Noticias del mercado

-

18:00

New Zealand’s producer price inflation slides in the fourth quarter

Statistics New Zealand released its output and input producer price index (PPI) data on the late Wednesday evening. New Zealand's input PPI slid 1.2% in the fourth quarter, after a 1.6% growth in the third quarter.

Output PPI fell 0.8% in the fourth quarter, after a 1.3% rise in the third quarter.

Prices received by dairy product manufacturers dropped 10% in the fourth quarter, prices received by petroleum and coal product manufacturers plunged 10%, while prices for purchasing capital goods increased 0.6%.

Prices paid by dairy product manufacturers fell 7.1% in the fourth quarter, while prices paid by petroleum and coal product manufacturers slid 22%.

-

17:23

ECB Monetary Policy Meeting Account: downside risks to the outlook increased

The European Central Bank's (ECB) its minutes of January meeting on Thursday. The minutes showed that downside risks to the outlook increased.

"Downside risks had increased again since the beginning of the current year, amid heightened uncertainty about the growth prospects of emerging market economies, volatility in financial markets and geopolitical risks," the ECB said.

"Weaker than anticipated growth in wages, in conjunction with declining inflation expectations, could also signal increased risks of second-round effects," the central bank noted.

According to the minutes, inflation in the Eurozone remained low due to further decline in oil prices.

The ECB kept its interest rate unchanged at 0.05% in January, but said that it will review its quantitative easing in March.

-

17:00

U.S.: Crude Oil Inventories, February 2.147 (forecast 4.0)

-

16:12

U.S. leading economic index falls 0.2% in January

The Conference Board released its leading economic index (LEI) for the U.S. on Thursday. The leading economic index fell 0.2% in January, missing expectations for a 0.2% decrease, after a 0.3% decline in December. December's figure was revised down from a 0.2% fall.

The coincident economic index rose 0.3% in January, after a 0.1% gain in December.

"The U.S. LEI fell slightly in January, driven primarily by large declines in stock prices and further weakness in initial claims for unemployment insurance. Despite back-to-back monthly declines, the index doesn't signal a significant increase in the risk of recession, and its six-month growth rate remains consistent with a modest economic expansion through early 2016," director of business cycles and growth research at The Conference Board, Ataman Ozyildirim, said.

-

16:00

U.S.: Leading Indicators , January -0.2% (forecast -0.2%)

-

15:49

Spain’s trade deficit narrows to €1.79 billion in December

Spain's Economy Ministry released its trade data on Thursday. The trade deficit narrowed to €1.79 billion in December from €1.82 billion in November a year ago.

Exports rose at an annual rate of 4.1% in December, while imports climbed 3.7%.

In 2015 as whole, the trade deficit totalled €24.17 billion, down 1.2% from last year. It was the second lowest reading since 1998.

Exports increased 4.3% in 2015, while imports gained 3.7%.

-

15:36

The European Central Bank lowers the amount of emergency funding (ELA) to Greek banks by €0.1 billion

According to the Bank of Greece on Thursday, the European Central Bank (ECB) lowered the amount of emergency funding (ELA) to Greek banks by €0.1 billion to €71.4 billion.

"The reduction of €0.1 billion in the ceiling reflects an improvement of the liquidity situation of Greek banks, amid a reduction of uncertainty and the stabilization of private sector deposits flows," the Bank of Greece said in its statement.

-

15:02

Philadelphia Federal Reserve Bank’s manufacturing index climbs to -2.8 in February

The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index climbed to -2.8 in February from -3.5 in January, exceeding expectations for an increase to -3.0.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

"Firms responding to the Manufacturing Business Outlook Survey reported continued weakness in business conditions this month. The indicator for general activity remained slightly negative this month, edging up only marginally from its reading in January," the Philadelphia Federal Reserve Bank said in its survey.

The shipments index was down to 2.5 in February from 9.6 in January.

The new orders index decreased to -5.3 in February from -1.4 in January.

