Noticias del mercado

-

20:21

American focus: the pound has fallen significantly against major currencies

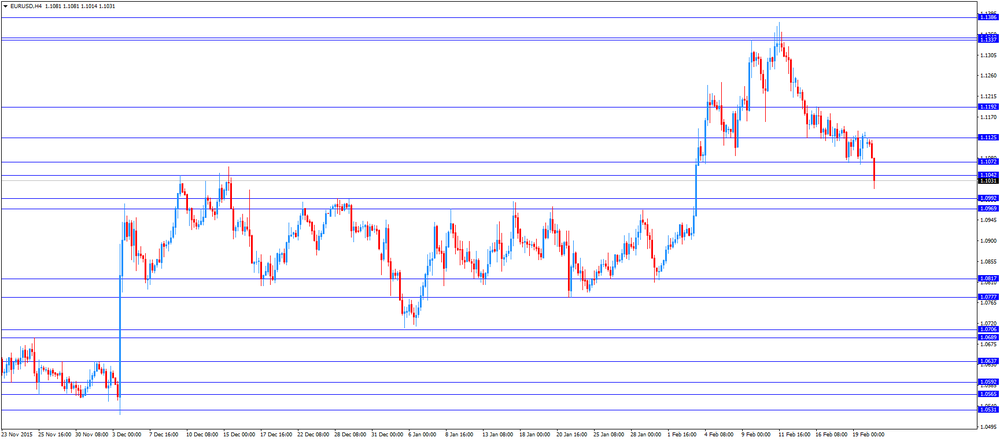

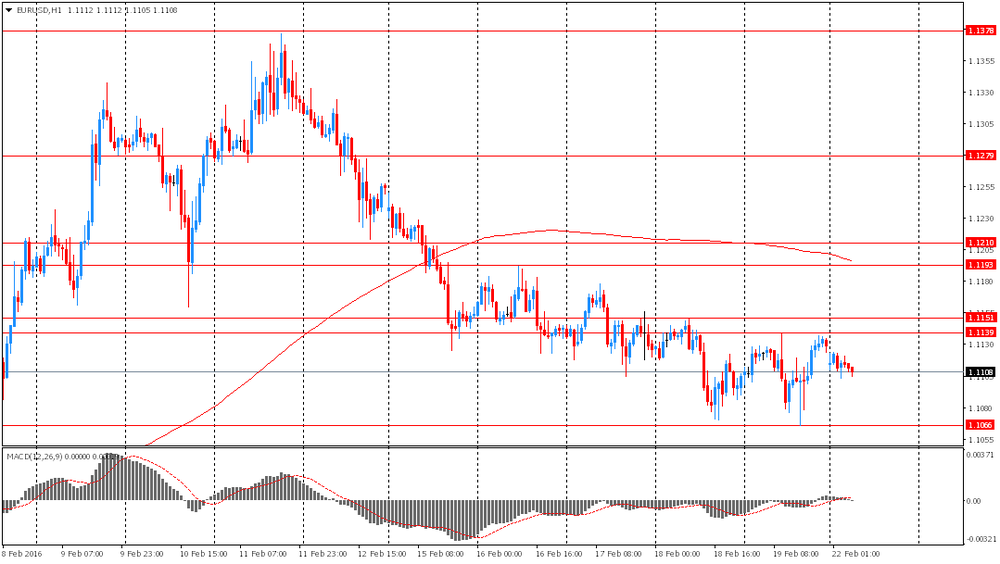

The euro fell more than 100 points against the dollar, approaching to the level of $ 1.1000. Experts point out that the reason for such dynamics were weak data on business activity in the euro area, the strengthening US currency and concerns about the potential prospect of Britain from the EU. Today, Markit said that its index of business activity in the manufacturing sector in Germany in February fell to 50.2 from 52.3. It is expected to decline to 52.0. index of business activity in Germany's services sector rose to 55.1 this month from 55.0 in January, beating expectations of growth to 54.7. French PMI index in the manufacturing sector rose to 50.3 in February to 50.0, exceeding expectations downward to 49.9. PMI French service sector fell to 49.8 from 50.3 in January, compared to expectations for no change. In the eurozone, the preliminary composite purchasing managers index fell to 52.7 in February from 53.6 in January. It was predicted that the index fell slightly to 53.5 in February. PMI in the euro zone services reached 13-month low of 53 compared to 53.6 last month. Economists had expected the figure will be 53.4. PMI for the euro zone's manufacturing sector fell to 51 from 52.3 in January. The expected result was 52.

