Noticias del mercado

-

21:00

Dow +1.84% 15,948.67 +288.49 Nasdaq +1.52% 4,331.74 +64.90 S&P +1.72% 1860.61 +31.53

-

18:06

European stocks close: stocks closed higher as shares of banking sector rebounded and oil prices increased

Stock indices closed higher as shares of banking sector rebounded and oil prices increased. Oil prices rose on hopes that oil producers will cut their oil output.

Market participants eyed the economic data from the Eurozone. Eurostat released its GDP growth figures for the Eurozone on Friday. Eurozone's preliminary gross domestic product (GDP) increased by 0.3% in the fourth quarter, in line with expectations, after a 0.3% gain in the third quarter.

On a yearly basis, Eurozone's preliminary GDP rose by 1.5% in the fourth quarter, in line with expectations, after a 1.6% gain in the third quarter.

Eurostat released no details of the component breakdown of GDP.

In 2015 as whole, GDP increased 1.5%.

According to a separate Eurostat report, industrial production in the Eurozone dropped 1.0% in December, missing expectations for a 0.3% increase, after a 0.5% fall in November. November's figure was revised down from a 0.7% decrease.

On a yearly basis, Eurozone's industrial production fell 1.3% in December, missing expectations for a 0.8% rise, after a 1.4% increase in November. November's figure was revised up from a 1.1% gain.

In 2015 as whole, industrial production climbed 1.4%.

Destatis released its gross domestic product (GDP) growth for Germany on Friday. Germany's preliminary GDP gained by 0.3% in the fourth quarter, in line with expectations, after a 0.3% increase in the third quarter.

The increase was driven by domestic demand and capital formation. General government final consumption expenditure grew faster, while household final consumption expenditure increased slightly.

On a yearly basis, Germany's GDP rose to 2.1% in the fourth quarter from 1.7% in the third quarter, missing expectations for a 2.3% growth. The third's quarter figure was revised down from a 1.8% increase.

In 2015 as whole, the economy expanded 1.7%.

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. climbed 1.5% in December, after a 1.1% drop in November.

The increase was driven by a rise in all new work. All new work increased 2.6% in December, while repair and maintenance fell 0.5%.

On a yearly basis, construction output increased 0.5% in December, after a 0.9% decrease in November.

In 2015 as whole, construction output jumped 3.4%.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,707.6 +170.63 +3.08 %

DAX 8,967.51 +214.64 +2.45 %

CAC 40 3,995.06 +98.35 +2.52 %

-

18:00

European stocks closed: FTSE 100 5,707.6 +170.63 +3.1% CAC 40 3,995.06 +98.35 +2.5% DAX 8,967.51 +214.64 +2.5%

