Noticias del mercado

-

22:15

U.S. stocks closed

U.S. stocks advanced, extending their eight-week highs with banks and energy shares rallying for a second day as improving data bolstered optimism on the economy.

A report today showed companies in the U.S. added more workers than forecast to their payrolls, another positive signal on the economy after gauges showing stability at American factories, major carmakers and in the public and private construction industries helped spur a rally yesterday. The improving data has also raised the odds the Federal Reserve will boost borrowing costs this year.

The S&P 500 has trimmed its 2016 decline to less than 3 percent, from more than 10 percent, amid a recovery from a 22-month low on Feb. 11. The benchmark is down 6.8 percent from an all-time high reached last May.

In Tuesday's votes, Donald Trump and Hillary Clinton solidified their positions in the race to their parties' presidential nominations. The impact on trading was muddied as global equities rebounded on the U.S. economic data and amid stability in China markets that spurred risk-taking.

The eighth year of a presidency typically ranks last in terms of equity returns, and the first half of an election year is often even worse. Add everything else that has been weighing on markets in 2016, from China to oil and the Fed, and few money managers see a return to the relative calm that reigned from 2012 to 2015.

A Fed report today showed the U.S. economy continued to expand across most of the country, while wage growth was described as varying widely, "from flat to strong." Seven of the Fed's 12 regional districts characterized the economy as growing "moderately," at a "modest pace" or "slightly," according to the central bank's Beige Book, an economic survey published eight times a year.

Separately, San Francisco Fed President John Williams said today domestic demand is overwhelming weakness from abroad, and inflation should move back to the central bank's 2 percent target over the next two years. Traders have raised the odds for rate increases this year, pricing in a 38 percent probability for a June boost in borrowing costs, up from about 26 percent a week ago. Chances for a December move have increased to 66 percent from 42 percent last Wednesday.

-

21:00

DJIA 16864.32 -0.76 0%, NASDAQ 4687.85 -1.75 -0.04%, S&P 500 1980.79 2.44 0.12%

-

18:00

European stocks close: stocks closed higher on expectations for a further monetary policy easing by the European Central Bank

Stock indices closed higher on expectations for a further stimulus measures by the European Central Bank (ECB). The ECB President Mario Draghi wrote in the letter to Jonas Fernández, member of the European Parliament, on Tuesday that the central bank will review its monetary policy measures at the monetary policy meeting next week as the downside risks to the outlook increased. He noted that the ECB's quantitative easing was working. Draghi also said that the Eurozone's inflation is weaker than expected.

ECB Executive Board member Benoit Coeure said on Wednesday that the central bank monitored the impact of negative rates. He pointed out that many banks could handle negative rates as they were "able to more than offset declining interest revenues with higher lending volumes, lower interest expenses, lower risk provisioning and capital gains".

Meanwhile, market participants eyed the economic data from the Eurozone. Eurostat released its producer price index for the Eurozone on Wednesday. Eurozone's producer price index declined 1.0% in January, missing expectations for a 0.7% fall, after a 0.8% decrease in December.

Intermediate goods prices fell 0.3% in January, capital goods prices rose 0.1%, non-durable consumer goods prices were flat and durable consumer goods prices were up 0.4%, while energy prices decreased 3.2%.

On a yearly basis, Eurozone's producer price index dropped 2.9% in January, in line with expectations, after a 3.0% fall in December.

Eurozone's producer prices excluding energy fell 0.6% year-on-year in January. Energy prices dropped at an annual rate of 8.6%.

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. declined to 54.2 in February from 55.0 in January, missing expectations for an increase to 55.5. It was the lowest level since April 2015.

A reading above 50 indicates expansion in the construction sector.

