Noticias del mercado

-

21:00

Dow -0.14% 16,409.49 -22.29 Nasdaq +0.32% 4,518.15 +14.57 S&P -0.02% 1,920.92 -0.35

-

18:10

Wages in Australia rise 0.6% in the fourth quarter

The Australian Bureau of Statistics released its wage price data on Wednesday. Wages in Australia rose at a seasonally adjusted rate of 0.6% in the fourth quarter, missing forecasts of a 0.6% gain, after a 0.6% increase in the previous quarter.

Both public and private wages increased 0.5% in the fourth quarter.

On a yearly basis, wages climbed 2.2% in the fourth quarter, missing expectations for a 2.3% increase, after a 2.3% gain in the third quarter.

On a yearly basis, private wages were up 2.0% in the fourth quarter, while public wages jumped 2.6%.

-

18:08

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes lower on Wednesday, as energy stocks took a hit from a slide in oil prices after Saudi Arabia ruled out a cut in output to help tackle a global glut.

Almost all Dow stocks in negative area (27 of 30). Top looser - The Boeing Company (BA, -2,93%). Top gainer - United Technologies Corporation (UNH, +1,40%).

All S&P sectors in negative area. Top gainer - Financial (-1,5%).

At the moment:

Dow 16264.00 -132.00 -0.81%

S&P 500 1903.00 -13.00 -0.68%

Nasdaq 100 4130.25 -29.00 -0.70%

Oil 31.81 -0.06 -0.19%

Gold 1245.50 +22.90 +1.87%

U.S. 10yr 1.69 -0.06

-

18:07

Construction work done in Australia drops 3.6% in the fourth quarter

The Australian Bureau of Statistics released its construction work done figures on Wednesday. Construction work done in Australia dropped 3.6% in the fourth quarter, missing forecasts of a 2.0% fall, after a 1.8% decrease in the previous quarter. The third quarter's figure was revised up from a 3.6% decline.

The seasonally adjusted estimate of total building work done rose 2.7% in the fourth quarter, while engineering work slid 9.5%.

On a yearly basis, total construction work plunged 4.3% in the fourth quarter.

-

18:00

European stocks close: stocks closed lower on a drop in oil prices

Stock indices closed lower as oil prices continued to decline. Oil prices fell on the U.S. crude oil inventories data and on comments by Saudi Arabian Oil Minister Ali Al-Naimi. He said that there will be no cut in oil output.

European Central Bank (ECB) Governing Council member and Deutsche Bundesbank President Jens Weidmann said Wednesday that the economic recovery would continue this year. He noted that the German economy was in good shape. Weidmann warned that further stimulus measures could entail longer-term risks and side-effects "that it would be dangerous to simply ignore".

Meanwhile, market participants eyed the economic data from France. French statistical office INSEE released its consumer confidence index for France on Wednesday. French consumer confidence index fell to 95 in February from 97 in January. Analysts had expected the index to remain unchanged at 97.

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Wednesday. The number of mortgage approvals rose to 47,509 in January from 43,660 in December, exceeding expectations for a rise to 45,200. It was the highest level since February 2014.

The Confederation of British Industry (CBI) released its retail sales balance data on Wednesday. The CBI retail sales balance plunged to +10% in February from +16% in January. It was the lowest level since May 2013. Sales growth is expected to slow next month, while orders are expected to decline.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,867.18 -95.13 -1.60 %

DAX 9,167.8 -248.97 -2.64 %

CAC 40 4,155.34 -83.08 -1.96 %

-

18:00

European stocks closed: FTSE 100 5,867.18 -95.13 -1.60% CAC 40 4,155.34 -83.08 -1.96% DAX 9,167.8 -248.97 -2.64%

