Noticias del mercado

-

17:57

Dallas Federal Reserve President Robert Kaplan: the Fed should be patient in raising its interest rates further

Dallas Federal Reserve President Robert Kaplan said on Thursday on the Fed should be patient in raising its interest rates further.

"While I believe that excessive accommodation carries a cost in terms of distortions and imbalances in hiring, asset allocation and investment decisions, I also believe that, at this juncture, the Fed needs to show patience in decisions to remove accommodation," he said.

"I believe that the Fed should avoid having a predetermined mindset regarding the path of policy," Kaplan added.

Dallas Federal Reserve president expects the U.S. economy to be resilient in 2016.

He pointed out that he did not expect the oil market to balance until mid-2017.

Kaplan is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

17:36

Australian Industry Group’s services purchasing managers’ index for Australia rises to 51.8 in February

The Australian Industry Group (AiG) released its services purchasing managers' index (PMI) for Australia on the late Wednesday evening. The index rose to 51.8 in February from 48.4 in January.

A reading above 50 indicates expansion in the sector, while a reading below 50 indicates contraction in the sector.

Four of the five activity sub-indexes were above 50 points in February.

Main contributor to the rise were sales and new orders sub-indexes.

-

17:02

Spain’s services PMI falls to 54.1 in February, the lowest level since November 2014

Markit Economics released services purchasing managers' index (PMI) for Spain on Thursday. Spain's services purchasing managers' index (PMI) fell to 54.1 in February from 54.6 in January. It was the lowest level since November 2014.

The decline was driven by a slower growth in new business. Political uncertainty also weighed on the index.

"While the latest set of PMI data for Spanish services companies paint a broadly positive picture of the state of the sector, there are some headwinds which appear to be limiting the scope for growth," Senior Economist at Markit Andrew Harker said.

-

16:53

Italy’s services PMI increases to 53.8 in February

Markit/ADACI's services purchasing managers' index (PMI) for Italy increased to 53.8 in February from 53.6 in January.

A reading above 50 indicates expansion in the sector.

The index was driven by a faster growth in new business.

"The service sector maintained growth momentum into February, with businesses recording higher levels of activity as well as a faster rise in incoming new work," an economist at Markit Phil Smith said.

-

16:34

Final U.S. services PMI drops to 49.7 in February

Markit Economics released final services purchasing managers' index (PMI) for the U.S. on Thursday. Final U.S. services purchasing managers' index (PMI) fell to 49.7 in February from 53.2 in January, down from the preliminary reading of 49.8. It was the lowest level since October 2013.

A reading above 50 indicates expansion in the sector, a reading below 50 indicates contraction of activity.

The index was driven by a decline in new business.

"The Markit PMIs are signalling a stagnation of the economy in February, suggesting growth has deteriorated further since late last year," Chief Economist at Markit Chris Williamson said.

-

16:20

U.S. factory orders rise 1.6% in January

The U.S. Commerce Department released factory orders data on Thursday. Factory orders in the U.S. rose 1.6% in January, missing expectations for a 2.0% gain, after a 2.9% decline in December. It was the biggest rise since June 2015.

The increase was mainly driven by a rise in orders for transportation equipment. Orders for transportation equipment climbed 11.4% in January, while orders for automobiles and parts climbed 2.9%.

Durable goods orders were jumped 4.7% in January.

Factory orders excluding transportation declined 0.2% in January, after a 0.9% drop in December. December's figure was revised down from a 0.8% fall.

-

16:12

ISM non-manufacturing purchasing managers’ index falls to 53.4 in February

The Institute for Supply Management released its non-manufacturing purchasing managers' index for the U.S. on Thursday. The index fell to 53.4 in February from 53.5 in January, beating expectations for a decrease to 53.2.

A reading above 50 indicates a growth in the service sector.

The ISM's new orders index slid to 55.5 in February from 56.5 in January.

The business activity/production index increased to 57.8 in February from 53.9 in January.

The ISM's employment index was down to 49.7 in February from 52.1 in January.

The prices index declined to 45.5 in February from 46.4 in January.

-

16:01

U.S.: Factory Orders , January 1.6% (forecast 2%)

-

16:00

U.S.: ISM Non-Manufacturing, February 53.4 (forecast 53.2)

-

15:45

U.S.: Services PMI, February 49.7 (forecast 49.8)

-

15:18

Final productivity in the U.S. non-farm businesses declines at a 2.2% annual rate in the fourth quarter

The U.S. Labor Department released its final non-farm productivity figures on Thursday. Final productivity in the U.S. non-farm businesses declined at a 2.2% annual rate in the fourth quarter, up from the preliminary reading of a 3.0% drop, after a 2.1% increase in the third quarter. It was the biggest drop since the first quarter of 2014.

