Noticias del mercado

-

21:02

DJIA 16348.92 -64.51 -0.39%, NASDAQ 4490.66 3.12 0.07%, S&P 500 1912.01 -5.82 -0.30%

-

18:52

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes slightly fells on Friday as a renewed slide in oil prices weighed on energy and materials stocks and prospects of a rate hike this year were rekindled by data pointing to firmer inflation trends. Crude prices, which have moved in lockstep with the stock market for much of the year, slid more than 4% after a record increase in U.S. stockpiles.

Report showed core consumer price index rose by a bigger-than-expected 0.3% in January, signs of an uptick in price pressures that could allow the Federal Reserve to gradually raise interest rates this year.

Most of Dow stocks in negative area (20 of 30). Top looser - Chevron Corporation (CVX, -2,02%). Top gainer - American Express Company (AXP, +0,96%).

Most of all S&P sectors in negative area. Top looser - Basic Materials (-1,5%). Top gainer - Conglomerates (+0,9%).

At the moment:

Dow 16332.00 -59.00 -0.36%

S&P 500 1911.50 -5.00 -0.26%

Nasdaq 100 4164.75 +9.75 +0.23%

Oil 31.71 -1.22 -3.70%

Gold 1232.20 +5.90 +0.48%

U.S. 10yr 1.75 -0.01

-

18:07

European stocks close: stocks closed lower as oil prices fell again

Stock indices closed lower as oil prices declined on concerns over the global oil oversupply.

The European Central Bank (ECB) Vice President Vitor Constancio said on Friday that the central bank could add further stimulus measures in March if it takes longer to reach 2% inflation target.

Constancio noted that inflation could turn negative in the short terms but it should rise in the second half of the year.

European Central Bank (ECB) Governing Council member Ignazio Visco said in an interview on Friday that there were no taboos to reach the price stability.

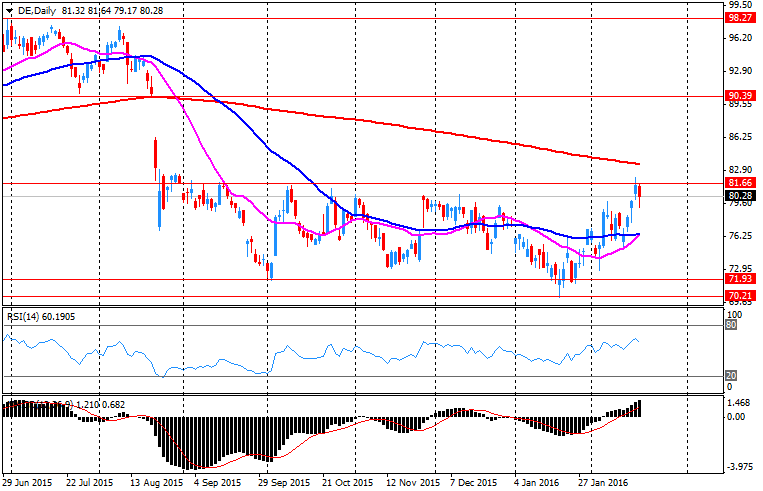

Market participants also eyed the economic data from the Eurozone. Destatis released its producer price index (PPI) for Germany on Friday. German PPI producer prices declined 0.7% in January, missing expectations for a 0.3% fall, after a 0.5% drop in December.

On a yearly basis, German PPI dropped 2.4% in January, missing expectations for a 2.0% decrease, after a 2.3% fall in December.

The decline was mainly driven by a drop in energy prices.

The Office for National Statistics released its retail sales data for the U.K. on Friday. Retail sales in the U.K. climbed 2.3% in January, exceeding expectations for a 0.8% gain, after a 1.4% drop in December. December's figure was revised down from a 1.0% decrease.

The increase was driven by lower demand for clothing and computer.

On a yearly basis, retail sales in the U.K. jumped 5.2% in January, beating forecasts of 3.6% increase, after a 2.3% rise in December. December's figure was revised down from a 2.6% gain.

Public sector net borrowing excluding banks rose to £11.2 billion in January from £10.2 billion in January last year. It was the biggest surplus since 2008.

