Noticias del mercado

-

23:56

Schedule for today, Thursday, Mar 3’2016:

(time / country / index / period / previous value / forecast)

00:30 Australia Trade Balance January -3.535 -3.1

01:45 China Markit/Caixin Services PMI February 52.4

07:00 United Kingdom Nationwide house price index February 0.3% 0.5%

07:00 United Kingdom Nationwide house price index, y/y February 4.4% 5%

08:30 United Kingdom Halifax house price index February 1.7% 0%

08:30 United Kingdom Halifax house price index 3m Y/Y February 9.7% 10.4%

08:50 France Services PMI (Finally) February 50.3 49.8

08:55 Germany Services PMI (Finally) February 55 55.1

09:00 Eurozone Services PMI (Finally) February 53.6 53

09:30 United Kingdom Purchasing Manager Index Services February 55.6 55.1

10:00 Eurozone Retail Sales (YoY) January 1.4% 1.3%

10:00 Eurozone Retail Sales (MoM) January 0.3% 0.1%

13:30 U.S. Continuing Jobless Claims February 2253 2258

13:30 U.S. Unit Labor Costs, q/q (Finally) Quarter IV 1.9% 4.7%

13:30 U.S. Initial Jobless Claims February 272 270

13:30 U.S. Nonfarm Productivity, q/q (Finally) Quarter IV 2.1% -3.3%

14:45 U.S. Services PMI (Finally) February 53.2 49.8

15:00 U.S. ISM Non-Manufacturing February 53.5 53.5

15:00 U.S. Factory Orders January -2.9% 1.6%

-

23:30

Australia: AIG Services Index, February 51.8

-

16:30

U.S.: Crude Oil Inventories, February 10.374 (forecast 3.5)

-

16:21

Bank of Japan Governor Haruhiko Kuroda: inflation in Japan was improving

Bank of Japan (BoE) Governor Haruhiko Kuroda said on Wednesday that inflation in Japan was improving.

"Underlying price trends are improving," he said.

-

15:47

European Central Bank Governing Council member François Villeroy de Galhau: the central bank could add further stimulus measures to boost inflation

European Central Bank (ECB) Governing Council member and Bank of France Governor François Villeroy de Galhau said on Wednesday that the central bank could add further stimulus measures to boost inflation. New ECB stimulus measures could targeted loans to commercials banks, higher asset purchases and more details about how long the central bank plans to keep its interest rates at low levels, de Galhau noted.

He also said that the Eurozone's inflation was too low, adding that inflation will likely be positive in the second half of the year.

-

14:55

European Central Bank Executive Board member Benoit Coeure: the central bank monitored the impact of negative rates

European Central Bank (ECB) Executive Board member Benoit Coeure said on Wednesday that the central bank monitored the impact of negative rates.

"We are monitoring it on a regular basis and we are studying carefully the schemes used in other jurisdictions to mitigate possible adverse consequences for the bank lending channel," he said.

Coeure pointed out that many banks could handle negative rates as they were "able to more than offset declining interest revenues with higher lending volumes, lower interest expenses, lower risk provisioning and capital gains".

He noted the Eurozone's economy continued to recover.

-

14:51

Option expiries for today's 10:00 ET NY cut

USDJPY: 112.00 (USD 210m) 113.25 (200m) 113.70-75 (320m) 114.00-05 (390m) 115.00 (500m)

EURUSD: 1.0800 (EUR 225m) 1.0950 (495m) 1.1000 (335m) 1.1100 (1.1bln)

GBPUSD: None listed at present

USDCHF: 1.0150 (USD200m)

EURCHF: 1.0950 (EUR 180m)

AUDUSD: 0.7100 (AUD 192m) ) 0.7150-55 (431m) 0.7200-05 (300m)

USDCAD 1.3370 (USD 380m) 1.3800 (250m)

NZDUSD 0.6510-15 (NZD 190m) 0.6630 (181m) 0.6725 (249m)

AUDJPY: 80.40 (AUD 225m) 82.95 (202m)

-

14:26

U.S. ADP Employment Report: private sector adds 214,000 jobs in February

Private sector in the U.S. added 214,000 jobs in February, according the ADP report on Wednesday. January's figure was revised up to 193,000 jobs from a previous reading of 205,000 jobs.

Analysts expected the private sector to add 190,000 jobs.

Services sector added 208,000 jobs in February, while goods-producing sector added 5,000.

