Noticias del mercado

-

21:00

Dow -1.34% 15,700.92 -213.82 Nasdaq -0.35% 4,268.48 -15.11 S&P -1.12% 1,831.13 -20.73

-

18:19

WSE: Session Results

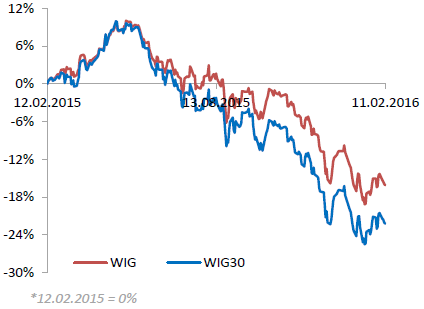

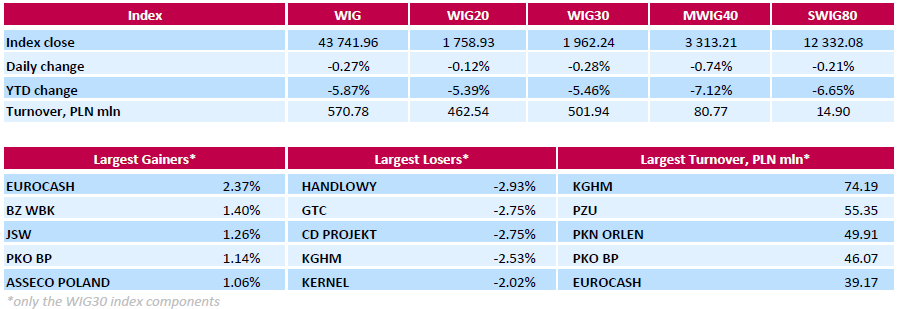

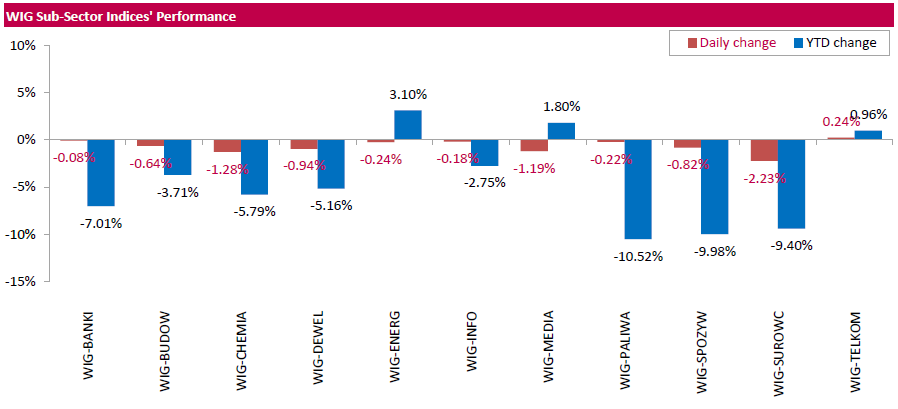

Polish equity market closed lower on Thursday. The broad market benchmark, the WIG Index, declined by 0.27%. Sector-wise, telecommunication sector (+0.24%) was sole gainer within the WIG Index, while materials sector (-2.23%) lagged behind.

The large-cap stocks' measure, the WIG30 Index fell by 0.28%. In the index basket, bank HANDLOWY (WSE: BHW) led the decliners with a 2.93% drop, followed by property developer GTC (WSE: GTC) and videogame developer CD PROJEKT (WSE: CDR), each plunging by 2.75%. On the other side of the ledger, FMCG wholesaler EUROCASH (WSE: EUR) recorded the biggest rise, up 2.37%. Polish Finance Minister informed that Poland had received a letter from the European Commission in which the European Union executive sharply criticized a planned Polish progressive retail tax. Other major gainers were coking coal miner JSW (WSE: JSW), IT-company ASSECO POLAND (WSE: ACP) and banking names BZ WBK (WSE: BZW) and PKO BP (WSE: PKO), which rose between 1.06% and 1.40%.

