4492.75 -11.75 -0.26%

Oil 36.39 -0.37 -1.01%

Gold 1076.90 +1.70 +0.16%

U.S. 10yr 2.25 +0.01

-

17:04

The International Monetary Fund Chief Economic Maurice Obstfeld: the slowdown in the Chinese economy could again have a negative impact on the global financial markets in 2016

The International Monetary Fund (IMF) Chief Economic Maurice Obstfeld said in an interview with IMF Survey on Monday that the slowdown in the Chinese economy could again have a negative impact on the global financial markets in 2016.

"Growth below the authorities' official targets could again spook global financial markets," he said.

Obstfeld pointed out that the spillovers from the slowdown in Chinese economy have been larger than expected.

"The global spillovers from China's reduced rate of growth, through its diminished imports and lower demand for commodities, have been much larger than we would have anticipated," the IMF chief economist noted.

-

16:49

European Central Bank purchases €50.3 billion of public and private debt in December

The European Central Bank (ECB) purchased €50.3 billion of public and private debt under its quantitative-easing program in December, compared to €62.6 billion in November.

The ECB bought €44.3 billion of government and agency bonds in December, €5.8 billion of covered bonds, and €0.1 billion of asset-backed securities.

The ECB kept its interest rate unchanged at 0.05% on December 04, but lowered its deposit rate to -0.3% from -0.2%. The asset-buying programme will be extended until the end of March 2017. The volume of the monthly purchases remained unchanged.

-

16:14

Number of registered unemployed people in Spain declines by 55,790 in December

Spain's labour ministry release its labour market figures on Tuesday The number of registered unemployed people dropped by 55,790 in December, after a 27,071 fall in November.

The decline was mainly driven by a rise in temporary services jobs.

The total number of people registered as unemployed was 4.04 million in 2015, down by 354,203 from the last year.

-

15:41

The People's Bank of China continues to weaken the yuan

The People's Bank of China (PBoC) continued to weaken the yuan. The central bank today set the yuan midpoint at 6.5169 prior to the market open against its previous fixing of 6.5032. It was the weakest level since April 2011.

-

15:33

U.S. Stocks open: Dow +0.21%, Nasdaq +0.45%, S&P +0.34%

-

15:20

Before the bell: S&P futures -0.11%, NASDAQ futures -0.14%

U.S. stock-index futures fluctuated.

Global Stocks:

Nikkei 18,374 -76.98 -0.42%

Hang Seng 21,188.72 -138.40 -0.65%

Shanghai Composite 3,287.71 -8.55 -0.26%

FTSE 6,129.56 +36.13 +0.59%

CAC 4,535.98 +13.53 +0.30%

DAX 10,313.4 +29.96 +0.29%

Crude oil $36.87 (+0.30%)

Gold $1078.00 (+0.26%)

-

14:55

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

6.67

1.83%

44.9K

Amazon.com Inc., NASDAQ

AMZN

641.14

0.65%

6.5K

Yahoo! Inc., NASDAQ

YHOO

31.60

0.64%

2.4K

Verizon Communications Inc

VZ

46.10

0.50%

0.5K

Tesla Motors, Inc., NASDAQ

TSLA

224.40

0.44%

4.5K

General Motors Company, NYSE

GM

33.43

0.36%

108.6K

Google Inc.

GOOG

744.00

0.29%

24.5K

Barrick Gold Corporation, NYSE

ABX

7.77

0.26%

25.3K

Wal-Mart Stores Inc

WMT

61.59

0.21%

27.2K

Ford Motor Co.

F

14.00

0.21%

348.2K

Microsoft Corp

MSFT

54.91

0.20%

1.7K

Boeing Co

BA

140.75

0.18%

0.1K

AT&T Inc

T

34.40

0.15%

10.1K

Cisco Systems Inc

CSCO

26.45

0.15%

3.9K

Exxon Mobil Corp

XOM

77.56

0.13%

14.8K

Nike

NKE

61.60

0.13%

1.2K

JPMorgan Chase and Co

JPM

63.70

0.13%

0.1K

Pfizer Inc

PFE

31.99

0.13%

1.0K

AMERICAN INTERNATIONAL GROUP

AIG

60.50

0.12%

2.4K

ALTRIA GROUP INC.

