Noticias del mercado

-

23:30

Australia: AIG Manufacturing Index, February 53.5

-

21:00

DJIA 16573.82 -66.15 -0.40%, NASDAQ 4578.11 -12.36 -0.27%, S&P 500 1940.46 -7.59 -0.39%

-

18:00

European stocks close: stocks closed mixed on higher oil prices

Stock indices closed mixed as oil prices rose. Oil prices increased on news about the supply disruption in Nigeria due to a leak.

Meanwhile, market participants eyed the economic data from the Eurozone. Eurostat released its consumer price inflation data for the Eurozone on Monday. The preliminary consumer price inflation in the Eurozone declined to -0.2% year-on-year in February from 0.3% in January, missing expectations for a flat reading.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco fell to an annual rate of 0.7% in February from 1.0% in January. Analysts had expected the index to decrease to 0.9%.

Food, alcohol and tobacco prices were up 0.7% in February, non-energy industrial goods prices gained 0.3%, and services prices climbed 1.0%, while energy prices dropped 8.0%.

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Monday. The number of mortgages approvals in the U.K. was up to 74,581 in January from 71,335 in December, exceeding expectations for an increase to 73,600. December's figure was revised up from 70,837.

Net lending to individuals in the U.K. increased by £5.3 billion in January, after a £4.3 billion gain in December. December's figure was revised down from a £4.4 rise.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,097.09 +1.08 +0.02 %

DAX 9,495.4 -17.90 -0.19 %

CAC 40 4,353.55 +38.98 +0.90 %

-

18:00

European stocks closed: FTSE 6097.09 1.08 0.02%, DAX 9495.19 -18.11 -0.19%, CAC 40 4353.41 38.84 0.90%

-

17:56

WSE: Session Results

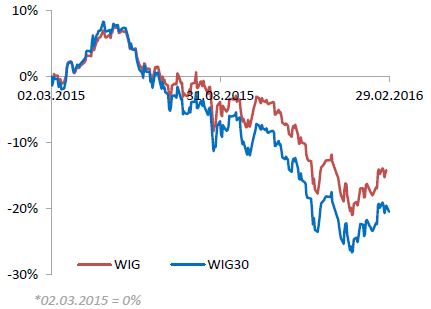

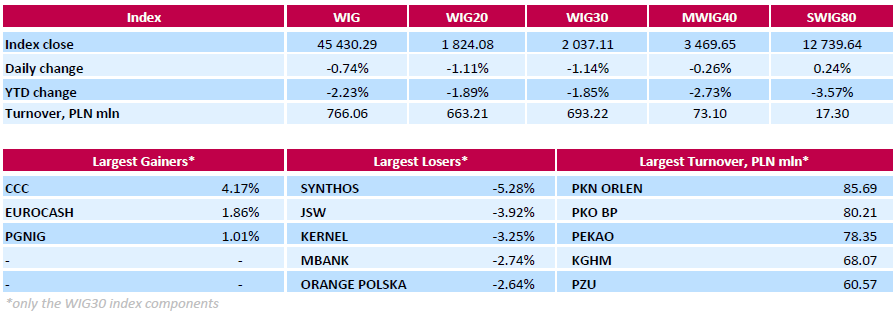

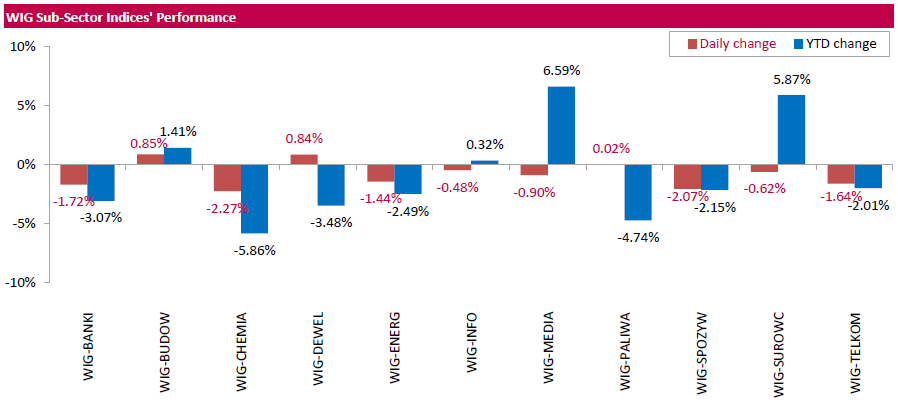

Polish equity market plunged on Monday. The broad market measure, the WIG Index, declined by 0.74%. From a sector perspective, chemicals (-2.27%) fared the worst, while construction sector (+0.85%) was the best-performing group.

The large-cap companies' measure, the WIG30 Index, lost 1.14%. Only three index constituents managed to generate positive returns: footwear retailer CCC (WSE: CCC) gained 4.17%, FMCG-wholesaler EUROCASH (WSE: EUR) advanced 1.86%, oil and gas producer PGNIG (WSE: PGN) added 1.01%. At the same time, the session's biggest loser was chemical company SYNTHOS (WSE: SNS), which tumbled by 5.28%. It was followed by coking coal producer JSW (WSE: JSW), which slumped by 3.92% after the company announced write-downs of PLN 2.8 bln in Q4 FY 2015 due to the loss of value of some of its coal assets.

-

17:45

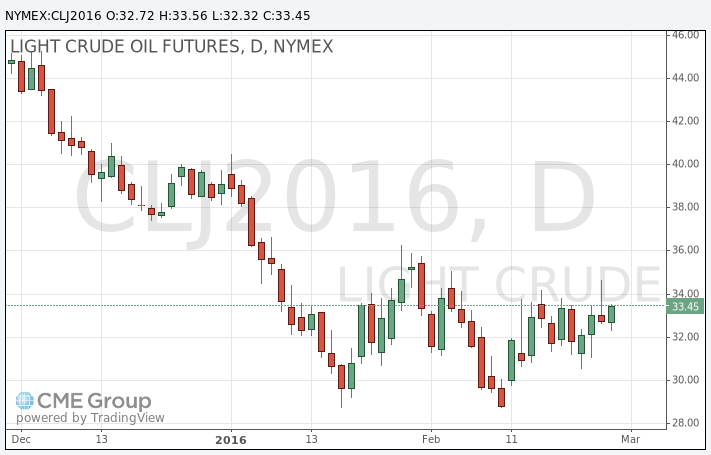

Oil prices increase

Oil prices rose on news about the supply disruption in Nigeria due to a leak. The Baker Hughes data also supported oil prices. The oil driller Baker Hughes reported on Friday that the number of active U.S. rigs declined by 13 rigs to 400 last week. It was the lowest level since December 2009.

According to a Reuters survey, the Organization of the Petroleum Exporting Countries' (OPEC) oil production fell in February due to the supply disruption from Iraq. OPEC's oil output decreased to 32.37 million barrels per day (bpd) in February from 32.65 million in January.

WTI crude oil for April delivery increased to $33.56 a barrel on the New York Mercantile Exchange.

Brent crude oil for April rose to $35.92 a barrel on ICE Futures Europe.

-

17:38

China plans to cut 1.8 million jobs in the coal and steel sectors

China's minister for human resources and social security, Yin Weimin, said on Monday that 1.3 million workers in the coal sector and 500,000 workers in the steel sector could lose jobs as there is a overcapacity in both sectors.

