Noticias del mercado

-

23:59

Schedule for today, Wednesday, Mar 2’2016:

(time / country / index / period / previous value / forecast)

00:30 Australia Gross Domestic Product (QoQ) Quarter IV 0.9% 0.5%

00:30 Australia Gross Domestic Product (YoY) Quarter IV 2.5% 2.6%

06:45 Switzerland Gross Domestic Product (YoY) Quarter IV 0.8% 0.1%

06:45 Switzerland Gross Domestic Product (QoQ) Quarter IV 0% 0.2%

09:30 United Kingdom PMI Construction February 55 55.5

10:00 Eurozone Producer Price Index, MoM January -0.8% -0.7%

10:00 Eurozone Producer Price Index (YoY) January -3.0% -2.9%

10:00 United Kingdom MPC Member Dr Ben Broadbent Speaks

12:00 U.S. MBA Mortgage Applications February -4.3%

13:15 U.S. ADP Employment Report February 205 190

14:00 United Kingdom BOE Deputy Governor for Financial Stability Jon Cunliffe speaks

15:30 U.S. Crude Oil Inventories February 3.502

19:00 U.S. Fed's Beige Book

22:30 Australia AIG Services Index February 48.4

-

18:12

Italian economy expands 0.8% in 2015

The Italian statistical office Istat released its gross domestic product (GDP) data for Italy on Tuesday. The Italian GDP increased 0.8% in 2015, after a 0.3% drop in 2014.

Final consumption expenditure climbed by 0.5% in 2015, gross fixed capital formation rose by 0.8%, imports rose by 6.0%, while exports increased by 4.3%.

General government net borrowing was -2.6% of GDP in 2015, up from -3.0% of GDP in 2014.

General government debt was 132.6% of GDP.

-

18:05

Capital spending in Japan jumps 8.5% in the fourth quarter

Japan's Ministry of Finance released its capital spending data on late Monday evening. Capital spending in Japan jumped 8.5% in the fourth quarter, after a 11.2% gain in the third quarter.

Capital spending excluding software soared 8.9% in the fourth quarter, after a 11.2% rise in the third quarter.

Company profits in Japan declined 1.7% in the fourth quarter, while company sales were down 2.7%.

-

17:32

Australia’s current account deficit widens to A$21.1 billion in the fourth quarter

The Australian Bureau of Statistics released its current account data on Tuesday. Australia's current account deficit widened to A$21.1 billion in the fourth quarter from A$18.8 billion in the third quarter, missing expectations for a decline to a deficit of A$20.0 billion. The third quarter's figure was revised down from a deficit of A$18.1 billion.

The seasonally adjusted deficit on goods and services rose by 35% to A$9.93 billion in the fourth quarter, which was 0.0% of gross domestic product.

Australia's net foreign debt climbed 2% in the fourth quarter.

-

17:01

Australian Industry Group’s services purchasing managers’ index for Australia rises to 53.5 in February, the highest level since July 2010

The Australian Industry Group (AiG) released its manufacturing purchasing managers' index (PMI) for Australia on the late Monday evening. The index rose to 53.5 in February from 51.5 in January. It was the highest level since July 2010.

A reading above 50 indicates expansion in the sector, while a reading below 50 indicates contraction in the sector.

Four of the five activity sub-indexes were below 50 points in February.

Main contributor to the rise was production.

-

16:52

Building permits in Australia drop 7.5% in January

The Australian Bureau of Statistics released its building permits data on Tuesday. Building permits in Australia dropped 7.5% in January, missing expectations for a 2.0% fall, after a 8.6% rise in December. December's figure was revised down from a 9.2% increase.

Building permits for private sector houses slid 6.0% in January, while building permits for private sector dwellings excluding houses plunged 10.8%.

The seasonally adjusted estimate of the value of total building approved was down 1.8% in January.

On a yearly basis, building permits fell 15.5% in January, after a 2.5% decrease in December.

-

16:47

Construction spending in the U.S. is up 1.5% in January

The U.S. Commerce Department released construction spending data on Tuesday. Construction spending in the U.S. rose 1.5% in January, exceeding expectations for a 0.4% gain, after a 0.6% increase in December. December's figure was revised up from a 0.1% rise.

The increase was mainly driven by a rise in private and public spending. Total private construction spending was up 0.5% in January, public spending climbed 4.4%.

Spending on private residential construction was flat in January, while spending on private non-residential construction projects increased 2.5%.