MO

57.45

0.10%

19.7K

Starbucks Corporation, NASDAQ

SBUX

58.30

0.07%

1.8K

3M Co

MMM

146.90

0.05%

0.1K

Citigroup Inc., NYSE

C

51.15

0.04%

0.1K

Apple Inc.

AAPL

105.37

0.02%

98.8K

Visa

V

75.70

0.00%

3.7K

Facebook, Inc.

FB

102.18

-0.04%

23.2K

Home Depot Inc

HD

131.00

-0.05%

0.1K

Chevron Corp

CVX

88.80

-0.06%

5.4K

Intel Corp

INTC

33.97

-0.06%

0.7K

Caterpillar Inc

CAT

67.94

-0.07%

41.5K

General Electric Co

GE

30.69

-0.07%

14.8K

Merck & Co Inc

MRK

52.40

-0.15%

78.6K

Goldman Sachs

GS

176.70

-0.25%

1.3K

ALCOA INC.

AA

9.68

-0.31%

2.0M

Twitter, Inc., NYSE

TWTR

22.47

-0.40%

6.5K

Yandex N.V., NASDAQ

YNDX

15.14

-0.53%

2.1K

Walt Disney Co

DIS

102.30

-0.66%

13.1K

E. I. du Pont de Nemours and Co

DD

62.48

-0.94%

5.0K

-

14:50

Option expiries for today's 10:00 ET NY cut

USDJPY 119.00-05 (USD 291m) 120.25 (200m)

EURUSD 1.0800 (EUR 1.09bln) 1.0865-70 (1.1bln) 1.0890 (393m) 1.1000 (196m)

GBPUSD 1.4950 (GBP 119m)

AUDUSD 0.7250-55 (AUD 442m)

EURJPY 130.40 (EUR 350m)

EURGBP 0.7130 (EUR 235m)

-

14:46

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

DuPont (DD) downgraded to Neutral from Buy at Citigroup

Walt Disney (DIS) downgraded to Neutral from Outperform at Macquarie

Other:

-

14:40

Canadian industrial product and raw materials prices decline in November

Statistics Canada released its industrial product and raw materials price indexes on Tuesday. The Industrial Product Price Index (IPPI) fell 0.2% in November, after a 0.5% decline in October.

The decrease was mainly driven lower prices for primary non-ferrous metal products, which slid 3.5% in November.

11 of the 21 commodity groups increased, 8 declined and 2 was unchanged.

The Raw Materials Price Index (RMPI) dropped 4.0% in November, after a flat reading in October. October's figure was revised down from a 0.4% rise.

The drop was driven by lower prices for crude energy products. Crude energy products fell by 5.7% in November.

2 of the 6 commodity groups rose and 4 decreased.

-

14:30

Canada: Industrial Product Price Index, m/m, November -0.2%

-

14:30

Canada: Industrial Product Price Index, y/y, November -0.2%

-

14:14

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the weak inflation data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

08:55 Germany Unemployment Change December -14 Revised From -13 -7 -14

08:55 Germany Unemployment Rate s.a. December 6.3% 6.3% 6.3%

09:30 United Kingdom PMI Construction December 55.3 56 57.8

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) December 0.2% 0.4% 0.2%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) December 0.9% 0.9% 0.9%

The U.S. dollar traded higher against the most major currencies in the absence of any major U.S. economic reports today.

The euro traded lower against the U.S. dollar after the release of the weak inflation data from the Eurozone. Eurostat released its consumer price inflation data for the Eurozone on Tuesday. The preliminary consumer price inflation in the Eurozone remained unchanged at an annual rate of 0.2% in December, missing expectations for a rise to 0.4%.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco remained unchanged at an annual rate of 0.9% in December, in line with expectations.

Food, alcohol and tobacco prices were up 1.2% in December, non-energy industrial goods prices gained 0.5%, and services prices climbed 1.1%, while energy prices dropped 5.9%.

