Noticias del mercado

-

22:46

New Zealand: Retail Sales, q/q, Quarter IV 1.2% (forecast 1.4%)

-

22:45

New Zealand: Retail Sales YoY, Quarter IV 5.3% (forecast 5.2%)

-

17:03

European Central Bank Executive Board member Benoît Cœuré: the interest rate in the Eurozone will remain low until 2% target will be reached

The European Central Bank (ECB) Executive Board member Benoît Cœuré said in an interview with the German newspaper Rheinische Post published on February 13 that the interest rate in the Eurozone will remain low until 2% target will be reached.

"Rates will have to stay low until we see that the inflation rate in the euro area is moving towards our objective of just below 2%. We at the ECB don't want this phase of low rates to become normality either," he said.

Cœuré pointed out that there are new downside risks to the inflation outlook due to falling oil prices and the slowdown in the global economy.

He noted that the ECB could expand its quantitative easing if needed.

"If necessary, we stand ready to use all of the instruments at our disposal. That includes the key interest rates and the size, composition and duration of our securities purchases," the ECB executive board member said.

Cœuré also said that new financial crisis was unlikely and the Greek crisis was over.

-

16:30

European Central Bank purchases €12.72 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €12.72 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €2.23 billion of covered bonds, and €134 million of asset-backed securities.

The European Central Bank (ECB) President Mario Draghi hinted at a press conference in January that the central bank may add further stimulus measures at its meeting in March as downside risks rose.

-

16:13

European Central Bank President Mario Draghi: the central bank has no plans to buy bad loans from Italian banks

The European Central Bank (ECB) President Mario Draghi said on Monday that the central bank has no plans to buy bad loans from Italian banks.

Earlier in the day, Reuters reported that the European Central Bank (ECB) was discussing with the Italian government about buying bad loans from Italian banks as part of its asset-buying programme, according to the Italian Treasury.

-

16:04

European Central Bank President Mario Dragh: the economy in the Eurozone expanded moderately

The European Central Bank (ECB) President Mario Draghi said in a speech on Monday that the economy in the Eurozone expanded moderately, supported by the central bank's quantitative easing and low oil prices. He added that investment remained weak.

Draghi repeated that the ECB will review its stimulus measures at it monetary policy meeting in March. It downward risks to price stability increase, the central bank will be ready to act, Draghi noted.

The ECB president pointed out that fiscal and structural policies should support the recovery in the Eurozone.

"It is becoming clearer and clearer that fiscal policies should support the economic recovery through public investment and lower taxation. In addition, the ongoing cyclical recovery should be supported by effective structural policies," he said.

Draghi noted that the slowdown in emerging economies is a risk to the global economy.

-

15:45

Bundesbank downgrades its inflation forecasts

The German Bundesbank cut its inflation forecasts on Monday. The central bank expects inflation in Germany to be 0.25% in 2016, down from its previous forecast of 1.1%, and 1.75% in 2017, down from its previous forecast of 2.0%. The downward revision was driven by a drop in oil prices.

The Bundesbank also said that the economic growth in Germany would accelerate in the first quarter of 2016 due to a rise in consumption and construction activity.

-

15:13

People's Bank of China Governor Zhou Xiaochuan: there is no need to depreciate the yuan

The People's Bank of China (PBoC) Governor Zhou Xiaochuan said in an interview with Caixin over the weekend that there is no need to depreciate the yuan. He also said that China would not tighten capital controls.

-

14:43

European Central Bank is discussing with the Italian government about buying bad loans from Italian banks

Reuters reported on Monday that the European Central Bank (ECB) was discussing with the Italian government about buying bad loans from Italian banks as part of its asset-buying programme, according to the Italian Treasury.

The ECB declined to comment.

-

14:40

Option expiries for today's 10:00 ET NY cut

USD/JPY: 115.00 (USD 576m) 115.50 (745m) 117.00 (455m) 117.50 (400m)

EUR/USD: 1.1100 (EUR 1.02bn) 1.1200 (742m) 1.1350 (244m) 1.1470 (863m)

EUR/GBP: 0.7650 (EUR 226m)

AUD/USD: 0.6980(AUD 300m) 0.7050 (456m) 0.7275 (1.1bn)

USD/CAD: 1.3700 (USD 615m) 1.3750 (350m) 1.3890-1.3300 (540m)

-

14:19

Foreign exchange market. European session: the euro traded lower against the U.S. dollar despite the positive trade data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia New Motor Vehicle Sales (YoY) January 2.4% Revised From 2.2% 5.1%

00:30 Australia New Motor Vehicle Sales (MoM) January -0.1% Revised From -0.5% 0.5%

02:00 China Trade Balance, bln January 60.09 58.85 62.15

02:00 China New Loans January 597.8 1800

04:30 Japan Tertiary Industry Index December -0.9% Revised From -0.8% -0.6%

04:30 Japan Industrial Production (MoM) (Finally) December -0.9% -1.7%

04:30 Japan Industrial Production (YoY) (Finally) 1.7% -1.9%

10:00 Eurozone Trade balance unadjusted December 23.6 24.3

12:00 U.S. Bank holiday

The U.S. dollar traded higher against the most major currencies in the absence of any major U.S. economic reports. The U.S. markets will be closed for a public holiday today.

