Noticias del mercado

-

22:45

New Zealand: PPI Output (QoQ) , Quarter IV -0.8%

-

22:45

New Zealand: PPI Input (QoQ), Quarter IV -1.2%

-

17:15

Zhao Chenxin, a spokesman for the National Development and Reform Commission (NDRC): economy would expand at a medium- to high-rate

Zhao Chenxin, a spokesman for the National Development and Reform Commission (NDRC), said on Wednesday that China's economy would expand at a medium- to high-rate.

"China's status as the world's largest holder of foreign exchange reserves has not changed, the large-scale trade surplus has not changed and the steady progress in the yuan internationalisation has not changed," he added.

-

16:37

Federal Reserve Bank of Minneapolis President Neel Kashkari: developments abroad also caused low interest rates

Federal Reserve Bank of Minneapolis President Neel Kashkari said in an interview with CNBC on Wednesday that developments abroad also caused low interest rates.

"It's also economic conditions around the world that are causing interest rates to be low and necessitating low interest rates," he said.

Federal Reserve Bank of Minneapolis president noted that further interest rate hikes will depend on the incoming economic data.

Kashkari pointed out that the slowdown in the Chinese economy could have an impact on the U.S. economy.

"It leads to great market upheaval and one of the transmission mechanisms from China to the U.S. are obviously risk premiums, obviously volatility in the markets. Even If our trade linkages may be moderate, if risk premiums go up all around the world, that could have an effect on our economy too," he said.

-

16:29

Federal Reserve Bank of Minneapolis President Neel Kashkari: the Fed should consider breaking up big banks

Federal Reserve Bank of Minneapolis President Neel Kashkari said in a speech on Tuesday that the Fed should consider breaking up big banks to prevent government bailouts in the future.

"Breaking up large banks into smaller, less connected, less important entities," he said.

Kashkari said that the biggest banks were still too big to fail.

"I believe the biggest banks are still too big to fail and continue to pose a significant, ongoing risk to our economy," Federal Reserve Bank of Minneapolis president said.

-

15:29

U.S. industrial production climbs 0.9% in January

The Federal Reserve released its industrial production report on Wednesday. The U.S. industrial production climbed 0.9% in January, missing expectations for a 0.4% increase, after a 0.7% decline in December. December's figure was revised down from a 0.6% fall.

The rise was mainly driven by increases in the manufacturing output and utilities.

Mining output was flat in January, while utilities production jumped 5.4%.

Manufacturing output rose 0.5% in January, after a 0.2% fall in December. December's figure was revised down from a 0.1% decrease.

Capacity utilisation rate increased to 77.1% in January from 76.4% in December, beating expectations for a rise to 76.7%. December's figure was revised down from 76.5%.

-

15:17

Greek consumer prices slide 1.9% in January

The Hellenic Statistical Authority released its consumer price inflation data for Greece on Wednesday. Greek consumer prices slid 1.9% in January, after the 0.1% rise in December.

On a yearly basis, the Greek consumer price index declined 0.7% in January, after a 0.2 fall in December. Consumer prices in Greece declined since March 2013.

Housing prices plunged at an annual rate of 3.7% in January, transport costs dropped by 0.9%, clothing and footwear prices were down 9.5%, while household equipment prices were down 0.2%.

Prices of food and non-alcoholic beverages climbed at an annual rate of 1.6% in January, while alcoholic beverages and tobacco prices increased by 1.1%.

-

15:16

U.S.: Capacity Utilization, January 77.1% (forecast 76.7%)

-

15:15

U.S.: Industrial Production YoY , January -0.7%

-

15:15

U.S.: Industrial Production (MoM), January 0.9% (forecast 0.4%)

-

15:10

U.S. producer prices rise 0.1% in January

The U.S. Commerce Department released the producer price index figures on Wednesday. The U.S. producer price index rose 0.1% in January, missing expectations for a 0.2% fall, after a 0.2% drop in December.

A stronger U.S. dollar and weak global demand weigh on inflation.

The increase was mainly driven by a rise in food prices.

Energy prices declined 5.0% in January, wholesale food prices increased 1.0%.

Services prices were up 0.5% in January, while prices for goods declined 0.7%.

On a yearly basis, the producer price index decreased 0.2% in January, beating expectations for a 0.6% decrease, after a 1.0% fall in December.

The producer price index excluding food and energy rose 0.4% in January, exceeding expectations for a 0.1% gain, after a 0.1% increase in December.

