Noticias del mercado

-

20:21

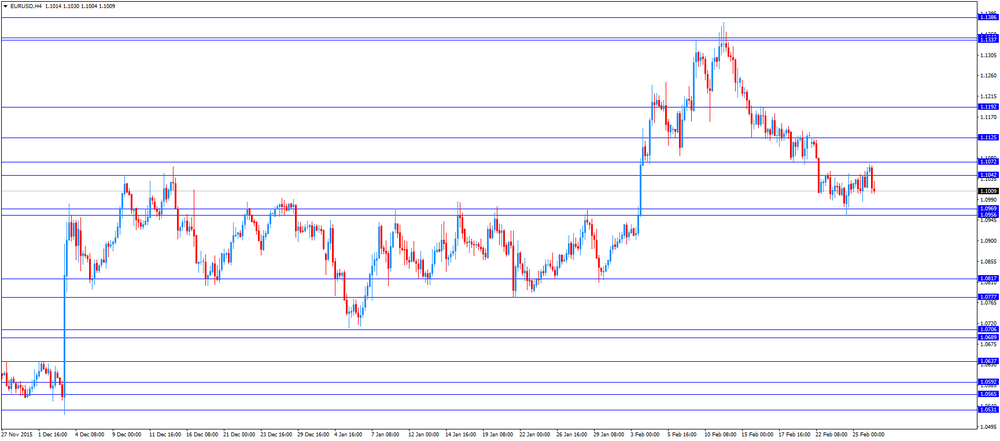

American focus: the US dollar has appreciated significantly against major currencies

Dollar rose significantly against the euro, which was mainly due to the publication of better than expected US GDP data. Additional support was provided by the statistics on personal income and spending American consumers. The Commerce Department said the US economic growth slowed in the fourth quarter, but not as sharp as originally anticipated, while the business has become less aggressive in the reduction of unwanted stocks of efforts that could damage the release during the first three months of 2016. Gross domestic product grew by 1.0 per cent per annum instead of the previously reported rate of 0.7 percent, it said on Friday in its second estimate of GDP. Economists had expected GDP growth in the fourth quarter will be revised down to 0.4 percent. The economy grew at a rate of 2.0 percent in the third quarter. Companies have accumulated reserves of $ 81.7 billion. Instead of $ 68.6 billion., Reported last month. This represents an upward revision of the adjustment of reserve estimates. The revision to the increase in GDP growth in the fourth quarter also reflects the lower trade deficit than initially anticipated, as imports fell. The trade deficit subtracts 0.25 percentage points from GDP growth instead of 0.47 percentage points, reported in the last month. Business spending on equipment decreased only by 1.8 percent last quarter, compared with the previous rate of 2.5 percent. Business spending on non-residential structures fell 6.6 percent rather than 5.3 percent, of which the government reported last month. Government spending fell by 0.1 percent instead of 0.7 percent.

Another report showed that personal income and spending in the US rose more than expected in January. Revenues of natural persons increased by 0.5 percent in January after rising 0.3 percent in December. Economists had expected income to increase by 0.4 percent. Disposable personal income, or personal income less personal current taxes, also increased by 0.5 percent in January after rising 0.3 percent the previous month. Personal spending rose 0.5 percent in January after being up 0.1 percent in December. Costs are expected to increase by 0.3 percent. The actual costs that are adjusted to remove price changes, increased 0.4 percent after rising 0.2 percent in December.