The index was driven by a softer growth in output, new orders and employment. Housing activity showed the slowest performance since June 2013.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,147.06 -5.82 -0.09 %

DAX 9,776.62 +59.46 +0.61 %

CAC 40 4,424.89 +18.05 +0.41 %

-

18:00

European stocks closed: FTSE 6147.06 -5.82 -0.09%, DAX 9776.62 59.46 0.61%, CAC 40 4424.89 18.05 0.41%

-

17:55

WSE: Session Results

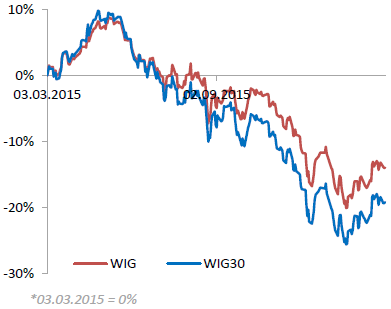

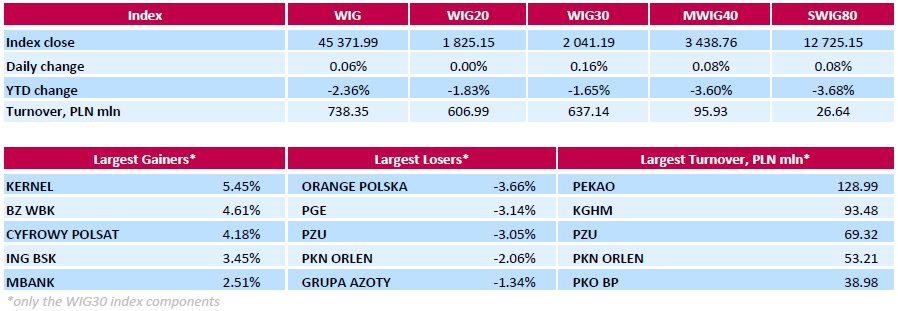

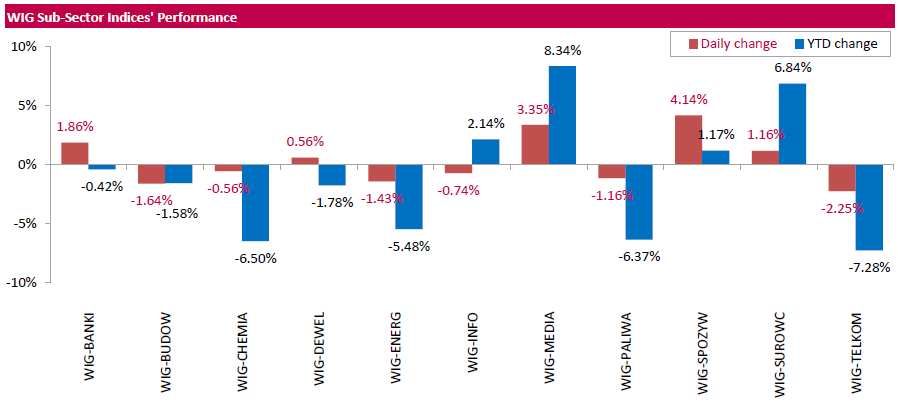

Polish equity market closed slightly higher Wednesday. The broad market measure, the WIG Index edged up 0.06%. Sector-wise, food sector (+4.14%) recorded the biggest advance, while telecommunication sector (-2.25%) fared the worst.

The large-cap stocks' measure, the WIG30 Index, added 0.16%. Within the index components, agricultural producer KERNEL (WSE: KER) was the best-performing name, climbing by 5.45%. It was followed by bank BZ WBK (WSE: BZW) and media group CYFROWY POLSAT (WSE: CPS), advancing 4.61% and 4.18% respectively. On the other side of the ledger, telecommunication services provider ORANGE POLSKA (WSE: OPL), genco PGE (WSE: PGE) and insurer PZU (WSE: PZU) were the biggest decliners, dropping by 3.05%-3.66%.

-

17:33

Wall Street. Major U.S. stock-indexes little changed

Wall Street little changed on Wednesday, moving from red area due to Crude oil rose. In the morning, U.S. crude fell about 1% after a report from the American Petroleum Institute (API) showed that an increase in crude stockpiles was way above estimates, but prices had been recovered.

