Noticias del mercado

-

21:00

DJIA 16573.82 -66.15 -0.40%, NASDAQ 4578.11 -12.36 -0.27%, S&P 500 1940.46 -7.59 -0.39%

-

18:00

European stocks close: stocks closed mixed on higher oil prices

Stock indices closed mixed as oil prices rose. Oil prices increased on news about the supply disruption in Nigeria due to a leak.

Meanwhile, market participants eyed the economic data from the Eurozone. Eurostat released its consumer price inflation data for the Eurozone on Monday. The preliminary consumer price inflation in the Eurozone declined to -0.2% year-on-year in February from 0.3% in January, missing expectations for a flat reading.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco fell to an annual rate of 0.7% in February from 1.0% in January. Analysts had expected the index to decrease to 0.9%.

Food, alcohol and tobacco prices were up 0.7% in February, non-energy industrial goods prices gained 0.3%, and services prices climbed 1.0%, while energy prices dropped 8.0%.

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Monday. The number of mortgages approvals in the U.K. was up to 74,581 in January from 71,335 in December, exceeding expectations for an increase to 73,600. December's figure was revised up from 70,837.

Net lending to individuals in the U.K. increased by £5.3 billion in January, after a £4.3 billion gain in December. December's figure was revised down from a £4.4 rise.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,097.09 +1.08 +0.02 %

DAX 9,495.4 -17.90 -0.19 %

CAC 40 4,353.55 +38.98 +0.90 %

-

18:00

European stocks closed: FTSE 6097.09 1.08 0.02%, DAX 9495.19 -18.11 -0.19%, CAC 40 4353.41 38.84 0.90%

-

17:56

WSE: Session Results

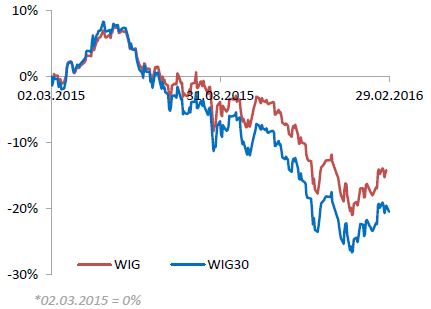

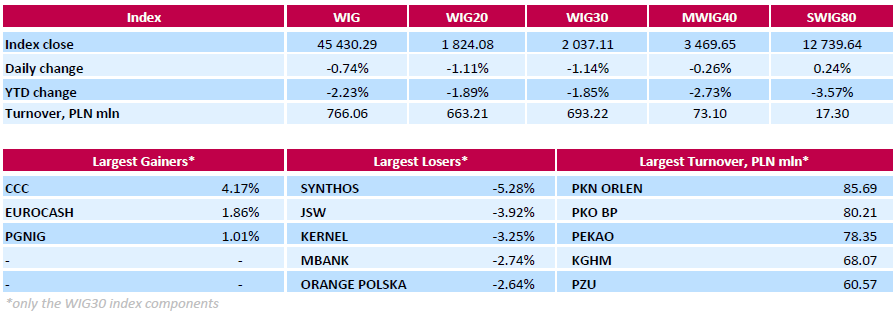

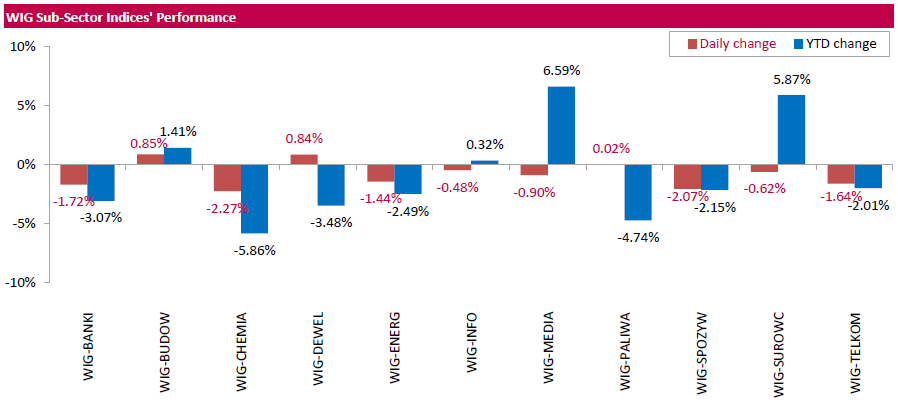

Polish equity market plunged on Monday. The broad market measure, the WIG Index, declined by 0.74%. From a sector perspective, chemicals (-2.27%) fared the worst, while construction sector (+0.85%) was the best-performing group.