-

18:10

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell more than 1% on Thursday, pushing the S&P 500 and the Dow Jones industrial average down 10 percent for the year, as investors jettisoned stocks and scurried toward safer shores. Federal Reserve Chair Janet Yellen stuck to her guns on her return to Capitol Hill on Thursday, saying a weakened global economy and steep slide in U.S. equity markets is tightening financial conditions faster than the Fed wants.

Most of Dow stocks in positive area (28 of 30). Top looser - The Boeing Company (BA, -10,87%). Top gainer - Cisco Systems, Inc. (CSCO, +8,40%).

All S&P sectors in negative area. Top looser - Financial (-2,9%).

At the moment:

Dow 15545.00 -321.00 -2.02%

S&P 500 1816.75 -30.00 -1.62%

Nasdaq 100 3925.50 -41.75 -1.05%

Oil 27.11 -0.34 -1.24%

Gold 1251.60 +57.00 +4.77%

U.S. 10yr 1.58 +0.13

-

18:04

Fed Chairwoman Janet Yellen: the Fed and markets were surprised by oil price movements

The Fed Chairwoman Janet Yellen testified before the Senate Banking Committee on Thursday. She said that the Fed and markets were surprised by oil price movements.

"We have been quite surprised by movements in oil prices. I think in part they reflect supply influences, but demand may also play a role," she said.

Yellen pointed out that it is too earlier to decide on monetary policy actions in March.

The Fed chairwoman noted that the Fed discussed negative rates in 2010, and it ready to implement negative rates if needed.

"We wouldn't take those [negative interest rates] off the table, but we have work to do to judge whether they would be workable here," Yellen said.

-

18:00

European stocks close: stocks closed lower as oil prices dropped again

Stock indices closed lower as oil prices dropped again. Oil prices traded lower on concerns over the slowdown in the global economy and on high U.S. crude oil inventories.

European Central Bank Governing Council member Ewald Nowotny said on Thursday that inflation in the Eurozone could turn into negative territory in the first half of 2016 but prices are expected to climb in the second half. He noted that there was no deflationary risk in the Eurozone.

The Royal Institution of Chartered Surveyors' (RICS) released its house price data for the U.K. on Thursday. The monthly house price balance remained unchanged at +49% in January. December's figure was revised down from +50%.

RICS Chief Economist, Simon Rubinsohn, said that the near-term pressure on house prices was intensifying despite a higher level of supply.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,536.97 -135.33 -2.39 %

DAX 8,752.87 -264.42 -2.93 %

CAC 40 3,896.71 -164.49 -4.05 %

-

15:51

Swiss National Bank Chairman Thomas Jordan: the central bank could cut its interest rates further

The Swiss National Bank (SNB) Chairman Thomas Jordan said in an interview on Thursday that the central bank could cut its interest rates further.

"At present we are monitoring the situation closely. We do not rule out anything," he said.

Jordan pointed out that the SNB was ready to intervene in the foreign exchange market if needed.

He also said that Swiss currency was overvalued.

-

15:33

U.S. Stocks open: Dow -1.26%, Nasdaq -1.22%, S&P -1.15%

-

15:27

Greek unemployment rate declines to 24.6% in November

The Hellenic Statistical Authority released its unemployment data on Thursday. The seasonally adjusted unemployment rate in Greece declined to 24.6% in November from 24.7% in October. October's figure was revised up from 24.5%.

The number of unemployed fell by 3,718 persons compared with October 2015.

The youth unemployment rate was 48.0% in November.

-

15:26

Before the bell: S&P futures -1.58%, NASDAQ futures -1.60%

U.S. stock-index futures fell.

Global Stocks:

Nikkei Closed

Hang Seng 18,545.8 -742.37 -3.85%

Shanghai Composite Closed

FTSE 5,565.27 -107.03 -1.89%

CAC 3,927.33 -133.87 -3.30%

DAX 8,828.35 -188.94 -2.10%

Crude oil $26.70 (-2.73%)

Gold $1234.30 (+3.32%)

-

14:54

Canada’s new housing price index climbs 0.1% in December

Statistics Canada released its new housing price index on Thursday. New housing price index in Canada rose 0.1% in December, missing expectations for a 0.2% gain, after a 0.2% increase in November.