A further rise in the dollar held back by a weak US statistics. Today it became known that the US manufacturing PMI (seasonally adjusted) reached 51.0 in February, compared with 52.4 in January. February data showed a failure for the US manufacturing sector, whose growth momentum fell again after a slight recovery at the beginning of 2016 The latest survey pointed to the weakest overall improvement in business conditions in just over three years, and the index was also at its lowest level since September 2009. The weaker rate of output, new orders and employment growth had a negative impact on the index. Output growth slowed for the third time in the last four months. The volume of new orders increased by one of the weakest pace in three years.

Also today, the representative of the Federal Reserve Williams noted that continues to support a gradual increase in the Central Bank rate. "The overall picture remains the same, and the basic approach of the Fed, expressed the intention of gradually raising rates, remain faithful", - the politician said. He expressed hope for the further growth of wages and productivity, as well as higher inflation around the target of 2%.

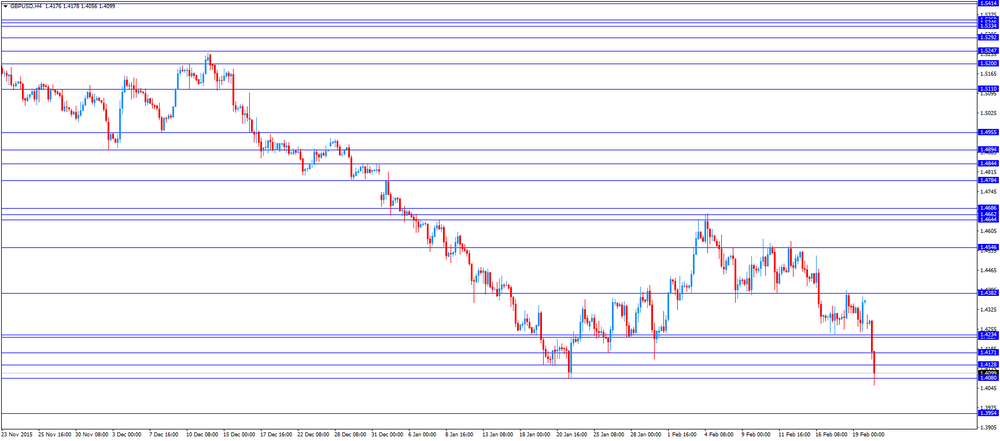

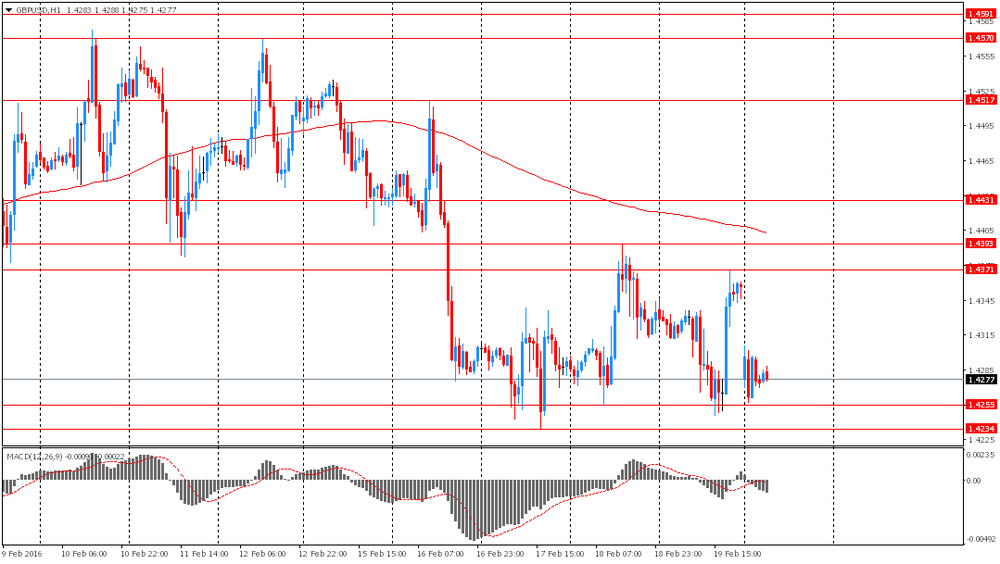

The British pound dropped significantly against the US dollar, updating at least this year, but then was able to recover some positions. The collapse of the pound was triggered by increased fears of Britain's exit from the EU. In addition, Moody's agency warned today that in the case of the British exit from the EU's rating could be revised. Some economists believe that the output of the UK will lead to capital outflows from the country and reduction of foreign investment, as well as a negative impact on economic growth.

