Noticias del mercado

-

16:49

Bank of England's Monetary Policy Committee member Martin Weale: the central bank could hike its interest rate sooner than expected by markets

The Bank of England's (BoE) Monetary Policy Committee (MPC) member Martin Weale said in an interview with the Irish Newson Monday that the central bank could hike its interest rate sooner than expected by markets.

"I would be surprised if people had to wait as long as markets are currently implying," he said.

"But markets may well turn out to be right," Weale added.

He noted that inflation remained below the central bank's target longer than expected.

"There is a longer waiting period than we had expected but if we look at core measures of inflation, those are closer to the target but still below the target," MPC member said.

-

16:40

Britain’s Prime Minister David Cameron: there is “some progress” in talks between Britain and the EU

Britain's Prime Minister David Cameron said on Friday that there was "some progress" but no deal in talks between Britain and the European Union (EU).

"We've made some progress but there's still no deal," he said.

"I'll only do a deal if we get what Britain needs," Cameron added.

The EU and Britain discussed conditions to keep Britain in the EU.

-

16:34

The People's Bank of China (PBoC) Vice Governor Yi Gang said on Friday that too much quantitative easing in China would lead to asset bubbles and would weigh on the yuan

-

16:20

European Central Bank Governing Council member Ignazio Visco: there are no taboos to reach the price stability

European Central Bank (ECB) Governing Council member Ignazio Visco said in an interview on Friday that there were no taboos to reach the price stability.

He also said that the central bank should act before inflation will decline strongly.

"Acting pre-emptively and aggressively may mean having to act less than you would have done, had you acted too late," ECB Governing Council member noted.

Visco said that he saw the second-round effect of the oil price drop.

"I see that the risk of second-round effects is materializing. For example we already see wage contracts which include the possibility of a revision if inflation is lower than expected," he pointed out.

-

16:13

Eurozone’s preliminary consumer confidence index falls to -8.8 in February

The European Commission released its preliminary consumer confidence figures for the Eurozone on Friday. Eurozone's preliminary consumer confidence index fell to -8.8 in February from -6.3 in January. Analysts had expected the index to decline to -6.7.

European Union's consumer confidence index decreased by 2.4 points to -6.6 in February.

-

16:10

European Central Bank (ECB) Vice President Vitor Constancio: the central bank could add further stimulus measures in March if it takes longer to reach 2% inflation target

The European Central Bank (ECB) Vice President Vitor Constancio said on Friday that the central bank could add further stimulus measures in March if it takes longer to reach 2% inflation target.

"The main thing for us discussing our decisions is the prospect for inflation going forward. We don't expect to reach our goal in a short time, but to go in that direction. If the conclusion of the Governing Council is that path is at stake and that the delay in normalizing may get bigger...it may decide to act," he said.

Constancio noted that inflation could turn negative in the short terms but it should rise in the second half of the year.

-

16:03

Cleveland Fed President Loretta Mester expects the U.S. economy to grow

Cleveland Fed President Loretta Mester said in a speech on Friday that she expected the U.S. economy to grow.

"My current expectation is that the U.S. economy will work through this episode of market turbulence and the soft patch of economic data to regain its footing for moderate growth, even as the energy and manufacturing sectors remain challenged," she said.

Mester noted that ties between the U.S. and the Chinese economies were "not very strong".

She pointed out that she expected the Fed to continue raising its interest rate gradually.

Mester is a voting member of the Federal Open Markets Committee this year.

-

16:00

Eurozone: Consumer Confidence, February -8.8 (forecast -6.7)

-

15:18

U.S. weekly earnings rise 0.7% in January

The U.S. Labor Department released its real earnings data on Wednesday. Average weekly earnings rose 0.7% in January, after a 0.1% increase in December.

The increase was driven by rises in in average hourly earnings.

Average hourly earnings climbed 0.4% in January, after a 0.2% rise in December.

On a yearly basis, real average weekly earnings increased 1.2% in January, while hourly earnings rose 1.1%.

-

15:14

U.S. consumer price inflation is flat in January

The U.S. Labor Department released consumer price inflation data on Friday. The U.S. consumer price inflation was flat in January, beating expectations for a 0.1% decline, after a 0.1% fall in December.

The index was mainly driven by higher prices of rents and medical care, and higher shelter costs. Rents rose 0.5% in January, while both medical care and shelter costs were up 0.3%.

Gasoline prices fell 4.8% in January, while food prices were flat.

On a yearly basis, the U.S. consumer price index increased to 1.4% in January from 0.7% in December, exceeding expectations for a rise to 1.3%. It was the biggest increase since October 2014.