-

17:45

WSE: Session Results

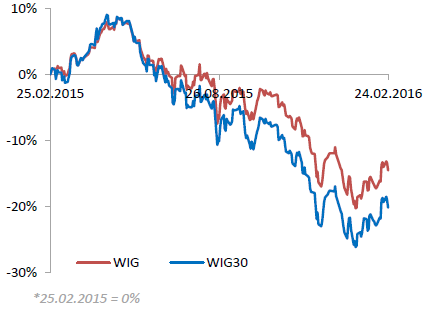

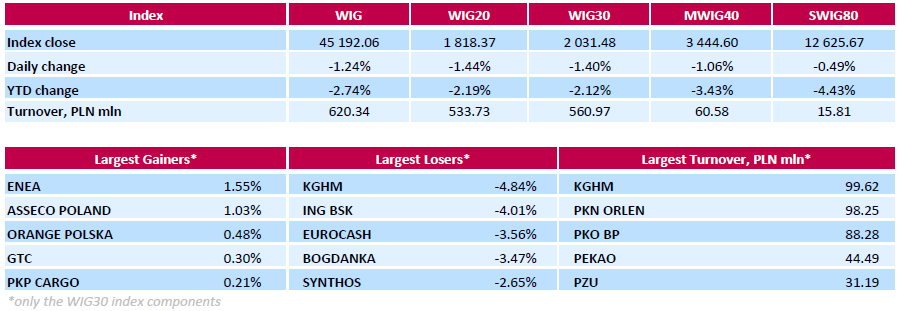

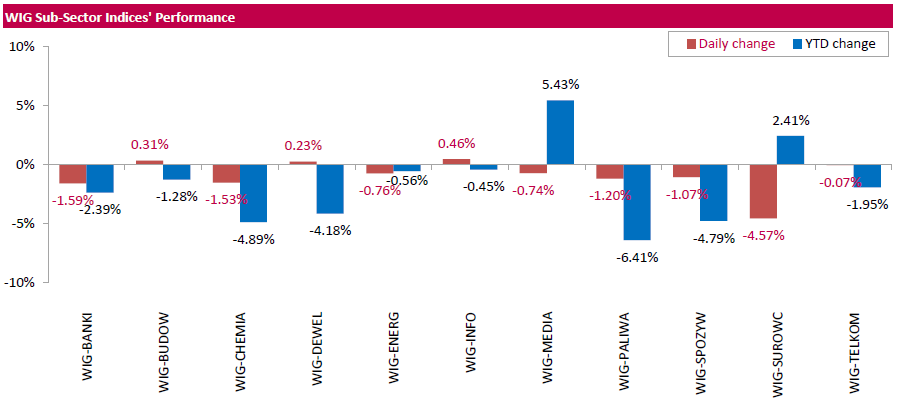

Polish equity market closed lower on Wednesday. The broad market measure, the WIG index, fell by 1.24%. Sector-wise, materials (-4.57%) fared the worst, while informational technology sector (+0.46%) was the best-performer.

The large-cap stocks' gauge, the WIG30 Index, dropped by 1.4%. A majority of the index components recorded declines. Copper producer KGHM (WSE: KGH) posted the biggest drop, down by 4.84%, amid sliding prices for copper. Other most prominent losers were FMCG wholesaler EUROCASH (WSE: EUR), thermal coal miner BOGDANKA (WSE: LWB), chemical producer SYNTHOS (WSE: SNS) and two banks ING BSK (WSE: ING) and PKO BP (WSE: PKO), which lost between 2.64% and 4.01%. At the same time, genco ENEA (WSE: ENA) and IT-company ASSECO POLAND (WSE: ACP) led a handful of gainers, adding 1.55% and 1.03% respectively.

-

17:15

European Central Bank Governing Council member and Deutsche Bundesbank President Jens Weidmann: the economic recovery would continue this year

European Central Bank (ECB) Governing Council member and Deutsche Bundesbank President Jens Weidmann said Wednesday that the economic recovery would continue this year.

"The euro area's gradual economic recovery is likely to continue in the rest of this year and in 2017," he said.

Weidmann noted that the German economy was in good shape.

"While wage growth was marked, inflation remained subdued; this led to a distinct rise in real disposable income," Bundesbank president added.

Weidmann warned that further stimulus measures could entail longer-term risks and side-effects "that it would be dangerous to simply ignore".

-

16:37

Richmond Fed President Jeffrey Lacker: interest rate hikes are still possible this year

Richmond Fed President Jeffrey Lacker said in a speech on Wednesday that interest rate hikes are still possible this year. He noted that the Fed's federal-funds rate, adjusted for inflation, was below the natural rate.

