Noticias del mercado

-

21:00

Dow +1.35% 16,613.13 +221.14 Nasdaq +1.38% 4,566.40 +61.97 S&P +1.28% 1,942.38 +24.60

-

18:38

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes higher on Monday as prices of oil and other commodities surged, pointing to an uptick in investors' risk appetite following a rout in global markets. The recovery in commodity prices comes on the heels of recent data pointing to a strengthening of the U.S. economy, which has helped stabilize the market.

All Dow stocks in positive area (30 of 30). Top looser - UnitedHealth Group Incorporated (UNH, +3,44%).

All S&P sectors in positive area. Top gainer - Basic Materials (+2,8%).

At the moment:

Dow 16578.00 +220.00 +1.34%

S&P 500 1939.25 +24.75 +1.29%

Nasdaq 100 4224.50 +63.50 +1.53%

Oil 33.47 +1.72 +5.42%

Gold 1210.90 -0.20 -0.02%

U.S. 10yr 1.76 +0.01

-

18:00

European stocks close: stocks closed higher as oil prices increased

Stock indices closed higher as oil prices rose. Oil prices increased on the IEA report and the Baker Hughes data.

Meanwhile, the economic data from the Eurozone was mostly weaker-than-expected. Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's preliminary manufacturing PMI declined to 51.0 in February from 52.3 in January. Analysts had expected the index to fall to 52.0.

The decline was driven by a softer growth in new orders and exports.

Eurozone's preliminary services PMI fell to 53.0 in February from 53.6 in January. Analysts had expected the index to decrease to 53.4.

"Disappointing PMI survey data for February greatly increase the odds of more aggressive stimulus from the ECB in March. Not only did the survey indicate the weakest pace of economic growth for just over a year, but deflationary forces intensified", Markit's Chief Economist Chris Williamson said.

He noted that data was signalling the Eurozone's economy could expand 0.3% in the first quarter.

Germany's preliminary manufacturing PMI fell to 50.2 in February from 52.3 in January, missing forecasts of a decline to 52.0. It was the slowest reading since November 2014.

The fall in the manufacturing PMI was driven by a weaker increase in new export business, a drop in purchasing activity and input prices.

Germany's preliminary services PMI was up to 55.1 in February from 55.0 in January. Analysts had expected index to decrease to 54.7.

The decline of the services PMI was driven by a faster growth in new business.

France's preliminary manufacturing PMI rose to 50.3 in February from 50.0 in January, beating forecasts of a decline to 49.9.

France's preliminary services PMI fell to 49.8 in February from 50.6 in January. Analysts had expected the index to remain unchanged at 50.3.

Britain's Prime Minister David Cameron said on Saturday that the country's referendum on the European Union (EU) membership will take place on June 23. Cameron secured a deal with the EU, which includes changes to migrant welfare payments, safeguards that Britain would not be a part of the Eurozone and safeguards for Britain's financial sector.

Some ministers support Brexit.

The Confederation of British Industry (CBI) released its industrial order books balance on Monday. The CBI industrial order books balance slid to -17 in February from-15 in January.

Export orders improved slightly in February.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,037.73 +87.50 +1.47 %

DAX 9,573.59 +185.54 +1.98 %

CAC 40 4,298.7 +75.66 +1.79 %

-

18:00

European stocks closed: FTSE 100 6,037.73 +87.50 +1.47% CAC 40 4,298.7 +75.66 +1.79% DAX 9,573.59 +185.54 +1.98%