The U.S. consumer price inflation excluding food and energy gained 0.3% in January, exceeding expectations for a 0.2% rise, after a 0.2% increase in December.

On a yearly basis, the U.S. consumer price index excluding food and energy increased to 2.2% in January from 2.1% in December, beating expectations for a 2.1% rise.

The consumer price index is not preferred Fed's inflation measure.

-

15:00

Canadian consumer price inflation rises 0.2% in January

Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation rose 0.2% in January, beating expectations for a 0.1% decline, after a 0.5% fall in December.

The monthly rise was mainly driven by an increase in food prices, which climbed 1.5% in January.

On a yearly basis, the consumer price index rose to 2.0% in January from 1.6% in December, exceeding expectations for a gain to 1.7%.

The consumer price index was mainly driven by higher food, and alcoholic beverages and tobacco products prices. Food prices climbed 4.0% year-on-year in January, while alcoholic beverages and tobacco products prices increased 3.1%.

The index for recreation, education and reading climbed by 2.2% in January from the same month a year earlier, the shelter index gained 1.1%, while energy prices dropped 0.4%.

The Canadian core consumer price index, which excludes some volatile goods, increased 0.3% in January, after a 0.4% fall in December.

On a yearly basis, core consumer price index in Canada climbed to 2.0% in January from 1.9% in December. Analysts had expected the index to remain unchanged at 1.9%.

The Bank of Canada's inflation target is 2.0%.

-

14:46

Canadian retail sales drop by 2.2% in December

Statistics Canada released retail sales data on Friday. Canadian retail sales dropped by 2.2% in December, missing expectations for a 0.6% fall, after a 1.7% increase in November.

The decline was mainly driven by lower sales at motor vehicle and parts dealers, which slid by 3.9% in December.

Sales at gasoline stations declined 1.1% in December, while sales at food and beverage stores were down 1.2%.

Motor vehicle and parts sales increased 3.5% in November, while sales at furniture and home furnishings stores rose 0.5%.

Canadian retail sales excluding automobiles declined 1.6% in December, missing expectations for a 0.5% decline, after a 1.0% rise in November. November's figure was revised down from a 1.1% gain.

-

14:44

Option expiries for today's 10:00 ET NY cut

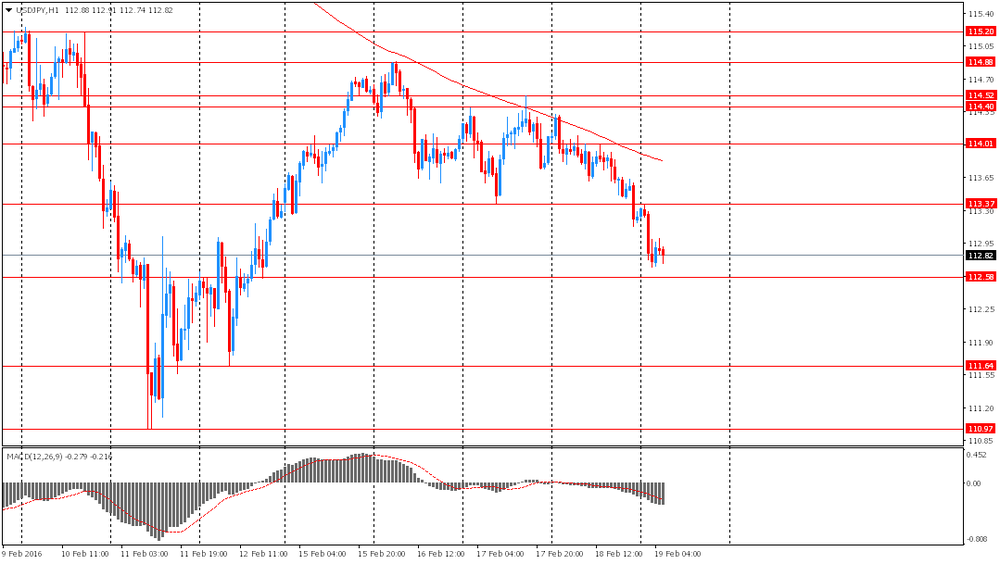

USDJPY: 112.70-75 (376m) 115.00 (227m)

EURUSD: 1.0800 (EUR 570m) 1.0950 (261m) 1.1150 (259m) 1.1200 (336m) 1.1275(255m) 1.1300 (289m)

