Noticias del mercado

-

16:08

Canada’s Ivey purchasing managers’ index drops to 53.4 in February

Canada's seasonally adjusted Ivey purchasing managers' index dropped to 53.4 in February from 66.0 in January. Analysts had expected the index to decline to 59.0.

A reading above 50 indicates a rise in the pace of activity, below 50 indicates a contraction in the pace of activity.

The supplier deliveries index was down to 49.4 in February from 51.1 in January, while employment index fell to 50.3 in 55.1.

The prices index was slid to 57.8 in February from 71.6 in January, while inventories plunged to 49.9 from 61.4.

-

16:01

Canada: Ivey Purchasing Managers Index, February 53.4 (forecast 59)

-

15:44

Labour productivity of Canadian businesses rises by 0.1% in the fourth quarter

Statistics Canada released labour productivity data of Canadian businesses on Friday. The labour productivity of Canadian businesses rose by 0.1% in the fourth quarter, exceeding expectations for a flat reading, after a 0.4% rise in the third quarter. The third quarter's figure was revised up from a 0.1% gain.

The increase was driven by a rise in productivity of service-producing businesses, which was up 0.4% in the fourth quarter.

Productivity of goods-producing businesses fell 0.6%.

For 2015 as a whole, the labour productivity in Canadian businesses climbed by 0.2%, after a 2.5% rise in 2014.

-

15:30

U.S. trade deficit widens to $45.68 billion in January

The U.S. Commerce Department released the trade data on Friday. The U.S. trade deficit widened to $45.68 billion in January from a deficit of $44.7 billion in December. December's figure was revised down from a deficit of $43.36 billion.

Analysts had expected a trade deficit of $44.0 billion.

The rise of a deficit was driven by a drop in exports. A stronger U.S. dollar and a weak demand abroad weighed on exports.

Exports fell by 2.1% in January, while imports decreased by 1.3%.

-

15:21

U.S. unemployment rate remains unchanged at 4.9% in February, 242,000 jobs are added

The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 242,000 jobs in February, exceeding expectations for a rise of 190,000 jobs, after a gain of 172,000 jobs in January. January's figure was revised up from a rise of 151,000 jobs.

The increase was driven by rises in health care and social assistance, retail trade, food services and drinking places, and private educational services.

The services sector added 245,000 jobs in February, while the manufacturing sector shed 16,000 jobs.

Construction added 19,000 in February, while mining sector shed 18,000 jobs.

The U.S. unemployment rate remained unchanged at 4.9% in February, the lowest level since February 2008, in line with expectations.

Average hourly earnings dropped 0.1% in February, missing forecasts of a 0.2% gain, after a 0.5% rise in January.

The labour-force participation rate increased to 62.9% in February from 62.7% in January.

A drop in wages could lead to a delay in further interest rate hikes by the Fed.

-

14:54

Canada's trade deficit widens to C$0.66 billion in January

Statistics Canada released the trade data on Friday. Canada's trade deficit widened to C$0.66 billion in January from a deficit of C$0.63 billion in December. December's figure was revised down from a deficit of C$0.59 billion.

Analysts had expected a trade deficit of C$1.05 billion.

The rise in deficit was driven by higher imports.

Exports climbed 1.0% in January.

Exports of aircraft and other transportation equipment and parts dropped by 35.2% in January, exports of consumer goods increased 13.7%, exports of energy products fell by 7.7%, while exports of motor vehicles and parts were up 7.2%.

Imports rose 1.1% in January.

Imports of motor vehicles and parts slid by 16.1% in January, imports of motor vehicles and parts increased by 3.3%, while imports of consumer goods rose 1.8%.