The euro traded lower against the U.S. dollar despite the positive trade data from the Eurozone. Eurostat released its trade data for the Eurozone on Monday. Eurozone's unadjusted trade surplus increased to €24.3 billion in December from €23.6 billion in November.

Exports rose at an unadjusted annual rate of 3.0% in December, while imports increased 3.0%.

Eurozone's adjusted trade surplus declined to €21.0 billion in December from €22.6 billion in November.

Exports fell at an adjusted 0.3% in December, while imports increased 0.8%.

The European Central Bank (ECB) President Mario Draghi is scheduled to speak at 14:00 GMT.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

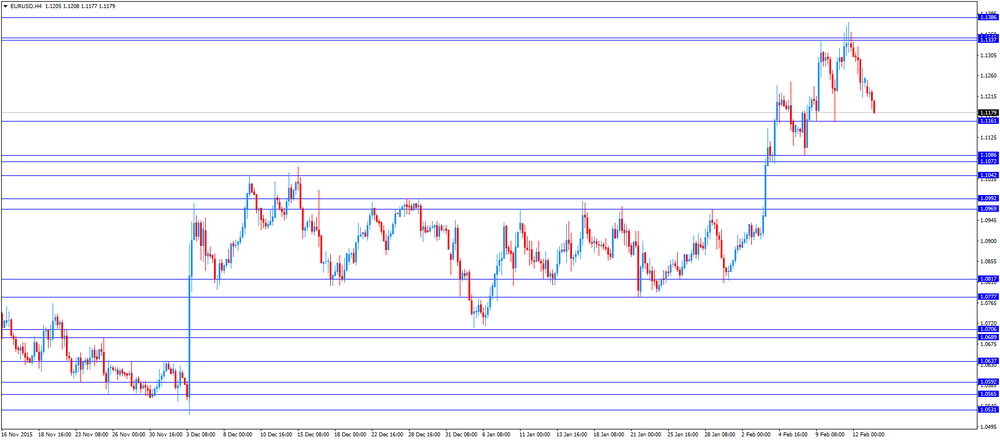

EUR/USD: the currency pair fell to $1.1177

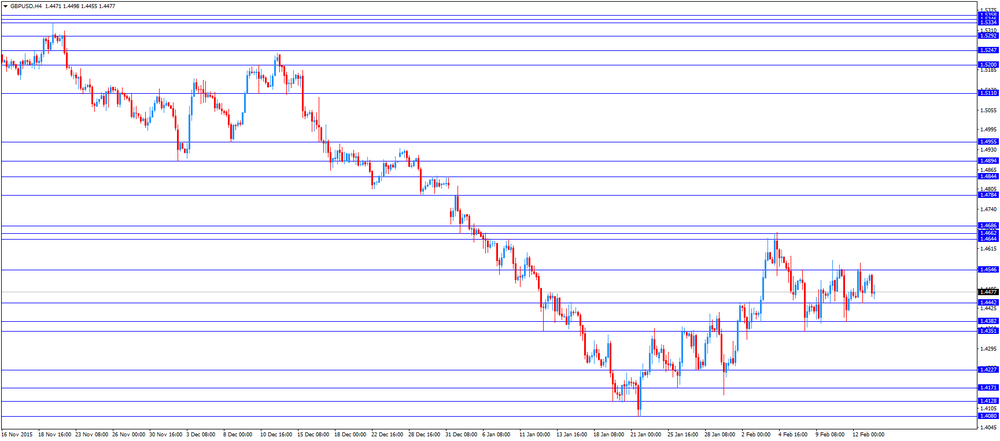

GBP/USD: the currency pair declined to $1.4455

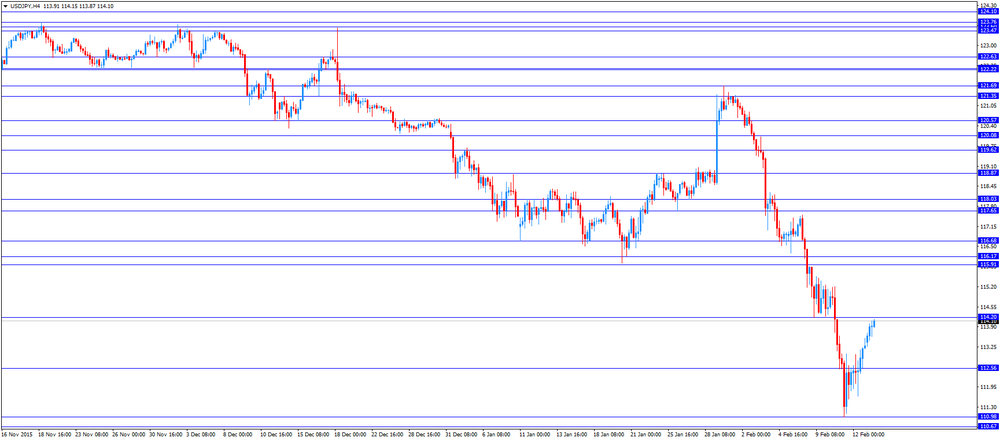

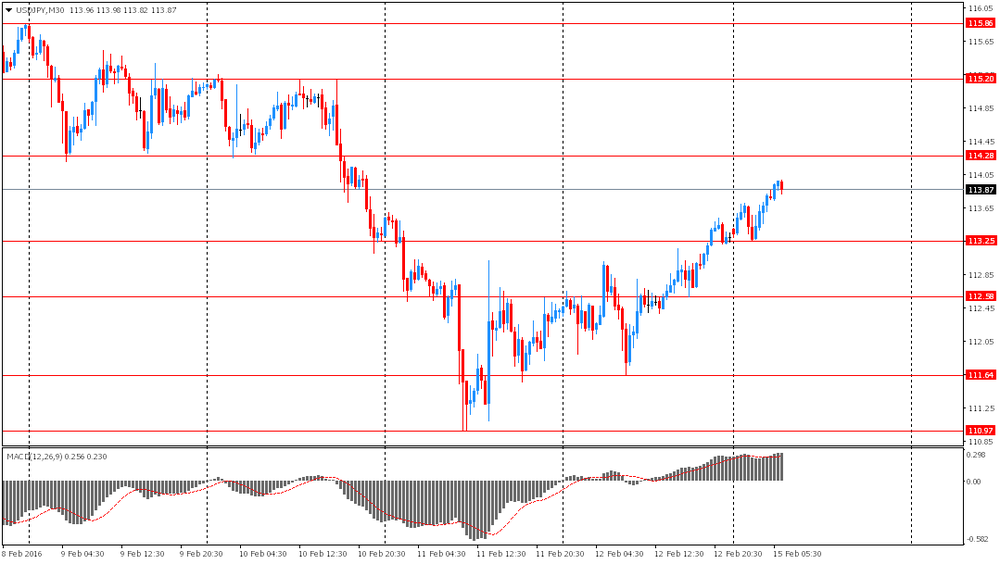

USD/JPY: the currency pair rose to Y114.15

The most important news that are expected (GMT0):

14:00 Eurozone ECB President Mario Draghi Speaks

21:45 New Zealand Retail Sales, q/q Quarter IV 1.6% 1.4%