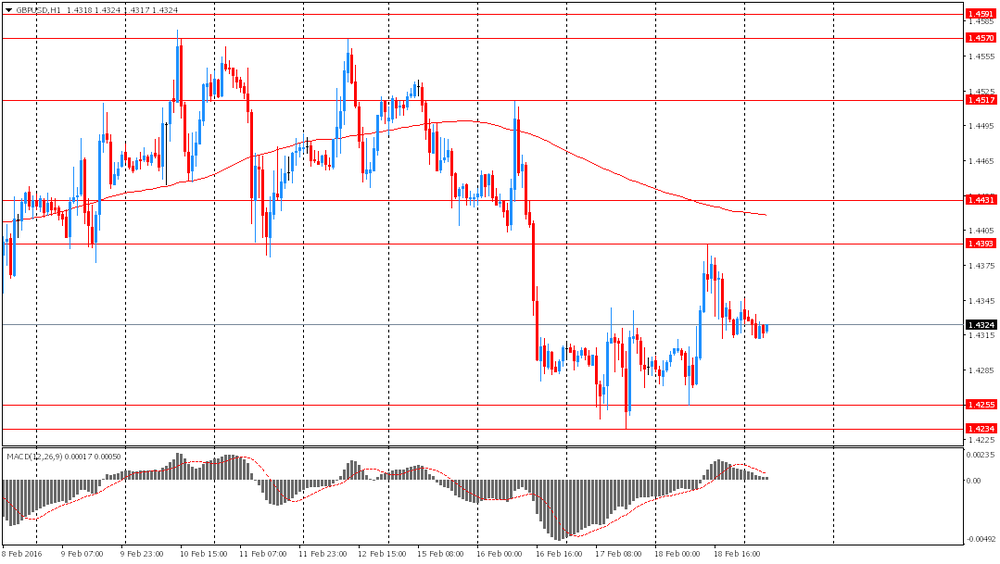

GBPUSD: 1.4400(GBP 293m)

EURGBP: 0.7500 (310m) 0.7700 (350m)

AUDUSD: 0.6950 (AUD 288m) 0.7050 (246m) 0.7110 (149m) 0.7155 (140m) 0.7325(152m)

USDCAD: 1.3500 (USD 300m) 1.3700 (442m) 1.3800-05 (874m) 1.3900 (440m) 1.4000 (2.39bn)

-

14:31

Canada: Retail Sales YoY, December 2.6%

-

14:30

Canada: Consumer Price Index m / m, January 0.2% (forecast -0.1%)

-

14:30

Canada: Retail Sales ex Autos, m/m, December -1.6% (forecast -0.5%)

-

14:30

Canada: Retail Sales, m/m, December -2.2% (forecast -0.6%)

-

14:30

U.S.: CPI excluding food and energy, m/m, January 0.3% (forecast 0.2%)

-

14:30

U.S.: CPI, m/m , January 0.0% (forecast -0.1%)

-

14:30

Canada: Consumer price index, y/y, January 2.0% (forecast 1.7%)

-

14:30

U.S.: CPI, Y/Y, January 1.4% (forecast 1.3%)

-

14:30

U.S.: CPI excluding food and energy, Y/Y, January 2.2% (forecast 2.1%)

-

14:30

Canada: Bank of Canada Consumer Price Index Core, y/y, January 2.0% (forecast 1.9%)

-

14:25

Preliminary real GDP of 20 OECD member countries falls to 0.2% in the fourth quarter

The Organization for Economic Cooperation and Development (OECD) released its preliminary real gross domestic product (GDP) growth figures on Friday. Real GDP of 20 OECD member countries fell to 0.2% in the fourth quarter from 0.5% in the third quarter.

Real GDP of the United States was down to 0.2% in the fourth quarter from 0.5% in the third quarter, real GDP of Germany remained unchanged at 0.3%, while Britain's economy increased to 0.5% from 0.4%.

GDP of France decreased to 0.2% from 0.3%, while Japan's GDP dropped to -0.4% from 0.3%.

Eurozone's economy expanded at 0.3% in the fourth quarter, after a 0.4% rise in the third quarter.

On a yearly basis, GDP of 20 OECD member countries was up 1.8% in the fourth quarter, after a 2.1% gain in the previous quarter.

In 2015 as whole, GDP of 20 OECD member countries increased 2.0%, after a 1.8% growth in 2014.