Dow stocks mixed (15 vs 15). Top looser - NIKE, Inc. (NKE, -1,65%). Top gainer - The Procter & Gamble Company (PG, +1,10%).

S&P sectors also mixed. Top looser - Utilities (-0,3%). Top gainer - Conglomerates (+1,9%).

At the moment:

Dow 16835.00 -14.00 -0.08%

S&P 500 1975.25 -2.75 -0.14%

Nasdaq 100 4313.00 -24.75 -0.57%

Oil 34.82 +0.42 +1.22%

Gold 1238.00 +7.20 +0.58%

U.S. 10yr 1.87 +0.03

-

16:21

Bank of Japan Governor Haruhiko Kuroda: inflation in Japan was improving

Bank of Japan (BoE) Governor Haruhiko Kuroda said on Wednesday that inflation in Japan was improving.

"Underlying price trends are improving," he said.

-

15:47

European Central Bank Governing Council member François Villeroy de Galhau: the central bank could add further stimulus measures to boost inflation

European Central Bank (ECB) Governing Council member and Bank of France Governor François Villeroy de Galhau said on Wednesday that the central bank could add further stimulus measures to boost inflation. New ECB stimulus measures could targeted loans to commercials banks, higher asset purchases and more details about how long the central bank plans to keep its interest rates at low levels, de Galhau noted.

He also said that the Eurozone's inflation was too low, adding that inflation will likely be positive in the second half of the year.

-

15:33

U.S. Stocks open: Dow -0.25%, Nasdaq -0.11%, S&P -0.18%

-

15:20

Before the bell: S&P futures -0.25%, NASDAQ futures -0.21%

U.S. stock-index futures slipped.

Global Stocks:

Nikkei 16,746.55 +661.04 +4.1%

Hang Seng 20,003.49 +596.03 +3.1%

Shanghai Composite 2,849.1 +115.93 +4.2%

FTSE 6,127.61 -25.27 -0.41%

CAC 4,403.88 -2.96 -0.07%

DAX 9,725.2 +8.04 +0.08%

Crude oil $34.04 (-1.05%)

Gold $1233.00 (+0.18%)

-

14:57

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Yahoo! Inc., NASDAQ

YHOO

33.20

1.22%

0.4K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

7.80

0.52%

36.9K

Amazon.com Inc., NASDAQ

AMZN

581.70

0.46%

12.3K

American Express Co

AXP

56.98

0.32%

0.1K

Pfizer Inc

PFE

30.11

0.23%

15.7K

Tesla Motors, Inc., NASDAQ

TSLA

186.70

0.19%

10.1K

Barrick Gold Corporation, NYSE

ABX

13.29

0.15%

76.6K

Procter & Gamble Co

PG

81.29

0.07%

1.3K

AT&T Inc

T

37.40

0.03%

4.9K

Boeing Co

BA

120.00

0.03%

1.8K

Caterpillar Inc

CAT

69.11

0.03%

0.2K

Merck & Co Inc

MRK

51.75

0.00%

0.1K

Walt Disney Co

DIS

97.65

0.00%

0.5K

General Motors Company, NYSE

GM

30.01

0.00%

2.3K

Twitter, Inc., NYSE

TWTR

17.85

0.00%

11.0K

Google Inc.

GOOG

718.49

-0.04%

0.7K

Microsoft Corp

MSFT

52.55

-0.06%

0.1K

Apple Inc.

AAPL

100.47

-0.06%

71.3K

JPMorgan Chase and Co

JPM

59.16

-0.07%

1.1K

Goldman Sachs

GS

154.53

-0.08%

0.4K

Ford Motor Co.