The increase was driven by the high level of tax receipts.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,950.23 -21.72 -0.36 %

DAX 9,388.05 -75.59 -0.80 %

CAC 40 4,223.04 -16.72 -0.39 %

-

18:00

European stocks closed: FTSE 5950.23 -21.72 -0.36%, DAX 9388.05 -75.59 -0.80%, CAC 40 4223.04 -16.72 -0.39%

-

17:46

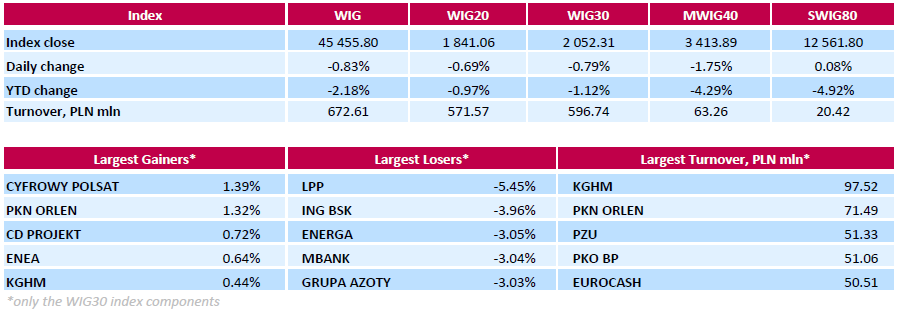

WSE: Session Results

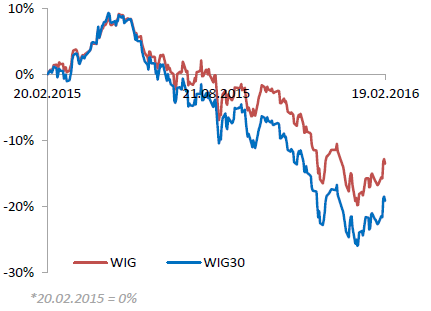

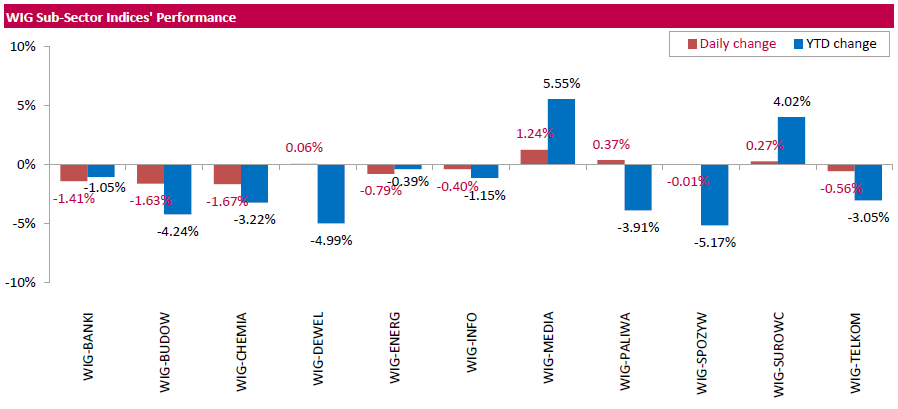

Polish equity market closed lower on Friday. The broad market measure, the WIG Index, fell by 0.83%. Sector-wise, chemicals (-1.67%) fared the worst, while media sector (+1.24%) was the best-performer.

The large-cap stocks' measure, the WIG30 Index, dropped by 0.79%. Within the WIG30 Index components, clothing retailer LPP (WSE: LPP) recorded the biggest decline, down 5.45%, after reporting worse-than-expected bottom line result for Q4 FY2015 (the company posted net profit of PLN 170 mln, whereas the analysts forecasted PLN 194 mln). Other major laggards were genco ENERGA (WSE: ENG), chemical producer GRUPA AZOTY (WSE: ATT) and two banking names ING BSK (WSE: ING) and MBANK (WSE: MBK), which quotations slid down 3.03%-3.96%. On the other side of the ledger, media- and telecom-group CYFROWY POLSAT (WSE: CPS) led a handful of gainers with a 1.39% advance, followed by oil refiner PKN ORLEN (WSE: PKN), adding 1.32%.

-

16:49

Bank of England's Monetary Policy Committee member Martin Weale: the central bank could hike its interest rate sooner than expected by markets

The Bank of England's (BoE) Monetary Policy Committee (MPC) member Martin Weale said in an interview with the Irish Newson Monday that the central bank could hike its interest rate sooner than expected by markets.

