Noticias del mercado

-

20:22

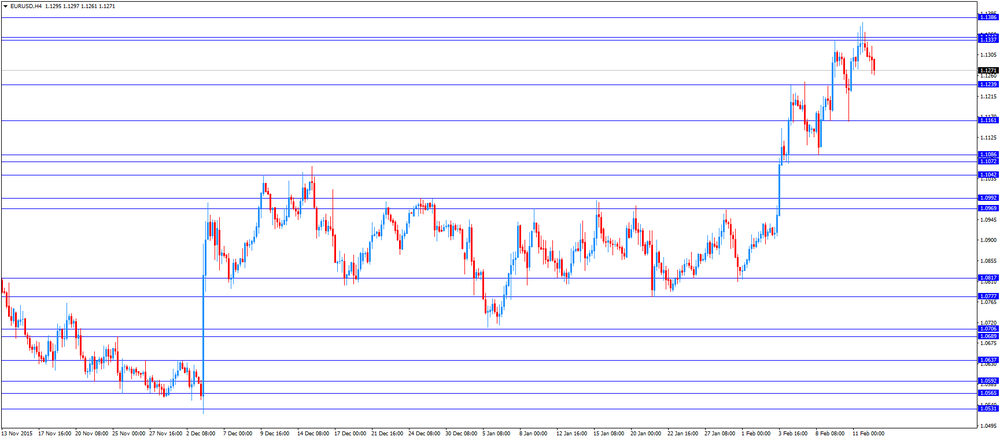

American focus: The US dollar rose against major currencies

The US dollar appreciated strongly against the euro, approaching to the level of $ 1.1200, helped by the publication of data waiting on US retail sales. The growth of the dollar increased after it became known that sales increased more than forecast. Today, the Commerce Department reported that US consumer spending rebounded in January, as households increased their purchases of various goods, sparking hope that economic growth accelerated after slowing in late 2015. Retail sales excluding autos, gasoline and building materials and catering services increased by 0.6 percent last month after falling 0.3 percent in December. These so-called core retail sales is most closely correlated with consumer spending as a component of GDP. Economists had forecast that sales will increase by 0.3 percent. Growth in consumer spending, which accounts for over two-thirds of US economic activity was moderate in the fourth quarter. This, along with weak growth of exports due to the strong dollar, business efforts on selling stocks and reducing the cost of capital goods among energy companies, restrained GDP growth to an annual rate of 0.7 percent. Consumer spending is currently supported by the strengthening of the labor market. Overall, retail sales rose 0.2 percent in January, as cheaper petrol has led to a reduction in the cost of service stations and severe winter weather has reduced costs in restaurants and bars.

Sentiment also improved significantly on the background of rising oil prices after the Thursday evening Minister of Energy of the United Arab Emirates announced the availability of OPEC to negotiate with other exporters to cut production.

