Noticias del mercado

-

21:00

Dow +0.75% 16,608.27 +123.28 Nasdaq +0.22% 4,552.75 +10.14 S&P +0.57% 1,940.79 +10.99

-

19:30

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes slightly rose on Thursday, breaking away from sliding oil prices, as strong U.S. durable goods data pointed to a recovery in the struggling manufacturing sector. Orders for U.S. durable goods rose more than expected in January, as demand picked up across the board. Movements in crude prices have been the biggest influence on stock markets this year as investors see weak energy demand as a sign of sluggish global growth.

Most of all Dow stocks in positive area (22 of 30). Top looser - Chevron Corporation (CVX, -1,58%). Top gainer - United Technologies Corporation (UTX, +3,87%).

Most of S&P sectors also in positive area. Top looser - Basic Materials (-1,0%). Top gainer - Utilities (+0,8%).

At the moment:

Dow 16530.00 +57.00 +0.35%

S&P 500 1932.50 +2.25 +0.12%

Nasdaq 100 4199.50 -9.00 -0.21%

Oil 31.65 -0.50 -1.56%

Gold 1241.10 +2.00 +0.16%

U.S. 10yr 1.69 -0.05

-

18:38

WSE: Session Results

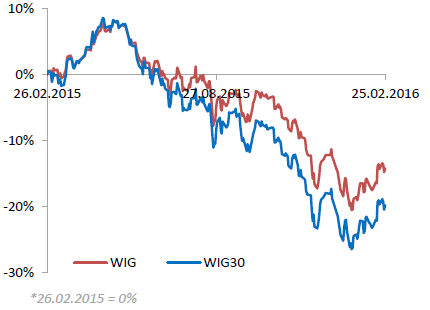

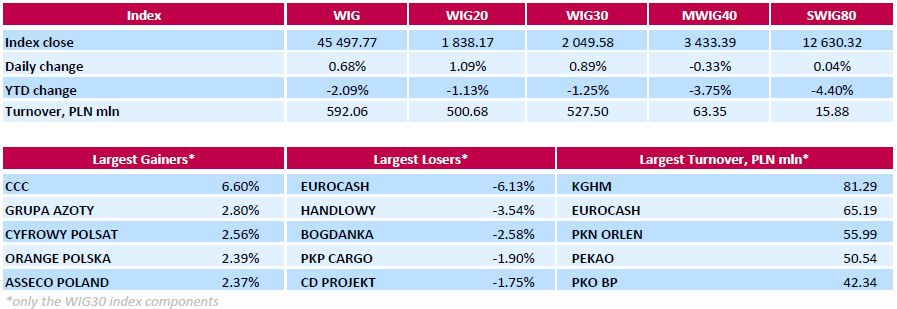

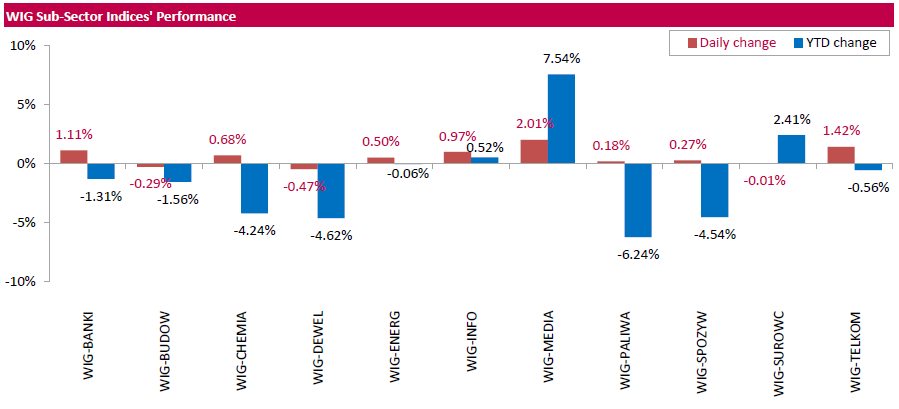

Polish equity market closed higher on Thursday. The broad market measure, the WIG Index, surged by 0.48%. From a sector perspective, developing sector (-0.47%) fared the worst, while media sector (+2.01%) was the best-performing group.

