Noticias del mercado

-

22:46

New Zealand: Trade Balance, mln, January 8 (forecast -246)

-

21:00

Dow +0.75% 16,608.27 +123.28 Nasdaq +0.22% 4,552.75 +10.14 S&P +0.57% 1,940.79 +10.99

-

20:19

American focus: the Canadian dollar strengthened significantly against the US dollar

The dollar traded mixed against the euro, but generally stayed in a small range. The dynamics of trading dictate risk appetite, statements by the Federal Reserve and US statistics. Today the president of Federal Reserve Bank of St. Louis James Bullard said inappropriate prediction of rate increases. He added that since the Fed's policy is determined by the incoming data, the decline in inflation expectations and financial markets means that the Central Bank has more room to maneuver within the framework of the normalization of monetary policy. Meanwhile, the chairman of the Federal Reserve Bank of Atlanta Dennis Lockhart said that an increase in US interest rates could have a negative impact on bank profits. "The Fed will decide on a further increase in interest rates on the basis of data This drop in fuel prices and slowing growth in China have complicated the assessment of the US economic outlook.", - He added. The next FOMC meeting will be held March 15-16. the average market estimates the chances of a rate hike in March, only 6%. In general, the chances of growth rates are measured in less than 50% of 2016 year.

With regard to statistics, the Labor Department reported that the number of initial applications for unemployment benefits rose last week, although the overall level remained unchanged amid growing labor market. Primary applications for unemployment benefits, layoffs indicator increased by 10,000 and reached a seasonally adjusted 272,000 for the week ended February 20. Economists forecast 270,000 hits. The four-week moving average of applications, which smooths the volatile weekly data, fell by 1,250 to 272,000, the lowest level since mid-December. Repeated requests for unemployment benefits fell by 19,000 to 2.253 million in the week to 13 February.

Another report showed that orders for durable goods in the US rose in January, the most since August 2014, reflecting a pause in the decline in production. Orders for non-military equipment, except for commercial aircraft, jumped by 3.9 percent, more than forecast, after a decline of 3.7 percent in December, which was lower than previously reported. Orders for durable goods rose by 4.9 percent.

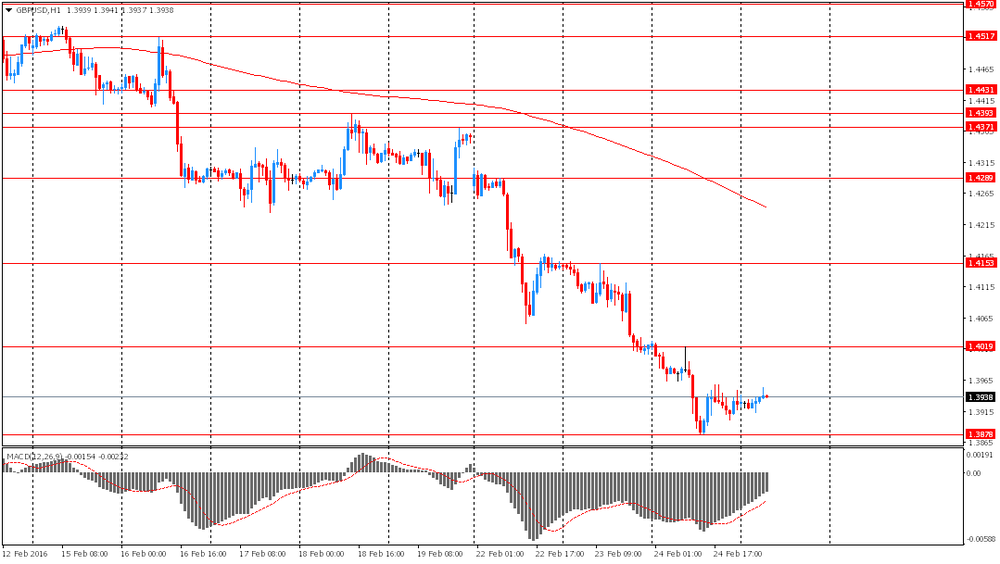

The pound depreciated moderately against the dollar, returning to opening levels. Initially, the pound rose to $ 1.4000 against the background of general decline in the US currency and data on UK GDP, but after the publication of data on US demand for the dollar has returned. Recall, the Office for National Statistics (ONS) reported that the UK economy expanded in line with the preliminary estimates in the fourth quarter. Gross domestic product grew 0.5 percent sequentially, according to preliminary estimates published on 28 January. The growth was slightly faster than the expansion of 0.4 percent in the third quarter. On an annual basis, GDP grew by 1.9 percent, according to the previously published estimates. In the fourth quarter, output in the service sector rose by 0.7 percent sequentially, according to preliminary estimates. Output in the service sector grew by 2.5 percent in 2015 after rising 3.3 percent the previous year. In the 4th quarter, business investment expanded by 2.4 per cent compared with last year. In 2015, investments grew by 4.7 per cent.

The Canadian dollar rose substantially against the US dollar, reaching a peak from December 9, 2015, which was caused by the triggering of stop orders at CAD1.3600 level and the resumption of growth in oil prices. I stand by commodity currencies also have comments from the central bank of China that the country can increase the budget deficit to 4% of GDP. In an article published in "The Economic Daily", said that according to research by the head of the Central Bank of China and expert statistical department Sheng Songchena, deficit increase will not be large risk of insolvency for the government. China raised its budget deficit to 2.3 percent of GDP in 2015 from 2.1 percent in 2014. Usually, the 3 per cent deficit level is considered a "red line" that must not be crossed. But Sheng said that there should be universal "dangerous" level. "Most likely, the deficit to GDP ratio should be determined by a country's balance of debt and the structure, economic conditions and interest rates, - he said the 3 per cent." Dangerous "level does not match the reality of China." In support of their point of view Sheng refers to a relatively small debt of China, a rational structure, the continuing growth of budget revenues and safe assets state-owned firms.

-

19:30

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes slightly rose on Thursday, breaking away from sliding oil prices, as strong U.S. durable goods data pointed to a recovery in the struggling manufacturing sector. Orders for U.S. durable goods rose more than expected in January, as demand picked up across the board. Movements in crude prices have been the biggest influence on stock markets this year as investors see weak energy demand as a sign of sluggish global growth.

Most of all Dow stocks in positive area (22 of 30). Top looser - Chevron Corporation (CVX, -1,58%). Top gainer - United Technologies Corporation (UTX, +3,87%).

Most of S&P sectors also in positive area. Top looser - Basic Materials (-1,0%). Top gainer - Utilities (+0,8%).