-

14:40

Option expiries for today's 10:00 ET NY cut

USDJPY: 112.00 (USD 460m) 113.00 (506m) 113.95-114.00 (1.05bln) 114.75 (210m0 115.00 (495m)

EURUSD: 1.0775 (EUR 265m) 1.0800 (343m) 1.0850 (490m) 1.0900-10 (2.64bln)1.0920-25 (380m) 1.0960-65 (506m) 1.0980 (319m) 1.1000 (667m) 1.1100 (534m)

GBPUSD: 1.3900 (GBP 394m) 1.4075 (358m) 1.4200 (303m) 1.4250 (514m)

EURGBP: 0.7400 (EUR 1.12bln)

USDCHF: 0.9915-25 (USD 510m)

EURCHF 1.0850 (EUR 283m)

AUDUSD: 0.7100 (AUD 314m) 0.7150-55 (642m) 0.7200 (487m) 0.7250 (205m)0.7300 (1.01bln) 0.7350-55 0.7400 (203m)

USDCAD 1.3350 (USD 565m) 1.3370 (321m) 1.3440 (210m) 1.3645-55 (725m)

NZDUSD 0.6550 (302m) 0.6700 (468m)

AUDJPY: 83.50 (AUD 483m)

-

14:31

U.S.: Average workweek, February 34.4 (forecast 34.6)

-

14:31

Canada: Trade balance, billions, January -0.66 (forecast -1.05)

-

14:30

Canada: Labor Productivity, Quarter IV 0.1% (forecast 0%)

-

14:30

U.S.: Unemployment Rate, February 4.9% (forecast 4.9%)

-

14:30

U.S.: International Trade, bln, January -45.68 (forecast -44)

-

14:30

U.S.: Average hourly earnings , February -0.1% (forecast 0.2%)

-

14:30

U.S.: Nonfarm Payrolls, February 242 (forecast 190)

-

14:16

Foreign exchange market. European session: the U.S. dollar traded mixed to lower against the most major currencies ahead of the release of the U.S. labour market data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Retail Sales, M/M January 0.0% 0.4% 0.3%

01:30 Japan Labor Cash Earnings, YoY February -0.2% Revised From 0.1% 0.2% 0.4%

The U.S. dollar traded mixed to lower against the most major currencies ahead of the release of the U.S. labour market data. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 4.9% in February. The U.S. economy is expected to add 190,000 jobs in February, after adding 151,000 jobs in January.

The U.S. trade deficit is expected to widen to $44.0 billion in January from $43.36 billion in December.

The euro traded higher against the U.S. dollar in the absence of any major economic reports from the Eurozone.

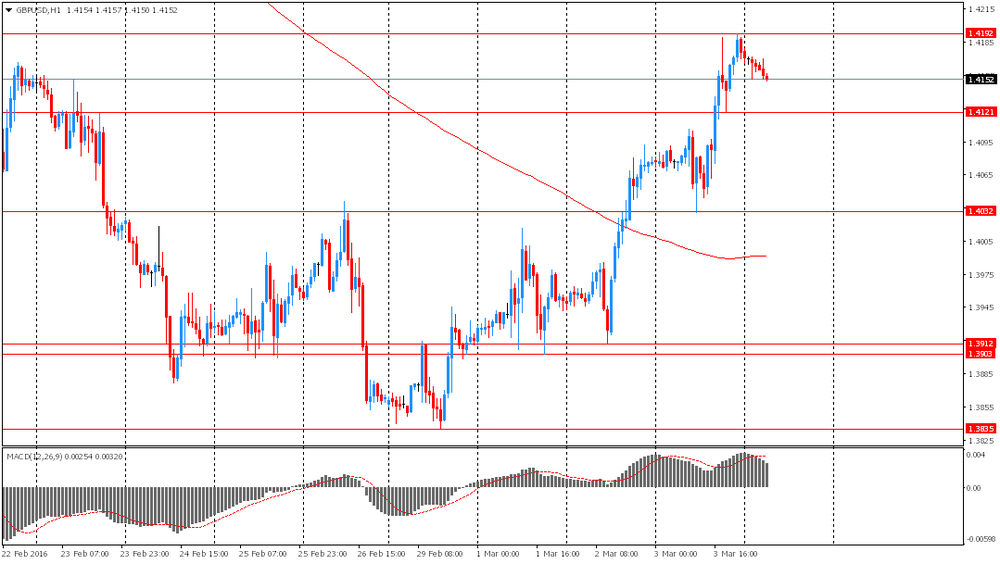

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded mixed against the U.S. dollar ahead of the Canadian economic data. The Canadian trade deficit is expected to widen to C$1.05 billion in January from C$0.59 billion in December.