-

17:52

WSE: Session Results

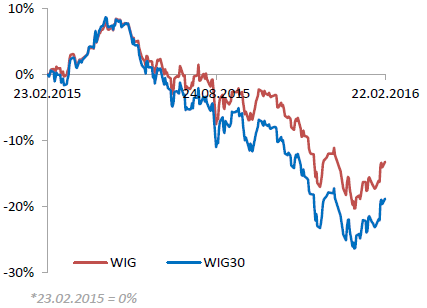

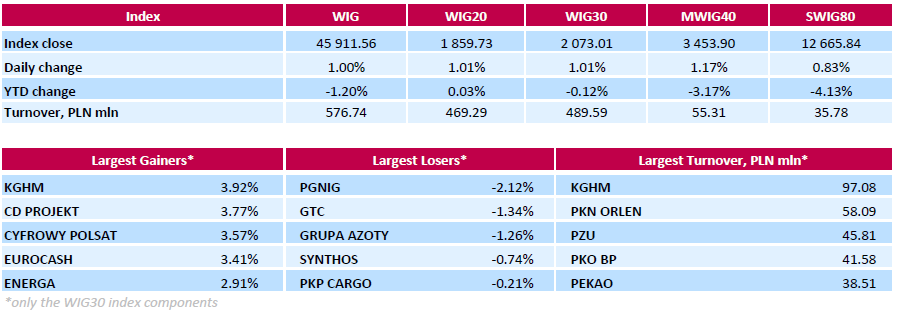

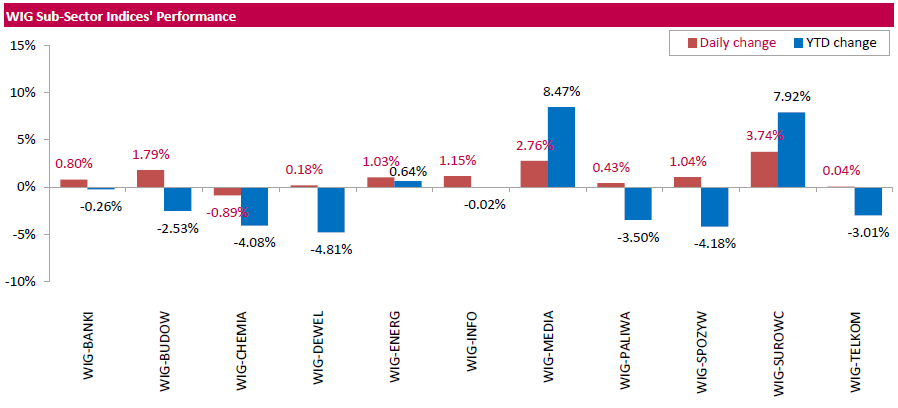

Polish equity market surged on Monday. The broad market measure, the WIG Index, added 1%. Chemical sector (-0.89%) was sole decliner within the WIG Index, while materials (+3.74%) outpaced.

The large-cap stocks' measure, the WIG30 Index, advanced by 1.01%. There were only six decliners among the index components. Oil and gas producer PGNIG (WSE: PGN), property developer GTC (WSE: GTC) and chemical producer GRUPA AZOTY (WSE: ATT) became the worst-performing names, falling by 2.12%, 1.34% and 1.26% respectively. Other losers were chemical producer SYNTHOS (WSE: SNS), railway freight transport operator PKP CARGO (WSE: PKP) and bank BZ WBK (WSE: BZW), declining by 0.02%-0.74%. On the other side of the ledger, copper producer KGHM (WSE: KGH) was the strongest advancer, climbing by 3.92% due to rising copper prices. It was followed by videogame developer CD PROJEKT (WSE: CDR), media group CYFROWY POLSAT (WSE: CPS) and FMCG wholesaler EUROCASH (WSE: EUR), surging by 3.77%, 3.57% and 3.41% respectively.

-

17:37

U.K. leading economic index increases 0.4% in December

The Conference Board (CB) released its leading economic index for the U.K. on Friday. The leading economic index (LEI) increased 0.4% in December, after a 0.4% rise in November.

The coincident index was flat in December, after a 0.1% gain in November.

-

17:02

Canada’s finance ministry cuts its economic growth forecast for 2016

Canada's finance ministry on Monday cut its economic growth forecast due to low oil prices. Canadian Finance Minister Bill Morneau said that the economy is expected to expand 1.4% in 2016, down from the November forecast of 2.0%, and 2.2% in 2017, unchanged from the November estimate.

The 2016-17 budget deficit is expected to be C$18.4 billion, while the 2017-18 deficit is forecasted to be C$15.5 billion.

