Noticias del mercado

-

18:14

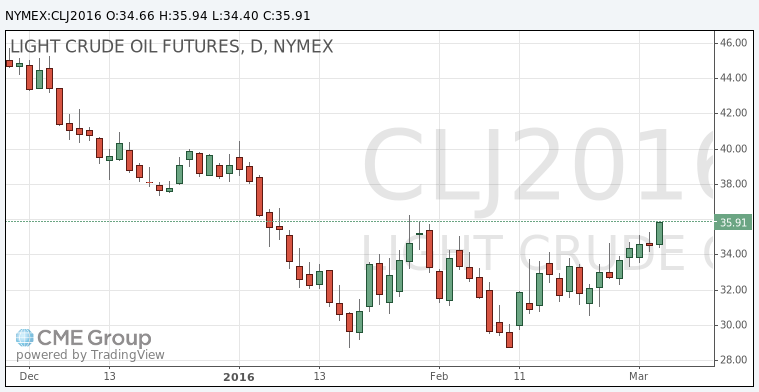

Oil prices increase ahead the release of the number of active U.S. rigs

Oil prices rose ahead the release of the number of active U.S. rigs later in the day. The oil driller Baker Hughes reported on last Friday that the number of active U.S. rigs by 13 rigs to 400 last week. It was the lowest level since December 2009.

Hopes that top oil producers could cooperate to stabilise the oil market continued to support oil prices. Nigeria's petroleum minister Emmanuel Ibe Kachikwu said on Thursday that the Organization of the Petroleum Exporting Countries (OPEC) and non-OPEC members will meet in Moscow on March 20.

WTI crude oil for April delivery increased to $35.91 a barrel on the New York Mercantile Exchange.

Brent crude oil for April rose to $37.39 a barrel on ICE Futures Europe.

-

18:08

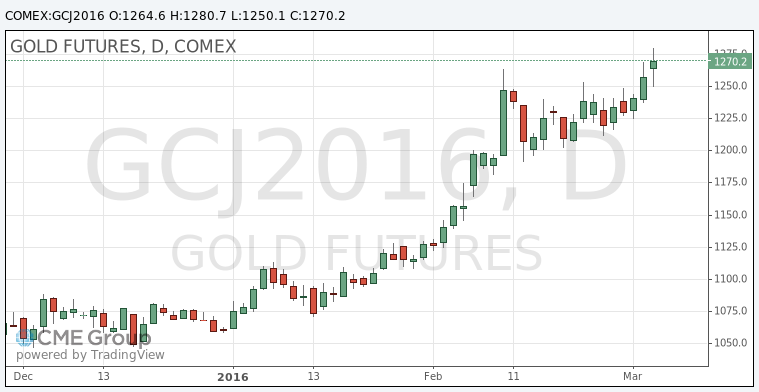

Gold increases on a weaker the U.S. dollar

Gold price rose on a weaker the U.S. dollar. The U.S. dollar fell against other currencies on the mixed U.S. labour market data. The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 242,000 jobs in February, exceeding expectations for a rise of 190,000 jobs, after a gain of 172,000 jobs in January. January's figure was revised up from a rise of 151,000 jobs.

The increase was driven by rises in health care and social assistance, retail trade, food services and drinking places, and private educational services.

The U.S. unemployment rate remained unchanged at 4.9% in February, the lowest level since February 2008, in line with expectations.

Average hourly earnings dropped 0.1% in February, missing forecasts of a 0.2% gain, after a 0.5% rise in January.

April futures for gold on the COMEX today rose to 1279.90 dollars per ounce.

-

15:21

U.S. unemployment rate remains unchanged at 4.9% in February, 242,000 jobs are added

The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 242,000 jobs in February, exceeding expectations for a rise of 190,000 jobs, after a gain of 172,000 jobs in January. January's figure was revised up from a rise of 151,000 jobs.

The increase was driven by rises in health care and social assistance, retail trade, food services and drinking places, and private educational services.

The services sector added 245,000 jobs in February, while the manufacturing sector shed 16,000 jobs.

Construction added 19,000 in February, while mining sector shed 18,000 jobs.

The U.S. unemployment rate remained unchanged at 4.9% in February, the lowest level since February 2008, in line with expectations.

Average hourly earnings dropped 0.1% in February, missing forecasts of a 0.2% gain, after a 0.5% rise in January.

The labour-force participation rate increased to 62.9% in February from 62.7% in January.

A drop in wages could lead to a delay in further interest rate hikes by the Fed.

-

10:38

National People's Congress in China: Chinese officials will likely announce their plans for reform

The National People's Congress will begin in Beijing tomorrow. Chinese officials will likely announce their plans for reform.

Market participants speculate that the government will revise its growth forecasts. Observers expect that the government will set its annual GDP target within a range of 6.5% - 7%.

-

10:24

Canada’s government sells almost all gold reserves

The Canadian government sold almost all gold reserves. Canada's Finance Department said on Thursday that it sold off 21,851 ounces of gold coins in February. The government still has 77 ounces of gold.

A department spokesman said that it was the government's strategy to diversify its portfolio.

-

10:11

A former adviser to the People’s Bank of China, Li Daokui: the Chinese was likely to expand around 6.7% this year

A former adviser to the People's Bank of China (PBoC), Li Daokui, said on Thursday that the Chinese was likely to expand around 6.7% this year.

"The main challenge this year is how to make sure policies and reform get up to speed," he noted.

-

00:37

Commodities. Daily history for Mar 3’2016:

(raw materials / closing price /% change)

Oil 34.69 +0.35%

Gold 1,264.90 +0.53%

-