The Federal Labour Agency released its unemployment figures for Germany on Tuesday. The number of unemployed people in Germany fell by 14,000 in December, exceeding expectations for a 7,000 decline, after a 14,000 decrease in November. November's figure was revised up from a 13,000 decline.

The unemployment rate remained unchanged at 6.3% in December, in line with expectations.

The British pound traded lower against the U.S. dollar despite the better-than-expected construction PMI data from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. rose to 57.8 in December from 55.3 in November, exceeding expectations for an increase to 56.0.

A reading above 50 indicates expansion in the construction sector.

The index was driven by a rise in commercial construction.

"UK construction companies finished 2015 in a positive fashion, as overall output growth recovered from November's seven-month low. Commercial building was the main engine of growth, with this area of activity expanding at the strongest pace since autumn 2014. There was also a rebound in house building activity in December, but momentum was still much softer than the post-crisis highs achieved during 2014," Senior Economist at Markit, Tim Moore, said.

The Canadian dollar traded lower against the U.S. dollar head of the release of Canadian Industrial Product Price Index.

EUR/USD: the currency pair fell to $1.0745

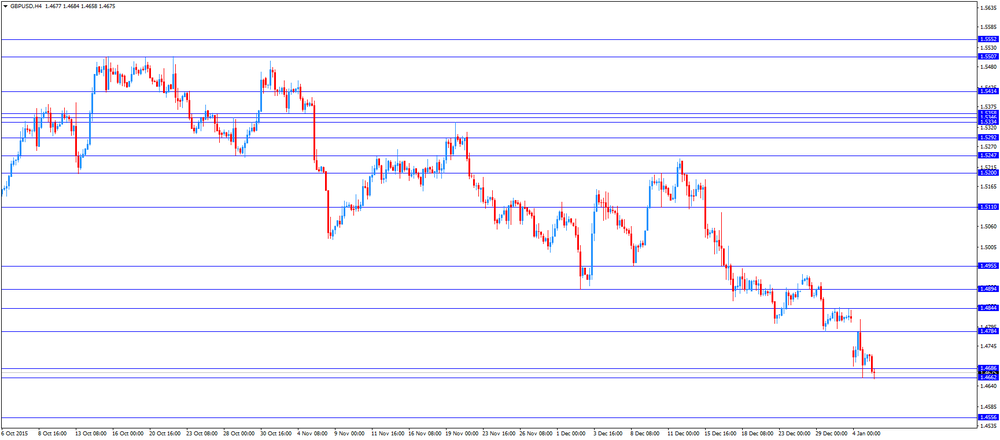

GBP/USD: the currency pair declined to $1.4658

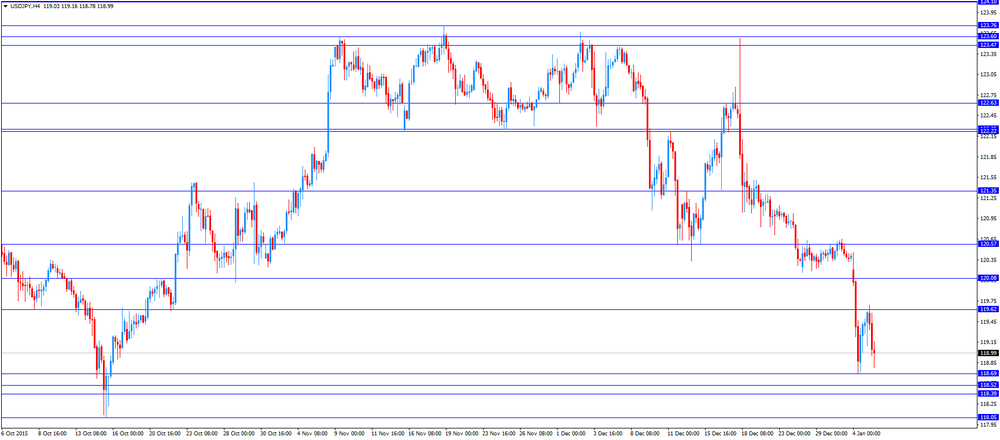

USD/JPY: the currency pair decreased to Y118.78

The most important news that are expected (GMT0):