The large-cap companies' measure, the WIG30 Index, lost 1.14%. Only three index constituents managed to generate positive returns: footwear retailer CCC (WSE: CCC) gained 4.17%, FMCG-wholesaler EUROCASH (WSE: EUR) advanced 1.86%, oil and gas producer PGNIG (WSE: PGN) added 1.01%. At the same time, the session's biggest loser was chemical company SYNTHOS (WSE: SNS), which tumbled by 5.28%. It was followed by coking coal producer JSW (WSE: JSW), which slumped by 3.92% after the company announced write-downs of PLN 2.8 bln in Q4 FY 2015 due to the loss of value of some of its coal assets.

-

17:38

China plans to cut 1.8 million jobs in the coal and steel sectors

China's minister for human resources and social security, Yin Weimin, said on Monday that 1.3 million workers in the coal sector and 500,000 workers in the steel sector could lose jobs as there is a overcapacity in both sectors.

-

17:35

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes slightly rose on Monday as cautious investors assessed China's move to boost its slowing economy and an increase in oil prices raised hopes that the market had bottomed out. China's central bank on Monday cut its reserve requirement ratio, or the amount of cash that banks must hold as reserves, for the fifth time in a year. Crude prices rose more than 1% after Saudi Arabia said it would work with other producers to limit oil market volatility.

Most of Dow stocks in positive area (19 of 30). Top looser - JPMorgan Chase & Co. (JPM, -0,82%). Top gainer - E. I. du Pont de Nemours and Company (DD, +0,98%).

Most of S&P sectors also in positive area. Top looser - Healthcare (-0,7%). Top gainer - Conglomerates (+4,4%).

At the moment:

Dow 16642.00 +41.00 +0.25%

S&P 500 1949.00 +6.25 +0.32%

Nasdaq 100 4246.50 +16.50 +0.39%

Oil 33.47 +0.69 +2.10%

Gold 1233.30 +12.90 +1.06%

U.S. 10yr 1.76 +0.06

-

17:05

People's Bank of China cuts the deposit reserve requirement ratio

The People's Bank of China (PBoC) announced on Monday that it lowered the deposit reserve requirement ratio by 50 basis points to 17%. The cut should help to provide enough liquidity in the financial system.

The ratio cut will be effective from Tuesday.

-

16:53

European Central Bank purchases €12.15 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €12.15 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €1.83 billion of covered bonds, and €13 million of asset-backed securities.

The ECB President Mario Draghi hinted at a press conference in January that the central bank may add further stimulus measures at its meeting in March as downside risks rose.

February's consumer price inflation data from the Eurozone (-0.2% year-on-year) added to speculation that the ECB could add further stimulus measures.

-

16:39

U.S. pending home sales drop 2.5% in January

The National Association of Realtors (NAR) released its pending home sales figures for the U.S. on Monday. Pending home sales in the U.S. slid 2.5% in January, missing expectations for a 0.5% gain, after a 0.9% increase in December. December's figure was revised up from a 0.1% rise.

The fall was mainly lead by declines in almost all regions. Only pending home sales in the South rose in January.

"While January's blizzard possibly caused some of the pullback in the Northeast, the recent acceleration in home prices and minimal inventory throughout the country appears to be the primary obstacle holding back would-be buyers," the NAR's chief economist Lawrence Yun said.

"Additionally, some buyers could be waiting for a hike in listings come springtime," he added.

-

16:33

Chicago purchasing managers' index drops to 47.6 in February

The Institute for Supply Management released its Chicago purchasing managers' index on Monday. The Chicago purchasing managers' index dropped to 47.6 in February from 55.6 in January, missing expectations for a decrease to 53.0.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The decline was mainly driven by drop in production and in new orders. The production index plunged to 44.0 in February from 62.5 in January, while the new orders declined sharply.

