Noticias del mercado

-

21:01

DJIA 16171.96 198.12 1.24%, NASDAQ 4427.01 89.49 2.06%, S&P 500 1892.55 27.77 1.49%

-

18:42

WSE: Session Results

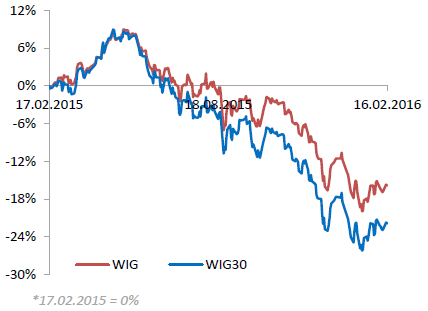

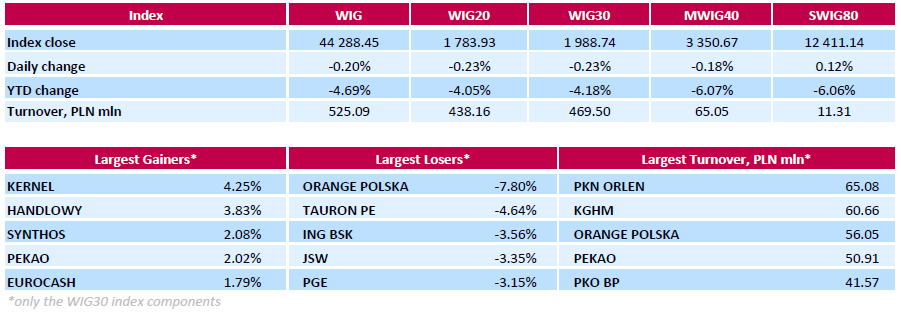

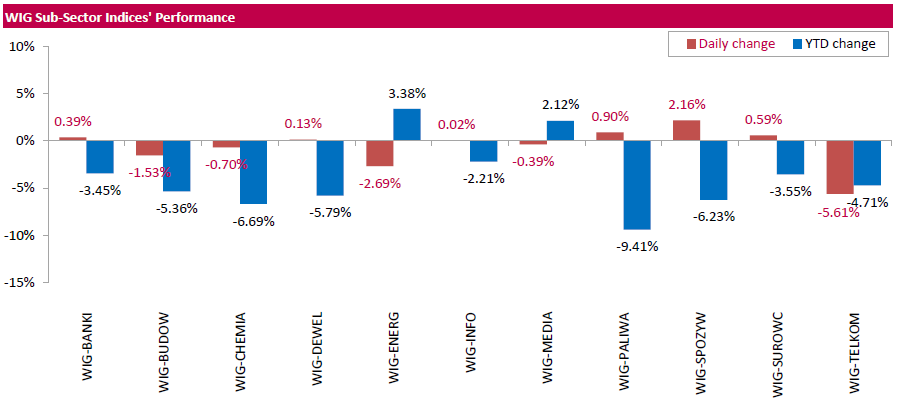

Polish equity market closed lower on Tuesday. The broad market measure, the WIG index, lost 0.2%. Sector-wise, telecommunications sector (-5.61%) was the weakest, while food sector (+2.16%) outperformed.

The large-cap stocks' measure, the WIG30 Index, declined by 0.23%. Within the WIG30 Index components, telecommunication services provider ORANGE POLSKA (WSE: OPL) fared the worst, slumping by 7.8% after the company reported a bigger-than-expected Q4 net loss and pessimistic forecast for 2016. It was followed by genco TAURON PE (WSE: TPE), which fell by 4.64% after the company announced it expects to take a PLN 4.931 bln hit from asset impairments on its 2015 net profit. Bank ING BSK (WSE: ING), coking coal producer JSW (WSE: JSW), genco PGE (WSE: PGE) and chemical producer GRUPA AZOTY (WSE: ATT) also generated solid losses, tumbling by 3%-3.56%. On the other side of the ledger, agricultural producer KERNEL (WSE: KER) and bank HANDLOWY (WSE: BHW) were the best performers, advancing 4.25% and 3.83% respectively.

-

18:01

European stocks close: stocks closed mixed as oil prices fell again

Stock indices closed mixed as oil prices fell again. Oil prices traded lower on news that Russia and Saudi Arabia on Tuesday agreed to freeze the oil production at the level of January if other oil producers join.