13:30 Canada Industrial Product Price Index, m/m November -0.5%

13:30 Canada Industrial Product Price Index, y/y November -0.4%

20:45 U.S. Total Vehicle Sales, mln December 18.19 18.1

22:30 Australia AIG Services Index December 48.2

-

13:49

Orders

EUR/USD

Offers 1.0825 1.0840 1.0865 1.0880 1.0900 1.0920 1.0950 1.0965 1.0985 1.1000

Bids 1.0800 1.0780-85 1.0750 1.0730 1.0700 1.0680 1.0665 1.0650

GBP/USD

Offers 1.4725-30 1.4750 1.4765 1.4780 1.4800 1.4820-25 1.4840 1.4865 1.4885 1.4900

Bids 1.4700 1.4680 1.4665 1.4650 1.4630 1.4600 1.4580 1.4565 1.4550

EUR/GBP

Offers 0.7370 0.7385 0.740 0.7420 0.7435 0.7450 0.7475-80 0.7500 0.7530 0.7550

Bids 0.7335 0.7320 0.7300 0.7275-80 0.7250 0.7230 0.7200

EUR/JPY

Offers 129.00 129.20 129.50 129.80 130.00 130.20 130.50 130.80 131.00

Bids 128.75 128.50 128.30 128.00 127.85 127.50 127.30 127.00

USD/JPY

Offers 119.65 119.80 120.00 120.20-25 120.50 120.75 121.00

Bids 119.20 119.00 118.85 118.65 118.50 118.30 118.00 117.80-85 117.50

AUD/USD

Offers 0.7200 0.7220-25 0.7250 0.7280 0.7300 0.7320 0.7350

Bids 0.7180-85 0.7150 0.7120-25 0.7100 0.7085 0.7050

-

12:00

European stock markets mid session: stocks traded lower as the weaker-than-expected Chinese manufacturing data continued to weigh

Stock indices traded lower as the weaker-than-expected Chinese manufacturing data continued to weigh.

Meanwhile, the economic data from Eurozone was mixed. Eurostat released its consumer price inflation data for the Eurozone on Tuesday. The preliminary consumer price inflation in the Eurozone remained unchanged at an annual rate of 0.2% in December, missing expectations for a rise to 0.4%.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco remained unchanged at an annual rate of 0.9% in December, in line with expectations.

Food, alcohol and tobacco prices were up 1.2% in December, non-energy industrial goods prices gained 0.5%, and services prices climbed 1.1%, while energy prices dropped 5.9%.

The Federal Labour Agency released its unemployment figures for Germany on Tuesday. The number of unemployed people in Germany fell by 14,000 in December, exceeding expectations for a 7,000 decline, after a 14,000 decrease in November. November's figure was revised up from a 13,000 decline.

The unemployment rate remained unchanged at 6.3% in December, in line with expectations.

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. rose to 57.8 in December from 55.3 in November, exceeding expectations for an increase to 56.0.

A reading above 50 indicates expansion in the construction sector.

The index was driven by a rise in commercial construction.

"UK construction companies finished 2015 in a positive fashion, as overall output growth recovered from November's seven-month low. Commercial building was the main engine of growth, with this area of activity expanding at the strongest pace since autumn 2014. There was also a rebound in house building activity in December, but momentum was still much softer than the post-crisis highs achieved during 2014," Senior Economist at Markit, Tim Moore, said.

Current figures:

Name Price Change Change %

FTSE 100 6,086.96 -6.47 -0.11 %

DAX 10,207.13 -76.31 -0.74 %

CAC 40 4,495.56 -26.89 -0.59 %

-

11:49

The People’s Bank of China adds 130 billion yuan to the financial system

The People's Bank of China today added 130 billion yuan to the financial system. The central bank offered seven-day reverse repos at an interest rate of 2.25%. It was the biggest injection since September 2015.