The employment index fell to the lowest level since November 2009.

"If one looks beyond the gyrations seen over the past three months then trend activity has been running a little below the 50 neutral mark, highlighting continued sluggish activity levels, with manufacturers under particular pressure. It looks like activity should pick up during Q1," Chief Economist of MNI Indicators Philip Uglow said.

-

15:43

The ANZ business confidence index for New Zealand slides to7.1% in January

ANZ Bank released its latest business sentiment survey for New Zealand on Monday. The ANZ business confidence index for New Zealand slid to7.1% in January from 23.0% in December. The index means that 7.1% of respondents expected the country's economy to improve over the coming year.

"The New Zealand economy is not immune from global pressures. We are a small, commodity dependent, debtor nation," the ANZ Chief Economist Cameron Bagrie said.

-

15:35

U.S. Stocks open: Dow-0.10%, Nasdaq -0.09%, S&P -0.12%

-

15:34

Company gross profits in Australia drop 2.8% in the fourth quarter

The Australian Bureau of Statistics released its company gross profits data on Monday. Company gross profits in Australia dropped seasonally adjusted 2.8% in the fourth quarter, missing expectations for a 1.8% fall, after a 1.4% increase in the third quarter. The third quarter's figure was revised up from a 1.3% gain.

Sales of goods and services in the manufacturing sector dropped seasonally adjusted 2.0% in the fourth quarter, sales of goods and services in wholesale trade climbed 1.6%.

Inventories fell seasonally adjusted 0.4% in the fourth quarter, while wages and salaries increased 0.5%.

-

15:29

Before the bell: S&P futures +0.12%, NASDAQ futures +0.01%

U.S. stock-index futures fluctuated.

Global Stocks:

Nikkei 16,026.76 -161.65 -1.00%

Hang Seng 19,111.93 -252.22 -1.30%

Shanghai Composite 2,687.83 -79.38 -2.87%

FTSE 6,092.86 -3.15 -0.05%

CAC 4,325.79 +11.22 +0.26%

DAX 9,446.35 -66.95 -0.70%

Crude oil $33.24 (+1.40%)

Gold $1229.40 (+0.74%)

-

15:24

Private sector credit in Australia rises 0.5% in January

The Reserve Bank of Australia (RBA) released its private sector credit data on Friday. The total value of private sector credit in Australia rose 0.5% in January, in line with expectations, after a 0.5% increase in December. December's figure was revised down from a 0.6% gain.

Housing credit increased 0.5% in January, personal credit declined 0.2%, while business credit rose 0.6%.

On a yearly basis, the private sector credit in Australia jumped 6.5% in January, after a 6.6% rise in December.

-

15:19

Housing starts in Japan rise 0.2% year-on-year in January

Japan's Ministry of Land, Infrastructure, Transport and Tourism released its housing starts data on Monday. Housing starts in Japan rose 0.2% year-on-year in January, beating expectations for a flat reading, after a 1.3% drop in December.

On a yearly basis, housing starts were up to 873,000 in January from 860,000 in December.

Construction orders slid 13.8% year-on-year in January, after a 14.8% rise in December.

-

15:14

Building permits in New Zealand plunge 8.2% in January

Statistics New Zealand released its building permits data on late Sunday evening. Building permits in New Zealand plunged 8.2% in January, after a 2.3% gain in December.

Residential work rose 17% year-on-year in January, while non-residential work dropped 12%.

"While January is usually a quiet month for building consents, Canterbury had the lowest January number in five years," business indicators senior manager Neil Kelly said.

-

14:57

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

7.67

3.23%

10.3K

Tesla Motors, Inc., NASDAQ

TSLA

192.51

1.14%

1.8K

American Express Co

AXP

56.00

1.12%

57.2K

Barrick Gold Corporation, NYSE

ABX

13.68

1.11%

25.6K

ALCOA INC.

