Noticias del mercado

-

21:00

Dow -0.35% 16,638.64 -58.65 Nasdaq +0.09% 4,586.45 +4.24 S&P -0.24% 1,946.99 -4.71

-

18:20

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes are little changed on Friday after data showed that a slowdown in U.S. economic growth was not as bad as expected, but gains were capped as oil prices came off sessions highs. GDP increased at a 1% annual rate instead of the previously reported 0,7% pace. The economy grew at a rate of 2,0% in the third quarter.

Dow stocks mixed (15 vs 15). Top looser - Wal-Mart Stores Inc. (WMT, -1,96%). Top gainer - E. I. du Pont de Nemours and Company (DD, +1,95%).

S&P sectors also mixed. Top looser - Utilities (-2,1%). Top gainer - Conglomerates (+3,1%).

At the moment:

Dow 16637.00 -35.00 -0.21%

S&P 500 1947.75 -2.75 -0.14%

Nasdaq 100 4225.50 -18.75 -0.44%

Oil 33.23 +0.16 +0.48%

Gold 1220.50 -18.30 -1.48%

U.S. 10yr 1.76 +0.06

-

18:16

Home prices in China rise in January

According to Reuters calculations based on data from China's National Bureau of Statistics (NBS), average new home prices in 70 major cities climbed at an annual rate of 2.5% in January, after a 1.6% gain in December.

The main contributor was Shenzhen, where home prices jumped by 51.9% year-on-year in January.

On a monthly base, house prices increased in 38 of 70 cities, prices slid in 24 cities, while prices remained unchanged in 8 cities.

-

18:00

European stocks closed: FTSE 100 6,096.01 +83.20 +1.38% CAC 40 4,314.57 +66.12 +1.56% DAX 9,513.3 +181.82 +1.95%

-

18:00

European stocks close: stocks closed higher as oil prices rebounded

Stock indices closed higher as oil prices increased. Oil prices rose on news that Russia, Saudi Arabia, Venezuela and Qatar plan to meet in March to discuss the freeze of the oil production.

Meanwhile, market participants eyed the economic data from the Eurozone. The European Commission released its economic sentiment index for the Eurozone on Friday. The index slid to 103.8 in February from 106.7 in January. January's figure was revised up from 105.0.

Analysts had expected the index to decline to 104.4.

The drop was driven by a fall in confidence among consumers and in all business sectors but construction.

The industrial confidence index fell to -4.0 in February from -3.0 in January, missing expectations for a drop to -3.5.

The final consumer confidence index was down to -9.0 in February from -6.3 in January, missing expectations for a decline to -7.0.

The business climate index decreased to 0.1 in February from 0.29 in January. Analysts had expected the index to fall to 0.28.

The decline in business climate index was driven by a less favourable managers' assessment of past production, total order books and production expectations.

Bank of England (BoE) Governor Mark Carney warned major central banks at the G20 summit on Friday that implementing negative rates was the wrong answer to the slowdown in the global economy.

"To the extent it pushes greater savings onto the global markets, global short-term equilibrium rates would fall further, pulling the global economy closer to a liquidity trap. At the global zero bound, there is no free lunch," he said.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,096.01 +83.20 +1.38 %