-

16:42

Canadian manufacturing PMI rises to 49.4 in February

Royal Bank of Canada (RBC), the Supply Chain Management Association (SCMA) and Markit Economics released their RBC Canadian manufacturing PMI on Tuesday. The index rose to 49.4 in February from 49.3 in January. It was the highest level since August 2015.

The rise was driven by a softer decline in output and new orders.

"The U.S. expansion alongside a more competitive Canadian dollar is continuing to drive stronger export sales and stabilize manufacturing conditions," RBC senior vice-president and chief economist, Craig Wright, said.

-

16:17

ISM manufacturing purchasing managers’ index rises to 49.5 in February

The Institute for Supply Management released its manufacturing purchasing managers' index for the U.S. on Tuesday. The index rose to 49.5 in February from 48.2 in January. Analysts had expected the index to increase to 48.5.

A reading above 50 indicates expansion, below indicates contraction.

The increase was mainly driven by rises in production and employment. The production index increased to 52.8 in February from 50.2 in January, while the employment index was up to 48.5 from 45.9.

The new orders index remained unchanged at 51.5 in February.

The price index increased to 38.5 in February from 33.5 in January.

-

16:07

U.S. final manufacturing purchasing managers' index (PMI) decreases to 51.3 in February

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the U.S. on Tuesday. The U.S. final manufacturing purchasing managers' index (PMI) decreased to 51.3 in February from 52.4 in January, up from the previous estimate of 51.0.

A reading above 50 indicates expansion in economic activity.

The index was driven by a slower pace of growth in output and new orders.

"The February data add to signs of distress in the US manufacturing economy. Production and order book growth continues to worsen, led by falling exports. Jobs are being added at a slower pace and output prices are dropping at a rate not seen since mid-2012," Markit's Chief Economist Chris Williamson said.

-

16:00

U.S.: Construction Spending, m/m, January 1.5% (forecast 0.4%)

-

16:00

U.S.: ISM Manufacturing, February 49.5 (forecast 48.5)

-

15:45

U.S.: Manufacturing PMI, February 51.3 (forecast 51)

-

15:36

Swiss retail sales rise 0.2% year-on-year in January

The Federal Statistical Office released its retail sales data for Switzerland on Tuesday. Retail sales in Switzerland were up at an annual rate of 0.2% in January, beating expectations for a 1.2% decline, after a 1.7% decrease in December. December's figure was revised down from a 1.6% drop.

Sales of food, beverages and tobacco declined at an annual rate of 1.0% in January, while non-food sales climbed 2.7%.

On a monthly basis, retail sales fell by 0.3% in January, after a 0.9% rise in December. December's figure was revised down from a 1.1% gain.

Sales of food, beverages and tobacco were flat in January, while non-food sales decreased 0.2%.

-

15:24

Swiss manufacturing PMI climbs to 51.6 in February

Credit Suisse and procure.ch released their manufacturing purchasing managers' index (PMI) for Switzerland on Tuesday. The manufacturing purchasing managers' index in Switzerland climbed to 51.6 in February from 50.0 in January, beating expectations for a decrease to 49.6.

A reading above 50 indicates contraction.

The increase was largely driven by rises in production and backlog of orders. The production increased to 56.9 in February from 54.6 In January, while the backlog of orders sub-index jumped to 53.3 from 49.3, the highest level since October 2014.

Purchase prices were up to 43.8 in February from 41.7 in January.

Employment declined to 45.6 in February from 47.9 in January.

-

15:16

Italy’s manufacturing PMI slides to 52.2 in February

Markit Economics released its manufacturing purchasing managers' index (PMI) for Italy on Tuesday. Italy's Markit/ADACI manufacturing PMI slid to 52.2 in February from 53.2 in January.

The decline was driven by a softer growth in output and new orders.

"February survey data confirm that the manufacturing sector has started 2016 on a softer footing. Growth rates for both output and new orders waned further from the highs seen late in 2015, while manufacturers' buying levels failed to rise for the first time in over a year," Markit economist Phil Smith said.

-

15:02

Greece’s manufacturing PMI declines to 48.4 in February

Markit Economics released its manufacturing purchasing managers' index (PMI) for Greece on Tuesday. Greece's manufacturing purchasing managers' index (PMI) declined to 48.4 in February from 50.0 in January.

Output and new orders fell in February, while input prices showed the biggest drop since January 2009.