F

13.08

-0.08%

20.7K

Wal-Mart Stores Inc

WMT

66.40

-0.09%

0.2K

Cisco Systems Inc

CSCO

26.80

-0.11%

2.7K

International Paper Company

IP

36.60

-0.11%

0.4K

Verizon Communications Inc

VZ

51.40

-0.12%

2.5K

Visa

V

74.54

-0.13%

8.5K

McDonald's Corp

MCD

118.65

-0.17%

7.6K

Intel Corp

INTC

30.30

-0.23%

1.5K

Starbucks Corporation, NASDAQ

SBUX

59.90

-0.23%

41.6K

Citigroup Inc., NYSE

C

41.15

-0.29%

1.5K

Facebook, Inc.

FB

109.50

-0.29%

64.9K

Exxon Mobil Corp

XOM

81.00

-0.34%

3.8K

Nike

NKE

62.70

-0.35%

1.5K

General Electric Co

GE

29.77

-0.37%

1.8K

Chevron Corp

CVX

85.66

-0.55%

6.8K

ALCOA INC.

AA

9.03

-0.88%

6.3K

E. I. du Pont de Nemours and Co

DD

62.21

-1.16%

3.9K

-

14:55

European Central Bank Executive Board member Benoit Coeure: the central bank monitored the impact of negative rates

European Central Bank (ECB) Executive Board member Benoit Coeure said on Wednesday that the central bank monitored the impact of negative rates.

"We are monitoring it on a regular basis and we are studying carefully the schemes used in other jurisdictions to mitigate possible adverse consequences for the bank lending channel," he said.

Coeure pointed out that many banks could handle negative rates as they were "able to more than offset declining interest revenues with higher lending volumes, lower interest expenses, lower risk provisioning and capital gains".

He noted the Eurozone's economy continued to recover.

-

14:45

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Amazon (AMZN) initiated with an Outperform at BMO Capital; target $700

Alcoa (AA) target lowered to $10 from $13 at Cowen

-

14:26

U.S. ADP Employment Report: private sector adds 214,000 jobs in February

Private sector in the U.S. added 214,000 jobs in February, according the ADP report on Wednesday. January's figure was revised up to 193,000 jobs from a previous reading of 205,000 jobs.

Analysts expected the private sector to add 190,000 jobs.

Services sector added 208,000 jobs in February, while goods-producing sector added 5,000.

"Despite the turmoil in the global financial markets, the American job machine remains in high gear. Energy and manufacturing remain blemishes on the job market, but other sectors continue to add strongly to payrolls. Full-employment is fast approaching," the Chief Economist of Moody's Analytics Mark Zandi said.

Official labour market data will be released on Friday. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 4.9% in February. The U.S. economy is expected to add 190,000 jobs in February, after adding 151,000 jobs in January.

-

12:02

European stock markets mid session: stocks traded higher on expectations for a further stimulus measures by the European Central Bank

Stock indices traded higher on expectations for a further stimulus measures by the European Central Bank (ECB). The ECB President Mario Draghi wrote in the letter to Jonas Fernández, member of the European Parliament, on Tuesday that the central bank will review its monetary policy measures at the monetary policy meeting next week as the downside risks to the outlook increased. He noted that the ECB's quantitative easing was working. Draghi also said that the Eurozone's inflation is weaker than expected.

Gains were limited by falling oil prices.

Meanwhile, market participants eyed the economic data from the Eurozone. Eurostat released its producer price index for the Eurozone on Wednesday. Eurozone's producer price index declined 1.0% in January, missing expectations for a 0.7% fall, after a 0.8% decrease in December.

Intermediate goods prices fell 0.3% in January, capital goods prices rose 0.1%, non-durable consumer goods prices were flat and durable consumer goods prices were up 0.4%, while energy prices decreased 3.2%.

On a yearly basis, Eurozone's producer price index dropped 2.9% in January, in line with expectations, after a 3.0% fall in December.

Eurozone's producer prices excluding energy fell 0.6% year-on-year in January. Energy prices dropped at an annual rate of 8.6%.

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. declined to 54.2 in February from 55.0 in January, missing expectations for an increase to 55.5. It was the lowest level since April 2015.

A reading above 50 indicates expansion in the construction sector.