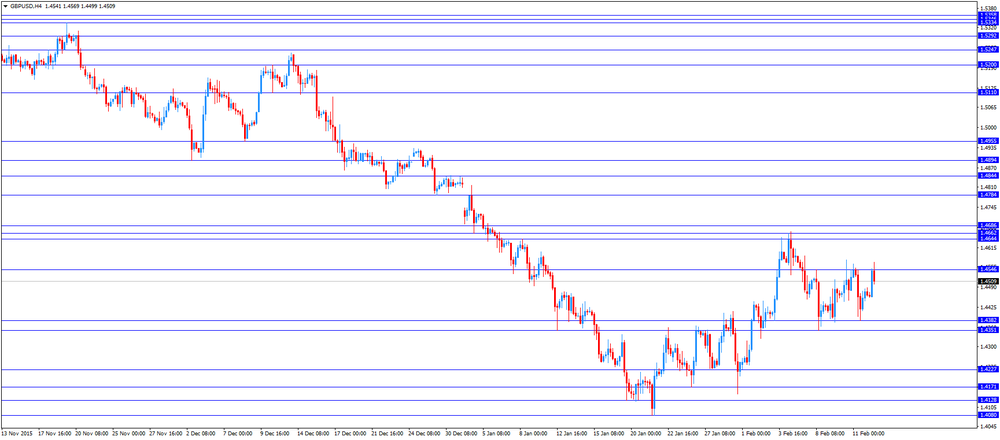

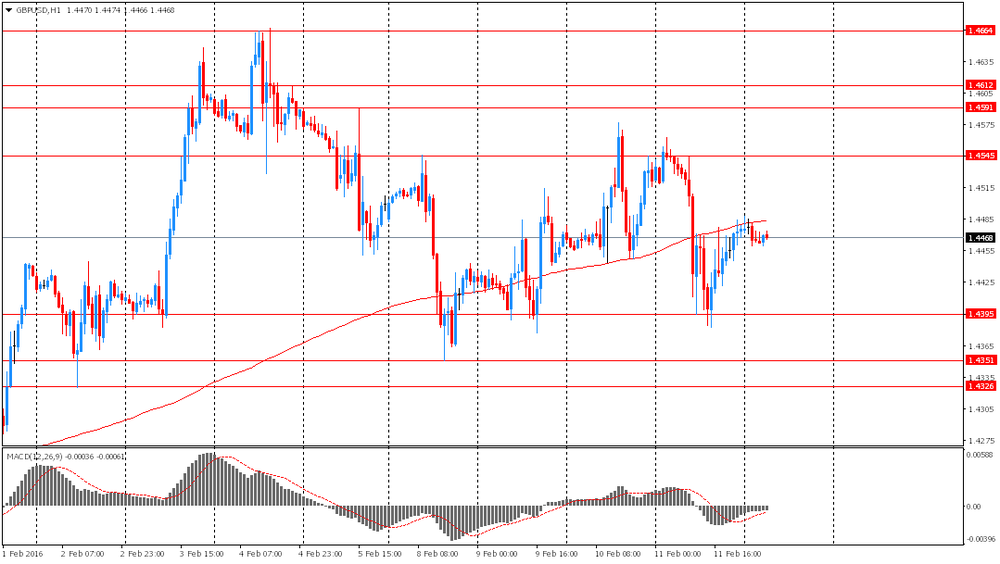

The British pound fell sharply against the dollar, returning to the level of opening of the session, as strong data on US retail sales supported the US currency. Earlier, during the trading session for a couple of influence increased demand for the pound and increased risk appetite. A slight effect on the dynamics of the pound have data on the volume of construction in the UK. British construction output grew at a slower-than-expected pace in December, after falling in the previous month, data showed on Friday, the Office for National Statistics. Construction output increased by 1.5 percent for the month in December, succeeding the fall of 1.1 percent in November. The expected growth rate was 2.0 percent.

The increase in December was largely due to an increase of 2.6 per cent of total new orders. This was offset by the repair and maintenance sector, which was down 0.5 percent. On an annual basis, construction output grew by 0.5 per cent at the end of the year, which was below the expectations of economists rise by 0.8 percent. In November, production fell by 0.9 percent. On the whole, in 2015 the total volume in the construction sector expanded by 3.4 percent in comparison with 2014 year.