-

11:40

Preliminary consumer prices in Italy are flat in December

The Italian statistical office Istat released its preliminary consumer price inflation data for Italy on Tuesday. Preliminary consumer prices in Italy were flat in December, after a 0.4% fall in November.

Prices for services related to recreation including repair and personal care rose 0.3% in December, while prices of durable goods increased 0.4%.

On a yearly basis, consumer prices climbed 0.1% in December, after a 0.1% increase in November.

The increase was mainly driven by higher prices for services related to recreation including repair and personal care. Prices for services related to recreation including repair and personal care rose 0.9% year-on-year in December, after a 0.6% gain in November.

Consumer price inflation excluding unprocessed food and energy prices fell to 0.6% year-on-year in December from 0.7% in November.

-

11:19

Preliminary consumer price inflation in the Eurozone remains unchanged at 0.2% year-on-year in December

Eurostat released its consumer price inflation data for the Eurozone on Tuesday. The preliminary consumer price inflation in the Eurozone remained unchanged at an annual rate of 0.2% in December, missing expectations for a rise to 0.4%.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco remained unchanged at an annual rate of 0.9% in December, in line with expectations.

Food, alcohol and tobacco prices were up 1.2% in December, non-energy industrial goods prices gained 0.5%, and services prices climbed 1.1%, while energy prices dropped 5.9%.

-

11:12

Number of unemployed people in Germany declines by 14,000 in December

The Federal Labour Agency released its unemployment figures for Germany on Tuesday. The number of unemployed people in Germany fell by 14,000 in December, exceeding expectations for a 7,000 decline, after a 14,000 decrease in November. November's figure was revised up from a 13,000 decline.

The unemployment rate remained unchanged at 6.3% in December, in line with expectations.

The number of unemployed people was 1.94 million in November, according to Destatis.

Destatis said that Germany's adjusted unemployment rate remained unchanged at 4.5% in November.

The employment rate climbed to 65.9% in November from 65.4% in October, according to Destatis.

-

11:01

Eurozone: Harmonized CPI ex EFAT, Y/Y, December 0.9% (forecast 0.9%)

-

11:00

Eurozone: Harmonized CPI, Y/Y, December 0.2% (forecast 0.4%)

-

10:45

UK construction PMI climbs to 57.8 in December

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. rose to 57.8 in December from 55.3 in November, exceeding expectations for an increase to 56.0.

A reading above 50 indicates expansion in the construction sector.

The index was driven by a rise in commercial construction.

"UK construction companies finished 2015 in a positive fashion, as overall output growth recovered from November's seven-month low. Commercial building was the main engine of growth, with this area of activity expanding at the strongest pace since autumn 2014. There was also a rebound in house building activity in December, but momentum was still much softer than the post-crisis highs achieved during 2014," Senior Economist at Markit, Tim Moore, said.

-

10:30

United Kingdom: PMI Construction, December 57.8 (forecast 56)

-

10:27

Foreign reserves of the 12 biggest emerging economies slides about 2% in 2015

According to Bloomberg's data, foreign reserves of the 12 biggest emerging economies, excluding China and economies with pegged exchange rates, dropped about 2% to $2.8 trillion in 2015. The actual fall may be smaller as the stronger U.S. dollar led to a lower value of other reserve currencies.

China used more than $400 billion in reserves to stabilise its currency, while most other developing countries such as Russia and Thailand used their foreign reserves to boost their exports.

-

10:20

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0800 (EUR 532m) 1.0865 (904m) 1.0890 (393m)

AUD/USD 0.7250-55 (AUD 442m)

EUR/JPY 130.40 (EUR 350m)

-

10:11

Cleveland Fed President Loretta Mester: it was the right decision to start raising interest rates in December

Cleveland Fed President Loretta Mester said on Sunday that it was the right decision to start raising interest rates in December.

"I fully supported the FOMC's December action: Based on the economic outlook, I thought it was prudent to take the first step on the path of gradual normalization of interest rates," she said.

Mester pointed out that further interest rate hikes will depend on the incoming economic data.

