Noticias del mercado

-

22:01

U.S.: Net Long-term TIC Flows , December -29.4

-

22:00

U.S.: Total Net TIC Flows, December -114

-

17:14

Reserve Bank of New Zealand’s inflation expectations for the next 12 months drops to 1.09% in the three months to February

According to the Reserve Bank of New Zealand's survey published on Tuesday, New Zealand's inflation expectations for the next 12 months dropped to 1.09% in the three months to February from 1.51% the previous quarter.

Inflation expectations for the next 24 months slid to 1.63% from 1.85%. It was the lowest reading since the second quarter of 1994.

-

17:01

UK house price inflation falls 0.2% in December

The Office for National Statistics (ONS) released its house inflation data for the U.K. on Tuesday. The U.K. house price index fell at a seasonally adjusted rate of 0.2% in December, after a 1.0% increase in November.

On a yearly basis, the U.K. house price index increased at a seasonally adjusted rate of 6.7% in December, after a 7.7% in November.

The higher house price inflation England was mainly driven by an increase in prices in the East, the South East and London.

The average mix-adjusted house price was £288,000 in December, unchanged from November.

-

16:18

NAHB housing market index declines to 58 in February

The National Association of Home Builders (NAHB) released its housing market index for the U.S. on Tuesday. The NAHB housing market index declined to 58 in February from 61 in January, missing expectations for a decrease to 60. January's figure was revised up from 60.

A level above 50.0 is considered positive, below indicates a negative outlook.

The buyer traffic sub-index decreased to 39 in February from 44 in January, the current sales conditions sub-index fell to 65 from 68, while the sub-index measuring sales expectations in the next six months increased to 65 from 64.

"Builders reported more consumer concern over the price of new homes relative to existing homes as builders face higher costs for labour, land and materials," the NAHB Chief Economist David Crowe said.

"Historically low mortgage rates, steady job gains, improved household formations and significant pent up demand all point to a gradual upward trend for housing in the year ahead," he added.

-

16:00

U.S.: NAHB Housing Market Index, February 58 (forecast 60)

-

14:59

NY Fed Empire State manufacturing index rises to -16.64 in February

The New York Federal Reserve released its survey on Tuesday. The NY Fed Empire State manufacturing index rose to -16.64 in February from -19.37 in January, missing expectations for an increase to -10.00.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

"The February 2016 Empire State Manufacturing Survey indicates that business activity continued to decline for New York manufacturers," the New York Federal Reserve said in its report.

The new orders index increased to -11.63 in February from -23.54 in January, while the shipments index climbed to -11.56 from -14.39.

The general business conditions expectations index for the next six months jumped to 14.48 in February from 9.51 in January.

The price-paid index dropped to 2.97 in February from 16.00 in January.

The index for the number of employees rose to -0.99 in February from -13.00 in January.

-

14:45

Option expiries for today's 10:00 ET NY cut

USDJPY: 115.00-10 (USD 305m) 116.00 (340m)

EURUSD: 1.0995-1.1000 (EUR 363m) 1.1250 (460m) 1.1275-80 (458m) 1.1375 (498m)

GBPUSD: 1.4425 (GBP 202m)

EURGBP: 0.7650 (EUR 226m)

USDCHF: 1.0000 (USD 298m)

AUDUSD: 0.7070-75 (AUD 293m) 0.7100 (466m) 0.7125 (1.01bn) 0.7250 (1.16bn)

USD/CAD: 1.3400 (USD300m) 1.3500 (200m) 1.3700 (240m)

1.3750 (350m) 1.3890-1.3300 (540m)

AUDJPY: Y82.50(AUD173m) Y82.80(362m)

-

14:44

Canadian manufacturing shipments rise 1.2% in December

Statistics Canada released manufacturing shipments on Tuesday. Canadian manufacturing shipments rose 1.2% in December, beating expectations for a 0.7% increase, after a 1.2% increase in November. November's figure was revised up from a 1.0% rise.

The increase was mainly driven by higher motor vehicle and wood products sales. Motor vehicle rose 3.6% in December, while sales of wood products climbed 5.5%.

Inventories decreased 1.6% in December, driven by drops in in aerospace products and parts, petroleum and coal.

