Noticias del mercado

-

21:00

DJIA 16439.59 243.18 1.50%, NASDAQ 4524.91 88.96 2.01%, S&P 500 1924.69 29.11 1.54%

-

18:02

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose a third straight day of gains on Wednesday, led by energy and materials stocks as oil prices rallied. Crude oil prices were at session-highs, up more than 5%, despite Iran refusing to be part of a group of top oil producers to freeze output. Data released on Wednesday showed that U.S. housing starts unexpectedly fell in January. But, a separate report showed producer prices rose last month and there were signs of an uptick in underlying producer inflation.

Most of Dow stocks in positive area (27 of 30). Top looser - McDonald's Corp. (MCD, -1,43%). Top gainer - Chevron Corporation (CVX, +3,76%).

All of S&P sectors in positive area. Top gainer - Conglomerates (+3,9%).

At the moment:

Dow 16367.00 +236.00 +1.46%

S&P 500 1917.75 +29.00 +1.54%

Nasdaq 100 4170.50 +77.75 +1.90%

Oil 30.71 +1.67 +5.75%

Gold 1212.20 +4.00 +0.33%

U.S. 10yr 1.84 +0.06

-

18:00

European stocks close: stocks closed higher as oil prices climbed

Stock indices closed higher as oil prices rose. Oil prices traded higher on news that Iran supports the decision to freeze the oil production at the level of January.

Market participants are awaiting the release of the latest Fed's monetary policy minutes later in the day. They hope for some hints regarding further interest rate hikes.

Market participants also eyed the economic data from the Eurozone. The Eurostat released its construction production data for the Eurozone on Wednesday. Construction production in the Eurozone declined 0.6% in December, after a 0.9% rise in November.

Civil engineering output declined 0.7% in December, while production in the building sector was down 0.4%.

In 2015 as whole, construction production fell 1.0%, compared with 2014.

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate remained unchanged at 5.1% in the October to December quarter. It was the lowest reading since three months to October 2005.

Analysts had expected the unemployment rate to decline to 5.0%.

Average weekly earnings, excluding bonuses, climbed by 2.0% in the October to December quarter, beating expectations for a 1.8% rise, after a 1.9% gain in the September to November quarter.

Average weekly earnings, including bonuses, rose by 1.9% in the October to December quarter, in line with expectations, after a 2.1% increase in the September to November quarter. The previous quarter's figure was revised up from a 2.0% rise.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,020.99 +158.82 +2.71 %

DAX 9,377.21 +242.10 +2.65 %

CAC 40 4,233.47 +122.81 +2.99 %

-

18:00

European stocks closed: FTSE 6020.99 158.82 2.71%, DAX 9377.21 242.10 2.65%, CAC 40 4233.47 122.81 2.99%