-

17:35

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes slightly rose on Monday as cautious investors assessed China's move to boost its slowing economy and an increase in oil prices raised hopes that the market had bottomed out. China's central bank on Monday cut its reserve requirement ratio, or the amount of cash that banks must hold as reserves, for the fifth time in a year. Crude prices rose more than 1% after Saudi Arabia said it would work with other producers to limit oil market volatility.

Most of Dow stocks in positive area (19 of 30). Top looser - JPMorgan Chase & Co. (JPM, -0,82%). Top gainer - E. I. du Pont de Nemours and Company (DD, +0,98%).

Most of S&P sectors also in positive area. Top looser - Healthcare (-0,7%). Top gainer - Conglomerates (+4,4%).

At the moment:

Dow 16642.00 +41.00 +0.25%

S&P 500 1949.00 +6.25 +0.32%

Nasdaq 100 4246.50 +16.50 +0.39%

Oil 33.47 +0.69 +2.10%

Gold 1233.30 +12.90 +1.06%

U.S. 10yr 1.76 +0.06

-

17:29

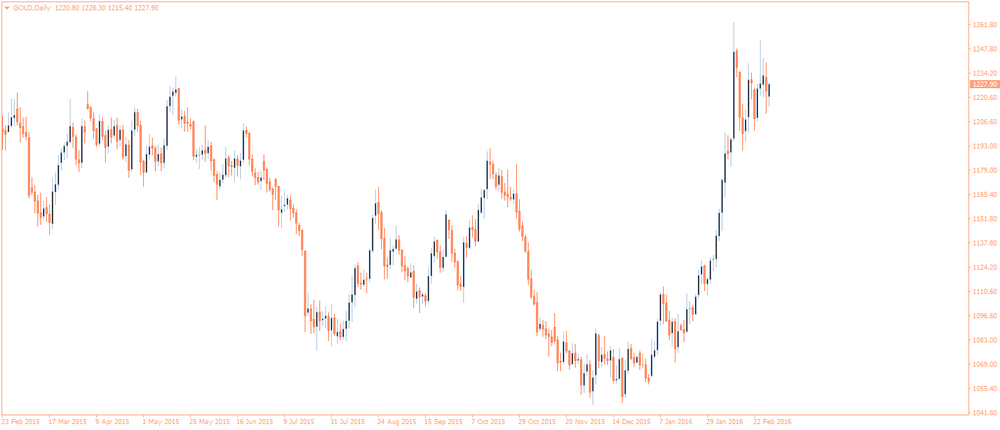

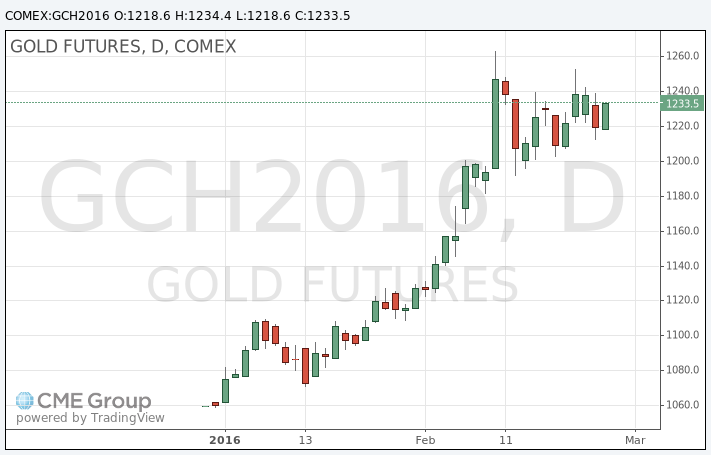

Gold price rise

Gold price rose on the weak U.S. economic data. The Institute for Supply Management released its Chicago purchasing managers' index on Monday. The Chicago purchasing managers' index dropped to 47.6 in February from 55.6 in January, missing expectations for a decrease to 53.0. The decline was mainly driven by drop in production and in new orders.

The National Association of Realtors (NAR) released its pending home sales figures for the U.S. on Monday. Pending home sales in the U.S. slid 2.5% in January, missing expectations for a 0.5% gain, after a 0.9% increase in December. The fall was mainly lead by declines in almost all regions. Only pending home sales in the South rose in January.

March futures for gold on the COMEX today increased to 1234.40 dollars per ounce.

-

17:12

Reuters survey: OPEC’s oil production declines in February

According to a Reuters survey, the Organization of the Petroleum Exporting Countries' (OPEC) oil production fell in February due to the supply disruption from Iraq. OPEC's oil output decreased to 32.37 million barrels per day (bpd) in February from 32.65 million in January.

Saudi Arabia produced 10.20 million bpd in February.

Iran increased its oil production by 200,000 bpd since December 2015.

-

17:05

People's Bank of China cuts the deposit reserve requirement ratio

The People's Bank of China (PBoC) announced on Monday that it lowered the deposit reserve requirement ratio by 50 basis points to 17%. The cut should help to provide enough liquidity in the financial system.

The ratio cut will be effective from Tuesday.

-

16:53

European Central Bank purchases €12.15 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €12.15 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €1.83 billion of covered bonds, and €13 million of asset-backed securities.

The ECB President Mario Draghi hinted at a press conference in January that the central bank may add further stimulus measures at its meeting in March as downside risks rose.

February's consumer price inflation data from the Eurozone (-0.2% year-on-year) added to speculation that the ECB could add further stimulus measures.

-

16:39

U.S. pending home sales drop 2.5% in January

The National Association of Realtors (NAR) released its pending home sales figures for the U.S. on Monday. Pending home sales in the U.S. slid 2.5% in January, missing expectations for a 0.5% gain, after a 0.9% increase in December. December's figure was revised up from a 0.1% rise.

The fall was mainly lead by declines in almost all regions. Only pending home sales in the South rose in January.

"While January's blizzard possibly caused some of the pullback in the Northeast, the recent acceleration in home prices and minimal inventory throughout the country appears to be the primary obstacle holding back would-be buyers," the NAR's chief economist Lawrence Yun said.

"Additionally, some buyers could be waiting for a hike in listings come springtime," he added.

-

16:33

Chicago purchasing managers' index drops to 47.6 in February

The Institute for Supply Management released its Chicago purchasing managers' index on Monday. The Chicago purchasing managers' index dropped to 47.6 in February from 55.6 in January, missing expectations for a decrease to 53.0.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The decline was mainly driven by drop in production and in new orders. The production index plunged to 44.0 in February from 62.5 in January, while the new orders declined sharply.

The employment index fell to the lowest level since November 2009.

"If one looks beyond the gyrations seen over the past three months then trend activity has been running a little below the 50 neutral mark, highlighting continued sluggish activity levels, with manufacturers under particular pressure. It looks like activity should pick up during Q1," Chief Economist of MNI Indicators Philip Uglow said.

-

16:00

U.S.: Pending Home Sales (MoM) , January -2.5% (forecast 0.5%)

-

15:45

U.S.: Chicago Purchasing Managers' Index , February 47.6 (forecast 53)

-

15:43

The ANZ business confidence index for New Zealand slides to7.1% in January

ANZ Bank released its latest business sentiment survey for New Zealand on Monday. The ANZ business confidence index for New Zealand slid to7.1% in January from 23.0% in December. The index means that 7.1% of respondents expected the country's economy to improve over the coming year.

"The New Zealand economy is not immune from global pressures. We are a small, commodity dependent, debtor nation," the ANZ Chief Economist Cameron Bagrie said.