At the moment:

Dow 16530.00 +57.00 +0.35%

S&P 500 1932.50 +2.25 +0.12%

Nasdaq 100 4199.50 -9.00 -0.21%

Oil 31.65 -0.50 -1.56%

Gold 1241.10 +2.00 +0.16%

U.S. 10yr 1.69 -0.05

-

18:38

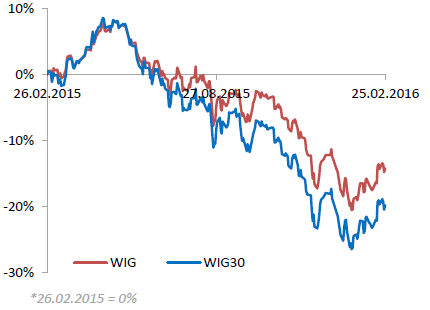

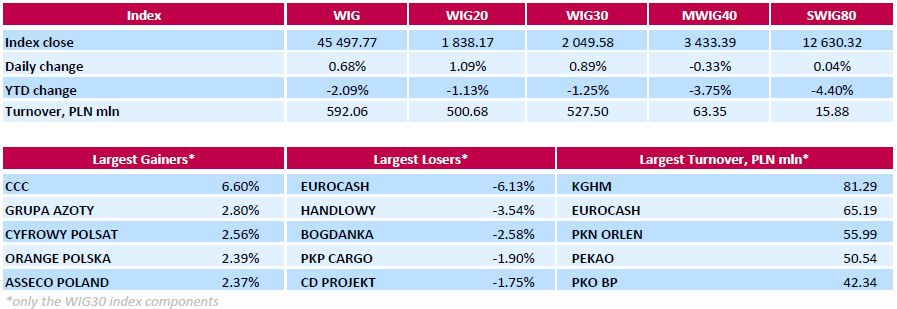

WSE: Session Results

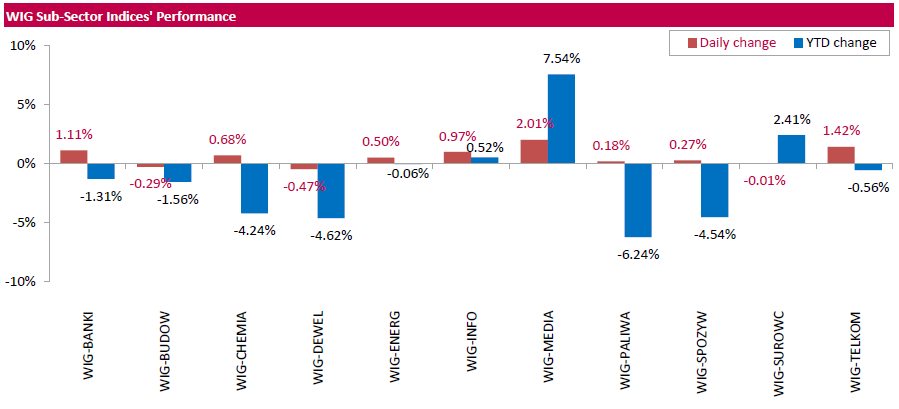

Polish equity market closed higher on Thursday. The broad market measure, the WIG Index, surged by 0.48%. From a sector perspective, developing sector (-0.47%) fared the worst, while media sector (+2.01%) was the best-performing group.

The large-cap stocks' measure, the WIG30 Index, grew by 0.89%. In the index basket, footwear retailer CCC (WSE: CCC) recorded the strongest daily performance, soaring by 6.6% on better-than-expected quarterly earnings: the company posted Q4 net profit of PLN 105 mln versus consensus of PLN 92 mln. Other major gainers were chemical producer GRUPA AZOTY (WSE: ATT), media group CYFROWY POLSAT (WSE: CPS), telecommunication services provider ORANGE POLSKA (WSE: OPL) and IT-company ASSECO POLAND (WSE: ACP), which advanced by 2.37%-2.8%. On the other side of the ledger, FMCG-wholesaler EUROCASH (WSE: EUR) was weakest performer, tumbling by 6.13% as the company's Q4 FY2015 earnings of PLN 97 mln were weaker than the analysts' estimates of PLN 103 mln. It was followed by bank BZ WBK (WSE: BZW) and thermal coal miner BOGDANKA (WSE: LWB), which lost 3.54% and 2.58% respectively.

-

18:01

European stocks close: stocks closed higher ahead of the G20 summit

Stock indices closed higher as market participants are awaiting the G20 summit, which is scheduled to be in Shanghai on February 26 - 27. The International Monetary Fund (IMF) said in its report prepared for the summit that G20 countries should coordinate their stimulus measures to boost the global economy.

Meanwhile, market participants eyed the economic data from the Eurozone. Eurostat released its final consumer price inflation data for the Eurozone on Thursday. Eurozone's harmonized consumer price index dropped 1.4% in January, in line with expectations, after a flat reading in December.

On a yearly basis, Eurozone's final consumer price inflation rose to 0.3% in January from 0.2% in December, down from the preliminary reading of 0.4%.

Restaurants and cafés prices were up 0.10% year-on-year in January, tobacco and vegetables prices rose by 0.06% each, fuel prices for transport declined by 0.28%, heating oil prices decreased by 0.18%, while gas prices were down by 0.11%.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco increased to at an annual rate of 1.0 in January from 0.9% in December, in line with the preliminary reading.

The European Central Bank (ECB) released its M3 money supply figures on Thursday. M3 money supply rose 5.0% in January from last year, exceeding expectations for a 4.7% gain, after a 4.7 % increase in December.

Loans to the private sector in the Eurozone climbed 1.4% in January from the last year, missing expectations for a 1.5% rise, after a 1.4% gain in December.

The Office for National Statistics (ONS) released its revised gross domestic product (GDP) data on Thursday. The revised U.K. GDP expanded at 0.5% in the fourth quarter, in line with the preliminary reading, after a 0.4% rise in the third quarter.

The growth was driven by a rise in household spending. Household spending rose 0.7% in the fourth quarter.

Business investment slid 2.1% in the fourth quarter.

On a yearly basis, the revised U.K. GDP rose 1.9% in the fourth quarter, in line with the preliminary reading, after a 2.1% gain in the third quarter.

In 2015 as whole, U.K. GDP rose 2.2%, in line with the preliminary reading, after a 2.9% growth in 2014.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,012.81 +145.63 +2.48 %

DAX 9,331.48 +163.68 +1.79 %

CAC 40 4,248.45 +93.11 +2.24 %

-

18:00

European stocks closed: FTSE 100 6,012.81 +145.63 +2.48% CAC 40 4,248.45 +93.11 +2.24% DAX 9,331.48 +163.68 +1.79%

-

17:48

Oil prices fall on concerns over the global oil oversupply

Oil prices declined on concerns over the global oil oversupply. According to market intelligence provider Genscape's data, crude stocks at the Cushing, Oklahoma, increased by more than 503,000 barrels between February 19 and February 24.

Market participants are awaiting comments by Saudi Arabian Oil Minister Ali Al-Naimi. He said this week that there will be no cut in oil output.

Oil prices yesterday were supported by the first decline of U.S. gasoline inventories since November, which decreased by 2.2 million barrels last week.

According to the U.S. Energy Information Administration's (EIA) data on Wednesday, U.S. crude inventories rose by 3.5 million barrels to 507.6 million in the week to February 19. Analysts had expected U.S. crude oil inventories to rise by 3.17 million barrels.

Crude stocks at the Cushing, Oklahoma, increased by 333,000 barrels.

WTI crude oil for April delivery decreased to $31.40 a barrel on the New York Mercantile Exchange.

Brent crude oil for April rose to $33.86 a barrel on ICE Futures Europe.

-

17:33

Bank of England (BoE) Deputy Governor Jon Cunliffe: the U.K. economy recovered slowly

Bank of England (BoE) Deputy Governor Jon Cunliffe said on Wednesday that the U.K. economy recovered slowly, noting that "there are deeper structural factors at work".

He pointed out that he expected the U.K. economy to continue to expand solidly and inflation to reach 2% target "over the next few years".

Cunliffe noted that the central bank was ready to act if needed.

"We have a range of tools at our disposal and should be ready to use them whichever risk materialises," he said.