The upward revision was driven by higher nonfarm business output, which rose 1.0% in the fourth quarter, up from the preliminary reading of a 0.1% gain.

Hours worked increased by 3.2% in the fourth quarter, down from the preliminary reading of a 3.3% rise.

In 2015 as whole, productivity rose 0.7%, the weakest rise since 2013, up from the preliminary reading of a 0.6% gain, after a 0.7% increase in 2014.

Final unit labour costs climbed 3.3% in the fourth quarter, up from the preliminary reading of a 4.5% increase, after a 1.9 gain in the third quarter.

In 2015 as whole, labour costs climbed 2.1, down from the preliminary reading of a 2.4% rise, after a 2.0% gain.

-

14:55

Option expiries for today's 10:00 ET NY cut

USDJPY: 112.75 (USD 1.3bln) 113.50 (584m) 114.00-05 (456m) 115.00 (780m)

EURUSD: 1.0700 (EUR 342m) 1.0800 (379m) 1.0945-50 (556m) 1.0975 (222m) 1.1000 (734m) 1.1100 (1.8bln)

GBPUSD: 1.3975 (GBP 444m)

EURGBP: 0.7500-05 (EUR 307m) 0.7545 (317m) 0.7600 (360m)

USDCHF: 0.9900 (USD 190m) 0.9935 (220m)

AUDUSD: 0.6900 (AUD 1.76bln) 0.7170-75 (396m)

USDCAD 1.3500 (USD 410m) 1.3600 (2.2bln) 1.3865 (400m)

NZDUSD 0.6650-55 (314m) 0.6700 (NZD 1.35bln)

AUDNZD 1.0710 (AUD 275m) 1.0900 (203m)

AUDJPY: 85.10 (AUD 411m)

-

14:46

Initial jobless claims increase to 278,000 in the week ending February 27

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending February 27 in the U.S. increased by 6,000 to 278,000 from 272,000 in the previous week.

Analysts had expected jobless claims to decline to 271,000.

Jobless claims remained below 300,000 the 52nd straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims climbed by 3,000 to 2,257,000 in the week ended February 20.

-

14:30

U.S.: Initial Jobless Claims, February 278 (forecast 271)

-

14:30

U.S.: Nonfarm Productivity, q/q, Quarter IV -2.2% (forecast -3.2%)

-

14:30

U.S.: Continuing Jobless Claims, February 2257 (forecast 2250)

-

14:30

U.S.: Unit Labor Costs, q/q, Quarter IV 3.3% (forecast 4.7%)

-

14:20

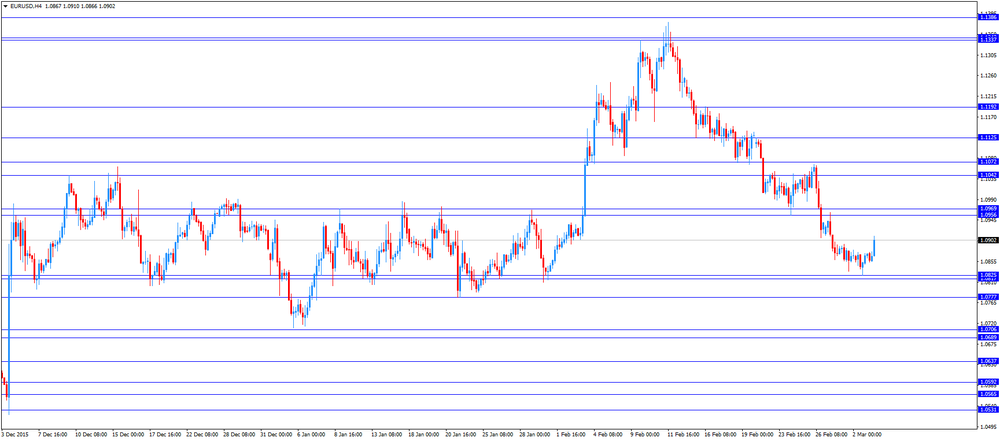

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the release of the mixed economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Trade Balance January -3.52 Revised From -3.535 -3.1 -2.94