-

16:52

Moody’s: Brexit would have a negative impact on Britain’s economy

The rating agency Moody's said on Monday that Britain's exit from the European Union (EU) ("Brexit") would have a negative impact on the country's economy.

"In our view, a decision to leave the EU would be credit negative for the UK economy," a senior vice president at Moody's, Kathrin Muehlbronner, said.

The agency noted that the outcome of the referendum remained "too close to call". Moody's added that the economic costs of Brexit would outweigh the economic benefits.

-

16:24

European Central Bank purchases €12.57 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €12.57 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €1.03 billion of covered bonds, and €838 million of asset-backed securities.

The European Central Bank (ECB) President Mario Draghi hinted at a press conference in January that the central bank may add further stimulus measures at its meeting in March as downside risks rose.

-

16:05

U.S. preliminary manufacturing purchasing managers' index plunges to 51.0 in January, the lowest level since October 2012

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the U.S. on Monday. The U.S. preliminary manufacturing purchasing managers' index (PMI) plunged to 51.0 in January from 52.4 in January, missing expectations for a decline to 52.3. It was the lowest level since October 2012.

A reading above 50 indicates expansion in economic activity.

The drop was driven by a slower pace of expansion in output, new business and employment.

"Every indicator from the flash PMI survey, from output, order books and exports to employment, inventories and prices, is flashing a warning light about the health of the manufacturing economy," Markit Chief Economist Chris Williamson.

-

15:38

U.S. Stocks open: Dow +1.07%, Nasdaq +1.15%, S&P +1.17%

-

15:20

Before the bell: S&P futures +1.06%, NASDAQ futures +1.05%

U.S. stock-index futures advanced.

Global Stocks:

Nikkei 16,111.05 +143.88 +0.90%

Hang Seng 19,464.09 +178.59 +0.93%

Shanghai Composite 2,927.73 +67.71 +2.37%

FTSE 6,038.46 +88.23 +1.48%

CAC 4,294.86 +71.82 +1.70%

DAX 9,563.12 +175.07 +1.86%

Crude oil $33.55 (+5.67%)

Gold $1209.60 (-1.72%)

-

15:00

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

7.29

5.35%

276.0K

Yandex N.V., NASDAQ

YNDX

13.11

3.47%

17.1K

Yahoo! Inc., NASDAQ

YHOO

30.7

2.20%

39.6K

ALCOA INC.

AA

8.04

2.16%

19.5K

Twitter, Inc., NYSE

TWTR

18.68

2.02%

9.2K

Tesla Motors, Inc., NASDAQ

TSLA

169.9

1.99%

6.6K

Citigroup Inc., NYSE

C

39.67

1.74%

20.3K

Chevron Corp

CVX

87.8

1.50%

0.1K

Nike

NKE

60.19

1.48%

15.3K

Walt Disney Co

DIS

96.32

1.38%

4.6K

Starbucks Corporation, NASDAQ

SBUX

58.4

1.27%

0.8K

Goldman Sachs

GS

148.7

1.22%

6.3K

Exxon Mobil Corp

XOM

83.51

1.22%

17.4K

Intel Corp

INTC

29.05

1.18%

4.2K

JPMorgan Chase and Co

JPM

58.5

1.18%

0.6K

ALTRIA GROUP INC.

MO

61.26

1.16%

1.3K

UnitedHealth Group Inc

UNH

119

1.12%

0.2K

American Express Co

AXP

55.31

1.10%

11.4K

Cisco Systems Inc

CSCO

26.84

1.09%

0.4K

Merck & Co Inc

MRK

50.66

1.08%

0.9K

Ford Motor Co.

F

12.23

1.08%

0.3K

General Electric Co

GE

29.33

1.07%

24.1K

Google Inc.

GOOG

708.4

1.07%

1.8K

Pfizer Inc

PFE

29.8

1.05%

0.1K

Facebook, Inc.