Market participants also eyed the weak ZEW economic sentiment data from Germany and the Eurozone. The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index declined to 1.0 in February from 10.2 in January, beating expectations for a fall to 0.0.

"The looming slowdown of the world economy and the uncertain consequences of the falling oil price put a strain on the ZEW Indicator of Economic Sentiment. In view of these developments, the concern over an increased credit default risk has already caused stock and bond prices for many banks in Europe, Japan and the US to slump," head of the "International Finance and Financial Management" Research Department at ZEW, Sascha Steffen, said.

Eurozone's ZEW economic sentiment index dropped to 13.6 in February from 22.7 in January, beating expectations for a decline to 10.3.

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index rose to 0.3% year-on-year in January from 0.2% in December, in line with expectations. It was the highest reading since January 2015.

The rise was driven by a softer decline in food and fuel prices.

On a monthly basis, U.K. consumer prices dropped 0.8% in January, missing expectations for a 0.7% fall, after a 0.1% gain in December.

The monthly decline was driven by a drop in air fare prices.

Consumer price inflation excluding food, energy, alcohol and tobacco prices decreased to 1.2% year-on-year in January from 1.4% in December, missing expectations for a 1.3% gain.

The consumer price inflation is below the Bank of England's 2% target.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,862.17 +37.89 +0.65 %

DAX 9,135.11 -71.73 -0.78 %

CAC 40 4,110.66 -4.59 -0.11 %

-

18:00

European stocks closed: FTSE 5862.17 37.89 0.65%, DAX 9135.11 -71.73 -0.78%, CAC 40 4110.66 -4.59 -0.11%

-

17:28

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes higher on Tuesday morning, extending a rally from Friday, as cautious investors looked for bargains among beaten-down stocks. Banks again gained. The S&P financial index posted its largest daily percentage gain since November 2011 on Friday. Consumer discretionary, technology and health stocks are down more than 9 percent this year. Only the financials' 13 percent drop is worse.

Most of Dow stocks in positive area (18 of 30). Top looser - Chevron Corporation (CVX, -2,22%). Top gainer - The Boeing Company (BA, +2,29%).

All of S&P sectors in positive area. Top gainer - Conglomerates (+2,8%).

At the moment:

Dow 16007.00 +94.00 +0.59%

S&P 500 1872.00 +13.75 +0.74%

Nasdaq 100 4051.25 +45.00 +1.12%

Oil 28.86 -0.58 -1.97%

Gold 1215.80 -23.60 -1.90%

U.S. 10yr 1.76 +0.02

-

17:14

Reserve Bank of New Zealand’s inflation expectations for the next 12 months drops to 1.09% in the three months to February

According to the Reserve Bank of New Zealand's survey published on Tuesday, New Zealand's inflation expectations for the next 12 months dropped to 1.09% in the three months to February from 1.51% the previous quarter.

Inflation expectations for the next 24 months slid to 1.63% from 1.85%. It was the lowest reading since the second quarter of 1994.

-

17:01

UK house price inflation falls 0.2% in December

The Office for National Statistics (ONS) released its house inflation data for the U.K. on Tuesday. The U.K. house price index fell at a seasonally adjusted rate of 0.2% in December, after a 1.0% increase in November.

On a yearly basis, the U.K. house price index increased at a seasonally adjusted rate of 6.7% in December, after a 7.7% in November.

The higher house price inflation England was mainly driven by an increase in prices in the East, the South East and London.

The average mix-adjusted house price was £288,000 in December, unchanged from November.

-

16:18

NAHB housing market index declines to 58 in February

The National Association of Home Builders (NAHB) released its housing market index for the U.S. on Tuesday. The NAHB housing market index declined to 58 in February from 61 in January, missing expectations for a decrease to 60. January's figure was revised up from 60.

A level above 50.0 is considered positive, below indicates a negative outlook.

The buyer traffic sub-index decreased to 39 in February from 44 in January, the current sales conditions sub-index fell to 65 from 68, while the sub-index measuring sales expectations in the next six months increased to 65 from 64.

"Builders reported more consumer concern over the price of new homes relative to existing homes as builders face higher costs for labour, land and materials," the NAHB Chief Economist David Crowe said.