On a yearly basis, the producer price index excluding food and energy climbed 0.6% in January, beating forecasts of a 0.4% increase, after a 0.3% rise in December.

These figures could mean that the Fed will delay its further interest rate hikes.

-

14:50

Housing starts in the U.S. fall 3.8% in January

The U.S. Commerce Department released the housing market data on Wednesday. Housing starts in the U.S. declined 3.8% to 1.099 million annualized rate in January from a 1.143 million pace in December, missing expectations for an increase to 1.170 million. December's figure was revised down from 1.149 million units.

The fall was driven by declines in starts of single-family and multifamily homes.

Housing market benefits from the strengthening of the labour market.

Building permits in the U.S. fell 0.2% to 1.202 million annualized rate in January from a 1.204 million pace in November, beating expectations for a 1,200 pace.

Starts of single-family homes decreased 3.9% in January. Building permits for single-family homes were down 1.6%.

Starts of multifamily buildings fell 3.7% in January. Permits for multi-family housing rose 2.1%.

-

14:44

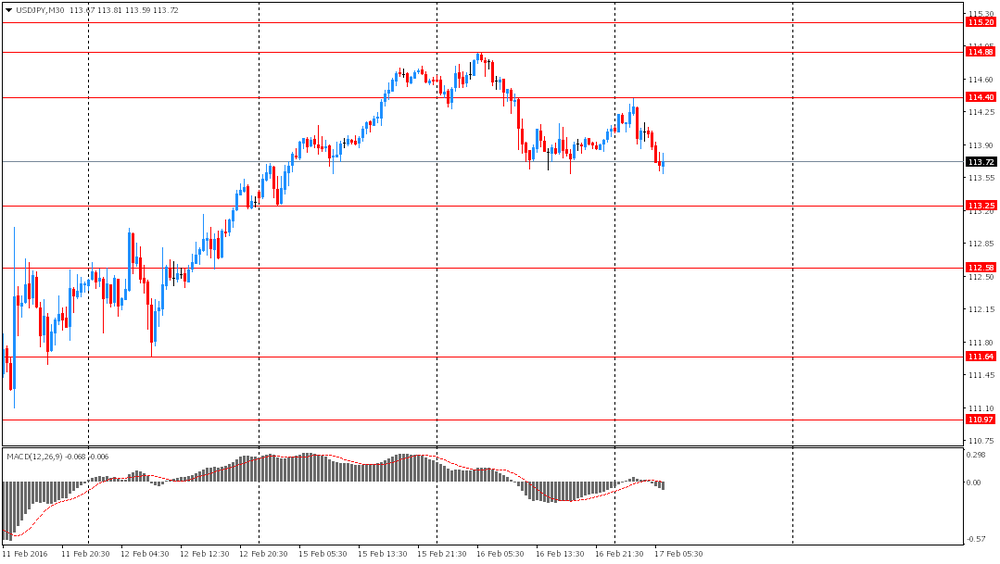

Option expiries for today's 10:00 ET NY cut

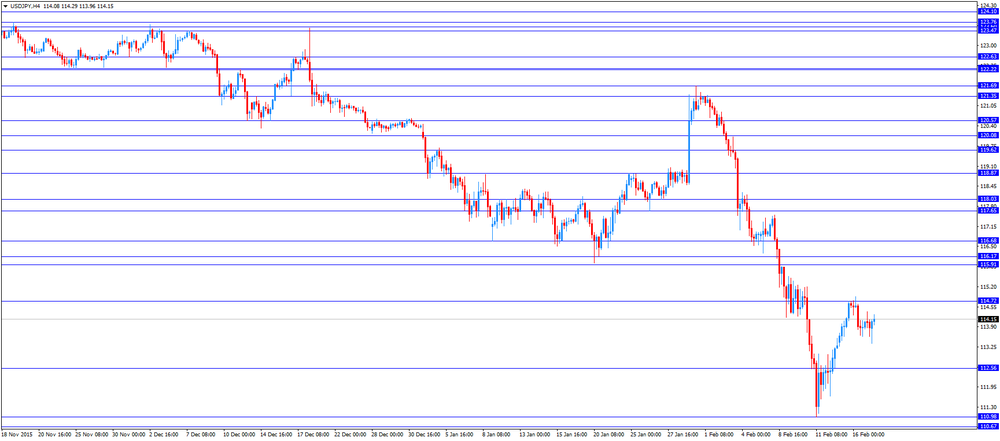

USDJPY: 113.75 (USD 200m) 114.55-60 (210m) 115.00 (338m) 116.00 428m)