-

15:35

U.S. Stocks open: Dow-0.10%, Nasdaq -0.09%, S&P -0.12%

-

15:34

Company gross profits in Australia drop 2.8% in the fourth quarter

The Australian Bureau of Statistics released its company gross profits data on Monday. Company gross profits in Australia dropped seasonally adjusted 2.8% in the fourth quarter, missing expectations for a 1.8% fall, after a 1.4% increase in the third quarter. The third quarter's figure was revised up from a 1.3% gain.

Sales of goods and services in the manufacturing sector dropped seasonally adjusted 2.0% in the fourth quarter, sales of goods and services in wholesale trade climbed 1.6%.

Inventories fell seasonally adjusted 0.4% in the fourth quarter, while wages and salaries increased 0.5%.

-

15:29

Before the bell: S&P futures +0.12%, NASDAQ futures +0.01%

U.S. stock-index futures fluctuated.

Global Stocks:

Nikkei 16,026.76 -161.65 -1.00%

Hang Seng 19,111.93 -252.22 -1.30%

Shanghai Composite 2,687.83 -79.38 -2.87%

FTSE 6,092.86 -3.15 -0.05%

CAC 4,325.79 +11.22 +0.26%

DAX 9,446.35 -66.95 -0.70%

Crude oil $33.24 (+1.40%)

Gold $1229.40 (+0.74%)

-

15:24

Private sector credit in Australia rises 0.5% in January

The Reserve Bank of Australia (RBA) released its private sector credit data on Friday. The total value of private sector credit in Australia rose 0.5% in January, in line with expectations, after a 0.5% increase in December. December's figure was revised down from a 0.6% gain.

Housing credit increased 0.5% in January, personal credit declined 0.2%, while business credit rose 0.6%.

On a yearly basis, the private sector credit in Australia jumped 6.5% in January, after a 6.6% rise in December.

-

15:19

Housing starts in Japan rise 0.2% year-on-year in January

Japan's Ministry of Land, Infrastructure, Transport and Tourism released its housing starts data on Monday. Housing starts in Japan rose 0.2% year-on-year in January, beating expectations for a flat reading, after a 1.3% drop in December.

On a yearly basis, housing starts were up to 873,000 in January from 860,000 in December.

Construction orders slid 13.8% year-on-year in January, after a 14.8% rise in December.

-

15:14

Building permits in New Zealand plunge 8.2% in January

Statistics New Zealand released its building permits data on late Sunday evening. Building permits in New Zealand plunged 8.2% in January, after a 2.3% gain in December.

Residential work rose 17% year-on-year in January, while non-residential work dropped 12%.

"While January is usually a quiet month for building consents, Canterbury had the lowest January number in five years," business indicators senior manager Neil Kelly said.

-

14:57

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

7.67

3.23%

10.3K

Tesla Motors, Inc., NASDAQ

TSLA

192.51

1.14%

1.8K

American Express Co

AXP

56.00

1.12%

57.2K

Barrick Gold Corporation, NYSE

ABX

13.68

1.11%

25.6K

ALCOA INC.

AA

8.94

0.79%

6.9K

Walt Disney Co

DIS

95.73

0.44%

31.9K

Yahoo! Inc., NASDAQ

YHOO

31.45

0.26%

1.3K

AT&T Inc

T

37.22

0.24%

1.1K

Exxon Mobil Corp

XOM

81.95

0.24%

2.7K

Amazon.com Inc., NASDAQ

AMZN

556.00

0.14%

4.0K

Wal-Mart Stores Inc

WMT

66.59

0.12%

0.4K

International Business Machines Co...

IBM

132.15

0.09%

4.6K

Chevron Corp

CVX

84.36

0.01%

2.0K

Nike

NKE

62.60

0.00%

44.1K

Microsoft Corp

MSFT

51.30

0.00%

1.3K

Ford Motor Co.

F

12.47

0.00%

8.2K

ALTRIA GROUP INC.

MO

61.54

0.00%

4.3K

Starbucks Corporation, NASDAQ

SBUX

58.33

-0.02%

0.1K

Caterpillar Inc

CAT

66.85

-0.03%

0.1K

Facebook, Inc.

FB

107.89

-0.03%

25.9K

Verizon Communications Inc

VZ

51.00

-0.04%

0.6K

The Coca-Cola Co

KO

43.12

-0.05%

31.5K

Procter & Gamble Co

PG

81.04

-0.07%

1.5K

Apple Inc.

AAPL

96.84

-0.07%

22.2K

3M Co

MMM

158.10

-0.11%

0.9K

HONEYWELL INTERNATIONAL INC.

HON

102.90

-0.13%

36.2K

Boeing Co

BA

118.00

-0.14%

0.4K

General Electric Co

GE

29.36

-0.14%

0.9K

Cisco Systems Inc

CSCO

26.37

-0.15%

1.7K

Johnson & Johnson

JNJ

105.62

-0.15%

0.2K

Intel Corp

INTC

29.75

-0.17%

14.5K

Merck & Co Inc

MRK

50.54

-0.20%

6.1K

FedEx Corporation, NYSE

FDX

137.00

-0.28%

0.1K

Goldman Sachs

GS

149.15

-0.30%

0.3K

United Technologies Corp

UTX

97.40

-0.30%

0.8K

Google Inc.

GOOG

702.75

-0.33%

15.3K

Twitter, Inc., NYSE

TWTR

17.86

-0.45%

1.3K

Pfizer Inc

PFE

30.09

-0.46%

0.3K

JPMorgan Chase and Co

JPM

57.25

-0.50%

30.3K

Citigroup Inc., NYSE

C

39.30

-0.51%

34.3K

Hewlett-Packard Co.

HPQ

10.58

-0.56%

5.1K

General Motors Company, NYSE

GM

29.40

-0.78%

4.4K

McDonald's Corp

MCD

116.00

-0.91%

0.3K

-

14:51

Canadian current account deficit widens to C$15.38 billion in the fourth quarter

Statistics Canada released current account data on Monday. Canadian current account deficit widened to C$15.38 billion in the fourth quarter from a deficit of C$15.3 billion in the third quarter. The third quarter figure was revised up from a deficit of C$16.2 billion.

Analysts had expected the deficit to rise to C$15.6 billion.

The trade in goods deficit fell by C$0.3 billion to C$4.8 billion in the fourth quarter, while the deficit on international trade in services declined by $0.1 billion to C$5.8 billion.

In 2015 as whole, the current deficit climbed to C$65.7 billion from C$44.9 billion.