Recall, on Saturday, David Cameron announced that a referendum on whether to continue the UK remain a member of the EU or to withdraw from the community, which he promised to carry out during his election campaign, will be held on 23 June. The UK government has supported the country's membership in the EU. According to the results of the summit, Prime Minister David Cameron failed to reach an agreement with the EU. He said that has achieved a special status for the UK in the EU. British Prime Minister said that the agreement reached at the EU summit agreement gives him reason to campaign for the country to remain part of the EU.

However, the Mayor of London, Boris Johnson, who is a popular figure among the public, announced that he would play for the country's exit from the EU. His opinion can influence the decision of a very large number of Britons. In the UK the government six ministers will also agitate citizens to withdraw from the EU. However, now, according to opinion polls, the majority of Britons do not support the country's exit from the EU structure. According to a survey conducted by the publication Daily Mail, 48% of respondents believe that the country should remain in the EU, 33% in favor of output and 19% are still undecided on their choice. Meanwhile, the ICM survey results showed that 42% want Britain remained in the EU, 40% support Brekzita, while others were not defined with the views. However, it should be noted that the survey was conducted even before the Mayor of London announced its position.

The Canadian dollar has appreciated by more than 100 points against the US dollar, reaching a peak on February 18, helped by a significant increase in oil prices. Today, oil futures rose nearly $ 2 on the background of the report of the International Energy Agency (IEA) and the number of drilling rigs from Baker Hughes data. However, analysts warned that the rally of oil is unlikely to be sustained, as the excess supply in the short term is likely to be maintained. IEA reported that the production of shale oil in the US will fall in March. After that, analysts say, will reduce the gap between supply and demand. Meanwhile, a report from Baker Hughes showed that the number of drilling rigs in the US last week fell by 26 units to 413 units, a decrease of 68% compared to the peak reached in October 2014. "The positive mood in the stock market and to reduce the amount of data drilling rigs in the United States provide some support to oil prices, "- said Hans van Cleef, an economist at ABN Amro.

-

17:37

U.K. leading economic index increases 0.4% in December

The Conference Board (CB) released its leading economic index for the U.K. on Friday. The leading economic index (LEI) increased 0.4% in December, after a 0.4% rise in November.

The coincident index was flat in December, after a 0.1% gain in November.

-

17:02

Canada’s finance ministry cuts its economic growth forecast for 2016

Canada's finance ministry on Monday cut its economic growth forecast due to low oil prices. Canadian Finance Minister Bill Morneau said that the economy is expected to expand 1.4% in 2016, down from the November forecast of 2.0%, and 2.2% in 2017, unchanged from the November estimate.

The 2016-17 budget deficit is expected to be C$18.4 billion, while the 2017-18 deficit is forecasted to be C$15.5 billion.

-

16:52

Moody’s: Brexit would have a negative impact on Britain’s economy

The rating agency Moody's said on Monday that Britain's exit from the European Union (EU) ("Brexit") would have a negative impact on the country's economy.

"In our view, a decision to leave the EU would be credit negative for the UK economy," a senior vice president at Moody's, Kathrin Muehlbronner, said.

The agency noted that the outcome of the referendum remained "too close to call". Moody's added that the economic costs of Brexit would outweigh the economic benefits.

-

16:24

European Central Bank purchases €12.57 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €12.57 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €1.03 billion of covered bonds, and €838 million of asset-backed securities.

The European Central Bank (ECB) President Mario Draghi hinted at a press conference in January that the central bank may add further stimulus measures at its meeting in March as downside risks rose.

-

16:05

U.S. preliminary manufacturing purchasing managers' index plunges to 51.0 in January, the lowest level since October 2012

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the U.S. on Monday. The U.S. preliminary manufacturing purchasing managers' index (PMI) plunged to 51.0 in January from 52.4 in January, missing expectations for a decline to 52.3. It was the lowest level since October 2012.