The index was driven by a softer growth in output, new orders and employment. Housing activity showed the slowest performance since June 2013.

Current figures:

Name Price Change Change %

FTSE 100 6,156.43 +3.55 +0.06 %

DAX 9,730.99 +13.83 +0.14 %

CAC 40 4,423.25 +16.41 +0.37 %

-

11:52

HIA new home sales in Australia jump 3.1% in January

The Housing Industry Association (HIA) released its new home sales data for Australia on Wednesday. New home sales jumped 3.1% in January, after a 6.0% gain in December.

Sales of detached homes increased 5.8% in January, while sales for multi-units slid 5.8%.

"This year will be another healthy one for detached house and 'multi-unit' construction, but we won't surpass the heights of 2015. The new home building sector is crucial to Australia's economic prospects in 2016 and should continue as a mainstay of domestic economic activity," the HIA's chief economist Harley Dale said.

-

11:45

BRC: U.K. shop prices are down 2.0% year-on-year in February

According to the British Retail Consortium (BRC), the U.K. shop prices declined by 2.0% year-on-year in February, after a 1.8% decline in January.

The decline was mainly driven by a drop in non-food prices, which plunged 3.0% year-on-year in February.

Food prices declined at an annual rate of 0.4% in February.

"Another fall in shop prices was seen in February, down 2.0 per cent compared with a year ago and a further fall on the numbers we saw in January as competition in the industry continues apace. This now marks the 34th consecutive month of price drops and 35th for non-food prices," BRC Chief Executive, Helen Dickinson, said.

-

11:39

Switzerland's GDP rises 0.4% in the fourth quarter

The State Secretariat for Economic Affairs (SECO) released its gross domestic product (GDP) data for Switzerland on Wednesday. Switzerland's GDP rose 0.4% in the fourth quarter, exceeding expectations for a 0.2% rise, after a 0.1% decrease in the third quarter. The third quarter's figure was revised down from a flat reading.

GDP was driven by a positive contribution from household and public spending.

Exports of goods climbed 2.9% in the fourth quarter, while exports of services decreased 3.2%.

Imports of goods climbed 4.2% in the fourth quarter, while imports of services were down 0.3%.

Household spending climbed by 0.1% in the fourth quarter, public spending was up 0.6%, equipment spending slid 0.9%, while construction spending increased 0.1%.

On a yearly basis, Switzerland's economy grew at 0.4% in the fourth quarter, exceeding expectations for a 0.1% rise, after a 0.8% increase in the third quarter.

In 2015 as whole, the Swiss economy expanded 0.9%, after a 1.9% growth in 2014.

-

11:28

Number of registered unemployed people in Spain increase by 2,231 in February

Spain's labour ministry release its labour market figures on Wednesday. The number of registered unemployed people increased by 2,231 in February, after a 57,247 rise in January.

On a yearly basis, the number of registered unemployed people fell by 359,167 people in February.

The total number of jobless in Spain was 4,152,986.

-

11:18

Eurozone's producer price index declines 1.0% in January

Eurostat released its producer price index for the Eurozone on Wednesday. Eurozone's producer price index declined 1.0% in January, missing expectations for a 0.7% fall, after a 0.8% decrease in December.

Intermediate goods prices fell 0.3% in January, capital goods prices rose 0.1%, non-durable consumer goods prices were flat and durable consumer goods prices were up 0.4%, while energy prices decreased 3.2%.

On a yearly basis, Eurozone's producer price index dropped 2.9% in January, in line with expectations, after a 3.0% fall in December.

Eurozone's producer prices excluding energy fell 0.6% year-on-year in January. Energy prices dropped at an annual rate of 8.6%.

-

11:04

UK construction PMI declines to 54.2 in February

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. declined to 54.2 in February from 55.0 in January, missing expectations for an increase to 55.5. It was the lowest level since April 2015.

A reading above 50 indicates expansion in the construction sector.

The index was driven by a softer growth in output, new orders and employment.

Housing activity showed the slowest performance since June 2013.

