Noticias del mercado

-

18:12

Oil prices plunge more than 4%

Oil prices slid on concerns over the global oil oversupply. Saudi Arabian Oil Minister Ali Al-Naimi said on Tuesday that the country was not ready to cut its oil output.

Iranian Oil Minister Bijan Namdar Zanganeh said the initiative to freeze the oil production at January level is unrealistic demand on Iran. Iran plans to boost its oil output.

Market participants are awaiting the release of U.S. crude oil inventories data. The American Petroleum Institute (API) is scheduled to release its U.S. oil inventories data later in the day, and U.S. oil inventories data from the U.S. Energy Information Administration is expected on Wednesday.

WTI crude oil for April delivery decreased to $31.75 a barrel on the New York Mercantile Exchange.

Brent crude oil for April rose to $33.29 a barrel on ICE Futures Europe.

-

17:30

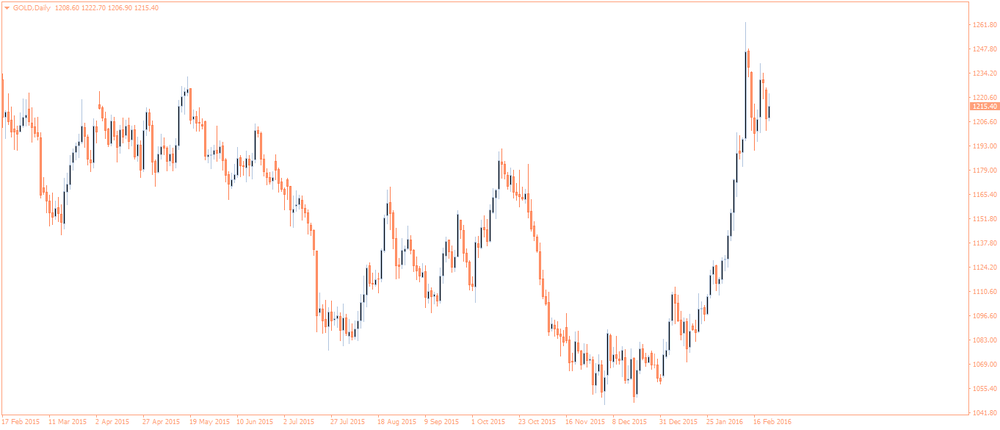

Gold increases more than 1%

Gold price rose on increasing demand for safe-haven assets.

Market participants speculate that the Fed will not raise its interest rate in March. They are focussed on the incoming U.S. economic data. The Conference Board released its consumer confidence index for the U.S. on Tuesday. The index dropped to 92.2 in February from 97.8 in January, missing expectations for a fall to 97.0. The present conditions index dropped to 112.1 in February from 116.6 in January. The Conference Board's consumer expectations index for the next six months decreased to 78.9 in February from 85.3 in January. The percentage of consumers expecting more jobs in the coming months was down to 22.1% in February from 23.0% in January.

The National Association of Realtors released existing homes sales figures in the U.S. on Tuesday. Sales of existing homes rose 0.4% to a seasonally adjusted annual rate of 5.47 million in January from 5.45 in December. Analysts had expected a decrease to 5.32 million units.

"The housing market has shown promising resilience in recent months, but home prices are still rising too fast because of ongoing supply constraints. Despite the global economic slowdown, the housing sector continues to recover and will likely help the U.S. economy avoid a recession," the NAR chief economist Lawrence Yun said.

March futures for gold on the COMEX today rose to 1226.40 dollars per ounce.

-

07:41

Oil retreated

West Texas Intermediate futures for April delivery fell to $32.79 (-1.80%), while Brent crude dropped to $34.12 (-1.64%) as market participants assessed a generally bearish report from the International Energy Agency. The agency estimates that U.S. oil output will decline by 600,000 barrels per day by the end of 2016. Nevertheless oil prices are unlikely to sustain gains as the supply glut will persist in the near-term future. Analysts believe that it will take more time to stabilize the market.

-

07:24

Gold climbed on weaker Asian stocks

Gold climbed to $1,217.90 (+0.64%) after Asian stocks reversed gains on lower oil prices. Analysts say that a rally in stocks could put pressure on the precious metal. Meanwhile physical demand in top consumers India and China struggled. Prices in both countries fell.

Nevertheless inflows data suggest that investors are interested in gold. Holdings of SPDR Gold Trust, the largest gold-backed exchange-traded-fund, rose by 2.64% to 752.29 tonnes on Monday. This year's inflows have already outrun outflows for the whole of 2015.

-

00:32

Commodities. Daily history for Feb 22’2016:

(raw materials / closing price /% change)

Oil 31.43 -0.16%

Gold 1,208.90 -0.10%

-