"The key areas covered by the survey provided alarming indicators on the current health of the Greek manufacturing sector. Output contracted further amid a solid decline in incoming new work, while job cuts were evident after another substantial deterioration in outstanding business levels was reported," Markit economist Samuel Agass said.

-

14:54

Canada's GDP climbs 0.2% in the fourth quarter

Statistics Canada released GDP (gross domestic product) growth data on Tuesday. Canada's GDP growth rose 0.2% in December, exceeding expectations for a 0.1% gain, after a 0.3% increase in November.

On a quarterly basis, GDP climbed 0.2% in the fourth quarter, after 0.6% rise in the third quarter.

The quarterly rise was driven by lower final domestic demand and exports. Final domestic demand fell 0.2% in the fourth quarter, after a flat reading in the third quarter.

Exports of goods and services decreased 0.6% in the fourth quarter, while imports of goods and services declined 2.3%.

Household final consumption expenditure was up 0.2% in the fourth quarter as spending on services rose 0.4% in the fourth quarter.

The household saving rate remained unchanged at 4.0% in the fourth quarter.

Business gross fixed capital formation dropped 1.7% in the fourth quarter.

On a yearly basis, GDP rose 0.8% in the fourth quarter, beating expectations for a flat reading, after a 2.4% gain in the third quarter. The third quarter's figure was revised up from a 2.3% increase.

In 2015 as whole, Canada's economy expanded 1.2%, after a 2.5% growth in 2014.

-

14:45

Option expiries for today's 10:00 ET NY cut

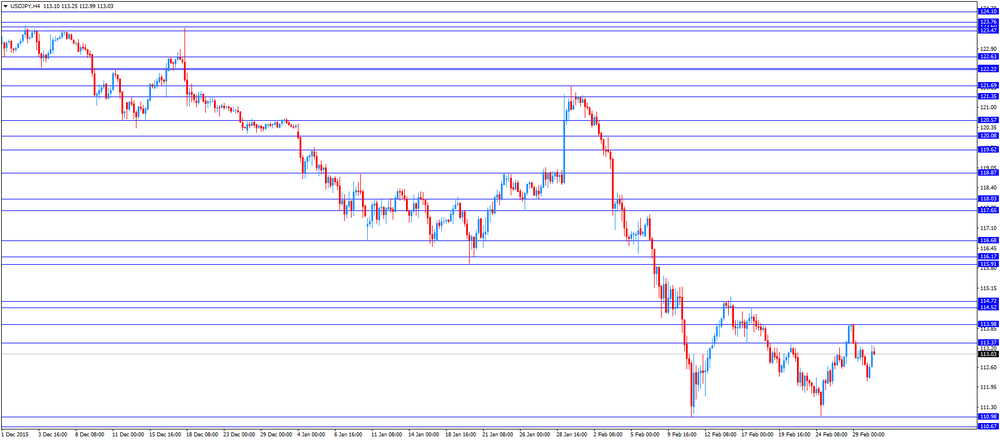

USD/JPY: 112.90-113.00 (USD 397m) 113.35 (225m) 114.00 (205m) 114.45 (200m)

EURUSD: 1.0680 (EUR 605m) 1.0800 (670m) 1.0850 (405m) 1.0887 (303m) 1.0900-10 (1.75bln) 1.0930 (382m) 1.1000 (1.32bln)

AUD/USD: 0.7000 (AUD 201m) ) 0.7100 (469m) 0.7200 (370m)

USD/CAD 1.3650 (USD 260m)

NZD/USD 0.6390 (NZD 469m) 0.6600 (666m) 0.6650 (212m)

-

14:31

Canada: GDP (m/m) , December 0.2% (forecast 0.1%)

-

14:31

Canada: GDP (YoY), Quarter IV 0.8% (forecast 0%)

-

14:31

Canada: GDP QoQ, Quarter IV 0.2%

-

14:24

Spain’s manufacturing PMI drops to 54.1 in February

Markit Economics released its manufacturing purchasing managers' index (PMI) for Spain on Tuesday. Spain's manufacturing purchasing managers' index (PMI) declined to 54.1 in February from 55.4 in January.

The decrease was driven by a slower growth in output, while input costs fell.

"Spanish manufacturers continued to rise above economic and political uncertainty in February, once again increasing output at a rapid rate and taking on extra staff at the fastest pace since the summer of 2015," a senior economist at Markit Andrew Harker said.

