Noticias del mercado

-

21:00

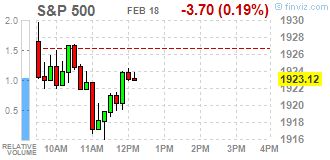

DJIA 16461.54 7.71 0.05%, NASDAQ 4507.73 -26.34 -0.58%, S&P 500 1923.83 -2.99 -0.16%

-

18:18

Wall Street. Major U.S. stock-indexes fell

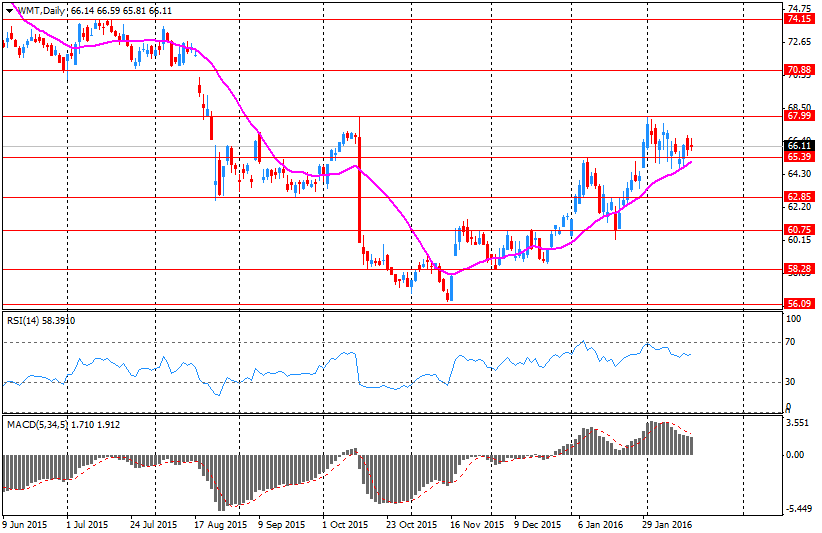

Major U.S. stock-indexes fell on Thursday after a slump in Wal-Mart weighed on consumer stocks, oil prices retreated and sectors that drove the three-day rally gave up some gains. Crude oil prices, whose performance has been tightly tied to the stock market, dropped from session highs after a report showed U.S. crude stocks rose last week. Brent crude was flat.

Dow stocks mixed (15 vs 15). Top looser - Wal-Mart Stores Inc. (WMT, -4,70%). Top gainer - International Business Machines Corporation (IBM, +5,34%).

Most of all S&P sectors in negative area. Top looser - Basic Materials (-0,3%). Top gainer - Utilities (+1,3%).

At the moment:

Dow 16418.00 +5.00 +0.03%

S&P 500 1920.25 -2.50 -0.13%

Nasdaq 100 4180.50 -16.25 -0.39%

Oil 33.22 +0.24 +0.73%

Gold 1218.90 +7.50 +0.62%

U.S. 10yr 1.79 -0.03

-

18:06

European stocks close: stocks closed mixed as oil prices fell again

Stock indices closed mixed as oil prices fell again. Oil prices declined after the release of the U.S. crude oil inventories data.

The European Central Bank's (ECB) its minutes of January meeting on Thursday. The minutes showed that downside risks to the outlook increased.

"Downside risks had increased again since the beginning of the current year, amid heightened uncertainty about the growth prospects of emerging market economies, volatility in financial markets and geopolitical risks," the ECB said.

"Weaker than anticipated growth in wages, in conjunction with declining inflation expectations, could also signal increased risks of second-round effects," the central bank noted.

The Organization for Economic Cooperation and Development (OECD) released its growth forecast on Thursday. The OECD downgraded its global growth outlook.

"Global growth prospects have practically flat-lined, recent data have disappointed and indicators point to slower growth in major economies, despite the boost from low oil prices and low interest rates," OECD Chief Economist Catherine L. Mann.

"Given the significant downside risks posed by financial sector volatility and emerging market debt, a stronger collective policy approach is urgently needed, focusing on a greater use of fiscal and pro-growth structural policies, to strengthen growth and reduce financial risks," she added.