"Despite the turmoil in the global financial markets, the American job machine remains in high gear. Energy and manufacturing remain blemishes on the job market, but other sectors continue to add strongly to payrolls. Full-employment is fast approaching," the Chief Economist of Moody's Analytics Mark Zandi said.

Official labour market data will be released on Friday. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 4.9% in February. The U.S. economy is expected to add 190,000 jobs in February, after adding 151,000 jobs in January.

-

14:15

U.S.: ADP Employment Report, February 214 (forecast 190)

-

14:07

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the weak economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Gross Domestic Product (QoQ) Quarter IV 1.1% Revised From 0.9% 0.5% 0.6%

00:30 Australia Gross Domestic Product (YoY) Quarter IV 2.7% Revised From 2.5% 2.6% 3.0%

06:45 Switzerland Gross Domestic Product (YoY) Quarter IV 0.8% 0.1% 0.4%

06:45 Switzerland Gross Domestic Product (QoQ) Quarter IV -0.1% Revised From 0% 0.2% 0.4%

09:30 United Kingdom PMI Construction February 55 55.5 54.2

10:00 Eurozone Producer Price Index, MoM January -0.8% -0.7% -1.0%

10:00 Eurozone Producer Price Index (YoY) January -3.0% -2.9% -2.9%

10:00 United Kingdom MPC Member Dr Ben Broadbent Speaks

12:00 U.S. MBA Mortgage Applications February -4.3% -4.8%

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. According to the ADP employment report, the U.S. economy is expected to add 190,000 jobs in February.

The euro traded lower against the U.S. dollar after the release of the weak economic data from the Eurozone. Eurostat released its producer price index for the Eurozone on Wednesday. Eurozone's producer price index declined 1.0% in January, missing expectations for a 0.7% fall, after a 0.8% decrease in December.

Intermediate goods prices fell 0.3% in January, capital goods prices rose 0.1%, non-durable consumer goods prices were flat and durable consumer goods prices were up 0.4%, while energy prices decreased 3.2%.

On a yearly basis, Eurozone's producer price index dropped 2.9% in January, in line with expectations, after a 3.0% fall in December.

Eurozone's producer prices excluding energy fell 0.6% year-on-year in January. Energy prices dropped at an annual rate of 8.6%.

The British pound traded higher against the U.S. dollar despite the release of the weaker-than-expected U.K. construction PMI data. Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. declined to 54.2 in February from 55.0 in January, missing expectations for an increase to 55.5. It was the lowest level since April 2015.

A reading above 50 indicates expansion in the construction sector.

The index was driven by a softer growth in output, new orders and employment. Housing activity showed the slowest performance since June 2013.

The Swiss franc traded mixed against the U.S. dollar. The State Secretariat for Economic Affairs (SECO) released its gross domestic product (GDP) data for Switzerland on Wednesday. Switzerland's GDP rose 0.4% in the fourth quarter, exceeding expectations for a 0.2% rise, after a 0.1% decrease in the third quarter.

GDP was driven by a positive contribution from household and public spending.

On a yearly basis, Switzerland's economy grew at 0.4% in the fourth quarter, exceeding expectations for a 0.1% rise, after a 0.8% increase in the third quarter.

In 2015 as whole, the Swiss economy expanded 0.9%, after a 1.9% growth in 2014.