The prices paid index fell to -2.2 in February from -1.1 in January, while the prices received index slid to -4.5 from -2.8.

The number of employees index dropped to -5.0 in February from -1.9 in January.

According to the report, the future general activity index slid to 17.3 in February from 19.1 in January.

-

14:50

Canada’s wholesale sales climb 2.0% in December

Statistics Canada released wholesale sales figures on Thursday. Wholesale sales climbed 2.0% in December, exceeding expectations for a 0.2% gain, after a 1.9% rise in November. November's figure was revised up from a 1.8% increase.

The increase was mainly driven by higher sales in the motor vehicle and parts subsectors.

Sales of motor vehicle and parts were up 10.6% in December, while sales in the food, beverage and tobacco subsector rose 1.3%.

Sales in the building material and supplies subsector climbed 1.0% in December.

Inventories fell by 0.1% in December.

-

14:50

Option expiries for today's 10:00 ET NY cut

USD/JPY: 112.50 (USD 261m) 114.40-45 (470m) 115.00 555m)

EUR/USD:1.0895-1.0905 (EUR 1.06bln) 1.0915 (295m) 1.1000 (227m) 1.1050 (200m) 1.1100 (1.02bln) 1.1110 (302m) 1.1130-35 (1bln) 1.1150 (343m) 1.1200 (889m) 1.1250 (935m) 1.1300 (360m) 1.1400 (1.27bln) 1.1450 (821m)

GBP/USD: 1.4220 (GBP 232m) 1.4250 ( 174m)

EUR/GBP: 0.7620 (EUR 297m) 0.7710 (202m) 0.7735 (356m)

USD/CHF: 0.9910 (USD 336m)

AUD/USD: 0.6975 (AUD 294m) 0.7100 (191m) 0.7120 (1.13bln) 0.7150 (684m) 0.7160 (365m) 0.7250 739m) 0.7264 (550m)

USD/CAD: 1.3800 (USD 1.19bln) 1.3945 (USD 745m) 1.4000 (480m) 1.4100 (830m)

EUR/JPY: 127.00 (EUR 200m)

AUD/JPY: 81.60 (AUD 382m)

USD/CNY 6.3000 (USD 2.75bln)

-

14:43

Initial jobless claims decline to 262,000 in the week ending February 13

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending February 13 in the U.S. declined by 7,000 to 262,000 from 269,000 in the previous week.

Analysts had expected jobless claims to rise to 275,000.

Jobless claims remained below 300,000 the 50th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims climbed by 30,000 to 2,273,000 in the week ended February 06.

-

14:31

U.S.: Philadelphia Fed Manufacturing Survey, February -2.8 (forecast -3)

-

14:30

Canada: Wholesale Sales, m/m, December 2.0% (forecast 0.2%)

-

14:30

U.S.: Initial Jobless Claims, February 262 (forecast 275)

-

14:30

U.S.: Continuing Jobless Claims, February 2273 (forecast 2250)