-

17:25

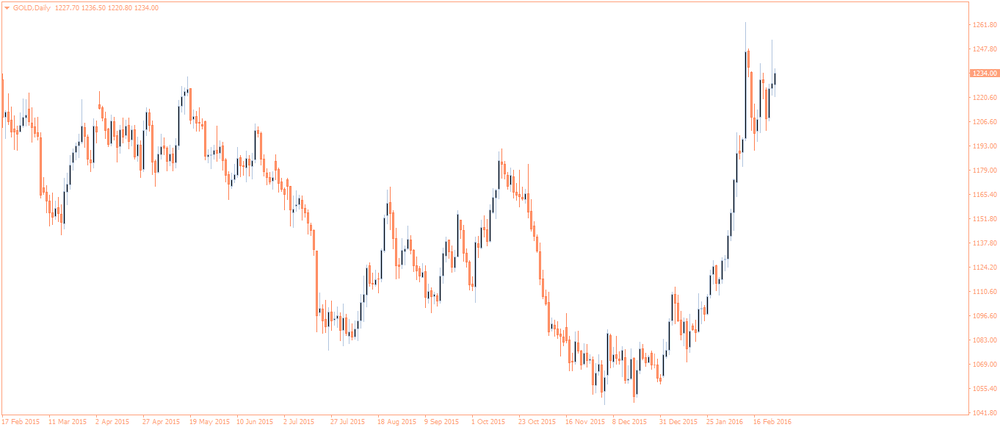

Gold increases slightly

Gold price rose on increasing demand for safe-haven assets as oil prices declined. A weaker U.S. dollar also supported gold.

Market participants eyed the U.S. economic data. The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending February 20 in the U.S. increased by 10,000 to 272,000 from 262,000 in the previous week. Analysts had expected jobless claims to rise to 270,000.

The U.S. Commerce Department released durable goods orders data on Thursday. The U.S. durable goods orders jumped 4.9% in January, exceeding expectations for a 2.9% gain, after a 4.6% drop in December. December's figure was revised up from a 5.0% fall.

The increase was mainly driven by a strong demand for transportation equipment.

The U.S. durable goods orders excluding transportation climbed 1.8% in January, exceeding expectations for a 0.2% increase, after a 0.7% decline in December. December's figure was revised up from a 1.2% drop.

The U.S. durable goods orders excluding defence rose 4.5 % in January, after a 2.5% decline in December. December's figure was revised up from a 2.9% decrease.

March futures for gold on the COMEX today rose to 1237.60 dollars per ounce.

-

16:54

German construction orders increase 3.9% in December

Destatis released its construction orders data on Thursday. German construction orders rose by a seasonally and working-day-adjusted rate of 3.9% in December.

On an annual basis, German construction orders climbed by a seasonally and working-day-adjusted rate of 19.8% in December.

In 2015 as whole, total construction orders rose 3.7%.

-

16:50

Dallas Federal Reserve President Robert Kaplan does not expect the U.S. economy to enter recession this year

Dallas Federal Reserve President Robert Kaplan said on Wednesday that he did not expect the U.S. economy to enter recession this year.

He also said that the U.S. economic growth was sluggish.

-

16:43

St. Louis Fed President James Bullard: the likelihood for the global recession was not high

St. Louis Fed President James Bullard said in an interview with CNBC on Thursday that the likelihood for the global recession was not high.

"I don't think the probabilities are particularly high right now," he said.

Bullard noted that if U.S. equities had continued to rise at the same pace, that would have led to an asset price bubble.

Bullard is a voting member of the Federal Open Market Committee (FOMC) this year.

-

16:16

Atlanta Fed President Dennis Lockhart: higher interest rates could have a negative impact on U.S. banks

Atlanta Fed President Dennis Lockhart said on Thursday that higher interest rates could have a negative impact on U.S. banks.

"For the first time in more than a decade, bankers face the potential of operating in a rising rate environment. Rising rates will create challenges in managing net interest margins and risks," he said.

Lockhart noted that further interest rate hikes will depend on the incoming economic data, adding that low energy prices and the slowdown in the Chinese economy added "new complexity" to U.S. forecasts.

-

15:50

U.S. house price index rise 0.4% in December

The Federal Housing Finance Agency (FHFA) released its monthly house price index for the U.S. on Thursday. The U.S. house price index rose 0.4% on a seasonally adjusted basis in December, missing expectations for a 0.5% increase, after a 0.6% gain in November. November's figure was revised up from a 0.5% rise.

On a yearly basis, U.S. house prices climbed 5.7% in December, after a 5.9% rise in November.

House prices increased 1.4% in the fourth quarter.

"Instability in financial markets did not seem to put much of a drag on home prices in the fourth quarter," FHFA Supervisory Economist, Andrew Leventis, said.

-

15:34

U.S. Stocks open: Dow +0.34%, Nasdaq +0.34%, S&P +0.39%

-

15:25

Before the bell: S&P futures +0.08%, NASDAQ futures +0.01%

U.S. stock-index futures were little changed.

Global Stocks:

Nikkei 16,140.34 +224.55 +1.41%

Hang Seng 18,888.75 -303.70 -1.58%

Shanghai Composite 2,741.42 -187.48 -6.40%

FTSE 6,005.39 +138.21 +2.36%

CAC 4,247.81 +92.47 +2.23%

DAX 9,319.26 +151.46 +1.65%

Crude oil $31.61 (-1.68%)

Gold $1236.80 (-0.19%)

-

15:16

U.S.: Housing Price Index, m/m, December 0.4% (forecast 0.5%)

-

15:04

U.S. durable goods orders jump 4.9% in January

The U.S. Commerce Department released durable goods orders data on Thursday. The U.S. durable goods orders jumped 4.9% in January, exceeding expectations for a 2.9% gain, after a 4.6% drop in December. December's figure was revised up from a 5.0% fall.

The increase was mainly driven by a strong demand for transportation equipment, which climbed by 11.5% in January.

The U.S. durable goods orders excluding transportation climbed 1.8% in January, exceeding expectations for a 0.2% increase, after a 0.7% decline in December. December's figure was revised up from a 1.2% drop.

The U.S. durable goods orders excluding defence rose 4.5 % in January, after a 2.5% decline in December. December's figure was revised up from a 2.9% decrease.

-

15:00

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Barrick Gold Corporation, NYSE

ABX

13.59

0.97%

90.0K

General Motors Company, NYSE

GM

28.98

0.49%

1.1K

Twitter, Inc., NYSE

TWTR

18.08

0.44%

28.4K

Microsoft Corp

MSFT

51.57

0.41%

3.5K

Boeing Co

BA

116.00

0.35%

0.4K

Goldman Sachs

GS

146.04

0.33%

0.1K

American Express Co

AXP

54.82

0.33%

0.8K

Visa

V

72.08

0.32%

0.1K

General Electric Co

GE

28.81

0.28%

14.3K

Wal-Mart Stores Inc

WMT

67.30

0.27%

7.2K

International Business Machines Co...

IBM

133.15

0.26%

1.8K

Travelers Companies Inc

TRV

108.74

0.24%

0.1K

Cisco Systems Inc

CSCO

26.38

0.23%

0.4K

McDonald's Corp

MCD

117.32

0.22%

0.1K

Intel Corp

INTC

29.25

0.21%

19.4K

Pfizer Inc

PFE

30.08

0.20%

0.1K

ALTRIA GROUP INC.