A reading above 50 indicates expansion in economic activity.

The drop was driven by a slower pace of expansion in output, new business and employment.

"Every indicator from the flash PMI survey, from output, order books and exports to employment, inventories and prices, is flashing a warning light about the health of the manufacturing economy," Markit Chief Economist Chris Williamson.

-

15:45

U.S.: Manufacturing PMI, February 51 (forecast 52.3)

-

14:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.0980-85 (EUR 200m) 1.1100 (248m) 1.1165 (179m) 1.1200 (199m) 1.1240 (665m)

GBP/USD: 1.4200 (GBP 223m) 1.4320-25 (200m) 1.4425 (GBP 179m

AUD/USD: 0.7075 (AUD 202m) 0.7100 (451m) 0.7180 (269m) 0.7195-00 (200m)

-

14:49

CBI industrial order books balance declines to -17 in February

The Confederation of British Industry (CBI) released its industrial order books balance on Monday. The CBI industrial order books balance slid to -17 in February from-15 in January.

Export orders improved slightly in February.

"The challenging outlook for the manufacturing sector has stabilised a little, with sterling having depreciated, but Britain's manufacturers are still facing a difficult global situation," the CBI director of economics Rain Newton-Smith said.

"Despite the turbulence in emerging markets, economies such as China still represent a huge opportunity for British industry," he added.

-

14:23

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar on concerns over the possible Brexit from the EU

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:35 Japan Manufacturing PMI (Preliminary) February 52.3 50.2

08:00 France Manufacturing PMI (Preliminary) February 50 49.9 50.3

08:00 France Services PMI (Preliminary) February 50.3 50.3 49.8

08:15 Switzerland Producer & Import Prices, y/y January -5.5% -5.3%

08:15 Switzerland Producer & Import Prices, m/m January -0.4% -0.4%

08:30 Germany Services PMI (Preliminary) February 55 54.7 55.1

08:30 Germany Manufacturing PMI (Preliminary) February 52.3 52 50.2

09:00 Eurozone Manufacturing PMI (Preliminary) February 52.3 52.0 51

09:00 Eurozone Services PMI (Preliminary) February 53.6 53.4 53

11:00 United Kingdom CBI industrial order books balance February -15 -17

The U.S. dollar traded higher against the most major currencies ahead of the release of the U.S. manufacturing purchasing managers' index (PMI) data. The U.S. preliminary manufacturing PMI is expected to decline to 52.3 in February from 52.4 in January.

The euro traded lower against the U.S. dollar after the release of the mostly weaker-than-expected manufacturing PMI data from the Eurozone. Markit Economics released its preliminary manufacturing PMI for the Eurozone on Monday. Eurozone's preliminary manufacturing PMI declined to 51.0 in February from 52.3 in January. Analysts had expected the index to fall to 52.0.

The decline was driven by a softer growth in new orders and exports.

Eurozone's preliminary services PMI fell to 53.0 in February from 53.6 in January. Analysts had expected the index to decrease to 53.4.

"Disappointing PMI survey data for February greatly increase the odds of more aggressive stimulus from the ECB in March. Not only did the survey indicate the weakest pace of economic growth for just over a year, but deflationary forces intensified", Markit's Chief Economist Chris Williamson said.

He noted that data was signalling the Eurozone's economy could expand 0.3% in the first quarter.

Germany's preliminary manufacturing PMI fell to 50.2 in February from 52.3 in January, missing forecasts of a decline to 52.0. It was the slowest reading since November 2014.

The fall in the manufacturing PMI was driven by a weaker increase in new export business, a drop in purchasing activity and input prices.

Germany's preliminary services PMI was up to 55.1 in February from 55.0 in January. Analysts had expected index to decrease to 54.7.

The decline of the services PMI was driven by a faster growth in new business.

France's preliminary manufacturing PMI rose to 50.3 in February from 50.0 in January, beating forecasts of a decline to 49.9.

France's preliminary services PMI fell to 49.8 in February from 50.6 in January. Analysts had expected the index to remain unchanged at 50.3.