21:45 New Zealand Retail Sales YoY Quarter IV 5.7% 5.2%

-

13:59

Orders

EUR/USD

Offers 1.1220 1.1235 1.1250 1.1265 1.1285 1.1300 1.1320-25 1.1350

Bids 1.1185 1.1170 1.1150 1.1130 1.1100 1.1080 1.1065 1.1050

GBP/USD

Offers 1.4520-25 1.4545-50 1.4575-80 1.4600 1.4630 1.4650

Bids 1.4480-85 1.4460 1.4445-50 1.4425 1.4400 1.4385 1.4365 1.4350

EUR/JPY

Offers 127.80 128.00 128.30 128.50 128.75 129.00

Bids 127.50 127.25 127.00 126.80 126.50 126.20 126.00 125.80 125.50

EUR/GBP

Offers 0.7735 0.7750 0.7775-80 0.7800 0.7825 0.7855-60

Bids 0.7700-10 0.7685 0.7665 0.7650 0.7630 0.7600

USD/JPY

Offers 114.00 114.30 114.50 114.75-80 115.00 115.25 115.50

Bids 113.50 113.30 113.00 112.85 112.50 112.20 112.00 111.85 111.65 111.50

AUD/USD

Offers 0.7175-80 0.7200 0.7220 0.7235 0.7250 0.7275 0.7300

Bids 0.7150 0.7130 0.7100 0.7080 0.7065 0.7050 0.7030 0.7000

-

11:33

Eurozone's unadjusted trade surplus increases to €24.3 billion in December

Eurostat released its trade data for the Eurozone on Monday. Eurozone's unadjusted trade surplus increased to €24.3 billion in December from €23.6 billion in November.