-

17:46

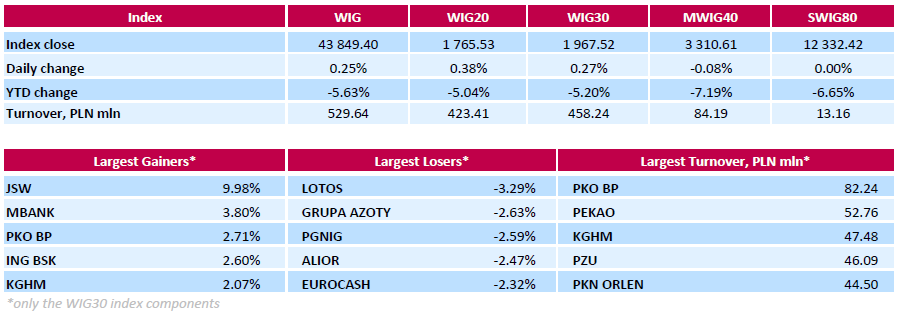

WSE: Session Results

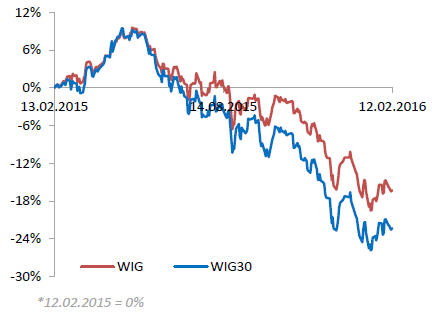

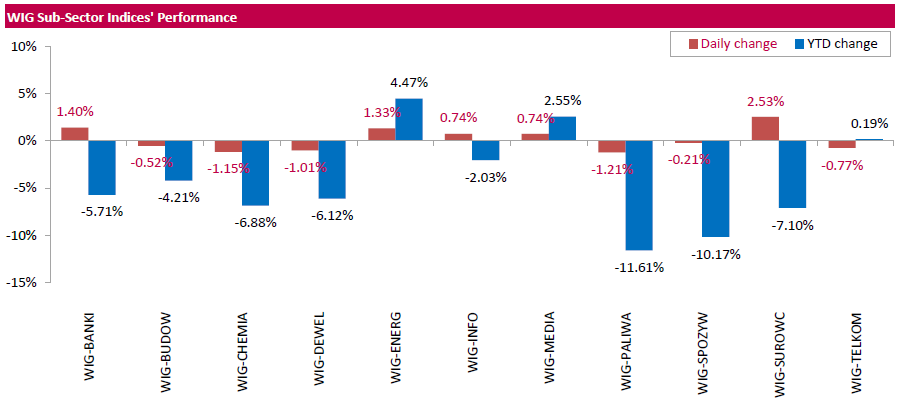

Polish equity market closed higher on Friday. The broad market measure, the WIG Index, added 0.25%. Sector-wise, materials stocks (+2.53%) fared the best, while oil and gas sector names (-1.21%) tumbled the most.

The large-cap stocks' measure, the WIG30 Index, rose by 0.27%. Within the index components, coking coal producer JSW (WSE: JSW) led the gainers, jumping by 9.98% after the EU executive announced provisional anti-dumping duties on cold-rolled flat steel from China and Russia. The action is expected to support steel prices' recovery at the European market. JSW's coking coal is used in steel production. Other major advancers were copper producer KGHM (WSE: KGH) and banking sector names MBANK (WSE: MBK), PKO BP (WSE: PKO) and ING BSK (WSE: ING), surging by 2.07%-3.8%. On the other side of the ledger, the session's biggest decliners were oil refiner LOTOS (WSE: LTS), chemical producer GRUPA AZOTY (WSE: ATT) and oil and gas producer PGNIG (WSE: PGN), falling by 3.29%, 2.63% and 2.59% respectively.

-

17:32

Wall Street. Major U.S. stock-indexes rose

Major U.S. stocks staged a modest comeback on Friday, led by a rebound in financial and energy stocks, after a punishing, widespread rout this week on concerns about the health of the global economy, and ahead of the long weekend.

Most of Dow stocks in positive area (26 of 30). Top looser - Merck & Co. Inc. (MRK, -1,02%). Top gainer - JPMorgan Chase & Co. (JPM, +7,27%).

Almost all of S&P sectors in positive area. Top looser - Utilities (-0,3%). Top gainer - Conglomerates (+3,6%).

At the moment:

Dow 15832.00 +220.00 +1.41%

S&P 500 1850.25 +25.75 +1.41%

Nasdaq 100 3998.50 +37.25 +0.94%

Oil 29.02 +2.81 +10.72%

Gold 1234.20 -13.60 -1.09%

U.S. 10yr 1.71 +0.07

-

16:59

New York Fed President William Dudley: the Fed’s monetary policy remains "quite accommodative"

New York Fed President William Dudley said in a speech on Friday that the Fed's monetary policy remains "quite accommodative" despite the interest rate hike in December. He added that the U.S. economy is in a good shape.

Dudley noted that the economy could handle any shocks.

"The good news is that the economy is more resilient to any shocks," he said.

New York Fed president also said that households could also handle better shocks.

"The household sector looks much better positioned today than in 2008 to absorb shocks and continue to contribute to the economic expansion," Dudley noted.

Dudley is a voting member on the Federal Open Market Committee (FOMC) this year.

-

16:37

U.S. business inventories increase 0.1% in December

The U.S. Commerce Department released the business inventories data on Friday. The U.S. business inventories rose 0.1% in December, in line with expectations, after a 0.1% decline in November. November's figure was revised up from a 0.2% drop.