-

14:20

Final Markit/Nikkei manufacturing purchasing managers' index for Japan declines to 50.1 in February

The final Markit/Nikkei manufacturing Purchasing Managers' Index (PMI) for Japan declined to 50.1 in February from 50.2 in January, down from the preliminary reading of 50.2.

A reading above 50 indicates expansion, a reading below 50 indicates contraction of activity.

The index was driven by a slower growth in output and a drop in new orders.

"Operating conditions in the Japanese manufacturing sector was little-changed in February, following a solid improvement in January. Production growth slowed to a fractional rate, alongside a marginal contraction in new orders," economist at Markit, Amy Brownbill, said.

-

14:15

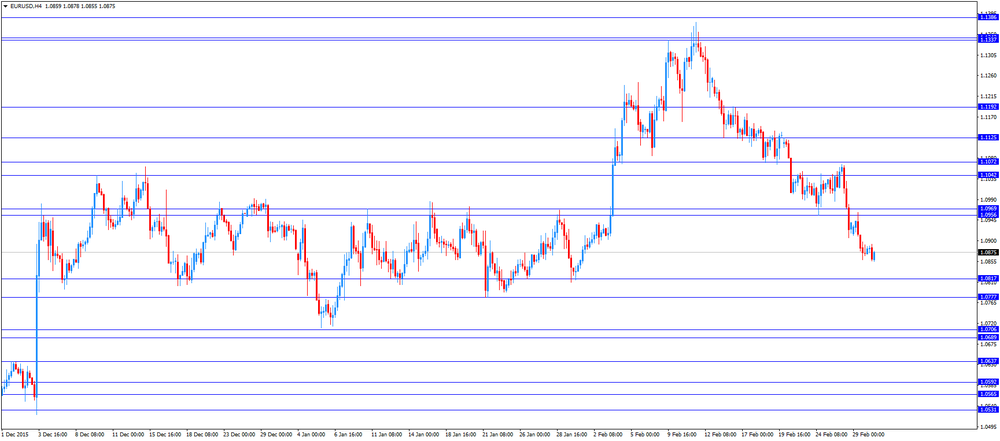

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the release of the mixed economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Current Account, bln Quarter IV -18.8 Revised From -18.1 -20 -21.1

00:30 Australia Building Permits, m/m January 8.6% Revised From 9.2% -2% -7.5%

01:00 China Manufacturing PMI February 49.4 49.3 49.0

01:00 China Non-Manufacturing PMI February 53.5 52.7

01:35 Japan Manufacturing PMI (Finally) February 52.3 52.1

01:45 China Markit/Caixin Manufacturing PMI February 48.4 48.0

03:30 Australia Announcement of the RBA decision on the discount rate 2% 2% 2%

03:30 Australia RBA Rate Statement

08:15 Switzerland Retail Sales (MoM) January 1.1% -0.3%

08:15 Switzerland Retail Sales Y/Y January -1.7% Revised From -1.6% -1.2% 0.2%

08:30 Switzerland Manufacturing PMI February 50 49.6 51.6

08:50 France Manufacturing PMI (Finally) February 50 50.3 50.2

08:55 Germany Unemployment Rate s.a. February 6.2% 6.2% 6.2%

08:55 Germany Unemployment Change February -20 -10 -10

08:55 Germany Manufacturing PMI (Finally) February 52.3 50.2 50.5

09:00 Eurozone Manufacturing PMI (Finally) February 52.3 51 51.2

09:30 United Kingdom Purchasing Manager Index Manufacturing February 52.9 52.2 50.8

10:00 Eurozone Unemployment Rate January 10.4% 10.4% 10.3%

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. The final manufacturing purchasing managers' index is expected to decline to 51.0 in February from 52.4 in January.

The ISM manufacturing purchasing managers' index is expected to rise to 48.5 in February from 48.2 in January.

The euro traded mixed against the U.S. dollar after the release of the mixed economic data from the Eurozone. Eurostat released its unemployment data for the Eurozone on Tuesday. Eurozone's unemployment rate declined to 10.3% in January from 10.4% in December. It was the lowest reading since August 2011. Analysts had expected the unemployment rate to remain unchanged at 10.4%.

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Tuesday. Eurozone's final manufacturing purchasing managers' index (PMI) dropped to 51.2 in February from 52.3 in January, up from the preliminary reading of 51.0.

The drop was driven by a softer growth in production, new orders, export business and employment.

"With factory output in the Eurozone showing the smallest rise for a year in February, concerns are growing that the region is facing yet another year of sluggish growth in 2016, or even another downturn," Chris Williamson, Chief Economist at Markit said.