EURUSD: 1.0960-65 1.0995-1.1000 (609m) 1.1050 (478m) 1.1100 (694m) 1.1125-30 (402m) 1.1165 (347m) 1.1200 (828m0 1.1230 (534m) 1.1300 (522m) 1.1380 (235m)

GBPUSD: 1.4270 (GBP 170m) 1.4500 ( 216m)

EURGBP: 0.7600 (EUR 510m)

USDCHF: 1.0010 (USD 314m)

AUDUSD: 0.6925-40 (AUD 980m) 0.7120 (224m)

USDCAD: 1.3945 (USD 745m) 1.4000 (480m) 1.4100 (830m)

AUDNZD: 1.0700 (AUD 250m)

AUDJPY: 83.50 (AUD 235m)

-

14:40

Foreign investors sell C$1.41 billion of Canadian securities in December

Statistics Canada released foreign investment figures on Wednesday. Foreign investors sold C$1.41 billion of Canadian securities in December, after an investment of C$2.94 billion in November. November's figure was revised up from an investment of C$2.58 billion.

The divestment was led by federal government debt securities.

Canadian investors added C$17.4 billion of foreign securities in December, mainly U.S. securities.

-

14:30

U.S.: PPI, m/m, January 0.1% (forecast -0.2%)

-

14:30

U.S.: Building Permits, January 1202 (forecast 1200)

-

14:30

U.S.: PPI, y/y, January -0.2% (forecast -0.6%)

-

14:30

U.S.: PPI excluding food and energy, Y/Y, January 0.6% (forecast 0.4%)

-

14:30

U.S.: Housing Starts, January 1099 (forecast 1170)

-

14:30

Canada: Foreign Securities Purchases, December -1.41

-

14:30

U.S.: PPI excluding food and energy, m/m, January 0.4% (forecast 0.1%)

-

14:17

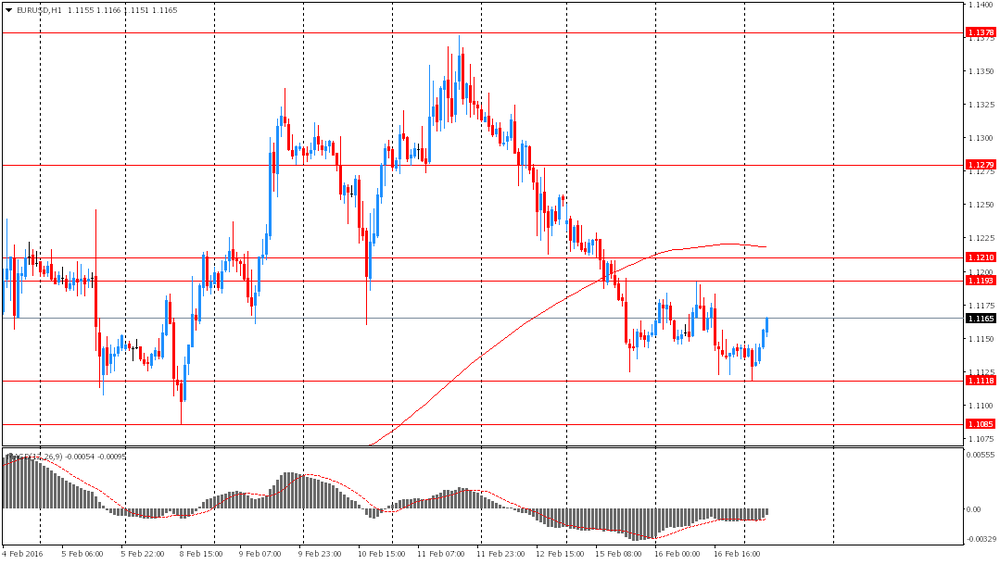

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the weak construction output data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 U.S. FOMC Member Rosengren Speaks

09:30 United Kingdom Average Earnings, 3m/y December 2.1% Revised From 2% 1.9% 1.9%

09:30 United Kingdom Average earnings ex bonuses, 3 m/y December 1.9% 1.8% 2%

09:30 United Kingdom Claimant count January -15.2 Revised From -4.3 -3 -14.8

09:30 United Kingdom ILO Unemployment Rate December 5.1% 5% 5.1%

10:00 Eurozone Construction Output, y/y December 0.3% Revised From 2.1% -0.4%

10:00 Switzerland Credit Suisse ZEW Survey (Expectations) February -3 -5.9

12:00 U.S. MBA Mortgage Applications February 9.3% 8.2%

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. The U.S. PPI is expected to decline 0.2% in January, after a 0.2% drop in December.

