Noticias del mercado

-

17:45

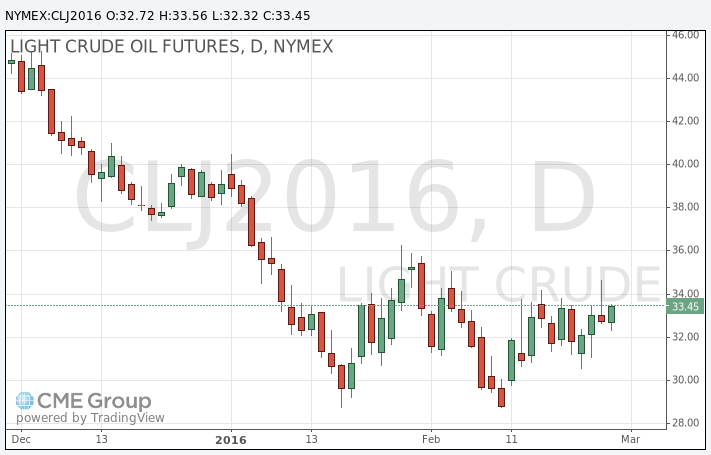

Oil prices increase

Oil prices rose on news about the supply disruption in Nigeria due to a leak. The Baker Hughes data also supported oil prices. The oil driller Baker Hughes reported on Friday that the number of active U.S. rigs declined by 13 rigs to 400 last week. It was the lowest level since December 2009.

According to a Reuters survey, the Organization of the Petroleum Exporting Countries' (OPEC) oil production fell in February due to the supply disruption from Iraq. OPEC's oil output decreased to 32.37 million barrels per day (bpd) in February from 32.65 million in January.

WTI crude oil for April delivery increased to $33.56 a barrel on the New York Mercantile Exchange.

Brent crude oil for April rose to $35.92 a barrel on ICE Futures Europe.

-

17:38

China plans to cut 1.8 million jobs in the coal and steel sectors

China's minister for human resources and social security, Yin Weimin, said on Monday that 1.3 million workers in the coal sector and 500,000 workers in the steel sector could lose jobs as there is a overcapacity in both sectors.

-

17:29

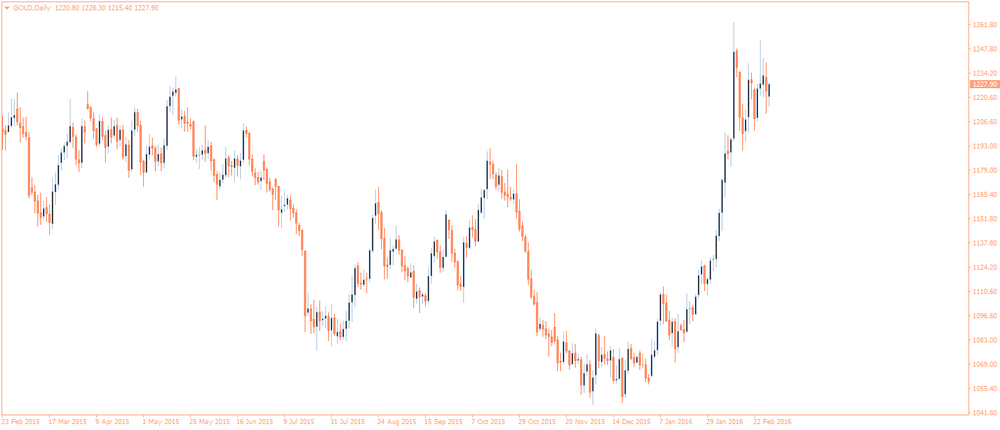

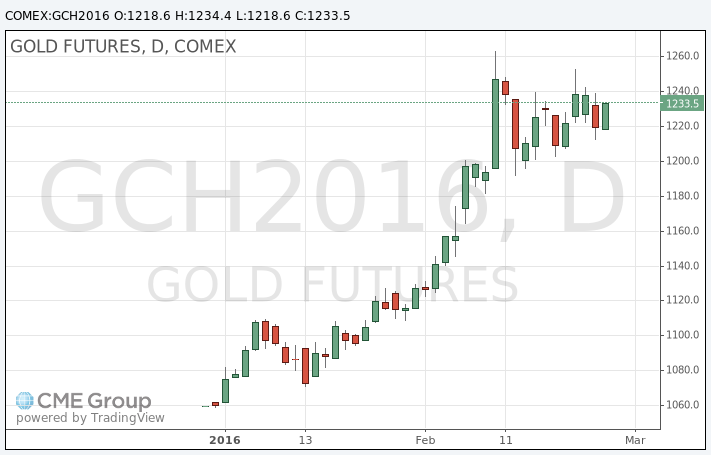

Gold price rise

Gold price rose on the weak U.S. economic data. The Institute for Supply Management released its Chicago purchasing managers' index on Monday. The Chicago purchasing managers' index dropped to 47.6 in February from 55.6 in January, missing expectations for a decrease to 53.0. The decline was mainly driven by drop in production and in new orders.

The National Association of Realtors (NAR) released its pending home sales figures for the U.S. on Monday. Pending home sales in the U.S. slid 2.5% in January, missing expectations for a 0.5% gain, after a 0.9% increase in December. The fall was mainly lead by declines in almost all regions. Only pending home sales in the South rose in January.

March futures for gold on the COMEX today increased to 1234.40 dollars per ounce.

-

17:12

Reuters survey: OPEC’s oil production declines in February

According to a Reuters survey, the Organization of the Petroleum Exporting Countries' (OPEC) oil production fell in February due to the supply disruption from Iraq. OPEC's oil output decreased to 32.37 million barrels per day (bpd) in February from 32.65 million in January.

Saudi Arabia produced 10.20 million bpd in February.

Iran increased its oil production by 200,000 bpd since December 2015.

-

17:05

People's Bank of China cuts the deposit reserve requirement ratio

The People's Bank of China (PBoC) announced on Monday that it lowered the deposit reserve requirement ratio by 50 basis points to 17%. The cut should help to provide enough liquidity in the financial system.

The ratio cut will be effective from Tuesday.

-

11:53

The number of active U.S. rigs falls by 13 rigs to 400 last week

The oil driller Baker Hughes reported on Friday that the number of active U.S. rigs declined by 13 rigs to 400 last week. It was the lowest level since December 2009.

Combined oil and gas rigs decreased by 12 to 502.

-

07:47

Oil prices steady

West Texas Intermediate futures for April delivery edged down to $32.75 (-0.9%), while Brent crude rose to $35.65 (+0.59%). Last week crude oil prices rose more than 15%. Some analysts started to say that prices may be bottoming out after a dramatic drop from the August 2013 high of $112.24.

The number of open positions in WTI crude contracts that bet on a further decline is still high by historical standards; however it has fallen by about 17% since the middle of February.

Data on Chinese manufacturing due tomorrow will help clarify further direction of oil prices.

-

07:21

Gold climbed on weaker stocks

Gold climbed to $1,227.90 (+0.61%) after declining on Friday. A selloff in stocks supported gold this morning. Bullion is on track to finish February with a nearly 10% gain, which would make this month the best one since January 2012.

Physical demand in Asia remained weak. Prices declined in India as buyers postponed purchases awaiting a cut in the import tax.

Holdings of SPDR Gold Trust, the largest gold-backed exchange-traded-fund, rose by 0.27% to 762.41 tonnes on Friday.

-

00:34

Commodities. Daily history for Feb 26’2016:

(raw materials / closing price /% change)

Oil 32.84 +0.18%

Gold 1,222.80 +0.20%

-