-

14:50

Option expiries for today's 10:00 ET NY cut

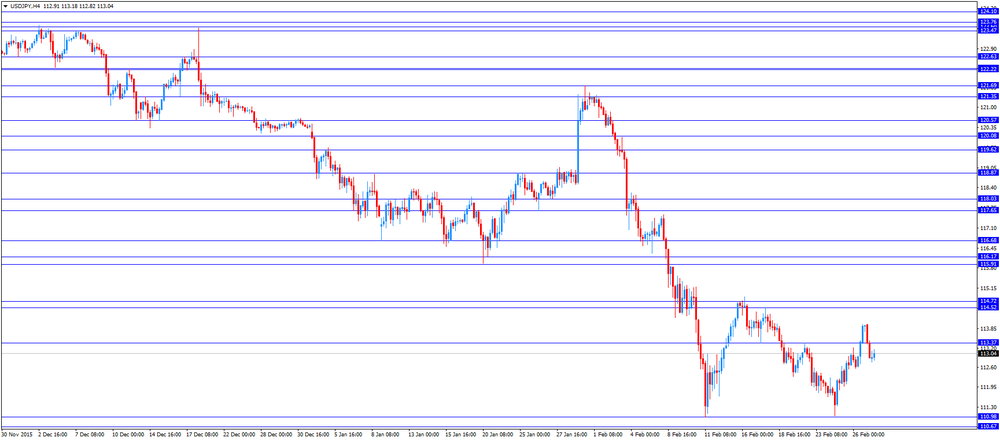

USD/JPY: 110.55 ( USD 227m) 112.00-05 (438m) 113.00 (295m) 113.50 (205m) 114.50 (320m) 115.00 (587m)

EU/RUSD: 1.0800(EUR 1.1bln) 1.0900 (1.17bln) 1.0925-35 (1.25bln) 1.1000 (1.14bln) 1.1015-25 (823m) 1.1050-55 (305m) 1.1125-35 (763m) 1.1150 (546m)

GBP/USD: 1.3900 (GBP 293m)

EUR/GBP 0.7635 (EUR 135m) 0.7710 (200m)

USD/CHF 1.0000 (USD 230m)

AUD/USD: 0.6900 (AUD 501m) 0.6975 (602m) 0.7000 (402m) ) 0.7100 (690m) 0.7150-55 392m) 0.7200 (532m)

USD/CAD 1.3600 (USD 301m) 1.3700 (190m) 1.3720 (315m) 1.3755 (290m) 1.3825(202m)

NZD/USD 0.6595-0.6600 (NZD 279m)

USD/CNY 6.600 (2.24bln)

-

14:44

Canadian industrial product prices rise 0.5% in January

Statistics Canada released its industrial product and raw materials price indexes on Monday. The Industrial Product Price Index (IPPI) climbed 0.5% in January, after a 0.3% decline in December. December's figure was revised down from 0.2% decrease.

The increase was mainly driven by higher prices for motorized and recreational vehicles, which rose 2.7% in January.

18 of the 21 commodity groups increased and 3 declined.

The Raw Materials Price Index (RMPI) dropped 0.4% in January, after a 5.2% fall in December. December's figure was revised down from a 5.0% decline.

The drop was driven by lower prices for crude energy products. Crude energy products plunged by 4.2% in January.

4 of the 6 commodity groups rose and 2 decreased.

-

14:43

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

General Motors (GM) downgraded to Hold from Buy at Argus

Other:

Yahoo! (YHOO) target raised to $32 from $29 at Mizuho

Freeport-McMoRan (FCX) initiated with a Hold at Berenberg

Hewlett Packard Enterprise (HPE) reiterated with a Neutral at Mizuho, target $13

-

14:30

Canada: Current Account, bln, Quarter IV -15.38 (forecast -15.6)

-

14:30

Canada: Industrial Product Price Index, m/m, January 0.5%

-

14:30

Canada: Industrial Product Price Index, y/y, January 1.7%

-

14:20

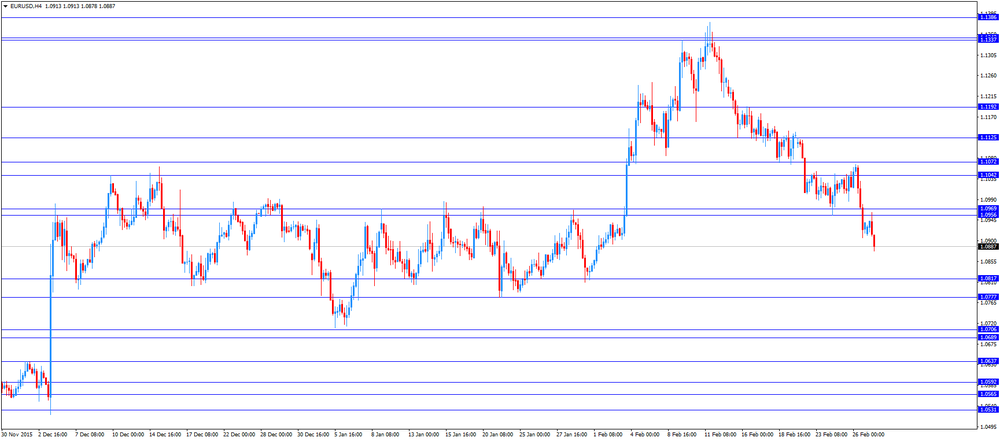

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the weak consumer price inflation data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia MI Inflation Gauge, m/m February 0.4% -0.2%

00:00 New Zealand ANZ Business Confidence January 23 7.1

00:30 Australia Company Gross Profits QoQ Quarter IV 1.4% Revised From 1.3% -1.8% -2.8%

00:30 Australia Private Sector Credit, m/m January 0.5% Revised From 0.6% 0.5% 0.5%

00:30 Australia Private Sector Credit, y/y January 6.6% 6.5%

05:00 Japan Housing Starts, y/y January -1.3% 0.0% 0.2%

05:00 Japan Construction Orders, y/y January 14.8% -13.8%

07:00 Germany Retail sales, real adjusted January 0.6% Revised From -0.2% 0.2% 0.7%

07:00 Germany Retail sales, real unadjusted, y/y January 2.5% Revised From 0.6% 1.5% -0.8%

08:00 Switzerland KOF Leading Indicator February 100.4 Revised From 100.3 98.8 102.4

09:30 United Kingdom Consumer credit, mln January 1169 1300 1564

09:30 United Kingdom Mortgage Approvals January 71.33 Revised From 70.84 73.6 74.581

09:30 United Kingdom Net Lending to Individuals, bln January 4.4 5.3

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) February 0.3% 0.0% -0.2%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) February 1% 0.9% 0.7%

The U.S. dollar traded higher against the most major currencies ahead of the release of the U.S. economic data. The Chicago purchasing managers' index is expected to decrease to 53.0 in February from 55.6 in January.

Pending home sales in the U.S. expected to rise 0.5% in January, after a 0.1% gain in December.

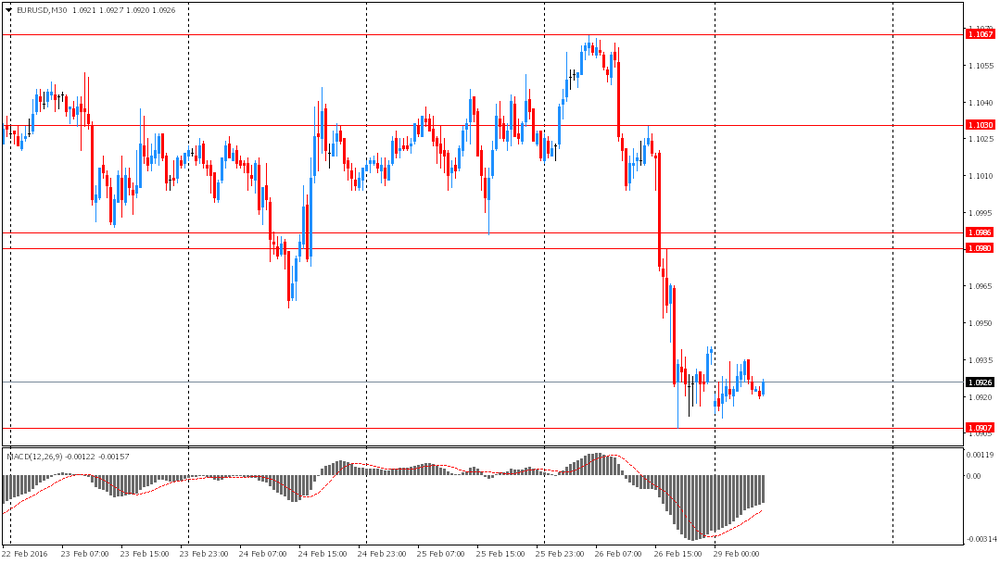

The euro traded lower against the U.S. dollar after the release of the weak consumer price inflation data from the Eurozone. Eurostat released its consumer price inflation data for the Eurozone on Monday. The preliminary consumer price inflation in the Eurozone declined to -0.2% year-on-year in February from 0.3% in January, missing expectations for a flat reading.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco fell to an annual rate of 0.7% in February from 1.0% in January. Analysts had expected the index to decrease to 0.9%.