"The actual path the fed funds rate will follow will depend on the economic outlook as informed by incoming information, but according to the FOMC's current assessment of the outlook, monetary policy is expected to remain accommodative for some time to come, with rates expected to move up only gradually to more normal levels," Cleveland Fed president noted.

"Starting on the gradual normalization path now helps ensure that policy doesn't lag too far behind the economy," she added.

-

09:55

Germany: Unemployment Rate s.a. , December 6.3% (forecast 6.3%)

-

09:55

Germany: Unemployment Change, December -14 (forecast -7)

-

08:30

Options levels on tuesday, January 5, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0937 (5496)

$1.0886 (2596)

$1.0860 (1790)

Price at time of writing this review: $1.0811

Support levels (open interest**, contracts):

$1.0788 (2971)

$1.0760 (6107)

$1.0726 (3026)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 55620 contracts, with the maximum number of contracts with strike price $1,1100 (7265);

- Overall open interest on the PUT options with the expiration date January, 8 is 74055 contracts, with the maximum number of contracts with strike price $1,0450 (8017);

- The ratio of PUT/CALL was 1.33 versus 1.33 from the previous trading day according to data from January, 4

GBP/USD

Resistance levels (open interest**, contracts)

$1.5000 (468)

$1.4901 (473)

$1.4803 (419)

Price at time of writing this review: $1.4707

Support levels (open interest**, contracts):

$1.4598 (782)

$1.4499 (207)

$1.4400 (132)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 21225 contracts, with the maximum number of contracts with strike price $1,5100 (2879);

- Overall open interest on the PUT options with the expiration date January, 8 is 19543 contracts, with the maximum number of contracts with strike price $1,5100 (3084);

- The ratio of PUT/CALL was 0.92 versus 0.99 from the previous trading day according to data from January, 4

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:01

Foreign exchange market. Asian session: the yen stabilized

The euro is range-bound ahead of data on consumer prices in the euro zone due at 10:00 GMT. Inflation is likely to show acceleration. The CPI is expected to have risen by 0.3% in December compared to a 0.2% gain in the previous month. Inflation is still well below ECB's 2% target.

The yen stabilized against the U.S. dollar after Chinese stock market rebounded. Yesterday the yen rose by more than 150 points as tensions in the Middle East and weak economic data from China raised demand for this safe-haven currency.

Persistent weakness of China's economy, driven by weaker activity in the manufacturing sector, undermines global commodity demand outlook. This puts pressure on emerging economies, which depend on profits from raw materials. A weaker yuan is also unfavorable for China's trading partners. It suggests that other countries will take steps to lower exchange rates of their currencies too.

EUR/USD: the pair edged down to $1.0827 in Asian trade

USD/JPY: the pair traded within Y119.09-119.69

GBP/USD: the pair rose to $1.4722

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:55 Germany Unemployment Change December -13 -7

08:55 Germany Unemployment Rate s.a. December 6.3% 6.3%

09:30 United Kingdom PMI Construction December 55.3 56

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) December 0.2% 0.4%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) December 0.9% 0.9%

13:30 Canada Industrial Product Price Index, m/m November -0.5%

13:30 Canada Industrial Product Price Index, y/y November -0.4%

20:45 U.S. Total Vehicle Sales, mln December 18.19 18.1

22:30 Australia AIG Services Index December 48.2

-

07:39

Oil prices climbed

West Texas Intermediate futures for February delivery climbed to $36.89 (+0.35%), while Brent crude advanced to $37.35 (+0.35%). Price increases continued to be driven by tensions between two major oil producers Saudi Arabia and Iran. However the global supply glut remained in place keeping lid on gains. In fact, some analysts believe that the conflict will only intensify the oversupply issue as now Saudi Arabia and Iran are even less likely to co-operate in order to support oil prices. Meanwhile Iran is preparing to raise supplies.

-

07:03

Gold extended gains

Gold climbed to $1,077.80 (+0.24%) amid demand for safe-haven assets, which rose after Saudi Arabia cut diplomatic relations with Iran on Sunday in response to an attack of its embassy in Tehran. On Monday Bahrain cut its diplomatic ties with Iran. A selloff in stocks supported bullion too.