-

17:58

WSE: Session Results

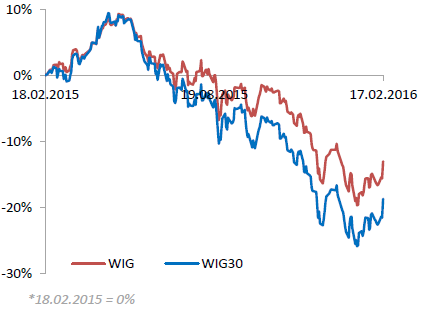

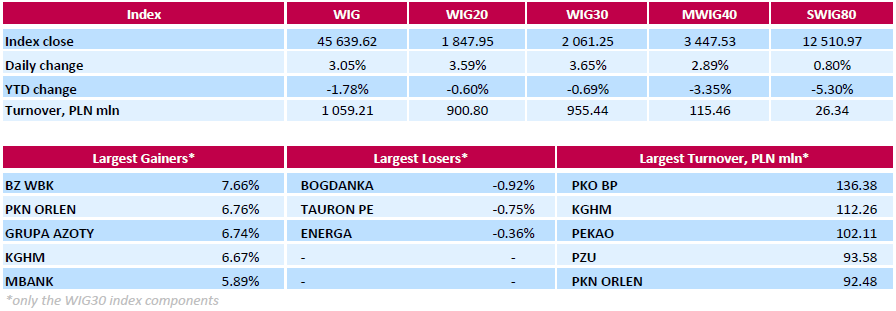

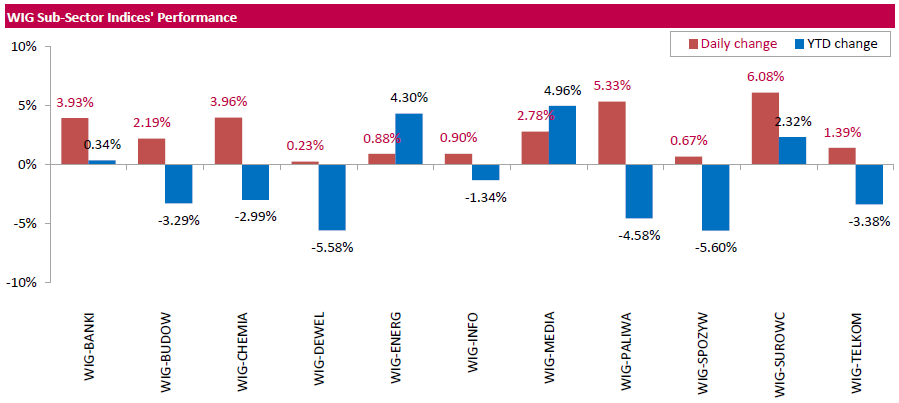

Polish equity market enjoyed a strong run on Wednesday. The broad market measure, the WIG Index, surged by 3.05%. All sectors in the WIG gained, with materials (+6.08%) outperforming.

The large-cap stocks' measure, the WIG30 Index, advanced 3.65%. A majority of the Index components returned gains, with the way up led by banking name BZ WBK (WSE: BZW), jumping by 7.66%. It was followed by oil refiner PKN ORLEN (WSE: PKN), chemical producer GRUPA AZOTY (WSE: ATT) and copper producer KGHM (WSE: KGH), climbing by 6.76%, 6.74% and 6.67% respectively. On the other side of the ledger, thermal coal miner BOGDANKA (WSE: LWB) and two gencos TAURON PE (WSE: TPE) and ENERGA (WSE: ENG) were the only decliners, falling by 0.92%, 0.75% and 0.36% respectively.

-

17:15

Zhao Chenxin, a spokesman for the National Development and Reform Commission (NDRC): economy would expand at a medium- to high-rate

Zhao Chenxin, a spokesman for the National Development and Reform Commission (NDRC), said on Wednesday that China's economy would expand at a medium- to high-rate.

"China's status as the world's largest holder of foreign exchange reserves has not changed, the large-scale trade surplus has not changed and the steady progress in the yuan internationalisation has not changed," he added.

-

16:37

Federal Reserve Bank of Minneapolis President Neel Kashkari: developments abroad also caused low interest rates

Federal Reserve Bank of Minneapolis President Neel Kashkari said in an interview with CNBC on Wednesday that developments abroad also caused low interest rates.

"It's also economic conditions around the world that are causing interest rates to be low and necessitating low interest rates," he said.

Federal Reserve Bank of Minneapolis president noted that further interest rate hikes will depend on the incoming economic data.

Kashkari pointed out that the slowdown in the Chinese economy could have an impact on the U.S. economy.

"It leads to great market upheaval and one of the transmission mechanisms from China to the U.S. are obviously risk premiums, obviously volatility in the markets. Even If our trade linkages may be moderate, if risk premiums go up all around the world, that could have an effect on our economy too," he said.

-

16:29

Federal Reserve Bank of Minneapolis President Neel Kashkari: the Fed should consider breaking up big banks

Federal Reserve Bank of Minneapolis President Neel Kashkari said in a speech on Tuesday that the Fed should consider breaking up big banks to prevent government bailouts in the future.

"Breaking up large banks into smaller, less connected, less important entities," he said.

Kashkari said that the biggest banks were still too big to fail.

"I believe the biggest banks are still too big to fail and continue to pose a significant, ongoing risk to our economy," Federal Reserve Bank of Minneapolis president said.

-

15:33

U.S. Stocks open: Dow +0.69%, Nasdaq +0.93%, S&P +0.81%

-

15:29

U.S. industrial production climbs 0.9% in January

The Federal Reserve released its industrial production report on Wednesday. The U.S. industrial production climbed 0.9% in January, missing expectations for a 0.4% increase, after a 0.7% decline in December. December's figure was revised down from a 0.6% fall.

The rise was mainly driven by increases in the manufacturing output and utilities.