In 2015 as whole, manufacturing shipments fell 1.5%. It was the first annual decline since 2009.

-

14:30

U.S.: NY Fed Empire State manufacturing index , February -16.64 (forecast -10)

-

14:30

Canada: Manufacturing Shipments (MoM), December 1.2% (forecast 0.7%)

-

14:20

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the release of the weak ZEW economic sentiment data from Germany and the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia RBA Meeting's Minutes

02:00 China New Loans January 597.8 1800 2510

09:30 United Kingdom Producer Price Index - Input (MoM) January -0.3% Revised From -0.8% -1.4% -0.7%

09:30 United Kingdom Retail prices, Y/Y January 1.2% 1.4% 1.3%

09:30 United Kingdom Producer Price Index - Output (MoM) January -0.3% Revised From -0.2% -0.2% -0.1%

09:30 United Kingdom Producer Price Index - Input (YoY) January -10.4% Revised From -10.8% -8.8% -7.6%

09:30 United Kingdom Producer Price Index - Output (YoY) January -1.4% Revised From -1.2% -0.9% -1.0%

09:30 United Kingdom Retail Price Index, m/m January 0.3% -0.6% -0.7%

09:30 United Kingdom HICP, m/m January 0.1% -0.7% -0.8%

09:30 United Kingdom HICP, Y/Y January 0.2% 0.3% 0.3%

09:30 United Kingdom HICP ex EFAT, Y/Y January 1.4% 1.3% 1.2%

10:00 Eurozone ZEW Economic Sentiment February 22.7 10.3 13.6

10:00 Germany ZEW Survey - Economic Sentiment February 10.2 0 1

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. The NAHB housing market index is expected to remain unchanged at 60 in February.

The NY Fed Empire State manufacturing index is expected to rise to -10.0 in February from -19.37 in January.

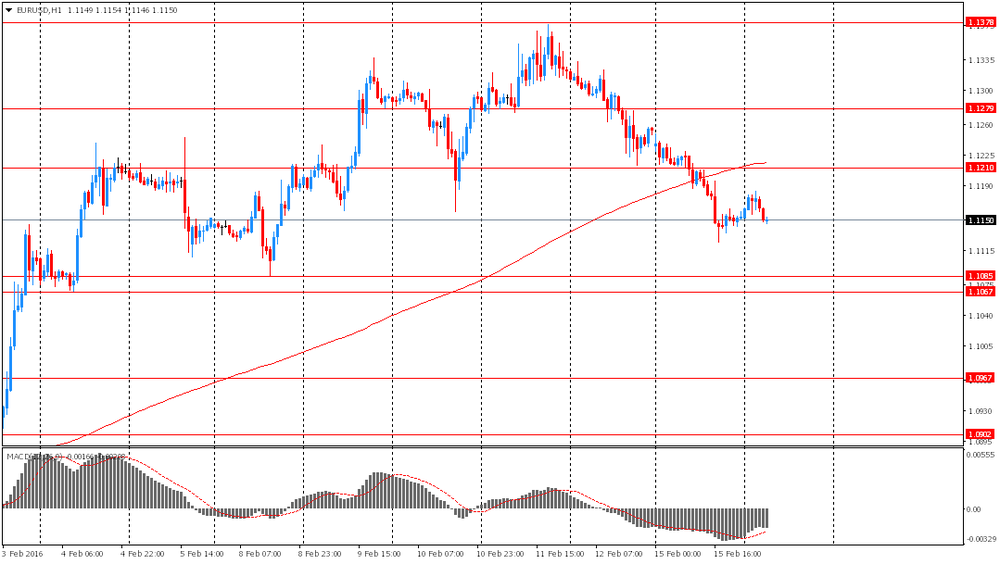

The euro traded mixed against the U.S. dollar after the release of the weak ZEW economic sentiment data from Germany and the Eurozone. The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index declined to 1.0 in February from 10.2 in January, beating expectations for a fall to 0.0.

"The looming slowdown of the world economy and the uncertain consequences of the falling oil price put a strain on the ZEW Indicator of Economic Sentiment. In view of these developments, the concern over an increased credit default risk has already caused stock and bond prices for many banks in Europe, Japan and the US to slump," head of the "International Finance and Financial Management" Research Department at ZEW, Sascha Steffen, said.