The increase was mainly driven by a gain in Toronto and Vancouver region. New home prices in Toronto and Oshawa region rose 0.2% in December, while prices in Vancouver also climbed 0.2%.

On a yearly basis, new housing price index in Canada climbed 1.6% in December, after a 1.6% gain in November.

-

14:54

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Barrick Gold Corporation, NYSE

ABX

12.42

7.25%

169.0K

Cisco Systems Inc

CSCO

23.90

6.18%

292.6K

Tesla Motors, Inc., NASDAQ

TSLA

151.26

5.28%

96.6K

Amazon.com Inc., NASDAQ

AMZN

489.00

-0.30%

39.8K

AT&T Inc

T

36.12

-0.85%

50.6K

The Coca-Cola Co

KO

42.18

-0.87%

13.1K

Apple Inc.

AAPL

93.34

-0.99%

166.1K

Wal-Mart Stores Inc

WMT

65.00

-1.20%

6.9K

E. I. du Pont de Nemours and Co

DD

57.16

-1.30%

1.5K

Ford Motor Co.

F

11.19

-1.32%

26.5K

ALTRIA GROUP INC.

MO

59.25

-1.33%

0.4K

Hewlett-Packard Co.

HPQ

9.15

-1.40%

0.2K

Johnson & Johnson

JNJ

100.30

-1.41%

0.8K

Procter & Gamble Co

PG

80.47

-1.41%

6.8K

Facebook, Inc.

FB

99.55

-1.44%

130.7K

Exxon Mobil Corp

XOM

78.20

-1.45%

25.9K

General Electric Co

GE

27.87

-1.52%

18.3K

International Business Machines Co...

IBM

118.36

-1.52%

5.4K

McDonald's Corp

MCD

115.75

-1.52%

3.3K

Verizon Communications Inc

VZ

49.21

-1.54%

2.5K

International Paper Company

IP

33.81

-1.54%

0.5K

Intel Corp

INTC

27.79

-1.56%

6.6K

Pfizer Inc

PFE

29.03

-1.56%

2.6K

Nike

NKE

56.50

-1.59%

0.3K

Walt Disney Co

DIS

87.39

-1.64%

6.2K

General Motors Company, NYSE

GM

27.25

-1.66%

2.9K

Google Inc.

GOOG

672.79

-1.66%

7.4K

Merck & Co Inc

MRK

48.70

-1.68%

0.4K

United Technologies Corp

UTX

85.50

-1.68%

0.2K

Home Depot Inc

HD

112.35

-1.73%

0.8K

Chevron Corp

CVX

81.54

-1.81%

1.8K

Caterpillar Inc

CAT

61.00

-1.83%

2.5K

Yahoo! Inc., NASDAQ

YHOO

26.59

-1.88%

18.6K

American Express Co

AXP

51.29

-1.91%

0.3K

Microsoft Corp

MSFT

48.75

-1.93%

41.4K

Boeing Co

BA

113.99

-2.04%

5.0K

Starbucks Corporation, NASDAQ

SBUX

54.00

-2.07%

15.0K

ALCOA INC.

AA

7.37

-2.25%

14.1K

Goldman Sachs

GS

143.33

-2.65%

13.4K

JPMorgan Chase and Co

JPM

54.03

-2.68%

28.9K

Visa

V

68.20

-2.78%

3.5K

AMERICAN INTERNATIONAL GROUP

AIG

50.91

-2.94%

0.3K

Citigroup Inc., NYSE

C

36.30

-2.97%

46.0K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

4.83

-3.01%

42.6K

Yandex N.V., NASDAQ

YNDX

12.26

-4.07%

1.5K

Twitter, Inc., NYSE

TWTR

14.06

-6.14%

548.4K

-

14:47

Upgrades and downgrades before the market open

Upgrades:

Cisco Systems (CSCO) upgraded to Buy from Hold at Jefferies; target raised to $27.50 from $26

Downgrades:

Twitter (TWTR) downgraded to Hold from Buy at Topeka Capital Markets; target lowered to $15

Twitter (TWTR) downgraded to Sector Weight from Overweigh at Pacific Crest

Visa (V) downgraded to Neutral from Buy at BofA/Merrill

MasterCard (MA) downgraded to Neutral from Buy at BofA/Merrill

Other:

Tesla Motors (TSLA) target lowered to $240 from $325 at Credit Suisse; maintain Outperform

Tesla Motors (TSLA) target lowered to $230 from $282 at Robert W. Baird; maintain Neutral

Tesla Motors (TSLA) target lowered to $180 at RBC Capital Mkts

Twitter (TWTR) target lowered to $23 from $34 at RBC Capital Mkts

Twitter (TWTR) target lowered to $15 from $21 at Mizuho

HP (HPQ) target lowered to $11 at RBC Capital Mkts

-

14:45

Initial jobless claims decline to 269,000 in the week ending February 06

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending February 06 in the U.S. declined by 16,000 to 269,000 from 285,000 in the previous week.

Analysts had expected jobless claims to fall to 281,000.

Jobless claims remained below 300,000 the 49th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims declined by 21,000 to 2,239,000 in the week ended January 30.

-

12:00

European stock markets mid session: stocks traded lower on yesterday’s testimony by the Fed Chairwoman Janet Yellen

Stock indices traded lower on yesterday's testimony by the Fed Chairwoman Janet Yellen. Yellen said in her prepared remarks before the House Financial Services Committee on Wednesday that further interest rate hikes will depend on the incoming economic data, adding that interest rate hikes will be gradual. She noted that there is a risk from developments abroad to the U.S. economy.

Yellen will testify before the Senate Banking Committee later in the day. It is likely that she will repeat her remarks. But questions could differ.

European Central Bank Governing Council member Ewald Nowotny said on Thursday that inflation in the Eurozone could turn into negative territory in the first half of 2016 but prices are expected to climb in the second half. He noted that there was no deflationary risk in the Eurozone.

Current figures:

Name Price Change Change %

FTSE 100 5,552.34 -119.96 -2.11 %

DAX 8,806.56 -210.73 -2.34 %

CAC 40 3,931.67 -129.53 -3.19 %

-

11:46

European Central Bank Governing Council member Ewald Nowotny expects inflation to rise in the second half of 2016

European Central Bank Governing Council member Ewald Nowotny said on Thursday that inflation in the Eurozone could turn into negative territory in the first half of 2016 but prices are expected to climb in the second half.

"In the second half, we could already see a clear increase in inflation because of the base effect from the previous year," he said.

Nowotny noted that there was no deflationary risk in the Eurozone.

-

11:30

RICS house price balance for the U.K. remains unchanged at +49% in January

The Royal Institution of Chartered Surveyors' (RICS) released its house price data for the U.K. on Thursday. The monthly house price balance remained unchanged at +49% in January. December's figure was revised down from +50%.

RICS Chief Economist, Simon Rubinsohn, said that the near-term pressure on house prices was intensifying despite a higher level of supply.

-

11:16

Business NZ performance of manufacturing index for New Zealand rises to 57.9 in January

According to the Business NZ Survey published on late Wednesday evening, the Business NZ performance of manufacturing index (PMI) for New Zealand rose to 57.9 in January from 57.0 in December. It was the highest level since October 2014.

December's figure was revised up from 56.7.

A reading above 50 indicates expansion in the manufacturing sector.

The rise was mainly driven by a faster expansion in new orders and production.

"Over two-thirds of manufacturers provided positive comments regarding their main influence on business activity, with increased sales both on a domestic and international basis. Other comments outlined the general positive sentiment occurring in the New Zealand economy," Business NZ's executive director for manufacturing, Catherine Beard, said.