DAX 9,513.3 +181.82 +1.95 %

CAC 40 4,314.57 +66.12 +1.56 %

-

17:50

WSE: Session Results

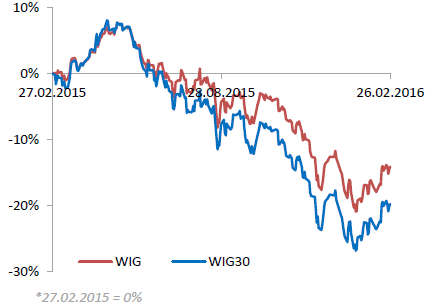

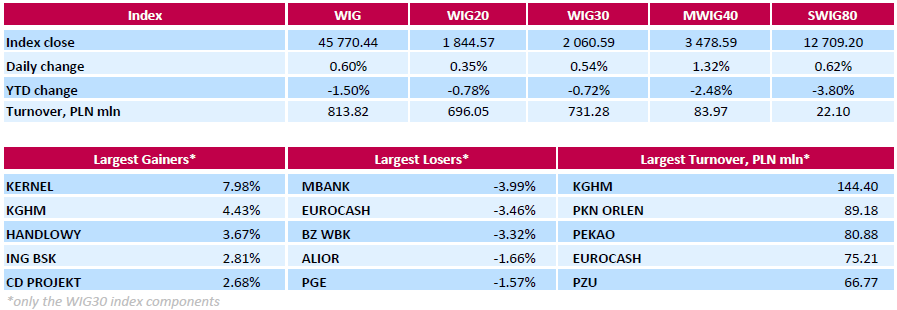

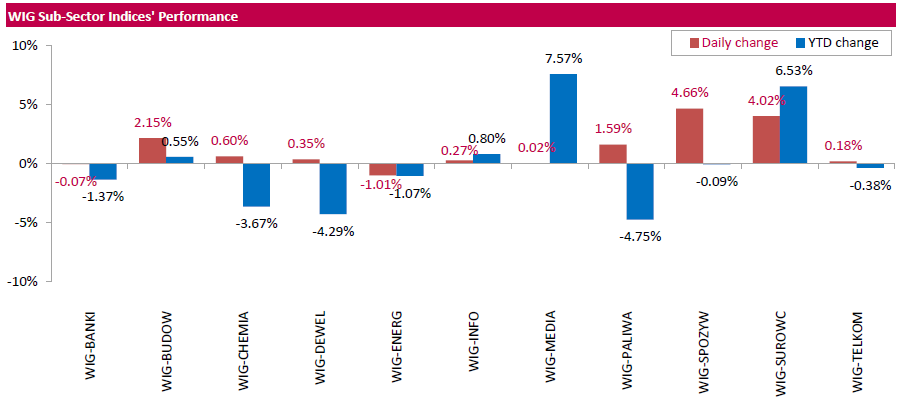

Polish equity market closed higher on Friday. The broad market measure, the WIG Index, rose by 0.60%. Almost all sectors in the WIG generated positive returns. The exception were utilities (-1.01%) and banking sector (-0.07%). At the same time, food sector (+4.66%) was the strongest group.

The large-cap stocks' measure, the WIG30 Index, added 0.54%. In the index basket, agricultural producer KERNEL (WSE: KER) led the way up, climbing by 7.98%. Other major gainers were copper producer KGHM (WSE: KGH), videogame developer CD PROJEKT (WSE: CDR) and two banking sector names HANDLOWY (WSE: BHW) and ING BSK (WSE: ING), which advanced between 2.68% and 4.43%. On the other side of the ledger, MBANK (WSE: MBK) recorded the largest decline, down 3.99%, as the bank announced intention to withhold dividend payouts from FY2015 profit. It was followed by FMCG-wholesaler EUROCASH (WSE: EUR) and bank BZ WBK (WSE: BZW), which tumbled by 3.46% and 3.32% respectively.

-

17:40

San Francisco Fed President John Williams: the Fed’s communications strategy (forward guidance) was effective

San Francisco Fed President John Williams said on Friday that the Fed's communications strategy (forward guidance) was effective.

"So, like a sledgehammer, strongly worded forward guidance can be a powerful tool when it's needed. But, like a sledgehammer, care needs to be taken when and where it is used," he said.

Williams pointed out that vague hints about future policy seemed to be ineffective.

-

17:26

Federal Reserve Governor Jerome Powell: interest rate decisions depending on the incoming data could surprise markets

Federal Reserve Governor Jerome Powell said in a speech on Friday that interest rate decisions depending on the incoming data could surprise markets.

"A data-driven Committee, making decisions meeting by meeting, is likely to surprise markets from time to time," he said.

Powell noted that it would be hard to avoid combination of time and data-based guidance.

Federal Reserve governor defended a dot plot forecasts by the Fed.

-

17:16

Cleveland Fed President Loretta Mester: the Fed should continue to hike its interest rate gradually

Cleveland Fed President Loretta Mester said in an interview on Thursday that the Fed should continue to hike its interest rate gradually as there was no deterioration in the U.S. economy.

"My forecasts, and the risks around those forecasts, suggest we still want to see gradually rising interest rates," she said.

Mester is a voting member on the Federal Open Market Committee (FOMC) this year.