"Historically low mortgage rates, steady job gains, improved household formations and significant pent up demand all point to a gradual upward trend for housing in the year ahead," he added.

-

15:33

U.S. Stocks open: Dow +1.05%, Nasdaq +1.40%, S&P +1.01%

-

15:27

Before the bell: S&P futures +1.02%, NASDAQ futures +1.41%

U.S. stock-index futures rose.

Global Stocks:

FTSE 5,847.16 +22.88 +0.39%

CAC 4,114.63 -0.62 -0.02%

DAX 9,130.14 -76.70 -0.83%

Nikkei 16,054.43 +31.85 +0.20%

Hang Seng 19,122.08 +203.94 +1.08%

Shanghai Composite 2,837.41 +91.21 +3.32%

Crude oil $29.54 (+0.34%)

Gold $1215.40 (-1.94%)

-

14:59

NY Fed Empire State manufacturing index rises to -16.64 in February

The New York Federal Reserve released its survey on Tuesday. The NY Fed Empire State manufacturing index rose to -16.64 in February from -19.37 in January, missing expectations for an increase to -10.00.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

"The February 2016 Empire State Manufacturing Survey indicates that business activity continued to decline for New York manufacturers," the New York Federal Reserve said in its report.

The new orders index increased to -11.63 in February from -23.54 in January, while the shipments index climbed to -11.56 from -14.39.

The general business conditions expectations index for the next six months jumped to 14.48 in February from 9.51 in January.

The price-paid index dropped to 2.97 in February from 16.00 in January.

The index for the number of employees rose to -0.99 in February from -13.00 in January.

-

14:56

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

5.86

5.97%

36.1K

Tesla Motors, Inc., NASDAQ

TSLA

156.7

3.75%

38.0K

ALCOA INC.

AA

7.87

2.34%

1.1K

Nike

NKE

57.66

2.20%

1.0K

Yahoo! Inc., NASDAQ

YHOO

27.6

2.07%

4.0K

Citigroup Inc., NYSE

C

38.3

2.02%

40.5K

Caterpillar Inc

CAT

64.3

1.82%

1.1K

Facebook, Inc.

FB

103.74

1.70%

116.3K

Amazon.com Inc., NASDAQ

AMZN

515.4

1.64%

13.8K

Goldman Sachs

GS

148.5

1.62%

10.7K

Procter & Gamble Co

PG

82.3

1.62%

4.8K

General Motors Company, NYSE

GM

28.13

1.52%

0.2K

Hewlett-Packard Co.

HPQ

9.56

1.49%

9.6K

Ford Motor Co.

F

11.72

1.47%

15.5K

Google Inc.

GOOG

692

1.41%

6.3K

Twitter, Inc., NYSE

TWTR

16.1

1.39%

105.0K

Visa

V

71.37

1.35%

0.7K

Microsoft Corp

MSFT

50.8

1.32%

28.2K

Walt Disney Co

DIS

92.3

1.26%

1.4K

Apple Inc.

AAPL

95.15

1.23%

126.8K

Starbucks Corporation, NASDAQ

SBUX

56.53

1.20%

3.7K

JPMorgan Chase and Co

JPM

58.15

1.15%

39.1K

International Business Machines Co...

IBM

122.4

1.12%

0.6K

United Technologies Corp

UTX

86.9

1.11%

0.2K

General Electric Co

GE

28.57

1.10%

19.2K

Chevron Corp

CVX

85.25

1.06%

11.9K

American Express Co

AXP

53.2

1.03%

2.5K

Yandex N.V., NASDAQ

YNDX

13.07

0.93%

5.8K

Pfizer Inc

PFE

29.63

0.92%

6.8K

Exxon Mobil Corp

XOM

81.75

0.89%

23.4K

Boeing Co

BA

109.5

0.80%

1K

Wal-Mart Stores Inc

WMT

66.7

0.79%

1.8K

Merck & Co Inc

MRK

49.4

0.75%

2.7K

The Coca-Cola Co

KO

43.43

0.74%

7.7K

Cisco Systems Inc

CSCO

25.29

0.72%

7.5K

AT&T Inc

T

36.7

0.63%

14.2K

Home Depot Inc

HD

117.05

0.63%

0.3K

UnitedHealth Group Inc

UNH

112.5

0.61%

0.6K

Verizon Communications Inc

VZ

50.38

0.54%

1.4K

McDonald's Corp

MCD

118.5

0.48%

3.4K

Johnson & Johnson

JNJ

102.19

0.36%

8.5K

Intel Corp

INTC

28.7

0.21%

7.3K

ALTRIA GROUP INC.