EUR/USD: the currency pair fell to $1.0842

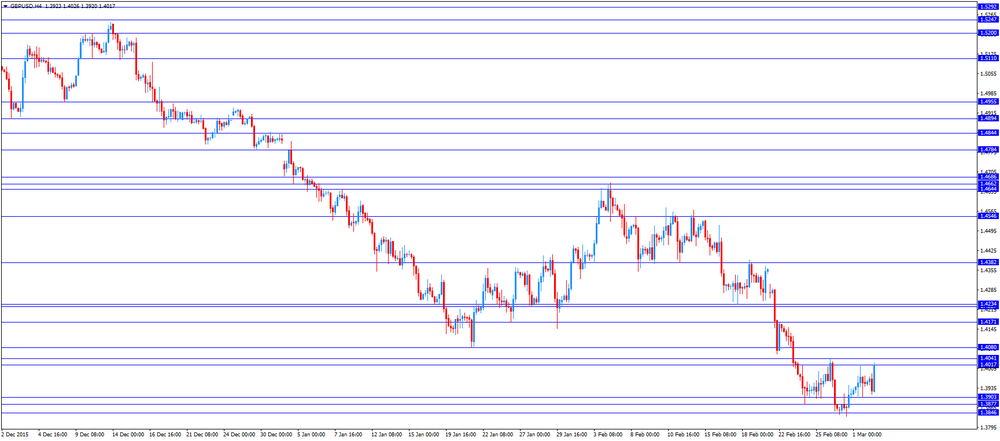

GBP/USD: the currency pair increased to $1.4026

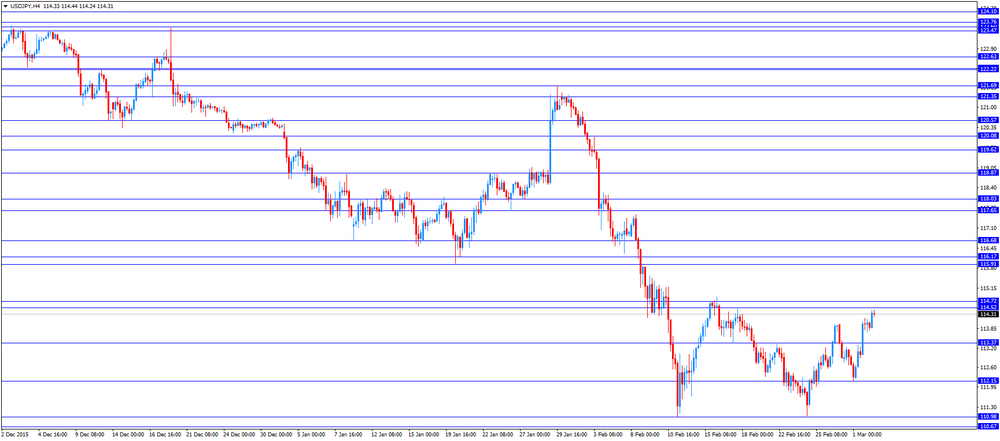

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:15 U.S. ADP Employment Report February 205 190

14:00 United Kingdom BOE Deputy Governor for Financial Stability Jon Cunliffe speaks

15:30 U.S. Crude Oil Inventories February 3.502 3.5

19:00 U.S. Fed's Beige Book

-

13:45

Orders

EUR/USD

Offers 1.0885.0900 1.0920 1.0935 1.0950 1.0975-80 1.1000 1.1025-30.1050

Bids 1.0845-50 1.0830 1.0800 1.0785 1.0750 1.0730 1.0700

GBP/USD

Offers 1.3985 1.4000 1.4020 1.4040-50 1.4080 1.4100

Bids 1.3945-50 1.3920 1.3900 1.3880-85 1.3860 1.3835 1.3820 1.3800

EUR/JPY

Offers 124.50 124.80 125.00 125.30 125.50 125.75 126.00

Bids 124.00 123.80 123.60 123.20 123.00 122.50 122.30 122.00

EUR/GBP

Offers 0.7800 0.7820-25 0.7850 0.7880 0.7900

Bids 0.7770-75 0.7750 0.7730 0.7700 0.7680 0.7650

USD/JPY

Offers 114.50 114.75-80 115.00 115.20 115.35 115.50

Bids 114.20 114.00 113.80 113.50 113.20 113.00 112.70-75 112.50

AUD/USD

Offers 0.7250-55 0.7275-80 0.7300 0.7320 0.7350

Bids 0.7200 0.7180 0.7165 0.7150 0.7130 0.7100 0.7080 0.7065 0.7050

-

13:00

U.S.: MBA Mortgage Applications, February -4.8%

-

11:52

HIA new home sales in Australia jump 3.1% in January

The Housing Industry Association (HIA) released its new home sales data for Australia on Wednesday. New home sales jumped 3.1% in January, after a 6.0% gain in December.

Sales of detached homes increased 5.8% in January, while sales for multi-units slid 5.8%.

"This year will be another healthy one for detached house and 'multi-unit' construction, but we won't surpass the heights of 2015. The new home building sector is crucial to Australia's economic prospects in 2016 and should continue as a mainstay of domestic economic activity," the HIA's chief economist Harley Dale said.

-

11:45

BRC: U.K. shop prices are down 2.0% year-on-year in February

According to the British Retail Consortium (BRC), the U.K. shop prices declined by 2.0% year-on-year in February, after a 1.8% decline in January.

The decline was mainly driven by a drop in non-food prices, which plunged 3.0% year-on-year in February.

Food prices declined at an annual rate of 0.4% in February.

"Another fall in shop prices was seen in February, down 2.0 per cent compared with a year ago and a further fall on the numbers we saw in January as competition in the industry continues apace. This now marks the 34th consecutive month of price drops and 35th for non-food prices," BRC Chief Executive, Helen Dickinson, said.