Retail inventories climbed 0.4% in December, wholesale inventories were down 0.1%, while manufacturing inventories increased 0.4%.

Retail sales were flat in December, while business sales were down 0.6%.

The business inventories/sales ratio rose to 1.39 months in December from 1.38 months in November. The business inventories /sales ratio is a measure of how long it would take to clear shelves.

-

16:10

Thomson Reuters/University of Michigan preliminary consumer sentiment index falls to 90.7 in February

The Thomson Reuters/University of Michigan preliminary consumer sentiment index fell to 90.7 in February from a final reading of 92.0 in January. Analysts had expected the index to remain unchanged at 92.0.

"The small early February decline was due to a less favourable outlook for the economy during the year ahead, while longer term prospects for the national economy remained unchanged at favourable levels," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin said.

"The data indicate that real consumption expenditures can be expected to advance by 2.7% in 2016," he added.

The index of current economic conditions declined to 105.8 in February from 106.4 in January, while the index of consumer expectations decreased to 81.0 from 82.7.

The one-year inflation expectations remained unchanged at 2.5% in February.

-

15:35

U.S. Stocks open: Dow +0.78%, Nasdaq +1.01%, S&P +0.94%

-

15:24

Before the bell: S&P futures +1.11%, NASDAQ futures +0.98%

U.S. stock-index futures advanced.

Global Stocks:

Nikkei 14,952.61 -760.78 -4.8%

Hang Seng 18,319.58 -226.22 -1.2%

Shanghai Composite Closed

FTSE 5,650.37 +113.40 +2.0%

CAC 3,961.53 +64.82 +1.7%

DAX 8,931.45 +178.58 +2.0%

Crude oil $27.93 (+6.56%)

Gold $1234.30 (-1.07%)

-

15:08

U.S. retail sales rise 0.2% in January

The U.S. Commerce Department released the retail sales data on Friday. The U.S. retail sales increased 0.2% in January, exceeding expectations for a 0.1% rise, after a 0.2% gain in December. December's figure was revised up from a 0.1% decrease.

The increase was mainly driven by a rise in sales at auto dealerships, sales at clothing retailers and sales at building material and garden equipment stores.

Sales at clothing retailers were up 0.2% in January, sales at building material and garden equipment stores increased 0.6%, while sales at auto dealerships rose 0.6%.

Retail sales excluding automobiles rose 0.1% in January, exceeding expectations for a flat reading, after a 0.1% rise in December. December's figure was revised up from a 0.1% fall.

Sales at service stations dropped 3.1% in January, while sales at furniture stores fell 0.5%.

These figures could mean that the Fed will likely not raise its interest rate in March as consumers remained cautious.

-

14:53

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

5.12

4.70%

21.9K

JPMorgan Chase and Co

JPM

55.29

4.18%

98.1K

Tesla Motors, Inc., NASDAQ

TSLA

154.94

2.97%

34.3K

Citigroup Inc., NYSE

C

35.98

2.86%

22.4K

Twitter, Inc., NYSE

TWTR

14.67

2.52%

47.3K

ALCOA INC.

AA

7.50

2.32%

49.5K

Goldman Sachs

GS

143.87

2.26%

6.7K

AMERICAN INTERNATIONAL GROUP

AIG

51.45

1.84%

0.7K

Yahoo! Inc., NASDAQ

YHOO

27.19

1.61%

0.3K

Visa

V

69.49

1.49%

0.6K

Facebook, Inc.

FB

103.43

1.49%

50.2K

Home Depot Inc

HD

114.89

1.43%

2.9K

Amazon.com Inc., NASDAQ

AMZN

510.50

1.33%

18.1K

Exxon Mobil Corp

XOM

80.65

1.32%

14.8K

General Motors Company, NYSE

GM

27.25

1.30%

1.7K

Starbucks Corporation, NASDAQ

SBUX

55.62

1.27%

1.7K

Google Inc.

GOOG

691.50

1.23%

28.4K

Chevron Corp

CVX

84.00

1.22%

2.7K

Microsoft Corp

MSFT

50.28

1.19%

18.7K

Ford Motor Co.

