Noticias del mercado

-

21:00

Dow -1.10% 16,437.47 -183.19 Nasdaq -1.23% 4,514.45 -56.16 S&P -1.10% 1,924.09 -21.41

-

18:17

European stocks close: stocks closed lower on corporate earnings and a drop in oil prices

Stock indices closed lower on corporate earnings and as oil prices dropped again. Oil prices fell on concerns over the global oil oversupply.

Meanwhile, market participants eyed the economic data from Germany. German Ifo Institute released its business confidence figures for Germany on Tuesday. German business confidence index declines to 105.7 in February from 107.3 in January, missing expectations for a fall to 106.7.

"The majority of companies were pessimistic about their business outlook for the first time in over six months. Assessments of the current business situation, by contrast, were slightly better than last month. German businesses expressed growing concern, especially in manufacturing," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index increased to 112.9 from 112.5. Analysts had expected the index to decline to 112.0.

The Ifo expectations index dropped to 98.8 from 102.3, missing expectations for a decrease to 101.6. January's figure was revised down from 102.4.

Destatis released its final gross domestic product (GDP) growth for Germany on Tuesday. Germany's final GDP gained by 0.3% in the fourth quarter, in line with the preliminary reading, after a 0.3% increase in the third quarter.

The increase was driven by domestic final consumption expenditure. Household consumption expenditure rose by 0.2% in the fourth quarter, while government spending increased by 1.0%.

Exports of goods and services were down 0.6% in fourth quarter, while imports climbed 0.5%.

On a yearly basis, Germany's final GDP rose to 2.1% in the fourth quarter from 1.8% in the third quarter, in line with the preliminary reading.

In 2015 as whole, the economy expanded 1.7%, in line with the preliminary reading.

The Bank of England (BoE) Governor Mark Carney said on Tuesday that the outcome of Britain's referendum was treated like "any other political event which is not to make a judgement on the outcome and assume status quo continues" by the BoE. He added that the central bank wasn't making any judgment on the outcome of the referendum.

Carney noted that a weak pound could help to boost inflation in the U.K., noting that he believed that the recent drop in the pound was caused by the upcoming referendum.

The BoE governor pointed out that the central bank could add further stimulus measures if needed to stimulate the economy.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,962.31 -75.42 -1.25 %