"In fact, this perspective would bolster the case for raising the federal funds rate target," Lacker said.

He pointed out that the monetary policy's effect on real economic activity was limited and temporary.

Lacker is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

16:26

Kansas City Fed President Esther George: the Fed should consider to raise its interest rate at its monetary policy meeting in March

Kansas City Fed President Esther George said in an interview with Bloomberg Radio on Tuesday that the Fed should consider to raise its interest rate at its monetary policy meeting in March.

"It absolutely should be on the table," she said.

Kansas City Fed president added that there was no fundamental shift in the outlook.

George is a voting member of the Federal Open Market Committee (FOMC) this year.

-

16:18

New home sales in the U.S. slide 9.2% in January

The U.S. Commerce Department released new home sales data on Wednesday. New home sales slid 9.2% to a seasonally adjusted annual rate of 494,000 units in January from 544,000 units in December.

Analysts had expected new home sales to reach 520,000 units.

The decrease was mainly driven lower sales in the West region. New home sales in the West region plunged 32.1% in January.

-

16:13

U.S. preliminary services purchasing managers' index drops to 49.8 in February, the lowest level since October 2013

Markit Economics released its preliminary services purchasing managers' index (PMI) for the U.S. on Wednesday. The U.S. preliminary services purchasing managers' index (PMI) dropped to 49.8 in February from 53.2 in January. It was the lowest level since October 2013.

Analysts had expected the index to rise to 53.5.

A reading below 50 indicates contraction in economic activity.

The drop was driven by a softer growth in new work, the slowest since late-2009.

"The PMI survey data show a significant risk of the US economy falling into contraction in the first quarter. The flash PMI for February shows business activity stagnating as growth slowed for a third successive month. Slumping business confidence and an increased downturn in order book backlogs suggest there's worse to come," Markit Chief Economist Chris Williamson said.

-

15:34

U.S. Stocks open: Dow -1.02%, Nasdaq -1.27%, S&P -1.06%

-

15:26

Before the bell: S&P futures -0.84%, NASDAQ futures -1.17%

U.S. stock-index futures dropped.

Global Stocks:

Nikkei 15,915.79 -136.26 -0.85%

Hang Seng 19,192.45 -222.33 -1.15%

Shanghai Composite 2,929.57 +26.24 +0.90%

FTSE 5,878.01 -84.30 -1.41%

CAC 4,150.01 -88.41 -2.09%

DAX 9,191.62 -225.15 -2.39%

Crude oil $30.92 (-2.98%)

Gold $1241.80 (+1.57%)

-

14:59

Japan's final leading index declines to 102.1 in December, the lowest level since January 2013

Japan's Cabinet Office released its final leading index data on Wednesday. The leading index decreased to 102.1 in December from 103.2 in November, up from the preliminary estimate of 102.0. It was the lowest level since January 2013.

November's figure was revised down from 103.5.

Japan's coincident index was down to 110.9 in December from 111.9 in November, down from the preliminary reading of 111.2.

-

14:59

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Barrick Gold Corporation, NYSE

ABX

14.12

4.28%

136.1K

AT&T Inc

T

36.64

-0.27%

7.6K

International Business Machines Co...

IBM

131.84

-0.42%

0.2K

ALTRIA GROUP INC.

MO

61.26

-0.42%

1.8K

McDonald's Corp

MCD

116.35

-0.47%

1K

Pfizer Inc

PFE

29.81

-0.50%

1.2K

The Coca-Cola Co

KO

43.47

-0.50%

3.6K

Merck & Co Inc

MRK

50.27

-0.53%

0.3K

Procter & Gamble Co

PG

81.3

-0.62%

1.1K

Yandex N.V., NASDAQ

YNDX

12.83

-0.62%

7.2K

AMERICAN INTERNATIONAL GROUP

AIG

50.74

-0.63%

0.1K

Wal-Mart Stores Inc

WMT

66.05

-0.65%

6.1K

Verizon Communications Inc

VZ

50.28

-0.69%

0.6K

Yahoo! Inc., NASDAQ

YHOO

30.45

-0.72%

6.5K

Travelers Companies Inc

TRV

107.12

-0.73%

0.2K

Walt Disney Co

DIS

94.65

-0.77%

1.4K

American Express Co

AXP

54.68

-0.78%

0.3K

United Technologies Corp

UTX

90.85

-0.82%

0.9K

Nike

NKE

59.7

-0.85%

0.3K

General Electric Co

GE

28.97

-0.86%

28.4K

Johnson & Johnson

JNJ

103.11

-0.93%

1.0K

Intel Corp

INTC

28.53

-0.94%

10.7K

Hewlett-Packard Co.