Cleveland Fed president pointed out that an interest rate hike in March is possible, saying "march should be on the table".

-

17:10

U.S. Treasury Secretary Jacob Lew: governments should not depreciate their currencies to boost exports

U.S. Treasury Secretary Jacob Lew said at the G20 summit on Friday that governments should not depreciate their currencies to boost exports.

"It doesn't lead anywhere good. I hope we can get a commitment to avoid that," he said.

Lew noted that there was no crisis.

"There's a great deal of economic uncertainty in the world, but there's not a crisis," he said.

-

17:03

U.S. personal spending climbs 0.5% in January

The U.S. Commerce Department released personal spending and income figures on Friday. Personal spending climbed 0.5% in January, exceeding expectations for a 0.3% gain, after a 0.1% increase in December. December's figure was revised up from a flat reading.

Consumer spending makes more than two-thirds of U.S. economic activity. Consumer spending grew 2.0% in the fourth quarter, after a 3.0% increase in the third quarter.

This data suggests that American consumers remained cautious.

The saving rate remained unchanged 5.2% in January.

Personal income increased 0.5% in January, exceeding expectations for 0.4% rise, after a 0.3% gain in December.

Wages and salaries were up 0.6% in January, after a 0.3% gain in December.

The personal consumption expenditures (PCE) price index excluding food and energy rose 0.3% in January, beating forecasts of a 0.2% increase, after a 0.1% gain in December. It was the largest rise since January 2012.

December's figure was revised up from a flat reading.

On a yearly basis, the PCE price index excluding food and index jumped to 1.7% in January from 1.5% in December. It was the largest increase since July 2014.

December's figure was revised up from a 1.4% gain.

The PCE index is below the Fed's 2% inflation target. The PCE index is the Fed's preferred measure of inflation.

-

16:50

Thomson Reuters/University of Michigan final consumer sentiment index declines to 91.7 in February

The Thomson Reuters/University of Michigan final consumer sentiment index decreased to 91.7 in February from 92.0 in January, up from the preliminary estimate of 90.7 and beating expectations a fall to 91.0.

"Although consumers are not as optimistic as at the start of last year, the Sentiment Index is just 6.5% below the cyclical peak of 98.1 set in January 2015," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin.

"The current decline of just 6.5% hardly merits a recession warning, although it does indicate a somewhat slower expansion in consumer expenditures-to 2.7% in 2016, down from 3.1% in 2015," he added.

The current economic conditions index rose to 106.8 in February from 106.4 in January, up from a preliminary reading of 105.8.

The index of consumer expectations declined to 81.9 in February from 82.7 in January, up from a preliminary reading of 81.0.

-

15:41

International Monetary Fund Managing Director Christine Lagarde: capital outflows from China pose risks to the global economy

International Monetary Fund (IMF) Managing Director Christine Lagarde said at the G20 summit on Friday that capital outflows from China pose risks to the global economy.

IMF expects the Chinese economy to expand 6.3% in 2016.

She noted that risks to the global economy increased.

Lagarde also said that government should implement structural reforms.

-

15:34

U.S. Stocks open: Dow +0.53%, Nasdaq +0.66%, S&P +0.47%

-

15:28

Before the bell: S&P futures +0.65%, NASDAQ futures +0.77%

U.S. stock-index futures rose.

Global Stocks:

Nikkei 16,188.41 +48.07 +0.30%

Hang Seng 19,364.15 +475.40 +2.52%

Shanghai Composite 2,767.21 +25.96 +0.95%

FTSE 6,098.11 +85.30 +1.42%

CAC 4,331.04 +82.59 +1.94%

DAX 9,522.77 +191.29 +2.05%

Crude oil $33.99 (+2.78%)

Gold $1228.40 (-0.84%)

-

15:17

U.S. revised GDP rises 1.0% in the fourth quarter

The U.S. Commerce Department released gross domestic product (GDP) figures on Friday. The U.S. revised GDP climbed 1.0% in the fourth quarter, up from the preliminary estimate of a 0.4% rise, after a 2.0% in the third quarter.

The upward revision was partly driven by an upward revision to business inventories.

Consumer spending was revised down.

Consumer spending rose by 2.0% in the fourth quarter, down from the previous estimate of a 2.2% increase.