-

14:21

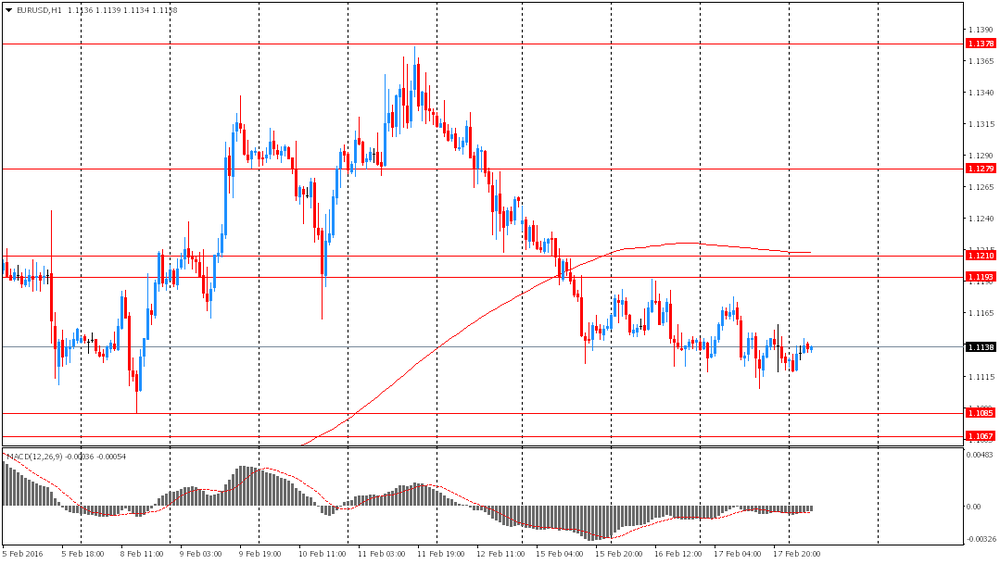

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the European Central Bank's (ECB) minutes

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Unemployment rate January 5.8% 5.8% 6.0%

00:30 Australia Changing the number of employed January -0.8 Revised From -1.0 15 -7.9

01:30 China PPI y/y January -5.9% -5.4% -5.3%

01:30 China CPI y/y January 1.6% 1.9% 1.8%

07:00 Switzerland Trade Balance January 2.59 Revised From 2.54 2.67 3.513

09:00 Eurozone Current account, unadjusted, bln December 30.3 Revised From 29.8 41.4

12:30 Eurozone ECB Monetary Policy Meeting Accounts

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. The number of initial jobless claims in the U.S. is expected to rise by 6,000 to 275,000 last week.

The Philadelphia Federal Reserve Bank' manufacturing index is expected to increase to -3 in February from -3.5 in January.

The euro traded lower against the U.S. dollar after the release of the European Central Bank's (ECB) minutes. The minutes showed that downside risks to the outlook increased.

The ECB kept its interest rate unchanged at 0.05% in January, but said that it will review its quantitative easing in March.