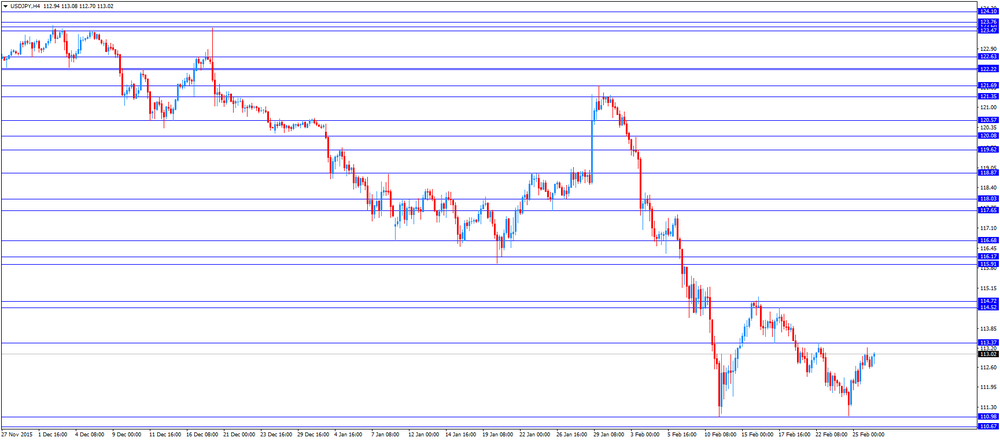

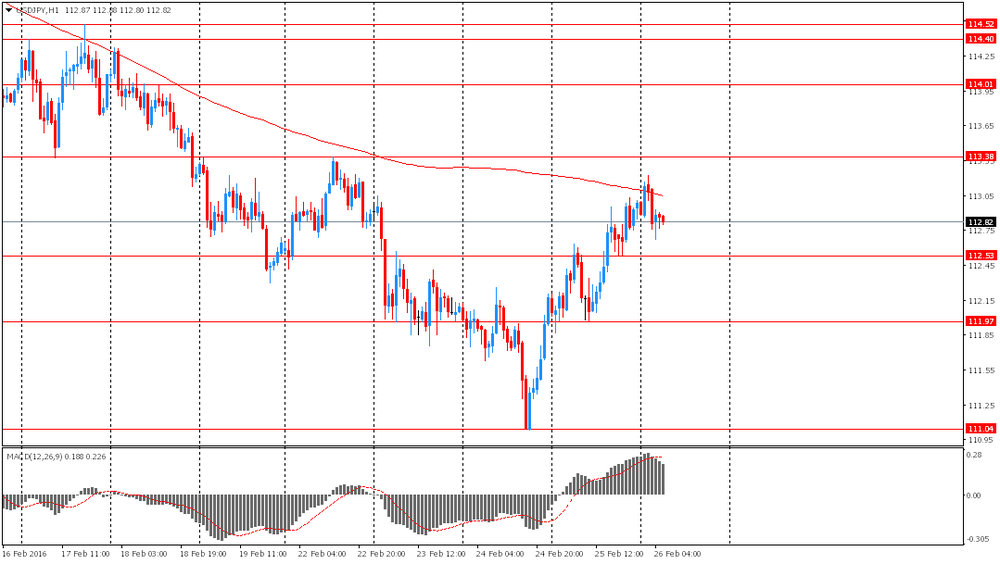

Yen declined significantly against the dollar, reaching a low of February 18 on the back of strong US data, which were published recently. Investors also gradually turn their attention to the report on employment in the US non-farm sector, which will be released next week. TD Securities analysts believe that the US report on the labor market does not justify the consensus and will be released in the area of 170 thousand. The level of b / r is likely to rise from 4.9% to 5%. In general, the report will reflect the weak and fading positive momentum of economic growth. However, given the nature of this report, it is unlikely to somehow clarify the situation as to where to move the US economy. As a result, on the eve of the March meeting of the Fed's market reach again the uncertainty as to what position the Committee. Meanwhile, the head of the Federal Reserve Bank of Cleveland Mester said that a decision on monetary policy at the March meeting will be taken depending on the current situation, adding that a gradual increase in rates - is still the right way.

-

18:16

Home prices in China rise in January

According to Reuters calculations based on data from China's National Bureau of Statistics (NBS), average new home prices in 70 major cities climbed at an annual rate of 2.5% in January, after a 1.6% gain in December.

The main contributor was Shenzhen, where home prices jumped by 51.9% year-on-year in January.

On a monthly base, house prices increased in 38 of 70 cities, prices slid in 24 cities, while prices remained unchanged in 8 cities.

-

17:40

San Francisco Fed President John Williams: the Fed’s communications strategy (forward guidance) was effective

San Francisco Fed President John Williams said on Friday that the Fed's communications strategy (forward guidance) was effective.

"So, like a sledgehammer, strongly worded forward guidance can be a powerful tool when it's needed. But, like a sledgehammer, care needs to be taken when and where it is used," he said.

Williams pointed out that vague hints about future policy seemed to be ineffective.

-

17:26

Federal Reserve Governor Jerome Powell: interest rate decisions depending on the incoming data could surprise markets

Federal Reserve Governor Jerome Powell said in a speech on Friday that interest rate decisions depending on the incoming data could surprise markets.

"A data-driven Committee, making decisions meeting by meeting, is likely to surprise markets from time to time," he said.

Powell noted that it would be hard to avoid combination of time and data-based guidance.

Federal Reserve governor defended a dot plot forecasts by the Fed.

-

17:16

Cleveland Fed President Loretta Mester: the Fed should continue to hike its interest rate gradually

Cleveland Fed President Loretta Mester said in an interview on Thursday that the Fed should continue to hike its interest rate gradually as there was no deterioration in the U.S. economy.

"My forecasts, and the risks around those forecasts, suggest we still want to see gradually rising interest rates," she said.

Mester is a voting member on the Federal Open Market Committee (FOMC) this year.

Cleveland Fed president pointed out that an interest rate hike in March is possible, saying "march should be on the table".

-

17:10

U.S. Treasury Secretary Jacob Lew: governments should not depreciate their currencies to boost exports

U.S. Treasury Secretary Jacob Lew said at the G20 summit on Friday that governments should not depreciate their currencies to boost exports.

"It doesn't lead anywhere good. I hope we can get a commitment to avoid that," he said.

Lew noted that there was no crisis.

"There's a great deal of economic uncertainty in the world, but there's not a crisis," he said.

-

17:03

U.S. personal spending climbs 0.5% in January

The U.S. Commerce Department released personal spending and income figures on Friday. Personal spending climbed 0.5% in January, exceeding expectations for a 0.3% gain, after a 0.1% increase in December. December's figure was revised up from a flat reading.

Consumer spending makes more than two-thirds of U.S. economic activity. Consumer spending grew 2.0% in the fourth quarter, after a 3.0% increase in the third quarter.

This data suggests that American consumers remained cautious.

The saving rate remained unchanged 5.2% in January.

Personal income increased 0.5% in January, exceeding expectations for 0.4% rise, after a 0.3% gain in December.

Wages and salaries were up 0.6% in January, after a 0.3% gain in December.

The personal consumption expenditures (PCE) price index excluding food and energy rose 0.3% in January, beating forecasts of a 0.2% increase, after a 0.1% gain in December. It was the largest rise since January 2012.