Eurozone's ZEW economic sentiment index dropped to 13.6 in February from 22.7 in January, beating expectations for a decline to 10.3.

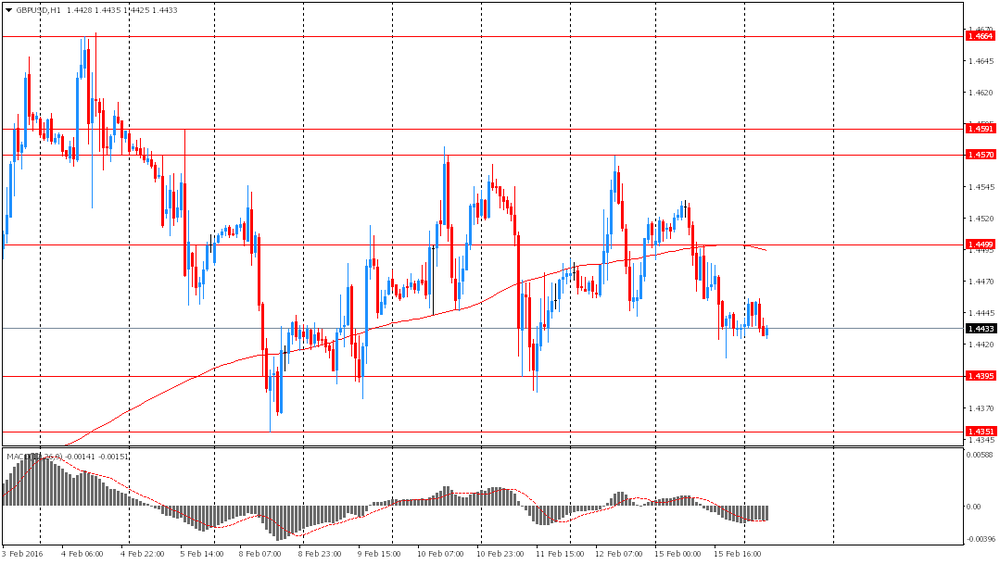

The British pound traded lower against the U.S. dollar after the release of the U.K. inflation data. The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index rose to 0.3% year-on-year in January from 0.2% in December, in line with expectations. It was the highest reading since January 2015.

The rise was driven by a softer decline in food and fuel prices.

On a monthly basis, U.K. consumer prices dropped 0.8% in January, missing expectations for a 0.7% fall, after a 0.1% gain in December.

The monthly decline was driven by a drop in air fare prices.

Consumer price inflation excluding food, energy, alcohol and tobacco prices decreased to 1.2% year-on-year in January from 1.4% in December, missing expectations for a 1.3% gain.

The consumer price inflation is below the Bank of England's 2% target.

The Canadian dollar traded lower against the U.S. dollar ahead of the release of the manufacturing shipments data from Canada. Canadian manufacturing shipments are expected to rise 0.7% in December, after a 1.0% gain in November.