AA

8.94

0.79%

6.9K

Walt Disney Co

DIS

95.73

0.44%

31.9K

Yahoo! Inc., NASDAQ

YHOO

31.45

0.26%

1.3K

AT&T Inc

T

37.22

0.24%

1.1K

Exxon Mobil Corp

XOM

81.95

0.24%

2.7K

Amazon.com Inc., NASDAQ

AMZN

556.00

0.14%

4.0K

Wal-Mart Stores Inc

WMT

66.59

0.12%

0.4K

International Business Machines Co...

IBM

132.15

0.09%

4.6K

Chevron Corp

CVX

84.36

0.01%

2.0K

Nike

NKE

62.60

0.00%

44.1K

Microsoft Corp

MSFT

51.30

0.00%

1.3K

Ford Motor Co.

F

12.47

0.00%

8.2K

ALTRIA GROUP INC.

MO

61.54

0.00%

4.3K

Starbucks Corporation, NASDAQ

SBUX

58.33

-0.02%

0.1K

Caterpillar Inc

CAT

66.85

-0.03%

0.1K

Facebook, Inc.

FB

107.89

-0.03%

25.9K

Verizon Communications Inc

VZ

51.00

-0.04%

0.6K

The Coca-Cola Co

KO

43.12

-0.05%

31.5K

Procter & Gamble Co

PG

81.04

-0.07%

1.5K

Apple Inc.

AAPL

96.84

-0.07%

22.2K

3M Co

MMM

158.10

-0.11%

0.9K

HONEYWELL INTERNATIONAL INC.

HON

102.90

-0.13%

36.2K

Boeing Co

BA

118.00

-0.14%

0.4K

General Electric Co

GE

29.36

-0.14%

0.9K

Cisco Systems Inc

CSCO

26.37

-0.15%

1.7K

Johnson & Johnson

JNJ

105.62

-0.15%

0.2K

Intel Corp

INTC

29.75

-0.17%

14.5K

Merck & Co Inc

MRK

50.54

-0.20%

6.1K

FedEx Corporation, NYSE

FDX

137.00

-0.28%

0.1K

Goldman Sachs

GS

149.15

-0.30%

0.3K

United Technologies Corp

UTX

97.40

-0.30%

0.8K

Google Inc.

GOOG

702.75

-0.33%

15.3K

Twitter, Inc., NYSE

TWTR

17.86

-0.45%

1.3K

Pfizer Inc

PFE

30.09

-0.46%

0.3K

JPMorgan Chase and Co

JPM

57.25

-0.50%

30.3K

Citigroup Inc., NYSE

C

39.30

-0.51%

34.3K

Hewlett-Packard Co.

HPQ

10.58

-0.56%

5.1K

General Motors Company, NYSE

GM

29.40

-0.78%

4.4K

McDonald's Corp

MCD

116.00

-0.91%

0.3K

-

14:51

Canadian current account deficit widens to C$15.38 billion in the fourth quarter

Statistics Canada released current account data on Monday. Canadian current account deficit widened to C$15.38 billion in the fourth quarter from a deficit of C$15.3 billion in the third quarter. The third quarter figure was revised up from a deficit of C$16.2 billion.

Analysts had expected the deficit to rise to C$15.6 billion.

The trade in goods deficit fell by C$0.3 billion to C$4.8 billion in the fourth quarter, while the deficit on international trade in services declined by $0.1 billion to C$5.8 billion.

In 2015 as whole, the current deficit climbed to C$65.7 billion from C$44.9 billion.

-

14:44

Canadian industrial product prices rise 0.5% in January

Statistics Canada released its industrial product and raw materials price indexes on Monday. The Industrial Product Price Index (IPPI) climbed 0.5% in January, after a 0.3% decline in December. December's figure was revised down from 0.2% decrease.

The increase was mainly driven by higher prices for motorized and recreational vehicles, which rose 2.7% in January.

18 of the 21 commodity groups increased and 3 declined.

The Raw Materials Price Index (RMPI) dropped 0.4% in January, after a 5.2% fall in December. December's figure was revised down from a 5.0% decline.

The drop was driven by lower prices for crude energy products. Crude energy products plunged by 4.2% in January.

4 of the 6 commodity groups rose and 2 decreased.