December's figure was revised up from a flat reading.

On a yearly basis, the PCE price index excluding food and index jumped to 1.7% in January from 1.5% in December. It was the largest increase since July 2014.

December's figure was revised up from a 1.4% gain.

The PCE index is below the Fed's 2% inflation target. The PCE index is the Fed's preferred measure of inflation.

-

16:50

Thomson Reuters/University of Michigan final consumer sentiment index declines to 91.7 in February

The Thomson Reuters/University of Michigan final consumer sentiment index decreased to 91.7 in February from 92.0 in January, up from the preliminary estimate of 90.7 and beating expectations a fall to 91.0.

"Although consumers are not as optimistic as at the start of last year, the Sentiment Index is just 6.5% below the cyclical peak of 98.1 set in January 2015," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin.

"The current decline of just 6.5% hardly merits a recession warning, although it does indicate a somewhat slower expansion in consumer expenditures-to 2.7% in 2016, down from 3.1% in 2015," he added.

The current economic conditions index rose to 106.8 in February from 106.4 in January, up from a preliminary reading of 105.8.

The index of consumer expectations declined to 81.9 in February from 82.7 in January, up from a preliminary reading of 81.0.

-

16:01

U.S.: Reuters/Michigan Consumer Sentiment Index, February 91.7 (forecast 91)

-

16:01

U.S.: PCE price index ex food, energy, Y/Y, January 1.7%

-

16:01

U.S.: PCE price index ex food, energy, m/m, January 0.3% (forecast 0.2%)

-

16:00

U.S.: Personal Income, m/m, January 0.5% (forecast 0.4%)

-

16:00

U.S.: Personal spending , January 0.5% (forecast 0.3%)

-

15:41

International Monetary Fund Managing Director Christine Lagarde: capital outflows from China pose risks to the global economy

International Monetary Fund (IMF) Managing Director Christine Lagarde said at the G20 summit on Friday that capital outflows from China pose risks to the global economy.

IMF expects the Chinese economy to expand 6.3% in 2016.

She noted that risks to the global economy increased.

Lagarde also said that government should implement structural reforms.

-

15:17

U.S. revised GDP rises 1.0% in the fourth quarter

The U.S. Commerce Department released gross domestic product (GDP) figures on Friday. The U.S. revised GDP climbed 1.0% in the fourth quarter, up from the preliminary estimate of a 0.4% rise, after a 2.0% in the third quarter.

The upward revision was partly driven by an upward revision to business inventories.

Consumer spending was revised down.

Consumer spending rose by 2.0% in the fourth quarter, down from the previous estimate of a 2.2% increase.

Exports fell 2.7% in the fourth quarter, down from the preliminary estimate of a 2.5% fall, while imports were down 0.6%, down from the preliminary estimate of a 1.1% rise.

The PCE price index increased 0.4% in the fourth quarter, up from the preliminary estimate of 0.1%, after a 1.3% rise in the third quarter.

The PCE price index excluding food and energy costs increased 1.3% in the fourth quarter, up from the preliminary estimate of 1.2%, after a 1.4% rise in the third quarter.

The PCE price index is the Fed's preferred gauge for inflation.

-

14:46

German consumer price inflation increases 0.4% in February

Destatis released its consumer price data for Germany on Friday. German preliminary consumer price index increased 0.4% in February, missing expectations for a 0.5% rise, after a 0.8% drop in January.

On a yearly basis, German preliminary consumer price index declined to 0.0% in February from 0.5% in January, missing expectations for a decline to 0.1%.

The annual inflation was mainly driven by a drop in energy prices. Energy prices slid 8.5% year-on-year in February.

Goods prices dropped 1.1% year-on-year in February, while services prices increased 0.9%.

-

14:46

Bureau of Economic Analysis shifted initial release time of Personal Income/Spending data on 15:00 GMT

-

14:44

Option expiries for today's 10:00 ET NY cut

USD/JPY: 112.70-75 (USD 455m) 113.00 (981m) 113.50 (440m) 114.75 (200m)

EUR/USD: 1.0900-10 (EUR 1.35bln) 1.0970-80 (1bln) 1.1000 (223m) 1.1050-60 (503m) 1.1100 (625m) 1.1150 (324m) 1.1200 (292m)