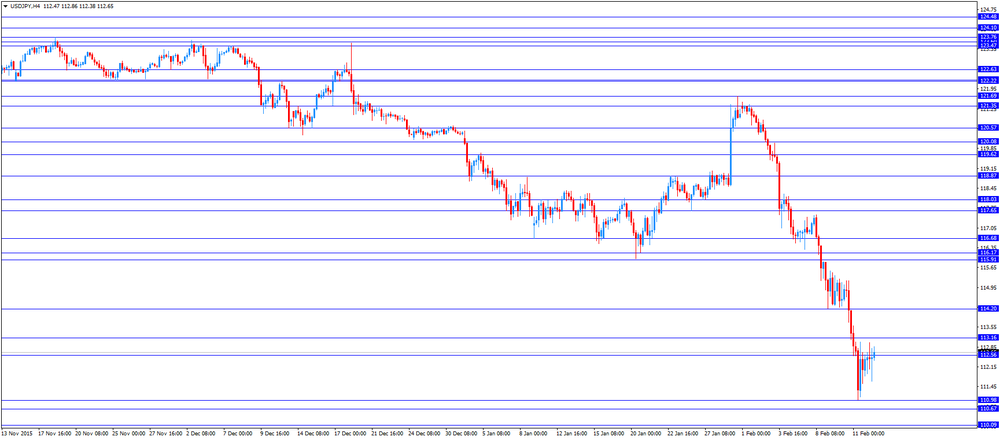

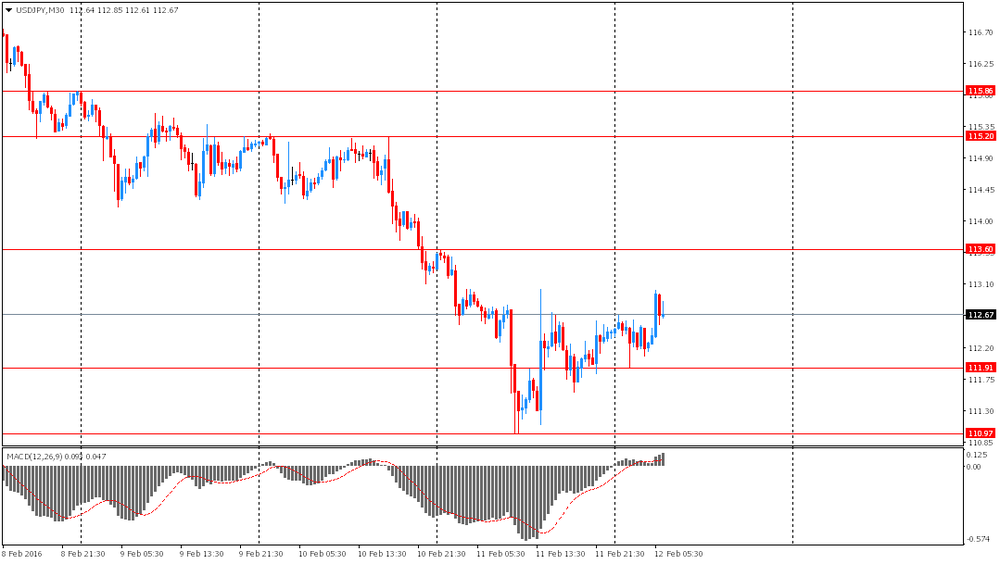

The yen fell against the dollar significantly, approaching to yesterday's low in view of the increase in risk appetite and upbeat data on US retail sales. Support was also provided statements of the Federal Reserve Bank of New York William Dudley. He noted that the US economy is in good enough shape to withstand any shocks. "Despite an era of strong growth, monetary policy remains very accommodative. This somewhat limits its ability to reflect external shocks, but the good news is that it is now less susceptible to shocks. Consumer, are in good shape. Regulation of the financial system has improved thanks to enhanced capitalization of the banking sector ", - said Dudley.

Little influenced by the preliminary results of the studies submitted by Thomson-Reuters and the Institute of Michigan. It is learned that in February the US consumers feel more pessimistic about the economy than last month. According to published data, this month the index of consumer sentiment fell to 90.7 points compared with a final reading of 92.0 points in January. According to experts the average index had to stay at the level of 92.0 points.

-

16:59

New York Fed President William Dudley: the Fed’s monetary policy remains "quite accommodative"

New York Fed President William Dudley said in a speech on Friday that the Fed's monetary policy remains "quite accommodative" despite the interest rate hike in December. He added that the U.S. economy is in a good shape.

Dudley noted that the economy could handle any shocks.

"The good news is that the economy is more resilient to any shocks," he said.

New York Fed president also said that households could also handle better shocks.

"The household sector looks much better positioned today than in 2008 to absorb shocks and continue to contribute to the economic expansion," Dudley noted.

Dudley is a voting member on the Federal Open Market Committee (FOMC) this year.

-

16:37

U.S. business inventories increase 0.1% in December

The U.S. Commerce Department released the business inventories data on Friday. The U.S. business inventories rose 0.1% in December, in line with expectations, after a 0.1% decline in November. November's figure was revised up from a 0.2% drop.

Retail inventories climbed 0.4% in December, wholesale inventories were down 0.1%, while manufacturing inventories increased 0.4%.

Retail sales were flat in December, while business sales were down 0.6%.

The business inventories/sales ratio rose to 1.39 months in December from 1.38 months in November. The business inventories /sales ratio is a measure of how long it would take to clear shelves.

-

16:10

Thomson Reuters/University of Michigan preliminary consumer sentiment index falls to 90.7 in February

The Thomson Reuters/University of Michigan preliminary consumer sentiment index fell to 90.7 in February from a final reading of 92.0 in January. Analysts had expected the index to remain unchanged at 92.0.

"The small early February decline was due to a less favourable outlook for the economy during the year ahead, while longer term prospects for the national economy remained unchanged at favourable levels," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin said.

"The data indicate that real consumption expenditures can be expected to advance by 2.7% in 2016," he added.

The index of current economic conditions declined to 105.8 in February from 106.4 in January, while the index of consumer expectations decreased to 81.0 from 82.7.

The one-year inflation expectations remained unchanged at 2.5% in February.

-

16:01

U.S.: Business inventories , December 0.1% (forecast 0.1%)

-

16:00

U.S.: Reuters/Michigan Consumer Sentiment Index, February 90.7 (forecast 92)

-

15:08

U.S. retail sales rise 0.2% in January

The U.S. Commerce Department released the retail sales data on Friday. The U.S. retail sales increased 0.2% in January, exceeding expectations for a 0.1% rise, after a 0.2% gain in December. December's figure was revised up from a 0.1% decrease.

The increase was mainly driven by a rise in sales at auto dealerships, sales at clothing retailers and sales at building material and garden equipment stores.

Sales at clothing retailers were up 0.2% in January, sales at building material and garden equipment stores increased 0.6%, while sales at auto dealerships rose 0.6%.

Retail sales excluding automobiles rose 0.1% in January, exceeding expectations for a flat reading, after a 0.1% rise in December. December's figure was revised up from a 0.1% fall.

Sales at service stations dropped 3.1% in January, while sales at furniture stores fell 0.5%.

These figures could mean that the Fed will likely not raise its interest rate in March as consumers remained cautious.

-

14:53

U.S. import price index falls 1.1% in January

The U.S. Labor Department released its import and export prices data on Friday. The U.S. import price index fell by 1.1% in January, beating expectations for a 1.4% decrease, after a 1.1% decline in December. December's figure was revised up from a 1.2% drop.