01:45 China Markit/Caixin Services PMI February 52.4 52.6 51.2

07:00 United Kingdom Nationwide house price index February 0.3% 0.5% 0.3%

07:00 United Kingdom Nationwide house price index, y/y February 4.4% 5% 4.8%

08:30 United Kingdom Halifax house price index February 1.7% 0% -1.4%

08:30 United Kingdom Halifax house price index 3m Y/Y February 9.7% 10.4% 9.7%

08:50 France Services PMI (Finally) February 50.3 49.8 49.2

08:55 Germany Services PMI (Finally) February 55 55.1 55.3

09:00 Eurozone Services PMI (Finally) February 53.6 53 53.3

09:30 United Kingdom Purchasing Manager Index Services February 55.6 55.1 52.7

10:00 Eurozone Retail Sales (YoY) January 2.1% Revised From 1.4% 1.3% 2.0%

10:00 Eurozone Retail Sales (MoM) January 0.6% Revised From 0.3% 0.1% 0.4%

The U.S. dollar traded mixed to lower against the most major currencies ahead of the release of the U.S. economic data. The ISM non-manufacturing purchasing managers' index is expected to fall to 53.2 in February from 53.5 in January.

The number of initial jobless claims in the U.S. is expected to decrease by 1,000 to 271,000 last week.

Final productivity in the U.S. non-farm businesses is expected to decline at a 3.2% annual rate in the fourth quarter, after a 2.1% rise in the third quarter.

Final unit labour costs are expected to increase 4.7% in the fourth quarter, after a 1.9 gain in the third quarter.

The U.S. factory orders are expected to rise 2.0% in January, after a 2.9% drop in December.

The euro traded higher against the U.S. dollar after the release of the mixed economic data from the Eurozone. Eurostat released its retail sales data for the Eurozone on Thursday. Retail sales in the Eurozone increased 0.4% in January, beating expectations for a 0.1% rise, after a 0.6% gain in December. December's figure was revised up from a 0.3% increase.

Non-food sales increased 0.7% in January, food, drinks and tobacco sales rose 0.5%, while automotive fuel sales were up 0.1%.

On a yearly basis, retail sales in the Eurozone climbed 2.0% in January, beating forecasts of a 1.3% gain, after a 2.1% increase in December. December's figure was revised up from a 1.4% gain.

Non-food sales gained 3.0% year-on-year in January, gasoline sales increased 0.3%, while food, drinks and tobacco sales rose 1.4%.

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Thursday. Eurozone's final services PMI declined to 53.3 in February from 53.6 in January, up from the preliminary reading of 53.0. It was the lowest level since January 2015.

The index was mainly driven by a weaker rate of improvement in new business, while job creation also slowed.

Eurozone's final composite output index fell to 53.0 in February from 53.6 in January, up from the preliminary reading of 52.7.

"The survey data raise the prospect of economic growth deteriorating further from the already meagre pace seen late last year, when GDP rose only 0.3%," Chief Economist at Markit Chris Williamson said.

Germany's final services PMI rose to 55.3 in February from 55.0 in January, up from the preliminary reading of 55.1. The index was mainly driven by a faster growth in new orders.

France's final services PMI slid to 49.2 in February from 50.3 in January, down from the preliminary reading of 49.8. It was the lowest level since November 2014. The index was driven by declines in new business and backlogs of work.