HPQ

10.21

-0.97%

0.1K

Cisco Systems Inc

CSCO

25.85

-1.03%

2.0K

Microsoft Corp

MSFT

50.65

-1.04%

61.7K

Boeing Co

BA

115.65

-1.07%

0.5K

Apple Inc.

AAPL

93.67

-1.08%

157.4K

Facebook, Inc.

FB

104.28

-1.12%

32.0K

Google Inc.

GOOG

687.75

-1.16%

0.8K

Caterpillar Inc

CAT

65

-1.19%

2.9K

Home Depot Inc

HD

123

-1.23%

3.2K

Goldman Sachs

GS

143.01

-1.31%

9.3K

Exxon Mobil Corp

XOM

80.11

-1.38%

2.8K

Chevron Corp

CVX

83.55

-1.60%

7.8K

Amazon.com Inc., NASDAQ

AMZN

544.1

-1.60%

9.0K

Starbucks Corporation, NASDAQ

SBUX

57.52

-1.61%

0.6K

JPMorgan Chase and Co

JPM

55.21

-1.62%

31.9K

Citigroup Inc., NYSE

C

37.6

-1.62%

15.1K

Visa

V

70.81

-1.86%

3.6K

General Motors Company, NYSE

GM

28.83

-1.87%

4.1K

Twitter, Inc., NYSE

TWTR

17.92

-2.08%

39.7K

Tesla Motors, Inc., NASDAQ

TSLA

173

-2.38%

8.1K

Ford Motor Co.

F

12.05

-2.98%

150.4K

ALCOA INC.

AA

8.27

-3.05%

55.3K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

6.75

-6.77%

194.3K

-

14:48

Upgrades and downgrades before the market open

Upgrades:

Deere (DE) upgraded to Buy at Argus; target $85

Downgrades:

Ford Motor (F) downgraded to Underperform from Neutral at Credit Suisse; target $13

Other:

AT&T (T) initiated with a Buy at Deutsche Bank

Verizon (VZ) initiated with a Hold at Deutsche Bank

JPMorgan Chase (JPM) reiterated with an Outperform at FBR & Co.

-

14:38

CBI retail sales balance slides to +10% in February

The Confederation of British Industry (CBI) released its retail sales balance data on Wednesday. The CBI retail sales balance plunged to +10% in February from +16% in January. It was the lowest level since May 2013.

Sales growth is expected to slow next month, while orders are expected to decline.

"Overall, conditions remain challenging for retailers. Although sales have continued to grow and optimism has risen, expectations for sales growth are lacklustre and retailers are still wary of investing," CBI Director of Economics, Rain Newton-Smith, said.

-

14:10

European stock markets mid session: stocks traded lower on a further decline in oil prices

Stock indices traded lower as oil prices continued to decline. Oil prices fell on comments by Saudi Arabian Oil Minister Ali Al-Naimi. He said on Tuesday that the country was not ready to cut its oil output.

Meanwhile, market participants eyed the economic data from France. French statistical office INSEE released its consumer confidence index for France on Wednesday. French consumer confidence index fell to 95 in February from 97 in January. Analysts had expected the index to remain unchanged at 97.

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Wednesday. The number of mortgage approvals rose to 47,509 in January from 43,660 in December, exceeding expectations for a rise to 45,200. It was the highest level since February 2014.

Current figures:

Name Price Change Change %

FTSE 100 5,887.46 -74.85 -1.26 %

DAX 9,229.74 -187.03 -1.99 %

CAC 40 4,170.15 -68.27 -1.61 %

-

11:47

NBB business climate for Belgium slides to -6.6 in February

The National Bank of Belgium (NBB) released its business survey on Tuesday. The business climate dropped to -6.6 in February from -3.0 in January. Analysts had expected the index to decline to -3.6.