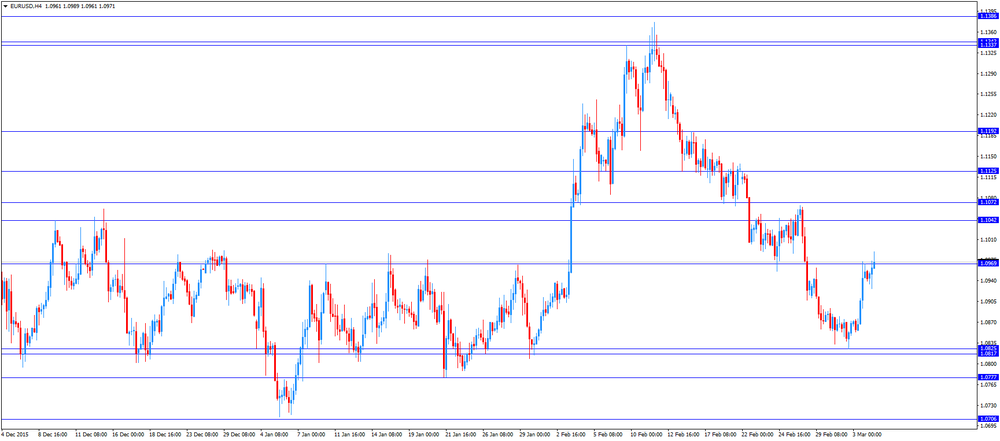

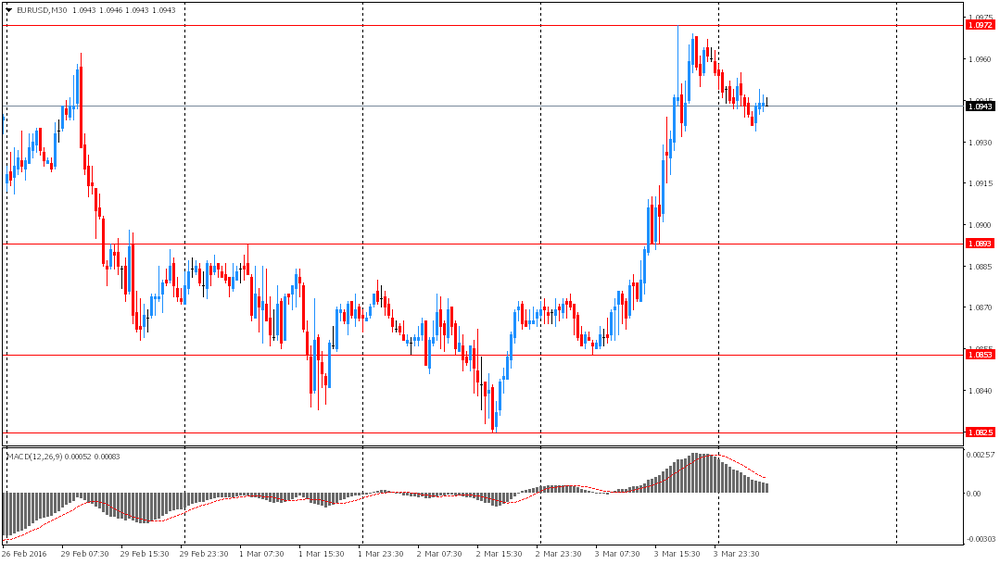

EUR/USD: the currency pair rose to $1.0989

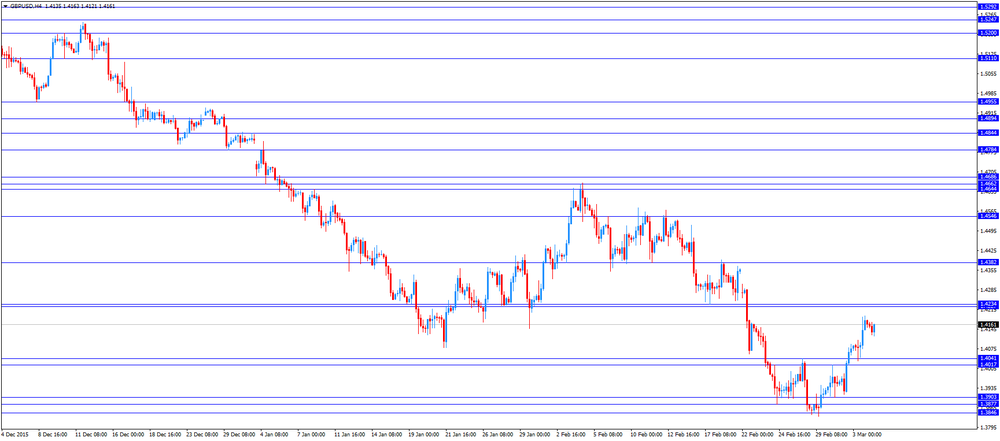

GBP/USD: the currency pair traded mixed