DAX 9,416.77 -156.82 -1.64 %

CAC 40 4,238.42 -60.28 -1.40 %

-

17:46

WSE: Session Results

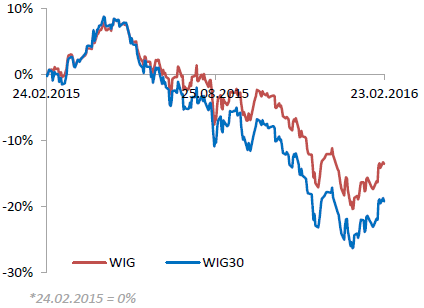

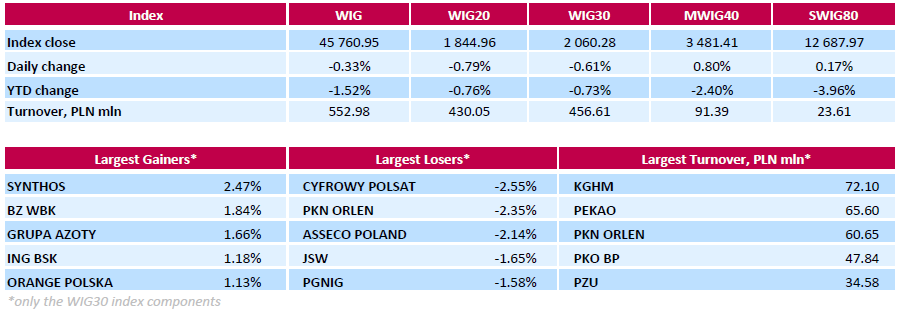

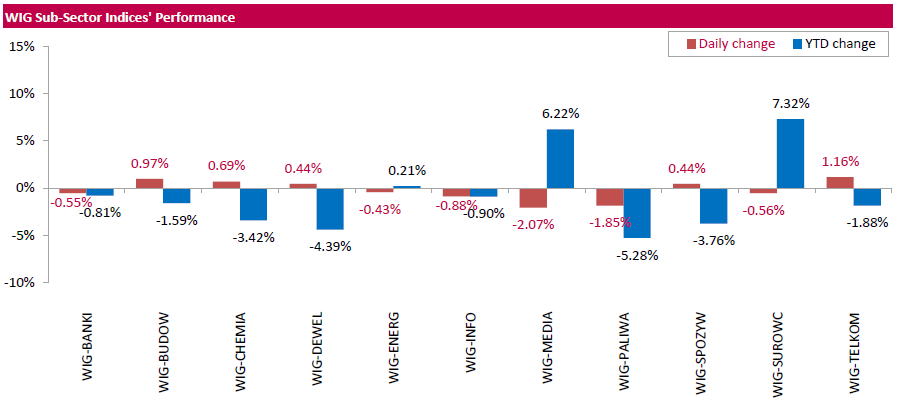

Polish equities closed lower on Tuesday. The broad market measure, the WIG Index, declined by 0.64%. Sector performance within the WIG Index was mixed. Media segment (-2.07%) was the weakest group, while telecoms (+1.16%) outperformed.

Large-cap stocks measure, the WIG30 Index suffered a 0.61% drop. In the index basket, media group CYFROWY POLSAT (WSE: CPS) and oil refiner PKN ORLEN (WSE: PKN) were the sharpest decliners, tumbling by 2.55% and 2.35% respectively. Other biggest laggards were IT-company ASSECO POLAND (WSE: ACP), coking coal producer JSW (WSE: JSW), oil and gas producer PGNIG (WSE: PGN) and FMCG wholesaler EUROCASH (WSE: EUR), plunging by 1.52%-2.14%. On the other side of the ledger, two chemicals names SYNTHOS (WSE: SNS) and GRUPA AZOTY (WSE: ATT), and bank BZ WBK (WSE: BZW) were recorded as the biggest gainers, advancing 2.47%, 1.66% and 1.84% respectively.

-

17:23

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes lower on Tuesday, failing to sustain yet another rally in what has been a turbulent year so far, as prices of oil and other commodities resumed their declines. Stocks have moved in tandem with volatile oil prices, which are hovering near multi-year lows, as investors see tepid demand for energy as a sign of broader global economic weakness.

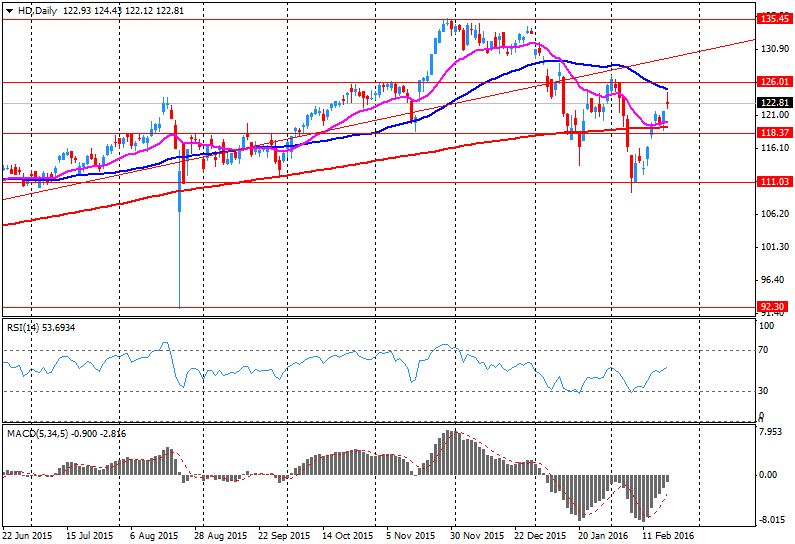

Almost all Dow stocks in negative area (26 of 30). Top looser - JPMorgan Chase & Co. (JPM, -3,62%). Top gainer - The Home Depot, Inc. (HD, +1,38%).