-

11:39

Switzerland's GDP rises 0.4% in the fourth quarter

The State Secretariat for Economic Affairs (SECO) released its gross domestic product (GDP) data for Switzerland on Wednesday. Switzerland's GDP rose 0.4% in the fourth quarter, exceeding expectations for a 0.2% rise, after a 0.1% decrease in the third quarter. The third quarter's figure was revised down from a flat reading.

GDP was driven by a positive contribution from household and public spending.

Exports of goods climbed 2.9% in the fourth quarter, while exports of services decreased 3.2%.

Imports of goods climbed 4.2% in the fourth quarter, while imports of services were down 0.3%.

Household spending climbed by 0.1% in the fourth quarter, public spending was up 0.6%, equipment spending slid 0.9%, while construction spending increased 0.1%.

On a yearly basis, Switzerland's economy grew at 0.4% in the fourth quarter, exceeding expectations for a 0.1% rise, after a 0.8% increase in the third quarter.

In 2015 as whole, the Swiss economy expanded 0.9%, after a 1.9% growth in 2014.

-

11:28

Number of registered unemployed people in Spain increase by 2,231 in February

Spain's labour ministry release its labour market figures on Wednesday. The number of registered unemployed people increased by 2,231 in February, after a 57,247 rise in January.

On a yearly basis, the number of registered unemployed people fell by 359,167 people in February.

The total number of jobless in Spain was 4,152,986.

-

11:18

Eurozone's producer price index declines 1.0% in January

Eurostat released its producer price index for the Eurozone on Wednesday. Eurozone's producer price index declined 1.0% in January, missing expectations for a 0.7% fall, after a 0.8% decrease in December.

Intermediate goods prices fell 0.3% in January, capital goods prices rose 0.1%, non-durable consumer goods prices were flat and durable consumer goods prices were up 0.4%, while energy prices decreased 3.2%.

On a yearly basis, Eurozone's producer price index dropped 2.9% in January, in line with expectations, after a 3.0% fall in December.

Eurozone's producer prices excluding energy fell 0.6% year-on-year in January. Energy prices dropped at an annual rate of 8.6%.

-

11:04

UK construction PMI declines to 54.2 in February

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. declined to 54.2 in February from 55.0 in January, missing expectations for an increase to 55.5. It was the lowest level since April 2015.

A reading above 50 indicates expansion in the construction sector.

The index was driven by a softer growth in output, new orders and employment.

Housing activity showed the slowest performance since June 2013.

"UK construction firms remained in expansion mode during February, but a loss of momentum within the residential building sector meant that overall output growth was the weakest since April 2015. Aside from the pre-election slowdown last year, the latest upturn in construction output was the weakest for over-two and-a-half years," Senior Economist at Markit, Tim Moore, said.

-

11:00

Eurozone: Producer Price Index, MoM , January -1.0% (forecast -0.7%)

-

11:00

Eurozone: Producer Price Index (YoY), January -2.9% (forecast -2.9%)

-

10:50

European Central Bank President Mario Draghi: the central bank will review its monetary policy measures at the monetary policy meeting next week

The European Central Bank (ECB) President Mario Draghi wrote in the letter to Jonas Fernández, member of the European Parliament, on Tuesday that the central bank will review its monetary policy measures at the monetary policy meeting next week as the downside risks to the outlook increased. He noted that the ECB's quantitative easing was working.

Draghi also said that the Eurozone's inflation is weaker than expected.

The ECB president pointed out that the central bank could add further stimulus measures if needed.

"The Governing Council has a variety of instruments at its disposal to respond, if warranted, and there are no limits to how far we are willing to deploy our instruments within our mandate to achieve our objective of inflation rates below, but close to, 2% over the medium term," Draghi wrote.

-

10:37

Standard and Poor's expects global government debt to rise 2% this year

The rating agency Standard and Poor's (S&P) said on Monday that the government debt of the United States, China, Brazil and India is expected to rise further this year. The U.S. government debt is expected to climb 8% or $163 billion year-on-year in 2016, while China's debt is expected to jump 18% or $51 billion.

The Eurozone's debt is expected to decline 6%.

Global government debt is forecasted to increase 2% to $42.4 trillion.