MO

61.48

0.20%

0.4K

3M Co

MMM

157.48

0.17%

0.1K

AT&T Inc

T

37.16

0.16%

0.8K

Nike

NKE

60.49

0.15%

0.7K

United Technologies Corp

UTX

93.74

0.14%

3.4K

Facebook, Inc.

FB

107.02

0.13%

121.3K

Verizon Communications Inc

VZ

50.87

0.10%

0.7K

Ford Motor Co.

F

12.09

0.08%

29.8K

The Coca-Cola Co

KO

43.94

0.07%

0.4K

Google Inc.

GOOG

700.05

0.07%

1.2K

JPMorgan Chase and Co

JPM

56.17

0.05%

0.6K

Amazon.com Inc., NASDAQ

AMZN

554.25

0.04%

12.7K

Citigroup Inc., NYSE

C

38.10

0.03%

15.0K

Starbucks Corporation, NASDAQ

SBUX

58.10

-0.02%

3.5K

Apple Inc.

AAPL

96.05

-0.05%

71.1K

Johnson & Johnson

JNJ

104.84

-0.11%

3.5K

Chevron Corp

CVX

85.14

-0.15%

7.6K

Exxon Mobil Corp

XOM

81.30

-0.27%

7.6K

Tesla Motors, Inc., NASDAQ

TSLA

178.51

-0.27%

6.4K

Walt Disney Co

DIS

95.11

-0.34%

0.5K

Home Depot Inc

HD

125.10

-0.41%

0.5K

Caterpillar Inc

CAT

65.56

-0.49%

9.1K

ALCOA INC.

AA

8.70

-0.68%

10.4K

Yahoo! Inc., NASDAQ

YHOO

30.63

-1.03%

7.0K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

7.12

-1.11%

37.7K

Yandex N.V., NASDAQ

YNDX

12.99

-1.37%

1.7K

Hewlett-Packard Co.

HPQ

10.35

-4.34%

7.8K

-

14:48

Initial jobless claims increase to 272,000 in the week ending February 20

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending February 20 in the U.S. increased by 10,000 to 272,000 from 262,000 in the previous week.

Analysts had expected jobless claims to rise to 270,000.

Jobless claims remained below 300,000 the 51st straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims declined by 19,000 to 2,253,000 in the week ended February 13.

-

14:45

Option expiries for today's 10:00 ET NY cut

USD/JPY: 110.10 (USD 205m) 112.00 (USD 135m) 114.00 (284m) 115.00 (245m)

EUR/USD: 1.0800-15 (EUR 1.8bln) 1.0900 (383m) 1.1000 (425m) 1.1010-15 (361m) 1.1025-35 (1.1bln) 1.1050 (744m) 1.1075 (198m) 1.1140-50 (877m) 1.1190-112.00 (551m) 1.1250 (2.03bln)

EUR/GBP 0.7750 (EUR 777m)

AUD/USD: 0.6950 (AUD 151m) 0.7050 (290m) 0.7150 (425m) 0.7200 (191m)

USD/CAD 1.3500 (USD 600m) 1.3950 (570m)

USD/CNY 6.5000 (1.97bln) 6.55 (1.47bln)

-

14:41

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Yahoo! (YHOO) reiterated with a Neutral at Mizuho; target $29

-

14:30

U.S.: Initial Jobless Claims, February 272 (forecast 270)

-

14:30

U.S.: Durable Goods Orders , January 4.9% (forecast 2.9%)

-

14:30

U.S.: Continuing Jobless Claims, February 2253 (forecast 2260)

-

14:30

U.S.: Durable goods orders ex defense, January 4.5%

-

14:30

U.S.: Durable Goods Orders ex Transportation , January 1.8% (forecast 0.2%)