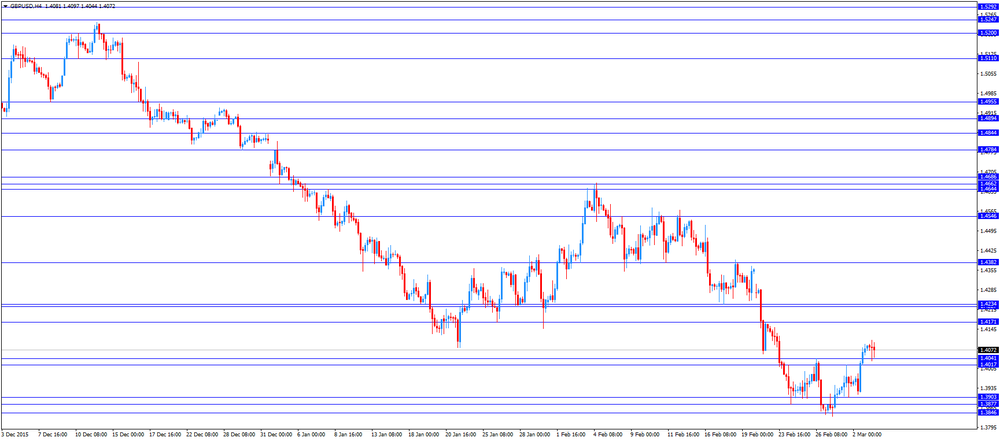

The British pound traded mixed against the U.S. dollar after the release of the weaker-than-expected U.K. services PMI data. Markit's and the Chartered Institute of Purchasing & Supply's services PMI for the U.K. dropped to 52.7 in February from 55.6 in January, missing expectations for a fall to 55.1. It was the lowest level since March 2013.

The decrease was driven by a slower growth in new business and employment.

"The slowdown in February leaves the PMI surveys suggesting that economic growth could weaken to 0.3% in the first quarter, but there are downside risks to even this modest expansion," the Chief Economist at Markit Chris Williamson said.

EUR/USD: the currency pair rose to $1.0910

GBP/USD: the currency pair traded mixed

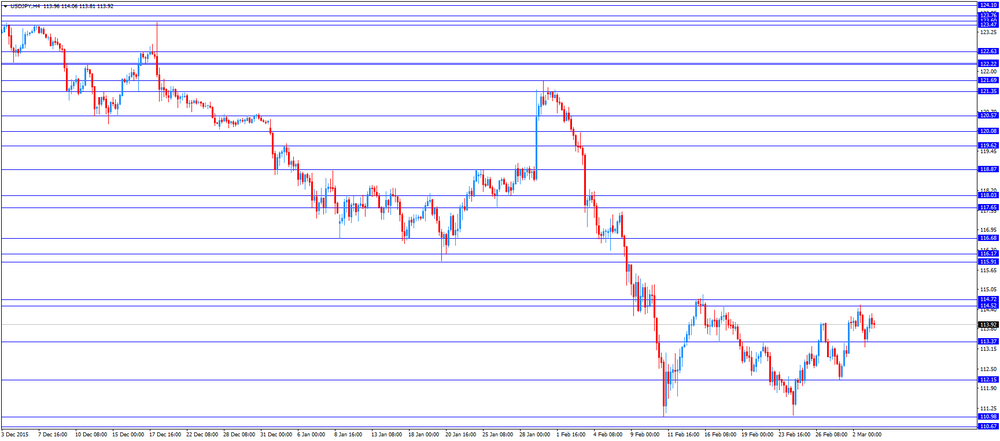

USD/JPY: the currency pair fell to Y113.80

The most important news that are expected (GMT0):

13:30 U.S. Unit Labor Costs, q/q (Finally) Quarter IV 1.9% 4.7%

13:30 U.S. Initial Jobless Claims February 272 271

13:30 U.S. Nonfarm Productivity, q/q (Finally) Quarter IV 2.1% -3.2%

14:45 U.S. Services PMI (Finally) February 53.2 49.8

15:00 U.S. ISM Non-Manufacturing February 53.5 53.2

15:00 U.S. Factory Orders January -2.9% 2%

-

14:00

Orders

EUR/USD

Offers 1.0875-80.0900 1.0920 1.0935 1.0950 1.0975-80 1.1000 1.1025-30.1050

Bids 1.0845-50 1.0830 1.0800 1.0785 1.0750 1.0730 1.0700

GBP/USD

Offers 1.4100-05 1.4120 1.4135 1.4150 1.4180 1.4200

Bids 1.4070 1.4045-50 1.4020 1.4000 1.3985 1.3945-50 1.3920 1.3900

EUR/JPY

Offers 124.30 124.50 124.80 125.00 125.30 125.50 125.75 126.00

Bids 123.60 123.20 123.00 122.50 122.30 122.00

EUR/GBP

Offers 0.7730 0.7750 0.7775-80 0.7800 0.7820-25 0.7850

Bids 0.7700 0.7675 0.7650 0.7625-30 0.7600

USD/JPY

Offers 114.25-30 114.50 114.75-80 115.00 115.20 115.35 115.50

Bids 113.80 113.50 113.20 113.00 112.70-75 112.50

AUD/USD

Offers 0.7320 0.7350 0.7375-80 0.7400 0.7430 0.7450

Bids 0.7300 0.7280 0.7260 0.7220 0.7200 0.7180 0.7165 0.7150

-

11:57

Markit/Nikkei services purchasing managers' index for Japan decreases to 51.2 in February

The Markit/Nikkei services Purchasing Managers' Index (PMI) for Japan decreased to 51.2 in February from 52.4 in January.