-

11:10

Switzerland’s consumer price inflation declines 0.4% in January

The Swiss Federal Statistics Office released its consumer inflation data on Thursday. Switzerland's consumer price index fell 0.4% in January, in line with expectations, after a 0.4% decrease in December.

The decline was mainly driven by lower prices for clothing and petroleum products.

On a yearly basis, Switzerland's consumer price index remained unchanged at -1.3% in January, in line with forecasts.

-

10:55

U.S. budget surplus is $55.2 billion in January

The U.S. Treasury Department released its federal budget data on Wednesday. The budget deficit turned into a surplus of $55.2 billion in January, beating expectations for a surplus of $45.0 billion, after a deficit of $14.0 billion growth in December.

The budget surplus was driven by higher receipts of individual and social insurance taxes.

In the four months of the fiscal year 2016, which ends at September this year, the budget deficit totalled $160.4 billion, down from a deficit of $194.2 billion a year ago.

-

10:45

European Central Bank Governing Council member Villeroy de Galhau: the French economy was not affected by the recent market turmoil

European Central Bank (ECB) Governing Council member and Bank of France Governor Francois Villeroy de Galhau said in an interview on Wednesday that the French economy was not affected by the recent market turmoil. He noted that the economy was driven by domestic demand.

"The French economy is driven by an internal engine, first and foremost by household consumption," Villeroy de Galhau said.

-

10:22

German Chambers of Commerce (DIHK): German companies say business conditions were better now and exports were improving

The German Chambers of Commerce (DIHK) noted on Wednesday that German companies said business conditions were better now and exports were improving.

The DIHK expect the German economy to expand 1.3% this year, lower than the government's forecast of a 1.7% growth.

-

10:08

Fed Vice Chairman Stanley Fischer is worried that U.S. reforms implemented after the global financial crisis can handle a credit market panic

Fed Vice Chairman Stanley Fischer said on Wednesday that he was worried that U.S. reforms implemented after the global financial crisis can handle a credit market panic.

"The new system has not undergone its own stress test," he said.

"The financial system will undergo its fundamental stress test only when we have to deal with the next potential financial crisis," Fischer added.

-

07:02

Global Stocks: U.S. stock indices traded mixed

U.S. stock indices posted mixed results on Wednesday amid lower oil prices and Federal Reserve Chairwoman Janet Yellen remarks.

The Dow Jones Industrial Average declined 99.64 points, or 0.6%, to 15,914.74. The S&P 500 was almost unchanged at 1,851.86 (healthcare and technology were the only sectors to finish in the positive area with gains of 0.9% and 0.4% respectively). The Nasdaq Composite climbed 14.83 points, or 0.4%, to 4,283.59.

Janet Yellen admitted that financial conditions "have become less supportive to growth" and noted that the slowing economy of China had created risks. Nevertheless Yellen tried to defend the central bank's intension to raise rates and left the door open for further increases this year. Market participants are waiting for Yellen to speak to the Senate Banking Committee today.

This morning in Asia Hong Kong Hang Seng plunged 3.90%, or 753.17, to 18,535.00 after investors returned from a holiday. Analysts had expected a decline in Hong Kong stocks. Investors panicked amid ongoing declines in foreign stock markets and commodities.

Markets in mainland China and Japan are on holiday.

-

01:28

S&P/ASX 200 4,791.3 +15.62 +0.33 %

-

00:33

Stocks. Daily history for Sep Feb 10’2016:

(index / closing price / change items /% change)

Nikkei 225 15,713.39 -372.05 -2.31 %

Topix 1,264.96 -39.37 -3.02 %

FTSE 100 5,672.3 +40.11 +0.71 %

CAC 40 4,061.2 +63.66 +1.59 %

Xetra DAX 9,017.29 +137.89 +1.55 %

S&P 500 1,851.86 -0.35 -0.02 %

NASDAQ Composite 4,283.59 +14.83 +0.35 %

Dow Jones 15,914.74 -99.64 -0.62 %

-