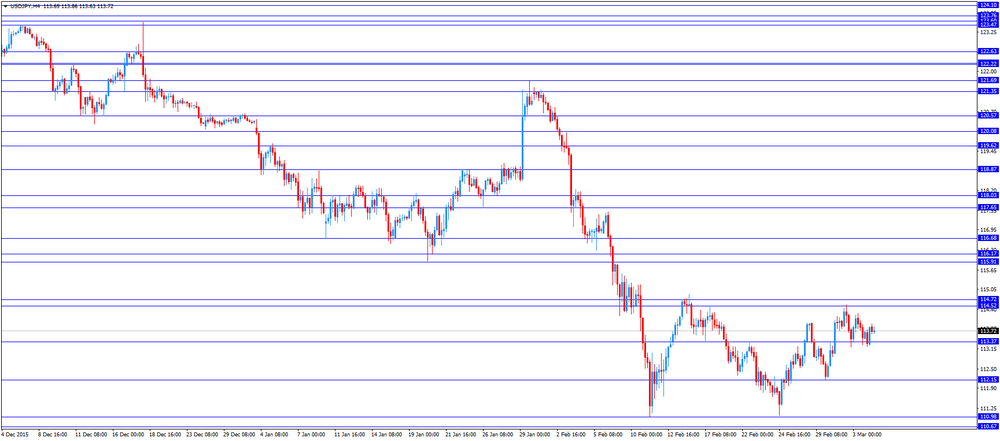

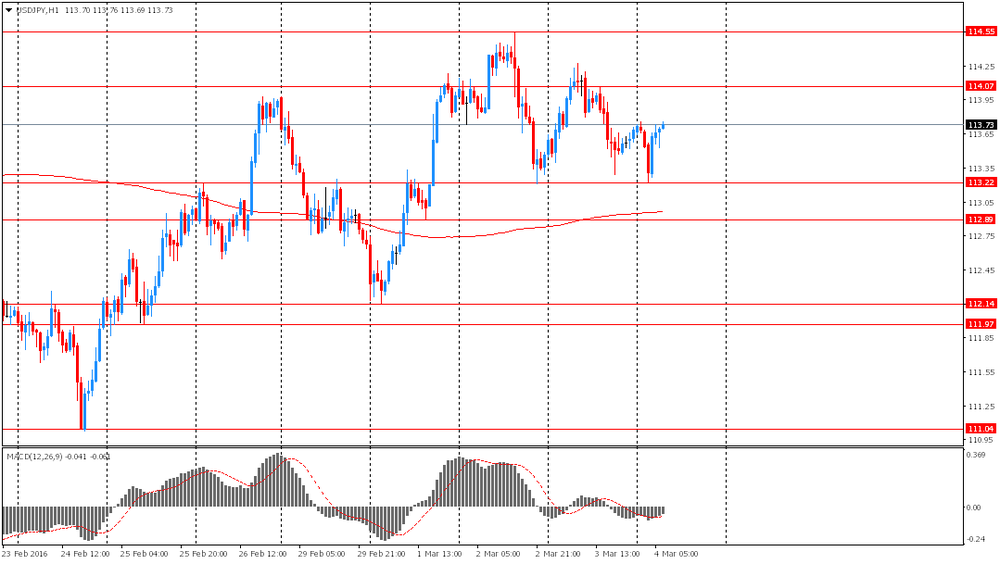

USD/JPY: the currency pair fell to Y113.73

The most important news that are expected (GMT0):