The OECD expect the global economy to grow 3.0% in 2016, down from the previous estimate of 3.3%, and at 3.3% in 2017, down from the previous estimate of 3.6%.

Market participants also eyed the economic data from the Eurozone. The ECB released its current account on Thursday. Eurozone's current account surplus declined to a seasonally adjusted €25.5 billion in December from €26.9 billion in November. The trade surplus fell to €26.5 billion in December from €27.5 billion in November. In 2015 as whole, current account surplus €314.0 billion or 3% of GDP.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,971.95 -58.37 -0.97 %

DAX 9,463.64 +86.43 +0.92 %

CAC 40 4,239.76 +6.29 +0.15 %

-

18:00

New Zealand’s producer price inflation slides in the fourth quarter

Statistics New Zealand released its output and input producer price index (PPI) data on the late Wednesday evening. New Zealand's input PPI slid 1.2% in the fourth quarter, after a 1.6% growth in the third quarter.

Output PPI fell 0.8% in the fourth quarter, after a 1.3% rise in the third quarter.

Prices received by dairy product manufacturers dropped 10% in the fourth quarter, prices received by petroleum and coal product manufacturers plunged 10%, while prices for purchasing capital goods increased 0.6%.

Prices paid by dairy product manufacturers fell 7.1% in the fourth quarter, while prices paid by petroleum and coal product manufacturers slid 22%.

-

18:00

European stocks closed: FTSE 5971.95 -58.37 -0.97%, DAX 9463.64 86.43 0.92%, CAC 40 4239.76 6.29 0.15%

-

17:59

WSE: Session Results

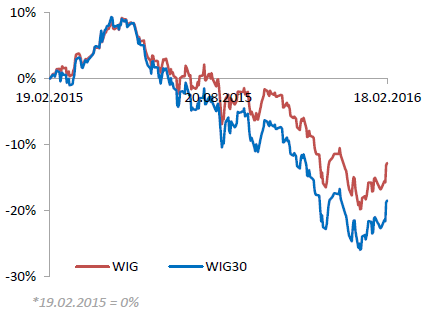

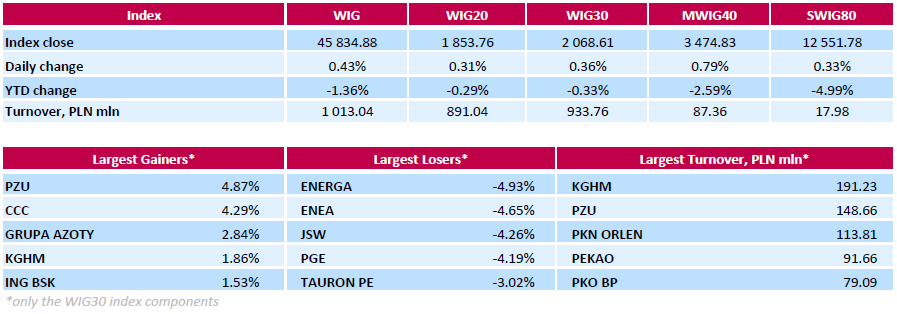

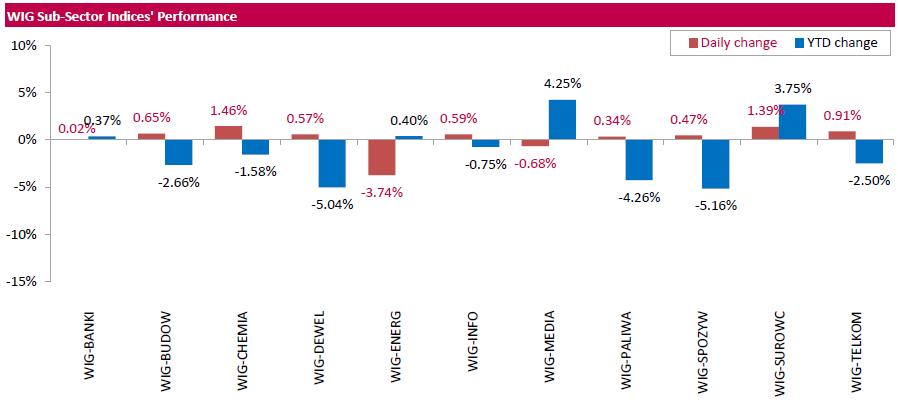

Polish equity market closed flat on Thursday. The broad market measure, the WIG Index added 0.43%. Almost all sectors in the WIG generated positive returns. The exception were utilities (-3.74%) and media sector (-0.68%). At the same time, chemical sector (+1.46%) was the strongest group.