-

14:00

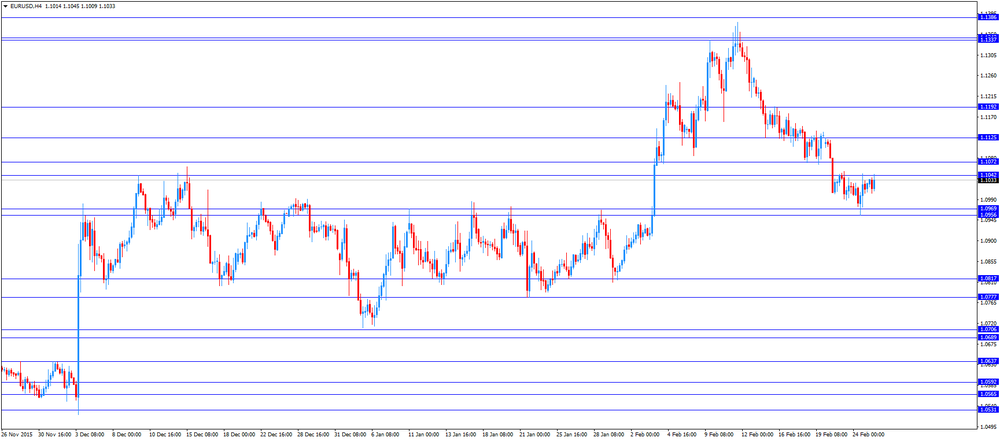

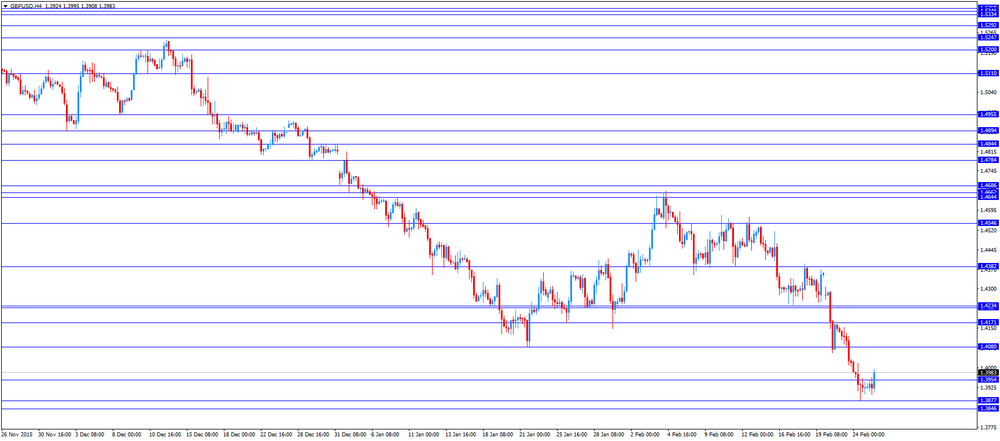

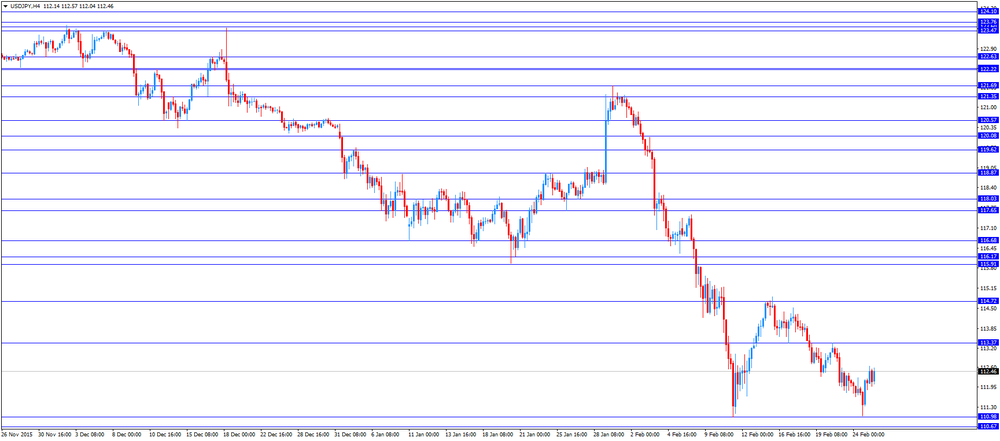

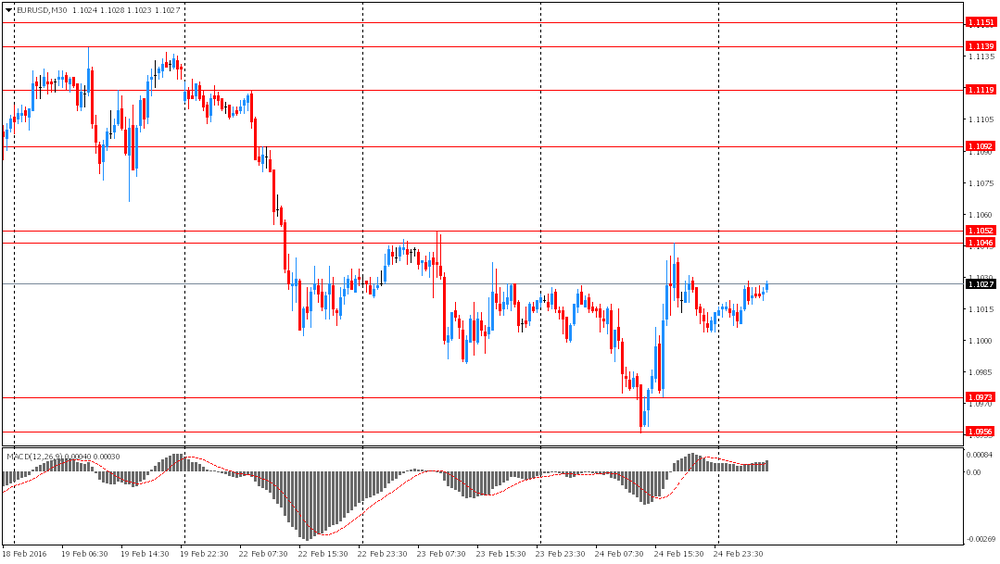

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the release of the economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 U.S. FOMC Member James Bullard Speaks

00:30 Australia Private Capital Expenditure December -8.4% Revised From -9.2% -3% 0.8%

07:00 Germany Gfk Consumer Confidence Survey March 9.4 9.3 9.5

09:00 Eurozone Private Loans, Y/Y January 1.4% 1.5% 1.4%

09:00 Eurozone M3 money supply, adjusted y/y January 4.7% 4.7% 5.0%

09:30 United Kingdom Business Investment, q/q Quarter IV 1.2% Revised From 2.2% 0.9% -2.1%

09:30 United Kingdom Business Investment, y/y Quarter IV 4.5% Revised From 6.6% 2.4%

09:30 United Kingdom GDP, y/y (Revised) Quarter IV 2.1% 1.9% 1.9%

09:30 United Kingdom GDP, q/q (Revised) Quarter IV 0.4% 0.5% 0.5%

10:00 Eurozone Harmonized CPI January 0.0% -1.4% -1.4%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) January 0.2% 0.4% 0.3%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) January 0.9% 1.0% 1%

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. The number of initial jobless claims in the U.S. is expected to rise by 8,000 to 270,000 last week.

The U.S. durable goods orders are expected to increase 2.9% in January, after a 5.0% drop in December.

The U.S. durable goods orders excluding transportation are expected to climb 0.2% in January, after a 1.2% decline in December.

The euro traded higher against the U.S. dollar after the release of the economic data from the Eurozone. Eurostat released its final consumer price inflation data for the Eurozone on Thursday. Eurozone's harmonized consumer price index dropped 1.4% in January, in line with expectations, after a flat reading in December.

On a yearly basis, Eurozone's final consumer price inflation rose to 0.3% in January from 0.2% in December, down from the preliminary reading of 0.4%.

Restaurants and cafés prices were up 0.10% year-on-year in January, tobacco and vegetables prices rose by 0.06% each, fuel prices for transport declined by 0.28%, heating oil prices decreased by 0.18%, while gas prices were down by 0.11%.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco increased to at an annual rate of 1.0 in January from 0.9% in December, in line with the preliminary reading.

The European Central Bank (ECB) released its M3 money supply figures on Thursday. M3 money supply rose 5.0% in January from last year, exceeding expectations for a 4.7% gain, after a 4.7 % increase in December.

Loans to the private sector in the Eurozone climbed 1.4% in January from the last year, missing expectations for a 1.5% rise, after a 1.4% gain in December.

The British pound traded higher against the U.S. dollar after the release of the revised U.K. GDP data. The Office for National Statistics (ONS) released its revised gross domestic product (GDP) data on Thursday. The revised U.K. GDP expanded at 0.5% in the fourth quarter, in line with the preliminary reading, after a 0.4% rise in the third quarter.

The growth was driven by a rise in household spending. Household spending rose 0.7% in the fourth quarter.

Business investment slid 2.1% in the fourth quarter.

On a yearly basis, the revised U.K. GDP rose 1.9% in the fourth quarter, in line with the preliminary reading, after a 2.1% gain in the third quarter.

In 2015 as whole, U.K. GDP rose 2.2%, in line with the preliminary reading, after a 2.9% growth in 2014.

EUR/USD: the currency pair increased to $1.1045

GBP/USD: the currency pair rose to $1.3995

USD/JPY: the currency pair was up to Y112.57

The most important news that are expected (GMT0):

13:30 U.S. Initial Jobless Claims February 262 270

13:30 U.S. Durable Goods Orders January -5.0% 2.9%

13:30 U.S. Durable Goods Orders ex Transportation January -1.2% 0.2%

13:30 U.S. Durable goods orders ex defense January -2.9%

14:00 U.S. Housing Price Index, m/m December 0.5% 0.5%

21:45 New Zealand Trade Balance, mln January -53 -246

23:30 Japan Tokyo Consumer Price Index, y/y February -0.3% -0.3%

23:30 Japan Tokyo CPI ex Fresh Food, y/y February -0.1% -0.2%

23:30 Japan National Consumer Price Index, y/y January 0.2% 0.0%

23:30 Japan National CPI Ex-Fresh Food, y/y January 0.1% -0.2%

-

14:00

Orders

EUR/USD

Offers: 1.1035 1.1050 1.1080 1.1100 1.1120 1.1135 1.1150 1.1200

Bids: 1.1000 1.0985 1.0965 1.0950 1.0920 1.0900 1.0880 1.0860 1.0830 1.0800

GBP/USD

Offers: 1.3970 1.3985 1.4000 1.4020-25 1.4050 1.4080 1.4100

Bids: 1.3920-25 1.3900 1.3885 1.3865 1.3850 1.3830 1.3800

EUR/JPY

Offers: 123.80 124.00 124.50 124.75 125.00 125.50 126.00

Bids: 123.00 122.75-80 122.50 122.30 122.00 121.50

EUR/GBP

Offers: 0.7925-30 0.7950 0.7975 0.8000

Bids: 0.7885 0.7865 0.7850 0.7830-35 0.7800

USD/JPY

Offers: 112.50 112.80 113.00 113.20-25 113.40 113.65 113.85 114.00

Bids: 112.00 111.80 111.65-70 111.50 111.30 111.00 110.80 110.50

AUD/USD

Offers: 0.7185 0.7200 0.7220 0.7250 0.7265 0.7285 0.7300

Bids: 0.7160 0.7140-45 0.7120 0.7100 0.7080 0.7050

-

12:08

European stock markets mid session: stocks traded higher ahead of the G20 summit

Stock indices traded higher as market participants are awaiting the G20 summit, which is scheduled to be in Shanghai on February 26 - 27. The International Monetary Fund (IMF) said in its report prepared for the summit that G20 countries should coordinate their stimulus measures to boost the global economy.