The British pound traded lower against the U.S. dollar on concerns over the possible exit of Britain (Brexit) from the European Union (EU). Britain's Prime Minister David Cameron said on Saturday that the country's referendum on the EU membership will take place on June 23. Cameron secured a deal with the EU, which includes changes to migrant welfare payments, safeguards that Britain would not be a part of the Eurozone and safeguards for Britain's financial sector.

Some ministers support Brexit.

The CBI industrial order books balance slid to -17 in February from -15 in January.

The Swiss franc traded lower against the U.S. dollar. The Federal Statistical Office released its producer and import prices data on Monday. Switzerland's producer and import prices fell 0.4% in January, after a 0.4% decrease in December.

The decrease was mainly driven by lower prices for petroleum products.

On a yearly basis, producer and import prices plunged 5.3% in January, after a 5.5% drop in December.

EUR/USD: the currency pair decreased to $1.1014

GBP/USD: the currency pair fell to $1.4056

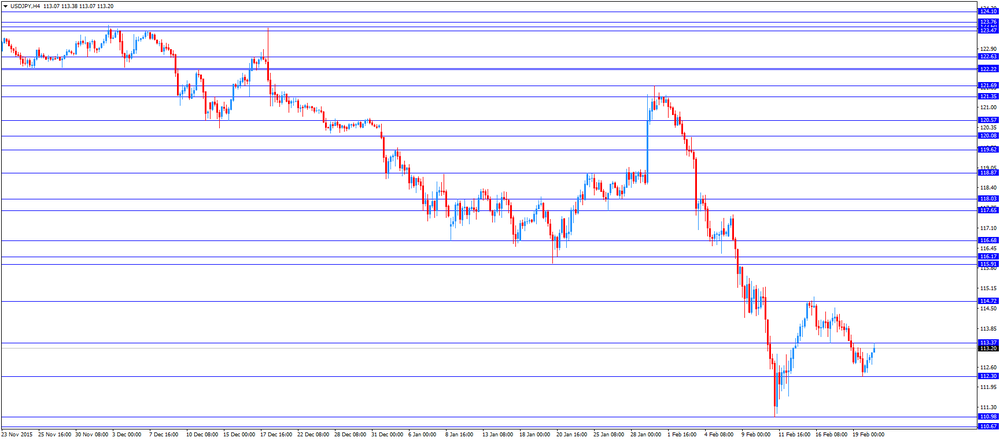

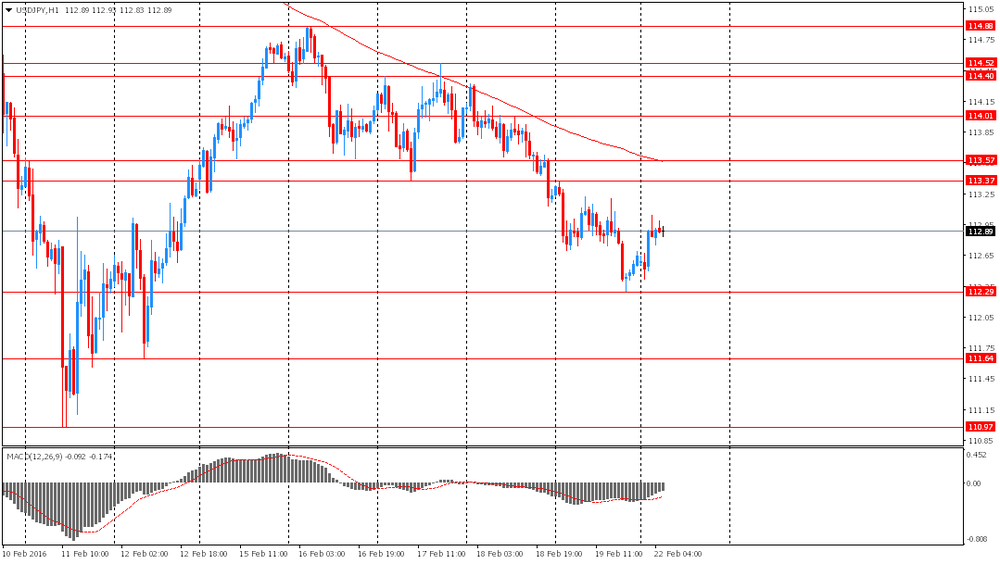

USD/JPY: the currency pair rose to Y113.38

The most important news that are expected (GMT0):