Food, alcohol and tobacco prices were up 0.7% in February, non-energy industrial goods prices gained 0.3%, and services prices climbed 1.0%, while energy prices dropped 8.0%.

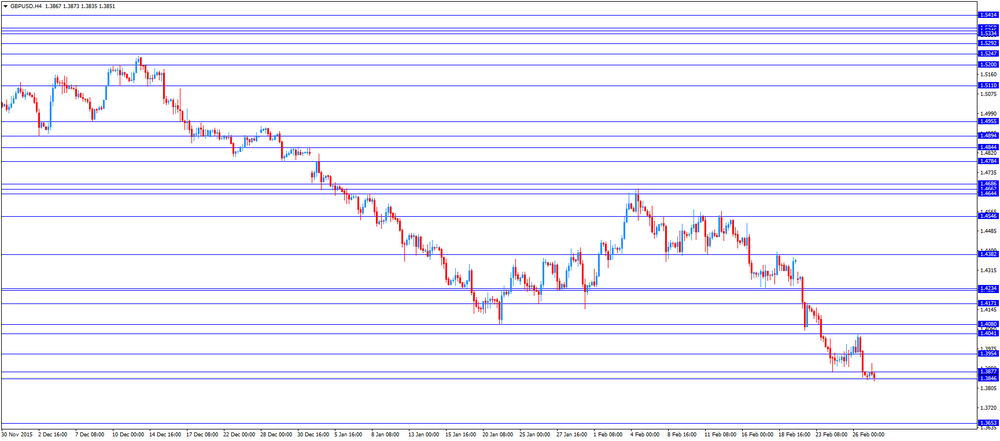

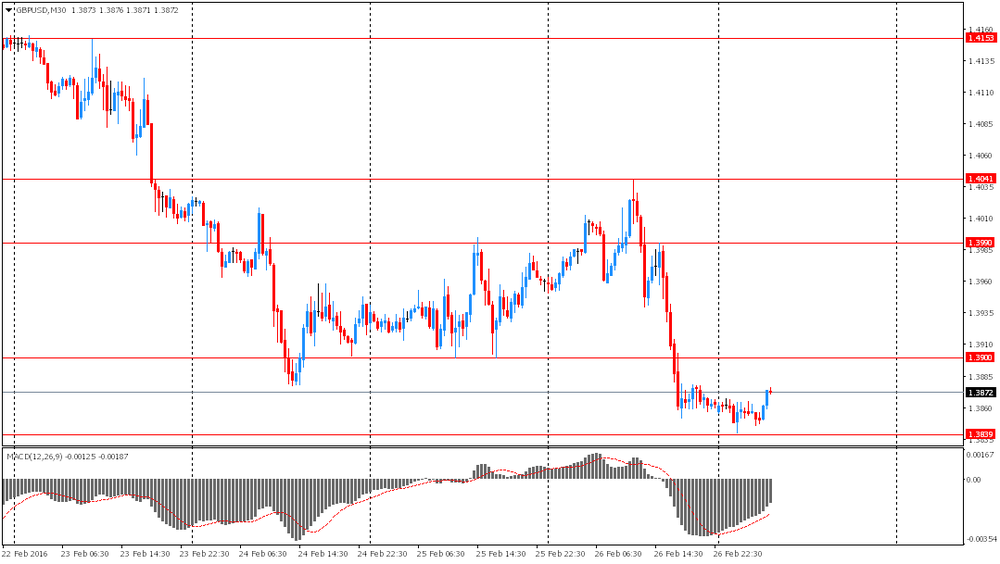

The British pound traded lower against the U.S. dollar after the release of the U.K. lending data. The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Monday. The number of mortgages approvals in the U.K. was up to 74,581 in January from 71,335 in December, exceeding expectations for an increase to 73,600. December's figure was revised up from 70,837.

Net lending to individuals in the U.K. increased by £5.3 billion in January, after a £4.3 billion gain in December. December's figure was revised down from a £4.4 rise.

The Canadian dollar traded lower against the U.S. dollar ahead of the release of the Canadian economic data. The Canadian current account deficit is expected to narrow to C$15.6 billion in the fourth quarter from a deficit of C$16.2 billion in the third quarter.

The Swiss franc traded lower against the U.S. dollar. The Swiss Economic Institute KOF released its leading indicator for Switzerland on Monday. The KOF leading indicator climbed to 102.4 in February from 100.4 in January, beating expectations for a fall to 98.8. The increase was mainly driven by the manufacturing industry.

EUR/USD: the currency pair decreased to $1.0878

GBP/USD: the currency pair fell to $1.3835

USD/JPY: the currency pair rose to Y113.18

The most important news that are expected (GMT0):

13:30 Canada Current Account, bln Quarter IV -16.2 -15.6

13:30 Canada Industrial Product Price Index, m/m January -0.2%

14:45 U.S. Chicago Purchasing Managers' Index February 55.6 53

15:00 U.S. Pending Home Sales (MoM) January 0.1% 0.5%

23:30 Japan Unemployment Rate January 3.3% 3.3%

23:30 Japan Household spending Y/Y January -4.4% -2.7%

-

14:00

Orders

EUR/USD

Offers 1.0975-80 1.1000 1.1025-30.1050 1.1080 1.1100 1.1120 1.1135 1.1150

Bids 1.0910 1.0900 1.0880 1.0860 1.0830 1.0800 1.0785 1.0750 1.0730 1.0700

GBP/USD

Offers 1.3900 1.3920 1.3950 1.3970 1.3985 1.40001.4020-25 1.4050

Bids 1.3860 1.3835 1.3820 1.3800 1.3785 1.3750

EUR/JPY

Offers 123.80 124.00 124.50 124.80 125.00 125.50 126.00

Bids 123.00 122.75-80 122.50 122.30 122.00 121.50

EUR/GBP

Offers 0.7900 0.7925-30 0.7950 0.7970 0.7985 0.8000

Bids 0.7865-70 0.7850 0.7830-35 0.7800 0.7785 0.7750

USD/JPY

Offers 113.00-05 113.20-25 113.40 113.65 113.85 114.00

Bids 112.70-75 112.50 112.30 112.00 111.80 111.65-70 111.50 111.30 111.00

AUD/USD

Offers 0.7160 0.7185 0.7200 0.7235 0.7250-55

Bids 0.7120 0.7100 0.7080 0.7065 0.7050 0.7000

-

12:25

European stock markets mid session: stocks traded lower on disappointing results of the G20 summit

Stock indices traded lower on disappointing results of the G20 summit. The G20 finance ministers and central bank governors said at the G20 summit in Shanghai on Saturday that they will use the monetary policy tools to boost the global economic growth. They also said that downside risks to the global economy increased.