The U.S. producer price inflation excluding food and energy is expected to rise 0.1% in January, after a 0.1 gain in December.

The U.S. industrial production is expected to increase 0.4% in January, after a 0.4% fall in December.

Housing starts in the U.S. are expected to rise to 1.170 million units in January from 1.149 million units in December.

The number of building permits is expected to decrease to 1.200 million units in January from 1.204 million units in December.

The Fed is scheduled to release its latest monetary policy minutes at 19:00 GMT.

The euro traded lower against the U.S. dollar after the release of the weak construction output data from the Eurozone. The Eurostat released its construction production data for the Eurozone on Wednesday. Construction production in the Eurozone declined 0.6% in December, after a 0.9% rise in November.

Civil engineering output declined 0.7% in December, while production in the building sector was down 0.4%.

In 2015 as whole, construction production fell 1.0%, compared with 2014.

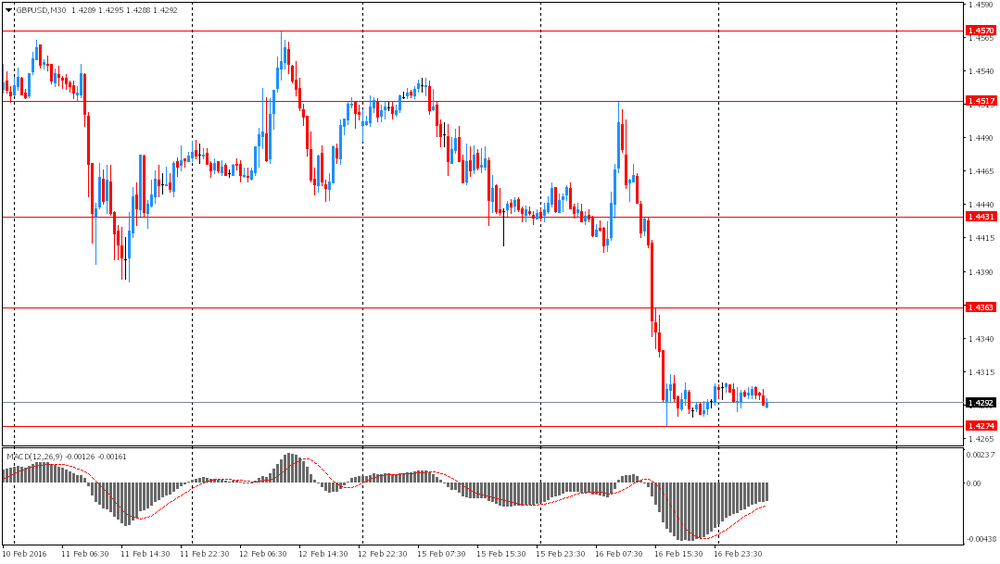

The British pound traded higher against the U.S. dollar after the release of the U.K. labour market data. The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate remained unchanged at 5.1% in the October to December quarter. It was the lowest reading since three months to October 2005.

Analysts had expected the unemployment rate to decline to 5.0%.

Average weekly earnings, excluding bonuses, climbed by 2.0% in the October to December quarter, beating expectations for a 1.8% rise, after a 1.9% gain in the September to November quarter.

Average weekly earnings, including bonuses, rose by 1.9% in the October to December quarter, in line with expectations, after a 2.1% increase in the September to November quarter. The previous quarter's figure was revised up from a 2.0% rise.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

The Canadian dollar traded higher against the U.S. dollar ahead of the release of the Canadian economic data.

The Swiss franc traded lower against the U.S. dollar. A survey by the ZEW Institute and Credit Suisse Group showed on Wednesday that Switzerland's economic sentiment index plunged to -5.9 in February from -3.0 in January. "The analysts surveyed tend to expect a decline in Swiss economic activity. Most of the analysts surveyed (82%) continue to rate the present state of Switzerland's economy as being "normal"," the ZEW said.