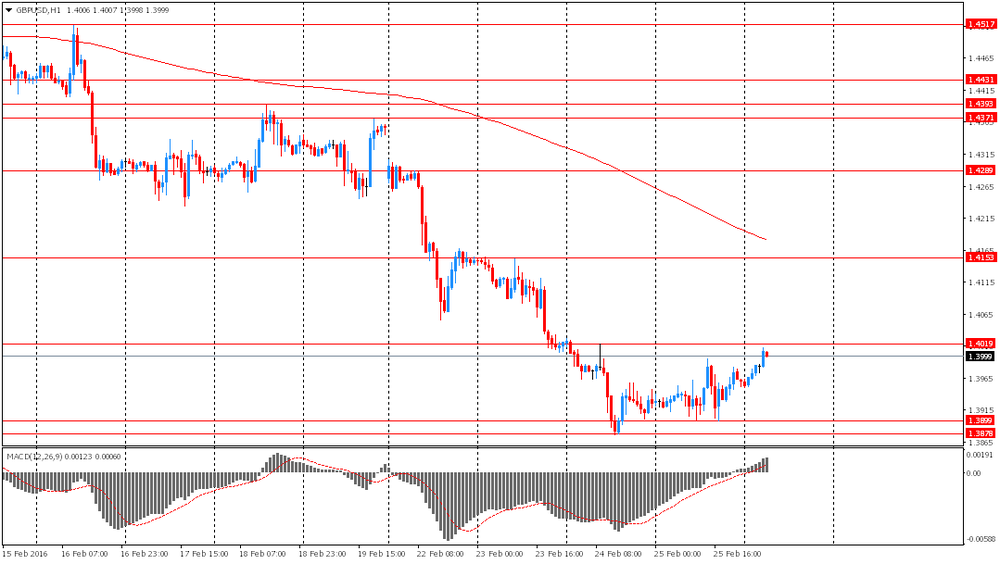

GBP/USD: 1.4000 (GBP 721m) 1.4075 (129m) 1.4250 (547m)

AUD/USD: 0.7025 (AUD 199m) 0.7040-50 (516m) 0.7200 (212m) 0.7250 (213m

USD/CAD 1.3500 (USD 480m) 1.3600 (1bln) 1.3800 (374m) 1.4000 (1.22bln)

USD/CNY 6.4925 (USD 1.39bln) 6.5255 (1.3bln) 6.55 (410m)

-

14:31

U.S.: PCE price index ex food, energy, q/q, Quarter IV 1.3% (forecast 1.2%)

-

14:30

U.S.: GDP, q/q, Quarter IV 1.0% (forecast 0.4%)

-

14:30

U.S.: PCE price index, q/q, Quarter IV 0.4% (forecast 0.1%)

-

14:19

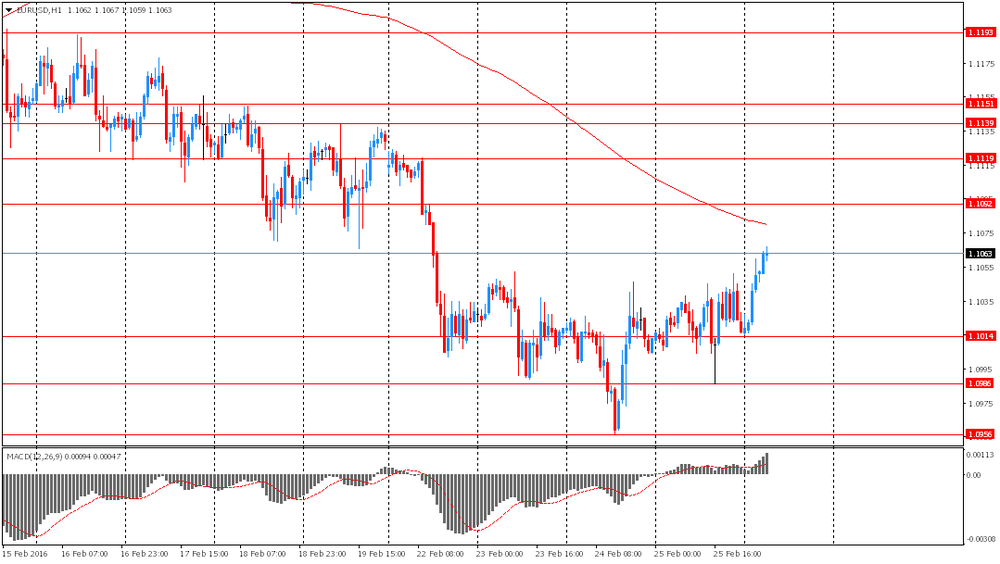

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the weak economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:05 United Kingdom Gfk Consumer Confidence February 4 3 0

03:15 United Kingdom BOE Gov Mark Carney Speaks

07:45 France GDP, q/q (Finally) Quarter IV 0.3% 0.2% 0.3%

07:45 France GDP, Y/Y (Finally) Quarter IV 1.1% 1.4%

10:00 Eurozone Industrial confidence February -3 Revised From -3.2 -3.5 -4

10:00 Eurozone Economic sentiment index February 105 104.4 103.8

10:00 Eurozone Consumer Confidence (Finally) February -6.3 Revised From -8.8 -7 -9

10:00 Eurozone Business climate indicator February 0.29 0.28 0.07

13:00 Germany CPI, m/m (Preliminary) February -0.8% 0.5% 0.4%

13:00 Germany CPI, y/y (Preliminary) February 0.5% 0.1% 0%

The U.S. dollar traded mixed to higher against the most major currencies ahead of the release of the U.S. economic data. The personal consumer expenditures (PCE) price index excluding food and energy is expected to increase 0.2% in January, after a flat reading in December.

Personal income in the U.S. is expected to rise 0.4% in January, after a 0.3% gain in December.

Personal spending in the U.S. is expected to gain 0.3% in January, after a flat reading in December.

The revised U.S. GDP is expected to rise 0.4% in the fourth quarter, after a 2.0% growth in the third quarter.

The euro traded lower against the U.S. dollar after the release of the weak economic data from the Eurozone. The European Commission released its economic sentiment index for the Eurozone on Friday. The index slid to 103.8 in February from 106.7 in January. January's figure was revised up from 105.0.

Analysts had expected the index to decline to 104.4.

The drop was driven by a fall in confidence among consumers and in all business sectors but construction.

The industrial confidence index fell to -4.0 in February from -3.0 in January, missing expectations for a drop to -3.5.