MO

60.09

0.20%

1.4K

Barrick Gold Corporation, NYSE

ABX

11.63

-5.06%

89.7K

-

14:46

Upgrades and downgrades before the market open

Upgrades:

Goldman Sachs (GS) upgraded to Overweight from Underweight at JP Morgan; target raised to $180 from $170

Procter & Gamble (PG) upgraded to Buy from Neutral at Sterne Agee CRT

Downgrades:

Other:

Barrick Gold (ABX) initiated with a Neutral at Clarkson Platou

-

14:44

Canadian manufacturing shipments rise 1.2% in December

Statistics Canada released manufacturing shipments on Tuesday. Canadian manufacturing shipments rose 1.2% in December, beating expectations for a 0.7% increase, after a 1.2% increase in November. November's figure was revised up from a 1.0% rise.

The increase was mainly driven by higher motor vehicle and wood products sales. Motor vehicle rose 3.6% in December, while sales of wood products climbed 5.5%.

Inventories decreased 1.6% in December, driven by drops in in aerospace products and parts, petroleum and coal.

In 2015 as whole, manufacturing shipments fell 1.5%. It was the first annual decline since 2009.

-

14:09

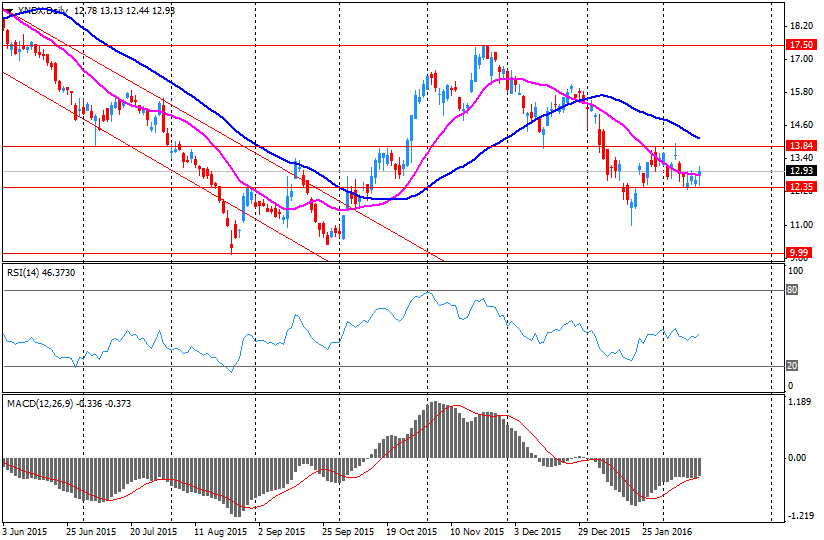

Company News: Yandex N.V. (YNDX) Posts Q4 Results

Yandex reported Q4 FY 2015 earnings of RUB 11.24 per share versus RUB 23.44 in Q4 FY 2014 and analysts' consensus of RUB 11.97.

The company's quarterly revenues amounted to RUB 18.094 bln (+23.4% y/y) versus consensus estimate of RUB 17.331 bln.

Yandex also announced the company's ruble-based revenue is expected to grow in the range of 12% to 18% in the full year 2016 compared to 2015.

YNDX rose to $13.07 (+0.93%) in pre-market trading.

-

12:00

European stock markets mid session: stocks traded mixed on weak ZEW economic sentiment data from Germany and the Eurozone

Stock indices traded mixed after the release of the weak ZEW economic sentiment data from Germany and the Eurozone. The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index declined to 1.0 in February from 10.2 in January, beating expectations for a fall to 0.0.

"The looming slowdown of the world economy and the uncertain consequences of the falling oil price put a strain on the ZEW Indicator of Economic Sentiment. In view of these developments, the concern over an increased credit default risk has already caused stock and bond prices for many banks in Europe, Japan and the US to slump," head of the "International Finance and Financial Management" Research Department at ZEW, Sascha Steffen, said.