The decline was mainly driven by lower prices for fuel imports, which slid 13.4% in January.

A strong U.S. currency lowers the price of imported goods.

U.S. export prices declined by 0.8% in January, after a 1.1% fall in December.

-

14:45

Option expiries for today's 10:00 ET NY cut

USD/JPY: 116.00 (USD 1.51bn) 117.50 (620m)

EUR/USD: 1.1000 (EUR 258m) 1.1050 (159m) 1.1205 (189m) 1.1300 (146m)

GBP/USD: 1.4600 (GBP 265m)

AUD/USD: 0.6950 (250m) 0.6975 (402m) 0.7025 (325m) 0.7100 (229mn) 0.7150 (458m)

USD/CAD: 1.3900 (445m)

-

14:31

Home loans in Australia climb 2.6% in December

The Australian Bureau of Statistics released its home loans data on Friday. Home loans in Australia climbed 2.6% in December, missing expectations for a 3.0% rise, after 1.9% increase in November. November's figure was revised up from a 1.8% rise.

The value of owner occupied loans rose at a seasonally adjusted 0.9% in December, investment lending increased 0.6%, while the number of loans for the construction of dwellings climbed 1.8%.

-

14:30

U.S.: Retail sales excluding auto, January 0.1% (forecast 0%)

-

14:30

U.S.: Retail sales, January 0.2% (forecast 0.1%)

-

14:30

U.S.: Import Price Index, January -1.1% (forecast -1.4%)

-

14:30

U.S.: Retail Sales YoY, January 3.4%

-

14:13

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the preliminary GDP data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 China Bank holiday

00:30 Australia Home Loans December 1.9% Revised From 1.8% 3% 2.6%

07:00 Germany CPI, m/m (Finally) January -0.1% -0.8% -0.8%

07:00 Germany CPI, y/y (Finally) January 0.3% 0.5% 0.5%

07:00 Germany GDP (QoQ) (Preliminary) Quarter IV 0.3% 0.3% 0.3%

07:00 Germany GDP (YoY) (Preliminary) Quarter IV 1.7% Revised From 1.8% 2.3% 2.1%

07:45 France Non-Farm Payrolls (Preliminary) Quarter IV 0% 0.1% 0.2%

10:00 Eurozone Industrial production, (MoM) December -0.5% Revised From -0.7% 0.3% -1%

10:00 Eurozone Industrial Production (YoY) December 1.4% Revised From 1.1% 0.8% -1.3%

10:00 Eurozone GDP (QoQ) (Preliminary) Quarter IV 0.3% 0.3% 0.3%

10:00 Eurozone GDP (YoY) (Preliminary) Quarter IV 1.6% 1.5% 1.5%

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. The U.S. retail sales are expected to rise 0.1% in January, after a 0.1% decline in December.

The U.S. import price index is expected to decline 1.4% in January, after a 1.2% fall in December.

The preliminary Thomson Reuters/University of Michigan consumer sentiment index is expected to remain unchanged at 92 in February.

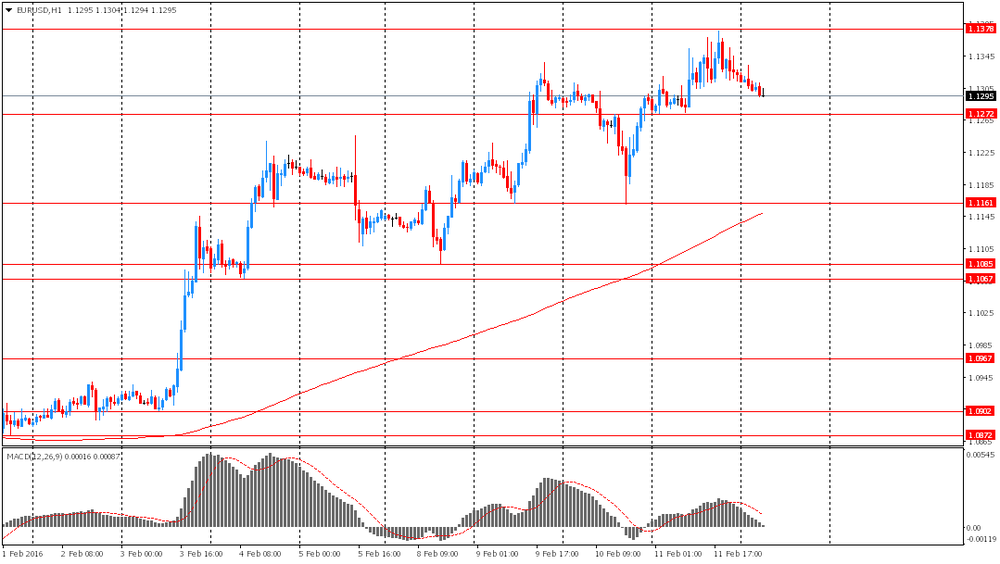

The euro traded lower against the U.S. dollar after the release of the preliminary GDP data from the Eurozone. Eurostat released its GDP growth figures for the Eurozone on Friday. Eurozone's preliminary gross domestic product (GDP) increased by 0.3% in the fourth quarter, in line with expectations, after a 0.3% gain in the third quarter.