The large-cap stocks' measure, the WIG30 Index, rose by 0.36%. Within the index components, gencos ENERGA (WSE: ENG), ENEA (WSE: ENA), PGE (WSE: PGE) and TAURON PE (WSE: TPE) were the weakest performers, tumbling by 3.02%-4.93%. Other major laggards were coking coal producer JSW (WSE: JSW), FMCG wholesaler EUROCASH (WSE: EUR) and bank BZ WBK (WSE: BZW), dropping by 4.26 %, 2.22% and 1.81% respectively. On the other side of the ledger, insurer PZU (WSE: PZU), footwear retailer CCC (WSE: CCC) and chemical producer GRUPA AZOTY (WSE: ATT) became the biggest gainers, surging by 4.87%, 4.29% and 2.84% respectively.

-

17:23

ECB Monetary Policy Meeting Account: downside risks to the outlook increased

The European Central Bank's (ECB) its minutes of January meeting on Thursday. The minutes showed that downside risks to the outlook increased.

"Downside risks had increased again since the beginning of the current year, amid heightened uncertainty about the growth prospects of emerging market economies, volatility in financial markets and geopolitical risks," the ECB said.

"Weaker than anticipated growth in wages, in conjunction with declining inflation expectations, could also signal increased risks of second-round effects," the central bank noted.

According to the minutes, inflation in the Eurozone remained low due to further decline in oil prices.

The ECB kept its interest rate unchanged at 0.05% in January, but said that it will review its quantitative easing in March.

-

16:12

U.S. leading economic index falls 0.2% in January

The Conference Board released its leading economic index (LEI) for the U.S. on Thursday. The leading economic index fell 0.2% in January, missing expectations for a 0.2% decrease, after a 0.3% decline in December. December's figure was revised down from a 0.2% fall.

The coincident economic index rose 0.3% in January, after a 0.1% gain in December.

"The U.S. LEI fell slightly in January, driven primarily by large declines in stock prices and further weakness in initial claims for unemployment insurance. Despite back-to-back monthly declines, the index doesn't signal a significant increase in the risk of recession, and its six-month growth rate remains consistent with a modest economic expansion through early 2016," director of business cycles and growth research at The Conference Board, Ataman Ozyildirim, said.

-

15:49

Spain’s trade deficit narrows to €1.79 billion in December

Spain's Economy Ministry released its trade data on Thursday. The trade deficit narrowed to €1.79 billion in December from €1.82 billion in November a year ago.

Exports rose at an annual rate of 4.1% in December, while imports climbed 3.7%.

In 2015 as whole, the trade deficit totalled €24.17 billion, down 1.2% from last year. It was the second lowest reading since 1998.

Exports increased 4.3% in 2015, while imports gained 3.7%.

-

15:36

The European Central Bank lowers the amount of emergency funding (ELA) to Greek banks by €0.1 billion

According to the Bank of Greece on Thursday, the European Central Bank (ECB) lowered the amount of emergency funding (ELA) to Greek banks by €0.1 billion to €71.4 billion.

"The reduction of €0.1 billion in the ceiling reflects an improvement of the liquidity situation of Greek banks, amid a reduction of uncertainty and the stabilization of private sector deposits flows," the Bank of Greece said in its statement.

-

15:32

U.S. Stocks open: Dow +0.25%, Nasdaq +0.19%, S&P +0.10%

-

15:16

Before the bell: S&P futures +0.23%, NASDAQ futures +0.38%

U.S. stock-index futures rose.