The final consumer confidence index was down to -9.0 in February from -6.3 in January, missing expectations for a decline to -7.0.

The business climate index decreased to 0.1 in February from 0.29 in January. Analysts had expected the index to fall to 0.28.

The decline in business climate index was driven by a less favourable managers' assessment of past production, total order books and production expectations.

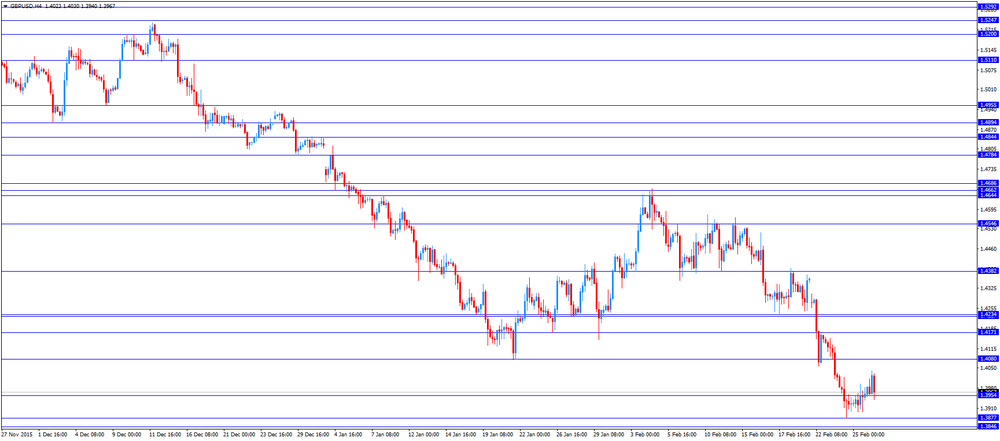

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

Bank of England (BoE) Governor Mark Carney warned major central banks at the G20 summit on Friday that implementing negative rates was the wrong answer to the slowdown in the global economy.

"To the extent it pushes greater savings onto the global markets, global short-term equilibrium rates would fall further, pulling the global economy closer to a liquidity trap. At the global zero bound, there is no free lunch," he said.

EUR/USD: the currency pair decreased to $1.1004

GBP/USD: the currency pair fell to $1.3940

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:30 U.S. Personal Income, m/m January 0.3% 0.4%

13:30 U.S. Personal spending January 0.0% 0.3%

13:30 U.S. PCE price index ex food, energy, m/m January 0.0% 0.2%

13:30 U.S. PCE price index ex food, energy, Y/Y January 1.4%

13:30 U.S. PCE price index, q/q (Revised) Quarter IV 1.3% 0.1%

13:30 U.S. PCE price index ex food, energy, q/q (Revised) Quarter IV 1.4% 1.2%

13:30 U.S. GDP, q/q (Revised) Quarter IV 2.0% 0.4%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) February 92 91

15:15 U.S. FOMC Member Jerome Powell Speaks

18:30 U.S. FOMC Member Brainard Speaks

-

14:00

Germany: CPI, y/y , February 0% (forecast 0.1%)

-

14:00

Germany: CPI, m/m, February 0.4% (forecast 0.5%)

-

13:44

Orders

EUR/USD

Offers: 1.1050 1.1080 1.1100 1.1120 1.1135 1.1150 1.1200

Bids: 1.1000 1.0985 1.0965 1.0950 1.0920 1.0900 1.0880 1.0860 1.0830 1.0800

GBP/USD

Offers: 1.4020-25 1.4050 1.4080 1.4100 1.4120 1.4135 1.4150

Bids: 1.3965 1.3950 1.3920-25 1.3900 1.3885 1.3865 1.3850

EUR/JPY

Offers: 124.50 124.80 125.00 125.50 126.00

Bids: 124.00 123.80 123.50 123.00 122.75-80 122.50 122.30 122.00 121.50

EUR/GBP

Offers: 0.7925-30 0.7950 0.7975 0.8000

Bids: 0.7865 0.7850 0.7830-35 0.7800

USD/JPY

Offers: 113.00 113.20-25 113.40 113.65 113.85 114.00

Bids: 112.50 112.30 112.00 111.80 111.65-70 111.50 111.30 111.00

AUD/USD

Offers: 0.7235 0.7250-55 0.7265 0.7285 0.7300

Bids: 0.7200 0.7180 0.7160 0.7140-45 0.7120 0.7100

-

12:32

Bank of England Governor Mark Carney: implementing negative rates was the wrong answer to the slowdown in the global economy

Bank of England (BoE) Governor Mark Carney warned major central banks at the G20 summit on Friday that implementing negative rates was the wrong answer to the slowdown in the global economy.

"To the extent it pushes greater savings onto the global markets, global short-term equilibrium rates would fall further, pulling the global economy closer to a liquidity trap. At the global zero bound, there is no free lunch," he said.

Carney also warned that central bank should not depreciate their currencies.

"For monetary easing to work at a global level it cannot rely on simply moving scarce demand from one country to another," BoE governor noted.

Carney pointed out that structural measures were needed to boost the global economy.

"Global growth has disappointed because the innovation and ambition of global monetary policy has not been matched by structural measures," he said.

-

12:13

Preliminary consumer price inflation in Spain slides 0.3% in February

The Spanish statistical office INE released its preliminary consumer price inflation data on Friday. Consumer price inflation in Spain slides 0.3% in February, after a 1.9% fall in January.