Almost all S&P sectors also in negative area. Top gainer - Basic Materials (-2,4%). Top gainer - Conglomerates (+0,7%).

At the moment:

Dow 16421.00 -118.00 -0.71%

S&P 500 1920.25 -16.00 -0.83%

Nasdaq 100 4170.50 -44.25 -1.05%

Oil 31.76 -1.63 -4.88%

Gold 1226.70 +16.60 +1.37%

U.S. 10yr 1.73 -0.03

-

17:16

Bank of England's Monetary Policy Committee member Martin Weale: the strong pound weighed in inflation in the U.K.

The Bank of England's (BoE) Monetary Policy Committee (MPC) member Martin Weale said on Tuesday that the strong pound weighed in inflation in the U.K.

"The fall of the exchange rate does weaken one of the factors holding inflation down. In that sense, it's good news," he commented on the recent drop in the pound.

-

17:10

Bank of England's Monetary Policy Committee member Gertjan Vlieghe: the recent decline in the pound was caused by the uncertainty around the upcoming referendum

The Bank of England's (BoE) Monetary Policy Committee (MPC) member Gertjan Vlieghe said on Tuesday that the recent decline in the pound was caused by the uncertainty around the upcoming referendum.

"It is possible that at some point that increased uncertainty from foreign exchange investors also ends up manifesting itself in increased uncertainty by households and businesses which may or may not reduce or delay their spending," he added.

Vlieghe pointed out that he could vote for an interest rate cut if the downside risks increase.

-

17:02

Bank of England's Deputy Governor Minouche Shafik: the next monetary policy action is likely to be an interest rate hike than an interest rate cut

The Bank of England's (BoE) Deputy Governor Minouche Shafik said on Tuesday that the next monetary policy action was likely to be an interest rate hike than an interest rate cut.

She also said that she expected wages to rise if the U.K. labour market continues to improve. But she could not say when wages would start to pick up.

-

16:57

Richmond Fed Manufacturing Index falls to -4 in February

The Federal Reserve Bank of Richmond released its survey of manufacturing activity on Tuesday. The composite index for manufacturing declined to -4 in February from 2 in January. Analysts had expected the index to remain unchanged at 2.

The decrease was mainly driven by declines in shipments and new orders.

Shipments sub-index slid to -11 in February from -6 in January.

New orders sub-index was down to -6 from 4.

The employment sub-index remained unchanged at 9.

"Shipments and the volume of new orders decreased modestly this month. Manufacturing hiring continued to increase at a modest pace, while average wages grew mildly and the average workweek lengthened slightly. Prices of raw materials and finished goods rose at a slower pace this month, compared to January," the survey said.

-

16:48

U.S. consumer confidence index drops to 92.2 in February

The Conference Board released its consumer confidence index for the U.S. on Tuesday. The index dropped to 92.2 in February from 97.8 in January, missing expectations for a fall to 97.0. January's figure was revised down from 98.1.

The present conditions index dropped to 112.1 in February from 116.6 in January.

The Conference Board's consumer expectations index for the next six months decreased to 78.9 in February from 85.3 in January.

The percentage of consumers expecting more jobs in the coming months was down to 22.1% in February from 23.0% in January.

"Consumers' assessment of current conditions weakened, primarily due to a less favourable assessment of business conditions. Consumers' short-term outlook grew more pessimistic, with consumers expressing greater apprehension about business conditions, their personal financial situation, and to a lesser degree, labour market prospects," the director of economic indicators at The Conference Board, Lynn Franco, said.

-

16:39

U.S. existing homes sales increase 0.4% in January

The National Association of Realtors released existing homes sales figures in the U.S. on Tuesday. Sales of existing homes rose 0.4% to a seasonally adjusted annual rate of 5.47 million in January from 5.45 in December. December's figure was revised down from 5.46 million units.

Analysts had expected a decrease to 5.32 million units.