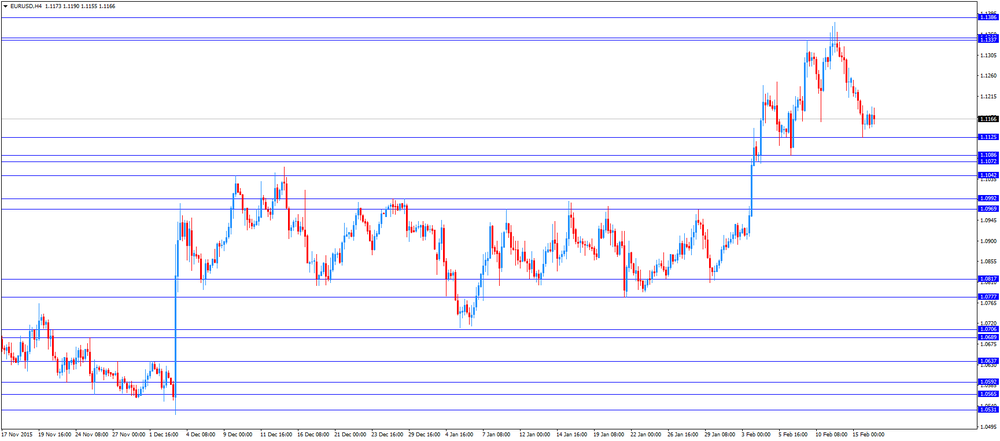

EUR/USD: the currency pair traded mixed

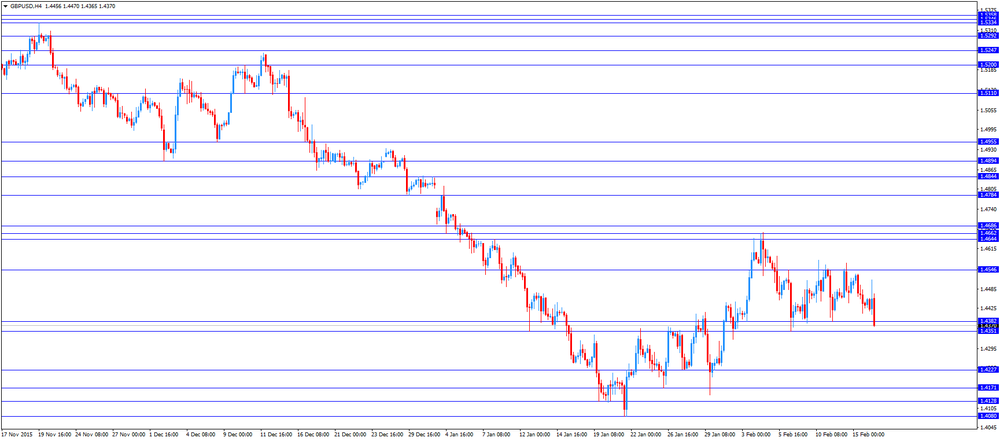

GBP/USD: the currency pair declined to $1.4365

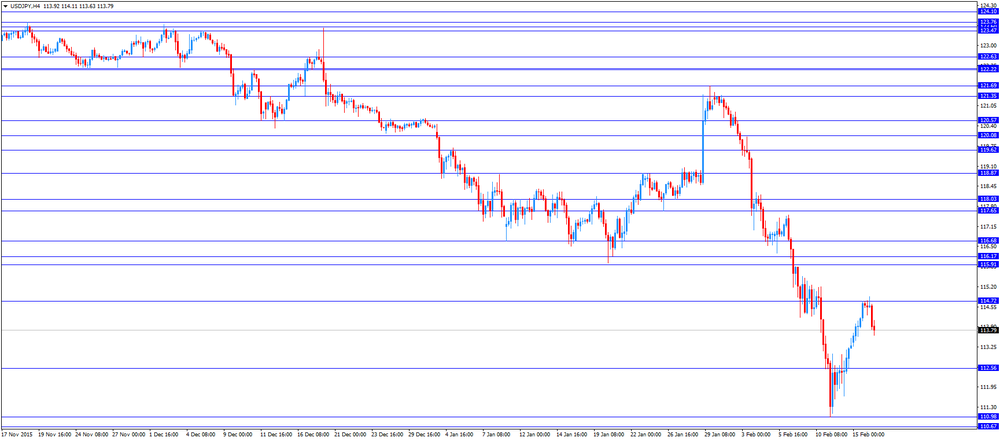

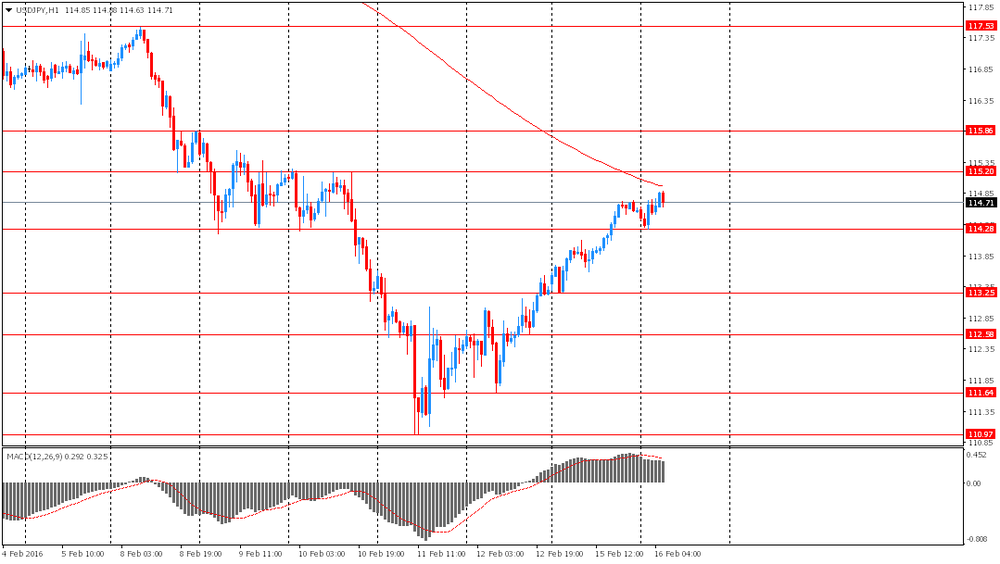

USD/JPY: the currency pair fell to Y113.63

The most important news that are expected (GMT0):

13:30 Canada Manufacturing Shipments (MoM) December 1% 0.7%

13:30 U.S. NY Fed Empire State manufacturing index February -19.37 -10

15:00 U.S. NAHB Housing Market Index February 60 60

21:00 U.S. Total Net TIC Flows December -3.2

21:00 U.S. Net Long-term TIC Flows December 31.4

23:50 Japan Core Machinery Orders December -14.4% 4.7%

23:50 Japan Core Machinery Orders, y/y December 1.2% -3.1%

-

14:01

Orders

EUR/USD

Offers 1.1200 1.1220 1.1235 1.1250 1.1265 1.1285 1.1300 1.1320-25 1.1350

Bids 1.1170 1.1150 1.1130 1.1100 1.1080 1.1065 1.1050

GBP/USD

Offers 1.4520-25 1.4535 1.4550 1.4575-80 1.4600 1.4630 1.4650 1.4675 1.4700

Bids 1.4485 1.4460 1.4440 1.4425 1.4400 1.4385 1.4365 1.4350

EUR/JPY

Offers 127.80 128.00 128.30 128.50 128.75 129.00

Bids 127.30 127.00 126.80 126.50 126.20 126.00 125.80 125.50

EUR/GBP

Offers 0.7720 0.7735 0.7750 0.7775-80 0.7800 0.7825 0.7855-60

Bids 0.7695-0.7700 0.7680 0.7665 0.7650 0.7630 0.7600

USD/JPY

Offers 114.25-30 114.50 114.75-80 115.00 115.25 115.50

Bids 113.80 113.65 113.50 113.30 113.00 112.85 112.50 112.20 112.00

AUD/USD