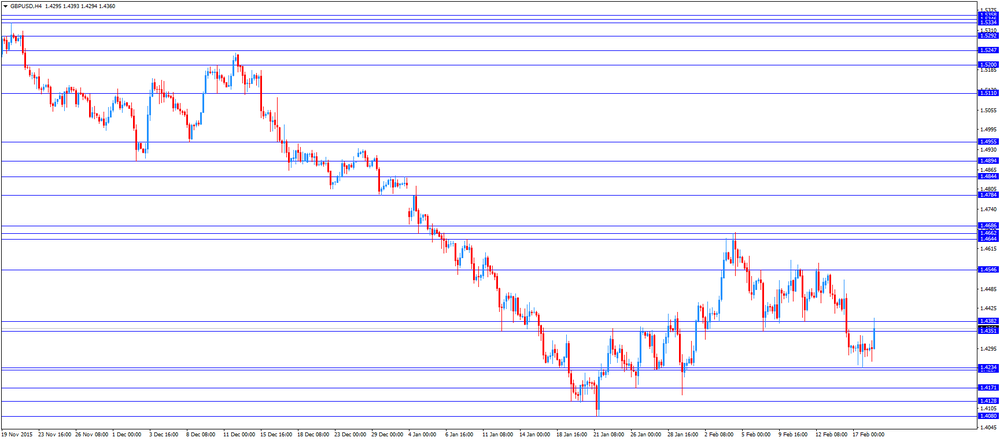

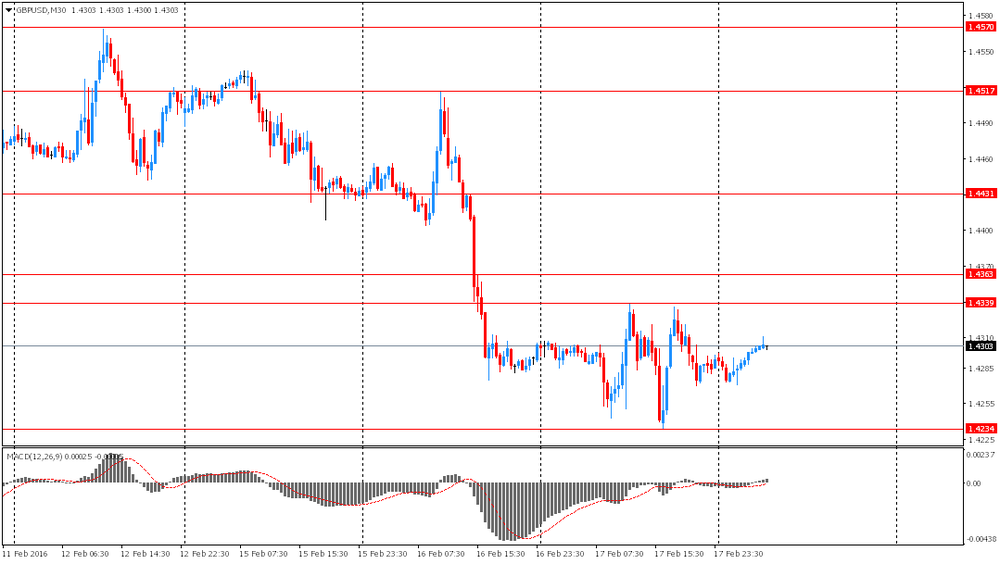

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded mixed against the U.S. dollar ahead of the release of the Canadian economic data. Wholesales sales in Canada are expected to increase 0.2% in December, after a 1.8% rise in November.

The Swiss franc traded lower against the U.S. dollar. The Swiss Federal Customs Administration released its trade data on Thursday. The Swiss trade surplus widened to CHF3.51 billion in January from CHF2.59 billion in the previous month. December's figure was revised up from a surplus of CHF2.54 billion. Exports dropped 3.9% year-on-year in January, while imports were down 5.0%.

EUR/USD: the currency pair decreased to $1.1077

GBP/USD: the currency pair rose to $1.4393

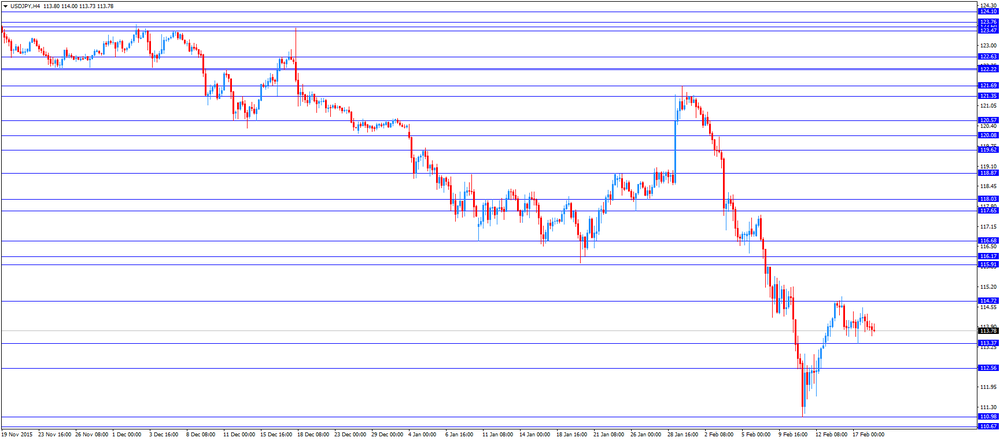

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:30 Canada Wholesale Sales, m/m December 1.8% 0.2%