"With all indicators - from output and demand to employment and prices - turning down, the survey will add pressure on the ECB to act quickly and aggressively to avert another economic downturn," he added.

Germany's final Markit/BME manufacturing PMI fell to 50.5 in February from 52.3 in January, up from the preliminary reading of 50.2. The index was driven by declines in all subindexes.

France's final manufacturing PMI increased to 50.2 in February from 50.0 in January, down from the preliminary reading of 50.3. The index was driven by a rise in backlogs of work.

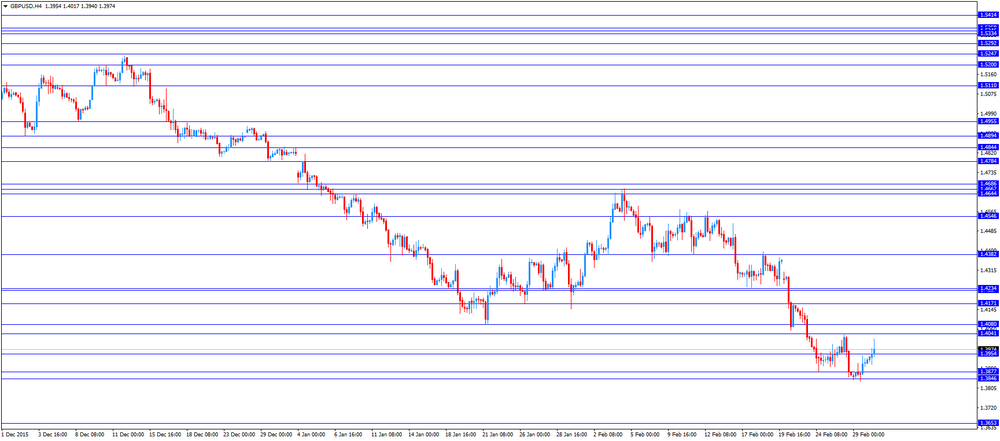

The British pound traded higher against the U.S. dollar after the release of the U.K. manufacturing PMI data. Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Tuesday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. decreased to 50.8 in February from 52.9 in January, missing expectations for a fall to 52.2. it was the lowest level since April 2013.

The decrease was driven by a drop in output.

"The near-stagnation of manufacturing highlights the ongoing fragility of the economic recovery at the start of the year and provides further cover for the Bank of England's increasingly dovish stance. The breadth of the slowdown is especially worrisome," Markit's Senior Economist Rob Dobson said.

The Canadian dollar traded mixed against the U.S. dollar ahead of the release of the Canadian GDP data. Canada's GDP growth is expected to rise 0.1% in December, after a 0.3% gain in November.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair increased to $1.4017

USD/JPY: the currency pair rose to Y113.33

The most important news that are expected (GMT0):

13:30 Canada GDP (m/m) December 0.3% 0.1%

13:30 Canada GDP QoQ Quarter IV 0.6%

13:30 Canada GDP (YoY) Quarter IV 2.3% 0%

14:45 U.S. Manufacturing PMI (Finally) February 52.4 51

15:00 U.S. Construction Spending, m/m January 0.1% 0.4%

15:00 U.S. ISM Manufacturing February 48.2 48.5

-

13:52

Orders

EUR/USD

Offers 1.0900 1.0920 1.0935 1.0950 1.0975-80 1.1000 1.1025-30.1050

Bids 1.0850 1.0830 1.0800 1.0785 1.0750 1.0730 1.0700

GBP/USD

Offers 1.3985 1.4000 1.4020-25 1.4050 1.4080 1.4100

Bids 1.3920 1.3900 1.3880-85 1.3860 1.3835 1.3820 1.3800

EUR/JPY

Offers 123.25 123.45-50 123.80 124.00 124.50124.80 125.00

Bids 122.50 122.30 122.00 121.50 121.00

EUR/GBP

Offers 0.7820-25 0.7850 0.7880 0.7900 0.7925-30 0.7950

Bids 0.7780-85 0.7750 0.7730 0.7700

USD/JPY

Offers 113.50 113.65 113.85 114.00 114.30 114.50

Bids 113.00 112.70-75 112.50 112.25-30 112.00

AUD/USD

Offers 0.7180 0.7200 0.7235 0.7250-55

Bids 0.7125-30 0.7100 0.7080 0.7065 0.7050 0.7000

-

12:23

Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. decreases to 50.8 in February

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Tuesday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. decreased to 50.8 in February from 52.9 in January, missing expectations for a fall to 52.2. it was the lowest level since April 2013.