A reading above 50 indicates expansion in the sector, a reading below 50 indicates contraction of activity.

The index was mainly driven by declines in new business and employment.

"Latest survey data pointed to a general slowdown of growth in the Japanese service sector. Business activity and new order growth both slowed, leading to an easing in the rate of staff hiring," economist at Markit, Amy Brownbill, said.

-

11:52

Halifax: House prices in the U.K. drop 1.4% in February

Halifax released its house prices data for the U.K. on Thursday. House prices in the U.K. slid 1.4% in February, missing expectations for a flat reading, after a 1.7% gain in January.

On a yearly basis, house prices climbed 9.7% in the three months to February, missing expectations for a 10.4% rise, after a 9.7% increase in the three months to January.

"Prices continue to rise at a robust pace driven by a significant imbalance between supply and demand. Whilst this position is likely to continue over the coming months, there are some tentative signs that the supply situation may be beginning to improve," Halifax's housing economist Martin Ellis said.

-

11:47

Nationwide: UK house prices rise 0.3% in February

The Nationwide Building Society released its house prices data for the U.K. on Thursday. UK house prices were up 0.3% in February, missing expectations for a 0.5% rise, after a 0.3% increase in January.

On a yearly basis, house prices rose to 4.8% in February from 4.4% in January. Analysts had expected house prices to rise by 5.0%.

"Much of the increase is likely to be related to the impending increase in Stamp Duty on second homes which is due to take effect in April 2016. This is likely to have brought forward a significant number of purchases, which in turn will probably result in a fall back in approvals during the spring/summer, Nationwide's Chief Economist, Robert Gardner, said.

-

11:42

France’s unemployment rate falls to 10.3% in the fourth quarter

The French statistical office Insee released its unemployment data on Thursday. The unemployment rate in France fell to 10.3% in the fourth quarter from 10.4% in the third quarter. The third quarter's figure was revised down from 10.6%.

The number of unemployed people in metropolitan France dropped by 47,000 to 2.86 million in the fourth quarter.

The employment rate remained unchanged at 64.3% in the fourth quarter.

The number of unemployed people under 24 years fell to 24.0% in the fourth quarter from 24.3% in the third quarter.

The unemployment in France remains at high levels since French President Francois Hollande took office in 2012.

The French government is struggling to bring down unemployment.

-

11:35

France's final services PMI slides to 49.2 in February, the lowest level since November 2014

Markit Economics released final services purchasing managers' index (PMI) for France on Thursday. France's final services purchasing managers' index (PMI) slid to 49.2 in February from 50.3 in January, down from the preliminary reading of 49.8. It was the lowest level since November 2014.

The index was driven by declines in new business and backlogs of work.

"February's PMI data highlight a disappointing performance of France's dominant service sector, precipitated by a fall in new business intakes. A fragile and uncertain economic climate continues to cloud the outlook for the sector, with businesses and consumers reluctant to commit to new spending," Senior Economist at Markit Jack Kennedy said.

-

11:31

Germany's final services PMI rises to 55.3 in February

Markit Economics released final services purchasing managers' index (PMI) for Germany on Thursday. Germany's final services purchasing managers' index (PMI) rose to 55.3 in February from 55.0 in January, up from the preliminary reading of 55.1.

The index was mainly driven by a faster growth in new orders.

"Today's PMI results for Germany's service sector offer some relief and suggest that the Eurozone's largest economy is not performing as poorly as signalled by the manufacturing numbers earlier this week. However, trends in the two sectors are clearly diverging, with manufacturers recording the weakest growth of production in 14 months, while service sector firms enjoyed a further above average expansion," an economist at Markit, Oliver Kolodseike, said.

-

11:27

Eurozone's final services PMI declines to 53.3 in February

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Thursday. Eurozone's final services purchasing managers' index (PMI) declined to 53.3 in February from 53.6 in January, up from the preliminary reading of 53.0. It was the lowest level since January 2015.

The index was mainly driven by a weaker rate of improvement in new business, while job creation also slowed.

Eurozone's final composite output index fell to 53.0 in February from 53.6 in January, up from the preliminary reading of 52.7.