Global Stocks:

Nikkei 16,196.8 +360.44 +2.28%

Hang Seng 19,363.08 +438.51 +2.32%

Shanghai Composite 2,862.84 -4.50 -0.16%

FTSE 5,996.63 -33.69 -0.56%

CAC 4,266.59 +33.12 +0.78%

DAX 9,511.58 +134.37 +1.43%

Crude oil $31.45 (+2.58%)

Gold $1207.00 (-0.36%)

-

15:02

Philadelphia Federal Reserve Bank’s manufacturing index climbs to -2.8 in February

The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index climbed to -2.8 in February from -3.5 in January, exceeding expectations for an increase to -3.0.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

"Firms responding to the Manufacturing Business Outlook Survey reported continued weakness in business conditions this month. The indicator for general activity remained slightly negative this month, edging up only marginally from its reading in January," the Philadelphia Federal Reserve Bank said in its survey.

The shipments index was down to 2.5 in February from 9.6 in January.

The new orders index decreased to -5.3 in February from -1.4 in January.

The prices paid index fell to -2.2 in February from -1.1 in January, while the prices received index slid to -4.5 from -2.8.

The number of employees index dropped to -5.0 in February from -1.9 in January.

According to the report, the future general activity index slid to 17.3 in February from 19.1 in January.

-

14:55

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

7.39

3.21%

176.8K

International Business Machines Co...

IBM

130

3.09%

33.4K

Tesla Motors, Inc., NASDAQ

TSLA

173.44

2.82%

27.5K

Yandex N.V., NASDAQ

YNDX

13.91

1.98%

10.9K

Twitter, Inc., NYSE

TWTR

17.77

1.78%

116.8K

Amazon.com Inc., NASDAQ

AMZN

541.68

1.42%

18.7K

Yahoo! Inc., NASDAQ

YHOO

29.76

1.33%

32.5K

Walt Disney Co

DIS

96.5

1.05%

5.8K

Boeing Co

BA

117.21

0.75%

12.6K

Goldman Sachs

GS

151.96

0.68%

2.1K

Nike

NKE

58.56

0.67%

24.9K

Caterpillar Inc

CAT

67.7

0.65%

3.6K

Ford Motor Co.

F

12.35

0.65%

5.7K

Exxon Mobil Corp

XOM

82.5

0.61%

1.7K

ALCOA INC.

AA

8.57

0.59%

19.2K

Visa

V

72.45

0.58%

4.4K

Pfizer Inc

PFE

29.8

0.57%

4.0K

Intel Corp

INTC

29.62

0.51%

2.6K

Google Inc.

GOOG

712

0.51%

3.3K

Apple Inc.

AAPL

98.59

0.48%

74.0K

Chevron Corp

CVX

88.7

0.44%

5.6K

General Motors Company, NYSE

GM

29.4

0.44%

0.7K

Johnson & Johnson

JNJ

102.94

0.43%

0.2K

Citigroup Inc., NYSE

C

39.95

0.43%

14.3K

Facebook, Inc.

FB

105.65

0.43%

60.4K

Cisco Systems Inc

CSCO

26.57

0.42%

2.5K

American Express Co

AXP

53.8

0.35%

2.3K

Microsoft Corp

MSFT

52.58

0.31%

31.9K

JPMorgan Chase and Co

JPM

58.92

0.26%

7.1K

Procter & Gamble Co

PG

82.6

0.18%

0.1K

General Electric Co

GE

29.39

0.17%

8.8K

ALTRIA GROUP INC.

MO

60.5

0.17%

0.2K

AT&T Inc

T

36.69

0.14%

3.0K

Starbucks Corporation, NASDAQ

SBUX

57.7

0.12%

7.3K

McDonald's Corp

MCD

118.75

0.09%

0.6K

The Coca-Cola Co

KO

43.52

0.07%

0.8K

Verizon Communications Inc

VZ

50.35

0.06%

2.6K

HONEYWELL INTERNATIONAL INC.