Exports rose at an unadjusted annual rate of 3.0% in December, while imports increased 3.0%.

Eurozone's adjusted trade surplus declined to €21.0 billion in December from €22.6 billion in November.

Exports fell at an adjusted 0.3% in December, while imports increased 0.8%.

-

11:00

Eurozone: Trade balance unadjusted, December 24.3

-

10:35

Final industrial production in Japan drops 1.7% in December

Japan's Ministry of Economy, Trade and Industry released its final industrial production data on Monday. Final industrial production in Japan declined 1.7% in December, down from the preliminary estimate of a 1.4% drop, after a 0.9% decrease in November.

Industrial shipments slid 1.8% in December, down from the preliminary estimate of a 1.7% fall, while inventories rose 0.4%, in line with the preliminary estimate.

On a yearly basis, Japan's industrial production was down 1.9% in December, after a 1.7% rise in November.

-

10:24

Option expiries for today's 10:00 ET NY cut

USD/JPY: 115.00 (USD 576m) 115.50 (745m) 117.00 (455m) 117.50 (400m)

EUR/USD: 1.1100 (EUR 1.02bn) 1.1200 (742m) 1.1350 (244m) 1.1470 (863m)

EUR/GBP: 0.7650 (EUR 226m)

AUD/USD: 0.6980(AUD 300m) 0.7050 (456m) 0.7275 (1.1bn)

USD/CAD: 1.3700 (USD 615m) 1.3750 (350m) 1.3890-1.3300 (540m)

-

10:15

Japan's tertiary industry activity index drops 0.6% in December

Japan's Ministry of Economy, Trade and Industry released its tertiary industry activity index on Monday. The index dropped 0.6% in December, after a 0.9% fall in November. November's figure was revised down from a 0.8% decline.

The fall was driven by declines in finance and insurance, real Estate, business-related services, electricity, gas, heat supply and water, transport and postal activities, information and communications.

-

09:55

Japan’s preliminary GDP shrinks 0.4% in the fourth quarter

Japan's Cabinet Office released its preliminary gross domestic product (GDP) data for Japan late Sunday. Japan's GDP declined by 0.4% in the fourth quarter, missing expectations for a 0.2% fall, after a 0.3% increase in the third quarter.

The decline was driven by a drop in private consumption. Private consumption dropped 0.8% in the fourth quarter, while capital expenditure climbed 1.4%.

On a yearly basis, Japan's economy shrank 1.4% in the fourth quarter, missing forecasts of 1.2% decline, after a 1.3% rise in the third quarter. The third quarter's figure was revised up from a 1.0% gain.

-

09:39

China's trade surplus climbs to $62.15 billion in January

The Chinese Customs Office released its trade data on Monday. China's trade surplus climbed to $62.15 billion in January from $60.09 billion in December, beating expectations for a decline to a surplus of $58.85 billion.

Exports fell at an annual rate of 11.2% in January, while imports slid at an annual rate of 18.8%, the fifteenth consecutive decline.

-

09:32

Rightmove: U.K. house prices rise 2.9% in February

According to property tracking website Rightmove, U.K. house prices rose 2.9% in February, after a 0.5% increase in January.

Housing demand was higher than ever, Rightmove said in its statement.

"The new year's market has hit the ground running in many locations, continuing last year's momentum and resulting in the price of property coming to the market hitting a new high. Many agents reported high numbers of sales in November and December and properties selling more quickly, so it's encouraging to see signs of replenishment of property, especially in the first-time buyer sector," Rightmove director and housing market analyst, Miles Shipside, said.

On a yearly basis, house prices in the U.K. climbed 7.2% in February, after a 6.5% increase in January.

-

08:14

Foreign exchange market. Asian session: the euro declined

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia New Motor Vehicle Sales (YoY) January 2.4% Revised From 2.2% 5.1%

00:30 Australia New Motor Vehicle Sales (MoM) January -0.1% Revised From -0.5% 0.5%

02:00 China Trade Balance, bln January 60.09 58.85 62.15

02:00 China New Loans January 597.8 1800

04:30 Japan Tertiary Industry Index December -0.8% -0.6%

04:30 Japan Industrial Production (MoM) (Finally) December -0.9% -1.7%

04:30 Japan Industrial Production (YoY) (Finally) 1.7% -1.9%

The euro declined slightly ahead of euro zone consumer confidence data, which will be released tomorrow. Economists expect to see a decline amid market turbulence in February. Market participants are also waiting for minutes of January ECB meeting. The central bank is expected to add stimulus in March, that's why the minutes will be studied carefully.

