Noticias del mercado

-

18:10

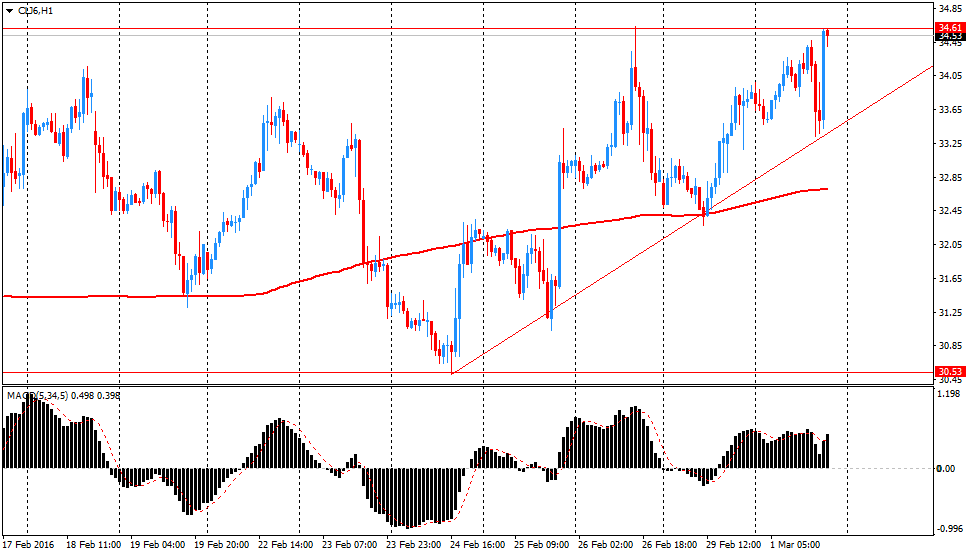

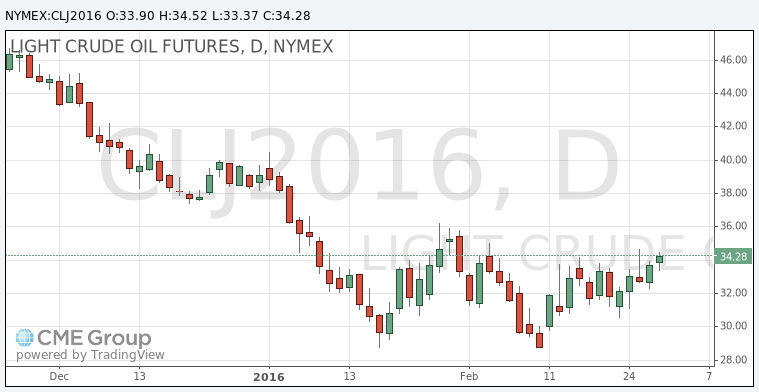

Oil advanced

Oil prices rose on comments from Russian President Vladimir Putin and better then expeted ISM data.

Vladimir Putin said Russian oil companies had agreed not to raise oil production this year, but made no mention of any producer-coordinated output cuts. He added it was Moscow's task to ensure stability in the Russian oil industry and that weak oil prices had been a result of a global economic slowdown and speculative deals.

Oil got support from signs that a global supply glut is easing are beginning to emerge. Exports from Iraq's southern fields dropped in February to an average of 3.225 million bpd, the country's oil ministry said.

The Institute for Supply Management released its manufacturing purchasing managers' index for the U.S. on Tuesday. The index rose to 49.5 in February from 48.2 in January. Analysts had expected the index to increase to 48.5.

WTI for delivery in April climbed 2.04% to stand at $34.27 a barrel. Brent for May advanced 1.53% to $37.13 a barrel compared with yesterday's close.

-

17:53

Oil prices increase on hopes for lower oil output

Oil prices rose on hopes for lower oil output. Reuters reported on Monday that the Organization of the Petroleum Exporting Countries' (OPEC) oil production fell in February due to the supply disruption from Iraq. OPEC's oil output decreased to 32.37 million barrels per day (bpd) in February from 32.65 million in January.

The U.S. Energy Information Administration (EIA) said on Monday that the oil production in the U.S. declined by 43,000 bpd in December to 9.26 million bpd. It was the lowest level since November 2014.

Russian President Vladimir Putin said on Tuesday that Russian oil companies decided not rise their oil output this year.

WTI crude oil for April delivery increased to $34.27 a barrel on the New York Mercantile Exchange.

Brent crude oil for April rose to $36.86 a barrel on ICE Futures Europe.