The large-cap stocks' measure, the WIG30 Index, grew by 0.89%. In the index basket, footwear retailer CCC (WSE: CCC) recorded the strongest daily performance, soaring by 6.6% on better-than-expected quarterly earnings: the company posted Q4 net profit of PLN 105 mln versus consensus of PLN 92 mln. Other major gainers were chemical producer GRUPA AZOTY (WSE: ATT), media group CYFROWY POLSAT (WSE: CPS), telecommunication services provider ORANGE POLSKA (WSE: OPL) and IT-company ASSECO POLAND (WSE: ACP), which advanced by 2.37%-2.8%. On the other side of the ledger, FMCG-wholesaler EUROCASH (WSE: EUR) was weakest performer, tumbling by 6.13% as the company's Q4 FY2015 earnings of PLN 97 mln were weaker than the analysts' estimates of PLN 103 mln. It was followed by bank BZ WBK (WSE: BZW) and thermal coal miner BOGDANKA (WSE: LWB), which lost 3.54% and 2.58% respectively.

-

18:01

European stocks close: stocks closed higher ahead of the G20 summit

Stock indices closed higher as market participants are awaiting the G20 summit, which is scheduled to be in Shanghai on February 26 - 27. The International Monetary Fund (IMF) said in its report prepared for the summit that G20 countries should coordinate their stimulus measures to boost the global economy.

Meanwhile, market participants eyed the economic data from the Eurozone. Eurostat released its final consumer price inflation data for the Eurozone on Thursday. Eurozone's harmonized consumer price index dropped 1.4% in January, in line with expectations, after a flat reading in December.

On a yearly basis, Eurozone's final consumer price inflation rose to 0.3% in January from 0.2% in December, down from the preliminary reading of 0.4%.

Restaurants and cafés prices were up 0.10% year-on-year in January, tobacco and vegetables prices rose by 0.06% each, fuel prices for transport declined by 0.28%, heating oil prices decreased by 0.18%, while gas prices were down by 0.11%.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco increased to at an annual rate of 1.0 in January from 0.9% in December, in line with the preliminary reading.

The European Central Bank (ECB) released its M3 money supply figures on Thursday. M3 money supply rose 5.0% in January from last year, exceeding expectations for a 4.7% gain, after a 4.7 % increase in December.

Loans to the private sector in the Eurozone climbed 1.4% in January from the last year, missing expectations for a 1.5% rise, after a 1.4% gain in December.

The Office for National Statistics (ONS) released its revised gross domestic product (GDP) data on Thursday. The revised U.K. GDP expanded at 0.5% in the fourth quarter, in line with the preliminary reading, after a 0.4% rise in the third quarter.

The growth was driven by a rise in household spending. Household spending rose 0.7% in the fourth quarter.

Business investment slid 2.1% in the fourth quarter.

On a yearly basis, the revised U.K. GDP rose 1.9% in the fourth quarter, in line with the preliminary reading, after a 2.1% gain in the third quarter.

In 2015 as whole, U.K. GDP rose 2.2%, in line with the preliminary reading, after a 2.9% growth in 2014.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,012.81 +145.63 +2.48 %

DAX 9,331.48 +163.68 +1.79 %

CAC 40 4,248.45 +93.11 +2.24 %

-

17:33

Bank of England (BoE) Deputy Governor Jon Cunliffe: the U.K. economy recovered slowly

Bank of England (BoE) Deputy Governor Jon Cunliffe said on Wednesday that the U.K. economy recovered slowly, noting that "there are deeper structural factors at work".

He pointed out that he expected the U.K. economy to continue to expand solidly and inflation to reach 2% target "over the next few years".

Cunliffe noted that the central bank was ready to act if needed.

"We have a range of tools at our disposal and should be ready to use them whichever risk materialises," he said.

-

16:54

German construction orders increase 3.9% in December

Destatis released its construction orders data on Thursday. German construction orders rose by a seasonally and working-day-adjusted rate of 3.9% in December.

On an annual basis, German construction orders climbed by a seasonally and working-day-adjusted rate of 19.8% in December.

In 2015 as whole, total construction orders rose 3.7%.

-

16:50

Dallas Federal Reserve President Robert Kaplan does not expect the U.S. economy to enter recession this year

Dallas Federal Reserve President Robert Kaplan said on Wednesday that he did not expect the U.S. economy to enter recession this year.

He also said that the U.S. economic growth was sluggish.

-

16:43

St. Louis Fed President James Bullard: the likelihood for the global recession was not high

St. Louis Fed President James Bullard said in an interview with CNBC on Thursday that the likelihood for the global recession was not high.

"I don't think the probabilities are particularly high right now," he said.

Bullard noted that if U.S. equities had continued to rise at the same pace, that would have led to an asset price bubble.

Bullard is a voting member of the Federal Open Market Committee (FOMC) this year.