Meanwhile, market participants eyed the economic data from the Eurozone. Eurostat released its final consumer price inflation data for the Eurozone on Thursday. Eurozone's harmonized consumer price index dropped 1.4% in January, in line with expectations, after a flat reading in December.

On a yearly basis, Eurozone's final consumer price inflation rose to 0.3% in January from 0.2% in December, down from the preliminary reading of 0.4%.

Restaurants and cafés prices were up 0.10% year-on-year in January, tobacco and vegetables prices rose by 0.06% each, fuel prices for transport declined by 0.28%, heating oil prices decreased by 0.18%, while gas prices were down by 0.11%.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco increased to at an annual rate of 1.0 in January from 0.9% in December, in line with the preliminary reading.

The European Central Bank (ECB) released its M3 money supply figures on Thursday. M3 money supply rose 5.0% in January from last year, exceeding expectations for a 4.7% gain, after a 4.7 % increase in December.

Loans to the private sector in the Eurozone climbed 1.4% in January from the last year, missing expectations for a 1.5% rise, after a 1.4% gain in December.

The Office for National Statistics (ONS) released its revised gross domestic product (GDP) data on Thursday. The revised U.K. GDP expanded at 0.5% in the fourth quarter, in line with the preliminary reading, after a 0.4% rise in the third quarter.

The growth was driven by a rise in household spending. Household spending rose 0.7% in the fourth quarter.

Business investment slid 2.1% in the fourth quarter.

On a yearly basis, the revised U.K. GDP rose 1.9% in the fourth quarter, in line with the preliminary reading, after a 2.1% gain in the third quarter.

In 2015 as whole, U.K. GDP rose 2.2%, in line with the preliminary reading, after a 2.9% growth in 2014.

Current figures:

Name Price Change Change %

FTSE 100 5,990.52 +123.34 +2.10 %

DAX 9,254.46 +86.66 +0.95 %

CAC 40 4,230.74 +75.40 +1.81 %

-

12:02

Spanish producer prices decline 2.5% in January

The Spanish statistical office INE released its producer price index (PPI) data for Spain on Thursday. The Spanish producer prices dropped 2.5% in January, after a 0.7% fall in December.

On a yearly basis, producer price inflation in Spain fell 2.5% in January, after a 1.7% decline in December. December's figure was revised up from a 2.2% drop.

Producer prices have been declining since July 2014.

Energy prices slid 9.8% year-on-year in January.

-

11:57

Spain’s economy expands 0.8% the fourth quarter

The Spanish statistical office INE released its final gross domestic product (GDP) for Spain on Thursday. Spain's economy expanded 0.8% the fourth quarter, in line with the preliminary reading, after a 0.8% growth in the third quarter. It was the tenth consecutive increase.

The increase was driven by a rise in household spending.

On a yearly, GDP grew 3.5% in the fourth quarter, in line with the preliminary reading, in line with the preliminary reading, after a 3.4% in the third quarter. It was the fastest growth since the fourth quarter of 2007.

In 2015 as whole, Spain's economy expanded 3.2%, in line with the preliminary reading.

-

11:45

Italian consumer confidence index slides to 114.5 in February

The Italian statistical office Istat released its consumer confidence index for Italy on Thursday. The Italian consumer confidence index slid to 114.5 in February from 118.6 in January. January's figure was revised down from 118.9.

The decrease was driven by drops in all components: economic, personal, current and future.

The business confidence index fell to 102.0 in February from 103.0 in January. January's figure was revised down from 103.2.

The decline was driven by less favourable assessments on order books and production expectations, and by a drop in inventories.

-

11:40

Italian retail sales fall 0.1% in December

The Italian statistical office Istat released its retail sales data for Italy on Thursday. Italian retail sales fell by 0.1% in December, after a 0.2% increase in November. November's figure was revised down from a 0.2% gain.

Sales of food products were down 0.3% in December, while sales of non-food products decreased by 0.1%.

On a yearly basis, retail sales in Italy climbed 0.6% in December, after a 0.2% decline in November. November's figure was revised down from a 0.1% fall.

-

11:36

Private capital expenditure in Australia increases 0.8% in the fourth quarter

The Australian Bureau of Statistics released its private capital expenditure data on Thursday. Private capital expenditure in Australia increased 0.8% in the fourth quarter, beating forecasts of a 3.0% drop, after a 8.4% decline in third quarter. The third quarter's figure was revised up a 9.2% fall.

Capex for buildings and structures rose 1.2% in the fourth quarter, while capital spending for equipment, plants and machinery was up 0.1%.

On a yearly basis, private capital expenditure in Australia declined 16.4% in the fourth quarter.

-

11:25

Revised U.K. GDP grows at 0.5% in the fourth quarter

The Office for National Statistics (ONS) released its revised gross domestic product (GDP) data on Thursday. The revised U.K. GDP expanded at 0.5% in the fourth quarter, in line with the preliminary reading, after a 0.4% rise in the third quarter.

The growth was driven by a rise in household spending. Household spending rose 0.7% in the fourth quarter.

Exports declined 0.1% in the fourth quarter, while imports were up 1.2%.

Business investment slid 2.1% in the fourth quarter.

The service sector climbed 0.7% in the fourth quarter, in line with the preliminary reading.

On a yearly basis, the revised U.K. GDP rose 1.9% in the fourth quarter, in line with the preliminary reading, after a 2.1% gain in the third quarter.

In 2015 as whole, U.K. GDP rose 2.2%, in line with the preliminary reading, after a 2.9% growth in 2014.

-

11:15

Eurozone's harmonized consumer price index drops 1.4% in January

Eurostat released its final consumer price inflation data for the Eurozone on Thursday. Eurozone's harmonized consumer price index dropped 1.4% in January, in line with expectations, after a flat reading in December.

On a yearly basis, Eurozone's final consumer price inflation rose to 0.3% in January from 0.2% in December, down from the preliminary reading of 0.4%.

Restaurants and cafés prices were up 0.10% year-on-year in January, tobacco and vegetables prices rose by 0.06% each, fuel prices for transport declined by 0.28%, heating oil prices decreased by 0.18%, while gas prices were down by 0.11%.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco increased to at an annual rate of 1.0 in January from 0.9% in December, in line with the preliminary reading.