Offers 0.7180-85 0.7200 0.7220 0.7235 0.7250 0.7275 0.7300

Bids 0.7140 0.7125 0.7100 0.7080 0.7065 0.7050 0.7030 0.7000

-

11:37

Italy’ trade surplus climbs to €6.02 billion in December

The Italian statistical office Istat released its trade data for Italy on Tuesday. Italy' trade surplus widened to €6.02 billion in December from €4.00 billion in November. November's figure was revised down €4.41 billion.

Exports climbed 3.0% year-on-year in December, while imports increased 2.6%.

On a monthly basis, exports fell a seasonally-adjusted 2.2% in December, while imports were down 3.5%.

The seasonally-adjusted trade surplus with the EU was €1.18 billion in December, while the trade surplus with non-EU countries was €3.41 billion.

-

11:31

UK consumer price inflation rises to 0.3% year-on-year in January

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index rose to 0.3% year-on-year in January from 0.2% in December, in line with expectations. It was the highest reading since January 2015.

The rise was driven by a softer decline in food and fuel prices.

On a monthly basis, U.K. consumer prices dropped 0.8% in January, missing expectations for a 0.7% fall, after a 0.1% gain in December.

The monthly decline was driven by a drop in air fare prices.

Consumer price inflation excluding food, energy, alcohol and tobacco prices decreased to 1.2% year-on-year in January from 1.4% in December, missing expectations for a 1.3% gain.