13:30 Canada Trade balance, billions January -0.59 -1.05

13:30 U.S. International Trade, bln January -43.36 -44

13:30 U.S. Average hourly earnings February 0.5% 0.2%

13:30 U.S. Unemployment Rate February 4.9% 4.9%

13:30 U.S. Nonfarm Payrolls February 151 190

15:00 Canada Ivey Purchasing Managers Index February 66 59

-

14:00

Orders

EUR/USD

Ордера на продажу: 1.0955-60 1.0975-80 1.1000 1.1025-30.1050 1.1080 1.1100

Bids 1.0920 1.0900 1.08875-80 1.0850 1.0830 1.0800 1.0785 1.0750 1.0730 1.0700

GBP/USD

Offers 1.4150-55 1.4170 1.4185 1.4200 1.4220-25 1.4250 1.4280 1.4300

Bids 1.4120 1.4100 1.4070 1.4045-50 1.4020 1.4000 1.3985 1.3945-50 1.3920 1.3900

EUR/JPY

Offers 124.50 124.80 125.00 125.30 125.50 125.75 126.00

Bids 124.00 123.60 123.20 123.00 122.50 122.30 122.00

EUR/GBP

Offers 0.7750 0.7760 0.7775-80 0.7800 0.7820-25 0.7850

Bids 0.7720 0.7700 0.7675 0.7650 0.7625-30 0.7600

USD/JPY

Offers 114.00 114.25-30 114.50 114.75-80 115.00 115.20 115.35 115.50

Bids 113.75 113.60 113.50 113.20 113.00 112.70-75 112.50 112.30 112.00

AUD/USD

Offers 0.7380-85 0.7400 0.7430 0.7450 0.7475 0.7500

Bids 0.7350 0.7330 0.7300 0.7280 0.7260 0.7220 0.7200

-

11:53

Germany's construction PMI increases to 59.6 in February, the highest level since March 2011

Markit Economics released construction purchasing managers' index (PMI) for Germany on Friday. Germany's construction PMI increased to 59.6 in February from 55.5 in. it was the highest level since March 2011.

A reading above 50 indicates expansion in the sector.

The index was driven by a rise in new business and employment.

"Residential building activity remained the main pillar of the upturn, increasing at the strongest rate in the sixteen-and a-half year survey history," an economist at Markit, Oliver Kolodseike, said.

-

11:48

Germany's retail PMI climbs to 52.5 in February

Markit Economics released its retail purchasing managers' index (PMI) for Germany on Friday. Germany's retail PMI climbed to 52.5 in February from 49.5 in January. It was the highest level since September 2015.

The increase was driven by rises in buying activity, inventories and employment.

"February's survey results provided some positive news for German retailers, as sales rose at the strongest rate since last September, suggesting that consumers were willing to open their purse strings again," an economist at Markit, Oliver Kolodseike, said.

-

11:43

Eurozone's retail PMI rises to 50.1 in February

Markit Economics released its retail purchasing managers' index (PMI) for Eurozone on Friday. Eurozone's construction purchasing managers' index (PMI) rise to 50.1 in February from 48.9 in January.

A reading above 50 indicates expansion in the sector, a reading below 50 indicates contraction.

Higher sales in Germany offset lower sales in France and Italy.

"It was once again left to German consumers to support overall retail sales, with a rebound in the euro area's largest economy just enough to counteract continuing weakness in both France and Italy," an economist at Markit, Phil Smith, said.