-

11:00

Eurozone: Harmonized CPI, Y/Y, January 0.3% (forecast 0.4%)

-

11:00

Eurozone: Harmonized CPI ex EFAT, Y/Y, January 1% (forecast 1.0%)

-

11:00

Eurozone: Harmonized CPI, January -1.4% (forecast -1.4%)

-

10:51

M3 money supply in the Eurozone rises 5.0% in January from last year

The European Central Bank (ECB) released its M3 money supply figures on Thursday. M3 money supply rose 5.0% in January from last year, exceeding expectations for a 4.7% gain, after a 4.7 % increase in December.

Loans to the private sector in the Eurozone climbed 1.4% in January from the last year, missing expectations for a 1.5% rise, after a 1.4% gain in December.

Total credit to euro area residents increased to 2.6% year-on-year in January from 2.4% in December.

Loans to non-financial corporations rose to 0.6% year-on-year in January from 0.1% in December.

-

10:31

German Gfk consumer confidence index rises to 9.5 in March

Market research group GfK released its consumer confidence index for Germany on Thursday. German Gfk consumer confidence index rose to 9.5 in March from 9.4 in February, beating expectations for a drop to 9.3.

The economic expectations index declined by 0.8 points to 3.4 points in February, while the willingness to buy index remained unchanged at 52.7.

The income expectations index climbed by 9.5 points to 56.7 in February.

"The pleasing start to the consumer climate this year has paved the way for 2016 to also be a good year for consumption. In its recently published forecast, GfK assumes that actual private consumer spending will rise by 2 percent this year. Growth for 2015 was also around 2 percent according to initial reports from the Federal Statistical Office," Gfk noted.

-

10:31

United Kingdom: Business Investment, y/y, Quarter IV 2.4%

-

10:30

United Kingdom: GDP, q/q, Quarter IV -2.1% (forecast 0.5%)

-

10:30

United Kingdom: GDP, y/y, Quarter IV 2.4% (forecast 1.9%)

-

10:30

United Kingdom: Business Investment, q/q, Quarter IV -2.1% (forecast 0.9%)

-

10:20

St. Louis Fed President James Bullard: the Fed should not raise its interest rate further

St. Louis Fed President James Bullard said in a speech on Wednesday that the Fed should not raise its interest rate further as inflation expectations declined.

"I regard it as unwise to continue a normalization strategy in an environment of declining market-based inflation expectations. A decline in inflation expectations represents an erosion of central bank credibility with respect to the inflation target," he said.

Bullard noted that the risk of asset price bubbles in the U.S. fell.

-

10:11

International Monetary Fund: global recovery weakened further

The International Monetary Fund (IMF) released its report "Global Prospects and Policy Challenges" prepared for the G20 summit. The IMF said that global recovery weakened further due to increasing financial turbulence and falling asset prices.

"Growth in advanced economies is modest already under the baseline, as low demand in some countries and a broad-based weakening of potential growth continue to hold back the recovery," it said.

"Adding to these headwinds are concerns about the global impact of China's transition to more balanced growth, along with signs of distress in other large emerging markets, including from falling commodity prices," the fund added.

The report said that the global economy was "highly vulnerable to adverse shocks".

The IMF noted that G20 countries should coordinate their stimulus measures to boost the global economy.

The IMF cut its global growth forecast in January to 3.4% from 3.6%. The fund pointed out that further cut is possible in April.

-

10:02

Eurozone: Private Loans, Y/Y, January 1.4% (forecast 1.5%)

-

10:01

Eurozone: M3 money supply, adjusted y/y, January 5.0% (forecast 4.7%)

-

10:01

Eurozone: M3 money supply, adjusted y/y, January 5.0% (forecast 4.7%)

-

09:38

Option expiries for today's 10:00 ET NY cut

USD/JPY: 110.10 (USD 205m) 112.00 (USD 135m) 114.00 (284m) 115.00 (245m)

EUR/USD: 1.0800-15 (EUR 1.8bln) 1.0900 (383m) 1.1000 (425m) 1.1010-15 (361m) 1.1025-35 (1.1bln) 1.1050 (744m) 1.1075 (198m) 1.1140-50 (877m) 1.1190-112.00 (551m) 1.1250 (2.03bln)

EUR/GBP 0.7750 (EUR 777m)

AUD/USD: 0.6950 (AUD 151m) 0.7050 (290m) 0.7150 (425m) 0.7200 (191m)

USD/CAD 1.3500 (USD 600m) 1.3950 (570m)

USD/CNY 6.5000 (1.97bln) 6.55 (1.47bln)

-

08:36

Foreign exchange market. Asian session: the Australian dollar fell

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 U.S. FOMC Member James Bullard Speaks

00:30 Australia Private Capital Expenditure December -8.4% Revised From -9.2% -3% 0.8%

07:00 Germany Gfk Consumer Confidence Survey March 9.4 9.3 9.5

The U.S. dollar fell against the euro on weak economic data. A preliminary report from Markit Economics showed that activity in the services sector of the U.S. economy contracted in February. The preliminary Services PMI fell to 49.8 in February from 53.2 in January, while economists had expected a modest increase to 53.5. Many analysts said that a recession in the manufacturing sector might have spread to the services sector. Meanwhile a report from the Department of Commerce showed that new home sales fell by 9.2% in January after a sharp increase in December.

The pound traded range-bound after Bank of England deputy governor Jon Cunliffe said the country's economy was recovering slowly and that there were reasons to expect a long period of stagnation.

The Australian dollar fell on private capital expenditure data. The report showed that private capital expenditure rose by 0.8% in the fourth quarter after a 3% drop reported previously. However investors ignored this modest increase and focused on a terrifying outlook. Planned expenditure for 2015/16 is expected to drop 18%.

EUR/USD: the pair rose to $1.0035 in Asian trade

USD/JPY: the pair rose to Y112.60

GBP/USD: the fluctuated within $1.3910-50

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:00 Eurozone Private Loans, Y/Y January 1.4% 1.5%

09:00 Eurozone M3 money supply, adjusted y/y January 4.7% 4.7%

09:30 United Kingdom Business Investment, q/q Quarter IV 2.2% 0.9%

09:30 United Kingdom Business Investment, y/y Quarter IV 6.6%

09:30 United Kingdom GDP, y/y (Revised) Quarter IV 2.1% 1.9%

09:30 United Kingdom GDP, q/q (Revised) Quarter IV 0.4% 0.5%

10:00 Eurozone Harmonized CPI January 0.0% -1.4%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) January 0.2% 0.4%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) January 0.9% 1.0%

13:30 U.S. Continuing Jobless Claims February 2273 2260

13:30 U.S. Initial Jobless Claims February 262 270

13:30 U.S. Durable Goods Orders January -5.0% 2.9%

13:30 U.S. Durable Goods Orders ex Transportation January -1.2% 0.2%

13:30 U.S. Durable goods orders ex defense January -2.9%

14:00 U.S. Housing Price Index, m/m December 0.5% 0.5%

21:45 New Zealand Trade Balance, mln January -53 -246

23:30 Japan Tokyo Consumer Price Index, y/y February -0.3% -0.3%

23:30 Japan Tokyo CPI ex Fresh Food, y/y February -0.1% -0.2%

23:30 Japan National Consumer Price Index, y/y January 0.2% 0.0%

23:30 Japan National CPI Ex-Fresh Food, y/y January 0.1% -0.2%

-

08:28

Options levels on thursday, February 25, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1179 (4577)

$1.1143 (3398)

$1.1084 (4912)

Price at time of writing this review: $1.1029

Support levels (open interest**, contracts):