-

16:16

Atlanta Fed President Dennis Lockhart: higher interest rates could have a negative impact on U.S. banks

Atlanta Fed President Dennis Lockhart said on Thursday that higher interest rates could have a negative impact on U.S. banks.

"For the first time in more than a decade, bankers face the potential of operating in a rising rate environment. Rising rates will create challenges in managing net interest margins and risks," he said.

Lockhart noted that further interest rate hikes will depend on the incoming economic data, adding that low energy prices and the slowdown in the Chinese economy added "new complexity" to U.S. forecasts.

-

15:50

U.S. house price index rise 0.4% in December

The Federal Housing Finance Agency (FHFA) released its monthly house price index for the U.S. on Thursday. The U.S. house price index rose 0.4% on a seasonally adjusted basis in December, missing expectations for a 0.5% increase, after a 0.6% gain in November. November's figure was revised up from a 0.5% rise.

On a yearly basis, U.S. house prices climbed 5.7% in December, after a 5.9% rise in November.

House prices increased 1.4% in the fourth quarter.

"Instability in financial markets did not seem to put much of a drag on home prices in the fourth quarter," FHFA Supervisory Economist, Andrew Leventis, said.

-

15:34

U.S. Stocks open: Dow +0.34%, Nasdaq +0.34%, S&P +0.39%

-

15:25

Before the bell: S&P futures +0.08%, NASDAQ futures +0.01%

U.S. stock-index futures were little changed.

Global Stocks:

Nikkei 16,140.34 +224.55 +1.41%

Hang Seng 18,888.75 -303.70 -1.58%

Shanghai Composite 2,741.42 -187.48 -6.40%

FTSE 6,005.39 +138.21 +2.36%

CAC 4,247.81 +92.47 +2.23%

DAX 9,319.26 +151.46 +1.65%

Crude oil $31.61 (-1.68%)

Gold $1236.80 (-0.19%)

-

15:04

U.S. durable goods orders jump 4.9% in January

The U.S. Commerce Department released durable goods orders data on Thursday. The U.S. durable goods orders jumped 4.9% in January, exceeding expectations for a 2.9% gain, after a 4.6% drop in December. December's figure was revised up from a 5.0% fall.

The increase was mainly driven by a strong demand for transportation equipment, which climbed by 11.5% in January.

The U.S. durable goods orders excluding transportation climbed 1.8% in January, exceeding expectations for a 0.2% increase, after a 0.7% decline in December. December's figure was revised up from a 1.2% drop.

The U.S. durable goods orders excluding defence rose 4.5 % in January, after a 2.5% decline in December. December's figure was revised up from a 2.9% decrease.

-

15:00

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Barrick Gold Corporation, NYSE

ABX

13.59

0.97%

90.0K

General Motors Company, NYSE

GM

28.98

0.49%

1.1K

Twitter, Inc., NYSE

TWTR

18.08

0.44%

28.4K

Microsoft Corp

MSFT

51.57

0.41%

3.5K

Boeing Co

BA

116.00

0.35%

0.4K

Goldman Sachs

GS

146.04

0.33%

0.1K

American Express Co

AXP

54.82

0.33%

0.8K

Visa

V

72.08

0.32%

0.1K

General Electric Co

GE

28.81

0.28%

14.3K

Wal-Mart Stores Inc

WMT

67.30

0.27%

7.2K

International Business Machines Co...

IBM

133.15

0.26%

1.8K

Travelers Companies Inc

TRV

108.74

0.24%

0.1K

Cisco Systems Inc

CSCO

26.38

0.23%

0.4K

McDonald's Corp

MCD

117.32

0.22%

0.1K

Intel Corp

INTC

29.25

0.21%

19.4K

Pfizer Inc

PFE

30.08

0.20%

0.1K

ALTRIA GROUP INC.

MO

61.48

0.20%

0.4K

3M Co

MMM

157.48

0.17%

0.1K

AT&T Inc

T

37.16

0.16%

0.8K

Nike

NKE

60.49

0.15%

0.7K

United Technologies Corp

UTX

93.74

0.14%

3.4K

Facebook, Inc.

FB

107.02

0.13%

121.3K

Verizon Communications Inc

VZ

50.87

0.10%

0.7K

Ford Motor Co.

F

12.09

0.08%

29.8K

The Coca-Cola Co

KO

43.94

0.07%

0.4K

Google Inc.