Eurozone's ZEW economic sentiment index dropped to 13.6 in February from 22.7 in January, beating expectations for a decline to 10.3.

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index rose to 0.3% year-on-year in January from 0.2% in December, in line with expectations. It was the highest reading since January 2015.

The rise was driven by a softer decline in food and fuel prices.

On a monthly basis, U.K. consumer prices dropped 0.8% in January, missing expectations for a 0.7% fall, after a 0.1% gain in December.

The monthly decline was driven by a drop in air fare prices.

Consumer price inflation excluding food, energy, alcohol and tobacco prices decreased to 1.2% year-on-year in January from 1.4% in December, missing expectations for a 1.3% gain.

The consumer price inflation is below the Bank of England's 2% target.

Current figures:

Name Price Change Change %

FTSE 100 5,825.84 +1.56 +0.03 %

DAX 9,142.93 -63.91 -0.69 %

CAC 40 4,105.58 -9.67 -0.23 %

-

11:37

Italy’ trade surplus climbs to €6.02 billion in December

The Italian statistical office Istat released its trade data for Italy on Tuesday. Italy' trade surplus widened to €6.02 billion in December from €4.00 billion in November. November's figure was revised down €4.41 billion.

Exports climbed 3.0% year-on-year in December, while imports increased 2.6%.

On a monthly basis, exports fell a seasonally-adjusted 2.2% in December, while imports were down 3.5%.

The seasonally-adjusted trade surplus with the EU was €1.18 billion in December, while the trade surplus with non-EU countries was €3.41 billion.

-

11:31

UK consumer price inflation rises to 0.3% year-on-year in January

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index rose to 0.3% year-on-year in January from 0.2% in December, in line with expectations. It was the highest reading since January 2015.

The rise was driven by a softer decline in food and fuel prices.

On a monthly basis, U.K. consumer prices dropped 0.8% in January, missing expectations for a 0.7% fall, after a 0.1% gain in December.

The monthly decline was driven by a drop in air fare prices.

Consumer price inflation excluding food, energy, alcohol and tobacco prices decreased to 1.2% year-on-year in January from 1.4% in December, missing expectations for a 1.3% gain.

The Retail Prices Index climbed to 1.3% year-on-year in January from 1.2% in December, missing expectations for an increase to 1.4%.

The consumer price inflation is below the Bank of England's 2% target.

-

11:23

Germany's ZEW economic sentiment index declines to 1.0 in February

The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index declined to 1.0 in February from 10.2 in January, beating expectations for a fall to 0.0.

The assessment of the current situation in Germany declined by 7.4 points to 52.3 points.

"The looming slowdown of the world economy and the uncertain consequences of the falling oil price put a strain on the ZEW Indicator of Economic Sentiment. In view of these developments, the concern over an increased credit default risk has already caused stock and bond prices for many banks in Europe, Japan and the US to slump," head of the "International Finance and Financial Management" Research Department at ZEW, Sascha Steffen, said.

Eurozone's ZEW economic sentiment index dropped to 13.6 in February from 22.7 in January, beating expectations for a decline to 10.3.

The assessment of the current situation in the Eurozone fell by 0.5 points to -8.0 points.

-

11:16

Japanese Finance Minister Taro Aso: the government will not implement additional economic policy

Japanese Finance Minister Taro Aso said on Tuesday that the government will not implement additional economic policy after the Japanese economy contracted in the fourth quarter of 2015.

He also said that the recent turmoil in financial markets was driven by global risk aversion.

-

11:05

February’s Reserve Bank of Australia monetary policy meeting: the Australian labour market improved in 2015, while household consumption increased

The Reserve Bank of Australia (RBA) released its minutes from February monetary policy meeting on Tuesday. The RBA said that the Australian labour market improved in 2015, while household consumption increased.

The Australian inflation remained at low levels, the RBA said.

According to the central bank, low interest rates supported growth in household consumption and dwelling investment, while the weak Australian dollar boosted demand for domestic production.

Members said that the global growth would be supported by accommodative monetary policies and lower oil prices.

The central bank noted that it could ease monetary policy further if needed, the minutes said.