13:30 U.S. Initial Jobless Claims February 269 275

13:30 U.S. Philadelphia Fed Manufacturing Survey February -3.5 -3

15:00 U.S. Leading Indicators January -0.2% -0.2%

16:00 U.S. Crude Oil Inventories February -0.754 4.0

-

14:00

Orders

EUR/USD

Offers 1.1150 1.1165 1.1185 1.1200 1.1220 1.1235 1.1250 1.1265 1.1285 1.1300

Bids 1.1120-25 1.1100 1.1080 1.1065 1.1050 1.1030 1.1000 1.0985 1.0965 1.0950

GBP/USD

Offers 1.4300 1.4325-30 1.4350 1.4365 1.4385 1.4400 1.4420 1.4435-40 1.4460 1.4480 1.4500

Bids 1.4250-55 1.4230 1.4200 1.4185 1.4150 1.4125-30 1.4100 1.4080-85 1.4050

EUR/JPY

Offers 126.80 127.00 127.25 127.50 127.80 128.00 128.30 128.50

Bids 126.50 126.20 126.00 125.80 125.50 125.00 124.80 124.50

EUR/GBP

Offers 0.7825-30 0.7850-55 0.7875 0.7884 0.7900 0.7930 0.7950

Bids 0.7775-80 0.7755-60 0.7730 0.7700 0.7680 0.7665 0.7650

USD/JPY

Offers 114.00 114.20-25 114.50 114.75-80 115.00 115.25 115.50

Bids 113.75 113.60 113.50 113.30 113.00 112.85 112.50 112.20 112.00

AUD/USD

Offers 0.7150 0.7165 0.7180-85 0.7200 0.7220 0.7235 0.7250

Bids 0.7100 0.7080 0.7065 0.7050 0.7030 0.7000 0.6980 0.6950

-

12:07

Italy’s current account surplus climbs to €6.14 billion in December

The Bank of Italy released its current account on Thursday. Italy's current account surplus increased to €6.14 billion in December from €4.4 billion in November.

The trade surplus rose to €7.2 billion in December from €6.2 billion in November.

The deficit on services decreased to €274 million in December from €350 million in November.

The primary income surplus fell to €661 million in December from €1.9 billion in November, while the secondary income deficit declined to €1.5 billion from €1.7 billion.

In 2015 as whole, current account surplus €34.9 billion.

-

12:02

French final consumer price inflation drops 1.0% in January

The French statistical office Insee released its final consumer price inflation for France on Thursday. The French consumer price inflation dropped 1.0% in January, in line with the preliminary reading, after a 0.2% increase in December.

On a yearly basis, the consumer price index increased 0.2% in January, in line with the preliminary reading, after a 0.2% rise in December.

Fresh food prices rose 0.4% year-on-year in January, services prices climbed by 1.1%, while petroleum products prices dropped by 7.4%.

-

11:57

Swiss trade surplus rises to CHF3.51 billion in January

The Swiss Federal Customs Administration released its trade data on Thursday. The Swiss trade surplus widened to CHF3.51 billion in January from CHF2.59 billion in the previous month. December's figure was revised up from a surplus of CHF2.54 billion.

Exports dropped 3.9% year-on-year in January, while imports were down 5.0%.

On a monthly basis, exports slid 1.1% in January, while imports increased 2.5%.

-

11:50

OECD downgrades its global growth outlook

The Organization for Economic Cooperation and Development (OECD) released its growth forecast on Thursday. The OECD downgraded its global growth outlook.

"Global growth prospects have practically flat-lined, recent data have disappointed and indicators point to slower growth in major economies, despite the boost from low oil prices and low interest rates," OECD Chief Economist Catherine L. Mann.

"Given the significant downside risks posed by financial sector volatility and emerging market debt, a stronger collective policy approach is urgently needed, focusing on a greater use of fiscal and pro-growth structural policies, to strengthen growth and reduce financial risks," she added.

The OECD expect the global economy to grow 3.0% in 2016, down from the previous estimate of 3.3%, and at 3.3% in 2017, down from the previous estimate of 3.6%.