F

11.30

1.16%

13.1K

Walt Disney Co

DIS

91.30

1.10%

3.4K

Cisco Systems Inc

CSCO

24.95

1.09%

26.1K

Intel Corp

INTC

28.51

1.03%

2.5K

United Technologies Corp

UTX

85.50

0.99%

1.4K

General Electric Co

GE

27.71

0.95%

26.4K

International Business Machines Co...

IBM

118.95

0.93%

24.7K

Pfizer Inc

PFE

29.40

0.93%

4.3K

UnitedHealth Group Inc

UNH

111.60

0.89%

0.4K

American Express Co

AXP

51.55

0.86%

1.0K

Verizon Communications Inc

VZ

49.80

0.83%

1.2K

AT&T Inc

T

36.50

0.80%

3.5K

Apple Inc.

AAPL

94.40

0.75%

77.8K

The Coca-Cola Co

KO

42.72

0.73%

0.4K

Wal-Mart Stores Inc

WMT

65.80

0.73%

0.6K

Procter & Gamble Co

PG

80.30

0.50%

6.4K

Johnson & Johnson

JNJ

102.05

0.34%

0.2K

McDonald's Corp

MCD

117.02

0.25%

6.2K

Yandex N.V., NASDAQ

YNDX

12.62

0.08%

0.3K

ALTRIA GROUP INC.

MO

60.01

0.03%

0.4K

Boeing Co

BA

108.00

-0.41%

24.6K

Barrick Gold Corporation, NYSE

ABX

11.71

-2.17%

66.7K

-

14:53

U.S. import price index falls 1.1% in January

The U.S. Labor Department released its import and export prices data on Friday. The U.S. import price index fell by 1.1% in January, beating expectations for a 1.4% decrease, after a 1.1% decline in December. December's figure was revised up from a 1.2% drop.

The decline was mainly driven by lower prices for fuel imports, which slid 13.4% in January.

A strong U.S. currency lowers the price of imported goods.

U.S. export prices declined by 0.8% in January, after a 1.1% fall in December.

-

14:49

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Boeing (BA) downgraded to Neutral from Overweight at JP Morgan

Other:

Twitter (TWTR) target lowered to $24 from $45 at Argus

-

14:31

Home loans in Australia climb 2.6% in December

The Australian Bureau of Statistics released its home loans data on Friday. Home loans in Australia climbed 2.6% in December, missing expectations for a 3.0% rise, after 1.9% increase in November. November's figure was revised up from a 1.8% rise.

The value of owner occupied loans rose at a seasonally adjusted 0.9% in December, investment lending increased 0.6%, while the number of loans for the construction of dwellings climbed 1.8%.

-

13:23

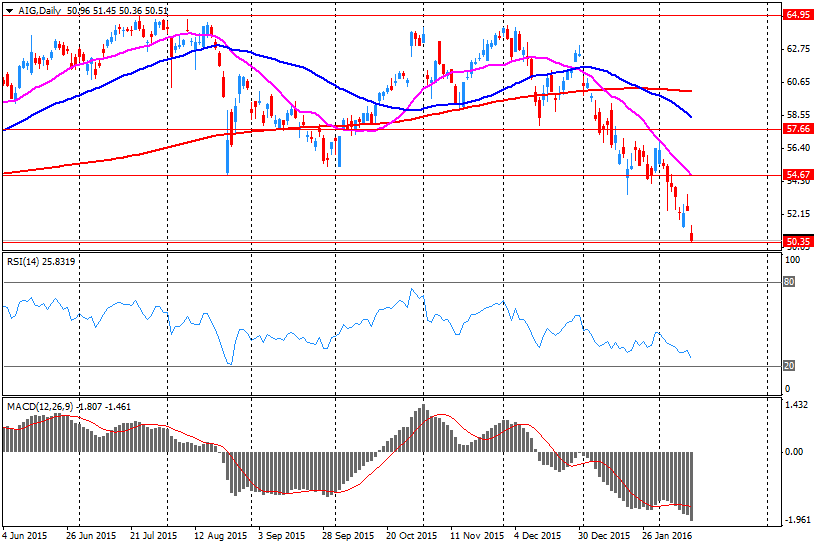

Company News: American International Group (AIG) Quarterly Results Miss Forecasts

American International Group reported Q4 FY 2015 net loss of $1.10 per share (versus earnings of $0.97 in Q4 FY 2014), missing analysts' consensus estimate of a $0.17 loss.