On a yearly basis, consumer prices fell by 0.8% in February, after a 0.3% decrease in January.

The annual decline was mainly driven by the drop in in the prices of fuels (gas and diesel oil) and food and non-alcoholic beverages.

-

12:09

French preliminary consumer price inflation increases 0.2% in February

The French statistical office Insee released its preliminary consumer price inflation for France on Friday. The French consumer price inflation increased 0.2% in February, after a 1.0% decline in January.

The monthly increase was driven by a rise in prices for manufactured products.

On a yearly basis, the consumer price index slid to -0.2% in February from 0.2% in January. It was the first drop since March 2015.

The annual drop was driven by a fall in energy prices.

Food prices rose 0.1% year-on-year in February, services prices climbed 1.3%, while energy prices dropped by 5.3%.

-

12:01

French producer prices decrease 0.8% in January

French statistical office INSEE released its producer price index (PPI) data on Friday. French producer prices decreased 0.8% in January, after a 1.2% drop in December.

The increase was driven a rise in prices for refined petroleum products, mining and quarrying industry, energy, water, and food products.

On a yearly basis, French PPI fell 2.5% in January.

The annual drop was driven by a decline in prices for refined petroleum products, which slid 27.9 year-on-year in January.

Import prices decreased 1.6% in January, after a 1.7% fall in December.

-

11:56

French consumer spending rises 0.6% in January

French statistical office INSEE released its consumer spending data on Friday. French consumer spending rose 0.6% in January, after a 1.0% gain in December. December's figure was revised up from a 0.7% increase.

The increase was mainly driven by a rise in expenditure on energy. Spending on energy climbed by 3.4% in January.

Spending on food declined 0.8% in January.

On a yearly basis, consumer spending climbed 0.6% in January.

-

11:51

French final GDP rises 0.3% in the fourth quarter

The French statistical office Insee released its final gross domestic product data for France on Friday. The French final GDP rose 0.3% in the fourth quarter, up from the preliminary estimate of 0.2%, after a 0.3% increase in the third quarter.

Household spending decline 0.2% in the fourth quarter, up from the preliminary estimate of -0.4%, after a 0.5% gain in the third quarter, while government spending rose 0.5%, after a 0.4% gain in the third quarter.

Total production in goods and services was up 0.6% in the fourth quarter, up from the preliminary estimate of 0.5%, after a 0.3% rise in the third quarter.

Export increased 1.0% in the fourth quarter, up from the preliminary estimate of 0.6%, while imports rose 2.5%, up from the preliminary estimate of 1.6%

On a yearly basis, French final GDP climbed 1.4% in the fourth quarter, down from the preliminary estimate of 1.5% growth, after a 1.1% rise in the third quarter.

In 2015 as whole, the French economy expanded 1.1%, in line with the preliminary estimate, after a 0.2% growth in 2014.

-

11:37

GfK’s U.K. consumer confidence index drops to 0 in February

Gfk released its consumer confidence index for the U.K. on Friday. GfK's U.K. consumer confidence index decreased to 0 in February from 4 in January, missing expectations for a decline to 3.

3 of 5 measures increased and 2 declined.

"While faith in our own personal financial situation continues to remain strong for the year ahead with just a one-point drop to +8 points, we are clearly worried about the general economic situation for the country. Here, there have been sharp drops both for the view over the past year and the coming year," Joe Staton, Head of Market Dynamics at GfK, said.

-

11:29

Eurozone’s economic sentiment index slides to 103.8 in February

The European Commission released its economic sentiment index for the Eurozone on Friday. The index slid to 103.8 in February from 106.7 in January. January's figure was revised up from 105.0.

Analysts had expected the index to decline to 104.4.

The drop was driven by a fall in confidence among consumers and in all business sectors but construction.

The industrial confidence index fell to -4.0 in February from -3.0 in January, missing expectations for a drop to -3.5.

The final consumer confidence index was down to -9.0 in February from -6.3 in January, missing expectations for a decline to -7.0.

The business climate index decreased to 0.1 in February from 0.29 in January. Analysts had expected the index to fall to 0.28.

The decline in business climate index was driven by a less favourable managers' assessment of past production, total order books and production expectations.

-

11:19

Bank of Japan Governor Haruhiko Kuroda: the central bank could cut its interest rate further

Bank of Japan Governor Haruhiko Kuroda said on Friday that the central bank could cut its interest rate further.

"It is technically possible to implement a larger negative rate, although I couldn't say with certainty how far we can go," he said.

Kuroda defended the central bank's move to implement negative interest rates, saying that the central bank wants to achieve price stability.

-

11:14

People's Bank of China Governor Zhou Xiaochuan: the central bank had enough tools to address the downside risks

The People's Bank of China (PBoC) Governor Zhou Xiaochuan said on Friday that the central bank had enough tools to address the downside risks.

"China still has monetary policy space and tools to avert downside risks," he said.

Zhou noted that the economic growth remained strong.

He pointed out that there is no basis for further depreciation of the yuan.

-

11:04

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy fall to 44.2 in in the week ended February 21

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy fell to 44.2 in in the week ended February 21 from 44.3 the prior week.

The index was supported by a rise in buying climate sub-index. The measure of views of the economy and the personal finances index were little changed last week.