EUR/USD: the currency pair decreased to $1.1123

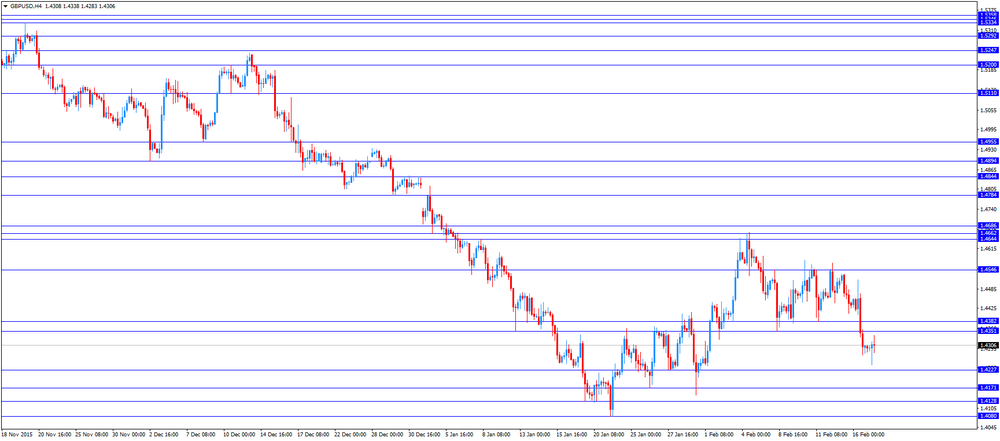

GBP/USD: the currency pair rose to $1.4338

USD/JPY: the currency pair increased to Y114.29

The most important news that are expected (GMT0):

13:30 Canada Foreign Securities Purchases December 2.58

13:30 U.S. PPI, m/m January -0.2% -0.2%

13:30 U.S. PPI, y/y January -1% -0.6%

13:30 U.S. PPI excluding food and energy, m/m January 0.1% 0.1%

13:30 U.S. PPI excluding food and energy, Y/Y January 0.3% 0.4%

13:30 U.S. Building Permits January 1204 1200

13:30 U.S. Housing Starts January 1149 1170

14:15 U.S. Capacity Utilization January 76.5% 76.7%

14:15 U.S. Industrial Production YoY January -1.8%

14:15 U.S. Industrial Production (MoM) January -0.4% 0.4%

19:00 U.S. FOMC meeting minutes

21:45 New Zealand PPI Input (QoQ) Quarter IV 1.6%

21:45 New Zealand PPI Output (QoQ) Quarter IV 1.3%

23:50 Japan Trade Balance Total, bln January 140 -680.2

-

14:00

Orders

EUR/USD

Offers: 1.1165 1.1185 1.1200 1.1220 1.1235 1.1250 1.1265 1.1285 1.1300

Bids 1.1130 1.1100 1.1080 1.1065 1.1050 1.1030 1.1000

GBP/USD

Offers: 1.4285 1.4300 1.4325-30 1.4350 1.4365 1.4385 1.4400 1.4420 1.4435-40 1.4460 1.4480 1.4500

Bids 1.4250 1.4230 1.4200 1.4185 1.4150 1.4125-30 1.4100 1.4080-85 1.4050

EUR/JPY

Offers: 127.30 127.80 128.00 128.30 128.50 128.75 129.00

Bids 126.50 126.20 126.00 125.80 125.50

EUR/GBP

Offers: 0.7825-30 0.7850-55 0.7875 0.7884 0.7900 0.7930 0.7950

Bids 0.7800 0.7780 0.7755-60 0.7730 0.7700 0.7680 0.7665 0.7650

USD/JPY

Offers: 114.20-25 114.50 114.75-80 115.00 115.25 115.50

Bids 113.80 113.65 113.50 113.30 113.00 112.85 112.50 112.20 112.00

AUD/USD

Offers: 0.7135 0.7150 0.7180-85 0.7200 0.7220 0.7235 0.7250

Bids 0.7100 0.7080 0.7065 0.7050 0.7030 0.7000 0.6980 0.6950

-

13:00

U.S.: MBA Mortgage Applications, February 8.2%

-

11:49

Australian leading economic index is flat in January

Westpac Bank released the Westpac-Melbourne Institute leading economic index for Australia on late Tuesday evening. The leading economic index was flat in January, after a 0.3% drop in December.

"Disappointing results continue. The Index has now been growing below trend for the last nine months. It continues to signal that growth in the Australian economy in the first half of 2016 will be below trend," Westpac's Chief Economist, Bill Evans, said.

-

11:45

Construction production in the Eurozone declines 0.6% in December

The Eurostat released its construction production data for the Eurozone on Wednesday. Construction production in the Eurozone declined 0.6% in December, after a 0.9% rise in November.

Civil engineering output declined 0.7% in December, while production in the building sector was down 0.4%.

On a yearly basis, construction output decreased 0.4% in December, after a 0.3% gain in November. November's figure was revised down from a 2.1% rise.