The RBA kept unchanged its interest rate at 2.00% in February.

-

10:54

Retail sales in New Zealand rose 1.2% in the fourth quarter

Statistics New Zealand released retail sales data on late Monday evening. Retail sales in New Zealand climbed 1.2% in the fourth quarter, missing expectations for a 1.4% rise, after a 1.5% gain in the third quarter. The third quarter's figure was revised down from a 1.6% increase.

The increase was mainly driven by a rise in hardware, building, and garden supplies, which jumped 5.3% in the fourth quarter.

On a yearly basis, retail sales rose 5.3% in the fourth quarter, exceeding expectations for a 5.2% gain, after a 5.7% increase in the third quarter.

-

10:42

New loans in China rise to 2,510 billion yuan in January

The People's Bank of China (PBoC) released its new loans data on Tuesday. New loans in local currency in China were 2,510 billion yuan in January, up from December's 597.8 billion yuan and exceeding expectations of 1,800 billion yuan.

M2 money supply jumped by 14.0% year-on-year in January, after a 13.3% gain in December.

Total social financing increased to 3.42 trillion yuan in January from 1.82 trillion yuan in December.

-

10:29

Bad-loan ratio in China rise in 2015

Bloomberg reported, using data released by the China Banking Regulatory Commission (CBRC) on Monday, that bad-loan ratio in China rose to 1.67% of assets in 2015 from 1.25% in 2014, while the industry's bad-loan coverage ratio fell to 181% from more than 200% a year earlier.

-

10:12

Bank of England's Monetary Policy Committee member Ian McCafferty: there is no urgency to raise interest rates in the U.K. as wage growth slowed

The Bank of England's (BoE) Monetary Policy Committee (MPC) member Ian McCafferty said in an interview with The Wall Street Journal on Monday that there is no urgency to raise interest rates in the U.K. as wage growth slowed.

"I think an immediate rate rise isn't as necessary as I had felt last autumn," he said.

All MPC members voted this month to keep the central bank's monetary policy unchanged. Ian McCafferty, who voted to hike interest rate by 0.25% since August 2015, changed his mind.

McCafferty noted that the U.K. economy is still healthy, while he expected consumer spending to grow solidly.

-

09:11

Earnings Season in U.S.: Major Reports of the Week

February 16

Before the Open:

Yandex N.V. (YNDX). Consensus EPS $11.97, Consensus Revenue $17331.03 mln

February 17

After the Close:

Barrick Gold (ABX). Consensus EPS $0.06, Consensus Revenue $2214.79 mln

February 18

Before the Open:

Wal-Mart (WMT). Consensus EPS $1.43, Consensus Revenue $130491.71 mln

February 19

Before the Open:

Deere (DE). Consensus EPS $0.70, Consensus Revenue $4895.59 mln

-

06:47

Global Stocks: Asian stock indices rallied

U.S. stock markets were on holiday on Monday.

This morning in Asia Hong Kong Hang Seng gained 1.78%, or 337.33 points, to 19,255.47. China Shanghai Composite Index surged 3.18%, or 87.36 points, to 2,833.56. Meanwhile the Nikkei rose 0.91%, or 146.41 points, to 16,168.99.

Asian stocks rallied. Higher oil prices and stabilizing Chinese markets improved risk sentiment and persuaded investors to return to stocks.

Japanese stocks declined at the beginning of the session, but started to gain later. Some experts explain this situation by technical factors. By Friday Japanese indices had lost about 20-25% since the beginning of the year, which was enough for supply and demand to start to balance. A weaker yen supported exporters.

-

03:03

Nikkei 225 16,069.87 +47.29 +0.30 %, Hang Seng 19,064.24 +146.10 +0.77 %, Shanghai Composite 2,764.76 +18.56 +0.68 %

-

00:32

Stocks. Daily history for Sep Feb 15’2016:

(index / closing price / change items /% change)

Nikkei 225 16,022.58 +1,069.97 +7.16 %

Hang Seng 18,918.14 +598.56 +3.27 %

Shanghai Composite 2,746.2 -17.30 -0.63 %

FTSE 100 5,824.28 +116.68 +2.04 %

CAC 40 4,115.25 +120.19 +3.01 %

Xetra DAX 9,206.84 +239.33 +2.67 %

-