-

10:30

United Kingdom: PMI Construction, February 54.2 (forecast 55.5)

-

10:21

Moody's lowers China’s outlook to 'negative' from 'stable' on the country's government credit ratings

Moody's Investors Service cut China's outlook to 'negative' from 'stable' on the country's government credit ratings on Wednesday. The agency said that the downward revision was driven by the weak fiscal metrics, a decline in reserve buffers and the uncertainty about the government' capacity to implement reforms.

Moody's affirmed China's Aa3 rating.

The agency noted that the country's climbed to 40.6% of GDP at the end of 2015 from 32.5% in 2012, and expected to rise to 43.0% by 2017.

China's foreign exchange reserves dropped to $3.2 trillion in January 2016, down by $762 billion from June 2014.

-

10:11

Australia's GDP climbs 0.6% in the fourth quarter

The Australian Bureau of Statistics released its GDP data on Wednesday. Australia's GDP climbed 0.6% in the fourth quarter, exceeding expectations for a 0.5% gain, after a 1.1% rise in the third quarter. The third quarter's figure was revised up from a 0.9% increase.

Final consumption spending was up 0.7% in the fourth quarter.

Terms of trade dropped 3.2% in the fourth quarter, while real net national disposable income decreased 0.1%.

Private gross fixed capital formation dropped 1.9% in the fourth quarter.

Exports and imports both increased by 0.6% in the fourth quarter.

On a yearly basis, Australia's GDP rose 3.0% in the fourth quarter, beating expectations for a 2.6% increase, after a 2.7% gain in the third quarter. The third quarter's figure was revised up from a 2.5% rise.

-

10:02

Option expiries for today's 10:00 ET NY cut

USD/JPY: 112.00 (USD 210m) 113.25 (200m) 113.70-75 (320m) 114.00-05 (390m) 115.00 (500m)

EUR/USD: 1.0800 (EUR 225m) 1.0950 (495m) 1.1000 (335m) 1.1100 (1.1bln)

USD/CHF: 1.0150 (USD200m)

EUR/CHF: 1.0950 (EUR 180m)

AUD/USD: 0.7100 (AUD 192m) ) 0.7150-55 (431m) 0.7200-05 (300m)

USD/CAD 1.3370 (USD 380m) 1.3800 (250m)

NZD/USD 0.6510-15 (NZD 190m) 0.6630 (181m) 0.6725 (249m)

AUD/JPY: 80.40 (AUD 225m) 82.95 (202m)

-

08:30

Options levels on Wednesday, March 2, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1104 (4223)

$1.1012 (6448)

$1.0937 (2926)

Price at time of writing this review: $1.0855

Support levels (open interest**, contracts):

$1.0779 (7528)

$1.0740 (3574)

$1.0695 (6466)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 72150 contracts, with the maximum number of contracts with strike price $1,1000 (6448);

- Overall open interest on the PUT options with the expiration date March, 4 is 89887 contracts, with the maximum number of contracts with strike price $1,0800 (7528);

- The ratio of PUT/CALL was 1.25 versus 1.24 from the previous trading day according to data from March, 1

GBP/USD

Resistance levels (open interest**, contracts)

$1.4201 (532)

$1.4202 (445)

$1.4005 (592)

Price at time of writing this review: $1.3963

Support levels (open interest**, contracts):

$1.3895 (1784)

$1.3798 (1496)

$1.3699 (558)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 30942 contracts, with the maximum number of contracts with strike price $1,4350 (1966);

- Overall open interest on the PUT options with the expiration date March, 4 is 32353 contracts, with the maximum number of contracts with strike price $1,4350 (2954);

- The ratio of PUT/CALL was 1.05 versus 1.05 from the previous trading day according to data from March, 1

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:46

Switzerland: Gross Domestic Product (YoY), Quarter IV 0.4% (forecast 0.1%)

-

07:45

Switzerland: Gross Domestic Product (QoQ) , Quarter IV 0.4% (forecast 0.2%)

-

01:31

Australia: Gross Domestic Product (YoY), Quarter IV 3.0% (forecast 2.6%)

-

01:30

Australia: Gross Domestic Product (QoQ), Quarter IV 0.6% (forecast 0.5%)

-

00:35

Currencies. Daily history for Mar 1’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0865 -0,06%

GBP/USD $1,3951 +0,26%

USD/CHF Chf0,9973 -0,09%

USD/JPY Y113,99 +1,15%

EUR/JPY Y123,87 +1,11%

GBP/JPY Y159,02 +1,40%

AUD/USD $0,7173 +0,46%

NZD/USD $0,6628 +0,59%

USD/CAD C$1,3408 -0,98%

-