Meanwhile, market participants eyed the economic data from the Eurozone. Eurostat released its consumer price inflation data for the Eurozone on Monday. The preliminary consumer price inflation in the Eurozone declined to -0.2% year-on-year in February from 0.3% in January, missing expectations for a flat reading.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco fell to an annual rate of 0.7% in February from 1.0% in January. Analysts had expected the index to decrease to 0.9%.

Food, alcohol and tobacco prices were up 0.7% in February, non-energy industrial goods prices gained 0.3%, and services prices climbed 1.0%, while energy prices dropped 8.0%.

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Monday. The number of mortgages approvals in the U.K. was up to 74,581 in January from 71,335 in December, exceeding expectations for an increase to 73,600. December's figure was revised up from 70,837.

Net lending to individuals in the U.K. increased by £5.3 billion in January, after a £4.3 billion gain in December. December's figure was revised down from a £4.4 rise.

Current figures:

Name Price Change Change %

FTSE 100 6,055.47 -40.54 -0.67 %

DAX 9,352.49 -160.81 -1.69 %

CAC 40 4,281.78 -32.79 -0.76 %

-

12:22

Greek revised GDP rises 0.1% in the fourth quarter

The Hellenic Statistical Authority released its revised gross domestic product (GDP) data for Greece on Monday. The Greek GDP increased 0.1% in the fourth quarter, up from the preliminary reading of a 0.6% fall, after a 1.2% drop in the third quarter.

On a yearly basis, the Greek revised GDP fall at a seasonally-and-calendar adjusted 0.8% rate in the fourth quarter, down from the preliminary reading of a 1.9% drop, after a 1.7% decline in the third quarter.

On a yearly unadjusted basis, Greek final GDP slid 0.7% rate in the fourth quarter, down from the preliminary reading of a 2.0% decrease, after a 1.7% decrease in the third quarter.

Total consumption expenditure dropped 0.1% year-on-year in the fourth quarter.

Exports slid 8.8% year-on-year in the fourth quarter, while imports declined 12.5%.

-

12:10

Greek retail sales jump 22.4% in December

The Greek statistical office Hellenic Statistical Authority released its retail sales data on Monday. Greek retail sales jumped 22.4% in December.

On a yearly basis, Greek retail sales rose by 0.4% in December, after a 4.4% drop in November. November's figure was revised up from a 4.5% decline.

Sales of food products decreased by 6.2% year-on-year in December, sales of non-food products increased by 0.6%, while sales of automotive fuel dropped by 4.3%.

-

12:05

Greek producer prices decrease 3.2% in January

The Hellenic Statistical Authority released its producer price index (PPI) data on Monday. Greek producer prices decreased 3.2% in January.

Domestic market prices fell by 3.0% in January, while foreign market prices slid 4.1%.

On a yearly basis, Greek PPI plunged 7.3% in January, after a 7.8% drop in December.

Domestic market prices slid 6.3% year-on-year in January, while foreign market prices dropped 10.6%.

Energy prices plunged 16.5% year-on-year in January, while non-durable consumer goods industrial prices were up 0.7%.

-

12:01

Preliminary consumer prices in Italy decrease 0.2% in February

The Italian statistical office Istat released its preliminary consumer price inflation data for Italy on Monday. Preliminary consumer prices in Italy decreased 0.2% in February, after a 0.2% fall in January.

The monthly decline was driven by falls in almost all types of products.

Prices for non-regulated energy products dropped 2.2% in February, while prices of unprocessed food decreased 0.3%.

On a yearly basis, consumer prices fell 0.3% in February, after a 0.3% increase in January.

Prices for goods slid 0.3% year-on-year in February, while services prices were flat.

Consumer price inflation excluding unprocessed food and energy prices decreased to 0.5% year-on-year in February from 0.8% in January.

-

11:53

The number of active U.S. rigs falls by 13 rigs to 400 last week

The oil driller Baker Hughes reported on Friday that the number of active U.S. rigs declined by 13 rigs to 400 last week. It was the lowest level since December 2009.

Combined oil and gas rigs decreased by 12 to 502.

-

11:50

Spanish current account deficit widens to €4.49 billion in December

The Bank of Spain released its current account data on Monday. Spain's current account surplus widened to €4.49 billion in December from €2.11 billion in November.

The surplus on trade in goods and services totalled €0.5 billion in December, while the deficit on primary and second income totalled €4.0 billion.

-

11:42

German import prices decline 1.5% in January

Destatis released its import prices data for Germany on Monday. German import prices declined by 3.8% in January from last year, after a 3.1% fall in December.

The decline was driven by a drop in energy prices, which plunged 25.2% year-on-year in January.

Import prices decline since January 2013.

On a monthly base, import prices decreased 1.5% in January, after a 1.2% fall in December.

On a yearly base, import prices excluding crude oil and mineral oil products fell by 2.0% in January.

Export prices dropped 0.5% year-on-year in January, after a 0.2% rise in December.

On a monthly base, export prices were down 0.2% in January, after a 0.4% fall in December.

-

11:30

KOF leading indicator for Switzerland climbs to 102.4 in February

The Swiss Economic Institute KOF released its leading indicator for Switzerland on Monday. The KOF leading indicator climbed to 102.4 in February from 100.4 in January, beating expectations for a fall to 98.8. January's figure was revised up from 100.3.

The increase was mainly driven by the manufacturing industry.

"In the following months, the Swiss economic development might gather momentum," the KOF said.

-

11:27

German adjusted retail sales rise 0.7% in January

Destatis released its retail sales for Germany on Monday. German adjusted retail sales rose 0.7% in January, exceeding forecasts of a 0.2% gain, after a 0.6% increase in December. December's figure was revised up from a 0.2% decrease.

On a yearly basis, German unadjusted retail sales fell 0.8% in January, missing expectations for a 1.5% gain, after a 2.5% rise in December. December's figure was revised up from a 0.6% increase.

Sales of non-food products decreased at an annual rate of 0.3% in January, while sales of food, beverages and tobacco products slid by 1.4%.

-

11:20

Number of mortgages approvals in the U.K. rises to 74,581 in January

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Monday. The number of mortgages approvals in the U.K. was up to 74,581 in January from 71,335 in December, exceeding expectations for an increase to 73,600. December's figure was revised up from 70,837.

Consumer credit in the U.K. rose by £1.564 billion in January, beating expectations for an £1.300 billion increase, after a £1.148 billion gain in December. December's figure was revised down from £1.169 billion.

Net lending to individuals in the U.K. increased by £5.3 billion in January, after a £4.3 billion gain in December. December's figure was revised down from a £4.4 rise.

-

11:12

Preliminary consumer price inflation in the Eurozone slides to -0.4% year-on-year in February

Eurostat released its consumer price inflation data for the Eurozone on Monday. The preliminary consumer price inflation in the Eurozone declined to -0.2% year-on-year in February from 0.3% in January, missing expectations for a flat reading.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco fell to an annual rate of 0.7% in February from 1.0% in January. Analysts had expected the index to decrease to 0.9%.