HON

106.13

0.00%

0.4K

Home Depot Inc

HD

121.02

-0.16%

3.1K

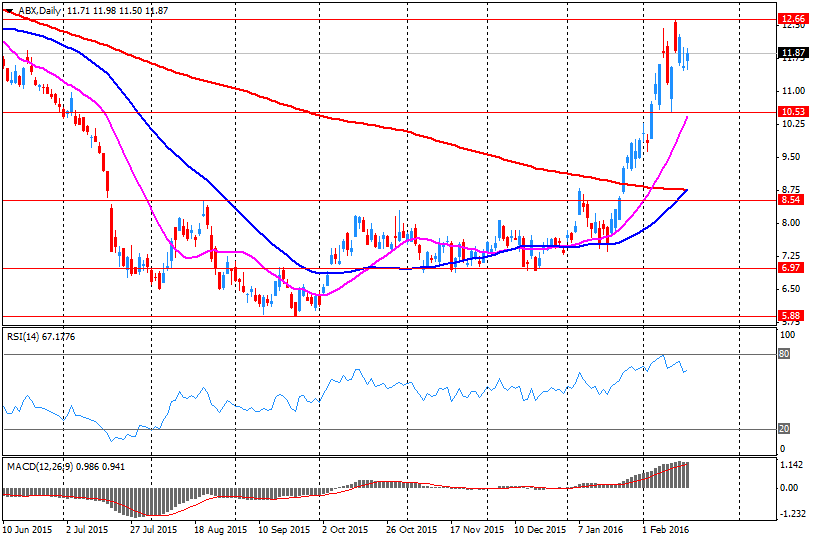

Barrick Gold Corporation, NYSE

ABX

11.59

-2.52%

41.3K

Wal-Mart Stores Inc

WMT

63.6

-3.80%

811.5K

-

14:50

Canada’s wholesale sales climb 2.0% in December

Statistics Canada released wholesale sales figures on Thursday. Wholesale sales climbed 2.0% in December, exceeding expectations for a 0.2% gain, after a 1.9% rise in November. November's figure was revised up from a 1.8% increase.

The increase was mainly driven by higher sales in the motor vehicle and parts subsectors.

Sales of motor vehicle and parts were up 10.6% in December, while sales in the food, beverage and tobacco subsector rose 1.3%.

Sales in the building material and supplies subsector climbed 1.0% in December.

Inventories fell by 0.1% in December.

-

14:43

Initial jobless claims decline to 262,000 in the week ending February 13

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending February 13 in the U.S. declined by 7,000 to 262,000 from 269,000 in the previous week.

Analysts had expected jobless claims to rise to 275,000.

Jobless claims remained below 300,000 the 50th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims climbed by 30,000 to 2,273,000 in the week ended February 06.

-

14:41

Upgrades and downgrades before the market open

Upgrades:

IBM (IBM) upgraded to Overweight from Equal-Weight at Morgan Stanley

Amazon (AMZN) upgraded to Buy from Hold at Canaccord Genuity

Boeing (BA) upgraded to Neutral from Underperform at Buckingham Research

Downgrades:

Other:

-

13:49

Company News: Wal-Mart (WMT) Posts Q4 Results and Q1 and FY 2017 Guidance

Wal-Mart reported Q4 FY 2016 earnings of $1.49 per share (versus $1.61 in Q4 FY 2015), beating analysts' consensus of $1.44.

The company's quarterly revenues amounted to $128.684 bln (-1.5% y/y), missing consensus estimate of $130.407 bln.

The company also reveals guidance for Q1 and FY 2017. It sees Q1 EPS of $0.80-0.95 versus consensus of $0.91. For FY 2017, the company projects EPS of $4.00-4.30 versus consensus of $4.18 and net sales of $478.6 bln versus consensus of $488.13 bln.

The Board of Directors of Wal-Mart approved an annual cash dividend for FY 2017 of $2.00 per share, an increase of 2% from the $1.96 per share paid for the last fiscal year.

WMT fell to $62.73 (-5.11%) in pre-market trading.