The Retail Prices Index climbed to 1.3% year-on-year in January from 1.2% in December, missing expectations for an increase to 1.4%.

The consumer price inflation is below the Bank of England's 2% target.

-

11:23

Germany's ZEW economic sentiment index declines to 1.0 in February

The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index declined to 1.0 in February from 10.2 in January, beating expectations for a fall to 0.0.

The assessment of the current situation in Germany declined by 7.4 points to 52.3 points.

"The looming slowdown of the world economy and the uncertain consequences of the falling oil price put a strain on the ZEW Indicator of Economic Sentiment. In view of these developments, the concern over an increased credit default risk has already caused stock and bond prices for many banks in Europe, Japan and the US to slump," head of the "International Finance and Financial Management" Research Department at ZEW, Sascha Steffen, said.

Eurozone's ZEW economic sentiment index dropped to 13.6 in February from 22.7 in January, beating expectations for a decline to 10.3.

The assessment of the current situation in the Eurozone fell by 0.5 points to -8.0 points.

-

11:16

Japanese Finance Minister Taro Aso: the government will not implement additional economic policy

Japanese Finance Minister Taro Aso said on Tuesday that the government will not implement additional economic policy after the Japanese economy contracted in the fourth quarter of 2015.

He also said that the recent turmoil in financial markets was driven by global risk aversion.

-

11:05

February’s Reserve Bank of Australia monetary policy meeting: the Australian labour market improved in 2015, while household consumption increased

The Reserve Bank of Australia (RBA) released its minutes from February monetary policy meeting on Tuesday. The RBA said that the Australian labour market improved in 2015, while household consumption increased.

The Australian inflation remained at low levels, the RBA said.

According to the central bank, low interest rates supported growth in household consumption and dwelling investment, while the weak Australian dollar boosted demand for domestic production.

Members said that the global growth would be supported by accommodative monetary policies and lower oil prices.

The central bank noted that it could ease monetary policy further if needed, the minutes said.

The RBA kept unchanged its interest rate at 2.00% in February.

-

11:00

Germany: ZEW Survey - Economic Sentiment, February 1

-

11:00

Eurozone: ZEW Economic Sentiment, February 13.6 (forecast 10.3)

-

10:54

Retail sales in New Zealand rose 1.2% in the fourth quarter

Statistics New Zealand released retail sales data on late Monday evening. Retail sales in New Zealand climbed 1.2% in the fourth quarter, missing expectations for a 1.4% rise, after a 1.5% gain in the third quarter. The third quarter's figure was revised down from a 1.6% increase.

The increase was mainly driven by a rise in hardware, building, and garden supplies, which jumped 5.3% in the fourth quarter.

On a yearly basis, retail sales rose 5.3% in the fourth quarter, exceeding expectations for a 5.2% gain, after a 5.7% increase in the third quarter.

-

10:42

New loans in China rise to 2,510 billion yuan in January

The People's Bank of China (PBoC) released its new loans data on Tuesday. New loans in local currency in China were 2,510 billion yuan in January, up from December's 597.8 billion yuan and exceeding expectations of 1,800 billion yuan.

M2 money supply jumped by 14.0% year-on-year in January, after a 13.3% gain in December.

Total social financing increased to 3.42 trillion yuan in January from 1.82 trillion yuan in December.

-

10:42

Option expiries for today's 10:00 ET NY cut

USD/JPY: 115.00-10 (USD 305m) 116.00 (340m)

EUR/USD: 1.0995-1.1000 (EUR 363m) 1.1250 (460m) 1.1275-80 (458m) 1.1375 (498m)

GBP/USD: 1.4425 (GBP 202m)

EUR/GBP: 0.7650 (EUR 226m)

USD/CHF: 1.0000 (USD 298m)

AUD/USD: 0.7070-75 (AUD 293m) 0.7100 (466m) 0.7125 (1.01bn) 0.7250 (1.16bn)

USD/CAD: 1.3400 (USD300m) 1.3500 (200m) 1.3700 (240m)1.3750 (350m) 1.3890-1.3300 (540m)

AUD/JPY: Y82.50(AUD173m) Y82.80(362m)