The company's quarterly revenues amounted to $4.991 bln, missing consensus estimate of a $14.152 bln.

The Group also announced that its Board of Directors had authorized the repurchase of additional shares of AIG Common Stock with an aggregate purchase price of up to $5 bln.

In addition, the company declared a 14% increase in the quarterly dividend to $0.32 per share.

AIG fell to $50.46 (-0.12%) in pre-market trading.

-

12:29

European stock markets mid session: stocks traded higher as shares of banking sector rebounded and oil prices increased

Stock indices traded higher as shares of banking sector rebounded and oil prices increased. Oil prices rose on hopes that oil producers will cut their oil output.

Market participants eyed the economic data from the Eurozone. Eurostat released its GDP growth figures for the Eurozone on Friday. Eurozone's preliminary gross domestic product (GDP) increased by 0.3% in the fourth quarter, in line with expectations, after a 0.3% gain in the third quarter.

On a yearly basis, Eurozone's preliminary GDP rose by 1.5% in the fourth quarter, in line with expectations, after a 1.6% gain in the third quarter.

Eurostat released no details of the component breakdown of GDP.

In 2015 as whole, GDP increased 1.5%.

According to a separate Eurostat report, industrial production in the Eurozone dropped 1.0% in December, missing expectations for a 0.3% increase, after a 0.5% fall in November. November's figure was revised down from a 0.7% decrease.

On a yearly basis, Eurozone's industrial production fell 1.3% in December, missing expectations for a 0.8% rise, after a 1.4% increase in November. November's figure was revised up from a 1.1% gain.

In 2015 as whole, industrial production climbed 1.4%.

Destatis released its gross domestic product (GDP) growth for Germany on Friday. Germany's preliminary GDP gained by 0.3% in the fourth quarter, in line with expectations, after a 0.3% increase in the third quarter.

The increase was driven by domestic demand and capital formation. General government final consumption expenditure grew faster, while household final consumption expenditure increased slightly.

On a yearly basis, Germany's GDP rose to 2.1% in the fourth quarter from 1.7% in the third quarter, missing expectations for a 2.3% growth. The third's quarter figure was revised down from a 1.8% increase.

In 2015 as whole, the economy expanded 1.7%.

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. climbed 1.5% in December, after a 1.1% drop in November.

The increase was driven by a rise in all new work. All new work increased 2.6% in December, while repair and maintenance fell 0.5%.

On a yearly basis, construction output increased 0.5% in December, after a 0.9% decrease in November.

In 2015 as whole, construction output jumped 3.4%.

Current figures:

Name Price Change Change %

FTSE 100 5,615.76 +78.79 +1.42 %

DAX 8,874.62 +121.75 +1.39 %

CAC 40 3,938.09 +41.38 +1.06 %

-

12:23

Greek GDP declines 0.6% in the fourth quarter

The Hellenic Statistical Authority released its preliminary gross domestic product (GDP) data for Greece on Friday. The Greek preliminary GDP declined 0.6% in the fourth quarter, after a 1.4% fall in the third quarter.

On a yearly basis, Greek preliminary GDP fell 1.9% in the fourth quarter, after a revised 1.9% decrease in the third quarter.

-

12:18

Final consumer price inflation in Spain falls 1.9% in January

The Spanish statistical office INE released its final consumer price inflation data on Friday. Consumer price inflation in Spain was down 1.9% in January, in line with the preliminary reading, after a 0.3% decrease in December.

The monthly drop was mainly driven by a fall in clothing and footwear prices, which plunged 15.3% in January.

On a yearly basis, consumer prices fell by 0.3% in January from a year ago, in line with preliminary reading, after a flat reading in December.

The annual decline was mainly driven by a drop in the prices of housing and transport.

-

12:10

UK’s construction output climbs 1.5% in December

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. climbed 1.5% in December, after a 1.1% drop in November.

The increase was driven by a rise in all new work. All new work increased 2.6% in December, while repair and maintenance fell 0.5%.

On a yearly basis, construction output increased 0.5% in December, after a 0.9% decrease in November.