-

12:14

European stock markets mid session: stocks traded mixed on corporate earnings

Stock indices traded mixed on corporate earnings. Market participants are awaiting the release of the European Central Bank's (ECB) latest monetary policy minutes later in the day.

The Organization for Economic Cooperation and Development (OECD) released its growth forecast on Thursday. The OECD downgraded its global growth outlook.

"Global growth prospects have practically flat-lined, recent data have disappointed and indicators point to slower growth in major economies, despite the boost from low oil prices and low interest rates," OECD Chief Economist Catherine L. Mann.

"Given the significant downside risks posed by financial sector volatility and emerging market debt, a stronger collective policy approach is urgently needed, focusing on a greater use of fiscal and pro-growth structural policies, to strengthen growth and reduce financial risks," she added.

The OECD expect the global economy to grow 3.0% in 2016, down from the previous estimate of 3.3%, and at 3.3% in 2017, down from the previous estimate of 3.6%.

Market participants also eyed the economic data from the Eurozone. The ECB released its current account on Thursday. Eurozone's current account surplus declined to a seasonally adjusted €25.5 billion in December from €26.9 billion in November. The trade surplus fell to €26.5 billion in December from €27.5 billion in November. In 2015 as whole, current account surplus €314.0 billion or 3% of GDP.

Current figures:

Name Price Change Change %

FTSE 100 6,008.67 -21.65 -0.36 %

DAX 9,473.9 +96.69 +1.03 %

CAC 40 4,258.01 +24.54 +0.58 %

-

12:07

Italy’s current account surplus climbs to €6.14 billion in December

The Bank of Italy released its current account on Thursday. Italy's current account surplus increased to €6.14 billion in December from €4.4 billion in November.

The trade surplus rose to €7.2 billion in December from €6.2 billion in November.

The deficit on services decreased to €274 million in December from €350 million in November.

The primary income surplus fell to €661 million in December from €1.9 billion in November, while the secondary income deficit declined to €1.5 billion from €1.7 billion.

In 2015 as whole, current account surplus €34.9 billion.

-

12:02

French final consumer price inflation drops 1.0% in January

The French statistical office Insee released its final consumer price inflation for France on Thursday. The French consumer price inflation dropped 1.0% in January, in line with the preliminary reading, after a 0.2% increase in December.

On a yearly basis, the consumer price index increased 0.2% in January, in line with the preliminary reading, after a 0.2% rise in December.

Fresh food prices rose 0.4% year-on-year in January, services prices climbed by 1.1%, while petroleum products prices dropped by 7.4%.

-

11:58

Company News: Barrick Gold (ABX) Q4 Results Beat Expectations

Barrick Gold reported Q4 FY 2015 earnings of $0.08 per share (versus $0.15 in Q4 FY 2014), beating analysts' consensus of $0.06.

The company's quarterly revenues amounted to $2.238 bln (-10.8% y/y), beating consensus estimate of $2.215 bln.

ABX rose to $11.89 (+2.59%) in yesterday's trading session.

-

11:57

Swiss trade surplus rises to CHF3.51 billion in January

The Swiss Federal Customs Administration released its trade data on Thursday. The Swiss trade surplus widened to CHF3.51 billion in January from CHF2.59 billion in the previous month. December's figure was revised up from a surplus of CHF2.54 billion.

Exports dropped 3.9% year-on-year in January, while imports were down 5.0%.

On a monthly basis, exports slid 1.1% in January, while imports increased 2.5%.

-

11:50

OECD downgrades its global growth outlook

The Organization for Economic Cooperation and Development (OECD) released its growth forecast on Thursday. The OECD downgraded its global growth outlook.

"Global growth prospects have practically flat-lined, recent data have disappointed and indicators point to slower growth in major economies, despite the boost from low oil prices and low interest rates," OECD Chief Economist Catherine L. Mann.

"Given the significant downside risks posed by financial sector volatility and emerging market debt, a stronger collective policy approach is urgently needed, focusing on a greater use of fiscal and pro-growth structural policies, to strengthen growth and reduce financial risks," she added.

The OECD expect the global economy to grow 3.0% in 2016, down from the previous estimate of 3.3%, and at 3.3% in 2017, down from the previous estimate of 3.6%.