"I would be surprised if people had to wait as long as markets are currently implying," he said.

"But markets may well turn out to be right," Weale added.

He noted that inflation remained below the central bank's target longer than expected.

"There is a longer waiting period than we had expected but if we look at core measures of inflation, those are closer to the target but still below the target," MPC member said.

-

16:40

Britain’s Prime Minister David Cameron: there is “some progress” in talks between Britain and the EU

Britain's Prime Minister David Cameron said on Friday that there was "some progress" but no deal in talks between Britain and the European Union (EU).

"We've made some progress but there's still no deal," he said.

"I'll only do a deal if we get what Britain needs," Cameron added.

The EU and Britain discussed conditions to keep Britain in the EU.

-

16:34

The People's Bank of China (PBoC) Vice Governor Yi Gang said on Friday that too much quantitative easing in China would lead to asset bubbles and would weigh on the yuan

-

16:20

European Central Bank Governing Council member Ignazio Visco: there are no taboos to reach the price stability

European Central Bank (ECB) Governing Council member Ignazio Visco said in an interview on Friday that there were no taboos to reach the price stability.

He also said that the central bank should act before inflation will decline strongly.

"Acting pre-emptively and aggressively may mean having to act less than you would have done, had you acted too late," ECB Governing Council member noted.

Visco said that he saw the second-round effect of the oil price drop.

"I see that the risk of second-round effects is materializing. For example we already see wage contracts which include the possibility of a revision if inflation is lower than expected," he pointed out.

-

16:13

Eurozone’s preliminary consumer confidence index falls to -8.8 in February

The European Commission released its preliminary consumer confidence figures for the Eurozone on Friday. Eurozone's preliminary consumer confidence index fell to -8.8 in February from -6.3 in January. Analysts had expected the index to decline to -6.7.

European Union's consumer confidence index decreased by 2.4 points to -6.6 in February.

-

16:10

European Central Bank (ECB) Vice President Vitor Constancio: the central bank could add further stimulus measures in March if it takes longer to reach 2% inflation target

The European Central Bank (ECB) Vice President Vitor Constancio said on Friday that the central bank could add further stimulus measures in March if it takes longer to reach 2% inflation target.

"The main thing for us discussing our decisions is the prospect for inflation going forward. We don't expect to reach our goal in a short time, but to go in that direction. If the conclusion of the Governing Council is that path is at stake and that the delay in normalizing may get bigger...it may decide to act," he said.

Constancio noted that inflation could turn negative in the short terms but it should rise in the second half of the year.

-

16:03

Cleveland Fed President Loretta Mester expects the U.S. economy to grow

Cleveland Fed President Loretta Mester said in a speech on Friday that she expected the U.S. economy to grow.

"My current expectation is that the U.S. economy will work through this episode of market turbulence and the soft patch of economic data to regain its footing for moderate growth, even as the energy and manufacturing sectors remain challenged," she said.

Mester noted that ties between the U.S. and the Chinese economies were "not very strong".

She pointed out that she expected the Fed to continue raising its interest rate gradually.

Mester is a voting member of the Federal Open Markets Committee this year.

-

15:32

U.S. Stocks open: Dow -0.13%, Nasdaq -0.39%, S&P -0.29%

-

15:18

U.S. weekly earnings rise 0.7% in January

The U.S. Labor Department released its real earnings data on Wednesday. Average weekly earnings rose 0.7% in January, after a 0.1% increase in December.

The increase was driven by rises in in average hourly earnings.

Average hourly earnings climbed 0.4% in January, after a 0.2% rise in December.

On a yearly basis, real average weekly earnings increased 1.2% in January, while hourly earnings rose 1.1%.

-

15:18

Before the bell: S&P futures -0.59%, NASDAQ futures -0.63%

U.S. stock-index futures declined.

Global Stocks:

Nikkei 15,967.17 -229.63 -1.42%

Hang Seng 19,285.5 -77.58 -0.40%

Shanghai Composite 2,861.38 -1.51 -0.05%

FTSE 5,940.11 -31.84 -0.53%

CAC 4,196.28 -43.48 -1.03%

DAX 9,371.94 -91.70 -0.97%

Crude oil $29.97 (-2.60%)

Gold $1226.00 (-0.02%)

-

15:14

U.S. consumer price inflation is flat in January

The U.S. Labor Department released consumer price inflation data on Friday. The U.S. consumer price inflation was flat in January, beating expectations for a 0.1% decline, after a 0.1% fall in December.