In 2015 as whole, construction output jumped 3.4%.

Construction makes up 6% of UK's economy.

-

12:06

Italian economy increases 0.1% in the fourth quarter

The Italian statistical office Istat released its gross domestic product (GDP) growth for Italy on Friday. Italy's preliminary GDP increased 0.1% in the fourth quarter, after a 0.2% rise in the third quarter.

On a yearly basis, Italy's GDP rose to 1.0% in the fourth quarter from 0.8% in the third quarter.

In 2015 as whole, the economy grew 0.7%.

-

11:59

German wholesale prices fall 0.4% in January

The German statistical office Destatis released its wholesale prices for Germany on Friday. German wholesale prices fell 0.4% in January, after a 0.8% decrease in December.

On a yearly basis, wholesale prices in Germany dropped 1.0% in January, after a 1.0% decline in December. Wholesale prices have been declining since July 2013.

The fall was mainly driven by a 9.3% drop in solid fuels and related products.

-

11:56

German final consumer price inflation falls 0.8% in January

Destatis released its final consumer price data for Germany on Friday. German final consumer price index were down 0.8% in January, in line with the preliminary estimate, after a 0.1% decline in December.

On a yearly basis, German final consumer price index rose to 0.5% in January from 0.3% in December, in line with the preliminary estimate.

Energy prices dropped 5.8% year-on-year in January, clothing and footwear prices increased 0.5%, while food prices climbed 0.9%.

Prices for goods (total) decreased 0.3% year-on-year in January, while prices for services rose 1.2%.

Consumer prices excluding energy increased 1.2% year-on-year in January.

-

11:47

German economy grows 0.3% in the fourth quarter

Destatis released its gross domestic product (GDP) growth for Germany on Friday. Germany's preliminary GDP gained by 0.3% in the fourth quarter, in line with expectations, after a 0.3% increase in the third quarter.

The increase was driven by domestic demand and capital formation. General government final consumption expenditure grew faster, while household final consumption expenditure increased slightly.

On a yearly basis, Germany's GDP rose to 2.1% in the fourth quarter from 1.7% in the third quarter, missing expectations for a 2.3% growth. The third's quarter figure was revised down from a 1.8% increase.

In 2015 as whole, the economy expanded 1.7%.

-

11:36

Eurozone’s economy expands at 0.3% in the fourth quarter

Eurostat released its GDP growth figures for the Eurozone on Friday. Eurozone's preliminary gross domestic product (GDP) increased by 0.3% in the fourth quarter, in line with expectations, after a 0.3% gain in the third quarter.

On a yearly basis, Eurozone's preliminary GDP rose by 1.5% in the fourth quarter, in line with expectations, after a 1.6% gain in the third quarter.

Eurostat released no details of the component breakdown of GDP.

In 2015 as whole, GDP increased 1.5%.

The U.S. economy grew 0.2% in the fourth quarter, after a 0.5% growth in third quarter. On a yearly basis, the U.S. economy expanded at 1.8% in fourth quarter, after a 2.1% increase in the third quarter.

-

11:29

Eurozone’s industrial production drops 1.0% in December

Eurostat released its industrial production data for the Eurozone on Friday. Industrial production in the Eurozone dropped 1.0% in December, missing expectations for a 0.3% increase, after a 0.5% fall in November. November's figure was revised down from a 0.7% decrease.

Durable consumer goods output increased 1.4% in December, capital goods output dropped 1.9%, while energy output plunged 2.4%.

Intermediate goods output was down 0.3% in December, while non-durable consumer goods fell 0.3%.

On a yearly basis, Eurozone's industrial production fell 1.3% in December, missing expectations for a 0.8% rise, after a 1.4% increase in November. November's figure was revised up from a 1.1% gain.

Durable consumer goods climbed by 0.8% in December from a year ago, capital goods declined by 2.6%, non-durable consumer goods gained by 1.4%, while intermediate goods output increased by 0.4%.

Energy output declined by 7.3% in December from a year ago.

In 2015 as whole, industrial production climbed 1.4%.

-

11:17

Reserve Bank of Australia Governor Glenn Stevens: the Australian labour market was improving

The Reserve Bank of Australia (RBA) Governor Glenn Stevens said on Thursday that the Australian labour market was improving.