Civil engineering output slid 6.1% year-on-year in December, while production in the building sector climbed 0.9% year-on-year.

In 2015 as whole, construction production fell 1.0%, compared with 2014.

-

11:38

ZEW Institute and Credit Suisse Group’s survey: Switzerland's economic sentiment index plunges to -5.9 in February

A survey by the ZEW Institute and Credit Suisse Group showed on Wednesday that Switzerland's economic sentiment index plunged to -5.9 in February from -3.0 in January.

"The analysts surveyed tend to expect a decline in Swiss economic activity. Most of the analysts surveyed (82%) continue to rate the present state of Switzerland's economy as being "normal"," the ZEW said.

The current conditions rose to -6.0 in February from -8.5 in January.

-

11:31

U.K. unemployment rate remains unchanged at 5.1% in the October to December quarter

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate remained unchanged at 5.1% in the October to December quarter. It was the lowest reading since three months to October 2005.

Analysts had expected the unemployment rate to decline to 5.0%.

The claimant count slid by 14,800 people in January, beating expectations for a fall by 3,000, after a decrease of 15,200 people in December. December's figure was revised down from a 4,300 decrease.

U.K. unemployment in the September to November period dropped by 60,000 to 1.69 million from the previous quarter.

The employment rate was 74.1% in the October to December quarter. It was the highest reading since 1971.

Average weekly earnings, excluding bonuses, climbed by 2.0% in the October to December quarter, beating expectations for a 1.8% rise, after a 1.9% gain in the September to November quarter.

Average weekly earnings, including bonuses, rose by 1.9% in the October to December quarter, in line with expectations, after a 2.1% increase in the September to November quarter. The previous quarter's figure was revised up from a 2.0% rise.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

-

11:21

Core machinery orders in Japan climb 4.2% in December

Japan's Cabinet Office released its core machinery orders data on late Tuesday evening. Core machinery orders in Japan climbed 4.2% in December, missing expectations for a 4.7% rise, after a 14.4% drop in November.

On a yearly basis, core machinery orders slid 3.6% in December, missing expectations for a 3.1% decrease, after a 1.2% rise in November.

The total number of machinery orders rose 5.4% in December from a month earlier.

Orders from non-manufacturers jumped 8.5% in December, while orders from manufacturers were down 3.4%.

-

11:14

Etsuro Honda, an adviser to Japanese Prime Minister Shinzo Abe: the Bank of Japan could add further stimulus measures at its monetary policy meeting in March

Etsuro Honda, an adviser to Japanese Prime Minister Shinzo Abe, said on Wednesday that the Bank of Japan could add further stimulus measures at its monetary policy meeting in March, adding that further stimulus measures were needed to stimulate the economy.

He also said that sales tax hike should be postponed by two years to April 2019.

-

11:05

Sales of existing homes in Canada climb 8% year-on-year in January

The Canadian Real Estate Association (CREA) released its existing homes sales data for Canada on Tuesday. Sales of existing homes in Canada climbed 8% year-on-year in January.

The national average home price jumped 17% year-on-year in January.

The increase in the national average home price was mainly driven rises in Vancouver and Toronto. The average sale price in greater Vancouver jumped 32.3% year-over-year in January, while the price in greater Toronto soared 14.2%.

On a monthly basis, sales of existing homes rose 0.5% in January.

-

11:00

Switzerland: Credit Suisse ZEW Survey (Expectations), February -5.9

-

11:00

Eurozone: Construction Output, y/y, December -0.4%

-

10:48

European Central Bank (ECB) Governing Council Member Ewald Nowotny: the recent turmoil in financial markets was mainly driven by emerging markets

European Central Bank (ECB) Governing Council Member Ewald Nowotny said in an interview published on Wednesday that the recent turmoil in financial markets was mainly driven by emerging markets. He noted that it was necessary to preserve liquidity.

"The ECB is a certain guarantor that appropriate liquidity backups are possible for banks, at least those in the euro zone," Nowotny said.