The index was mainly driven by higher prices of rents and medical care, and higher shelter costs. Rents rose 0.5% in January, while both medical care and shelter costs were up 0.3%.

Gasoline prices fell 4.8% in January, while food prices were flat.

On a yearly basis, the U.S. consumer price index increased to 1.4% in January from 0.7% in December, exceeding expectations for a rise to 1.3%. It was the biggest increase since October 2014.

The U.S. consumer price inflation excluding food and energy gained 0.3% in January, exceeding expectations for a 0.2% rise, after a 0.2% increase in December.

On a yearly basis, the U.S. consumer price index excluding food and energy increased to 2.2% in January from 2.1% in December, beating expectations for a 2.1% rise.

The consumer price index is not preferred Fed's inflation measure.

-

15:00

Canadian consumer price inflation rises 0.2% in January

Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation rose 0.2% in January, beating expectations for a 0.1% decline, after a 0.5% fall in December.

The monthly rise was mainly driven by an increase in food prices, which climbed 1.5% in January.

On a yearly basis, the consumer price index rose to 2.0% in January from 1.6% in December, exceeding expectations for a gain to 1.7%.

The consumer price index was mainly driven by higher food, and alcoholic beverages and tobacco products prices. Food prices climbed 4.0% year-on-year in January, while alcoholic beverages and tobacco products prices increased 3.1%.

The index for recreation, education and reading climbed by 2.2% in January from the same month a year earlier, the shelter index gained 1.1%, while energy prices dropped 0.4%.

The Canadian core consumer price index, which excludes some volatile goods, increased 0.3% in January, after a 0.4% fall in December.

On a yearly basis, core consumer price index in Canada climbed to 2.0% in January from 1.9% in December. Analysts had expected the index to remain unchanged at 1.9%.

The Bank of Canada's inflation target is 2.0%.

-

14:54

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Yahoo! Inc., NASDAQ

YHOO

30.16

2.52%

48.0K

McDonald's Corp

MCD

117.55

0.32%

0.7K

Procter & Gamble Co

PG

82.03

0.06%

0.1K

JPMorgan Chase and Co

JPM

57.82

0.02%

27.4K

Johnson & Johnson

JNJ

103.49

0.00%

21.0K

Merck & Co Inc

MRK

50.32

0.00%

667.4K

Facebook, Inc.

FB

103.38

-0.09%

21.9K

Intel Corp

INTC

29.39

-0.10%

1.2M

General Motors Company, NYSE

GM

29

-0.10%

6.5K

Starbucks Corporation, NASDAQ

SBUX

56.9

-0.11%

1.2K

International Business Machines Co...

IBM

132.28

-0.13%

9.6K

Pfizer Inc

PFE

29.51

-0.14%

0.6K

Apple Inc.

AAPL

96.1

-0.17%

278.8K

Google Inc.

GOOG

696.03

-0.19%

2.8K

Cisco Systems Inc

CSCO

26.37

-0.23%

395.1K

The Coca-Cola Co

KO

43.5

-0.25%

4.2K

Tesla Motors, Inc., NASDAQ

TSLA

166.3

-0.28%

5.3K

Verizon Communications Inc

VZ

50.79

-0.29%

24.1K

Home Depot Inc

HD

119.61

-0.30%

0.2K

Microsoft Corp

MSFT

52.01

-0.34%

2.1K

ALCOA INC.

AA

8.09

-0.37%

2.3K

Citigroup Inc., NYSE

C

38.77

-0.39%

3.2K

Goldman Sachs

GS

147.12

-0.41%

0.9K

Wal-Mart Stores Inc

WMT

63.85

-0.42%

562.3K

General Electric Co

GE

28.95

-0.45%

2.2K

Amazon.com Inc., NASDAQ

AMZN

522.51

-0.47%

2.8K

Boeing Co

BA

117

-0.48%

0.2K

AT&T Inc

T

36.8

-0.51%

3.1K

Nike

NKE

58.2

-0.68%

0.3K

Chevron Corp

CVX

86.13

-0.69%

0.3K

Exxon Mobil Corp

XOM

81.88

-0.69%

2.7K

American Express Co

AXP

53.75

-0.74%

0.1K

Yandex N.V., NASDAQ

YNDX

12.98

-0.76%

2.0K

Caterpillar Inc

CAT

65.53

-0.89%

1.5K

Ford Motor Co.