Exports fell 2.7% in the fourth quarter, down from the preliminary estimate of a 2.5% fall, while imports were down 0.6%, down from the preliminary estimate of a 1.1% rise.

The PCE price index increased 0.4% in the fourth quarter, up from the preliminary estimate of 0.1%, after a 1.3% rise in the third quarter.

The PCE price index excluding food and energy costs increased 1.3% in the fourth quarter, up from the preliminary estimate of 1.2%, after a 1.4% rise in the third quarter.

The PCE price index is the Fed's preferred gauge for inflation.

-

14:56

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Goldman Sachs

GS

149.48

0.83%

0.6K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

7.47

4.92%

75.7K

Yandex N.V., NASDAQ

YNDX

13.35

3.65%

11.6K

Yahoo! Inc., NASDAQ

YHOO

31.85

1.56%

3.6K

Citigroup Inc., NYSE

C

39.19

1.48%

9.7K

ALCOA INC.

AA

9.00

1.47%

5.5K

Twitter, Inc., NYSE

TWTR

17.80

1.19%

22.3K

Chevron Corp

CVX

86.15

1.00%

0.2K

Home Depot Inc

HD

128.13

1.00%

1.6K

Nike

NKE

63.00

0.99%

1.2K

Amazon.com Inc., NASDAQ

AMZN

560.50

0.96%

14.1K

Exxon Mobil Corp

XOM

82.73

0.88%

8.5K

Google Inc.

GOOG

711.60

0.83%

1.0K

HONEYWELL INTERNATIONAL INC.

HON

105.00

0.78%

0.9K

Tesla Motors, Inc., NASDAQ

TSLA

188.88

0.77%

18.2K

Intel Corp

INTC

29.84

0.74%

1.1K

United Technologies Corp

UTX

98.79

0.73%

0.5K

JPMorgan Chase and Co

JPM

57.41

0.70%

26.4K

Visa

V

73.75

0.66%

0.4K

Microsoft Corp

MSFT

52.43

0.63%

20.5K

Facebook, Inc.

FB

108.71

0.59%

134.7K

General Electric Co

GE

29.40

0.58%

2.6K

Cisco Systems Inc

CSCO

26.75

0.56%

1.1K

Ford Motor Co.

F

12.46

0.56%

10.3K

Starbucks Corporation, NASDAQ

SBUX

59.07

0.54%

1.5K

General Motors Company, NYSE

GM

29.65

0.51%

2.8K

American Express Co

AXP

55.65

0.47%

2.4K

Merck & Co Inc

MRK

51.24

0.47%

0.3K

Verizon Communications Inc

VZ

51.35

0.47%

0.6K

AMERICAN INTERNATIONAL GROUP

AIG

51.60

0.45%

1.5K

Apple Inc.

AAPL

97.17

0.42%

37.2K

Pfizer Inc

PFE

30.70

0.36%

0.3K

Johnson & Johnson

JNJ

106.75

0.35%

1.2K

Procter & Gamble Co

PG

82.60

0.32%

3.3K

International Business Machines Co...

IBM

134.91

0.30%

1K

AT&T Inc

T

37.47

0.27%

8.7K

Walt Disney Co

DIS

95.87

0.23%

1.7K

Deere & Company, NYSE

DE

79.66

0.08%

0.1K

Hewlett-Packard Co.

HPQ

10.34

0.00%

54.2K

Wal-Mart Stores Inc

WMT

68.01

-0.04%

0.2K

The Coca-Cola Co

KO

44.10

-0.14%

3.9K

Barrick Gold Corporation, NYSE

ABX

13.22

-2.65%

125.3K

-

14:46

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Coca-Cola (KO) downgraded to Neutral from Buy at Sterne Agee CRT

Other:

-

14:46

German consumer price inflation increases 0.4% in February

Destatis released its consumer price data for Germany on Friday. German preliminary consumer price index increased 0.4% in February, missing expectations for a 0.5% rise, after a 0.8% drop in January.

On a yearly basis, German preliminary consumer price index declined to 0.0% in February from 0.5% in January, missing expectations for a decline to 0.1%.

The annual inflation was mainly driven by a drop in energy prices. Energy prices slid 8.5% year-on-year in February.