-

14:10

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar despite the better-than-expected U.K. retail sales data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

04:30 Japan All Industry Activity Index, m/m December -1.1% Revised From -1.0% -0.3% -0.9%

07:00 Germany Producer Price Index (MoM) January -0.5% -0.3% -0.7%

07:00 Germany Producer Price Index (YoY) January -2.3% -2% -2.4%

09:30 United Kingdom PSNB, bln January -7.49 Revised From 7.49 13.95 11.81

09:30 United Kingdom Retail Sales (MoM) January -1.4% Revised From -1% 0.8% 2.3%

09:30 United Kingdom Retail Sales (YoY) January 2.3% Revised From 2.6% 3.6% 5.2%

13:00 U.S. FOMC Member Mester Speaks

The U.S. dollar traded mixed to higher against the most major currencies ahead of the release of the U.S. consumer price inflation data. The U.S. consumer price inflation is expected to rise to 1.3% year-on-year in January from 0.7% in December.

The U.S. consumer price index excluding food and energy is expected to remain unchanged at 2.1% year-on-year in January.

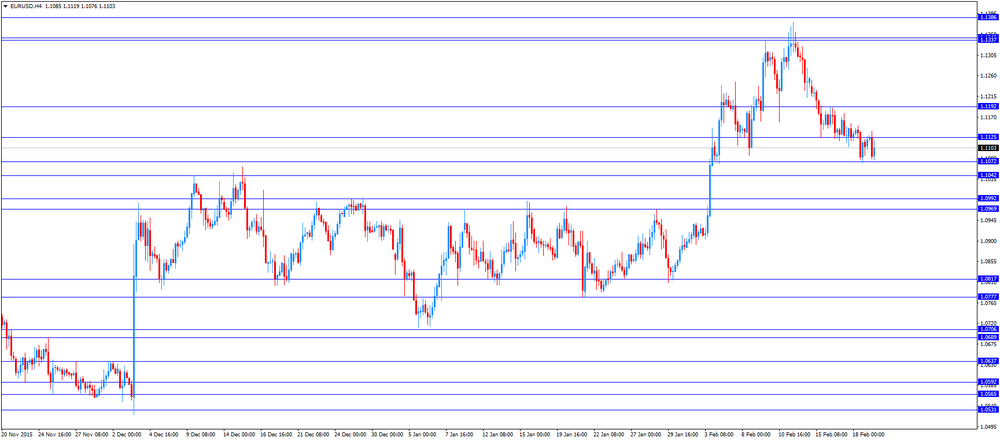

The euro traded lower against the U.S. dollar in the absence of any major economic reports from the Eurozone.

Destatis released its producer price index (PPI) for Germany on Friday. German PPI producer prices declined 0.7% in January, missing expectations for a 0.3% fall, after a 0.5% drop in December.

On a yearly basis, German PPI dropped 2.4% in January, missing expectations for a 2.0% decrease, after a 2.3% fall in December.

The decline was mainly driven by a drop in energy prices.

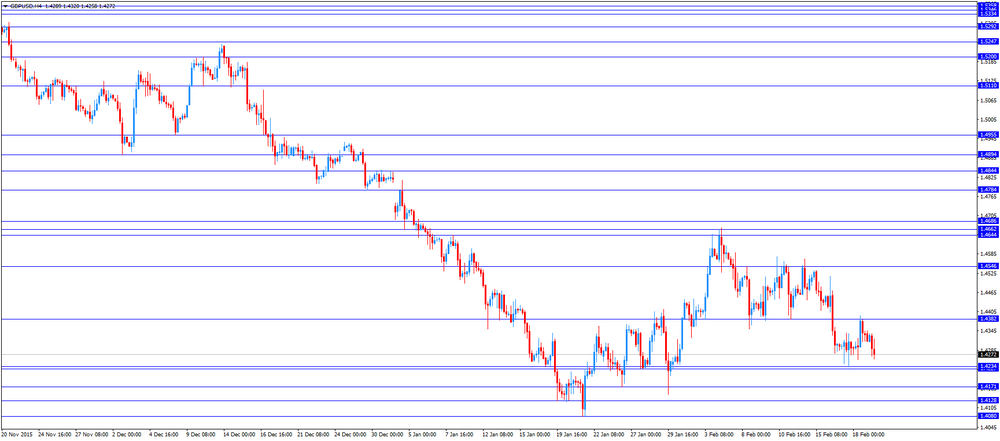

The British pound traded lower against the U.S. dollar despite the better-than-expected U.K. retail sales data. The Office for National Statistics released its retail sales data for the U.K. on Friday. Retail sales in the U.K. climbed 2.3% in January, exceeding expectations for a 0.8% gain, after a 1.4% drop in December. December's figure was revised down from a 1.0% decrease.

The increase was driven by lower demand for clothing and computer.

On a yearly basis, retail sales in the U.K. jumped 5.2% in January, beating forecasts of 3.6% increase, after a 2.3% rise in December. December's figure was revised down from a 2.6% gain.