-

14:43

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

General Motors (GM) downgraded to Hold from Buy at Argus

Other:

Yahoo! (YHOO) target raised to $32 from $29 at Mizuho

Freeport-McMoRan (FCX) initiated with a Hold at Berenberg

Hewlett Packard Enterprise (HPE) reiterated with a Neutral at Mizuho, target $13

-

12:25

European stock markets mid session: stocks traded lower on disappointing results of the G20 summit

Stock indices traded lower on disappointing results of the G20 summit. The G20 finance ministers and central bank governors said at the G20 summit in Shanghai on Saturday that they will use the monetary policy tools to boost the global economic growth. They also said that downside risks to the global economy increased.

Meanwhile, market participants eyed the economic data from the Eurozone. Eurostat released its consumer price inflation data for the Eurozone on Monday. The preliminary consumer price inflation in the Eurozone declined to -0.2% year-on-year in February from 0.3% in January, missing expectations for a flat reading.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco fell to an annual rate of 0.7% in February from 1.0% in January. Analysts had expected the index to decrease to 0.9%.

Food, alcohol and tobacco prices were up 0.7% in February, non-energy industrial goods prices gained 0.3%, and services prices climbed 1.0%, while energy prices dropped 8.0%.

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Monday. The number of mortgages approvals in the U.K. was up to 74,581 in January from 71,335 in December, exceeding expectations for an increase to 73,600. December's figure was revised up from 70,837.

Net lending to individuals in the U.K. increased by £5.3 billion in January, after a £4.3 billion gain in December. December's figure was revised down from a £4.4 rise.

Current figures:

Name Price Change Change %

FTSE 100 6,055.47 -40.54 -0.67 %

DAX 9,352.49 -160.81 -1.69 %

CAC 40 4,281.78 -32.79 -0.76 %

-

12:22

Greek revised GDP rises 0.1% in the fourth quarter

The Hellenic Statistical Authority released its revised gross domestic product (GDP) data for Greece on Monday. The Greek GDP increased 0.1% in the fourth quarter, up from the preliminary reading of a 0.6% fall, after a 1.2% drop in the third quarter.

On a yearly basis, the Greek revised GDP fall at a seasonally-and-calendar adjusted 0.8% rate in the fourth quarter, down from the preliminary reading of a 1.9% drop, after a 1.7% decline in the third quarter.

On a yearly unadjusted basis, Greek final GDP slid 0.7% rate in the fourth quarter, down from the preliminary reading of a 2.0% decrease, after a 1.7% decrease in the third quarter.

Total consumption expenditure dropped 0.1% year-on-year in the fourth quarter.

Exports slid 8.8% year-on-year in the fourth quarter, while imports declined 12.5%.

-

12:10

Greek retail sales jump 22.4% in December

The Greek statistical office Hellenic Statistical Authority released its retail sales data on Monday. Greek retail sales jumped 22.4% in December.

On a yearly basis, Greek retail sales rose by 0.4% in December, after a 4.4% drop in November. November's figure was revised up from a 4.5% decline.

Sales of food products decreased by 6.2% year-on-year in December, sales of non-food products increased by 0.6%, while sales of automotive fuel dropped by 4.3%.

-

12:05

Greek producer prices decrease 3.2% in January

The Hellenic Statistical Authority released its producer price index (PPI) data on Monday. Greek producer prices decreased 3.2% in January.

Domestic market prices fell by 3.0% in January, while foreign market prices slid 4.1%.

On a yearly basis, Greek PPI plunged 7.3% in January, after a 7.8% drop in December.

Domestic market prices slid 6.3% year-on-year in January, while foreign market prices dropped 10.6%.

Energy prices plunged 16.5% year-on-year in January, while non-durable consumer goods industrial prices were up 0.7%.

-

12:01

Preliminary consumer prices in Italy decrease 0.2% in February

The Italian statistical office Istat released its preliminary consumer price inflation data for Italy on Monday. Preliminary consumer prices in Italy decreased 0.2% in February, after a 0.2% fall in January.

The monthly decline was driven by falls in almost all types of products.