"The housing market has shown promising resilience in recent months, but home prices are still rising too fast because of ongoing supply constraints. Despite the global economic slowdown, the housing sector continues to recover and will likely help the U.S. economy avoid a recession," the NAR chief economist Lawrence Yun said.

Sales to first-time buyers remained unchanged at 32% in January.

"The spring buying season is right around the corner and current supply levels aren't even close to what's needed to accommodate the subsequent growth in housing demand. Home prices ascending near or above double-digit appreciation aren't healthy - especially considering the fact that household income and wages are barely rising," Yun said.

-

15:40

S&P/Case-Shiller home price index rises 5.7% in December

The S&P/Case-Shiller home price index increased 5.7% year-on-year in December, missing expectations for a 5.8% rise, after a 5.7% gain in November. November's figure was revised down from a 5.8% increase.

Portland, San Francisco and Denver were the largest contributors to the rise, where prices climbed by 11.4%, 10.3% and 10.2%, respectively.

"While home prices continue to rise, the pace is slowing a bit," chairman of the index committee at S&P Dow Jones Indices David Blitzer said.

On a monthly basis, the S&P/Case-Shiller home price index was flat in December.

The S&P/Case-Shiller home price index measures single-family home prices in 20 U.S. cities.

-

15:35

U.S. Stocks open: Dow -0.38%, Nasdaq -0.48%, S&P -0.47%

-

15:29

Before the bell: S&P futures -0.01%, NASDAQ futures -0.18%

U.S. stock-index futures fluctuated.

Global Stocks:

Nikkei 16,052.05 -59.00 -0.37%

Hang Seng 19,414.78 -49.31 -0.25%

Shanghai Composite 2,903.95 -23.22 -0.79%

FTSE 6,009.38 -28.35 -0.47%

CAC 4,283.04 -15.66 -0.36%

DAX 9,510.16 -63.43 -0.66%

Crude oil $33.03 (-1.08%)

Gold $1224.50 (+1.19%)

-

15:01

Bank of England Governor Mark Carney: the outcome of Britain's referendum is treated like any other political event by the BoE

The Bank of England (BoE) Governor Mark Carney said on Tuesday that the outcome of Britain's referendum was treated like "any other political event which is not to make a judgement on the outcome and assume status quo continues" by the BoE. He added that the central bank wasn't making any judgment on the outcome of the referendum.

Carney noted that a weak pound could help to boost inflation in the U.K., noting that he believed that the recent drop in the pound was caused by the upcoming referendum.

The BoE governor pointed out that the central bank could add further stimulus measures if needed to stimulate the economy.

"We could cut interest rates towards zero. We could engage in additional asset purchases, including a variety of assets. We could also provide a perspective where we could adjust our policy horizon," he said.

Carney noted that he was against negative interest rates.

-

14:56

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Home Depot Inc

HD

127

3.38%

70.7K

Barrick Gold Corporation, NYSE

ABX

13.15

2.57%

14.6K

Twitter, Inc., NYSE

TWTR

18.52

1.20%

67.8K

HONEYWELL INTERNATIONAL INC.

HON

105

0.41%

0.2K

Merck & Co Inc

MRK

50.95

0.35%

1.5K

ALTRIA GROUP INC.

MO

61.37

0.26%

1.1K

General Motors Company, NYSE

GM

29.63

0.00%

160.4K

Yahoo! Inc., NASDAQ

YHOO

31.14

-0.10%

22.6K

United Technologies Corp

UTX

92.24

-0.14%

19.1K

Starbucks Corporation, NASDAQ

SBUX

58.78

-0.15%

1K

McDonald's Corp

MCD

117.4

-0.23%

0.1K

Pfizer Inc

PFE

29.97

-0.27%

3.6K

FedEx Corporation, NYSE

FDX

135

-0.29%

0.1K

Nike

NKE

59.98

-0.32%

0.6K

Procter & Gamble Co

PG

81.87

-0.32%

3.8K

Facebook, Inc.

FB

106.74

-0.39%

57.7K

Citigroup Inc., NYSE

C

39.36

-0.40%

6.3K

Ford Motor Co.