The U.S. economy is expected to expand 2.0% in 2016 and 2.2% in 2017, down from the previous estimate of 2.5% and 2.4%, respectively.

Japan's economy is expected to grow 0.8% in 2016, down from its previous estimate of 1.0%, and 0.6% for 2017, up from the previous estimate of 0.5%.

Eurozone's forecasts were downgraded to 1.4% in 2016 from the previous estimate of 1.8% and to 1.7% in 2017 from the previous estimate of 1.9%.

China's growth forecast for 2016 remained unchanged at 6.5%, while 2017 forecast remained unchanged at 6.2%.

-

11:39

Eurozone’s current account surplus falls to a seasonally adjusted €25.5 billion in December

The European Central Bank (ECB) released its current account on Thursday. Eurozone's current account surplus declined to a seasonally adjusted €25.5 billion in December from €26.9 billion in November. November's figure was revised up from a surplus of €26.4 billion.

The trade surplus fell to €26.5 billion in December from €27.5 billion in November.

The surplus on services decreased to €4.6 billion in December from €6.0 billion in November.

The primary income surplus climbed to €5.5 billion in December from €4.5 billion in November, while the secondary income deficit rose to €11.2 billion from €11.0 billion.

Eurozone's unadjusted current account surplus rose to €41.4 billion in December from €30.3 billion in November. November's figure was revised up from a surplus of €29.8 billion.

In 2015 as whole, current account surplus €314.0 billion or 3% of GDP.

-

11:20

Chinese consumer price index rises at annual rate of 1.8% in January

The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Thursday. The Chinese consumer price index (CPI) rose at annual rate of 1.8% in January, in missing expectations for a 1.9% increase, after a 1.6% gain in December.

Food prices rose at an annual rate of 4.1% in January, while non-food prices increased 1.2%.

On a monthly basis, consumer price inflation increased 0.5% in January, after a 0.5% rise in December.

The Chinese producer price index (PPI) dropped 5.3% in January, beating expectations for a 5.4% fall, after a 5.9% decline in December.

-

11:13

Australia's unemployment rate rises to 6.0% in January

The Australian Bureau of Statistics released its labour market data on Thursday. Australia's unemployment rate rose to 6.0% in January from 5.8% in December. Analysts had expected the unemployment rate to remain unchanged at 5.8%.

The number of employed people in Australia fell by 7,900 in January, missing forecast of a rise by 15,000, after a decline by 800 in December. December's figure was revised up from a fall by 1,000.

Full-time employment slid by 40,600 in January, while part-time employment climbed by 32,700.

The participation rate remained unchanged at 65.2% in January.

-

11:00

Japan's trade surplus turns into a deficit of ¥140.3 billion in January

The Ministry of Finance released its trade data for Japan on the late Wednesday evening. Japan's trade deficit turned into a deficit of ¥645.9 billion in January from a surplus of ¥140.0 billion in December.

Analysts had expected a deficit of ¥680.2 billion.

Exports fell 12.9% year-on-year in January, while imports dropped 18.0%.

Exports to Asia declined by 17.8% year-on-year in January, exports to the United States decreased by 5.3%, while exports to the European Union fell by 3.6%.

Imports from Asia plunged by 12.0% year-on-year in January, imports from the United States declined by 9.7%, while imports from the European Union climbed by 6.0%.

-

10:47

Bank of Japan Governor Haruhiko Kuroda: the central bank’s negative rates were not directly aimed to weaken the currency

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said on Thursday that the central bank's negative rates were not directly aimed to weaken the currency.

"Central banks of big economies don't target currency rates in guiding policy," he said.

Kuroda pointed out that negative rates would be positive for the economy and prices.

He noted that developments abroad such the slowdown in the Chinese economy and falling oil prices supported the demand for safe-haven yen.

-

10:33

St. Louis Fed President James Bullard: the Fed should delay its further interest rate hikes

St. Louis Fed President James Bullard said in a speech on Wednesday that the Fed should delay its further interest rate hikes due to recent turmoil in financial markets and low inflation.