On a yearly basis, Eurozone's preliminary GDP rose by 1.5% in the fourth quarter, in line with expectations, after a 1.6% gain in the third quarter.

Eurostat released no details of the component breakdown of GDP.

In 2015 as whole, GDP increased 1.5%.

According to a separate Eurostat report, industrial production in the Eurozone dropped 1.0% in December, missing expectations for a 0.3% increase, after a 0.5% fall in November. November's figure was revised down from a 0.7% decrease.

On a yearly basis, Eurozone's industrial production fell 1.3% in December, missing expectations for a 0.8% rise, after a 1.4% increase in November. November's figure was revised up from a 1.1% gain.

In 2015 as whole, industrial production climbed 1.4%.

Destatis released its gross domestic product (GDP) growth for Germany on Friday. Germany's preliminary GDP gained by 0.3% in the fourth quarter, in line with expectations, after a 0.3% increase in the third quarter.

The increase was driven by domestic demand and capital formation. General government final consumption expenditure grew faster, while household final consumption expenditure increased slightly.

On a yearly basis, Germany's GDP rose to 2.1% in the fourth quarter from 1.7% in the third quarter, missing expectations for a 2.3% growth. The third's quarter figure was revised down from a 1.8% increase.

In 2015 as whole, the economy expanded 1.7%.

The British pound traded mixed against the U.S. dollar after the release of the U.K. construction output data. The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. climbed 1.5% in December, after a 1.1% drop in November.

The increase was driven by a rise in all new work. All new work increased 2.6% in December, while repair and maintenance fell 0.5%.

On a yearly basis, construction output increased 0.5% in December, after a 0.9% decrease in November.

In 2015 as whole, construction output jumped 3.4%.

EUR/USD: the currency pair fell to $1.1261

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair rose to Y112.86

The most important news that are expected (GMT0):

13:30 U.S. Retail sales January -0.1% 0.1%

13:30 U.S. Retail Sales YoY January 2.2%

13:30 U.S. Import Price Index January -1.2% -1.4%

13:30 U.S. Retail sales excluding auto January -0.1% 0%

15:00 U.S. Business inventories December -0.2% 0.1%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) February 92 92

15:00 U.S. FOMC Member Dudley Speak

-

14:00

Orders

EUR/USD

Offers: 1.1285 1.1300 1.1320-25 1.1350 1.1375-80 1.1400 1.1430 1.1450

Bids: 1.1265 1.1250 1.1235 1.1220 1.1200 1.1185 1.1170 1.1150

GBP/USD

Offers: 1.4500 1.4525 1.4545-50 1.4575-80 1.4600 1.4630 1.4650

Bids: 1.4460 1.4445-50 1.4425 1.4400 1.4385 1.4365 1.4350 1.4330 1.4300

EUR/JPY

Offers: 127.00 127.25 127.50 127.80 128.00 128.30 128.50

Bids: 126.50 126.20 126.00 125.80 125.50 125.00 124.75 124.50

EUR/GBP

Offers: 0.7800 0.7825 0.7855-60 0.7875-80 0.7900 0.7925-30 0.7950

Bids: 0.7765 0.7750 0.7725-30 0.7700 0.7685 0.7650

USD/JPY

Offers: 112.85 113.00 113.20 113.35 113.50 113.75 114.00

Bids: 112.20 112.00 111.85 111.65 111.50 111.30 111.00 110.85 110.65 110.50

AUD/USD

Offers: 0.7120 0.7150 0.7175-80 0.7200 0.7220 0.7235 0.7250

Bids: 0.7080 0.7065 0.7050 0.7030 0.7000 0.6980-85 0.6950

-

12:23

Greek GDP declines 0.6% in the fourth quarter

The Hellenic Statistical Authority released its preliminary gross domestic product (GDP) data for Greece on Friday. The Greek preliminary GDP declined 0.6% in the fourth quarter, after a 1.4% fall in the third quarter.

On a yearly basis, Greek preliminary GDP fell 1.9% in the fourth quarter, after a revised 1.9% decrease in the third quarter.

-

12:18

Final consumer price inflation in Spain falls 1.9% in January

The Spanish statistical office INE released its final consumer price inflation data on Friday. Consumer price inflation in Spain was down 1.9% in January, in line with the preliminary reading, after a 0.3% decrease in December.

The monthly drop was mainly driven by a fall in clothing and footwear prices, which plunged 15.3% in January.