The U.S. economy is expected to expand 2.0% in 2016 and 2.2% in 2017, down from the previous estimate of 2.5% and 2.4%, respectively.

Japan's economy is expected to grow 0.8% in 2016, down from its previous estimate of 1.0%, and 0.6% for 2017, up from the previous estimate of 0.5%.

Eurozone's forecasts were downgraded to 1.4% in 2016 from the previous estimate of 1.8% and to 1.7% in 2017 from the previous estimate of 1.9%.

China's growth forecast for 2016 remained unchanged at 6.5%, while 2017 forecast remained unchanged at 6.2%.

-

11:39

Eurozone’s current account surplus falls to a seasonally adjusted €25.5 billion in December

The European Central Bank (ECB) released its current account on Thursday. Eurozone's current account surplus declined to a seasonally adjusted €25.5 billion in December from €26.9 billion in November. November's figure was revised up from a surplus of €26.4 billion.

The trade surplus fell to €26.5 billion in December from €27.5 billion in November.

The surplus on services decreased to €4.6 billion in December from €6.0 billion in November.

The primary income surplus climbed to €5.5 billion in December from €4.5 billion in November, while the secondary income deficit rose to €11.2 billion from €11.0 billion.

Eurozone's unadjusted current account surplus rose to €41.4 billion in December from €30.3 billion in November. November's figure was revised up from a surplus of €29.8 billion.

In 2015 as whole, current account surplus €314.0 billion or 3% of GDP.

-

11:20

Chinese consumer price index rises at annual rate of 1.8% in January

The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Thursday. The Chinese consumer price index (CPI) rose at annual rate of 1.8% in January, in missing expectations for a 1.9% increase, after a 1.6% gain in December.

Food prices rose at an annual rate of 4.1% in January, while non-food prices increased 1.2%.

On a monthly basis, consumer price inflation increased 0.5% in January, after a 0.5% rise in December.

The Chinese producer price index (PPI) dropped 5.3% in January, beating expectations for a 5.4% fall, after a 5.9% decline in December.

-

11:13

Australia's unemployment rate rises to 6.0% in January

The Australian Bureau of Statistics released its labour market data on Thursday. Australia's unemployment rate rose to 6.0% in January from 5.8% in December. Analysts had expected the unemployment rate to remain unchanged at 5.8%.

The number of employed people in Australia fell by 7,900 in January, missing forecast of a rise by 15,000, after a decline by 800 in December. December's figure was revised up from a fall by 1,000.

Full-time employment slid by 40,600 in January, while part-time employment climbed by 32,700.

The participation rate remained unchanged at 65.2% in January.

-

11:00

Japan's trade surplus turns into a deficit of ¥140.3 billion in January

The Ministry of Finance released its trade data for Japan on the late Wednesday evening. Japan's trade deficit turned into a deficit of ¥645.9 billion in January from a surplus of ¥140.0 billion in December.

Analysts had expected a deficit of ¥680.2 billion.

Exports fell 12.9% year-on-year in January, while imports dropped 18.0%.

Exports to Asia declined by 17.8% year-on-year in January, exports to the United States decreased by 5.3%, while exports to the European Union fell by 3.6%.

Imports from Asia plunged by 12.0% year-on-year in January, imports from the United States declined by 9.7%, while imports from the European Union climbed by 6.0%.

-

10:47

Bank of Japan Governor Haruhiko Kuroda: the central bank’s negative rates were not directly aimed to weaken the currency

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said on Thursday that the central bank's negative rates were not directly aimed to weaken the currency.

"Central banks of big economies don't target currency rates in guiding policy," he said.

Kuroda pointed out that negative rates would be positive for the economy and prices.

He noted that developments abroad such the slowdown in the Chinese economy and falling oil prices supported the demand for safe-haven yen.