A reading above 50 indicates expansion.

The decrease was driven by a drop in output.

"The near-stagnation of manufacturing highlights the ongoing fragility of the economic recovery at the start of the year and provides further cover for the Bank of England's increasingly dovish stance. The breadth of the slowdown is especially worrisome," Markit's Senior Economist Rob Dobson said.

-

12:18

France’s final manufacturing PMI increases to 50.2 in February

Markit Economics released its final manufacturing purchasing managers' index (PMI) for France on Tuesday. France's final manufacturing purchasing managers' index (PMI) increased to 50.2 in February from 50.0 in January, down from the preliminary reading of 50.3.

The index was driven by a rise in backlogs of work.

"Falling new orders were again the source of weakness, leading firms to cut production levels slightly. Meanwhile, the survey's price indices point to continued downward pressure on already low inflation," Markit Senior Economist Jack Kennedy said.

-

12:14

Germany’s final manufacturing PMI falls to 50.5 in February

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Germany on Tuesday. Germany's final Markit/BME manufacturing purchasing managers' index (PMI) fell to 50.5 in February from 52.3 in January, up from the preliminary reading of 50.2.

The index was driven by declines in all subindexes.

"It looks as if the German manufacturing engine has run out of steam, with the headline PMI falling to a 15- month low in February. Faced with weak domestic and foreign demand and slow production growth, manufacturers reduced their workforce numbers for the first time in one-and-a-half years," Markit economist Oliver Kolodseike said.

-

12:09

Eurozone’s final manufacturing PMI drops to 51.2 in February

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Tuesday. Eurozone's final manufacturing purchasing managers' index (PMI) dropped to 51.2 in February from 52.3 in January, up from the preliminary reading of 51.0.

The drop was driven by a softer growth in production, new orders, export business and employment.

"With factory output in the Eurozone showing the smallest rise for a year in February, concerns are growing that the region is facing yet another year of sluggish growth in 2016, or even another downturn," Chris Williamson, Chief Economist at Markit said.

"With all indicators - from output and demand to employment and prices - turning down, the survey will add pressure on the ECB to act quickly and aggressively to avert another economic downturn," he added.

-

12:04

Italy’s unemployment rate falls to 11.5% in January

The Italian statistical office Istat released its unemployment data on Tuesday. The seasonally adjusted unemployment rate fell to 11.5% in January from 11.6% in December. December's figure was revised up from 11.4%.

The number of unemployed people was 2.951 million in January, unchanged from the month before.

The youth unemployment rate increased to 39.3 in January from 38.7% in December.

The employment rate increased to 56.8% in January from 56.7% in December.

-

11:57

Number of unemployed people in Germany declines by 10,000 in February

The Federal Labour Agency released its unemployment figures for Germany on Tuesday. The number of unemployed people in Germany fell by 10,000 in February, in line with expectations, after a 19,000 decrease in January. January's figure was revised down from a 20,000 decline.

The unemployment rate remained unchanged at 6.2% in February, in line with expectations.

The number of unemployed people was 1.83 million in January, according to Destatis.

Destatis said that Germany's adjusted unemployment rate declined to 4.3% in January from 4.4% in December.

The employment rate rose to an adjusted rate of 65.7 in January from 65.4% in December, according to Destatis.

-

11:50

Eurozone's unemployment rate drops to 10.3% in January, the lowest reading since August 2011

Eurostat released its unemployment data for the Eurozone on Tuesday. Eurozone's unemployment rate declined to 10.3% in January from 10.4% in December. It was the lowest reading since August 2011.

Analysts had expected the unemployment rate to remain unchanged at 10.4%.

There were 16.647 million unemployed in the Eurozone in January, down by 105.000 from December.

The lowest unemployment rate in the Eurozone in January was recorded in Germany (4.3%) and Malta (5.1%), and the highest in Greece (24.6% in November 2015) and Spain (20.5%).

The youth unemployment rate was 22.0% in the Eurozone in January, compared to 22.8% in January a year ago.

-

11:36

Official data: Chinese manufacturing PMI declines to 49.0 in February, the lowest reading since November 2011

The Chinese manufacturing PMI fell to 49.0 in February from 49.4 in January, according to the Chinese government. It was the lowest reading since November 2011.