Prices for non-regulated energy products dropped 2.2% in February, while prices of unprocessed food decreased 0.3%.

On a yearly basis, consumer prices fell 0.3% in February, after a 0.3% increase in January.

Prices for goods slid 0.3% year-on-year in February, while services prices were flat.

Consumer price inflation excluding unprocessed food and energy prices decreased to 0.5% year-on-year in February from 0.8% in January.

-

11:50

Spanish current account deficit widens to €4.49 billion in December

The Bank of Spain released its current account data on Monday. Spain's current account surplus widened to €4.49 billion in December from €2.11 billion in November.

The surplus on trade in goods and services totalled €0.5 billion in December, while the deficit on primary and second income totalled €4.0 billion.

-

11:42

German import prices decline 1.5% in January

Destatis released its import prices data for Germany on Monday. German import prices declined by 3.8% in January from last year, after a 3.1% fall in December.

The decline was driven by a drop in energy prices, which plunged 25.2% year-on-year in January.

Import prices decline since January 2013.

On a monthly base, import prices decreased 1.5% in January, after a 1.2% fall in December.

On a yearly base, import prices excluding crude oil and mineral oil products fell by 2.0% in January.

Export prices dropped 0.5% year-on-year in January, after a 0.2% rise in December.

On a monthly base, export prices were down 0.2% in January, after a 0.4% fall in December.

-

11:30

KOF leading indicator for Switzerland climbs to 102.4 in February

The Swiss Economic Institute KOF released its leading indicator for Switzerland on Monday. The KOF leading indicator climbed to 102.4 in February from 100.4 in January, beating expectations for a fall to 98.8. January's figure was revised up from 100.3.

The increase was mainly driven by the manufacturing industry.

"In the following months, the Swiss economic development might gather momentum," the KOF said.

-

11:27

German adjusted retail sales rise 0.7% in January

Destatis released its retail sales for Germany on Monday. German adjusted retail sales rose 0.7% in January, exceeding forecasts of a 0.2% gain, after a 0.6% increase in December. December's figure was revised up from a 0.2% decrease.

On a yearly basis, German unadjusted retail sales fell 0.8% in January, missing expectations for a 1.5% gain, after a 2.5% rise in December. December's figure was revised up from a 0.6% increase.

Sales of non-food products decreased at an annual rate of 0.3% in January, while sales of food, beverages and tobacco products slid by 1.4%.

-

11:20

Number of mortgages approvals in the U.K. rises to 74,581 in January

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Monday. The number of mortgages approvals in the U.K. was up to 74,581 in January from 71,335 in December, exceeding expectations for an increase to 73,600. December's figure was revised up from 70,837.

Consumer credit in the U.K. rose by £1.564 billion in January, beating expectations for an £1.300 billion increase, after a £1.148 billion gain in December. December's figure was revised down from £1.169 billion.

Net lending to individuals in the U.K. increased by £5.3 billion in January, after a £4.3 billion gain in December. December's figure was revised down from a £4.4 rise.

-

11:12

Preliminary consumer price inflation in the Eurozone slides to -0.4% year-on-year in February

Eurostat released its consumer price inflation data for the Eurozone on Monday. The preliminary consumer price inflation in the Eurozone declined to -0.2% year-on-year in February from 0.3% in January, missing expectations for a flat reading.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco fell to an annual rate of 0.7% in February from 1.0% in January. Analysts had expected the index to decrease to 0.9%.

Food, alcohol and tobacco prices were up 0.7% in February, non-energy industrial goods prices gained 0.3%, and services prices climbed 1.0%, while energy prices dropped 8.0%.

-

11:03

Retail sales in Japan decline at an annual rate of 0.1% in January

According to Japan's Ministry of Economy, Trade and Industry (METI), retail sales in Japan declined at an annual rate of 0.1% in January, after a 1.1% drop in December.

Sales at large-scale retailers increased 1.0% year-on-year in January, after a flat reading in December.

On a monthly basis, retail sales were down 1.1% in January, after a 0.3% decrease in December.