Mining output was flat in January, while utilities production jumped 5.4%.

Manufacturing output rose 0.5% in January, after a 0.2% fall in December. December's figure was revised down from a 0.1% decrease.

Capacity utilisation rate increased to 77.1% in January from 76.4% in December, beating expectations for a rise to 76.7%. December's figure was revised down from 76.5%.

-

15:27

Before the bell: S&P futures +0.82%, NASDAQ futures +1.01%

U.S. stock-index futures advanced.

Global Stocks:

Nikkei 15,836.36 -218.07 -1.36%

Hang Seng 18,924.57 -197.51 -1.03%

Shanghai Composite 2,867.7 +31.13 +1.10%

FTSE 5,965.91 +103.74 +1.77%

CAC 4,202.37 +91.71 +2.23%

DAX 9,324.12 +189.01 +2.07%

Crude oil $29.76 (+2.48%)

Gold $1207.60 (-0.05%)

-

15:17

Greek consumer prices slide 1.9% in January

The Hellenic Statistical Authority released its consumer price inflation data for Greece on Wednesday. Greek consumer prices slid 1.9% in January, after the 0.1% rise in December.

On a yearly basis, the Greek consumer price index declined 0.7% in January, after a 0.2 fall in December. Consumer prices in Greece declined since March 2013.

Housing prices plunged at an annual rate of 3.7% in January, transport costs dropped by 0.9%, clothing and footwear prices were down 9.5%, while household equipment prices were down 0.2%.

Prices of food and non-alcoholic beverages climbed at an annual rate of 1.6% in January, while alcoholic beverages and tobacco prices increased by 1.1%.

-

15:10

U.S. producer prices rise 0.1% in January

The U.S. Commerce Department released the producer price index figures on Wednesday. The U.S. producer price index rose 0.1% in January, missing expectations for a 0.2% fall, after a 0.2% drop in December.

A stronger U.S. dollar and weak global demand weigh on inflation.

The increase was mainly driven by a rise in food prices.

Energy prices declined 5.0% in January, wholesale food prices increased 1.0%.

Services prices were up 0.5% in January, while prices for goods declined 0.7%.

On a yearly basis, the producer price index decreased 0.2% in January, beating expectations for a 0.6% decrease, after a 1.0% fall in December.

The producer price index excluding food and energy rose 0.4% in January, exceeding expectations for a 0.1% gain, after a 0.1% increase in December.

On a yearly basis, the producer price index excluding food and energy climbed 0.6% in January, beating forecasts of a 0.4% increase, after a 0.3% rise in December.

These figures could mean that the Fed will delay its further interest rate hikes.

-

14:56

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Yandex N.V., NASDAQ

YNDX

13.95

2.80%

1.0K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

6.52

2.35%

44.1K

Tesla Motors, Inc., NASDAQ

TSLA

158.80

2.34%

3.4K

Barrick Gold Corporation, NYSE

ABX

11.75

1.38%

3.3K

Boeing Co

BA

113.99

1.23%

9.0K

Nike

NKE

58.50

1.23%

0.4K

Caterpillar Inc

CAT

65.95

1.13%

7.0K

Citigroup Inc., NYSE

C

39.33

1.13%

26.2K

Chevron Corp

CVX

85.61

0.94%

0.5K

Home Depot Inc

HD

120.50

0.90%

5.2K

Merck & Co Inc

MRK

50.23

0.90%

0.8K

General Motors Company, NYSE

GM

28.82

0.84%

10.1K

Google Inc.

GOOG

696.52

0.80%

3.0K

American Express Co

AXP

53.59

0.77%

12.1K

Amazon.com Inc., NASDAQ

AMZN

524.90

0.73%

1.9K

Visa

V

71.60

0.70%

4.8K

Starbucks Corporation, NASDAQ

SBUX

56.80

0.69%

0.9K

Ford Motor Co.

F

11.95

0.67%

105.0K

Exxon Mobil Corp

XOM

81.75

0.65%

9.8K

Facebook, Inc.

FB

102.27

0.65%

55.8K

Pfizer Inc

PFE

30.00

0.64%

30.0K

Cisco Systems Inc

CSCO

26.00

0.62%

5.1K

ALCOA INC.