14:45 U.S. Manufacturing PMI (Preliminary) February 52.4 52.3

-

13:50

Orders

EUR/USD

Offers : 1.1100 1.1120 1.1135 1.1150 1.1165 1.1185 1.1200 1.1220 1.1235 1.1250

Bids: 1.1065 1.1050 1.1030 1.1000 1.0985 1.0965 1.0950 1.0920 1.0900

GBP/USD

Offers : 1.4200 1.4220-25 1.4250 1.4265 1.4285 1.4300 1.4325 1.4350 1.4380 1.4400

Bids: 1.4165 1.4150 1.4130 1.4100 1.4085 1.4070 1.4050 1.4030 1.4000

EUR/JPY

Offers : 126.00 126.30 126.50 126.80 127.00 127.25 127.50

Bids: 125.30 125.00 124.80 124.50 124.00

EUR/GBP

Offers : 0.7830-35 0.7850-55 0.7875 0.7884 0.7900

Bids: 0.7800 0.7780 0.7765 0.7750 0.7725-30 0.7700

USD/JPY

Offers : 113.00 113.20-25 113.40 113.65 113.85 114.00 114.30 114.50

Bids: 112.70-75 112.50 112.35 112.20 112.00 111.85 111.50

AUD/USD

Offers : 0.7200 0.7220 0.7235 0.7250 0.7265 0.7285 0.7300

Bids: 0.7160 0.7140-45 0.7120 0.7100 0.7080 0.7065 0.7050

-

12:00

United Kingdom: CBI industrial order books balance, February -17

-

11:47

Britain’s referendum on the European Union membership will take place on June 23

Britain's Prime Minister David Cameron said on Saturday that the country's referendum on the European Union (EU) membership will take place on June 23. Cameron secured a deal with the EU, which includes changes to migrant welfare payments, safeguards that Britain would not be a part of the Eurozone and safeguards for Britain's financial sector.

Some ministers support Brexit.

-

11:30

Final consumer prices in Italy decline 0.2% in January

The Italian statistical office Istat released its final consumer price inflation data for Italy on Monday. Final consumer prices in Italy fell 0.2% in January, in line with preliminary reading, after a flat reading in December.

The drop was mainly driven by a decline in prices of energy products, which fell 2.4% in January.

On a yearly basis, consumer prices climbed 0.3% in January, in line with preliminary reading, after a 0.1% increase in December.

The increase was mainly driven by a softer decline of prices of non-regulated energy products (-5.9% from -8.7% in December 2015) and a rise in prices of services related to transport. Prices of non-regulated energy products slid 5.9% year-on-year in January, while prices of services related to transport increased 0.5%.

Final consumer price inflation excluding unprocessed food and energy prices climbed to 0.8% year-on-year in January from 0.6% in December.

-

11:17

France's preliminary manufacturing PMI rises in February, while services PMI declines

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for France on Monday. France's preliminary manufacturing PMI rose to 50.3 in February from 50.0 in January, beating forecasts of a decline to 49.9.

France's preliminary services PMI fell to 49.8 in February from 50.6 in January. Analysts had expected the index to remain unchanged at 50.3.

"The private sector economy continues to follow a broadly stagnant path, with first-quarter GDP looking likely to remain sluggish following a 0.2% rise at the end of 2015. The combination of weak demand conditions and strong competitive pressures saw firms' output prices cut at the sharpest rate in over a year, pointing to continued downward pressure on inflation," the Senior Economist at Markit Jack Kennedy said.

-

11:09

Germany's preliminary manufacturing PMI falls in February, while services PMI rose

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for Germany on Monday. Germany's preliminary manufacturing PMI fell to 50.2 in February from 52.3 in January, missing forecasts of a decline to 52.0. It was the slowest reading since November 2014.

The fall in the manufacturing PMI was driven by a weaker increase in new export business, a drop in purchasing activity and input prices.

Germany's preliminary services PMI was up to 55.1 in February from 55.0 in January. Analysts had expected index to decrease to 54.7.

The decline of the services PMI was driven by a faster growth in new business.

"The German economy appears to be in the midst of a slowdown, according to February's flash PMI results. Although the PMI is still signalling an overall expansion in economic activity, the rate of increase slowed for the second month running and was the weakest since last July," Markit's economist Oliver Kolodseike noted.