FB

105.67

1.05%

27.6K

Boeing Co

BA

116.35

1.03%

0.4K

Microsoft Corp

MSFT

52.35

1.02%

2.3K

Amazon.com Inc., NASDAQ

AMZN

540.31

1.01%

5.8K

General Motors Company, NYSE

GM

29.05

0.94%

1.5K

Home Depot Inc

HD

122.7

0.83%

3.0K

Visa

V

72.1

0.80%

5.6K

United Technologies Corp

UTX

88.83

0.68%

4.4K

HONEYWELL INTERNATIONAL INC.

HON

108

0.68%

0.2K

International Business Machines Co...

IBM

133.95

0.65%

0.3K

AT&T Inc

T

36.79

0.60%

13.8K

McDonald's Corp

MCD

117.16

0.54%

8.0K

Wal-Mart Stores Inc

WMT

65

0.53%

0.2K

Johnson & Johnson

JNJ

104.7

0.52%

3.6K

Deere & Company, NYSE

DE

77.4

0.52%

0.3K

Verizon Communications Inc

VZ

51.09

0.45%

7.3K

Apple Inc.

AAPL

96.35

0.32%

108.6K

3M Co

MMM

156.88

0.27%

0.8K

Procter & Gamble Co

PG

81.83

0.05%

0.6K

The Coca-Cola Co

KO

43.71

-0.14%

3.3K

Barrick Gold Corporation, NYSE

ABX

12.2

-2.87%

44.3K

-

14:49

CBI industrial order books balance declines to -17 in February

The Confederation of British Industry (CBI) released its industrial order books balance on Monday. The CBI industrial order books balance slid to -17 in February from-15 in January.

Export orders improved slightly in February.

"The challenging outlook for the manufacturing sector has stabilised a little, with sterling having depreciated, but Britain's manufacturers are still facing a difficult global situation," the CBI director of economics Rain Newton-Smith said.

"Despite the turbulence in emerging markets, economies such as China still represent a huge opportunity for British industry," he added.

-

14:47

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

HP (HPQ) reiterated with a Neutral at Mizuho; target $10

Hewlett Packard Enterprise (HPE) initiated with a Neutral at Macquarie

-

12:00

European stock markets mid session: stocks followed Asian stock indexes and traded higher

Stock indices followed Asian stock indexes and traded higher as oil prices increased.

Meanwhile, the economic data from the Eurozone was mostly weaker-than-expected. Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's preliminary manufacturing PMI declined to 51.0 in February from 52.3 in January. Analysts had expected the index to fall to 52.0.

The decline was driven by a softer growth in new orders and exports.

Eurozone's preliminary services PMI fell to 53.0 in February from 53.6 in January. Analysts had expected the index to decrease to 53.4.

"Disappointing PMI survey data for February greatly increase the odds of more aggressive stimulus from the ECB in March. Not only did the survey indicate the weakest pace of economic growth for just over a year, but deflationary forces intensified", Markit's Chief Economist Chris Williamson said.

He noted that data was signalling the Eurozone's economy could expand 0.3% in the first quarter.

Germany's preliminary manufacturing PMI fell to 50.2 in February from 52.3 in January, missing forecasts of a decline to 52.0. It was the slowest reading since November 2014.

The fall in the manufacturing PMI was driven by a weaker increase in new export business, a drop in purchasing activity and input prices.

Germany's preliminary services PMI was up to 55.1 in February from 55.0 in January. Analysts had expected index to decrease to 54.7.

The decline of the services PMI was driven by a faster growth in new business.

France's preliminary manufacturing PMI rose to 50.3 in February from 50.0 in January, beating forecasts of a decline to 49.9.

France's preliminary services PMI fell to 49.8 in February from 50.6 in January. Analysts had expected the index to remain unchanged at 50.3.

Britain's Prime Minister David Cameron said on Saturday that the country's referendum on the European Union (EU) membership will take place on June 23. Cameron secured a deal with the EU, which includes changes to migrant welfare payments, safeguards that Britain would not be a part of the Eurozone and safeguards for Britain's financial sector.

Some ministers support Brexit.