-

11:00

Eurozone: Consumer Confidence, February -9 (forecast -7)

-

11:00

Eurozone: Business climate indicator , February 0.1 (forecast 0.28)

-

11:00

Eurozone: Economic sentiment index , February 103.8 (forecast 104.4)

-

11:00

Eurozone: Industrial confidence, February -4 (forecast -3.5)

-

10:48

San Francisco Fed President John Williams: the Fed should continue to raise its interest rate further

San Francisco Fed President John Williams said on Thursday that the Fed should continue to raise its interest rate further, adding the hikes should depend on the economic data.

"I still think we should be following the same strategy, however many increases or the pace of increases, which will be driven by the data," he said.

Williams pointed out that the Fed should hike its interest rate gradually.

San Francisco Fed president also said that he did not see any deterioration in the U.S. economy.

-

10:34

Citigroup: the risk of global recession increased

Analysts at Citigroup said on Wednesday that the risk of global recession increased.

"In our view, global growth is at a highly precarious point, after 2-3 years of relative calm," Citigroup said.

"The most recent deterioration in the global outlook is due to a moderate worsening in the prospects for the advanced economies, a large increase in the uncertainty about the advanced economies outlook (notably for the U.S.) and a tightening in financial conditions everywhere," the bank noted.

Citigroup pointed out that the slowdown in the U.S. economy would have a negative impact on the global economic outlook.

-

10:20

New Zealand’s trade deficit turns into a surplus of NZ$8 million in January

Statistics New Zealand released its trade data on late Thursday evening. New Zealand's trade deficit turned into a surplus of NZ$8 million in January from a deficit of NZ$38 million in December. December's figure was revised up from a deficit of NZ$53 million.

Analysts had expected the deficit to decline to NZ$246 million.

Exports climbed 5.9% year-on-year in January, driven by milk powder, butter and cheese, while imports increased by 7.2%, driven by a rise in intermediate goods.

"The fall in the value of crude oil imports is a result of New Zealand importing slightly less crude oil than in January 2015, but at a much lower price," Statistics NZ international statistics senior manager Jason Attewell said.

-

10:12

Japan's national CPI declines to an annual rate of 0.0% in January

Japan's Ministry of Internal Affairs and Communications released its inflation data on late Thursday evening. Japan's national consumer price index (CPI) declined to an annual rate of 0.0% in January from 0.2% in December, in line with expectations.

Inflation was mainly driven by declines in fuel and communication prices. Fuel prices slid 6.7% year-on-year in January, while communication prices declined 2.4%.

Japan's national CPI excluding fresh food fell to an annual rate of 0.0% in January from 0.1%, beating expectations for a drop to -0.2%.

The Bank of Japan's inflation target is 2%.

-

09:19

Option expiries for today's 10:00 ET NY cut

USD/JPY: 112.70-75 (USD 455m) 113.00 (981m) 113.50 (440m) 114.75 (200m)

EUR/USD: 1.0900-10 (EUR 1.35bln) 1.0970-80 (1bln) 1.1000 (223m) 1.1050-60 (503m) 1.1100 (625m) 1.1150 (324m) 1.1200 (292m)

GBP/USD: 1.4000 (GBP 721m) 1.4075 (129m) 1.4250 (547m)

AUD/USD: 0.7025 (AUD 199m) 0.7040-50 (516m) 0.7200 (212m) 0.7250 (213m

USD/CAD 1.3500 (USD 480m) 1.3600 (1bln) 1.3800 (374m) 1.4000 (1.22bln)

USD/CNY 6.4925 (USD 1.39bln) 6.5255 (1.3bln) 6.55 (410m)

-

09:01

France: GDP, Y/Y, Quarter IV 1.4%

-

08:45

France: GDP, q/q, Quarter IV 0.3% (forecast 0.2%)

-

08:33

Options levels on friday, February 26, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1180 (4696)

$1.1145 (3567)

$1.1092 (5045)

Price at time of writing this review: $1.1057

Support levels (open interest**, contracts):

$1.1000 (5333)

$1.0953 (8404)

$1.0882 (7184)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 68632 contracts, with the maximum number of contracts with strike price $1,1000 (5045);

- Overall open interest on the PUT options with the expiration date March, 4 is 94361 contracts, with the maximum number of contracts with strike price $1,1000 (8404);

- The ratio of PUT/CALL was 1.37 versus 1.40 from the previous trading day according to data from February, 25

GBP/USD

Resistance levels (open interest**, contracts)

$1.4301 (1461)

$1.4203 (443)

$1.4105 (384)

Price at time of writing this review: $1.3984

Support levels (open interest**, contracts):

$1.3893 (1682)

$1.3794 (774)

$1.3698 (407)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 28476 contracts, with the maximum number of contracts with strike price $1,4750 (1652);

- Overall open interest on the PUT options with the expiration date March, 4 is 31322 contracts, with the maximum number of contracts with strike price $1,4350 (2954);

- The ratio of PUT/CALL was 1.10 versus 1.06 from the previous trading day according to data from February, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:46

Foreign exchange market. Asian session: the yen declined

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:05 United Kingdom Gfk Consumer Confidence February 4 3 3

03:15 United Kingdom BOE Gov Mark Carney Speaks

The U.S. dollar rose against the yen amid investors' hopes for a favorable outcome of the G20 meeting, which had started in Shanghai. The yen was also weighed by domestic inflation data. The National CPI, which excludes prices of fresh food, but includes energy costs, was unchanged in January compared to the same period last year after gaining 0.1% in each of the two previous months. The reading was in line with expectations and way below the 2% target set by the Bank of Japan.