"I regard it as unwise to continue a normalization strategy in an environment of declining market-based inflation expectations," he said.

Bullard noted that he expected a stronger U.S. economic growth and further improvement in the labour market.

Bullard is a voting member of the Federal Open Market Committee (FOMC) this year.

-

10:10

Fed’s January monetary policy meeting minutes: Fed could change its path of interest rate hikes

The Fed released its January monetary policy meeting minutes on Wednesday. The Fed kept its interest rate unchanged in January. Fed officials expressed concerns about global financial conditions and considered to change the number of interest rate hikes this year.

"Members observed that if the recent tightening of global financial conditions was sustained, it could be a factor amplifying downside risks," the minutes said.

According to the minutes, downside risks from low oil energy prices to the outlook are increased.

The Fed noted that it will closely monitor global economic and financial developments.

Some Fed officials expressed concerns that the slowdown in the Chinese economy would have a negative impact on the U.S. economy.

-

07:00

Global Stocks: U.S. stock indices gained

U.S. stock indices rose on Wednesday as minutes from the Federal Reserve's January meeting signaled policymakers prefer to delay the next rate hike because of economic uncertainties. Higher oil prices supported stocks of energy companies.

The Dow Jones Industrial Average rose 257.42 points, or 1.6%, to 16,453.83. The S&P 500 rose 33.25 points, or 1.7%, to 1,926.83 (its energy sector gained 2.9%). The Nasdaq Composite surged 98.11 points, or 2.2%, to 4,534.06.

January Fed meeting minutes showed that Federal Reserve policymakers had noted increased uncertainties over inflation and economic growth outlook and discussed how economic risks could influence the Fed's plan to raise interest rates. Not all policymakers believed that risks would materialize, however many of them noted that risks rose.

Meanwhile data from the Federal Reserve's showed that industrial production rose in January. The corresponding index rose by 0.9% marking the fastest growth pace since November 2015. Economists had expected a reading of +0.4% after a 0.7% decline in December (revised from -0.4%).

This morning in Asia Hong Kong Hang Seng gained 2.09%, or 395.60 points, to 19,320.17. China Shanghai Composite Index climbed 0.42%, or 12.16 points, to 2,879.50. Meanwhile the Nikkei jumped 2.84%, or 450.38 points, to 16,286.74.

Asian stocks advanced following gains in U.S. equities. Global stocks rose as oil prices jumped after Iran signaled it was ready to freeze oil output level.

Japanese trade data weighed on the yen allowing stocks climb. According to the Ministry of Finance, Japanese trade deficit came in at ¥-645.9 billion in January vs ¥-680 billion expected. Exports fell by 12.9% after an 8.0% decline in December. This was the fourth straight month of declines in exports. Shipping to China fell by 17.5% after an 8.6% drop in December. Imports fell by 18.0% extending the period of declines to 13 months.

China's consumer price data were published today too. The consumer price index rose by 1.8% y/y in January missing expectations for a 1.9% rise. Nevertheless the index picked up pace compared to a reading of 1.6% last December. Meanwhile the producer price index fell by 5.3% y/y marking the 47th month of declines.

-

03:01

Nikkei 225 16,207.74 +371.38 +2.35 %, Hang Seng 19,338.63 +414.06 +2.19 %, Shanghai Composite 2,887.22 +19.88 +0.69 %

-

00:34

Stocks. Daily history for Sep Feb 17’2016:

(index / closing price / change items /% change)

Nikkei 225 15,836.36 -218.07 -1.36 %

Hang Seng 18,924.57 -197.51 -1.03 %

Shanghai Composite 2,867.34 +30.77 +1.08 %

FTSE 100 6,030.32 +168.15 +2.87 %

CAC 40 4,233.47 +122.81 +2.99 %

Xetra DAX 9,377.21 +242.10 +2.65 %

S&P 500 1,926.82 +31.24 +1.65 %

NASDAQ Composite 4,534.07 +98.11 +2.21 %

Dow Jones 16,453.83 +257.42 +1.59 %

-