2 of 4 indicators dropped in February, while 2 indicators rose.

The business climate index for the manufacturing sector fell to -11.2 in February from -6.3 in January due to a less favourable assessments of total order books.

The business climate index for the services sector was up to 10.5 in February from 10.2 in January due to a more favourable assessment of the current activity.

The business climate index for the building sector slid to -4.1 in February from 0.5 in January due to a downward revision of all the demand-side components.

The business climate index for the trade sector increased to -5.1 in February from -8.6 in January due to more positive demand expectations.

-

11:39

Industrial orders in Italy decline at a seasonally adjusted rate of 2.8% in December

The Italian statistical office Istat released its industrial orders data for Italy on Wednesday. Industrial orders in Italy declined at a seasonally adjusted rate of 2.8% in December, after a 1.5% rise in November. November's figure was revised down from a 1.6% gain.

Domestic orders slid 4.8% in December, while non-domestic orders were up 0.2%.

On a yearly basis, the unadjusted industrial orders in Italy rose 1.5% in December, after a 12.1% rise in November.

The seasonally adjusted industrial turnover in Italy fell 1.6% in December, after a 1.1% decrease in November.

Domestic turnover decreased 1.7% in December, while non-domestic turnover plunged 1.4%.

On a yearly basis, the adjusted industrial turnover in Italy declined 3.0% in December, after a 0.8% increase in November.

-

11:31

Number of mortgage approvals in the U.K. rises to 47,509 in January

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Wednesday. The number of mortgage approvals rose to 47,509 in January from 43,660 in December, exceeding expectations for a rise to 45,200. It was the highest level since February 2014.

December's figure was revised up from 43,979.

"The start of the year has seen a significant rise in mortgage borrowing. It seems that this has been driven, in part, by borrowers looking to get ahead of the increases in stamp duty for buy-to-let and second home buyers scheduled to come into effect in April," the chief economist at the BBA, Richard Woolhouse, said.

-

11:18

French consumer confidence index falls to 95 in February

French statistical office INSEE released its consumer confidence index for France on Wednesday. French consumer confidence index fell to 95 in February from 97 in January. Analysts had expected the index to remain unchanged at 97.

The index of the outlook on consumers' saving capacity rose to -5 in February from -6 in January.

The index of households' assessment of their financial situation in the past twelve months declined to -25 in February from -24 in January.

The index of the outlook on consumers' financial situation for next twelve months decreased to -10 in February from -8 in January.

The index of the outlook on unemployment rising in coming months climbed to 46 in February from 33 in January.

The index for future inflation expectations was down to -38 in February from -39 in January.

-

11:09

UBS consumption index rises to 1.66 in January

UBS released its consumption index for Switzerland on Wednesday. The UBS consumption index increased to 1.66 in January from 1.61 in December. December's figure was revised down from 1.62.

The increase was driven by an improved business sentiment in the retail sector.

The bank noted that the outlook for retail remained subdued.

"The improvement of the UBS Consumption Indicator sends a positive signal for private consumption. However, unemployment could rise in the first half of the year as a delayed response to last year's weaker GDP growth, thereby dampening private consumption," the bank said.

The bank noted that private consumption could rise 1.4% in 2016, driven by the labour market recovery in the second half of the year.

-

11:03

Fed Vice Chairman Stanley Fischer: the economic growth in the U.S. picked up in the first quarter

The Fed Vice Chairman Stanley Fischer said on Tuesday that the economic growth in the U.S. picked up in the first quarter.

"The spending indicators that we have in hand for January point to a pickup in economic growth this quarter," he said.

Fischer noted that a tightening of financial conditions could mean a slowdown in the global economy that could have a negative impact on the economic growth and inflation in the U.S.

"If the recent financial market developments lead to a sustained tightening of financial conditions, they could signal a slowing in the global economy that could affect growth and inflation in the United States," the Fed vice chairman said.

He said nothing new about further interest rate hikes.

-

10:44

Germany’s Deutsche Börse is in talks to merge with the London Stock Exchange

Germany's Deutsche Börse is in talks to merge with the London Stock Exchange (LSE). It would be a £21bn deal. In case of a successful merger, Deutsche Börse shareholders will own 54.4% of the combined company, while LSE shareholders will hold 45.6%.