Food, alcohol and tobacco prices were up 0.7% in February, non-energy industrial goods prices gained 0.3%, and services prices climbed 1.0%, while energy prices dropped 8.0%.

-

11:03

Retail sales in Japan decline at an annual rate of 0.1% in January

According to Japan's Ministry of Economy, Trade and Industry (METI), retail sales in Japan declined at an annual rate of 0.1% in January, after a 1.1% drop in December.

Sales at large-scale retailers increased 1.0% year-on-year in January, after a flat reading in December.

On a monthly basis, retail sales were down 1.1% in January, after a 0.3% decrease in December.

-

11:01

Eurozone: Harmonized CPI ex EFAT, Y/Y, February 0.7% (forecast 0.9%)

-

11:00

Eurozone: Harmonized CPI, Y/Y, February -0.2% (forecast 0.0%)

-

10:49

Preliminary industrial production in Japan climb 3.7% in January

Japan's Ministry of Economy, Trade and Industry released its preliminary industrial production data on late Sunday evening. Preliminary industrial production in Japan climbed 3.7% in January, exceeding expectations for a 3.3% gain, after a 1.7% fall in December.

The rise was mainly driven by increases in general-purpose, production and business oriented machinery, transport equipment and electronic parts and devices.

According to a survey by the ministry, industrial production is expected to drop 5.2% in February, and to rise 3.1% in March.

On a yearly basis, Japan's industrial production was down 3.8% in January, after a 1.9% decrease in December.

-

10:44

European Central Bank Executive Board Member Peter Praet: the global economic growth was losing the momentum

European Central Bank (ECB) Executive Board Member Peter Praet said in New York on Friday that the global economic growth was losing the momentum. That should not be ignored, he added.

-

10:31

United Kingdom: Mortgage Approvals, January 74.581 (forecast 73.6)

-

10:31

United Kingdom: Net Lending to Individuals, bln, January 5.3

-

10:30

United Kingdom: Consumer credit, mln, January 1564 (forecast 1300)

-

10:24

Fed Governor Lael Brainard: developments abroad could have an impact on the Fed’s interest rate decision

Fed Governor Lael Brainard said on Friday that developments abroad could have an impact on the Fed's interest rate decision.

"The combination of heightened spillovers from weaker foreign economies, along with a lower neutral rate, could result in a lower policy path in the United States relative to what many had predicted," she said.

Brainard noted that policymakers of major economies should coordinate their monetary policies.

"A joint determination by policymakers across major economies to better deploy policy tools to provide support for global demand could be beneficial," Fed governor said.

-

10:12

G20 finance ministers and central bank governors will use the monetary policy tools to boost the global economic growth

The G20 finance ministers and central bank governors said at the G20 summit in Shanghai on Saturday that they will use the monetary policy tools to boost the global economic growth.

"We will use all policy tools -- monetary, fiscal and structural -- individually and collectively," they said.

The G20 finance ministers and central bank governors also said that downside risks to the global economy increased.

"Downside risks and vulnerabilities have risen, against the backdrop of volatile capital flows, a large drop of commodity prices, escalated geopolitical tensions, the shock of a potential U.K. exit from the European Union, and a large and increasing number of refugees in some regions," they noted.

-

09:18

Option expiries for today's 10:00 ET NY cut

USD/JPY: 110.55 ( USD 227m) 112.00-05 (438m) 113.00 (295m) 113.50 (205m) 114.50 (320m) 115.00 (587m)

EU/RUSD: 1.0800(EUR 1.1bln) 1.0900 (1.17bln) 1.0925-35 (1.25bln) 1.1000 (1.14bln) 1.1015-25 (823m) 1.1050-55 (305m) 1.1125-35 (763m) 1.1150 (546m)

GBP/USD: 1.3900 (GBP 293m)

EUR/GBP 0.7635 (EUR 135m) 0.7710 (200m)

USD/CHF 1.0000 (USD 230m)

AUD/USD: 0.6900 (AUD 501m) 0.6975 (602m) 0.7000 (402m) ) 0.7100 (690m) 0.7150-55 392m) 0.7200 (532m)

USD/CAD 1.3600 (USD 301m) 1.3700 (190m) 1.3720 (315m) 1.3755 (290m) 1.3825(202m)

NZD/USD 0.6595-0.6600 (NZD 279m)

USD/CNY 6.600 (2.24bln)

-

09:00

Switzerland: KOF Leading Indicator, February 100.4 (forecast 98.8)

-

08:16

Foreign exchange market. Asian session: the yen gained

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 Australia MI Inflation Gauge, m/m February 0.4% -0.2%

00:00 New Zealand ANZ Business Confidence January 23 7.1

00:30 Australia Company Gross Profits QoQ Quarter IV 1.4% Revised From 1.3% -1.8% -2.8%

00:30 Australia Private Sector Credit, m/m January 0.5% Revised From 0.6% 0.5% 0.5%

00:30 Australia Private Sector Credit, y/y January 6.6% 6.5%

05:00 Japan Housing Starts, y/y January -1.3% 0.0% 0.2%

05:00 Japan Construction Orders, y/y January 14.8% -13.8%

07:00 Germany Retail sales, real adjusted January -0.2% 0.2% 0.7%

07:00 Germany Retail sales, real unadjusted, y/y January 1.5% 1.5% 0.7%

The euro traded range-bound ahead of inflation data due later today. A median forecast suggests the consumer price index was unchanged in February compared to the same period last year after growth of 0.3% in January. The annualized core CPI is likely to have slowed down to 0.9% from 1%. If data meet expectations the ECB will be persuaded to announce new stimulus measures.

The yen rose amid declines in Asian stock markets. Strong domestic data supported the currency too. Japanese industrial production rose by 3.7% in January after a 1.7% drop in December. Analysts had expected a more modest growth of 3.3%. This is the first positive change in three months.

The New Zealand dollar fell amid ANZ business confidence data. The corresponding index fell to 7.1 in January from 23 reported previously. Analysts had expected the index to advance to 25.5. The latest reading is the weakest since October 2015. The report showed that companies' own activity expectations declined to 26 from 34, slipping below the historical average. Meanwhile profit expectations fell to 12 from 18. Employment intentions fell to 12 from 20. Investment intentions stood largely unchanged at 14.

EUR/USD: the pair rose to $1.1065 in Asian trade

USD/JPY: the pair traded around Y113.00

GBP/USD: the pair fluctuated within $1.3950-10

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:00 Switzerland KOF Leading Indicator February 100.3 98.8

09:30 United Kingdom Consumer credit, mln January 1169 1300

09:30 United Kingdom Mortgage Approvals January 70.84 73.6

09:30 United Kingdom Net Lending to Individuals, bln January 4.4

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) February 0.3% 0.0%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) February 1% 0.9%

13:30 Canada Current Account, bln Quarter IV -16.2 -15.6

13:30 Canada Industrial Product Price Index, m/m January -0.2%

13:30 Canada Industrial Product Price Index, y/y January 1.1%

14:45 U.S. Chicago Purchasing Managers' Index February 55.6 53

15:00 U.S. Pending Home Sales (MoM) January 0.1% 0.5%

22:30 Australia AIG Manufacturing Index February 51.5

23:30 Japan Unemployment Rate January 3.3% 3.3%

23:30 Japan Household spending Y/Y January -4.4% -2.7%

-

08:01

Germany: Retail sales, real adjusted , January 0.7% (forecast 0.2%)

-

08:00

Germany: Retail sales, real unadjusted, y/y, January 0.7% (forecast 1.5%)

-

07:47

Oil prices steady

West Texas Intermediate futures for April delivery edged down to $32.75 (-0.9%), while Brent crude rose to $35.65 (+0.59%). Last week crude oil prices rose more than 15%. Some analysts started to say that prices may be bottoming out after a dramatic drop from the August 2013 high of $112.24.