-

11:36

Italian final GDP rises 0.1% in the fourth quarter

The Italian statistical office Istat released its final gross domestic product (GDP) data for Italy on Friday. The Italian final GDP increased 0.1% in the fourth quarter, in line with the preliminary reading, after a 0.2% rise in the third quarter.

Final consumption expenditure climbed by 0.3% in the fourth quarter, gross fixed capital formation rose by 0.8%, imports increased by 1.0%, while exports were up 1.3%.

On a yearly basis, Italian final GDP rose 1.0% in the fourth quarter, in line with the preliminary reading, after a 0.8% increase in the third quarter.

-

11:32

Makoto Sakurai will replace Sayuri Shirai in the Board of the Bank of Japan

Makoto Sakurai, 70, will replace Sayuri Shirai, 53, in the Board of the Bank of Japan (BoJ). Shirai voted against the implementation of negative rates at the central bank's monetary policy meeting in January.

Sakurai is an international finance researcher.

-

11:24

Labour cash earnings in Japan rise 0.4% year-on-year in January

Japan's Ministry of Health, Labour and Welfare released its labour cash earnings data on Friday. Labour cash earnings in Japan rose 0.4% year-on-year in January, exceeding expectations for a 0.2% increase, after a 0.2% decline in December. December's figure was revised down from a 0.1% gain.

Contractual earnings were flat year-on-year in January, while special cash earnings gained 0.1%.

Total real wages climbed 0.4% in January, after a 0.2% drop in December.

-

11:15

Retail sales in Australia rise 0.3% in January

The Australian Bureau of Statistics released its retail sales data on Friday. Retail sales in Australia increased 0.3% in January, missing expectations for a 0.4% rise, after a flat reading in December.

Household goods sales were up 1.0% in January, department stores sales dropped 1.3% and food sales declined 0.2%, while clothing, footwear and personal accessory sales climbed 0.1%.

On a yearly basis, retail sales climbed 4.0% in January, after a 4.2% rise in December.

-

11:05

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy fall to 43.6 in in the week ended February 28

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy fell to 43.6 in in the week ended February 28 from 44.2 the prior week.

The drop was driven by declines in 2 of 3 sub-indexes. The measure of views of the economy declined to 35.0 from 35.5, the buying climate index was down to 39.9 from 41.7, while the personal finances index rose to 56.0 from 55.5.

-

10:58

Bank of Japan Governor Haruhiko Kuroda does not consider further interest rate cuts

Bank of Japan (BoJ) Governor Haruhiko Kuroda said on Friday that he did not consider further interest rate cuts. He repeated that the central bank could add further stimulus measures if needed.

"The BOJ will use three dimensions of policy choices, which include quantity, quality and rates, effectively," Kuroda noted.

-

10:38

National People's Congress in China: Chinese officials will likely announce their plans for reform

The National People's Congress will begin in Beijing tomorrow. Chinese officials will likely announce their plans for reform.

Market participants speculate that the government will revise its growth forecasts. Observers expect that the government will set its annual GDP target within a range of 6.5% - 7%.

-

10:11

A former adviser to the People’s Bank of China, Li Daokui: the Chinese was likely to expand around 6.7% this year

A former adviser to the People's Bank of China (PBoC), Li Daokui, said on Thursday that the Chinese was likely to expand around 6.7% this year.

"The main challenge this year is how to make sure policies and reform get up to speed," he noted.

-

09:21

Option expiries for today's 10:00 ET NY cut

USD/JPY: 112.00 (USD 460m) 113.00 (506m) 113.95-114.00 (1.05bln) 114.75 (210m0 115.00 (495m)

EUR/USD: 1.0775 (EUR 265m) 1.0800 (343m) 1.0850 (490m) 1.0900-10 (2.64bln) 1.0920-25 (380m) 1.0960-65 (506m) 1.0980 (319m) 1.1000 (667m) 1.1100 (534m)

GBP/USD: 1.3900 (GBP 394m) 1.4075 (358m) 1.4200 (303m) 1.4250 (514m)

EUR/GBP: 0.7400 (EUR 1.12bln)