GOOG

700.05

0.07%

1.2K

JPMorgan Chase and Co

JPM

56.17

0.05%

0.6K

Amazon.com Inc., NASDAQ

AMZN

554.25

0.04%

12.7K

Citigroup Inc., NYSE

C

38.10

0.03%

15.0K

Starbucks Corporation, NASDAQ

SBUX

58.10

-0.02%

3.5K

Apple Inc.

AAPL

96.05

-0.05%

71.1K

Johnson & Johnson

JNJ

104.84

-0.11%

3.5K

Chevron Corp

CVX

85.14

-0.15%

7.6K

Exxon Mobil Corp

XOM

81.30

-0.27%

7.6K

Tesla Motors, Inc., NASDAQ

TSLA

178.51

-0.27%

6.4K

Walt Disney Co

DIS

95.11

-0.34%

0.5K

Home Depot Inc

HD

125.10

-0.41%

0.5K

Caterpillar Inc

CAT

65.56

-0.49%

9.1K

ALCOA INC.

AA

8.70

-0.68%

10.4K

Yahoo! Inc., NASDAQ

YHOO

30.63

-1.03%

7.0K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

7.12

-1.11%

37.7K

Yandex N.V., NASDAQ

YNDX

12.99

-1.37%

1.7K

Hewlett-Packard Co.

HPQ

10.35

-4.34%

7.8K

-

14:48

Initial jobless claims increase to 272,000 in the week ending February 20

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending February 20 in the U.S. increased by 10,000 to 272,000 from 262,000 in the previous week.

Analysts had expected jobless claims to rise to 270,000.

Jobless claims remained below 300,000 the 51st straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims declined by 19,000 to 2,253,000 in the week ended February 13.

-

14:41

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Yahoo! (YHOO) reiterated with a Neutral at Mizuho; target $29

-

12:08

European stock markets mid session: stocks traded higher ahead of the G20 summit

Stock indices traded higher as market participants are awaiting the G20 summit, which is scheduled to be in Shanghai on February 26 - 27. The International Monetary Fund (IMF) said in its report prepared for the summit that G20 countries should coordinate their stimulus measures to boost the global economy.

Meanwhile, market participants eyed the economic data from the Eurozone. Eurostat released its final consumer price inflation data for the Eurozone on Thursday. Eurozone's harmonized consumer price index dropped 1.4% in January, in line with expectations, after a flat reading in December.

On a yearly basis, Eurozone's final consumer price inflation rose to 0.3% in January from 0.2% in December, down from the preliminary reading of 0.4%.

Restaurants and cafés prices were up 0.10% year-on-year in January, tobacco and vegetables prices rose by 0.06% each, fuel prices for transport declined by 0.28%, heating oil prices decreased by 0.18%, while gas prices were down by 0.11%.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco increased to at an annual rate of 1.0 in January from 0.9% in December, in line with the preliminary reading.

The European Central Bank (ECB) released its M3 money supply figures on Thursday. M3 money supply rose 5.0% in January from last year, exceeding expectations for a 4.7% gain, after a 4.7 % increase in December.

Loans to the private sector in the Eurozone climbed 1.4% in January from the last year, missing expectations for a 1.5% rise, after a 1.4% gain in December.

The Office for National Statistics (ONS) released its revised gross domestic product (GDP) data on Thursday. The revised U.K. GDP expanded at 0.5% in the fourth quarter, in line with the preliminary reading, after a 0.4% rise in the third quarter.

The growth was driven by a rise in household spending. Household spending rose 0.7% in the fourth quarter.

Business investment slid 2.1% in the fourth quarter.

On a yearly basis, the revised U.K. GDP rose 1.9% in the fourth quarter, in line with the preliminary reading, after a 2.1% gain in the third quarter.

In 2015 as whole, U.K. GDP rose 2.2%, in line with the preliminary reading, after a 2.9% growth in 2014.

Current figures:

Name Price Change Change %

FTSE 100 5,990.52 +123.34 +2.10 %

DAX 9,254.46 +86.66 +0.95 %

CAC 40 4,230.74 +75.40 +1.81 %

-

12:02

Spanish producer prices decline 2.5% in January

The Spanish statistical office INE released its producer price index (PPI) data for Spain on Thursday. The Spanish producer prices dropped 2.5% in January, after a 0.7% fall in December.

On a yearly basis, producer price inflation in Spain fell 2.5% in January, after a 1.7% decline in December. December's figure was revised up from a 2.2% drop.

Producer prices have been declining since July 2014.

Energy prices slid 9.8% year-on-year in January.