AA

8.17

0.62%

5.0K

Microsoft Corp

MSFT

51.40

0.61%

17.3K

Johnson & Johnson

JNJ

102.92

0.59%

0.1K

Walt Disney Co

DIS

93.40

0.53%

0.5K

Verizon Communications Inc

VZ

50.50

0.52%

3.1K

Goldman Sachs

GS

149.75

0.49%

1.0M

General Electric Co

GE

29.00

0.49%

2.6K

JPMorgan Chase and Co

JPM

58.62

0.46%

9.9K

International Business Machines Co...

IBM

123.24

0.41%

4.6K

ALTRIA GROUP INC.

MO

60.45

0.25%

1.8K

Intel Corp

INTC

28.85

0.24%

14.7K

Procter & Gamble Co

PG

81.65

0.22%

13.3K

Yahoo! Inc., NASDAQ

YHOO

29.34

0.20%

3.6K

AT&T Inc

T

36.70

0.14%

33.8K

Wal-Mart Stores Inc

WMT

65.90

0.00%

2.9K

Hewlett-Packard Co.

HPQ

9.81

0.00%

4.8K

Twitter, Inc., NYSE

TWTR

16.35

-0.06%

0.5K

The Coca-Cola Co

KO

43.32

-0.09%

0.3K

Apple Inc.

AAPL

96.24

-0.41%

264.7K

-

14:50

Housing starts in the U.S. fall 3.8% in January

The U.S. Commerce Department released the housing market data on Wednesday. Housing starts in the U.S. declined 3.8% to 1.099 million annualized rate in January from a 1.143 million pace in December, missing expectations for an increase to 1.170 million. December's figure was revised down from 1.149 million units.

The fall was driven by declines in starts of single-family and multifamily homes.

Housing market benefits from the strengthening of the labour market.

Building permits in the U.S. fell 0.2% to 1.202 million annualized rate in January from a 1.204 million pace in November, beating expectations for a 1,200 pace.

Starts of single-family homes decreased 3.9% in January. Building permits for single-family homes were down 1.6%.

Starts of multifamily buildings fell 3.7% in January. Permits for multi-family housing rose 2.1%.

-

14:48

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Intel (INTC) target lowered to $31 from $33 at RBC Capital Mkts

-

14:40

Foreign investors sell C$1.41 billion of Canadian securities in December

Statistics Canada released foreign investment figures on Wednesday. Foreign investors sold C$1.41 billion of Canadian securities in December, after an investment of C$2.94 billion in November. November's figure was revised up from an investment of C$2.58 billion.

The divestment was led by federal government debt securities.

Canadian investors added C$17.4 billion of foreign securities in December, mainly U.S. securities.

-

12:03

European stock markets mid session: stocks traded higher as oil prices rose

Stock indices traded higher as oil prices rose. Oil prices increased on hopes that oil producers could stabilise the oil market. Russia and Saudi Arabia on Tuesday agreed to freeze the oil production at the level of January if other oil producers join. Energy ministers from Saudi Arabia, Russia, Qatar and Venezuela met in Doha today to discuss the situation in the oil market.

Market participants also eyed the economic data from the Eurozone. The Eurostat released its construction production data for the Eurozone on Wednesday. Construction production in the Eurozone declined 0.6% in December, after a 0.9% rise in November.

Civil engineering output declined 0.7% in December, while production in the building sector was down 0.4%.

In 2015 as whole, construction production fell 1.0%, compared with 2014.

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate remained unchanged at 5.1% in the October to December quarter. It was the lowest reading since three months to October 2005.

Analysts had expected the unemployment rate to decline to 5.0%.

Average weekly earnings, excluding bonuses, climbed by 2.0% in the October to December quarter, beating expectations for a 1.8% rise, after a 1.9% gain in the September to November quarter.

Average weekly earnings, including bonuses, rose by 1.9% in the October to December quarter, in line with expectations, after a 2.1% increase in the September to November quarter. The previous quarter's figure was revised up from a 2.0% rise.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

Current figures:

Name Price Change Change %

FTSE 100 5,947.04 +84.87 +1.45 %

DAX 9,308.96 +173.85 +1.90 %

CAC 40 4,196.59 +85.93 +2.09 %

-

11:49

Australian leading economic index is flat in January

Westpac Bank released the Westpac-Melbourne Institute leading economic index for Australia on late Tuesday evening. The leading economic index was flat in January, after a 0.3% drop in December.