"UK construction firms remained in expansion mode during February, but a loss of momentum within the residential building sector meant that overall output growth was the weakest since April 2015. Aside from the pre-election slowdown last year, the latest upturn in construction output was the weakest for over-two and-a-half years," Senior Economist at Markit, Tim Moore, said.

-

10:50

European Central Bank President Mario Draghi: the central bank will review its monetary policy measures at the monetary policy meeting next week

The European Central Bank (ECB) President Mario Draghi wrote in the letter to Jonas Fernández, member of the European Parliament, on Tuesday that the central bank will review its monetary policy measures at the monetary policy meeting next week as the downside risks to the outlook increased. He noted that the ECB's quantitative easing was working.

Draghi also said that the Eurozone's inflation is weaker than expected.

The ECB president pointed out that the central bank could add further stimulus measures if needed.

"The Governing Council has a variety of instruments at its disposal to respond, if warranted, and there are no limits to how far we are willing to deploy our instruments within our mandate to achieve our objective of inflation rates below, but close to, 2% over the medium term," Draghi wrote.

-

10:37

Standard and Poor's expects global government debt to rise 2% this year

The rating agency Standard and Poor's (S&P) said on Monday that the government debt of the United States, China, Brazil and India is expected to rise further this year. The U.S. government debt is expected to climb 8% or $163 billion year-on-year in 2016, while China's debt is expected to jump 18% or $51 billion.

The Eurozone's debt is expected to decline 6%.

Global government debt is forecasted to increase 2% to $42.4 trillion.

-

10:21

Moody's lowers China’s outlook to 'negative' from 'stable' on the country's government credit ratings

Moody's Investors Service cut China's outlook to 'negative' from 'stable' on the country's government credit ratings on Wednesday. The agency said that the downward revision was driven by the weak fiscal metrics, a decline in reserve buffers and the uncertainty about the government' capacity to implement reforms.

Moody's affirmed China's Aa3 rating.

The agency noted that the country's climbed to 40.6% of GDP at the end of 2015 from 32.5% in 2012, and expected to rise to 43.0% by 2017.

China's foreign exchange reserves dropped to $3.2 trillion in January 2016, down by $762 billion from June 2014.

-

10:11

Australia's GDP climbs 0.6% in the fourth quarter

The Australian Bureau of Statistics released its GDP data on Wednesday. Australia's GDP climbed 0.6% in the fourth quarter, exceeding expectations for a 0.5% gain, after a 1.1% rise in the third quarter. The third quarter's figure was revised up from a 0.9% increase.

Final consumption spending was up 0.7% in the fourth quarter.

Terms of trade dropped 3.2% in the fourth quarter, while real net national disposable income decreased 0.1%.

Private gross fixed capital formation dropped 1.9% in the fourth quarter.

Exports and imports both increased by 0.6% in the fourth quarter.

On a yearly basis, Australia's GDP rose 3.0% in the fourth quarter, beating expectations for a 2.6% increase, after a 2.7% gain in the third quarter. The third quarter's figure was revised up from a 2.5% rise.

-

03:34

Nikkei 225 16,732.39 +646.88 +4.02 %, Hang Seng 19,914.59 +507.13 +2.61 %, Shanghai Composite 2,765.72 +32.55 +1.19 %

-

00:36

Stocks. Daily history for Sep Mar 1’2016:

(index / closing price / change items /% change)

Nikkei 225 16,085.51 +58.75 +0.37 %

Hang Seng 19,407.46 +295.53 +1.55 %

Shanghai Composite 2,733.91 +45.93 +1.71 %

FTSE 100 6,152.88 +55.79 +0.92 %

CAC 40 4,406.84 +53.29 +1.22 %

Xetra DAX 9,717.16 +221.76 +2.34 %

S&P 500 1,978.35 +46.12 +2.39 %

NASDAQ Composite 4,689.6 +131.65 +2.89 %

Dow Jones 16,865.08 +348.58 +2.11 %

-