Goods prices dropped 1.1% year-on-year in February, while services prices increased 0.9%.

-

12:35

European stock markets mid session: stocks traded higher as oil prices rose

Stock indices traded higher as oil prices rebounded. Oil prices rose on news that Russia, Saudi Arabia, Venezuela and Qatar plan to meet in March to discuss the freeze of the oil production.

Meanwhile, market participants eyed the economic data from the Eurozone. The European Commission released its economic sentiment index for the Eurozone on Friday. The index slid to 103.8 in February from 106.7 in January. January's figure was revised up from 105.0.

Analysts had expected the index to decline to 104.4.

The drop was driven by a fall in confidence among consumers and in all business sectors but construction.

The industrial confidence index fell to -4.0 in February from -3.0 in January, missing expectations for a drop to -3.5.

The final consumer confidence index was down to -9.0 in February from -6.3 in January, missing expectations for a decline to -7.0.

The business climate index decreased to 0.1 in February from 0.29 in January. Analysts had expected the index to fall to 0.28.

The decline in business climate index was driven by a less favourable managers' assessment of past production, total order books and production expectations.

Bank of England (BoE) Governor Mark Carney warned major central banks at the G20 summit on Friday that implementing negative rates was the wrong answer to the slowdown in the global economy.

"To the extent it pushes greater savings onto the global markets, global short-term equilibrium rates would fall further, pulling the global economy closer to a liquidity trap. At the global zero bound, there is no free lunch," he said.

Current figures:

Name Price Change Change %

FTSE 100 6,082.49 +69.68 +1.16 %

DAX 9,505.82 +174.34 +1.87 %

CAC 40 4,323.63 +75.18 +1.77 %

-

12:32

Bank of England Governor Mark Carney: implementing negative rates was the wrong answer to the slowdown in the global economy

Bank of England (BoE) Governor Mark Carney warned major central banks at the G20 summit on Friday that implementing negative rates was the wrong answer to the slowdown in the global economy.

"To the extent it pushes greater savings onto the global markets, global short-term equilibrium rates would fall further, pulling the global economy closer to a liquidity trap. At the global zero bound, there is no free lunch," he said.

Carney also warned that central bank should not depreciate their currencies.

"For monetary easing to work at a global level it cannot rely on simply moving scarce demand from one country to another," BoE governor noted.

Carney pointed out that structural measures were needed to boost the global economy.

"Global growth has disappointed because the innovation and ambition of global monetary policy has not been matched by structural measures," he said.

-

12:13

Preliminary consumer price inflation in Spain slides 0.3% in February

The Spanish statistical office INE released its preliminary consumer price inflation data on Friday. Consumer price inflation in Spain slides 0.3% in February, after a 1.9% fall in January.

On a yearly basis, consumer prices fell by 0.8% in February, after a 0.3% decrease in January.

The annual decline was mainly driven by the drop in in the prices of fuels (gas and diesel oil) and food and non-alcoholic beverages.

-

12:09

French preliminary consumer price inflation increases 0.2% in February

The French statistical office Insee released its preliminary consumer price inflation for France on Friday. The French consumer price inflation increased 0.2% in February, after a 1.0% decline in January.

The monthly increase was driven by a rise in prices for manufactured products.

On a yearly basis, the consumer price index slid to -0.2% in February from 0.2% in January. It was the first drop since March 2015.

The annual drop was driven by a fall in energy prices.

Food prices rose 0.1% year-on-year in February, services prices climbed 1.3%, while energy prices dropped by 5.3%.

-

12:01

French producer prices decrease 0.8% in January

French statistical office INSEE released its producer price index (PPI) data on Friday. French producer prices decreased 0.8% in January, after a 1.2% drop in December.

The increase was driven a rise in prices for refined petroleum products, mining and quarrying industry, energy, water, and food products.

On a yearly basis, French PPI fell 2.5% in January.

The annual drop was driven by a decline in prices for refined petroleum products, which slid 27.9 year-on-year in January.

Import prices decreased 1.6% in January, after a 1.7% fall in December.

-

11:56

French consumer spending rises 0.6% in January

French statistical office INSEE released its consumer spending data on Friday. French consumer spending rose 0.6% in January, after a 1.0% gain in December. December's figure was revised up from a 0.7% increase.