USD/CHF: 0.9915-25 (USD 510m)

EUR/CHF 1.0850 (EUR 283m)

AUD/USD: 0.7100 (AUD 314m) 0.7150-55 (642m) 0.7200 (487m) 0.7250 (205m) 0.7300 (1.01bln) 0.7350-55 0.7400 (203m)

USD/CAD 1.3350 (USD 565m) 1.3370 (321m) 1.3440 (210m) 1.3645-55 (725m)

NZD/USD 0.6550 (302m) 0.6700 (468m)

AUD/JPY: 83.50 (AUD 483m) -

08:34

Options levels on friday, March 4, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1154 (4379)

$1.1106 (3818)

$1.1022 (6488)

Price at time of writing this review: $1.0948

Support levels (open interest**, contracts):

$1.0884 (7096)

$1.0798 (7708)

$1.0699 (6337)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 75896 contracts, with the maximum number of contracts with strike price $1,1000 (6488);

- Overall open interest on the PUT options with the expiration date March, 4 is 90259 contracts, with the maximum number of contracts with strike price $1,0800 (7708);

- The ratio of PUT/CALL was 1.19 versus 1.22 from the previous trading day according to data from March, 3

GBP/USD

Resistance levels (open interest**, contracts)

$1.4400 (664)

$1.4301 (1500)

$1.4203 (554)

Price at time of writing this review: $1.4154

Support levels (open interest**, contracts):

$1.4098 (1570)

$1.3999 (2049)

$1.3900 (1651)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 32766 contracts, with the maximum number of contracts with strike price $1,4350 (1966);

- Overall open interest on the PUT options with the expiration date March, 4 is 31343 contracts, with the maximum number of contracts with strike price $1,4350 (2954);

- The ratio of PUT/CALL was 0.96 versus 1.01 from the previous trading day according to data from March, 3

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:21

Asian session: The yen fell

The Australian dollar's rally continued overnight, reaching levels not seen since the start of the year.

Absent releases in Euroland today, market participants expect the usual pre-Payrolls lull to prevail ahead of the NA session. Consensus expects the US economy to have added 190K jobs during February vs. 151K previous.

The unemployment rate is expected to remain unchanged at 4.9%, but even a small jump higher would not be a problem as long as the labour force participation rate increases. Discouraged unemployed who have stopped looking for a work and entering the labour force would be expected to temporarily increase the unemployment number.

EUR/USD: during the Asian session the pair traded in the range of $1.0935-55

GBP/USD: during the Asian session the pair traded in the range of $1.4150-70

USD/JPY: during the Asian session the pair was trading around Y113.50

-

02:29

Japan: Labor Cash Earnings, YoY, February 0.4% (forecast 0.2%)

-

01:46

Australia: Retail Sales, M/M, January 0.3% (forecast 0.4%)

-

00:31

Currencies. Daily history for Mar 3’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0956 +0,81%

GBP/USD $1,4176 +0,71%

USD/CHF Chf0,992 -0,44%

USD/JPY Y113,68 +0,19%

EUR/JPY Y124,53 +0,99%

GBP/JPY Y161,13 +0,87%

AUD/USD $0,7350 +0,79%

NZD/USD $0,6723 +0,73%

USD/CAD C$1,3402 -0,10%

-

00:01

Schedule for today, Friday, Mar 4’2016:

(time / country / index / period / previous value / forecast)

00:30 Australia Retail Sales, M/M January 0.0% 0.4%

01:30 Japan Labor Cash Earnings, YoY February 0.1% 0.2%

13:30 Canada Labor Productivity Quarter IV 0.1% 0%

13:30 Canada Trade balance, billions January -0.59 -1.05

13:30 U.S. Average workweek February 34.6 34.6

13:30 U.S. International Trade, bln January -43.36 -44

13:30 U.S. Average hourly earnings February 0.5% 0.2%

13:30 U.S. Unemployment Rate February 4.9% 4.9%

13:30 U.S. Nonfarm Payrolls February 151 190

15:00 Canada Ivey Purchasing Managers Index February 66 59

-