-

10:31

United Kingdom: Producer Price Index - Output (YoY) , January -1% (forecast -0.9%)

-

10:30

United Kingdom: Producer Price Index - Input (MoM), January -0.7% (forecast -1.4%)

-

10:30

United Kingdom: Producer Price Index - Input (YoY) , January -7.6% (forecast -8.8%)

-

10:30

United Kingdom: HICP, Y/Y, January 0.3% (forecast 0.3%)

-

10:30

United Kingdom: Retail Price Index, m/m, January -0.7% (forecast -0.6%)

-

10:30

United Kingdom: HICP, m/m, January -0.8% (forecast -0.7%)

-

10:30

United Kingdom: Retail prices, Y/Y, January 1.3% (forecast 1.4%)

-

10:30

United Kingdom: Producer Price Index - Output (MoM), January -0.1% (forecast -0.2%)

-

10:30

United Kingdom: HICP ex EFAT, Y/Y, January 1.2% (forecast 1.3%)

-

10:29

Bad-loan ratio in China rise in 2015

Bloomberg reported, using data released by the China Banking Regulatory Commission (CBRC) on Monday, that bad-loan ratio in China rose to 1.67% of assets in 2015 from 1.25% in 2014, while the industry's bad-loan coverage ratio fell to 181% from more than 200% a year earlier.

-

10:12

Bank of England's Monetary Policy Committee member Ian McCafferty: there is no urgency to raise interest rates in the U.K. as wage growth slowed

The Bank of England's (BoE) Monetary Policy Committee (MPC) member Ian McCafferty said in an interview with The Wall Street Journal on Monday that there is no urgency to raise interest rates in the U.K. as wage growth slowed.

"I think an immediate rate rise isn't as necessary as I had felt last autumn," he said.

All MPC members voted this month to keep the central bank's monetary policy unchanged. Ian McCafferty, who voted to hike interest rate by 0.25% since August 2015, changed his mind.

McCafferty noted that the U.K. economy is still healthy, while he expected consumer spending to grow solidly.

-

08:02

Foreign exchange market. Asian session: the New Zealand dollar dropped

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia RBA Meeting's Minutes

02:00 China New Loans January 597.8 1800 2510

The euro declined slightly ahead of euro zone consumer confidence data. Economists expect to see a decline amid market turbulence in February. Market participants are also waiting for minutes of January ECB meeting. The central bank is expected to add stimulus in March, that's why the minutes will be studied carefully.

The New Zealand dollar dropped after the Reserve Bank of New Zealand published its inflation expectations. The index came in at 1.6% in the first quarter of 2016 compared to its previous reading of 1.9%. This index reflects business managers' expectations regarding the annualized CPI over a two-year period of time. Higher expectations may provoke rate increases. Lower expectations are a negative factor for the NZD. The country's retail sales data were released today. Retail sales rose by 1.2% in the fourth quarter of 2015 missing expectations for a 1.4% rise.

Global Dairy Trade auction will take place at 12:00 GMT today. Milk powder is New Zealand's key export product. Analysts expect prices to fall by about 8%. This would weigh on the New Zealand dollar.

The yen declined after Japanese Prime Minister Shinzo Abe said that excessive currency volatility was undesirable noting the yen's rally last week. He added that Tokyo would take steps if needed.

EUR/USD: the pair fluctuated within $1.1145-80 in Asian trade

USD/JPY: the pair traded within Y111.30-85

GBP/USD: the pair traded within $1.4415-55

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:30 United Kingdom Producer Price Index - Input (MoM) January -0.8% -1.4%