"The survey data raise the prospect of economic growth deteriorating further from the already meagre pace seen late last year, when GDP rose only 0.3%," Chief Economist at Markit Chris Williamson said.

-

11:21

UK’s services PMI drops to 52.7 in February, the lowest level since March 2013

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. dropped to 52.7 in February from 55.6 in January, missing expectations for a fall to 55.1. It was the lowest level since March 2013.

A reading above 50 indicates expansion in the sector.

The decrease was driven by a slower growth in new business and employment.

"The slowdown in February leaves the PMI surveys suggesting that economic growth could weaken to 0.3% in the first quarter, but there are downside risks to even this modest expansion," the Chief Economist at Markit Chris Williamson said.

-

11:16

Eurozone’s retail sales increase 0.4% in January

Eurostat released its retail sales data for the Eurozone on Thursday. Retail sales in the Eurozone increased 0.4% in January, beating expectations for a 0.1% rise, after a 0.6% gain in December. December's figure was revised up from a 0.3% increase.

Non-food sales increased 0.7% in January, food, drinks and tobacco sales rose 0.5%, while automotive fuel sales were up 0.1%.

On a yearly basis, retail sales in the Eurozone climbed 2.0% in January, beating forecasts of a 1.3% gain, after a 2.1% increase in December. December's figure was revised up from a 1.4% gain.

Non-food sales gained 3.0% year-on-year in January, gasoline sales increased 0.3%, while food, drinks and tobacco sales rose 1.4%.

-

11:00

Eurozone: Retail Sales (MoM), January 0.4% (forecast 0.1%)

-

11:00

Eurozone: Retail Sales (YoY), January 2.0% (forecast 1.3%)

-

10:51

Bank of Japan Deputy Governor Hiroshi Nakaso: structural reforms were needed to boost the Japanese economy

Bank of Japan (BoJ) Deputy Governor Hiroshi Nakaso said in a speech on Thursday that structural reforms were needed to boost the Japanese economy.

"I believe that monetary policy to overcome deflation and the structural reform to raise the potential growth rate must be pursued in tandem to bring Japan's economy back on track toward sustained growth," he said.

"I expect the original third arrow of Abenomics, the growth strategy, to fly higher and faster," Nakaso added.

BoJ deputy governor noted that the economy continued to expand.

"Although global financial markets have been volatile since the turn of the year, I believe there is no need to be too pessimistic as the fundamentals of Japan's economy have been firm," he said.

-

10:40

Beige Book: the U.S. economic activity expanded in most districts

The Fed released its Beige Book on Wednesday. The central bank said that the U.S. economic activity expanded in most districts since the previous Beige Book report.

The Districts of Cleveland's, Atlanta's, Chicago's and Minneapolis' activity grew modestly, Richmond's and San Francisco's economy expanded moderately, Philadelphia's economy rose slightly, St. Louis' and Boston's economies were mixed, the New York District's and the Kansas City District's growth was steady, while Kansas City's activity declined modestly.

The growth outlook was generally optimistic, the Fed said.

Consumer spending rose in the majority of districts.

The manufacturing sector was flat, according to the Beige Book.

Labour markets continued to improve, while wage growth varied from flat to strong across all Districts, the Fed noted.

-

10:36

Australia's trade deficit narrows to A$2.94 billion in January

The Australian Bureau of Statistics released its trade data on Thursday. Australia's trade deficit narrowed to A$2.94 billion in January from A$3.52 billion in December, beating expectations for a decline to a deficit of A$3.1 billion. December's figure was revised up from a deficit of A$3.54 billion.

Exports increased by 1.0% in January, while imports fell 1.0%.

-

10:30

United Kingdom: Purchasing Manager Index Services, February 52.7 (forecast 55.1)

-

10:21

Chinese Markit/Caixin services PMI declines to 51.2 in February

The Caixin/Markit Services Purchasing Managers' Index (PMI) for China declined to 51.2 in February from 52.4 in January, missing expectations for a rise to 52.6.

The index was driven by a softer growth in new business and employment.

"The services sector has outperformed manufacturing industries, reflecting continued improvement in the economic structure. While implementing measures to stabilize economic growth, the government needs to push forward reform on the supply side in the services sector to release its potential," Dr. He Fan, Chief Economist at Caixin Insight Group, said.

-

10:09

San Francisco Federal Reserve President John Williams: the Fed could change the number of interest rate hikes after its monetary policy meeting in March

San Francisco Federal Reserve President John Williams said on Wednesday that the Fed could change the number of interest rate hikes after its monetary policy meeting in March.