-

11:02

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.0980-85 (EUR 200m) 1.1100 (248m) 1.1165 (179m) 1.1200 (199m) 1.1240 (665m)

GBP/USD: 1.4200 (GBP 223m) 1.4320-25 (200m) 1.4425 (GBP 179m

AUD/USD: 0.7075 (AUD 202m) 0.7100 (451m) 0.7180 (269m) 0.7195-00 (200m)

-

10:55

Eurozone's preliminary manufacturing and services PMIs decline in February

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's preliminary manufacturing PMI declined to 51.0 in February from 52.3 in January. Analysts had expected the index to fall to 52.0.

The decline was driven by a softer growth in new orders and exports.

Eurozone's preliminary services PMI fell to 53.0 in February from 53.6 in January. Analysts had expected the index to decrease to 53.4.

"Disappointing PMI survey data for February greatly increase the odds of more aggressive stimulus from the ECB in March. Not only did the survey indicate the weakest pace of economic growth for just over a year, but deflationary forces intensified", Markit's Chief Economist Chris Williamson said.

He noted that data was signalling the Eurozone's economy could expand 0.3% in the first quarter.

-

10:43

Switzerland's producer and import prices are down 0.4% in January

The Federal Statistical Office released its producer and import prices data on Monday. Switzerland's producer and import prices fell 0.4% in January, after a 0.4% decrease in December.

The decrease was mainly driven by lower prices for petroleum products.

The Import Price Index decreased by 0.8% in January, while producer prices fell 0.1%.

On a yearly basis, producer and import prices plunged 5.3% in January, after a 5.5% drop in December.

The Import Price Index fell by 8.8% year-on year in January, while producer prices dropped 3.7%.

-

10:33

Knight Frank/Markit House Price Sentiment Index for the U.K. increases to 59.6 in February

According to a survey from Markit Economics and Knight Frank published on Friday, the Knight Frank/Markit House Price Sentiment Index for the U.K. increased to 59.6 in February from 58.7 in January. It was the highest level since October 2014.

The biggest rise in house price expectations was recorded in London, while the modest rate was recorded in Scotland. Households in all UK regions expect house prices to increase over the next 12 months.

"February's survey highlights a continuation of the steady upward trend in UK house price sentiment from the pre-election lows seen in early 2015," Markit's senior economist, Tim Moore, said.

-

10:21

China’s finance ministry plans to cut transaction taxes for home buyers

China's finance ministry said on Friday that it plans to cut transaction taxes for second-time home buyers and some first home buyers to stimulate the property market. The transaction tax on second homes smaller than 90 square meters will be lowered to 1% from 3%, while tax for homes of more than 90 square meters will be cut to 2. The tax on first homes larger than 144 square meters will be cut to 1.5% from 3%.

-

10:08

Preliminary Markit/Nikkei manufacturing purchasing managers' index for Japan declines to 50.2 in February

The preliminary Markit/Nikkei manufacturing Purchasing Managers' Index (PMI) for Japan declined to 50.2 in February from 52.3 in January.

A reading below 50 indicates contraction of activity, a reading above 50 indicates expansion.

The index was driven by a drop in new orders.

"Production increased at the slowest rate in the current 10-month sequence of expansion, led by a marginal drop in new orders for the first time since June last year. Data suggests that the fall in total new work intakes was caused primarily by a contraction in international demand, with new exports declining at the sharpest rate in three years," economist at Markit, Amy Brownbill, said.

-

10:00

Eurozone: Services PMI, February 53 (forecast 53.4)

-

10:00

Eurozone: Manufacturing PMI, February 51 (forecast 52.0)

-

09:30

Germany: Manufacturing PMI, February 50.2 (forecast 52)

-

09:30

Germany: Services PMI, February 55.1 (forecast 54.7)

-

09:15

Switzerland: Producer & Import Prices, m/m, January -0.4%

-

09:15

Switzerland: Producer & Import Prices, y/y, January -5.3%

-

09:00

France: Manufacturing PMI, February 50.3 (forecast 49.9)

-

09:00

France: Services PMI, February 49.8 (forecast 50.3)

-

08:09

Foreign exchange market. Asian session: the pound tumbled

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:35 Japan Manufacturing PMI (Preliminary) February 52.3 50.2

The pound fell sharply as some influential U.K. officials including London Mayor Boris Johnson still support the idea of U.K.'s exit from the European Union. A referendum on this subject is scheduled for June 23 and any news on citizens' opinion may boost the pound's volatility. This morning the GBP/USD pair traded about 100 points below last week's close level.