09:30 United Kingdom Retail prices, Y/Y January 1.2% 1.4%

09:30 United Kingdom Producer Price Index - Output (MoM) January -0.2% -0.2%

09:30 United Kingdom Producer Price Index - Input (YoY) January -10.8% -8.8%

09:30 United Kingdom Producer Price Index - Output (YoY) January -1.2% -0.9%

09:30 United Kingdom Retail Price Index, m/m January 0.3% -0.6%

09:30 United Kingdom HICP, m/m January 0.1% -0.7%

09:30 United Kingdom HICP, Y/Y January 0.2% 0.3%

09:30 United Kingdom HICP ex EFAT, Y/Y January 1.4% 1.3%

10:00 Eurozone ZEW Economic Sentiment February 22.7 10.3

10:00 Germany ZEW Survey - Economic Sentiment February 10.2 0

13:30 Canada Manufacturing Shipments (MoM) December 1% 0.7%

13:30 U.S. NY Fed Empire State manufacturing index February -19.37 -10

15:00 U.S. NAHB Housing Market Index February 60 60

21:00 U.S. Total Net TIC Flows December -3.2

21:00 U.S. Net Long-term TIC Flows December 31.4

23:30 Australia Leading Index January -0.3%

23:50 Japan Core Machinery Orders December -14.4% 4.7%

23:50 Japan Core Machinery Orders, y/y December 1.2% -3.1%

-

07:07

Options levels on tuesday, February 16, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1354 (4273)

$1.1318 (3025)

$1.1277 (1501)

Price at time of writing this review: $1.1152

Support levels (open interest**, contracts):

$1.1110 (4413)

$1.1045 (4713)

$1.1008 (2680)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 61954 contracts, with the maximum number of contracts with strike price $1,1000 (5069);

- Overall open interest on the PUT options with the expiration date March, 4 is 90671 contracts, with the maximum number of contracts with strike price $1,1100 (7676);

- The ratio of PUT/CALL was 1.46 versus 1.42 from the previous trading day according to data from February, 12

GBP/USD

Resistance levels (open interest**, contracts)

$1.4708 (1287)

$1.4611 (1100)

$1.4516 (1193)

Price at time of writing this review: $1.4527

Support levels (open interest**, contracts):

$1.4390 (995)

$1.4293 (2087)

$1.4195 (1915)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 26293 contracts, with the maximum number of contracts with strike price $1,4650 (1664);

- Overall open interest on the PUT options with the expiration date March, 4 is 24973 contracts, with the maximum number of contracts with strike price $1,4350 (2936);

- The ratio of PUT/CALL was 0.95 versus 0.93 from the previous trading day according to data from February, 12

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:12

China: New Loans, January 2510 (forecast 1800)

-

00:31

Currencies. Daily history for Feb 15’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1154 -0,90%

GBP/USD $1,4433 -0,51%

USD/CHF Chf0,9871 +1,09%

USD/JPY Y114,58 +1,13%

EUR/JPY Y127,81 +0,25%

GBP/JPY Y165,36 +0,62%

AUD/USD $0,7136 +0,52%

NZD/USD $0,6647 +0,33%

USD/CAD C$1,3832 -0,21%

-

00:01

Schedule for today,Tuesday, Feb 16’2016:

(time / country / index / period / previous value / forecast)

00:30 Australia RBA Meeting's Minutes

09:30 United Kingdom Producer Price Index - Input (MoM) January -0.8% -1.4%

09:30 United Kingdom Retail prices, Y/Y January 1.2% 1.4%

09:30 United Kingdom Producer Price Index - Output (MoM) January -0.2% -0.3%

09:30 United Kingdom Producer Price Index - Input (YoY) January -10.8% -8.8%

09:30 United Kingdom Producer Price Index - Output (YoY) January -1.2% -0.9%

09:30 United Kingdom Retail Price Index, m/m January 0.3% -0.6%

09:30 United Kingdom HICP, m/m January 0.1% -0.7%

09:30 United Kingdom HICP, Y/Y January 0.2% 0.3%

09:30 United Kingdom HICP ex EFAT, Y/Y January 1.4% 1.3%

10:00 Eurozone ZEW Economic Sentiment February 22.7

10:00 Germany ZEW Survey - Economic Sentiment February 10.2 0

13:30 Canada Manufacturing Shipments (MoM) December 1% 0.8%

13:30 U.S. NY Fed Empire State manufacturing index February -19.37 -10

15:00 U.S. NAHB Housing Market Index February 60 60

21:00 U.S. Total Net TIC Flows December -3.2

21:00 U.S. Net Long-term TIC Flows December 31.4

23:30 Australia Leading Index January -0.3%

23:50 Japan Core Machinery Orders December -14.4% 4.7%

23:50 Japan Core Machinery Orders, y/y December 1.2% -3.1%

-