F

12.51

-0.40%

6.7K

AT&T Inc

T

36.7

-0.43%

5.0K

Johnson & Johnson

JNJ

104.3

-0.43%

1K

Wal-Mart Stores Inc

WMT

65.35

-0.43%

1.4K

General Electric Co

GE

29.28

-0.44%

22.8K

Exxon Mobil Corp

XOM

82

-0.47%

13.8K

Caterpillar Inc

CAT

66.97

-0.51%

0.2K

Visa

V

72.68

-0.52%

0.8K

International Business Machines Co...

IBM

133.05

-0.54%

4.9K

Amazon.com Inc., NASDAQ

AMZN

556.36

-0.56%

13.4K

Apple Inc.

AAPL

96.31

-0.59%

69.7K

Walt Disney Co

DIS

95.78

-0.61%

8.7K

Verizon Communications Inc

VZ

50.75

-0.63%

5.1K

Goldman Sachs

GS

147.83

-0.65%

1.3K

Intel Corp

INTC

29.16

-0.65%

38.7K

Chevron Corp

CVX

88.2

-0.70%

1.7K

The Coca-Cola Co

KO

43.62

-0.73%

72.6K

Cisco Systems Inc

CSCO

26.43

-0.75%

17.7K

Microsoft Corp

MSFT

52.25

-0.76%

10.1K

Yandex N.V., NASDAQ

YNDX

13.22

-0.83%

1.0K

Google Inc.

GOOG

700.5

-0.84%

0.6K

UnitedHealth Group Inc

UNH

120.05

-1.01%

0.1K

JPMorgan Chase and Co

JPM

57.96

-1.04%

5.0K

Tesla Motors, Inc., NASDAQ

TSLA

175.55

-1.23%

4.9K

ALCOA INC.

AA

8.79

-1.35%

114.7K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

7.46

-5.93%

341.1K

-

14:51

Upgrades and downgrades before the market open

Upgrades:

Twitter (TWTR) upgraded to Outperform from Market Perform at Raymond James; target $25

Downgrades:

Freeport-McMoRan (FCX) downgraded to Sell from Neutral at Citigroup

Other:

FedEx (FDX) resumed with a Equal-Weight at Morgan Stanley

-

14:49

Swiss National Bank Chairman Thomas Jordan: the options of the monetary policy are not unlimited

The Swiss National Bank (SNB) Chairman Thomas Jordan said in Frankfurt on Tuesday that the options of the monetary policy were not unlimited.

"Despite the expanded set of instruments available, the extent of the monetary policy can achieve is not unlimited," he said.

"The effects of monetary policy measures can wane with duration and dosage, especially when the solution to structural problems lies in adjustments to economic policy," Jordan noted, adding that "central banks must continually weigh the short-term benefits against long-term costs".

He pointed out that the Swiss franc was still overvalued.

-

12:44

Company News: Home Depot (HD) Q4 Results Beat Analysts’ Expectations

Home Depot reported Q4 FY 2015 earnings of $1.17 per share (versus $1.05 in Q4 FY 2014), beating analysts' consensus of $1.10.

The company's quarterly revenues amounted to $20.980 bln (+9.5% y/y), beating consensus estimate of $20.397 bln.

The company also issued guidance for FY 2016, projecting EPS of $6.12-6.18 versus consensus of $6.15 and revenues of $93.03-93.83 bln (+5.1-6% y/y) versus consensus of $92.92 bln.

Home Depot increased its quarterly dividend by 17% to $0.69/share from $0.59/share.

HD rose to $125.54 (+2.19%) in pre-market trading.

-

12:02

European stock markets mid session: stocks traded lower on corporate earnings and as oil prices fell

Stock indices traded lower on corporate earnings and as oil prices dropped again. Oil prices fell on concerns over the global oil oversupply.

Meanwhile, market participants eyed the economic data from Germany. German Ifo Institute released its business confidence figures for Germany on Tuesday. German business confidence index declines to 105.7 in February from 107.3 in January, missing expectations for a fall to 106.7.