"The demand for labour increased at an above average pace in 2015. The number of people employed, as measured, increased by well over 2 per cent, participation in the labour force picked up and the rate of unemployment declined, to be below 6 per cent. That is a noticeably better outcome than we expected a year ago," he said.

The RBA governor noted that monetary policy easing and a weak Australian dollar supported the economy, adding that the economy was expanding at a modest pace.

He said that the central bank could ease its monetary policy further if needed.

Stevens pointed out that the recent market turmoil was not caused by economic factors.

"Markets are dropping their bundle. There are some latent issues that have been there all along, actually, on which people have now chosen to focus more strongly than they were a couple of months back," he said.

-

11:06

Japanese Finance Minister Taro Aso: the government would take steps to deal with currency volatility if needed

Japanese Finance Minister Taro Aso said on Friday that the government would take steps to deal with currency volatility if needed.

"Recent foreign exchange moves have been very rough. I am very nervously watching these moves and will take appropriate steps as necessary," he said.

Aso declined to comment on if Japan intervened in the foreign exchange market on Thursday.

-

10:56

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy rise to 44.5 in in the week ended February 07

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy rose to 44.5 in in the week ended February 07 from 44.2 the prior week.

The increase was driven by rise in buying climate sub-index and in personal finances sub-index. The measure of views of the economy declined to 35.5 from 36.5, the buying climate sub-index was up to 41.9 from 40.6, while the personal finances index increased to 56.1 from 55.5.

-

10:22

Head of the Eurogroup Jeroen Dijsselbloem: the Eurozone and its banks were stronger than a few years ago

Head of the Eurogroup Jeroen Dijsselbloem said on Thursday that the Eurozone and its banks were stronger than a few years ago.

"I believe that in the Eurozone, structurally, we are in a much better place than we were a few years ago. That also goes for our banks," he said.

Dijsselbloem pointed out that banking union is needed to strengthen the banks.

-

10:13

The Wall Street Journal survey: only 9% of economists expect the Fed to raise its interest rate in March

According to The Wall Street Journal survey, only 9% of economists expect the Fed to raise its interest rate in March, down from 66% last month. 60% expect that the Fed would hike its interest rate in June, up from 25% last month.

13% of economists expect the Fed to raise its interest rate in April, up from 7% a month ago.

3% economists surveyed this month said that the Fed's next monetary policy action will be an interest rate cut.

The Wall Street Journal surveyed 69 economists.

-

07:16

Global Stocks: U.S. stock indices declined

U.S. stock indices fell on Thursday amid fresh declines in oil prices and concerns over global economic growth.

The Dow Jones Industrial Average fell 255 points, or 1.2%, to 15,660. The S&P 500 declined 23 points, or 1.2%, to 1,829 (all of its 10 sectors closed in the negative territory). The Nasdaq Composite lost 17 points, or 0.4%, to 4,266.

The S&P 500 and the Dow have lost 10% since the beginning of the year.

Boeing was the worst performer among Dow components. Stocks of the company fell by 6.45%.

This morning in Asia Hong Kong Hang Seng declined 0.80%, or 149.22, to 18,396.58. The Nikkei plunged 3.93%, or 616.77, to 15,096.62. Markets in mainland China are on holiday.

Japanese stocks fell sharply on Friday morning. The Nikkei is on track to post its biggest weekly drop since October 2008. The index lost over 12% this week.

-

03:02

Nikkei 225 15,040.7 -672.69 -4.28 %, Hang Seng 18,434.41 -111.39 -0.60 %, Topix 1,211.14 -53.82 -4.25 %

-

00:33

Stocks. Daily history for Sep Feb 11’2016:

(index / closing price / change items /% change)

Hang Seng 18,545.8 -742.37 -3.85 %

FTSE 100 5,536.97 -135.33 -2.39 %

CAC 40 3,896.71 -164.49 -4.05 %

Xetra DAX 8,752.87 -264.42 -2.93 %

S&P 500 1,829.08 -22.78 -1.23 %

NASDAQ Composite 4,266.84 -16.75 -0.39 %

Dow Jones 15,660.18 -254.56 -1.60 %

-