"It is really just the tactics, how many rate increases this year versus next year," he added.

Williams noted that there was no deterioration in the U.S. economy.

San Francisco Federal Reserve president declined to say if he would support an interest rate hike in March.

-

10:01

Eurozone: Services PMI, February 53.3 (forecast 53)

-

09:55

Germany: Services PMI, February 53.3 (forecast 55.1)

-

09:50

France: Services PMI, February 49.2 (forecast 49.8)

-

09:32

United Kingdom: Halifax house price index, February -1.4% (forecast 0%)

-

09:32

United Kingdom: Halifax house price index 3m Y/Y, February 9.7% (forecast 10.4%)

-

09:21

Option expiries for today's 10:00 ET NY cut

USD/JPY: 112.00 (USD 210m) 113.25 (200m) 113.70-75 (320m) 114.00-05 (390m) 115.00 (500m)

EUR/USD: 1.0800 (EUR 225m) 1.0950 (495m) 1.1000 (335m) 1.1100 (1.1bln)

USD/CHF: 1.0150 (USD200m)

EUR/CHF: 1.0950 (EUR 180m)

AUD/USD: 0.7100 (AUD 192m) ) 0.7150-55 (431m) 0.7200-05 (300m)

USD/CAD 1.3370 (USD 380m) 1.3800 (250m)

NZD/USD 0.6510-15 (NZD 190m) 0.6630 (181m) 0.6725 (249m)

AUD/JPY: 80.40 (AUD 225m) 82.95 (202m)

-

08:30

Options levels on thursday, March 3, 2016:

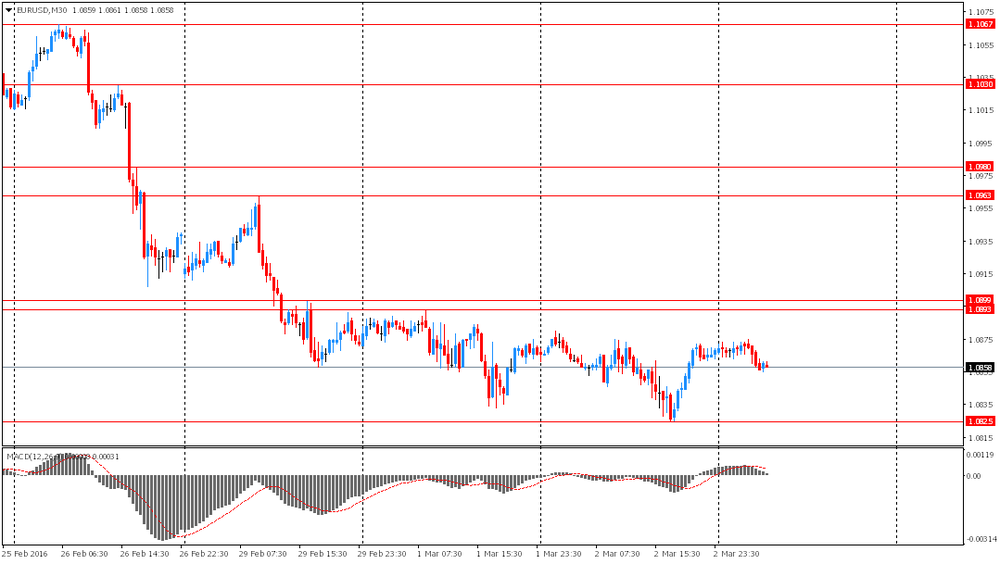

EUR / USD

Resistance levels (open interest**, contracts)

$1.1102 (4298)

$1.1008 (6383)

$1.0930 (2932)

Price at time of writing this review: $1.0860

Support levels (open interest**, contracts):

$1.0783 (7676)

$1.0743 (3680)

$1.0697 (6421)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 74227 contracts, with the maximum number of contracts with strike price $1,1000 (6383);

- Overall open interest on the PUT options with the expiration date March, 4 is 90247 contracts, with the maximum number of contracts with strike price $1,0800 (7676);

- The ratio of PUT/CALL was 1.22 versus 1.25 from the previous trading day according to data from March, 2