On a yearly basis, consumer prices fell by 0.3% in January from a year ago, in line with preliminary reading, after a flat reading in December.

The annual decline was mainly driven by a drop in the prices of housing and transport.

-

12:10

UK’s construction output climbs 1.5% in December

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. climbed 1.5% in December, after a 1.1% drop in November.

The increase was driven by a rise in all new work. All new work increased 2.6% in December, while repair and maintenance fell 0.5%.

On a yearly basis, construction output increased 0.5% in December, after a 0.9% decrease in November.

In 2015 as whole, construction output jumped 3.4%.

Construction makes up 6% of UK's economy.

-

12:06

Italian economy increases 0.1% in the fourth quarter

The Italian statistical office Istat released its gross domestic product (GDP) growth for Italy on Friday. Italy's preliminary GDP increased 0.1% in the fourth quarter, after a 0.2% rise in the third quarter.

On a yearly basis, Italy's GDP rose to 1.0% in the fourth quarter from 0.8% in the third quarter.

In 2015 as whole, the economy grew 0.7%.

-

11:59

German wholesale prices fall 0.4% in January

The German statistical office Destatis released its wholesale prices for Germany on Friday. German wholesale prices fell 0.4% in January, after a 0.8% decrease in December.

On a yearly basis, wholesale prices in Germany dropped 1.0% in January, after a 1.0% decline in December. Wholesale prices have been declining since July 2013.

The fall was mainly driven by a 9.3% drop in solid fuels and related products.

-

11:56

German final consumer price inflation falls 0.8% in January

Destatis released its final consumer price data for Germany on Friday. German final consumer price index were down 0.8% in January, in line with the preliminary estimate, after a 0.1% decline in December.

On a yearly basis, German final consumer price index rose to 0.5% in January from 0.3% in December, in line with the preliminary estimate.

Energy prices dropped 5.8% year-on-year in January, clothing and footwear prices increased 0.5%, while food prices climbed 0.9%.

Prices for goods (total) decreased 0.3% year-on-year in January, while prices for services rose 1.2%.

Consumer prices excluding energy increased 1.2% year-on-year in January.

-

11:47

German economy grows 0.3% in the fourth quarter

Destatis released its gross domestic product (GDP) growth for Germany on Friday. Germany's preliminary GDP gained by 0.3% in the fourth quarter, in line with expectations, after a 0.3% increase in the third quarter.

The increase was driven by domestic demand and capital formation. General government final consumption expenditure grew faster, while household final consumption expenditure increased slightly.

On a yearly basis, Germany's GDP rose to 2.1% in the fourth quarter from 1.7% in the third quarter, missing expectations for a 2.3% growth. The third's quarter figure was revised down from a 1.8% increase.

In 2015 as whole, the economy expanded 1.7%.

-

11:36

Eurozone’s economy expands at 0.3% in the fourth quarter

Eurostat released its GDP growth figures for the Eurozone on Friday. Eurozone's preliminary gross domestic product (GDP) increased by 0.3% in the fourth quarter, in line with expectations, after a 0.3% gain in the third quarter.

On a yearly basis, Eurozone's preliminary GDP rose by 1.5% in the fourth quarter, in line with expectations, after a 1.6% gain in the third quarter.

Eurostat released no details of the component breakdown of GDP.

In 2015 as whole, GDP increased 1.5%.

The U.S. economy grew 0.2% in the fourth quarter, after a 0.5% growth in third quarter. On a yearly basis, the U.S. economy expanded at 1.8% in fourth quarter, after a 2.1% increase in the third quarter.

-

11:29

Eurozone’s industrial production drops 1.0% in December

Eurostat released its industrial production data for the Eurozone on Friday. Industrial production in the Eurozone dropped 1.0% in December, missing expectations for a 0.3% increase, after a 0.5% fall in November. November's figure was revised down from a 0.7% decrease.

Durable consumer goods output increased 1.4% in December, capital goods output dropped 1.9%, while energy output plunged 2.4%.

Intermediate goods output was down 0.3% in December, while non-durable consumer goods fell 0.3%.

On a yearly basis, Eurozone's industrial production fell 1.3% in December, missing expectations for a 0.8% rise, after a 1.4% increase in November. November's figure was revised up from a 1.1% gain.

Durable consumer goods climbed by 0.8% in December from a year ago, capital goods declined by 2.6%, non-durable consumer goods gained by 1.4%, while intermediate goods output increased by 0.4%.

Energy output declined by 7.3% in December from a year ago.

In 2015 as whole, industrial production climbed 1.4%.

-

11:17

Reserve Bank of Australia Governor Glenn Stevens: the Australian labour market was improving

The Reserve Bank of Australia (RBA) Governor Glenn Stevens said on Thursday that the Australian labour market was improving.

"The demand for labour increased at an above average pace in 2015. The number of people employed, as measured, increased by well over 2 per cent, participation in the labour force picked up and the rate of unemployment declined, to be below 6 per cent. That is a noticeably better outcome than we expected a year ago," he said.