The euro, which is currently under pressure amid risk appetite, will be influenced by today's data on production activity in several European countries.

The yen declined against the U.S. dollar on preliminary manufacturing PMI data. The index declined to 50.2 points in February from 52.3 reported previously. Economists had expected a more modest decline to 52.0. New export orders fell at the fastest pace in three years coming in at 47.9 compared to 53.1 reported previously.

EUR/USD: the pair traded within $1.1100 in Asian trade

USD/JPY: the pair rose to Y113.05

GBP/USD: the pair fell to $1.4255

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:00 France Manufacturing PMI (Preliminary) February 50 49.9

08:00 France Services PMI (Preliminary) February 50.3 50.3

08:15 Switzerland Producer & Import Prices, y/y January -5.5%

08:15 Switzerland Producer & Import Prices, m/m January -0.4%

08:30 Germany Services PMI (Preliminary) February 55 54.7

08:30 Germany Manufacturing PMI (Preliminary) February 52.3 52

09:00 Eurozone Manufacturing PMI (Preliminary) February 52.3 52.0

09:00 Eurozone Services PMI (Preliminary) February 53.6 53.4

11:00 United Kingdom CBI industrial order books balance February -15

14:45 U.S. Manufacturing PMI (Preliminary) February 52.4 52.3

-

07:03

Options levels on monday, February 22, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1297 (2332)

$1.1235 (2495)

$1.1191 (2817)

Price at time of writing this review: $1.1115

Support levels (open interest**, contracts):

$1.1056 (1989)

$1.1000 (2896)

$1.0965 (8686)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 65116 contracts, with the maximum number of contracts with strike price $1,1000 (5211);

- Overall open interest on the PUT options with the expiration date March, 4 is 92962 contracts, with the maximum number of contracts with strike price $1,1000 (8686);

- The ratio of PUT/CALL was 1.43 versus 1.42 from the previous trading day according to data from February, 19

GBP/USD

Resistance levels (open interest**, contracts)

$1.4605 (1233)

$1.4507 (1560)

$1.4411 (710)

Price at time of writing this review: $1.4287

Support levels (open interest**, contracts):

$1.4193 (2055)

$1.4096 (1402)

$1.3097 (1732)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 27265 contracts, with the maximum number of contracts with strike price $1,4650 (1642);

- Overall open interest on the PUT options with the expiration date March, 4 is 26237 contracts, with the maximum number of contracts with strike price $1,4350 (2956);

- The ratio of PUT/CALL was 0.96 versus 0.94 from the previous trading day according to data from February, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:36

Japan: Manufacturing PMI, February 50.2

-

00:28

Currencies. Daily history for Feb 19’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1129 +0,22%

GBP/USD $1,4357 +0,16%

USD/CHF Chf0,9901 -0,27%

USD/JPY Y112,64 -0,52%

EUR/JPY Y125,36 -0,33%

GBP/JPY Y161,72 -0,36%

AUD/USD $0,7148 -0,10%

NZD/USD $0,6633 -0,14%

USD/CAD C$1,3767 +0,31%

-

00:00

Schedule for today, Monday, Feb 22’2016:

(time / country / index / period / previous value / forecast)

01:35 Japan Manufacturing PMI (Preliminary) February 52.3

08:00 France Manufacturing PMI (Preliminary) February 50 49.9

08:00 France Services PMI (Preliminary) February 50.3 50.3

08:15 Switzerland Producer & Import Prices, y/y January -5.5%

08:15 Switzerland Producer & Import Prices, m/m January -0.4%

08:30 Germany Services PMI (Preliminary) February 55 54.7

08:30 Germany Manufacturing PMI (Preliminary) February 52.3 52

09:00 Eurozone Manufacturing PMI (Preliminary) February 52.3 52.0

09:00 Eurozone Services PMI (Preliminary) February 53.6 53.4

11:00 United Kingdom CBI industrial order books balance February -15

14:45 U.S. Manufacturing PMI (Preliminary) February 52.4 52.3

-