The increase was mainly driven by a rise in expenditure on energy. Spending on energy climbed by 3.4% in January.

Spending on food declined 0.8% in January.

On a yearly basis, consumer spending climbed 0.6% in January.

-

11:51

French final GDP rises 0.3% in the fourth quarter

The French statistical office Insee released its final gross domestic product data for France on Friday. The French final GDP rose 0.3% in the fourth quarter, up from the preliminary estimate of 0.2%, after a 0.3% increase in the third quarter.

Household spending decline 0.2% in the fourth quarter, up from the preliminary estimate of -0.4%, after a 0.5% gain in the third quarter, while government spending rose 0.5%, after a 0.4% gain in the third quarter.

Total production in goods and services was up 0.6% in the fourth quarter, up from the preliminary estimate of 0.5%, after a 0.3% rise in the third quarter.

Export increased 1.0% in the fourth quarter, up from the preliminary estimate of 0.6%, while imports rose 2.5%, up from the preliminary estimate of 1.6%

On a yearly basis, French final GDP climbed 1.4% in the fourth quarter, down from the preliminary estimate of 1.5% growth, after a 1.1% rise in the third quarter.

In 2015 as whole, the French economy expanded 1.1%, in line with the preliminary estimate, after a 0.2% growth in 2014.

-

11:37

GfK’s U.K. consumer confidence index drops to 0 in February

Gfk released its consumer confidence index for the U.K. on Friday. GfK's U.K. consumer confidence index decreased to 0 in February from 4 in January, missing expectations for a decline to 3.

3 of 5 measures increased and 2 declined.

"While faith in our own personal financial situation continues to remain strong for the year ahead with just a one-point drop to +8 points, we are clearly worried about the general economic situation for the country. Here, there have been sharp drops both for the view over the past year and the coming year," Joe Staton, Head of Market Dynamics at GfK, said.

-

11:29

Eurozone’s economic sentiment index slides to 103.8 in February

The European Commission released its economic sentiment index for the Eurozone on Friday. The index slid to 103.8 in February from 106.7 in January. January's figure was revised up from 105.0.

Analysts had expected the index to decline to 104.4.

The drop was driven by a fall in confidence among consumers and in all business sectors but construction.

The industrial confidence index fell to -4.0 in February from -3.0 in January, missing expectations for a drop to -3.5.

The final consumer confidence index was down to -9.0 in February from -6.3 in January, missing expectations for a decline to -7.0.

The business climate index decreased to 0.1 in February from 0.29 in January. Analysts had expected the index to fall to 0.28.

The decline in business climate index was driven by a less favourable managers' assessment of past production, total order books and production expectations.

-

11:19

Bank of Japan Governor Haruhiko Kuroda: the central bank could cut its interest rate further

Bank of Japan Governor Haruhiko Kuroda said on Friday that the central bank could cut its interest rate further.

"It is technically possible to implement a larger negative rate, although I couldn't say with certainty how far we can go," he said.

Kuroda defended the central bank's move to implement negative interest rates, saying that the central bank wants to achieve price stability.

-

11:14

People's Bank of China Governor Zhou Xiaochuan: the central bank had enough tools to address the downside risks

The People's Bank of China (PBoC) Governor Zhou Xiaochuan said on Friday that the central bank had enough tools to address the downside risks.

"China still has monetary policy space and tools to avert downside risks," he said.

Zhou noted that the economic growth remained strong.

He pointed out that there is no basis for further depreciation of the yuan.

-

11:04

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy fall to 44.2 in in the week ended February 21

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy fell to 44.2 in in the week ended February 21 from 44.3 the prior week.

The index was supported by a rise in buying climate sub-index. The measure of views of the economy and the personal finances index were little changed last week.

-

10:48

San Francisco Fed President John Williams: the Fed should continue to raise its interest rate further

San Francisco Fed President John Williams said on Thursday that the Fed should continue to raise its interest rate further, adding the hikes should depend on the economic data.

"I still think we should be following the same strategy, however many increases or the pace of increases, which will be driven by the data," he said.

Williams pointed out that the Fed should hike its interest rate gradually.

San Francisco Fed president also said that he did not see any deterioration in the U.S. economy.

