Noticias del mercado

-

17:50

Oil prices rise sharply

Oil prices rose on news Russia, Saudi Arabia, Qatar and Venezuela plan to meet in March. Venezuelan Oil and Mining Minister Eulogio del Pino said on Thursday that Russia, Saudi Arabia, Qatar and Venezuela plan to meet in mid-March to discuss the freeze of the oil production at January levels. He called on all OPEC members to take part in the meeting.

The first decline of U.S. gasoline inventories since November, which decreased by 2.2 million barrels last week, continued to support.

According to the U.S. Energy Information Administration's (EIA) data on Wednesday, U.S. crude inventories rose by 3.5 million barrels to 507.6 million in the week to February 19. Analysts had expected U.S. crude oil inventories to rise by 3.17 million barrels.

Market participants are also awaiting the release of the number of active U.S. rigs later in the day. The oil driller Baker Hughes reported on last Friday that the number of active U.S. rigs by 26 rigs to 413 last week. It was the lowest level since December 2009.

WTI crude oil for April delivery increased to $33.67 a barrel on the New York Mercantile Exchange.

Brent crude oil for April rose to $35.97 a barrel on ICE Futures Europe.

-

17:33

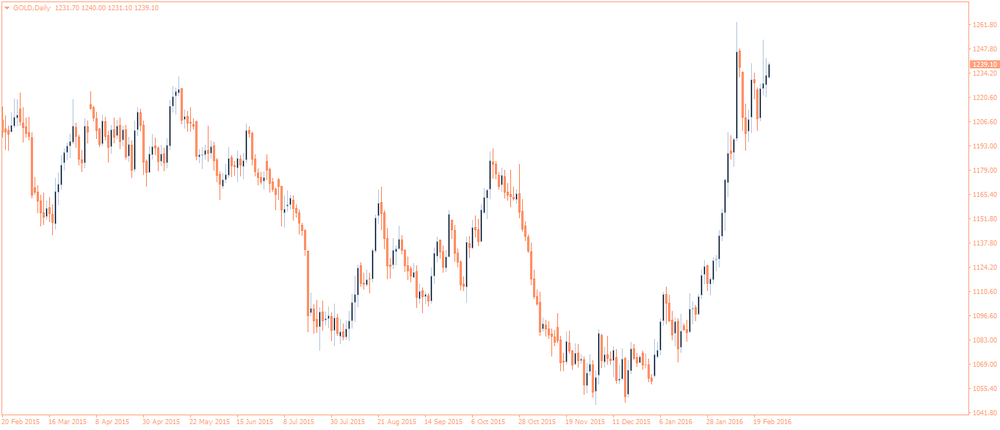

Gold slide on a stronger U.S. dollar and as global stocks rise

Gold price dropped on a stronger U.S. dollar and as global stocks rose. Global stocks increased as market participants hoped that the G20 summit would help to coordinate stimulus measures to boost the global economy.

The U.S. dollar increased against other currencies on the better-than-expected U.S. economic data. The U.S. Commerce Department released gross domestic product (GDP) figures on Friday. The U.S. revised GDP climbed 1.0% in the fourth quarter, up from the preliminary estimate of a 0.4% rise, after a 2.0% in the third quarter. The upward revision was partly driven by an upward revision to business inventories.

Personal spending climbed 0.5% in January, exceeding expectations for a 0.3% gain, after a 0.1% increase in December. December's figure was revised up from a flat reading.

Personal income increased 0.5% in January, exceeding expectations for 0.4% rise, after a 0.3% gain in December.

Wages and salaries were up 0.6% in January, after a 0.3% gain in December.

The personal consumption expenditures (PCE) price index excluding food and energy rose 0.3% in January, beating forecasts of a 0.2% increase, after a 0.1% gain in December. It was the largest rise since January 2012.

On a yearly basis, the PCE price index excluding food and index jumped to 1.7% in January from 1.5% in December. It was the largest increase since July 2014.

March futures for gold on the COMEX today declined to 1214.50 dollars per ounce.

-

15:47

Venezuelan Oil and Mining Minister Eulogio del Pino: Russia, Saudi Arabia, Qatar and Venezuela plan to meet in mid-March

Venezuelan Oil and Mining Minister Eulogio del Pino said on Thursday that Russia, Saudi Arabia, Qatar and Venezuela plan to meet in mid-March to discuss the freeze of the oil production at January levels.

He called on all OPEC members to take part in the meeting.

-

11:14

People's Bank of China Governor Zhou Xiaochuan: the central bank had enough tools to address the downside risks

The People's Bank of China (PBoC) Governor Zhou Xiaochuan said on Friday that the central bank had enough tools to address the downside risks.

"China still has monetary policy space and tools to avert downside risks," he said.

Zhou noted that the economic growth remained strong.

He pointed out that there is no basis for further depreciation of the yuan.

-

07:20

Oil prices edged down

West Texas Intermediate futures for April delivery is currently at $33.03 (-0.12%), while Brent crude declined to $35.08 (-0.60%). Yesterday prices rose on signs of stronger demand for refined oil products in the U.S., however that rally lost momentum after market participants took into account the persistent supply glut and the looming low-demand spring season.

Some sources reported that some leading oil producers are likely to meet in March to discuss freezing output at January levels, but many experts say that this would not be helpful at all even if such an agreement is reached and implemented.

-

07:01

Gold climbed despite higher stocks

Gold is currently at $1,240.50 (+0.14%). Favorable technical factors and exchange traded funds inflows outweighed stronger stocks. Bullion's 50-day moving average went above the 200-day moving average bringing the shorter-term price average about $3 higher compared to the longer-term average.

Holdings of SPDR Gold Trust, the largest gold-backed exchange-traded-fund, are at the highest level since March 2015.

-

01:04

Commodities. Daily history for Feb 25’2016:

(raw materials / closing price /% change)

Oil 33.08 +0.03%

Gold 1,233.70 -0.41%

-