-

10:41

Option expiries for today's 10:00 ET NY cut

USD/JPY: 112.50 (USD 261m) 114.40-45 (470m) 115.00 555m)

EUR/USD:1.0895-1.0905 (EUR 1.06bln) 1.0915 (295m) 1.1000 (227m) 1.1050 (200m) 1.1100 (1.02bln) 1.1110 (302m) 1.1130-35 (1bln) 1.1150 (343m) 1.1200 (889m) 1.1250 (935m) 1.1300 (360m) 1.1400 (1.27bln) 1.1450 (821m)

GBP/USD: 1.4220 (GBP 232m) 1.4250 ( 174m)

EUR/GBP: 0.7620 (EUR 297m) 0.7710 (202m) 0.7735 (356m)

USD/CHF: 0.9910 (USD 336m)

AUD/USD: 0.6975 (AUD 294m) 0.7100 (191m) 0.7120 (1.13bln) 0.7150 (684m) 0.7160 (365m) 0.7250 739m) 0.7264 (550m)

USD/CAD: 1.3800 (USD 1.19bln) 1.3945 (USD 745m) 1.4000 (480m) 1.4100 (830m)

EUR/JPY: 127.00 (EUR 200m)

AUD/JPY: 81.60 (AUD 382m)

USD/CNY 6.3000 (USD 2.75bln) -

10:33

St. Louis Fed President James Bullard: the Fed should delay its further interest rate hikes

St. Louis Fed President James Bullard said in a speech on Wednesday that the Fed should delay its further interest rate hikes due to recent turmoil in financial markets and low inflation.

"I regard it as unwise to continue a normalization strategy in an environment of declining market-based inflation expectations," he said.

Bullard noted that he expected a stronger U.S. economic growth and further improvement in the labour market.

Bullard is a voting member of the Federal Open Market Committee (FOMC) this year.

-

10:10

Fed’s January monetary policy meeting minutes: Fed could change its path of interest rate hikes

The Fed released its January monetary policy meeting minutes on Wednesday. The Fed kept its interest rate unchanged in January. Fed officials expressed concerns about global financial conditions and considered to change the number of interest rate hikes this year.

"Members observed that if the recent tightening of global financial conditions was sustained, it could be a factor amplifying downside risks," the minutes said.

According to the minutes, downside risks from low oil energy prices to the outlook are increased.

The Fed noted that it will closely monitor global economic and financial developments.

Some Fed officials expressed concerns that the slowdown in the Chinese economy would have a negative impact on the U.S. economy.

-

10:00

Eurozone: Current account, unadjusted, bln , December 41.4

-

08:21

Options levels on Thursday, February 18, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1274 (4425)

$1.1223 (3046)

$1.1188 (5146)

Price at time of writing this review: $1.1141

Support levels (open interest**, contracts):

$1.1104 (1506)

$1.1072 (3554)

$1.1023 (5091)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 63318 contracts, with the maximum number of contracts with strike price $1,1000 (5146);

- Overall open interest on the PUT options with the expiration date March, 4 is 91281 contracts, with the maximum number of contracts with strike price $1,1000 (8148);

- The ratio of PUT/CALL was 1.44 versus 1.42 from the previous trading day according to data from February, 17

GBP/USD

Resistance levels (open interest**, contracts)

$1.4604 (1247)

$1.4506 (1246)

$1.4409 (705)

Price at time of writing this review: $1.4288

Support levels (open interest**, contracts):

$1.4190 (2087)

$1.4093 (1290)

$1.3996 (1713)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 26539 contracts, with the maximum number of contracts with strike price $1,4650 (1644);

- Overall open interest on the PUT options with the expiration date March, 4 is 25164 contracts, with the maximum number of contracts with strike price $1,4350 (2932);

- The ratio of PUT/CALL was 0.95 versus 0.95 from the previous trading day according to data from February, 17

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:01

Switzerland: Trade Balance, January 3.513 (forecast 2.67)

-

07:50

Foreign exchange market. Asian session: the yen climbed

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Unemployment rate January 5.8% 5.8% 6.0%

00:30 Australia Changing the number of employed January -0.8 Revised From -1.0 15 -7.9

01:30 China PPI y/y January -5.9% -5.4% -5.3%

01:30 China CPI y/y January 1.6% 1.9% 1.8%

This session's key event was the release of China inflation data. The consumer price index rose by 1.8% y/y in January missing expectations for a 1.9% rise. Nevertheless the index picked up pace compared to a reading of 1.6% last December. Meanwhile the producer price index fell by 5.3% y/y marking the 47th month of declines.