Current figures:

Name Price Change Change %

FTSE 100 6,022.49 +72.26 +1.21 %

DAX 9,568 +179.95 +1.92 %

CAC 40 4,294.92 +71.88 +1.70 %

-

11:47

Britain’s referendum on the European Union membership will take place on June 23

Britain's Prime Minister David Cameron said on Saturday that the country's referendum on the European Union (EU) membership will take place on June 23. Cameron secured a deal with the EU, which includes changes to migrant welfare payments, safeguards that Britain would not be a part of the Eurozone and safeguards for Britain's financial sector.

Some ministers support Brexit.

-

11:30

Final consumer prices in Italy decline 0.2% in January

The Italian statistical office Istat released its final consumer price inflation data for Italy on Monday. Final consumer prices in Italy fell 0.2% in January, in line with preliminary reading, after a flat reading in December.

The drop was mainly driven by a decline in prices of energy products, which fell 2.4% in January.

On a yearly basis, consumer prices climbed 0.3% in January, in line with preliminary reading, after a 0.1% increase in December.

The increase was mainly driven by a softer decline of prices of non-regulated energy products (-5.9% from -8.7% in December 2015) and a rise in prices of services related to transport. Prices of non-regulated energy products slid 5.9% year-on-year in January, while prices of services related to transport increased 0.5%.

Final consumer price inflation excluding unprocessed food and energy prices climbed to 0.8% year-on-year in January from 0.6% in December.

-

11:17

France's preliminary manufacturing PMI rises in February, while services PMI declines

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for France on Monday. France's preliminary manufacturing PMI rose to 50.3 in February from 50.0 in January, beating forecasts of a decline to 49.9.

France's preliminary services PMI fell to 49.8 in February from 50.6 in January. Analysts had expected the index to remain unchanged at 50.3.

"The private sector economy continues to follow a broadly stagnant path, with first-quarter GDP looking likely to remain sluggish following a 0.2% rise at the end of 2015. The combination of weak demand conditions and strong competitive pressures saw firms' output prices cut at the sharpest rate in over a year, pointing to continued downward pressure on inflation," the Senior Economist at Markit Jack Kennedy said.

-

11:09

Germany's preliminary manufacturing PMI falls in February, while services PMI rose

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for Germany on Monday. Germany's preliminary manufacturing PMI fell to 50.2 in February from 52.3 in January, missing forecasts of a decline to 52.0. It was the slowest reading since November 2014.

The fall in the manufacturing PMI was driven by a weaker increase in new export business, a drop in purchasing activity and input prices.

Germany's preliminary services PMI was up to 55.1 in February from 55.0 in January. Analysts had expected index to decrease to 54.7.

The decline of the services PMI was driven by a faster growth in new business.

"The German economy appears to be in the midst of a slowdown, according to February's flash PMI results. Although the PMI is still signalling an overall expansion in economic activity, the rate of increase slowed for the second month running and was the weakest since last July," Markit's economist Oliver Kolodseike noted.

-

10:55

Eurozone's preliminary manufacturing and services PMIs decline in February

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's preliminary manufacturing PMI declined to 51.0 in February from 52.3 in January. Analysts had expected the index to fall to 52.0.

The decline was driven by a softer growth in new orders and exports.

Eurozone's preliminary services PMI fell to 53.0 in February from 53.6 in January. Analysts had expected the index to decrease to 53.4.

"Disappointing PMI survey data for February greatly increase the odds of more aggressive stimulus from the ECB in March. Not only did the survey indicate the weakest pace of economic growth for just over a year, but deflationary forces intensified", Markit's Chief Economist Chris Williamson said.

He noted that data was signalling the Eurozone's economy could expand 0.3% in the first quarter.

-

10:43

Switzerland's producer and import prices are down 0.4% in January

The Federal Statistical Office released its producer and import prices data on Monday. Switzerland's producer and import prices fell 0.4% in January, after a 0.4% decrease in December.

The decrease was mainly driven by lower prices for petroleum products.

The Import Price Index decreased by 0.8% in January, while producer prices fell 0.1%.

On a yearly basis, producer and import prices plunged 5.3% in January, after a 5.5% drop in December.