F

12.15

-0.90%

27.2K

Barrick Gold Corporation, NYSE

ABX

12.48

-1.19%

15.9K

Twitter, Inc., NYSE

TWTR

18.17

-1.41%

12.9K

Visa

V

70.2

-1.46%

0.9K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

7

-2.10%

51.4K

Deere & Company, NYSE

DE

77.79

-3.16%

13.7K

-

14:48

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Starbucks (SBUX) initiated with a Buy at Nomura; target $70

-

14:46

Canadian retail sales drop by 2.2% in December

Statistics Canada released retail sales data on Friday. Canadian retail sales dropped by 2.2% in December, missing expectations for a 0.6% fall, after a 1.7% increase in November.

The decline was mainly driven by lower sales at motor vehicle and parts dealers, which slid by 3.9% in December.

Sales at gasoline stations declined 1.1% in December, while sales at food and beverage stores were down 1.2%.

Motor vehicle and parts sales increased 3.5% in November, while sales at furniture and home furnishings stores rose 0.5%.

Canadian retail sales excluding automobiles declined 1.6% in December, missing expectations for a 0.5% decline, after a 1.0% rise in November. November's figure was revised down from a 1.1% gain.

-

14:25

Preliminary real GDP of 20 OECD member countries falls to 0.2% in the fourth quarter

The Organization for Economic Cooperation and Development (OECD) released its preliminary real gross domestic product (GDP) growth figures on Friday. Real GDP of 20 OECD member countries fell to 0.2% in the fourth quarter from 0.5% in the third quarter.

Real GDP of the United States was down to 0.2% in the fourth quarter from 0.5% in the third quarter, real GDP of Germany remained unchanged at 0.3%, while Britain's economy increased to 0.5% from 0.4%.

GDP of France decreased to 0.2% from 0.3%, while Japan's GDP dropped to -0.4% from 0.3%.

Eurozone's economy expanded at 0.3% in the fourth quarter, after a 0.4% rise in the third quarter.

On a yearly basis, GDP of 20 OECD member countries was up 1.8% in the fourth quarter, after a 2.1% gain in the previous quarter.

In 2015 as whole, GDP of 20 OECD member countries increased 2.0%, after a 1.8% growth in 2014.

-

13:18

Company News: Deere (DE) Posts Quarterly Results and FY 2016 Guidance

Deere reported Q1 FY 2016 earnings of $0.80 per share (versus $1.12 in Q1 FY 2015), beating analysts' consensus of $0.70.

The company's quarterly revenues amounted to $4.769 bln (-14.9% y/y), missing consensus estimate of $4.862 bln.

Deere issued downside guidance for FY 2016, lowering revenues to -10% to $23.2 bln from -7% (versus analysts' consensus of $23.56 bln) and net income to $1.3 bln from $1.4 bln.

DE fell to $78.25 (-2.59%) in pre-market trading.

-

12:09

European stock markets mid session: stocks traded lower as oil prices declined

Stock indices traded lower as oil prices declined on concerns over the global oil oversupply.

Market participants also eyed the economic data from the Eurozone. Destatis released its producer price index (PPI) for Germany on Friday. German PPI producer prices declined 0.7% in January, missing expectations for a 0.3% fall, after a 0.5% drop in December.

On a yearly basis, German PPI dropped 2.4% in January, missing expectations for a 2.0% decrease, after a 2.3% fall in December.

The decline was mainly driven by a drop in energy prices.

The Office for National Statistics released its retail sales data for the U.K. on Friday. Retail sales in the U.K. climbed 2.3% in January, exceeding expectations for a 0.8% gain, after a 1.4% drop in December. December's figure was revised down from a 1.0% decrease.

The increase was driven by lower demand for clothing and computer.

On a yearly basis, retail sales in the U.K. jumped 5.2% in January, beating forecasts of 3.6% increase, after a 2.3% rise in December. December's figure was revised down from a 2.6% gain.

Public sector net borrowing excluding banks rose to £11.2 billion in January from £10.2 billion in January last year. It was the biggest surplus since 2008.

The increase was driven by the high level of tax receipts.