"The majority of companies were pessimistic about their business outlook for the first time in over six months. Assessments of the current business situation, by contrast, were slightly better than last month. German businesses expressed growing concern, especially in manufacturing," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index increased to 112.9 from 112.5. Analysts had expected the index to decline to 112.0.

The Ifo expectations index dropped to 98.8 from 102.3, missing expectations for a decrease to 101.6. January's figure was revised down from 102.4.

Destatis released its final gross domestic product (GDP) growth for Germany on Tuesday. Germany's final GDP gained by 0.3% in the fourth quarter, in line with the preliminary reading, after a 0.3% increase in the third quarter.

The increase was driven by domestic final consumption expenditure. Household consumption expenditure rose by 0.2% in the fourth quarter, while government spending increased by 1.0%.

Exports of goods and services were down 0.6% in fourth quarter, while imports climbed 0.5%.

On a yearly basis, Germany's final GDP rose to 2.1% in the fourth quarter from 1.8% in the third quarter, in line with the preliminary reading.

In 2015 as whole, the economy expanded 1.7%, in line with the preliminary reading.

Current figures:

Name Price Change Change %

FTSE 100 5,992.15 -45.58 -0.75 %

DAX 9,485.24 -88.35 -0.92 %

CAC 40 4,273.61 -25.09 -0.58 %

-

11:52

Bank of Japan (BoJ) Governor Haruhiko Kuroda: the money printing alone would not lead to higher inflation

Bank of Japan (BoJ) Governor Haruhiko Kuroda said before the parliament on Tuesday that the money printing alone would not lead to higher inflation.

"It's not that the monetary base alone will pull up inflation or inflation expectations promptly. We aim to raise prices through an increase in inflation expectations and a tighter gap in supply and demand under QQE [qualitative and quantitative easing measures]," he said.

Kuroda noted that a risk aversion was responsible for the recent market turmoil.

The BoJ Governor pointed out that the central bank's stimulus measures had a positive effect on households and the economic growth.

-

11:31

Japanese Finance Minister Taro Aso: the government could implement additional fiscal stimulus measures

Japanese Finance Minister Taro Aso said before the parliament on Tuesday that the government could implement additional fiscal stimulus measures to support the economy if needed.

"We'll obviously act flexibly on fiscal policy as needed, looking at how the economy performs," he said.

"That will depend on economic conditions," Aso added.

-

11:20

Australia’s leading economic index falls 0.2% in December

The Conference Board (CB) released its leading economic index for Australia on Monday. The leading economic index (LEI) fell 0.2% in December, after a 0.3% rise in November.

The coincident index was increased 0.2% in December, after a 0.5% gain in November.

-

11:07

French manufacturing confidence index remains unchanged at 103 in February

The French statistical office Insee released its manufacturing confidence index for France on Tuesday. The French manufacturing confidence index remained unchanged at 103 in February. January's figure was revised up from 102.

Past change in production index was down to -3 in February from -1 in January.

Personal production expectations index rose to 17 in February from 11 in January, while general production outlook index slid to -4 from 2.

-

10:55

German final GDP increases 0.3% in the fourth quarter

Destatis released its final gross domestic product (GDP) growth for Germany on Tuesday. Germany's final GDP gained by 0.3% in the fourth quarter, in line with the preliminary reading, after a 0.3% increase in the third quarter.

The increase was driven by domestic final consumption expenditure. Household consumption expenditure rose by 0.2% in the fourth quarter, while government spending increased by 1.0%.

Exports of goods and services were down 0.6% in fourth quarter, while imports climbed 0.5%.

On a yearly basis, Germany's final GDP rose to 2.1% in the fourth quarter from 1.8% in the third quarter, in line with the preliminary reading.

In 2015 as whole, the economy expanded 1.7%, in line with the preliminary reading.

-

10:39

German Ifo business confidence index declines to 105.7 in February

German Ifo Institute released its business confidence figures for Germany on Tuesday. German business confidence index declines to 105.7 in February from 107.3 in January, missing expectations for a fall to 106.7.