"Disappointing results continue. The Index has now been growing below trend for the last nine months. It continues to signal that growth in the Australian economy in the first half of 2016 will be below trend," Westpac's Chief Economist, Bill Evans, said.

-

11:45

Construction production in the Eurozone declines 0.6% in December

The Eurostat released its construction production data for the Eurozone on Wednesday. Construction production in the Eurozone declined 0.6% in December, after a 0.9% rise in November.

Civil engineering output declined 0.7% in December, while production in the building sector was down 0.4%.

On a yearly basis, construction output decreased 0.4% in December, after a 0.3% gain in November. November's figure was revised down from a 2.1% rise.

Civil engineering output slid 6.1% year-on-year in December, while production in the building sector climbed 0.9% year-on-year.

In 2015 as whole, construction production fell 1.0%, compared with 2014.

-

11:38

ZEW Institute and Credit Suisse Group’s survey: Switzerland's economic sentiment index plunges to -5.9 in February

A survey by the ZEW Institute and Credit Suisse Group showed on Wednesday that Switzerland's economic sentiment index plunged to -5.9 in February from -3.0 in January.

"The analysts surveyed tend to expect a decline in Swiss economic activity. Most of the analysts surveyed (82%) continue to rate the present state of Switzerland's economy as being "normal"," the ZEW said.

The current conditions rose to -6.0 in February from -8.5 in January.

-

11:31

U.K. unemployment rate remains unchanged at 5.1% in the October to December quarter

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate remained unchanged at 5.1% in the October to December quarter. It was the lowest reading since three months to October 2005.

Analysts had expected the unemployment rate to decline to 5.0%.

The claimant count slid by 14,800 people in January, beating expectations for a fall by 3,000, after a decrease of 15,200 people in December. December's figure was revised down from a 4,300 decrease.

U.K. unemployment in the September to November period dropped by 60,000 to 1.69 million from the previous quarter.

The employment rate was 74.1% in the October to December quarter. It was the highest reading since 1971.

Average weekly earnings, excluding bonuses, climbed by 2.0% in the October to December quarter, beating expectations for a 1.8% rise, after a 1.9% gain in the September to November quarter.

Average weekly earnings, including bonuses, rose by 1.9% in the October to December quarter, in line with expectations, after a 2.1% increase in the September to November quarter. The previous quarter's figure was revised up from a 2.0% rise.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

-

11:21

Core machinery orders in Japan climb 4.2% in December

Japan's Cabinet Office released its core machinery orders data on late Tuesday evening. Core machinery orders in Japan climbed 4.2% in December, missing expectations for a 4.7% rise, after a 14.4% drop in November.

On a yearly basis, core machinery orders slid 3.6% in December, missing expectations for a 3.1% decrease, after a 1.2% rise in November.

The total number of machinery orders rose 5.4% in December from a month earlier.

Orders from non-manufacturers jumped 8.5% in December, while orders from manufacturers were down 3.4%.

-

11:14

Etsuro Honda, an adviser to Japanese Prime Minister Shinzo Abe: the Bank of Japan could add further stimulus measures at its monetary policy meeting in March

Etsuro Honda, an adviser to Japanese Prime Minister Shinzo Abe, said on Wednesday that the Bank of Japan could add further stimulus measures at its monetary policy meeting in March, adding that further stimulus measures were needed to stimulate the economy.

He also said that sales tax hike should be postponed by two years to April 2019.

-

11:05

Sales of existing homes in Canada climb 8% year-on-year in January

The Canadian Real Estate Association (CREA) released its existing homes sales data for Canada on Tuesday. Sales of existing homes in Canada climbed 8% year-on-year in January.

The national average home price jumped 17% year-on-year in January.

The increase in the national average home price was mainly driven rises in Vancouver and Toronto. The average sale price in greater Vancouver jumped 32.3% year-over-year in January, while the price in greater Toronto soared 14.2%.

On a monthly basis, sales of existing homes rose 0.5% in January.

-

10:48

European Central Bank (ECB) Governing Council Member Ewald Nowotny: the recent turmoil in financial markets was mainly driven by emerging markets

European Central Bank (ECB) Governing Council Member Ewald Nowotny said in an interview published on Wednesday that the recent turmoil in financial markets was mainly driven by emerging markets. He noted that it was necessary to preserve liquidity.