Current figures:

Name Price Change Change %

FTSE 100 5,959.52 -12.43 -0.21 %

DAX 9,405.95 -57.69 -0.61 %

CAC 40 4,221.88 -17.88 -0.42 %

-

12:04

Public sector net borrowing in the U.K. rises to £11.2 billion in January

The Office for National Statistics released public sector net borrowing for the U.K. on Friday. Public sector net borrowing excluding banks rose to £11.2 billion in January from £10.2 billion in January last year. It was the biggest surplus since 2008.

The increase was driven by the high level of tax receipts.

The debt-to-gross domestic product ratio declined to 82.8% in January, the first annual decline since September 2002.

-

11:54

Japan’s all industry activity index slides 0.9% in December

Japan's Ministry of Economy, Trade and Industry (METI) released its all industry activity index on Friday. The index slid 0.9% in December, missing expectations for a 0.3% fall, after a 1.1% drop in November. November's figure was revised down from a 1.0% decrease.

Construction industry activity index dropped 2.1% in December, industrial production index fell 1.7%, while tertiary industry activity declined 0.6%.

-

11:50

Greece’s current account narrows to €0.78 billion in December

The Bank of Greece released its current account data on Friday. Greece's current account deficit fell to €0.78 billion in December from €1.87 billion in December last year.

The Greek deficit on trade in goods declined to €1.49 billion in December from €2.04 billion in December last year, while the services surplus fell to €348 million from €521 million.

The primary income deficit turned into a surplus of €323 million in December from a deficit of €42 million in December last year, while the deficit on secondary income turned into a surplus of €43.5 million from a deficit of €309.5 million last year.

The capital account surplus decreased to €136.7 million in December from 245.3 million last year.

-

11:34

German producer prices drop 0.7% in January

Destatis released its producer price index (PPI) for Germany on Friday. German PPI producer prices declined 0.7% in January, missing expectations for a 0.3% fall, after a 0.5% drop in December.

On a yearly basis, German PPI dropped 2.4% in January, missing expectations for a 2.0% decrease, after a 2.3% fall in December.

PPI excluding energy sector fell by 0.6% year-on-year in January.

Energy prices were down 7.3% year-on-year in January.

Consumer non-durable goods prices rose 0.6% year-on-year in January, intermediate goods sector prices decreased by 2.2%, while capital goods prices increased 0.6% and durable consumer goods sector prices gained 1.4%.

-

11:29

UK retail sales climb 2.3% in January

The Office for National Statistics released its retail sales data for the U.K. on Friday. Retail sales in the U.K. climbed 2.3% in January, exceeding expectations for a 0.8% gain, after a 1.4% drop in December. December's figure was revised down from a 1.0% decrease.

The increase was driven by lower demand for clothing and computer.

On a yearly basis, retail sales in the U.K. jumped 5.2% in January, beating forecasts of 3.6% increase, after a 2.3% rise in December. December's figure was revised down from a 2.6% gain.

-

11:14

Reserve Bank of Australia board member John Edwards: the Australian dollar was still too high

The Reserve Bank of Australia (RBA) board member John Edwards said on Friday that the Australian dollar was still too high.

"I guess I would say I still think it is a bit too high. If it was driven entirely by commodity prices, it certainly should be lower," he said, adding that he would be more comfortable if the Australian dollar was trading at around $0.65.

Edwards pointed out that if major central banks keep their negative interest rates, the Australian dollar could rise.

His comments could mean that the central bank is likely to ease its monetary policy further.

-

11:04

The number of new and renewal claims for unemployment insurance benefits increases 3.4% in December

Statistics Canada released its number of new and renewal claims for unemployment insurance benefits on Thursday. The number of new and renewal claims for unemployment insurance benefits increased 3.4% in December.

On a yearly basis, the number of new and renewal claims for unemployment insurance benefits climbed 7.8% in December.

The number of people receiving regular jobless benefits fell 0.5% in December.

On a yearly basis, the total number of people receiving jobless benefits jumped 7.3%.

-

10:51

French President Francois Hollande: a deal between the European Union and the U.K. is "possible"

French President Francois Hollande said on Thursday that a deal between the European Union (EU) and the U.K. was "possible".

"A deal is possible if certain conditions are met. A deal is possible because it is necessary that Britain should remain in the EU," he said.

"But no country can have the right to a veto, no country can withdraw from the common rules... otherwise another country will demand exceptions," Hollande added.