The yen climbed against the U.S. dollar on Japanese trade balance data. According to the Ministry of Finance, Japanese trade deficit came in at ¥-645.9 billion in January vs ¥-680 billion expected. Exports fell by 12.9% after an 8.0% decline in December. This was the fourth straight month of declines in exports. Shipping to China fell by 17.5% after an 8.6% drop in December. Imports fell by 18.0% extending the period of declines to 13 months.

The Australian dollar fell amid weak domestic employment data. The unemployment rate rose to 6.0% in January from 5.8% reported previously. The number of employed fell by 7,900, while economists had expected an increase of 15,000. Full time employment fell by 40,600, outweighing a 32,700 increase in part time employment.

EUR/USD: the pair fluctuated within $1.1115-45 in Asian trade

USD/JPY: the pair traded within Y113.80-30

GBP/USD: the pair traded within $1.4270-10

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 Switzerland Trade Balance January 2.54 2.67

09:00 Eurozone Current account, unadjusted, bln December 29.8

12:30 Eurozone ECB Monetary Policy Meeting Accounts

13:30 Canada Wholesale Sales, m/m December 1.8% 0.2%

13:30 U.S. Continuing Jobless Claims February 2239 2250

13:30 U.S. Initial Jobless Claims February 269 275

13:30 U.S. Philadelphia Fed Manufacturing Survey February -3.5 -3

15:00 U.S. Leading Indicators January -0.2% -0.2%

16:00 U.S. Crude Oil Inventories February -0.754 4.0

-

02:31

China: PPI y/y, January -5.3% (forecast -5.4%)

-

02:31

China: CPI y/y, January 1.8% (forecast 1.9%)

-

01:31

Australia: Changing the number of employed, January -7.9 (forecast 15)

-

01:30

Australia: Unemployment rate, January 6.0% (forecast 5.8%)

-

00:50

Japan: Trade Balance Total, bln, January -645.9 (forecast -680.2)

-

00:32

Currencies. Daily history for Feb 17’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1126 -0,15%

GBP/USD $1,4292 -0,08%

USD/CHF Chf0,9922 +0,37%

USD/JPY Y114,09 +0,03%

EUR/JPY Y126,93 -0,13%

GBP/JPY Y163,03 -0,08%

AUD/USD $0,7182 +1,02%

NZD/USD $0,6632 +0,81%

USD/CAD C$1,3670 -1,41%

-

00:01

Schedule for today, Thursday, Feb 18’2016:

(time / country / index / period / previous value / forecast)

00:30 Australia Unemployment rate January 5.8% 5.8%

00:30 Australia Changing the number of employed January -1.0 15

01:30 China PPI y/y January -5.9% -5.4%

01:30 China CPI y/y January 1.6% 1.9%

07:00 Switzerland Trade Balance January 2.54 2.67

09:00 Eurozone Current account, unadjusted, bln December 29.8

12:30 Eurozone ECB Monetary Policy Meeting Accounts

13:30 Canada Wholesale Sales, m/m December 1.8% 0.2%

13:30 U.S. Continuing Jobless Claims February 2239 2250

13:30 U.S. Initial Jobless Claims February 269 275

13:30 U.S. Philadelphia Fed Manufacturing Survey February -3.5 -3

15:00 U.S. Leading Indicators January -0.2% -0.2%

16:00 U.S. Crude Oil Inventories February -0.754

-