Investors traditionally turn to gold at times of crisis and geopolitical tensions, but such gains are normally short-lived. Fundamentals remained unchanged: the dollar is expected to be strong on higher rates, which are expected to grow further in 2016.

-

06:56

Global Stocks: U.S. stock indices dropped

U.S. stock indices posted sharp declines on Monday amid a global stock selloff, which was triggered by tensions between Saudi Arabia and Iran. Recent weak data on China's economy contributed to these declines.

The Dow Jones Industrial Average fell 276.09 points, or 1.6%, to 17,148.94. The S&P 500 lost 31.28 points, or 1.5%, to 2,012.66 (all of its 10 sectors declined). The Nasdaq Composite dropped 104.32 points, or 2.1%, to 4,903.09.

A report from the Institute for Supply Management showed that activity in the U.S. manufacturing sector declined slightly in December. The corresponding index came in at 48.2 points compared to 48.6 points in the previous month.

Meanwhile construction spending unexpectedly declined in November offsetting a gain in the previous month. According to data by the U.S. Commerce Department, construction spending fell by 0.4% in November on a seasonally adjusted basis. Spending was expected to have grown by 0.5% after a 0.3% gain in October (revised from +1.0%). Construction spending rose by 10.5% on a y/y basis.

This morning in Asia Hong Kong Hang Seng fell 0.29%, or 62.59, to 21,264.53. China Shanghai Composite Index stabilized 0.00% with a margin 0.15 gain at 3,296.40. The Nikkei edged up 0.08%, or 14.25, to 18,465.23.

Asian stock indices traded mixed a day after Chinese stocks tumbled 7% amid disappointing economic data. Investors are concerned about China's economic growth and tensions in the Middle East. Japanese stocks climbed after China's markets stabilized.

-

03:03

Nikkei 225 18,427.93 -23.05 -0.12 %, Hang Seng 21,388.66 +61.54 +0.29 %, Shanghai Composite 3,198.42 -97.84 -2.97 %

-

01:04

Commodities. Daily history for Jan 4’2016:

(raw materials / closing price /% change)

Oil 36.88 +0.33%

Gold 1,073.90 -0.12%

-

01:03

Stocks. Daily history for Sep Jan 4’2016:

(index / closing price / change items /% change)

Nikkei 225 18,450.98 -582.73 -3.06 %

Hang Seng 21,327.12 -587.28 -2.68 %

Shanghai Composite 3,296.54 -242.64 -6.86 %

FTSE 100 6,093.43 -148.89 -2.39 %

CAC 40 4,522.45 -114.61 -2.47 %

Xetra DAX 10,283.44 -459.57 -4.28 %

S&P 500 2,012.66 -31.28 -1.53 %

NASDAQ Composite 4,903.09 -104.32 -2.08 %

Dow Jones 17,148.94 -276.09 -1.58 %

-

01:03

Currencies. Daily history for Jan 4’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0830 -0,48%

GBP/USD $1,4713 -0,71%

USD/CHF Chf1,002 +0,78%

USD/JPY Y119,43 -0,82%

EUR/JPY Y129,36 -1,29%

GBP/JPY Y175,73 -1,53%

AUD/USD $0,7188 -1,66%

NZD/USD $0,6750 -1,33%

USD/CAD C$1,3952 +0,67%

-

00:00

Schedule for today, Tuesday, Jan 5’2016:

(time / country / index / period / previous value / forecast)

08:55 Germany Unemployment Change December -13 -6

08:55 Germany Unemployment Rate s.a. December 6.3% 6.3%

09:30 United Kingdom PMI Construction December 55.3

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) December 0.2% 0.3%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) December 0.9%

13:30 Canada Industrial Product Price Index, m/m November -0.5%

13:30 Canada Industrial Product Price Index, y/y November -0.4%

20:45 U.S. Total Vehicle Sales, mln December 18.19 18.1

22:30 Australia AIG Services Index December 48.2

-