The RBA governor noted that monetary policy easing and a weak Australian dollar supported the economy, adding that the economy was expanding at a modest pace.

He said that the central bank could ease its monetary policy further if needed.

Stevens pointed out that the recent market turmoil was not caused by economic factors.

"Markets are dropping their bundle. There are some latent issues that have been there all along, actually, on which people have now chosen to focus more strongly than they were a couple of months back," he said.

-

11:06

Japanese Finance Minister Taro Aso: the government would take steps to deal with currency volatility if needed

Japanese Finance Minister Taro Aso said on Friday that the government would take steps to deal with currency volatility if needed.

"Recent foreign exchange moves have been very rough. I am very nervously watching these moves and will take appropriate steps as necessary," he said.

Aso declined to comment on if Japan intervened in the foreign exchange market on Thursday.

-

11:01

Eurozone: Industrial Production (YoY), December -1.3% (forecast 0.8%)

-

11:00

Eurozone: GDP (QoQ), Quarter IV 0.3% (forecast 0.3%)

-

11:00

Eurozone: GDP (YoY), Quarter IV 1.5% (forecast 1.5%)

-

11:00

Eurozone: Industrial production, (MoM), December -1% (forecast 0.3%)

-

10:56

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy rise to 44.5 in in the week ended February 07

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy rose to 44.5 in in the week ended February 07 from 44.2 the prior week.

The increase was driven by rise in buying climate sub-index and in personal finances sub-index. The measure of views of the economy declined to 35.5 from 36.5, the buying climate sub-index was up to 41.9 from 40.6, while the personal finances index increased to 56.1 from 55.5.

-

10:46

Option expiries for today's 10:00 ET NY cut

USD/JPY: 116.00 (USD 1.51bn) 117.50 (620m)

EUR/USD: 1.1000 (EUR 258m) 1.1050 (159m) 1.1205 (189m) 1.1300 (146m)

GBP/USD: 1.4600 (GBP 265m)

AUD/USD: 0.6950 (250m) 0.6975 (402m) 0.7025 (325m) 0.7100 (229mn) 0.7150 (458m)

USD/CAD: 1.3900 (445m)

-

10:37

Canadian Prime Minister Justin Trudeau: there was a risk to the outlook from low oil prices

Canadian Prime Minister Justin Trudeau said on Thursday that there was a risk to the outlook from low oil prices.

"We've seen with falling oil prices that there is a trajectory that continues to look difficult for Canada," he said.

"We continue to recognize that the Canadian economy is facing real challenges in terms of growth," Trudeau noted.

He also said this week that the government will unlikely balance the budget by 2019.

-

10:22

Head of the Eurogroup Jeroen Dijsselbloem: the Eurozone and its banks were stronger than a few years ago

Head of the Eurogroup Jeroen Dijsselbloem said on Thursday that the Eurozone and its banks were stronger than a few years ago.

"I believe that in the Eurozone, structurally, we are in a much better place than we were a few years ago. That also goes for our banks," he said.

Dijsselbloem pointed out that banking union is needed to strengthen the banks.

-

10:13

The Wall Street Journal survey: only 9% of economists expect the Fed to raise its interest rate in March

According to The Wall Street Journal survey, only 9% of economists expect the Fed to raise its interest rate in March, down from 66% last month. 60% expect that the Fed would hike its interest rate in June, up from 25% last month.

13% of economists expect the Fed to raise its interest rate in April, up from 7% a month ago.

3% economists surveyed this month said that the Fed's next monetary policy action will be an interest rate cut.

The Wall Street Journal surveyed 69 economists.

-

08:45

France: Non-Farm Payrolls, Quarter IV 0.2% (forecast 0.1%)

-

08:26

Options levels on friday, February 12, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1428 (2118)

$1.1394 (2564)

$1.1362 (5067)

Price at time of writing this review: $1.1308

Support levels (open interest**, contracts):

$1.1229 (306)

$1.1182 (1532)

$1.1122 (4467)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 60765 contracts, with the maximum number of contracts with strike price $1,1000 (5067);

- Overall open interest on the PUT options with the expiration date March, 4 is 86008 contracts, with the maximum number of contracts with strike price $1,0900 (6690);

- The ratio of PUT/CALL was 1.42 versus 1.41 from the previous trading day according to data from February, 11

GBP/USD

Resistance levels (open interest**, contracts)

$1.4805 (1430)

$1.4708 (1220)

$1.4611 (1098)

Price at time of writing this review: $1.4488

Support levels (open interest**, contracts):

$1.4387 (991)

$1.4290 (1945)

$1.4193 (1854)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 26426 contracts, with the maximum number of contracts with strike price $1,4650 (1654);

- Overall open interest on the PUT options with the expiration date March, 4 is 24493 contracts, with the maximum number of contracts with strike price $1,4350 (2912);

- The ratio of PUT/CALL was 0.93 versus 0.93 from the previous trading day according to data from February, 11

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:02

Germany: CPI, y/y , January 0.5% (forecast 0.5%)

-

08:01

Foreign exchange market. Asian session: the Australian dollar under pressure

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Home Loans December 1.9% Revised From 1.8% 3% 2.6%

The euro traded range bound ahead of euro zone GDP data. The GDP is expected to have grown by 0.3% in the fourth quarter of 2015 after growth of 0.3% in the third quarter. Economists believe that the euro zone economy grew steadily despite global economic uncertainties. Growth was driven by German and Italian economies.