-

10:40

Moody’s: the downside risks to the global economy increased

The rating agency Moody's said on Thursday that the downside risks to the global economy increased as the slowdown in the Chinese economy, lower commodity prices and tighter financing conditions in some countries weigh on the global economy. The G20 economies are expected to expand 2.6% in 2016 and 2.9% in 2017.

The Chinese economy is expected to grow 6.3% in 2016 and 6.1% in 2017. "China's slowdown will be concentrated in heavy industry sectors that are significant importers," Marie Diron, a Moody's Senior Vice President, said.

The U.S. GDP growth is expected to be 2.3% in 2016 and 2.5% in 2017. Moody's noted that the Fed will continue to raise its interest rate gradually, with the Fed's interest rate at around 1.75% by the end of 2017.

Japan's economy is expected to expand below 1% in 2016 and 2017. The agency noted that the Bank of Japan's (BoJ) 2% inflation target will remain elusive.

-

10:21

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy decline to 42.5 in February

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy decreased to 42.5 in February from 47.0 in January. January's reading was the highest level since June 2015.

The decline was driven by a less favourable assessment of the measure of views of the economy.

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy fell to 44.3 in in the week ended February 14 from 44.5 the prior week.

The weekly drop was driven by declines in all sub-indexes. The measure of views of the economy declined to 35.4 from 35.5, the buying climate index was down to 41.6 from 41.9, while the personal finances index fell to 55.8 from 56.1.

-

10:07

San Francisco Fed President John Williams: the U.S. economic growth remained strong

San Francisco Fed President John Williams said in a speech on Thursday that the U.S. economic growth remained strong.

"If we look at the domestic market in isolation, it shows strong growth. We're just contending with outside forces," he said.

Williams added that the effect of falling oil prices and a stronger U.S. dollar will dissipate.

San Francisco Fed president expects the inflation in the U.S. to rise toward the 2% target "over the next two years".

He also said that he was not concerned about the slowdown in the Chinese economy.

Williams pointed out that further interest rate hikes will be gradual and will depend on the incoming economic data.

-

06:59

Global Stocks: U.S. stock indices declined

U.S. stock indices declined on Thursday with Wal-Mart stocks leading declines amid a weaker-than-expected quarterly report. Lower oil prices weighed on stocks too.

The Dow Jones Industrial Average declined 40.40 points, or 0.3%, to 16,413.43. The S&P 500 lost 8.99 points, or 0.5%, to 1,917.83 (eight out of its ten sectors declined). The Nasdaq Composite fell 46.53 points, or 1%, to 4,487.54.

Philadelphia Fed Manufacturing Survey showed that business activity improved in the region in February. The corresponding index rose to -2.8 points from -3.5 in January. Economists had expected the index to climb to -3.0.

The U.S. leading indicators index from the Conference Board fell by 0.2% to 123.2 (2010=100) in January after a 0.3% decline in December and 0.5% rise in November. The latest reading was in line with forecasts.

This morning in Asia Hong Kong Hang Seng fell 0.35%, or 67.75 points, to 19,295.33. China Shanghai Composite Index declined 0.17%, or 4.74 points, to 2,858.15. Meanwhile the Nikkei fell 1.43%, or 231.89 points, to 15,964.91.

Asian stock indices fell following declines in U.S. equities. A stronger yen put additional pressure on stocks of Japanese exporters. The yen rose by almost 10% against the dollar in the past three weeks.

-

03:00

Nikkei 225 15,913.74 -283.06 -1.75 %, Hang Seng 19,274.57 -88.51 -0.46 %, Shanghai Composite 2,854.9 -7.99 -0.28 %

-

01:02

Stocks. Daily history for Sep Feb 18’2016:

(index / closing price / change items /% change)

S&P/ASX 200 4,992 +109.90 +2.25%

TOPIX 1,311.2 +28.80 +2.25%

Hang Seng 19,363.08 +438.51 +2.32 %

Shanghai Composite 2,862.89 -4.45 -0.16 %

FTSE 100 5,971.95 -58.37 -0.97 %

CAC 40 4,239.76 +6.29 +0.15 %

Xetra DAX 9,463.64 +86.43 +0.92 %

S&P 500 1,917.83 -8.99 -0.47 %

NASDAQ Composite 4,487.54 -46.53 -1.03 %

Dow Jones 16,413.43 -40.40 -0.25 %

-