The Import Price Index fell by 8.8% year-on year in January, while producer prices dropped 3.7%.

-

10:33

Knight Frank/Markit House Price Sentiment Index for the U.K. increases to 59.6 in February

According to a survey from Markit Economics and Knight Frank published on Friday, the Knight Frank/Markit House Price Sentiment Index for the U.K. increased to 59.6 in February from 58.7 in January. It was the highest level since October 2014.

The biggest rise in house price expectations was recorded in London, while the modest rate was recorded in Scotland. Households in all UK regions expect house prices to increase over the next 12 months.

"February's survey highlights a continuation of the steady upward trend in UK house price sentiment from the pre-election lows seen in early 2015," Markit's senior economist, Tim Moore, said.

-

10:21

China’s finance ministry plans to cut transaction taxes for home buyers

China's finance ministry said on Friday that it plans to cut transaction taxes for second-time home buyers and some first home buyers to stimulate the property market. The transaction tax on second homes smaller than 90 square meters will be lowered to 1% from 3%, while tax for homes of more than 90 square meters will be cut to 2. The tax on first homes larger than 144 square meters will be cut to 1.5% from 3%.

-

10:08

Preliminary Markit/Nikkei manufacturing purchasing managers' index for Japan declines to 50.2 in February

The preliminary Markit/Nikkei manufacturing Purchasing Managers' Index (PMI) for Japan declined to 50.2 in February from 52.3 in January.

A reading below 50 indicates contraction of activity, a reading above 50 indicates expansion.

The index was driven by a drop in new orders.

"Production increased at the slowest rate in the current 10-month sequence of expansion, led by a marginal drop in new orders for the first time since June last year. Data suggests that the fall in total new work intakes was caused primarily by a contraction in international demand, with new exports declining at the sharpest rate in three years," economist at Markit, Amy Brownbill, said.

-

06:56

Global Stocks: U.S. stock indices traded mixed

U.S. stock indices posted mixed results on Friday. Stocks seem to have reduced their dependence on oil prices, which posted significant losses.

The Dow Jones Industrial Average declined 21.44 points, or 0.1%, to 16,391.99 (+2.6% over the week). The S&P 500 edged down 0.05 points, or less than 0.1%, to 1,917.78 (+2.8% over the week). The Nasdaq Composite climbed 16.89 points, or 0.4%, to 4,504.43 (nearly +4% over the week).

Some analysts explain results of Friday session by technical factors. The market may have hesitated as the S&P ran into resistance at 1,950.

This morning in Asia Hong Kong Hang Seng rose 0.96%, or 185.23 points, to 19,470.73. China Shanghai Composite Index gained 2.04%, or 58.48 points, to 2,918.50. Meanwhile the Nikkei rose 1.17%, or 186.20 points, to 16,153.37.

Asian stock indices climbed as oil prices advanced. Chinese stocks also climbed as investors welcomed the decision to replace the head of the China Securities Regulatory Commission.

The yen slightly declined on preliminary manufacturing PMI data. The index declined to 50.2 points in February from 52.3 reported previously. Economists had expected a more modest decline to 52.0.

-

03:03

Nikkei 225 16,112.63 +145.46 +0.91 %, Hang Seng 19,466.92 +181.42 +0.94%, Shanghai Composite 2,890.2 +30.18 +1.06 %

-

00:29

Stocks. Daily history for Sep Feb 19’2016:

(index / closing price / change items /% change)

Nikkei 225 15,967.17 -229.63 -1.42 %

Hang Seng 19,285.5 -77.58 -0.40 %

Shanghai Composite 2,861.38 -1.51 -0.05 %

FTSE 100 5,950.23 -21.72 -0.36 %

CAC 40 4,223.04 -16.72 -0.39 %

Xetra DAX 9,388.05 -75.59 -0.80 %

S&P 500 1,917.78 -0.05 0.00%

NASDAQ Composite 4,504.43 +16.89 +0.38 %

Dow Jones 16,391.99 -21.44 -0.13 %

-