Noticias del mercado

-

17:49

Oil prices continue to decline

Oil prices slid on the U.S. crude oil inventories data and on comments by Saudi Arabian Oil Minister Ali Al-Naimi. He said that there will be no cut in oil output.

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories rose by 3.5 million barrels to 507.6 million in the week to February 19.

Analysts had expected U.S. crude oil inventories to rise by 3.17 million barrels.

Gasoline inventories decreased by 2.2 million barrels, the first decline since November, according to the EIA.

Crude stocks at the Cushing, Oklahoma, increased by 333,000 barrels.

U.S. crude oil imports decreased by 117,000 barrels per day.

Refineries in the U.S. were running at 87.3% of capacity, down from 88.3% the previous week.

WTI crude oil for April delivery decreased to $31.00 a barrel on the New York Mercantile Exchange.

Brent crude oil for April rose to $32.70 a barrel on ICE Futures Europe.

-

17:30

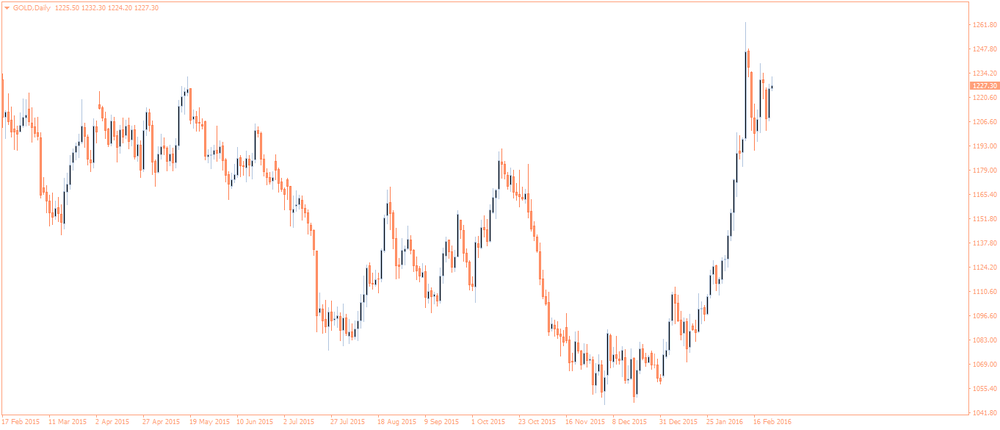

Gold increases around 2%

Gold price rose on increasing demand for safe-haven assets as global stocks and oil prices declined. A weaker U.S. dollar also supported gold. The U.S. dollar fell against other currencies after the release of the weak U.S. economic data. Markit Economics released its preliminary services purchasing managers' index (PMI) for the U.S. on Wednesday. The U.S. preliminary services purchasing managers' index (PMI) dropped to 49.8 in February from 53.2 in January. It was the lowest level since October 2013. Analysts had expected the index to rise to 53.5.

The U.S. Commerce Department released new home sales data on Wednesday. New home sales slid 9.2% to a seasonally adjusted annual rate of 494,000 units in January from 544,000 units in December. Analysts had expected new home sales to reach 520,000 units.

March futures for gold on the COMEX today rose to 1247.50 dollars per ounce.

-

16:51

U.S. crude inventories rise by 3.5 million barrels to 507.6 million in the week to February 19

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories rose by 3.5 million barrels to 507.6 million in the week to February 19.

Analysts had expected U.S. crude oil inventories to rise by 3.17 million barrels.

Gasoline inventories decreased by 2.2 million barrels, the first decline since November, according to the EIA.

Crude stocks at the Cushing, Oklahoma, increased by 333,000 barrels.

U.S. crude oil imports decreased by 117,000 barrels per day.

Refineries in the U.S. were running at 87.3% of capacity, down from 88.3% the previous week.

-

07:41

Oil plunged

West Texas Intermediate futures for April delivery tumbled to $31.14 (-2.29%), while Brent crude fell to $32.83 (-1.32%) as hopes for output cuts faded. Speaking on Tuesday at the IHS CERAWeek conference in the U.S., Saudi oil minister Ali Al-Naimi said his country would not take on production cuts, because other producers would not do the same even if they promise. Al-Naimi also said that in the current conditions producers will have to "lower costs, borrow or liquidate". He added that he doesn't know when prices will finally climb.

Signs of rising crude stockpiles in the U.S. also weighed on oil prices. The American Petroleum Institute said on Tuesday inventories likely rose by 7.1 million barrels in the week to February 19, while experts had expected a more modest increase of 3.4 million barrels. Official data from the Energy Information Administration will be published later today.

-

07:09

Gold climbed on weaker stocks

Gold climbed to $1,228.40 (+0.47%) as tumbling equities increased demand for safe-haven assets. Physical demand in top consumers India and China is not impressive; however investor appetite for bullion is quite high as shown by ETF data. Holdings of SPDR Gold Trust, the largest gold-backed exchange-traded-fund are at the highest level in almost a year.

Gold has been one of the best performers this year with a 16% gain.

Some analysts say the precious metal is likely to test its recent high of $1,240 some time soon.

-

00:32

Commodities. Daily history for Feb 23’2016:

(raw materials / closing price /% change)

Oil 31.37 -1.57%

Gold 1,226.00 +0.28%

-