-

10:43

Option expiries for today's 10:00 ET NY cut

USD/JPY: 115.00-10 (USD 305m) 116.00 (340m)

EUR/USD: 1.0995-1.1000 (EUR 363m) 1.1250 (460m) 1.1275-80 (458m) 1.1375 (498m)

GBP/USD: 1.4425 (GBP 202m)

EUR/GBP: 0.7650 (EUR 226m)

USD/CHF: 1.0000 (USD 298m)

AUD/USD: 0.7070-75 (AUD 293m) 0.7100 (466m) 0.7125 (1.01bn) 0.7250 (1.16bn)

USD/CAD: 1.3400 (USD300m) 1.3500 (200m) 1.3700 (240m)1.3750 (350m) 1.3890-1.3300 (540m)

AUD/JPY: Y82.50(AUD173m) Y82.80(362m)

-

10:40

Bank of America Merrill Lynch fund manager survey: 27% of respondents say the U.S. recession was the biggest risk to markets

According to the latest Bank of America Merrill Lynch fund manager survey, 27% of respondents said that the U.S. recession was the biggest risk to markets. 23% of respondents noted that emerging market or energy debt defaults were the biggest risks to markets.

-

10:30

United Kingdom: ILO Unemployment Rate, December 5.1% (forecast 5%)

-

10:30

United Kingdom: Average Earnings, 3m/y , December 2% (forecast 1.9%)

-

10:30

United Kingdom: Claimant count , January -14.8 (forecast -3)

-

10:30

United Kingdom: Average earnings ex bonuses, 3 m/y, December 2% (forecast 1.8%)

-

10:22

Federal Reserve Bank of Philadelphia President Patrick Harker: the Fed should not raise its interest rate further until inflation picks up

Federal Reserve Bank of Philadelphia President Patrick Harker said in a speech on Tuesday that the Fed should not raise its interest rate further until inflation picks up.

"It might prove prudent to wait until the inflation data are stronger before we undertake a second rate hike," he said.

Harker added that inflation could be negative in the first quarter.

Federal Reserve Bank of Philadelphia president noted that the Fed could hike its interest rate further in the second half of 2016.

Harker is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

10:12

Boston Fed President Eric Rosengren: there is no hurry to hike interest rates further as inflation remains low

Boston Fed President Eric Rosengren said in a speech on Tuesday that there is no hurry to hike interest rates further as inflation remains low.

"If inflation is slower to return to target, monetary policy normalization should be unhurried. A more gradual approach is an appropriate response to headwinds from abroad that slow exports, and financial volatility that raises the cost of funds to many firms," he said.

Rosengren pointed out that developments abroad and the recent turmoil in financial markets weigh on the U.S. economy.

"We have seen oil prices decline and global stock indices become more volatile - and more generally a lack of inflationary pressures and the presence of global headwinds that make future economic growth somewhat more uncertain," Boston Fed president said.

Rosengren added that the Fed should wait until the economic data improves to raise its interest rate further.

Rosengren is a voting member of the Federal Open Market Committee (FOMC) this year.

-

08:24

Options levels on wednesday, February 17, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1349 (3296)

$1.1283 (4457)

$1.1233 (3048)

Price at time of writing this review: $1.1174

Support levels (open interest**, contracts):

$1.1102 (1506)

$1.1068 (3557)

$1.1018 (4965)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 63299 contracts, with the maximum number of contracts with strike price $1,1000 (5126);

- Overall open interest on the PUT options with the expiration date March, 4 is 89929 contracts, with the maximum number of contracts with strike price $1,1000 (7602);

- The ratio of PUT/CALL was 1.42 versus 1.46 from the previous trading day according to data from February, 16

GBP/USD

Resistance levels (open interest**, contracts)

$1.4506 (1153)

$1.4409 (538)

$1.4314 (1396)

Price at time of writing this review: $1.4264

Support levels (open interest**, contracts):

$1.4189 (2088)

$1.4093 (1265)

$1.3995 (1505)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 26343 contracts, with the maximum number of contracts with strike price $1,4650 (1644);

- Overall open interest on the PUT options with the expiration date March, 4 is 25096 contracts, with the maximum number of contracts with strike price $1,4350 (2936);

- The ratio of PUT/CALL was 0.95 versus 0.95 from the previous trading day according to data from February, 16

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:02

Foreign exchange market. Asian session: the pound little changed

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 U.S. FOMC Member Rosengren Speaks

The pound traded range-bound ahead of data on employment in the U.K. Economists expect the unemployment rate calculated by the International Labor Organization method to have declined to 5% in December from 5.1%. Market participants also expect average earnings growth to have declined to 1.9% in the three months to December from +2%.

Market participants paid attention to comments by Boston Federal Reserve Bank President Eric Rosengren. He said that the Fed would have to delay further rate hikes if economic conditions don't become clearer. "Should these conditions persist, and slow progress on attaining the Fed's dual mandate, I believe the normalization of monetary policy should be unhurried, and wait for economic data to improve," Rosengren said.