Public sector net borrowing excluding banks rose to £11.2 billion in January from £10.2 billion in January last year. It was the biggest surplus since 2008.

The increase was driven by the high level of tax receipts.

The Canadian dollar traded lower against the U.S. dollar ahead of the release of the Canadian economic data. The consumer price index in Canada is expected to climb 1.7% year-on-year in January from 1.6% in December.

The core consumer price index in Canada is expected to remain unchanged at 1.9% year-on-year in January.

Canadian retail sales are expected to decrease 0.6% in December, after a 1.7% rise in November.

EUR/USD: the currency pair decreased to $1.1076

GBP/USD: the currency pair fell to $1.4258

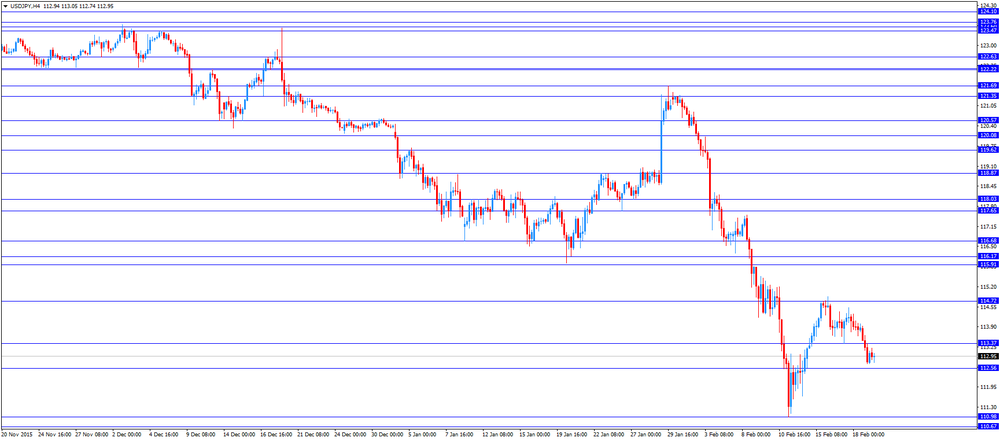

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:30 Canada Retail Sales, m/m December 1.7% -0.6%

13:30 Canada Retail Sales YoY December 3.2%

13:30 Canada Retail Sales ex Autos, m/m December 1.1% -0.5%

13:30 Canada Consumer Price Index m / m January -0.5% -0.1%

13:30 Canada Consumer price index, y/y January 1.6% 1.7%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y January 1.9% 1.9%

13:30 U.S. CPI, m/m January -0.1% -0.1%

13:30 U.S. CPI, Y/Y January 0.7% 1.3%

13:30 U.S. CPI excluding food and energy, m/m January 0.2% 0.2%

13:30 U.S. CPI excluding food and energy, Y/Y January 2.1% 2.1%

15:00 Eurozone Consumer Confidence (Preliminary) February -6.3 -6.7

-

14:00

Orders

EUR/USD

Offers 1.1135 1.1150 1.1165 1.1185 1.1200 1.1220 1.1235 1.1250

Bids 1.1100 1.1080 1.1065 1.1050 1.1030 1.1000 1.0985 1.0965 1.0950

GBP/USD

Offers 1.4325 1.4350 1.4365 1.4385 1.4400 1.4420 1.4435-40 1.4460

Bids 1.4280-85 1.4250-55 1.4230 1.4200 1.4185 1.4150

EUR/JPY

Offers 126.00 126.30 126.50 126.80 127.00 127.25 127.50

Bids 125.30 125.00 124.80 124.50 124.00

EUR/GBP

Offers 0.7780 0.7800 0.7820-25 0.7850-55 0.7875 0.7884 0.7900

Bids 0.7750 0.7730 0.7700 0.7680 0.7665 0.7650

USD/JPY

Offers 113.25 113.40 113.65 113.85 114.00 114.20-25 114.50 114.75-80 115.00

Bids 112.75-80 112.50 112.20 112.00 111.85 111.50

AUD/USD

Offers 0.7130 0.7150 0.7165 0.7180-85 0.7200 0.7220 0.7235 0.7250

Bids 0.7100 0.7080 0.7065 0.7050 0.7030 0.7000 0.6980 0.6950

-

12:04

Public sector net borrowing in the U.K. rises to £11.2 billion in January

The Office for National Statistics released public sector net borrowing for the U.K. on Friday. Public sector net borrowing excluding banks rose to £11.2 billion in January from £10.2 billion in January last year. It was the biggest surplus since 2008.

The increase was driven by the high level of tax receipts.

The debt-to-gross domestic product ratio declined to 82.8% in January, the first annual decline since September 2002.