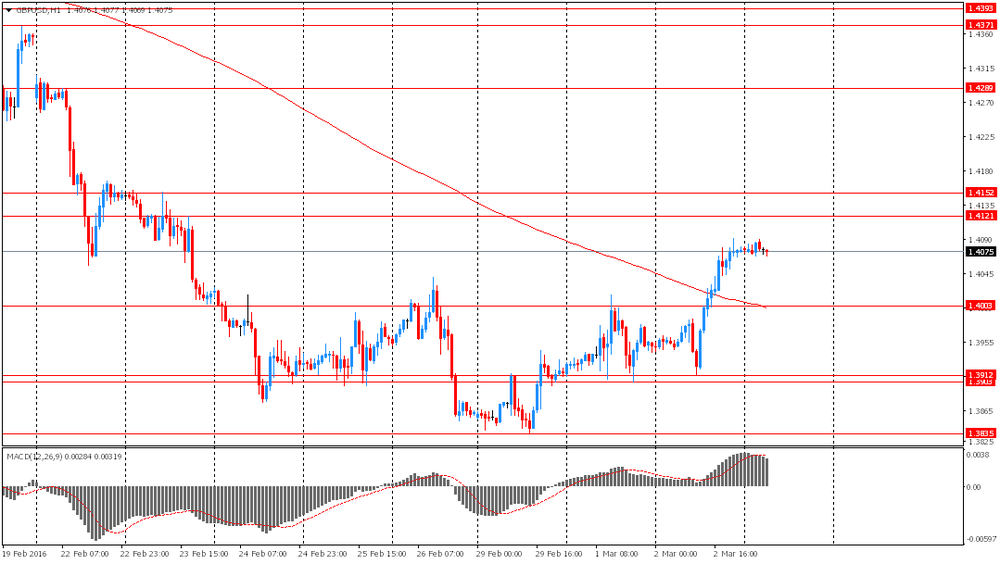

GBP/USD

Resistance levels (open interest**, contracts)

$1.4300 (1414)

$1.4201 (516)

$1.4104 (460)

Price at time of writing this review: $1.4074

Support levels (open interest**, contracts):

$1.3997 (2044)

$1.3899 (1778)

$1.3800 (1045)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 31352 contracts, with the maximum number of contracts with strike price $1,4350 (1966);

- Overall open interest on the PUT options with the expiration date March, 4 is 31513 contracts, with the maximum number of contracts with strike price $1,4350 (2954);

- The ratio of PUT/CALL was 1.01 versus 1.05 from the previous trading day according to data from March, 2

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:16

Asian session: The yen fell

The yen fell against all its major counterparts as improving U.S. economic data and a recovery in oil prices damped demand for safer assets. The currency approached the weakest level in two weeks against the greenback as Japanese shares advanced for a third day following gains in U.S. equities on Wednesday. The yen has still strengthened at least 2 percent versus all of its 16 major peers this year as concern China's economy is slowing roiled financial markets around the world. Demand for higher-yielding assets rose after a report on U.S. payrolls showed companies added more workers last month than economists projected. The U.S. will release monthly employment data Friday.

The Australian dollar rose for a fourth day against the greenback as oil climbed toward $35 a barrel and iron-ore futures on the Dalian Commodity Exchange traded at an eight-month high. Investors had shunned the currency as anxiety over China's ability to manage a slowing economy clouded the outlook for global growth, casting doubts on the Fed's ability to add to its December rate increase.

EUR / USD: during the Asian session, the pair was trading in the $ 1.0855-75

GBP / USD: during the Asian session, the pair was trading in the $ 1.4070-90

USD / JPY: during the Asian session, the pair rose to Y114.25

Moving back to the markets we have a busy data calendar today with UK services PMI the key release this morning given that sector's large impact on GDP.

-

08:01

United Kingdom: Nationwide house price index, y/y, February 4.8% (forecast 5%)

-

08:01

United Kingdom: Nationwide house price index , February 0.3% (forecast 0.5%)

-

02:45

China: Markit/Caixin Services PMI, February 51.2 (forecast 52.6)

-

01:30

Australia: Trade Balance , January -2.94 (forecast -3.1)

-

00:32

Currencies. Daily history for Mar 2’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0867 +0,02%

GBP/USD $1,4076 +0,89%

USD/CHF Chf0,9964 -0,09%

USD/JPY Y113,46 -0,47%

EUR/JPY Y123,30 -0,46%

GBP/JPY Y159,73 +0,44%

AUD/USD $0,7292 +1,63%

NZD/USD $0,6674 +0,69%

USD/CAD C$1,3415 +0,05%

-