-

11:57

Spain’s economy expands 0.8% the fourth quarter

The Spanish statistical office INE released its final gross domestic product (GDP) for Spain on Thursday. Spain's economy expanded 0.8% the fourth quarter, in line with the preliminary reading, after a 0.8% growth in the third quarter. It was the tenth consecutive increase.

The increase was driven by a rise in household spending.

On a yearly, GDP grew 3.5% in the fourth quarter, in line with the preliminary reading, in line with the preliminary reading, after a 3.4% in the third quarter. It was the fastest growth since the fourth quarter of 2007.

In 2015 as whole, Spain's economy expanded 3.2%, in line with the preliminary reading.

-

11:45

Italian consumer confidence index slides to 114.5 in February

The Italian statistical office Istat released its consumer confidence index for Italy on Thursday. The Italian consumer confidence index slid to 114.5 in February from 118.6 in January. January's figure was revised down from 118.9.

The decrease was driven by drops in all components: economic, personal, current and future.

The business confidence index fell to 102.0 in February from 103.0 in January. January's figure was revised down from 103.2.

The decline was driven by less favourable assessments on order books and production expectations, and by a drop in inventories.

-

11:40

Italian retail sales fall 0.1% in December

The Italian statistical office Istat released its retail sales data for Italy on Thursday. Italian retail sales fell by 0.1% in December, after a 0.2% increase in November. November's figure was revised down from a 0.2% gain.

Sales of food products were down 0.3% in December, while sales of non-food products decreased by 0.1%.

On a yearly basis, retail sales in Italy climbed 0.6% in December, after a 0.2% decline in November. November's figure was revised down from a 0.1% fall.

-

11:36

Private capital expenditure in Australia increases 0.8% in the fourth quarter

The Australian Bureau of Statistics released its private capital expenditure data on Thursday. Private capital expenditure in Australia increased 0.8% in the fourth quarter, beating forecasts of a 3.0% drop, after a 8.4% decline in third quarter. The third quarter's figure was revised up a 9.2% fall.

Capex for buildings and structures rose 1.2% in the fourth quarter, while capital spending for equipment, plants and machinery was up 0.1%.

On a yearly basis, private capital expenditure in Australia declined 16.4% in the fourth quarter.

-

11:25

Revised U.K. GDP grows at 0.5% in the fourth quarter

The Office for National Statistics (ONS) released its revised gross domestic product (GDP) data on Thursday. The revised U.K. GDP expanded at 0.5% in the fourth quarter, in line with the preliminary reading, after a 0.4% rise in the third quarter.

The growth was driven by a rise in household spending. Household spending rose 0.7% in the fourth quarter.

Exports declined 0.1% in the fourth quarter, while imports were up 1.2%.

Business investment slid 2.1% in the fourth quarter.

The service sector climbed 0.7% in the fourth quarter, in line with the preliminary reading.

On a yearly basis, the revised U.K. GDP rose 1.9% in the fourth quarter, in line with the preliminary reading, after a 2.1% gain in the third quarter.

In 2015 as whole, U.K. GDP rose 2.2%, in line with the preliminary reading, after a 2.9% growth in 2014.

-

11:15

Eurozone's harmonized consumer price index drops 1.4% in January

Eurostat released its final consumer price inflation data for the Eurozone on Thursday. Eurozone's harmonized consumer price index dropped 1.4% in January, in line with expectations, after a flat reading in December.

On a yearly basis, Eurozone's final consumer price inflation rose to 0.3% in January from 0.2% in December, down from the preliminary reading of 0.4%.

Restaurants and cafés prices were up 0.10% year-on-year in January, tobacco and vegetables prices rose by 0.06% each, fuel prices for transport declined by 0.28%, heating oil prices decreased by 0.18%, while gas prices were down by 0.11%.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco increased to at an annual rate of 1.0 in January from 0.9% in December, in line with the preliminary reading.

-

10:51

M3 money supply in the Eurozone rises 5.0% in January from last year

The European Central Bank (ECB) released its M3 money supply figures on Thursday. M3 money supply rose 5.0% in January from last year, exceeding expectations for a 4.7% gain, after a 4.7 % increase in December.

Loans to the private sector in the Eurozone climbed 1.4% in January from the last year, missing expectations for a 1.5% rise, after a 1.4% gain in December.

Total credit to euro area residents increased to 2.6% year-on-year in January from 2.4% in December.

Loans to non-financial corporations rose to 0.6% year-on-year in January from 0.1% in December.