-

11:54

Japan’s all industry activity index slides 0.9% in December

Japan's Ministry of Economy, Trade and Industry (METI) released its all industry activity index on Friday. The index slid 0.9% in December, missing expectations for a 0.3% fall, after a 1.1% drop in November. November's figure was revised down from a 1.0% decrease.

Construction industry activity index dropped 2.1% in December, industrial production index fell 1.7%, while tertiary industry activity declined 0.6%.

-

11:50

Greece’s current account narrows to €0.78 billion in December

The Bank of Greece released its current account data on Friday. Greece's current account deficit fell to €0.78 billion in December from €1.87 billion in December last year.

The Greek deficit on trade in goods declined to €1.49 billion in December from €2.04 billion in December last year, while the services surplus fell to €348 million from €521 million.

The primary income deficit turned into a surplus of €323 million in December from a deficit of €42 million in December last year, while the deficit on secondary income turned into a surplus of €43.5 million from a deficit of €309.5 million last year.

The capital account surplus decreased to €136.7 million in December from 245.3 million last year.

-

11:34

German producer prices drop 0.7% in January

Destatis released its producer price index (PPI) for Germany on Friday. German PPI producer prices declined 0.7% in January, missing expectations for a 0.3% fall, after a 0.5% drop in December.

On a yearly basis, German PPI dropped 2.4% in January, missing expectations for a 2.0% decrease, after a 2.3% fall in December.

PPI excluding energy sector fell by 0.6% year-on-year in January.

Energy prices were down 7.3% year-on-year in January.

Consumer non-durable goods prices rose 0.6% year-on-year in January, intermediate goods sector prices decreased by 2.2%, while capital goods prices increased 0.6% and durable consumer goods sector prices gained 1.4%.

-

11:29

UK retail sales climb 2.3% in January

The Office for National Statistics released its retail sales data for the U.K. on Friday. Retail sales in the U.K. climbed 2.3% in January, exceeding expectations for a 0.8% gain, after a 1.4% drop in December. December's figure was revised down from a 1.0% decrease.

The increase was driven by lower demand for clothing and computer.

On a yearly basis, retail sales in the U.K. jumped 5.2% in January, beating forecasts of 3.6% increase, after a 2.3% rise in December. December's figure was revised down from a 2.6% gain.

-

11:14

Reserve Bank of Australia board member John Edwards: the Australian dollar was still too high

The Reserve Bank of Australia (RBA) board member John Edwards said on Friday that the Australian dollar was still too high.

"I guess I would say I still think it is a bit too high. If it was driven entirely by commodity prices, it certainly should be lower," he said, adding that he would be more comfortable if the Australian dollar was trading at around $0.65.

Edwards pointed out that if major central banks keep their negative interest rates, the Australian dollar could rise.

His comments could mean that the central bank is likely to ease its monetary policy further.

-

11:04

The number of new and renewal claims for unemployment insurance benefits increases 3.4% in December

Statistics Canada released its number of new and renewal claims for unemployment insurance benefits on Thursday. The number of new and renewal claims for unemployment insurance benefits increased 3.4% in December.

On a yearly basis, the number of new and renewal claims for unemployment insurance benefits climbed 7.8% in December.

The number of people receiving regular jobless benefits fell 0.5% in December.

On a yearly basis, the total number of people receiving jobless benefits jumped 7.3%.

-

10:51

French President Francois Hollande: a deal between the European Union and the U.K. is "possible"

French President Francois Hollande said on Thursday that a deal between the European Union (EU) and the U.K. was "possible".

"A deal is possible if certain conditions are met. A deal is possible because it is necessary that Britain should remain in the EU," he said.

"But no country can have the right to a veto, no country can withdraw from the common rules... otherwise another country will demand exceptions," Hollande added.

-

10:40

Moody’s: the downside risks to the global economy increased

The rating agency Moody's said on Thursday that the downside risks to the global economy increased as the slowdown in the Chinese economy, lower commodity prices and tighter financing conditions in some countries weigh on the global economy. The G20 economies are expected to expand 2.6% in 2016 and 2.9% in 2017.

The Chinese economy is expected to grow 6.3% in 2016 and 6.1% in 2017. "China's slowdown will be concentrated in heavy industry sectors that are significant importers," Marie Diron, a Moody's Senior Vice President, said.

The U.S. GDP growth is expected to be 2.3% in 2016 and 2.5% in 2017. Moody's noted that the Fed will continue to raise its interest rate gradually, with the Fed's interest rate at around 1.75% by the end of 2017.