The yen fell against the U.S. dollar amid weak domestic GDP data. The country's GDP fell by 1.4% y/y in the fourth quarter of 2015. The index declined 0.4% on a quarterly basis after expanding by 0.3% in the previous quarter. Weak data may persuade the Bank of Japan to take steps.

The Australian dollar rose on new vehicle sales data. Sales of new vehicles rose by 0.5% m/m and 5.1% y/y in January. These data suggest suggest consumers were quite confident.

EUR/USD: the pair declined to $1.1210 in Asian trade

USD/JPY: the pair rose to Y114.10

GBP/USD: the pair rose to $1.4535

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

10:00 Eurozone Trade balance unadjusted December 23.6

14:00 Eurozone ECB President Mario Draghi Speaks

21:45 New Zealand Retail Sales, q/q Quarter IV 1.6% 1.4%

21:45 New Zealand Retail Sales YoY Quarter IV 5.7% 5.2%

-

07:05

Options levels on monday, February 15, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1402 (2323)

$1.1354 (4273)

$1.1318 (3025)

Price at time of writing this review: $1.1216

Support levels (open interest**, contracts):

$1.1162 (1498)

$1.1110 (4413)

$1.1045 (4713)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 61954 contracts, with the maximum number of contracts with strike price $1,1000 (5069);

- Overall open interest on the PUT options with the expiration date March, 4 is 90671 contracts, with the maximum number of contracts with strike price $1,1100 (7676);

- The ratio of PUT/CALL was 1.46 versus 1.42 from the previous trading day according to data from February, 12

GBP/USD

Resistance levels (open interest**, contracts)

$1.4805 (1211)

$1.4708 (1287)

$1.4611 (1100)

Price at time of writing this review: $1.4527

Support levels (open interest**, contracts):

$1.4390 (995)

$1.4293 (2087)

$1.4195 (1915)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 26293 contracts, with the maximum number of contracts with strike price $1,4650 (1664);

- Overall open interest on the PUT options with the expiration date March, 4 is 24973 contracts, with the maximum number of contracts with strike price $1,4350 (2936);

- The ratio of PUT/CALL was 0.95 versus 0.93 from the previous trading day according to data from February, 12

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:46

Japan: Tertiary Industry Index , December -0.6%

-

05:32

Japan: Industrial Production (YoY), -1.9%

-

05:31

Japan: Industrial Production (MoM) , December -1.7%

-

03:07

China: Trade Balance, bln, January 62.15 (forecast 58.85)

-

01:31

Australia: New Motor Vehicle Sales (YoY) , January 5.1%

-

01:31

Australia: New Motor Vehicle Sales (MoM) , January 0.5%

-

01:02

Currencies. Daily history for Feb 12’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1254 -0,60%

GBP/USD $1,4407 -0,21%

USD/CHF Chf0,9763 +0,42%

USD/JPY Y113,29 +0,77%

EUR/JPY Y127,49 +0,17%

GBP/JPY Y164,34 +0,99%

AUD/USD $0,7099 +1,28%

NZD/USD $0,6625 -1,36%

USD/CAD C$1,3861 -0,53%

-

00:50

Japan: GDP, y/y, Quarter IV -1.4% (forecast -1.2%)

-

00:50

Japan: GDP, q/q, Quarter IV -0.4% (forecast -0.3%)

-

00:02

Schedule for today, Monday, Feb 15’2016:

(time / country / index / period / previous value / forecast)

00:30 Australia New Motor Vehicle Sales (YoY) January 2.2%

00:30 Australia New Motor Vehicle Sales (MoM) January -0.5%

02:00 China Trade Balance, bln January 60.09 58.85

02:00 China New Loans January 597.8 1800

04:30 Japan Tertiary Industry Index December -0.8%

04:30 Japan Industrial Production (MoM) (Finally) December -0.9%

04:30 Japan Industrial Production (YoY) (Finally) 1.7%

10:00 Eurozone Trade balance unadjusted December 23.6

12:00 U.S. Bank holiday

14:00 Eurozone ECB President Mario Draghi Speaks

21:45 New Zealand Retail Sales, q/q Quarter IV 1.6% 1.4%

21:45 New Zealand Retail Sales YoY Quarter IV 5.7% 5.2%

-