The Australian dollar retreated after Reserve Bank of Australia Governor Glenn Stevens reiterated he was ready to consider monetary policy easing if necessary. Stevens noted that investment into the mining sector will continue declining for at least a year, concerns over the economic situation in China rose and global economic outlook deteriorated.

The yen slightly declined against the U.S. dollar after Japanese Finance Minister Taro Aso said the government will take steps at the currency market if the situation requires so. "We have seen quite rough movements in the exchange rate recently," Aso said. "We will continue to watch the foreign- exchange market with a sense of tension, and we will act appropriately if that becomes necessary." However analysts don't expect the government to intervene during an official holiday. Japanese policymakers are likely to continue trying to talk the yen down.

EUR/USD: the pair fluctuated within $1.1290-35 in Asian trade

USD/JPY: the pair rose to Y113.00

GBP/USD: the pair traded within $1.4455-85

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 Germany CPI, m/m (Finally) January -0.1% -0.8%

07:00 Germany CPI, y/y (Finally) January 0.3% 0.5%

07:00 Germany GDP (QoQ) (Preliminary) Quarter IV 0.3% 0.3%

07:00 Germany GDP (YoY) (Preliminary) Quarter IV 1.8% 2.3%

07:45 France Non-Farm Payrolls (Preliminary) Quarter IV 0% 0.1%

10:00 Eurozone Industrial production, (MoM) December -0.7% 0.3%

10:00 Eurozone Industrial Production (YoY) December 1.1% 0.8%

10:00 Eurozone GDP (QoQ) (Preliminary) Quarter IV 0.3% 0.3%

10:00 Eurozone GDP (YoY) (Preliminary) Quarter IV 1.6% 1.5%

13:30 U.S. Retail sales January -0.1% 0.1%

13:30 U.S. Retail Sales YoY January 2.2%

13:30 U.S. Import Price Index January -1.2% -1.4%

13:30 U.S. Retail sales excluding auto January -0.1% 0%

15:00 U.S. Business inventories December -0.2% 0.1%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) February 92 92

15:00 U.S. FOMC Member Dudley Speak

-

08:00

Germany: GDP (QoQ), Quarter IV 0.3% (forecast 0.3%)

-

08:00

Germany: GDP (YoY), Quarter IV 2.1% (forecast 2.3%)

-

01:30

Australia: Home Loans , December 2.6% (forecast 3%)

-

00:33

Currencies. Daily history for Feb 11’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1322 +0,28%

GBP/USD $1,4437 -0,58%

USD/CHF Chf0,9722 -0,12%

USD/JPY Y112,42 -0,81%

EUR/JPY Y127,27 -0,57%

GBP/JPY Y162,71 -1,14%

AUD/USD $0,7008 -1,21%

NZD/USD $0,6715 +0,45%

USD/CAD C$1,3935 +0,09%

-

00:02

Schedule for today, Friday, Feb 12’2016:

(time / country / index / period / previous value / forecast)

00:00 China Bank holiday

00:30 Australia Home Loans December 1.8% 3%

07:00 Germany CPI, m/m (Finally) January -0.1% -0.8%

07:00 Germany CPI, y/y (Finally) January 0.3% 0.5%

07:00 Germany GDP (QoQ) (Preliminary) Quarter IV 0.3% 0.3%

07:00 Germany GDP (YoY) (Preliminary) Quarter IV 1.8% 2.3%

07:45 France Non-Farm Payrolls (Preliminary) Quarter IV 0%

10:00 Eurozone Industrial production, (MoM) December -0.7% 0.3%

10:00 Eurozone Industrial Production (YoY) December 1.1% 0.8%

10:00 Eurozone GDP (QoQ) (Preliminary) Quarter IV 0.3% 0.3%

10:00 Eurozone GDP (YoY) (Preliminary) Quarter IV 1.6% 1.5%

13:30 U.S. Retail sales January -0.1% 0.1%

13:30 U.S. Retail Sales YoY January 2.2%

13:30 U.S. Import Price Index January -1.2% -1.4%

13:30 U.S. Retail sales excluding auto January -0.1% 0%

15:00 U.S. Business inventories December -0.2% 0.1%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) February 92 92

15:00 U.S. FOMC Member Dudley Speak

-