"The ECB is a certain guarantor that appropriate liquidity backups are possible for banks, at least those in the euro zone," Nowotny said.

-

10:40

Bank of America Merrill Lynch fund manager survey: 27% of respondents say the U.S. recession was the biggest risk to markets

According to the latest Bank of America Merrill Lynch fund manager survey, 27% of respondents said that the U.S. recession was the biggest risk to markets. 23% of respondents noted that emerging market or energy debt defaults were the biggest risks to markets.

-

10:22

Federal Reserve Bank of Philadelphia President Patrick Harker: the Fed should not raise its interest rate further until inflation picks up

Federal Reserve Bank of Philadelphia President Patrick Harker said in a speech on Tuesday that the Fed should not raise its interest rate further until inflation picks up.

"It might prove prudent to wait until the inflation data are stronger before we undertake a second rate hike," he said.

Harker added that inflation could be negative in the first quarter.

Federal Reserve Bank of Philadelphia president noted that the Fed could hike its interest rate further in the second half of 2016.

Harker is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

10:12

Boston Fed President Eric Rosengren: there is no hurry to hike interest rates further as inflation remains low

Boston Fed President Eric Rosengren said in a speech on Tuesday that there is no hurry to hike interest rates further as inflation remains low.

"If inflation is slower to return to target, monetary policy normalization should be unhurried. A more gradual approach is an appropriate response to headwinds from abroad that slow exports, and financial volatility that raises the cost of funds to many firms," he said.

Rosengren pointed out that developments abroad and the recent turmoil in financial markets weigh on the U.S. economy.

"We have seen oil prices decline and global stock indices become more volatile - and more generally a lack of inflationary pressures and the presence of global headwinds that make future economic growth somewhat more uncertain," Boston Fed president said.

Rosengren added that the Fed should wait until the economic data improves to raise its interest rate further.

Rosengren is a voting member of the Federal Open Market Committee (FOMC) this year.

-

06:59

Global Stocks: U.S. stock indices gained

U.S. stock indices rose on Tuesday despite lower oil prices. Investors also assessed rally in Chinese stocks.

The Dow Jones Industrial Average rose 222.57 points, or 1.2%, to 16,196.41. The S&P 500 rose 30.80 points, or 1.7%, to 1,895.58 (all of its 10 sectors climbed). The Nasdaq Composite surged 98.44 points, or 2.3%, to 4,435.96.

The Empire State manufacturing index showed business conditions in the New York region improved in December, but remained weak. The index rose to -4.59 from -10.74 in November. Economists had expected the index to climb to -10.

Meanwhile the National Association of Home Builders reported that an index of builder confidence in the market for new single-family homes fell in February. The index declined to 58 points (the lowest level since May) from 61 in January (revised from 60). A reading above 50 suggests most builders consider current conditions positive.

This morning in Asia Hong Kong Hang Seng lost 0.58%, or 110.14 points, to 19,011.94. China Shanghai Composite Index declined 0.14%, or 3.94 points, to 2,832.63. Meanwhile the Nikkei fell 1.84%, or 294.98 points, to 15,759.45.

Asian stocks declined despite gains in U.S. equities. Some analysts say that stock rally that started on Friday has depleted and U.S. stocks rose because investors wanted to catch up after a long weekend.

The yen resumed its growth weighing in Japanese exporters.

-

02:59

Nikkei 225 15,978.7 -75.73 -0.47 %, Hang Seng 19,186.61 +64.53 +0.34 %, Shanghai Composite 2,829.76 -6.81 -0.24 %

-

02:30

Stocks. Daily history for Sep Feb 16’2016:

(index / closing price / change items /% change)

S&P/ASX 200 4,910.04 +66.58 +1.37%

TOPIX 1,297.01 +4.78 +0.37%

SHANGHAI COMP 2,837.41 +91.21 +3.32%

HANG SENG 19,122.08 +203.94 +1.08%

FTSE 100 5,862.17 +37.89 +0.65 %

CAC 40и4,110.66 -4.59 -0.11 %

Xetra DAX 9,135.11 -71.73 -0.78 %

S&P 500 1,895.58 +30.80 +1.65 %

NASDAQ Composite 4,435.96 +98.44 +2.27 %

Dow Jones 16,196.41 +222.57 +1.39 %

-