"The majority of companies were pessimistic about their business outlook for the first time in over six months. Assessments of the current business situation, by contrast, were slightly better than last month. German businesses expressed growing concern, especially in manufacturing," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index increased to 112.9 from 112.5. Analysts had expected the index to decline to 112.0.

The Ifo expectations index dropped to 98.8 from 102.3, missing expectations for a decrease to 101.6. January's figure was revised down from 102.4.

-

10:26

Germany's Bertelsmann Foundation’s study: a Schengen collapse could cost up to €1.4 trillion or 10% of GDP between 2016 and 2025

Germany's Bertelsmann Foundation said in its study on Monday that a Schengen collapse could cost up to €1.4 trillion or 10% of GDP between 2016 and 2025.

"If border controls are reinstated within Europe, already weak growth will come under additional pressure," president of Bertelsmann, Aart De Geus, said.

-

10:20

Citi: the likelihood for Brexit increases

Citi said on Monday that the likelihood for Brexit increased to 30-40% from 20-30%, adding that investors would become nervous.

"The effects of Brexit, if it happens, are likely to be large and painful in economic and political terms, both for the UK and the overall EU," UK economist at Citi, Michael Saunders, wrote.

-

10:12

Italian Prime Minister Matteo Renzi: Brexit would hurt more Britain than the EU

Italian Prime Minister Matteo Renzi said on Monday that Brexit would hurt more Britain than the EU.

"I hope Britain remains inside the EU, but if it leaves, the consequences will be worse for British citizens than for European ones. If Great Britain leaves, the main problem will be for the UK, its businesses and its citizens," he said.

Britain's Prime Minister David Cameron said on Saturday that the referendum will take place on June 23. Cameron secured a deal with the EU, which includes changes to migrant welfare payments, safeguards that Britain would not be a part of the Eurozone and safeguards for Britain's financial sector.

-

07:10

Global Stocks: U.S. stock indices gained

U.S. stock indices rose on Monday amid an increase in oil prices underlining persistent connection between oil and stocks.

The Dow Jones Industrial Average gained 228.67 points, or 1.4%, to 16,620.66 29 out its 30 components advanced). The S&P 500 rose 27.72 points, or 1.4%, to 1,945.50 (its oil prices rose 2.2%). The Nasdaq Composite rose 66.18 points, or 1.5%, to 4,570.61.

Data from Markit Economics showed that the U.S. manufacturing PMI slid to 51.0 in February on a seasonally adjusted basis from 52.4 in January. The country's manufacturing sector lost momentum after a modest recovery at the beginning of 2016. Weaker output and new orders sub-indices weighed on the PMI.

This morning in Asia Hong Kong Hang Seng lost 0.39%, or 76.05 points, to 19,388.04. China Shanghai Composite Index fell 0.98%, or 28.75 points, to 2,898.43. Meanwhile the Nikkei declined 0.35%, or 56.74 points, to 16,054.31.

Asian stock indices retreated as investors took profits from a 2% rally in the previous session. However analysts note that stocks should climb as they normally do before China's National People's Congress, which starts on March 5 this year.

-

03:02

Nikkei 225 16,178.02 +66.97 +0.42 %, Hang Seng 19,482.77 +18.68 +0.10 %, Shanghai Composite 2,920.15 -7.02 -0.24 %

-

00:31

Stocks. Daily history for Sep Feb 22’2016:

(index / closing price / change items /% change)

S&P/ASX 200 5,001.22 +48.43 +0.98%

TOPIX 1,300 +8.18 +0.63%

SHANGHAI COMP 2,927.73 +67.71 +2.37%

HANG SENG 19,464.09 +178.59 +0.93%

FTSE 100 6,037.73 +87.50 +1.47 %

CAC 40 4,298.7 +75.66 +1.79 %

Xetra DAX 9,573.59 +185.54 +1.98 %

S&P 500 1,945.5 +27.72 +1.45 %

NASDAQ Composite 4,570.61 +66.18 +1.47 %

Dow Jones 16,620.66 +228.67 +1.40 %

-