-

10:49

Preliminary industrial production in Japan climb 3.7% in January

Japan's Ministry of Economy, Trade and Industry released its preliminary industrial production data on late Sunday evening. Preliminary industrial production in Japan climbed 3.7% in January, exceeding expectations for a 3.3% gain, after a 1.7% fall in December.

The rise was mainly driven by increases in general-purpose, production and business oriented machinery, transport equipment and electronic parts and devices.

According to a survey by the ministry, industrial production is expected to drop 5.2% in February, and to rise 3.1% in March.

On a yearly basis, Japan's industrial production was down 3.8% in January, after a 1.9% decrease in December.

-

10:44

European Central Bank Executive Board Member Peter Praet: the global economic growth was losing the momentum

European Central Bank (ECB) Executive Board Member Peter Praet said in New York on Friday that the global economic growth was losing the momentum. That should not be ignored, he added.

-

10:24

Fed Governor Lael Brainard: developments abroad could have an impact on the Fed’s interest rate decision

Fed Governor Lael Brainard said on Friday that developments abroad could have an impact on the Fed's interest rate decision.

"The combination of heightened spillovers from weaker foreign economies, along with a lower neutral rate, could result in a lower policy path in the United States relative to what many had predicted," she said.

Brainard noted that policymakers of major economies should coordinate their monetary policies.

"A joint determination by policymakers across major economies to better deploy policy tools to provide support for global demand could be beneficial," Fed governor said.

-

10:12

G20 finance ministers and central bank governors will use the monetary policy tools to boost the global economic growth

The G20 finance ministers and central bank governors said at the G20 summit in Shanghai on Saturday that they will use the monetary policy tools to boost the global economic growth.

"We will use all policy tools -- monetary, fiscal and structural -- individually and collectively," they said.

The G20 finance ministers and central bank governors also said that downside risks to the global economy increased.

"Downside risks and vulnerabilities have risen, against the backdrop of volatile capital flows, a large drop of commodity prices, escalated geopolitical tensions, the shock of a potential U.K. exit from the European Union, and a large and increasing number of refugees in some regions," they noted.

-

07:08

Global Stocks: U.S. stock indices mostly declined

U.S. stock indices weakened on Friday, although the recent rally in oil prices allowed them to post the second straight week of gains.

The Dow Jones Industrial Average declined 57.32 points, or 0.3%, to 16639.97 (+1.5% over the week). The S&P 500 lost 3.65 points, or 0.2%, to 1948.05. The Nasdaq Composite climbed 8.27 points, or 0.2%, to 4,590.47.

On Friday the U.S. Commerce Department reported that the country's gross domestic product rose by 1% q/q in the fourth quarter. This reading was better than +0.7% estimated previously and +0.4% expected. Nevertheless concerns over slow global economic growth outweighed this report; investors remained cautious.

This morning in Asia Hong Kong Hang Seng fell 1.23%, or 237.89 points, to 19,126.26. China Shanghai Composite Index plunged 3.90%, or 107.95 points, to 2,659.26. Meanwhile the Nikkei lost 0.23%, or 36.53 points, to 16,151.88.

Asian stock indices fell with Chinese stocks leading declines. Some analysts say that the recovery in China's property market may be responsible for some of these losses, because investors favor to benefit from higher interest in home buying.

Japanese stocks rose at the beginning of the session, but were not able to sustain gains.

-

03:35

Nikkei 225 16,276.29 +87.88 +0.54%, Hang Seng 19,189.69 -174.46 -0.90%, Shanghai Composite 2,667.3 -99.91 -3.61%

-

00:33

Stocks. Daily history for Sep Feb 26’2016:

(index / closing price / change items /% change)

Nikkei 225 16,188.41 +48.07 +0.30%

Hang Seng 19,364.15 +475.40 +2.52%

Shanghai Composite 2,767.21 +25.96 +0.95%

FTSE 100 6,096.01 +83.20 +1.38%

CAC 40 4,314.57 +66.12 +1.56%

Xetra DAX 9,513.3 +181.82 +1.95%

S&P 500 1,948.05 -3.65 -0.19%

NASDAQ Composite 4,590.47 +8.27 +0.18%

Dow Jones 16,639.97 -57.32 -0.34%

-