Analysts had expected the index to decline to 49.3.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The new orders subindex fell to 48.6 in February from 49.5 in January, while the production subindex decclined to 50.2 from 51.4

The services PMI decreased to 52.7 in February from 53.5 in January.

-

11:10

Chinese Markit/Caixin manufacturing PMI falls to 48.0 in February

The Chinese Markit/Caixin manufacturing PMI declined to 48.0 in February from 48.4 in January. The decrease was driven by a drop in output and new orders.

"The index readings for all key categories including output, new orders and employment signalled that conditions worsened, in line with signs that the economy's road to stability remains bumpy," Dr. He Fan, Chief Economist at Caixin Insight Group, said.

"The government needs to press ahead with reforms, while adopting moderate stimulus policies and strengthening support of the economy in other ways to prevent it from falling off a cliff," he added.

-

11:00

Eurozone: Unemployment Rate , January 10.3% (forecast 10.4%)

-

10:58

New York Fed President William Dudley: the downside risks to the U.S. outlook increased

New York Fed President William Dudley said on Tuesday that the downside risks to the U.S. outlook increased.

"The balance of risks to my growth and inflation outlooks may be starting to tilt slightly to the downside," he said.

Dudley added that the tightening of financial market conditions could have a significant negative impact on the U.S. economy.

-

10:45

Household spending in Japan declines 3.1% year-on-year in January

Japan's Ministry of Internal Affairs and Communications released its inflation data on late Monday evening. Household spending in Japan fell 3.1% year-on-year in January, missing expectations of a 2.7% drop, after a 4.4% decline in December.

The decline was mainly driven by drops in spending on housing, fuel, education, and clothing.

Spending on housing plunged 16.1% year-on-year in January, spending on fuel slid 10.7%, spending on education dropped 7.6%, while spending on clothing declined 5.9%.

-

10:30

United Kingdom: Purchasing Manager Index Manufacturing , February 50.8 (forecast 52.2)

-

10:23

Reserve Bank of Australia keeps its interest rate unchanged at 2.00% in March

The Reserve Bank of Australia (RBA) kept its interest rate unchanged at 2.00% on Tuesday. This decision was expected by analysts.

The RBA Governor Glenn Stevens said that the board' decision was reasonable "for continued growth in the economy, with inflation close to target".

He pointed out that further interest rate cut is possible.

"Continued low inflation would provide scope for easier policy, should that be appropriate to lend support to demand," the RBA governor said.

But Stevens noted that the next central bank's decision would depend on the incoming economic data.

The RBA governor said that the global economy continued to grow.

Stevens also said that the growth in the non-mining parts of the Australian economy strengthened in 2015, while the labour market improved.

The RBA governor also said that consumer price inflation remained "quite low", adding that the monetary policy should be accommodative.

Stevens noted that the Australian dollar was adjusting to the evolving economic outlook.

-

10:14

Japan’s unemployment rate declines to 3.2% in January

Japan's Ministry of Internal Affairs and Communications released its unemployment rate on late Monday evening. Unemployment rate in Japan fell to 3.2% in January from 3.3% in December. Analysts had expected the unemployment rate to remain unchanged.

The number of unemployed persons fell by 200,000 in January to 2.11 million from a year ago.

The number of employed persons rose by 900,000 in December to 63.99 million from a year ago.

-

10:00

Eurozone: Manufacturing PMI, February 51.2 (forecast 51)

-

09:55

Germany: Unemployment Rate s.a. , February 6.2% (forecast 6.2%)

-

09:55

Germany: Unemployment Change, February -10 (forecast -10)

-

09:55

Germany: Manufacturing PMI, February 50.5 (forecast 50.2)

-

09:50

France: Manufacturing PMI, February 50.2 (forecast 50.3)

-

09:30

Switzerland: Manufacturing PMI, February 51.6 (forecast 49.6)

-

09:17

Switzerland: Retail Sales (MoM), January -0.3%

-

09:15

Switzerland: Retail Sales Y/Y, January 0.2% (forecast -1.2%)

-

08:59

Option expiries for today's 10:00 ET NY cut

USD/JPY: 112.90-113.00 (USD 397m) 113.35 (225m) 114.00 (205m) 114.45 (200m) EURUSD: 1.0680 (EUR 605m) 1.0800 (670m) 1.0850 (405m) 1.0887 (303m) 1.0900-10 (1.75bln) 1.0930 (382m) 1.1000 (1.32bln)

AUD/USD: 0.7000 (AUD 201m) ) 0.7100 (469m) 0.7200 (370m)