The number of open positions in WTI crude contracts that bet on a further decline is still high by historical standards; however it has fallen by about 17% since the middle of February.

Data on Chinese manufacturing due tomorrow will help clarify further direction of oil prices.

-

07:21

Gold climbed on weaker stocks

Gold climbed to $1,227.90 (+0.61%) after declining on Friday. A selloff in stocks supported gold this morning. Bullion is on track to finish February with a nearly 10% gain, which would make this month the best one since January 2012.

Physical demand in Asia remained weak. Prices declined in India as buyers postponed purchases awaiting a cut in the import tax.

Holdings of SPDR Gold Trust, the largest gold-backed exchange-traded-fund, rose by 0.27% to 762.41 tonnes on Friday.

-

07:08

Global Stocks: U.S. stock indices mostly declined

U.S. stock indices weakened on Friday, although the recent rally in oil prices allowed them to post the second straight week of gains.

The Dow Jones Industrial Average declined 57.32 points, or 0.3%, to 16639.97 (+1.5% over the week). The S&P 500 lost 3.65 points, or 0.2%, to 1948.05. The Nasdaq Composite climbed 8.27 points, or 0.2%, to 4,590.47.

On Friday the U.S. Commerce Department reported that the country's gross domestic product rose by 1% q/q in the fourth quarter. This reading was better than +0.7% estimated previously and +0.4% expected. Nevertheless concerns over slow global economic growth outweighed this report; investors remained cautious.

This morning in Asia Hong Kong Hang Seng fell 1.23%, or 237.89 points, to 19,126.26. China Shanghai Composite Index plunged 3.90%, or 107.95 points, to 2,659.26. Meanwhile the Nikkei lost 0.23%, or 36.53 points, to 16,151.88.

Asian stock indices fell with Chinese stocks leading declines. Some analysts say that the recovery in China's property market may be responsible for some of these losses, because investors favor to benefit from higher interest in home buying.

Japanese stocks rose at the beginning of the session, but were not able to sustain gains.

-

07:07

Options levels on monday, February 29, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1117 (3727)

$1.1039 (5515)

$1.0982 (2349)

Price at time of writing this review: $1.0943

Support levels (open interest**, contracts):

$1.0892 (6938)

$1.0849 (7883)

$1.0781 (6710)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 70791 contracts, with the maximum number of contracts with strike price $1,1000 (5515);

- Overall open interest on the PUT options with the expiration date March, 4 is 93792 contracts, with the maximum number of contracts with strike price $1,0900 (7883);

- The ratio of PUT/CALL was 1.32 versus 1.37 from the previous trading day according to data from February, 26

GBP/USD

Resistance levels (open interest**, contracts)

$1.4102 (422)

$1.4004 (548)

$1.3908 (84)

Price at time of writing this review: $1.3874

Support levels (open interest**, contracts):

$1.3793 (783)

$1.3696 (468)

$1.3598 (783)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 29429 contracts, with the maximum number of contracts with strike price $1,4750 (1652);

- Overall open interest on the PUT options with the expiration date March, 4 is 31687 contracts, with the maximum number of contracts with strike price $1,4350 (2954);

- The ratio of PUT/CALL was 1.08 versus 1.10 from the previous trading day according to data from February, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:02

Japan: Housing Starts, y/y, January 0.2% (forecast 0.0%)

-

06:02

Japan: Construction Orders, y/y, January -13.8%

-

03:35

Nikkei 225 16,276.29 +87.88 +0.54%, Hang Seng 19,189.69 -174.46 -0.90%, Shanghai Composite 2,667.3 -99.91 -3.61%

-

01:32

Australia: Private Sector Credit, y/y, January 6.5%

-

01:31

Australia: Private Sector Credit, m/m, January 0.5% (forecast 0.5%)

-

01:31

Australia: Company Gross Profits QoQ, Quarter IV -2.8% (forecast -1.8%)

-

01:02

Australia: MI Inflation Gauge, m/m, February -0.2%

-

00:51

Japan: Industrial Production (YoY), January -3.8%

-

00:51

Japan: Industrial Production (MoM) , January 3.7% (forecast 3.3%)

-

00:34

Commodities. Daily history for Feb 26’2016:

(raw materials / closing price /% change)

Oil 32.84 +0.18%

Gold 1,222.80 +0.20%

-

00:33

Stocks. Daily history for Sep Feb 26’2016:

(index / closing price / change items /% change)

Nikkei 225 16,188.41 +48.07 +0.30%

Hang Seng 19,364.15 +475.40 +2.52%

Shanghai Composite 2,767.21 +25.96 +0.95%

FTSE 100 6,096.01 +83.20 +1.38%

CAC 40 4,314.57 +66.12 +1.56%

Xetra DAX 9,513.3 +181.82 +1.95%

S&P 500 1,948.05 -3.65 -0.19%

NASDAQ Composite 4,590.47 +8.27 +0.18%

Dow Jones 16,639.97 -57.32 -0.34%

-

00:33

Currencies. Daily history for Feb 26’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0939 -0,71%

GBP/USD $1,3863 -0,70%

USD/CHF Chf0,9959 +0,58%

USD/JPY Y113,94 +0,84%

EUR/JPY Y124,63 +0,12%

GBP/JPY Y157,93 +0,13%

AUD/USD $0,7127 -1,52%

NZD/USD $0,6629 -1,39%

USD/CAD C$1,3512 -0,13%

-

00:00

Schedule for today,Monday, Feb 29’2016:

(time / country / index / period / previous value / forecast)

00:00 New Zealand ANZ Business Confidence January 23

00:30 Australia Company Gross Profits QoQ Quarter IV 1.3% -1.8%

00:30 Australia Private Sector Credit, m/m January 0.6% 0.5%

00:30 Australia Private Sector Credit, y/y January 6.6%

05:00 Japan Housing Starts, y/y January -1.3% 0.0%

05:00 Japan Construction Orders, y/y January 14.8%

07:00 Germany Retail sales, real adjusted January -0.2% 0.2%

07:00 Germany Retail sales, real unadjusted, y/y January 1.5% 1.5%

08:00 Switzerland KOF Leading Indicator February 100.3 98.8

09:30 United Kingdom Consumer credit, mln January 1169 1300

09:30 United Kingdom Mortgage Approvals January 70.84 73.6

09:30 United Kingdom Net Lending to Individuals, bln January 4.4

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) February 0.3% 0.0%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) February 1% 0.9%

13:30 Canada Current Account, bln Quarter IV -16.2 -15.6

13:30 Canada Industrial Product Price Index, m/m January -0.2%

13:30 Canada Industrial Product Price Index, y/y January 1.1%

14:45 U.S. Chicago Purchasing Managers' Index February 55.6 53

15:00 U.S. Pending Home Sales (MoM) January 0.1% 0.5%

22:30 Australia AIG Manufacturing Index February 51.5

23:30 Japan Unemployment Rate January 3.3% 3.3%

23:30 Japan Household spending Y/Y January -4.4% -2.7%

-