Japan's economy is expected to expand below 1% in 2016 and 2017. The agency noted that the Bank of Japan's (BoJ) 2% inflation target will remain elusive.

-

10:30

United Kingdom: Retail Sales (MoM), January 2.3% (forecast 0.8%)

-

10:30

United Kingdom: PSNB, bln, January -11.81 (forecast 13.95)

-

10:30

United Kingdom: Retail Sales (YoY) , January 5.2% (forecast 3.6%)

-

10:21

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy decline to 42.5 in February

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy decreased to 42.5 in February from 47.0 in January. January's reading was the highest level since June 2015.

The decline was driven by a less favourable assessment of the measure of views of the economy.

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy fell to 44.3 in in the week ended February 14 from 44.5 the prior week.

The weekly drop was driven by declines in all sub-indexes. The measure of views of the economy declined to 35.4 from 35.5, the buying climate index was down to 41.6 from 41.9, while the personal finances index fell to 55.8 from 56.1.

-

10:07

San Francisco Fed President John Williams: the U.S. economic growth remained strong

San Francisco Fed President John Williams said in a speech on Thursday that the U.S. economic growth remained strong.

"If we look at the domestic market in isolation, it shows strong growth. We're just contending with outside forces," he said.

Williams added that the effect of falling oil prices and a stronger U.S. dollar will dissipate.

San Francisco Fed president expects the inflation in the U.S. to rise toward the 2% target "over the next two years".

He also said that he was not concerned about the slowdown in the Chinese economy.

Williams pointed out that further interest rate hikes will be gradual and will depend on the incoming economic data.

-

08:22

Options levels on friday, February 19, 2016:

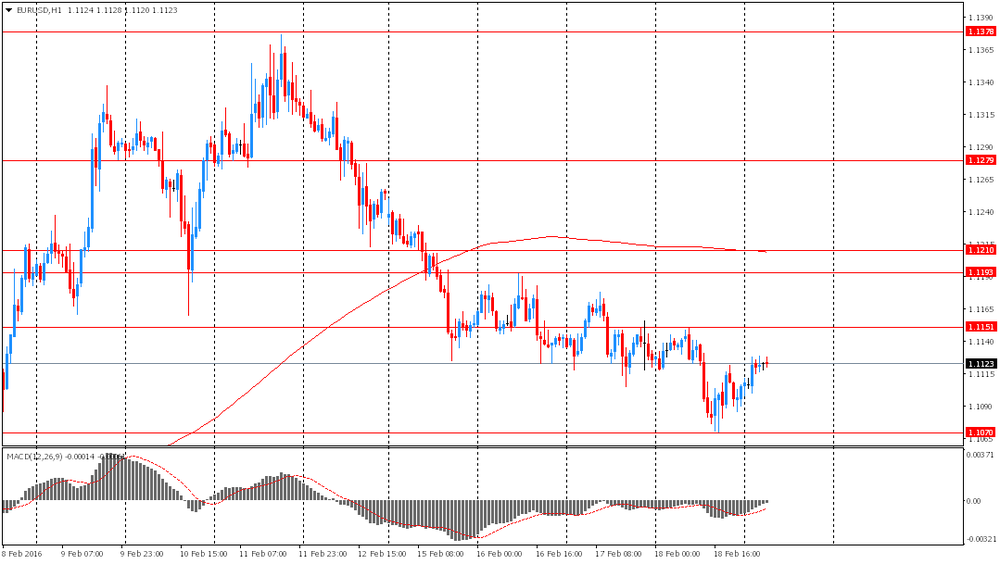

EUR / USD

Resistance levels (open interest**, contracts)

$1.1252 (5094)

$1.1193 (3103)

$1.1152 (5217)

Price at time of writing this review: $1.1118

Support levels (open interest**, contracts):

$1.1052 (2815)

$1.1010 (5165)

$1.0951 (9279)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 64762 contracts, with the maximum number of contracts with strike price $1,1000 (5217);

- Overall open interest on the PUT options with the expiration date March, 4 is 91692 contracts, with the maximum number of contracts with strike price $1,1000 (9279);

- The ratio of PUT/CALL was 1.42 versus 1.44 from the previous trading day according to data from February, 18

GBP/USD

Resistance levels (open interest**, contracts)

$1.4604 (1233)

$1.4506 (1289)

$1.4409 (705)

Price at time of writing this review: $1.4321

Support levels (open interest**, contracts):

$1.4288 (1999)

$1.4192 (2064)

$1.4095 (1409)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 26972 contracts, with the maximum number of contracts with strike price $1,4650 (1643);

- Overall open interest on the PUT options with the expiration date March, 4 is 25377 contracts, with the maximum number of contracts with strike price $1,4350 (2928);