-

17:46

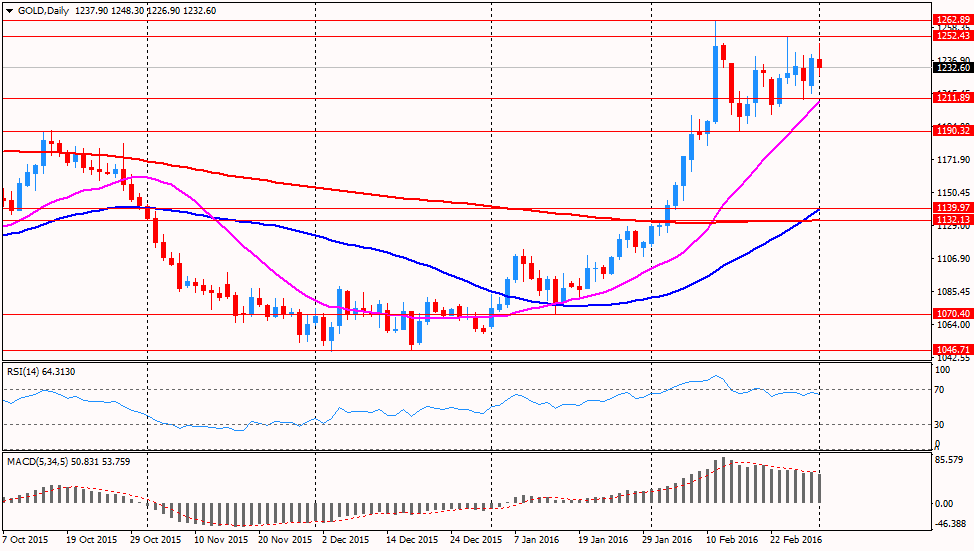

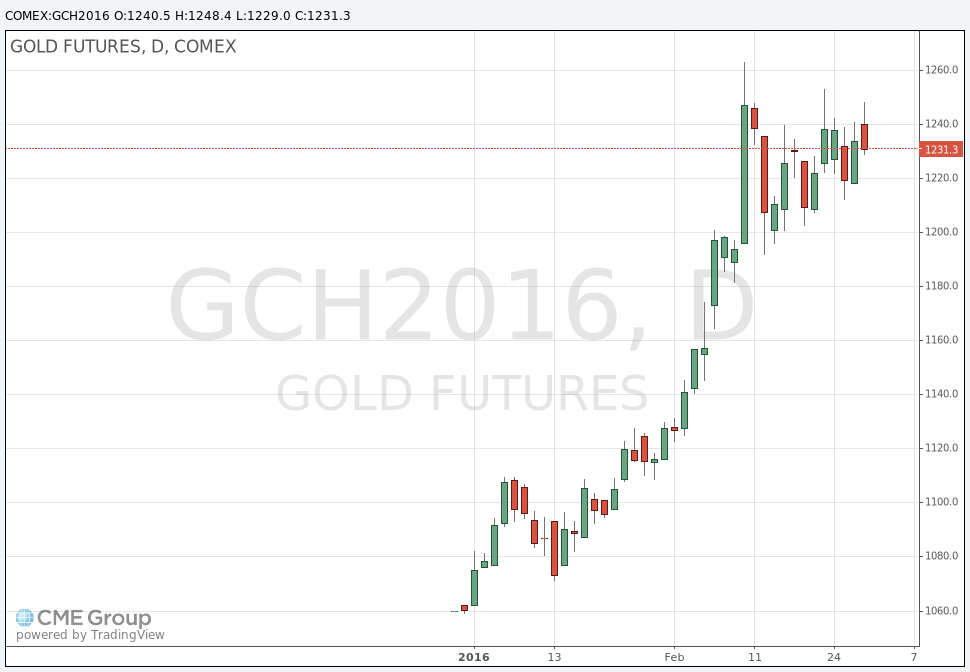

Gold fell on better then expected ISM data

Gold fell after better-than-expected U.S. data showed improvement in the business sector. The Institute for Supply Management released its manufacturing purchasing managers' index for the U.S. on Tuesday. The index rose to 49.5 in February from 48.2 in January. Analysts had expected the index to increase to 48.5.

Gold futures for March delivery decreased to $1232,60 (-0,33%) per ounce.

-

17:44

Gold declines on a stronger U.S. dollar

Gold price fell on a stronger U.S. dollar. The greenback increased against other currencies on the better-than-expected U.S. economic data. Markit Economics released its final manufacturing purchasing managers' index (PMI) for the U.S. on Tuesday. The U.S. final manufacturing purchasing managers' index (PMI) decreased to 51.3 in February from 52.4 in January, up from the previous estimate of 51.0. The index was driven by a slower pace of growth in output and new orders.

The Institute for Supply Management released its manufacturing purchasing managers' index for the U.S. on Tuesday. The index rose to 49.5 in February from 48.2 in January. Analysts had expected the index to increase to 48.5. The increase was mainly driven by rises in production and employment. The production index increased to 52.8 in February from 50.2 in January, while the employment index was up to 48.5 from 45.9.

March futures for gold on the COMEX today decreased to 1231.30 dollars per ounce.

-

11:36

Official data: Chinese manufacturing PMI declines to 49.0 in February, the lowest reading since November 2011

The Chinese manufacturing PMI fell to 49.0 in February from 49.4 in January, according to the Chinese government. It was the lowest reading since November 2011.

Analysts had expected the index to decline to 49.3.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The new orders subindex fell to 48.6 in February from 49.5 in January, while the production subindex decclined to 50.2 from 51.4

The services PMI decreased to 52.7 in February from 53.5 in January.

-

11:10

Chinese Markit/Caixin manufacturing PMI falls to 48.0 in February

The Chinese Markit/Caixin manufacturing PMI declined to 48.0 in February from 48.4 in January. The decrease was driven by a drop in output and new orders.

"The index readings for all key categories including output, new orders and employment signalled that conditions worsened, in line with signs that the economy's road to stability remains bumpy," Dr. He Fan, Chief Economist at Caixin Insight Group, said.

"The government needs to press ahead with reforms, while adopting moderate stimulus policies and strengthening support of the economy in other ways to prevent it from falling off a cliff," he added.

-

01:02

Commodities. Daily history for Feb 29’2016:

(raw materials / closing price /% change)

Oil 33.90 +0.44%

Gold 1,239.30 +0.40%

-