Both companies expect to strengthen their market position, to generate extra revenues and to save costs.

-

10:34

U.S. banks’ aggregate net income increases by 11.9% in the fourth quarter of 2015

The U.S. Federal Deposit Insurance Corporation (FDIC) said on Tuesday that the U.S. banks' aggregate net income increased by 11.9% year-on-year to $40.8 billion in the fourth quarter. The rise was mainly driven by an increase in net operating revenue and a fall in noninterest expenses.

-

10:22

World Bank: the economy in the European Union continued to improve in 2015

World Bank released its European Union Regular Economic Report (EU RER) on Tuesday. The bank said that the economy in the European Union (EU) continued to improve in 2015. The growth is estimated to be 2% in 2015.

Central Europe showed the highest growth, driven by the Czech Republic, Poland, and Romania, while Southern Europe expanded 1.4% in 2015, driven by an improvement in labour markets.

"The story in the region is positive. Unemployment rates are reaching pre-crisis levels in many EU countries and unemployment among the young - who suffered the largest increase in poverty during the crisis - is finally declining," World Bank Lead Economist and co-author of the latest report, Doerte Doemeland, said.

-

10:12

Minneapolis Federal Reserve President Neel Kashkari expects the U.S. economy to expand moderately

Minneapolis Federal Reserve President Neel Kashkari said on Tuesday that he expected the U.S. economy to expand moderately.

"The moderate economic outlook is still the base case for the U.S.," he said.

Kashkari noted that further labour market improvement could lead to a rise in wages.

Kashkari is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

06:52

Global Stocks: U.S. stock indices posted declines

U.S. stock indices fell on Tuesday as oil prices tumbled after Saudi Arabia said it wouldn't implement output cuts, because there is no guarantee other producers would do the same. Shares of energy companies and banks exposed to shocks from the oil market led declines.

The Dow Jones Industrial Average fell 189 points, or 1.1%, to 16,431. The S&P 500 lost 24 points, or 1.2%, to 1,921 (its energy sector plunged 3.2%). The Nasdaq Composite fell 67 points, or 1.5%, to 4,503.

Meanwhile the Conference Board reported that consumer confidence declined in the U.S. in February. The corresponding index fell to 92.2 (1985=100) from 97.8 in January. The current situation assessment declined to 112.1 from 116.6, while the expectations sub-index slid to 78.9 from 85.3.

Other data showed real estate prices continued rising in major cities in December, although the pace of growth was slightly below expectations. The S&P/Case-Shiller Home Price composite index rose by 5.7% y/y. Economists had expected prices to add 5.8%.

This morning in Asia Hong Kong Hang Seng dropped 1.78%, or 345.53 points, to 19,069.25. China Shanghai Composite Index fell 0.60%, or 17.46 points, to 2,885.88. Meanwhile the Nikkei declined 1.09%, or 174.31 points, to 15,877.74.

Asian stock indices fell as fresh declines in oil prices intensified concerns over the global economic growth. Energy and financial shares suffered most. Japanese banks on the broader Topix index lost 1.2%. A stronger yen harmed exporters' competiveness.

-

03:33

Nikkei 225 15,955.62 -96.43 -0.60 %, Hang Seng 19,327.47 -87.31 -0.45 %, Shanghai Composite 2,906.27 +2.94 +0.10 %

-

00:31

Stocks. Daily history for Sep Feb 23’2016:

(index / closing price / change items /% change)

S&P/ASX 200 4,979.59 -21.64 -0.43%

TOPIX 1,291.17 -8.83 -0.68%

SHANGHAI COMP 2,903.95 -23.22 -0.79%

HANG SENG 19,414.78 -49.31 -0.25%

FTSE 100 5,962.31 -75.42 -1.25 %

CAC 40 4,238.42 -60.28 -1.40 %

Xetra DAX 9,416.77 -156.82 -1.64 %

S&P 500 1,921.27 -24.23 -1.25 %

NASDAQ Composite 4,503.58 -67.02 -1.47 %

Dow Jones 16,431.78 -188.88 -1.14 %

-