Noticias del mercado

-

17:43

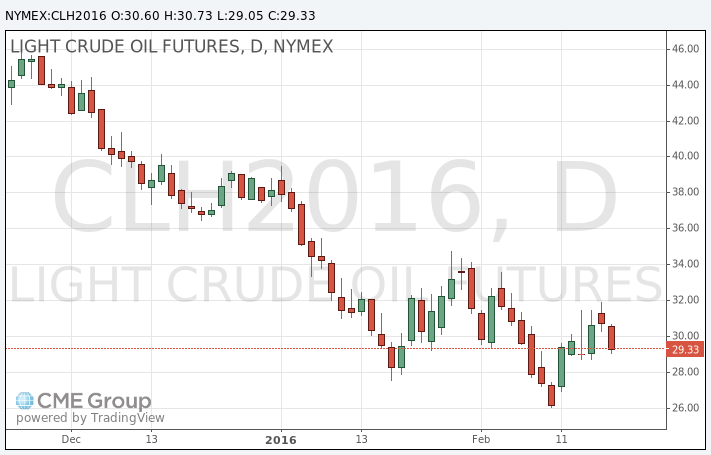

Oil prices continue to decline

Oil prices continued to decline on concerns over the global oil oversupply. Earlier this week, oil prices rose on news that Russia and Saudi Arabia agreed to freeze the oil production at the level of January if other oil producers join. But it is unclear if other oil producers will join. Especially, Iran plans to boost its exports.

Yesterday's U.S. crude oil inventories data also added to concerns over the global oil oversupply. According to the U.S. Energy Information Administration (EIA), U.S. crude inventories rose by 2.15 million barrels to 504.1 million in the week to February 12. Analysts had expected U.S. crude oil inventories to rise by 4.0 million barrels.

Market participants are also awaiting the release of the number of active U.S. rigs later in the day. The oil driller Baker Hughes reported on last Friday that the number of active U.S. rigs declined by 28 rigs to 439 last week. It was the lowest level since January 2010.

WTI crude oil for April delivery declined to $29.05 a barrel on the New York Mercantile Exchange.

Brent crude oil for April fell to $33.48 a barrel on ICE Futures Europe.

-

17:26

Gold rises on a weaker U.S. dollar

Gold price rose on a weaker U.S. dollar. The U.S. dollar fell against other currencies despite the better-than-expected U.S. consumer price inflation data. The U.S. Labor Department released consumer price inflation data on Friday. The U.S. consumer price inflation was flat in January, beating expectations for a 0.1% decline, after a 0.1% fall in December.

The index was mainly driven by higher prices of rents and medical care, and higher shelter costs.

On a yearly basis, the U.S. consumer price index increased to 1.4% in January from 0.7% in December, exceeding expectations for a rise to 1.3%. It was the biggest increase since October 2014.

The U.S. consumer price inflation excluding food and energy gained 0.3% in January, exceeding expectations for a 0.2% rise, after a 0.2% increase in December.

On a yearly basis, the U.S. consumer price index excluding food and energy increased to 2.2% in January from 2.1% in December, beating expectations for a 2.1% rise.

The consumer price index is not preferred Fed's inflation measure.

April futures for gold on the COMEX today increased to 1235.30 dollars per ounce.

-

16:34

The People's Bank of China (PBoC) Vice Governor Yi Gang said on Friday that too much quantitative easing in China would lead to asset bubbles and would weigh on the yuan

-

15:48

Saudi Arabian Foreign Minister Adel Al Jubeir: Saudi Arabia is not ready to lower its oil output

Saudi Arabian Foreign Minister Adel Al Jubeir said in an interview on Thursday that Saudi Arabia was not ready to lower its oil output.

"If other producers want to limit or agree to a freeze in terms of additional production that may have an impact on the market but Saudi Arabia is not prepared to cut production," he said.

"The oil issue will be determined by supply and demand and by market forces. The kingdom of Saudi Arabia will protect its market share and we have said so," he added.

-

07:28

Oil retreated

West Texas Intermediate futures for March delivery declined to $32.77 (-0.49%), while Brent crude fell to $34.10 (-0.53%) as concerns over the global supply glut outweighed optimism about the latest deal between Russia, Saudi Arabia, Venezuela and Qatar.

Renewed concerns were driven by data from the Energy Information Administration. Last week U.S. crude oil inventories rose by 2.1 million barrels to 504.1 million barrels marking the third week of record highs.

On Thursday Iraqi oil minister said that OPEC and non-OPEC members will continue searching for a way to improve conditions in the market. However most analysts point to Iran, because its officials made clear multiple statements that Tehran wants return to its pre-sanctions output level.

-

07:13

Gold steadied

Gold is currently at $1,226.60 (+0.02%) holding above the key $1,200 an ounce level amid declines in stocks. Concerns over the global economy and a global equity selloff allowed gold price to gain 16% since the beginning of 2016. However many analysts say that the recent rally was overdone and bullion may lose more. Concerns over Federal Reserve's plan to continue raising rates support the precious metal too.

Holdings of SPDR Gold Trust, the largest gold-backed exchange-traded-fund, rose by 0.38% to 713.63 tonnes on Thursday.

-

01:03

Commodities. Daily history for Feb 18’2016:

(raw materials / closing price /% change)

Oil 30.62 -0.49%

Gold 1,232.00 +0.46%

-