-

10:34

Citigroup: the risk of global recession increased

Analysts at Citigroup said on Wednesday that the risk of global recession increased.

"In our view, global growth is at a highly precarious point, after 2-3 years of relative calm," Citigroup said.

"The most recent deterioration in the global outlook is due to a moderate worsening in the prospects for the advanced economies, a large increase in the uncertainty about the advanced economies outlook (notably for the U.S.) and a tightening in financial conditions everywhere," the bank noted.

Citigroup pointed out that the slowdown in the U.S. economy would have a negative impact on the global economic outlook.

-

10:20

New Zealand’s trade deficit turns into a surplus of NZ$8 million in January

Statistics New Zealand released its trade data on late Thursday evening. New Zealand's trade deficit turned into a surplus of NZ$8 million in January from a deficit of NZ$38 million in December. December's figure was revised up from a deficit of NZ$53 million.

Analysts had expected the deficit to decline to NZ$246 million.

Exports climbed 5.9% year-on-year in January, driven by milk powder, butter and cheese, while imports increased by 7.2%, driven by a rise in intermediate goods.

"The fall in the value of crude oil imports is a result of New Zealand importing slightly less crude oil than in January 2015, but at a much lower price," Statistics NZ international statistics senior manager Jason Attewell said.

-

10:12

Japan's national CPI declines to an annual rate of 0.0% in January

Japan's Ministry of Internal Affairs and Communications released its inflation data on late Thursday evening. Japan's national consumer price index (CPI) declined to an annual rate of 0.0% in January from 0.2% in December, in line with expectations.

Inflation was mainly driven by declines in fuel and communication prices. Fuel prices slid 6.7% year-on-year in January, while communication prices declined 2.4%.

Japan's national CPI excluding fresh food fell to an annual rate of 0.0% in January from 0.1%, beating expectations for a drop to -0.2%.

The Bank of Japan's inflation target is 2%.

-

06:47

Global Stocks: U.S. stock indices rose following oil prices

U.S. stock indices traded higher on Thursday following oil prices.

The Dow Jones Industrial Average rose 212.30 points, or 1.3%, to 16697.29. The S&P 500 gained 21.90 points, or 1.1%, to 1951.70 (all of its 10 sectors finished the session in the green). The Nasdaq Composite climbed 39.60 points, or 0.9%, to 4582.20.

Stocks were influenced by comments from St. Louis Fed President James Bullard, who said that any changes to monetary policy would largely depend on inflation expectations.

Meanwhile U.S. durable goods orders rose in January. Orders excluding defense equipment and commercial aircrafts rose by 3.9% after a 3.7% drop in December. A broader durable goods orders index rose by 4.9%.

This morning in Asia Hong Kong Hang Seng rose 1.73%, or 325.90 points, to 19,214.65. China Shanghai Composite Index gained 0.50%, or 13.61 points, to 2,754.86. Meanwhile the Nikkei rose 0.99%, or 160.28 points, to 16,300.62.

Asian stock indices rose on optimistic expectations regarding the G20 two-day meeting, which started today in Shanghai.

Japanese stocks rose amid gains in Wall Street and a weaker yen. The yen was partly influenced by domestic inflation data. The National CPI, which excludes prices of fresh food, but includes energy costs, was unchanged in January compared to the same period last year after gaining 0.1% in each of the two previous months. The reading was in line with expectations.

-

03:29

Nikkei 225 16,361.04 +220.70 +1.37 %, Hang Seng 19,180.53 +291.78 +1.54 %, Shanghai Composite 2,757.11 +15.86 +0.58 %

-

01:03

Stocks. Daily history for Sep Feb 25’2016:

(index / closing price / change items /% change)

Nikkei 225 16,140.34 +224.55 +1.41 %

Hang Seng 18,888.75 -303.70 -1.58 %

Shanghai Composite 2,741.25 -187.65 -6.41 %

FTSE 100 6,012.81 +145.63 +2.48 %

CAC 40 4,248.45 +93.11 +2.24 %

Xetra DAX 9,331.48 +163.68 +1.79 %

S&P 500 1,951.7 +21.90 +1.13 %

NASDAQ Composite 4,582.2 +39.60 +0.87 %

Dow Jones 16,697.29 +212.30 +1.29 %

-