Japanese Economic and Social Research Institute released data on core machinery orders. The corresponding index rose by 4.2% m/m in December marking first rise in two months. Economists expected a reading of +4.7%. The index is expected to post a stronger gain of 8.6% in the January-March period suggesting strong investment. A higher reading for the machinery orders index points to growing confidence among producers, however it is uncertain how producers will react to the recent stock selloff and a stronger yen.

EUR/USD: the pair rose to $1.1170 in Asian trade

USD/JPY: the pair traded around Y114.00

GBP/USD: the pair traded within $1.4285-05

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:30 United Kingdom Average Earnings, 3m/y December 2% 1.9%

09:30 United Kingdom Average earnings ex bonuses, 3 m/y December 1.9% 1.8%

09:30 United Kingdom Claimant count January -4.3 -3

09:30 United Kingdom ILO Unemployment Rate December 5.1% 5%

10:00 Eurozone Construction Output, y/y December 2.1%

10:00 Switzerland Credit Suisse ZEW Survey (Expectations) February -3

12:00 U.S. MBA Mortgage Applications February 9.3%

13:30 Canada Foreign Securities Purchases December 2.58

13:30 U.S. PPI, m/m January -0.2% -0.2%

13:30 U.S. PPI, y/y January -1% -0.6%

13:30 U.S. PPI excluding food and energy, m/m January 0.1% 0.1%

13:30 U.S. PPI excluding food and energy, Y/Y January 0.3% 0.4%

13:30 U.S. Building Permits January 1204 1200

13:30 U.S. Housing Starts January 1149 1170

13:30 U.S. NY Fed Empire State manufacturing index February -19.37

14:15 U.S. Capacity Utilization January 76.5% 76.7%

14:15 U.S. Industrial Production YoY January -1.8%

14:15 U.S. Industrial Production (MoM) January -0.4% 0.4%

19:00 U.S. FOMC meeting minutes

21:45 New Zealand PPI Input (QoQ) Quarter IV 1.6%

21:45 New Zealand PPI Output (QoQ) Quarter IV 1.3%

23:50 Japan Trade Balance Total, bln January 140 -680.2

-

02:30

Currencies. Daily history for Feb 16’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1143 -0,10%

GBP/USD $1,4304 -0,90%

USD/CHF Chf0,9885 +0,14%

USD/JPY Y114,06 -0,46%

EUR/JPY Y127,10 -0,56%

GBP/JPY Y163,16 -1,35%

AUD/USD $0,7109 -0,38%

NZD/USD $0,6578 -1,05%

USD/CAD C$1,3863 +0,22%

-

02:01

Schedule for today, Wednesday, Feb 17’2016:

(time / country / index / period / previous value / forecast)

00:30 U.S. FOMC Member Rosengren Speaks

09:30 United Kingdom Average Earnings, 3m/y December 2% 1.9%

09:30 United Kingdom Average earnings ex bonuses, 3 m/y December 1.9% 1.8%

09:30 United Kingdom Claimant count January -4.3 -3

09:30 United Kingdom ILO Unemployment Rate December 5.1% 5%

10:00 Eurozone Construction Output, y/y December 2.1%

10:00 Switzerland Credit Suisse ZEW Survey (Expectations) February -3

12:00 U.S. MBA Mortgage Applications February 9.3%

13:30 Canada Foreign Securities Purchases December 2.58

13:30 U.S. PPI, m/m January -0.2% -0.2%

13:30 U.S. PPI, y/y January -1% -0.6%

13:30 U.S. PPI excluding food and energy, m/m January 0.1% 0.1%

13:30 U.S. PPI excluding food and energy, Y/Y January 0.3% 0.4%

13:30 U.S. Building Permits January 1204 1200

13:30 U.S. Housing Starts January 1149 1170

13:30 U.S. NY Fed Empire State manufacturing index February -19.37

14:15 U.S. Capacity Utilization January 76.5% 76.7%

14:15 U.S. Industrial Production YoY January -1.8%

14:15 U.S. Industrial Production (MoM) January -0.4% 0.4%

19:00 U.S. FOMC meeting minutes

21:45 New Zealand PPI Input (QoQ) Quarter IV 1.6%

21:45 New Zealand PPI Output (QoQ) Quarter IV 1.3%

23:50 Japan Trade Balance Total, bln January 140 -680.2

-

00:50

Japan: Core Machinery Orders, y/y, December -3.6% (forecast -3.1%)

-

00:50

Japan: Core Machinery Orders, December 4.2% (forecast 4.7%)

-

00:30

Australia: Leading Index, January 0.0%

-