-

10:31

German Gfk consumer confidence index rises to 9.5 in March

Market research group GfK released its consumer confidence index for Germany on Thursday. German Gfk consumer confidence index rose to 9.5 in March from 9.4 in February, beating expectations for a drop to 9.3.

The economic expectations index declined by 0.8 points to 3.4 points in February, while the willingness to buy index remained unchanged at 52.7.

The income expectations index climbed by 9.5 points to 56.7 in February.

"The pleasing start to the consumer climate this year has paved the way for 2016 to also be a good year for consumption. In its recently published forecast, GfK assumes that actual private consumer spending will rise by 2 percent this year. Growth for 2015 was also around 2 percent according to initial reports from the Federal Statistical Office," Gfk noted.

-

10:20

St. Louis Fed President James Bullard: the Fed should not raise its interest rate further

St. Louis Fed President James Bullard said in a speech on Wednesday that the Fed should not raise its interest rate further as inflation expectations declined.

"I regard it as unwise to continue a normalization strategy in an environment of declining market-based inflation expectations. A decline in inflation expectations represents an erosion of central bank credibility with respect to the inflation target," he said.

Bullard noted that the risk of asset price bubbles in the U.S. fell.

-

10:11

International Monetary Fund: global recovery weakened further

The International Monetary Fund (IMF) released its report "Global Prospects and Policy Challenges" prepared for the G20 summit. The IMF said that global recovery weakened further due to increasing financial turbulence and falling asset prices.

"Growth in advanced economies is modest already under the baseline, as low demand in some countries and a broad-based weakening of potential growth continue to hold back the recovery," it said.

"Adding to these headwinds are concerns about the global impact of China's transition to more balanced growth, along with signs of distress in other large emerging markets, including from falling commodity prices," the fund added.

The report said that the global economy was "highly vulnerable to adverse shocks".

The IMF noted that G20 countries should coordinate their stimulus measures to boost the global economy.

The IMF cut its global growth forecast in January to 3.4% from 3.6%. The fund pointed out that further cut is possible in April.

-

07:04

Global Stocks: U.S. stock indices rose following oil prices

U.S. stock indices closed in the positive territory on Wednesday amid higher oil prices despite weak economic data.

The Dow Jones Industrial Average rose 53.21 points, or 0.3%, to 16,484.99 after an initial decline of about 250 points. The S&P 500 climbed 8.53 points, or 0.4%, to 1,929.30 (its financial sector was the only one that fell, down 0.2%). The Nasdaq Composite gained 39.02 points, or 0.9%, to 4,542.61.

Financial stocks have been the worst performers among S&P's sectors in 2016. Financial companies suffered because of concerns over the health of the U.S. economy and prospects of low interest rates for a longer period of time.

Meanwhile a preliminary report on activity in the services sector of the U.S. economy showed contraction. The preliminary Services PMI fell to 49.8 in February from 53.2 in January, while economists had expected a modest increase to 53.5. Many analysts said that a recession in the manufacturing sector might have spread to the services sector.

This morning in Asia Hong Kong Hang Seng fell 1.15%, or 221.16 points, to 18,971.29. China Shanghai Composite Index dropped 3.73%, or 109.12 points, to 2,819.78. Meanwhile the Nikkei rose 1.64%, or 260.56 points, to 16,176.35.

Asian stock indices traded mixed. Japanese stocks rose following gains in U.S. equities.

Chinese stocks dropped on persistent concerns over the country's economy. Investors may also be concerned that representatives of leading economies may agree on some policy moves that could impact financial markets. The G20 meeting will be held in Shanghai on Friday and Saturday. Slumping oil prices also keep investors cautious.

-

03:29

Nikkei 225 15,985 +69.21 +0.43 %, Hang Seng 19,063.14 -129.31 -0.67 %, Shanghai Composite 2,916.38 -12.52 -0.43 %

-

00:54

Stocks. Daily history for Sep Feb 24’2016:

(index / closing price / change items /% change)

S&P/ASX 200 4,875.02 -104.57 -2.10%

TOPIX 1,284.53 -6.64 -0.51%

SHANGHAI COMP 2,929.57 +26.24 +0.90%

HANG SENG 19,192.45 -222.33 -1.15%

FTSE 100 5,867.18 -95.13 -1.60 %

CAC 40 4,155.34 -83.08 -1.96 %

Xetra DAX 9,167.8 -248.97 -2.64 %

S&P 500 1,929.8 +8.53 +0.44 %

NASDAQ Composite 4,542.61 +39.02 +0.87 %

Dow Jones 16,484.99 +53.21 +0.32 %

-