$1.0976 (5332)

$1.0935 (8423)

$1.0872 (7228)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 67205 contracts, with the maximum number of contracts with strike price $1,1000 (4912);

- Overall open interest on the PUT options with the expiration date March, 4 is 94390 contracts, with the maximum number of contracts with strike price $1,1000 (8423);

- The ratio of PUT/CALL was 1.40 versus 1.38 from the previous trading day according to data from February, 24

GBP/USD

Resistance levels (open interest**, contracts)

$1.4203 (420)

$1.4105 (361)

$1.4008 (114)

Price at time of writing this review: $1.3911

Support levels (open interest**, contracts):

$1.3793 (502)

$1.3696 (349)

$1.3598 (1033)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 28109 contracts, with the maximum number of contracts with strike price $1,4750 (1652);

- Overall open interest on the PUT options with the expiration date March, 4 is 29912 contracts, with the maximum number of contracts with strike price $1,4350 (2954);

- The ratio of PUT/CALL was 1.06 versus 1.05 from the previous trading day according to data from February, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:01

Germany: Gfk Consumer Confidence Survey, March 9.5 (forecast 9.3)

-

07:44

Oil prices retreated

West Texas Intermediate futures for April delivery is currently at $32.12 (-0.09%), while Brent crude is at $34.36 (-0.15%). Crude oil prices rose on Wednesday as market participants assessed a report on U.S. crude oil inventories. The Energy Information Administration reported that crude oil inventories rose by 3.5 million barrels in the week ended February 19. Investors looked beyond this increase and welcomed declines in stocks of refined products: gasoline and distillate stockpiles fell by 2.2 million barrels and 1.7 million barrels respectively. However concerns over the persistent supply glut outweighed optimism about declining gasoline inventories and weighed on prices.

-

07:27

Gold holds above $1,200

Gold is currently at $1,235.20 (-0.31%). The precious metal retreated on Wednesday after climbing 2% as stocks advanced. Stocks rose following higher oil prices, however many Asian shared fell after crude resumed declines. Weak stocks and oil support demand for gold and other safe-haven assets. Rising expectations that the Federal Reserve will keep delaying the next rate hike are favorable for bullion too.

Holdings of SPDR Gold Trust, the largest gold-backed exchange-traded-fund, rose to 760.32 tonnes on Wednesday.

-

07:04

Global Stocks: U.S. stock indices rose following oil prices

U.S. stock indices closed in the positive territory on Wednesday amid higher oil prices despite weak economic data.

The Dow Jones Industrial Average rose 53.21 points, or 0.3%, to 16,484.99 after an initial decline of about 250 points. The S&P 500 climbed 8.53 points, or 0.4%, to 1,929.30 (its financial sector was the only one that fell, down 0.2%). The Nasdaq Composite gained 39.02 points, or 0.9%, to 4,542.61.

Financial stocks have been the worst performers among S&P's sectors in 2016. Financial companies suffered because of concerns over the health of the U.S. economy and prospects of low interest rates for a longer period of time.

Meanwhile a preliminary report on activity in the services sector of the U.S. economy showed contraction. The preliminary Services PMI fell to 49.8 in February from 53.2 in January, while economists had expected a modest increase to 53.5. Many analysts said that a recession in the manufacturing sector might have spread to the services sector.

This morning in Asia Hong Kong Hang Seng fell 1.15%, or 221.16 points, to 18,971.29. China Shanghai Composite Index dropped 3.73%, or 109.12 points, to 2,819.78. Meanwhile the Nikkei rose 1.64%, or 260.56 points, to 16,176.35.

Asian stock indices traded mixed. Japanese stocks rose following gains in U.S. equities.

Chinese stocks dropped on persistent concerns over the country's economy. Investors may also be concerned that representatives of leading economies may agree on some policy moves that could impact financial markets. The G20 meeting will be held in Shanghai on Friday and Saturday. Slumping oil prices also keep investors cautious.

-

03:29

Nikkei 225 15,985 +69.21 +0.43 %, Hang Seng 19,063.14 -129.31 -0.67 %, Shanghai Composite 2,916.38 -12.52 -0.43 %

-

01:30

Australia: Private Capital Expenditure, December 0.8% (forecast -3%)

-

00:55

Commodities. Daily history for Feb 24’2016:

(raw materials / closing price /% change)

Oil 32.20 +0.16%

Gold 1,227.30 -0.95%

-

00:54

Stocks. Daily history for Sep Feb 24’2016:

(index / closing price / change items /% change)

S&P/ASX 200 4,875.02 -104.57 -2.10%

TOPIX 1,284.53 -6.64 -0.51%

SHANGHAI COMP 2,929.57 +26.24 +0.90%

HANG SENG 19,192.45 -222.33 -1.15%

FTSE 100 5,867.18 -95.13 -1.60 %

CAC 40 4,155.34 -83.08 -1.96 %

Xetra DAX 9,167.8 -248.97 -2.64 %

S&P 500 1,929.8 +8.53 +0.44 %

NASDAQ Composite 4,542.61 +39.02 +0.87 %

Dow Jones 16,484.99 +53.21 +0.32 %

-

00:53

Currencies. Daily history for Feb 24’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1013 -0,15%

GBP/USD $1,3926 -0,68%

USD/CHF Chf0,9886 -0,25%

USD/JPY Y112,17 +0,07%

EUR/JPY Y123,53 +0,02%

GBP/JPY Y156,2 -0,61%

AUD/USD $0,7195 -0,07%

NZD/USD $0,6658 +0,27%

USD/CAD C$1,3700 -0,67%

-

00:01

Schedule for today, Thursday, Feb 25’2016:

(time / country / index / period / previous value / forecast)

00:00 U.S. FOMC Member James Bullard Speaks

00:30 Australia Private Capital Expenditure December -9.2% -3%

07:00 Germany Gfk Consumer Confidence Survey March 9.4 9.3

09:00 Eurozone Private Loans, Y/Y January 1.4% 1.5%

09:00 Eurozone M3 money supply, adjusted y/y January 4.7% 4.7%

09:30 United Kingdom Business Investment, q/q Quarter IV 2.2% 0.9%

09:30 United Kingdom Business Investment, y/y Quarter IV 6.6%

09:30 United Kingdom GDP, y/y (Revised) Quarter IV 2.1% 1.9%

09:30 United Kingdom GDP, q/q (Revised) Quarter IV 0.4% 0.5%

10:00 Eurozone Harmonized CPI January 0.0% -1.4%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) January 0.2% 0.4%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) January 0.9% 1.0%

13:30 U.S. Continuing Jobless Claims February 2273 2257

13:30 U.S. Initial Jobless Claims February 262 270

13:30 U.S. Durable Goods Orders January -5.0% 2.9%

13:30 U.S. Durable Goods Orders ex Transportation January -1.2% 0.2%

13:30 U.S. Durable goods orders ex defense January -2.9%

14:00 U.S. Housing Price Index, m/m December 0.5% 0.5%

21:45 New Zealand Trade Balance, mln January -53 -246

23:30 Japan Tokyo Consumer Price Index, y/y February -0.3% -0.3%

23:30 Japan Tokyo CPI ex Fresh Food, y/y February -0.1% -0.2%

23:30 Japan National Consumer Price Index, y/y January 0.2% 0.0%

23:30 Japan National CPI Ex-Fresh Food, y/y January 0.1% -0.2%

-