USD/CAD 1.3650 (USD 260m)

NZD/USD 0.6390 (NZD 469m) 0.6600 (666m) 0.6650 (212m)

-

08:25

Options levels on Tuesday, March 1, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1107 (4167)

$1.1020 (6524)

$1.0952 (2571)

Price at time of writing this review: $1.0875

Support levels (open interest**, contracts):

$1.0807 (3065)

$1.0775 (6830)

$1.0736 (3803)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 71709 contracts, with the maximum number of contracts with strike price $1,1000 (6524);

- Overall open interest on the PUT options with the expiration date March, 4 is 89237 contracts, with the maximum number of contracts with strike price $1,0900 (8557);

- The ratio of PUT/CALL was 1.24 versus 1.32 from the previous trading day according to data from February, 29

GBP/USD

Resistance levels (open interest**, contracts)

$1.4201 (538)

$1.4202 (434)

$1.4004 (591)

Price at time of writing this review: $1.3934

Support levels (open interest**, contracts):

$1.3893 (1726)

$1.3796 (1429)

$1.3698 (550)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 30848 contracts, with the maximum number of contracts with strike price $1,4350 (1966);

- Overall open interest on the PUT options with the expiration date March, 4 is 32355 contracts, with the maximum number of contracts with strike price $1,4350 (2954);

- The ratio of PUT/CALL was 1.05 versus 1.08 from the previous trading day according to data from February, 29

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

04:30

Australia: Announcement of the RBA decision on the discount rate, 2% (forecast 2%)

-

02:00

China: Manufacturing PMI , February 49.0 (forecast 49.3)

-

02:00

China: Non-Manufacturing PMI, February 52.7

-

01:30

Australia: Current Account, bln, Quarter IV 21.1 (forecast -20)

-

01:30

Australia: Building Permits, m/m, January -7.5% (forecast -2%)

-

01:01

Currencies. Daily history for Feb 29’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0872 -0,62%

GBP/USD $1,3915 +0,37%

USD/CHF Chf0,9982 +0,23%

USD/JPY Y112,68 -1,12%

EUR/JPY Y122,49 -1,75%

GBP/JPY Y156,79 -0,73%

AUD/USD $0,7140 +0,18%

NZD/USD $0,6589 -0,61%

USD/CAD C$1,3539 +0,20%

-

00:30

Japan: Household spending Y/Y, January -3.1% (forecast -2.7%)

-

00:30

Japan: Unemployment Rate, January 3.2% (forecast 3.3%)

-

00:00

Schedule for today, Tuesday, Mar 1’2016:

(time / country / index / period / previous value / forecast)

00:30 Australia Current Account, bln Quarter IV -18.1 -20

00:30 Australia Building Permits, m/m January 9.2% -2%

01:00 China Manufacturing PMI February 49.4 49.3

01:00 China Non-Manufacturing PMI February 53.5

01:35 Japan Manufacturing PMI (Finally) February 52.3

01:45 China Markit/Caixin Manufacturing PMI February 48.4

03:30 Australia Announcement of the RBA decision on the discount rate 2% 2%

03:30 Australia RBA Rate Statement

08:15 Switzerland Retail Sales (MoM) January 1.1%

08:15 Switzerland Retail Sales Y/Y January -1.6%

08:30 Switzerland Manufacturing PMI February 50 49.6

08:50 France Manufacturing PMI (Finally) February 50 50.3

08:55 Germany Unemployment Rate s.a. February 6.2% 6.2%

08:55 Germany Unemployment Change February -20 -10

08:55 Germany Manufacturing PMI (Finally) February 52.3 50.2

09:00 Eurozone Manufacturing PMI (Finally) February 52.3 51

09:30 United Kingdom Purchasing Manager Index Manufacturing February 52.9 52.2

10:00 Eurozone Unemployment Rate January 10.4% 10.4%

13:30 Canada GDP (m/m) December 0.3% 0.1%

13:30 Canada GDP QoQ Quarter IV 0.6%

13:30 Canada GDP (YoY) Quarter IV 2.3% 0.1%

14:45 U.S. Manufacturing PMI (Finally) February 52.4 51

15:00 U.S. Construction Spending, m/m January 0.1% 0.3%

15:00 U.S. ISM Manufacturing February 48.2 48.6

21:00 U.S. Total Vehicle Sales, mln February 17.58 17.7

23:50 Japan Capital Spending Quarter IV

-