Noticias del mercado

-

17:41

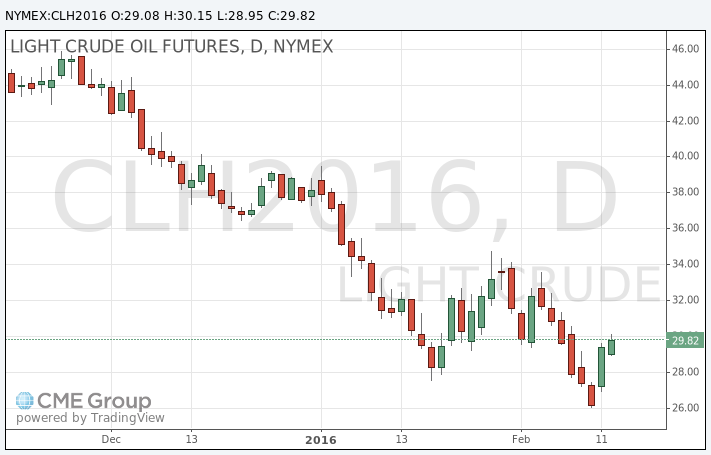

Oil prices trade higher on hopes that oil producers will cut their oil output

Oil prices traded higher on hopes that oil producers will cut their oil output. United Arabian Emirates (UAE) Energy Minister Suhail bin Mohammed al-Mazrouei said last Thursday that the Organization of the Petroleum Exporting Countries (OPEC) was ready to cooperate to lower oil production.

Market participants are also eyed the number of active U.S. rigs data. The oil driller Baker Hughes reported on Friday that the number of active U.S. rigs declined by 28 rigs to 439 last week. It was the lowest level since January 2010. Combined oil and gas rigs declined by 30 to 514.

WTI crude oil for March delivery rose to $30.15 a barrel on the New York Mercantile Exchange.

Brent crude oil for March increased to $33.76 a barrel on ICE Futures Europe.

-

17:23

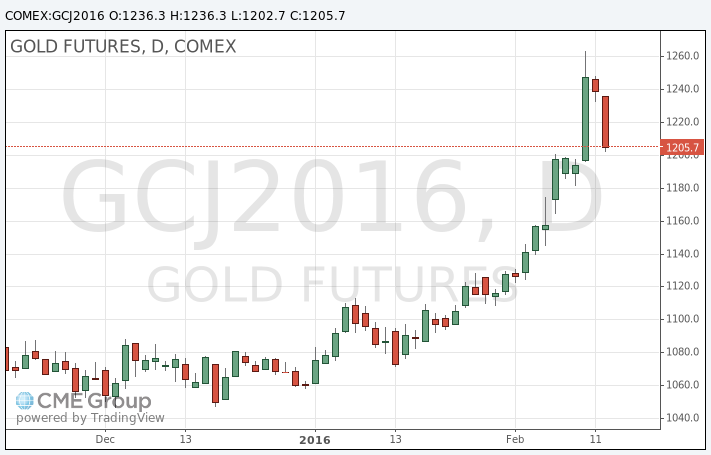

Gold declines on a stronger U.S. dollar

Gold price declined on a stronger U.S. dollar and on decreasing demand for safe-haven assets.

The U.S. markets are closed for a public holiday.

Market participants speculate that the Fed will not raise its interest rate in March. They are focussed on the incoming U.S. economic data. The Fed Chairwoman Janet Yellen said last week that further interest rate hikes will depend on the U.S. economic data.

April futures for gold on the COMEX today fell to 1202.70 dollars per ounce.

-

15:13

People's Bank of China Governor Zhou Xiaochuan: there is no need to depreciate the yuan

The People's Bank of China (PBoC) Governor Zhou Xiaochuan said in an interview with Caixin over the weekend that there is no need to depreciate the yuan. He also said that China would not tighten capital controls.

-

10:54

The number of active U.S. rigs falls by 28 rigs to 439 last week

The oil driller Baker Hughes reported on Friday that the number of active U.S. rigs declined by 28 rigs to 439 last week. It was the lowest level since January 2010.

Combined oil and gas rigs declined by 30 to 514.

-

09:39

China's trade surplus climbs to $62.15 billion in January

The Chinese Customs Office released its trade data on Monday. China's trade surplus climbed to $62.15 billion in January from $60.09 billion in December, beating expectations for a decline to a surplus of $58.85 billion.

Exports fell at an annual rate of 11.2% in January, while imports slid at an annual rate of 18.8%, the fifteenth consecutive decline.

-

08:00

Oil weakened

West Texas Intermediate futures for March delivery slid to $29.35 (-0.31%), while Brent crude is currently at $33.40 (+0.12%). Prices retreated from Friday's 10%-increase after Chinese trade data cast a shadow over potential demand. Nevertheless oil stayed not far from levels reached on Friday on speculation that OPEC may finally act to support prices. However, some analysts say that production cuts would be effective only in a short period of time.

-

07:33

Gold retreated

Gold retreated to $1,220.00 (-1.57%) extending Friday's declines as European stocks rose on strong retail sales data.

Analysts also note some profit-taking. The price of the precious metal is about $60 an ounce higher than February 5 before Chinese markets closed for a holiday. Now investors might wish to take profits.

Holdings of SPDR Gold Trust, the largest gold-backed exchange-traded-fund, fell by 0.71% to 710.95 tonnes on Friday.

-

01:03

Commodities. Daily history for Feb 12’2016:

(raw materials / closing price /% change)

Oil 29.02 +7.84%

Gold 1,238.50 -0.07%

-

01:02

Stocks. Daily history for Sep Feb 12’2016:

(index / closing price / change items /% change)

Nikkei 225 14,952.61 -760.78 -4.84 %

Hang Seng 18,319.58 -226.22 -1.22 %

Topix 1,196.28 -68.68 -5.43 %

FTSE 100 5,707.6 +170.63 +3.08 %

CAC 40 3,995.06 +98.35 +2.52 %

Xetra DAX 8,967.51 +214.64 +2.45 %

FTSE 100 5,707.6 +170.63 +3.08 %

CAC 40 3,995.06 +98.35 +2.52 %

Xetra DAX 8,967.51 +214.64 +2.45 %

-