Today market participants are waiting for revised data on the U.S. GDP. The index is expected to have grown by 0.4% in the fourth quarter.

The New Zealand dollar rose on strong trade data. The country's trading surplus came in at $8.0 million in January despite expectations for a $241 million deficit. December reading was revised to -$38 million from -$53 million. Exports rose by $217 million to $3.9 billion in January compared to January 2015. Imports rose by $261 million to $3.89 billion compared to the same period last year.

EUR/USD: the pair rose to $1.1065 in Asian trade

USD/JPY: the pair traded around Y113.00

GBP/USD: the pair fluctuated within $1.3950-10

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:45 France GDP, q/q (Finally) Quarter IV 0.3% 0.2%

07:45 France GDP, Y/Y (Finally) Quarter IV 1.1%

10:00 Eurozone Industrial confidence February -3.2 -3.5

10:00 Eurozone Economic sentiment index February 105 104.4

10:00 Eurozone Consumer Confidence (Finally) February -8.8 -7

10:00 Eurozone Business climate indicator February 0.29 0.28

13:00 Germany CPI, m/m (Preliminary) February -0.8% 0.5%

13:00 Germany CPI, y/y (Preliminary) February 0.5% 0.1%

13:30 U.S. Personal Income, m/m January 0.3% 0.4%

13:30 U.S. Personal spending January 0.0% 0.3%

13:30 U.S. PCE price index ex food, energy, m/m January 0.0% 0.2%

13:30 U.S. PCE price index ex food, energy, Y/Y January 1.4%

13:30 U.S. PCE price index, q/q (Revised) Quarter IV 1.3% 0.1%

13:30 U.S. PCE price index ex food, energy, q/q (Revised) Quarter IV 1.4% 1.2%

13:30 U.S. Personal Income, m/m January 0.3% 0.4%

13:30 U.S. Personal spending January 0.0% 0.3%

13:30 U.S. PCE price index ex food, energy, Y/Y January 1.4%

13:30 U.S. PCE price index ex food, energy, m/m January 0.0% 0.2%

13:30 U.S. GDP, q/q (Revised) Quarter IV 2.0% 0.4%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) February 92 91

15:15 U.S. FOMC Member Jerome Powell Speaks

18:30 U.S. FOMC Member Brainard Speaks

-

01:04

United Kingdom: Gfk Consumer Confidence, February 3 (forecast 3)

-

01:02

Currencies. Daily history for Feb 25’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1017 -0,11%

GBP/USD $1,3960 +0,24%

USD/CHF Chf0,9901 +0,15%

USD/JPY Y112,98 +0,72%

EUR/JPY Y124,48 +0,76%

GBP/JPY Y157,72 +0,96%

AUD/USD $0,7235 +0,55%

NZD/USD $0,6721 +0,94%

USD/CAD C$1,3529 -1,26%

-

00:31

Japan: Tokyo CPI ex Fresh Food, y/y, February -0.1% (forecast -0.2%)

-

00:31

Japan: National CPI Ex-Fresh Food, y/y, January 0% (forecast -0.2%)

-

00:30

Japan: National Consumer Price Index, y/y, January 0% (forecast 0.0%)

-

00:30

Japan: Tokyo Consumer Price Index, y/y, February 0.1% (forecast -0.3%)

-

00:00

Schedule for today, Friday, Feb 26’2016:

(time / country / index / period / previous value / forecast)

00:05 United Kingdom Gfk Consumer Confidence February 4 3

03:15 United Kingdom BOE Gov Mark Carney Speaks

07:45 France GDP, q/q (Finally) Quarter IV 0.3% 0.2%

07:45 France GDP, Y/Y (Finally) Quarter IV 1.1%

10:00 Eurozone Industrial confidence February -3.2 -3.5

10:00 Eurozone Economic sentiment index February 105 104.4

10:00 Eurozone Consumer Confidence (Finally) February -8.8 -6.7

10:00 Eurozone Business climate indicator February 0.29 0.28

13:00 Germany CPI, m/m (Preliminary) February -0.8% 0.5%

13:00 Germany CPI, y/y (Preliminary) February 0.5% 0.1%

13:30 U.S. Personal Income, m/m January 0.3% 0.4%

13:30 U.S. Personal spending January 0.0% 0.3%

13:30 U.S. PCE price index ex food, energy, m/m January 0.0% 0.2%

13:30 U.S. PCE price index ex food, energy, Y/Y January 1.4%

13:30 U.S. PCE price index, q/q (Revised) Quarter IV 1.3% 0.1%

13:30 U.S. PCE price index ex food, energy, q/q (Revised) Quarter IV 1.4% 1.2%

13:30 U.S. Personal Income, m/m January 0.3% 0.4%

13:30 U.S. Personal spending January 0.0% 0.3%

13:30 U.S. PCE price index ex food, energy, Y/Y January 1.4%

13:30 U.S. PCE price index ex food, energy, m/m January 0.0% 0.2%

13:30 U.S. GDP, q/q (Revised) Quarter IV 2.0% 0.4%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) February 92 91

15:15 U.S. FOMC Member Jerome Powell Speaks

18:30 U.S. FOMC Member Brainard Speaks

-