- The ratio of PUT/CALL was 0.94 versus 0.95 from the previous trading day according to data from February, 18

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:00

Germany: Producer Price Index (MoM), January -0.7% (forecast -0.3%)

-

08:00

Germany: Producer Price Index (YoY), January -2.4% (forecast -2%)

-

07:54

Foreign exchange market. Asian session: the yen rose

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

04:30 Japan All Industry Activity Index, m/m December -1.0% -0.3% -0.9%

The euro climbed ahead of consumer confidence data due later today. Analysts expect the index to come in at -6.7 points in February compared to -6.3 in the previous month. The survey is based on answers from about 2,300 respondents from all euro zone states.

The yen rose against most major currencies amid greater safe-haven demand. Lower oil prices and a selloff in Japanese stocks persuaded investors to secure their funds and turn to the yen.

The Australian dollar fell after Reserve Bank of Australia Board member John Edwards said the national currency was "a bit too high". According to the Wall Street Journal, the policymaker also said he would be more comfortable with a level around 65 U.S. cents, though he's not sure the AUD would drop so much. The Australian economy depends on exports and a stronger national currency could undermine exporters' interests.

EUR/USD: the pair rose to $1.1130 in Asian trade

USD/JPY: the pair fell to Y112.70

GBP/USD: the pair traded within $1.4310-40

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 Germany Producer Price Index (MoM) January -0.5% -0.3%

07:00 Germany Producer Price Index (YoY) January -2.3% -2%

09:30 United Kingdom PSNB, bln January -6.87 13.95

09:30 United Kingdom Retail Sales (MoM) January -1% 0.8%

09:30 United Kingdom Retail Sales (YoY) January 2.6% 3.6%

13:00 U.S. FOMC Member Mester Speaks

13:30 Canada Retail Sales, m/m December 1.7% -0.6%

13:30 Canada Retail Sales YoY December 3.2%

13:30 Canada Retail Sales ex Autos, m/m December 1.1% -0.5%

13:30 Canada Consumer Price Index m / m January -0.5% -0.1%

13:30 Canada Consumer price index, y/y January 1.6% 1.7%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y January 1.9% 1.9%

13:30 U.S. CPI, m/m January -0.1% -0.1%

13:30 U.S. CPI, Y/Y January 0.7% 1.3%

13:30 U.S. CPI excluding food and energy, m/m January 0.2% 0.2%

13:30 U.S. CPI excluding food and energy, Y/Y January 2.1% 2.1%

15:00 Eurozone Consumer Confidence (Preliminary) February -6.3 -6.7

-

05:31

Japan: All Industry Activity Index, m/m, December -0.9% (forecast -0.3%)

-

01:00

Currencies. Daily history for Feb 18’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1105 -0,19%

GBP/USD $1,4334 +0,29%

USD/CHF Chf0,9928 +0,06%

USD/JPY Y113,23 -0,76%

EUR/JPY Y125,77 -0,92%

GBP/JPY Y162,31 -0,44%

AUD/USD $0,7155 -0,38%

NZD/USD $0,6642 +0,15%

USD/CAD C$1,3725 +0,40%

-

00:00

Schedule for today, Thursday, Feb 19,8’2016:

(time / country / index / period / previous value / forecast)

04:30 Japan All Industry Activity Index, m/m December -1.0% -0.3%

07:00 Germany Producer Price Index (MoM) January -0.5% -0.3%

07:00 Germany Producer Price Index (YoY) January -2.3% -2%

09:30 United Kingdom PSNB, bln January -6.87 13.95

09:30 United Kingdom Retail Sales (MoM) January -1% 0.8%

09:30 United Kingdom Retail Sales (YoY) January 2.6% 3.6%

13:00 U.S. FOMC Member Mester Speaks

13:30 Canada Retail Sales, m/m December 1.7% -0.6%

13:30 Canada Retail Sales YoY December 3.2%

13:30 Canada Retail Sales ex Autos, m/m December 1.1% -0.5%

13:30 Canada Consumer Price Index m / m January -0.5% -0.1%

13:30 Canada Consumer price index, y/y January 1.6% 1.7%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y January 1.9% 1.9%

13:30 U.S. CPI, m/m January -0.1% -0.1%

13:30 U.S. CPI, Y/Y January 0.7% 1.3%

13:30 U.S. CPI excluding food and energy, m/m January 0.2% 0.2%

13:30 U.S. CPI excluding food and energy, Y/Y January 2.1% 2.1%

15:00 Eurozone Consumer Confidence (Preliminary) February -6.3 -6.7

-