Noticias del mercado

-

17:48

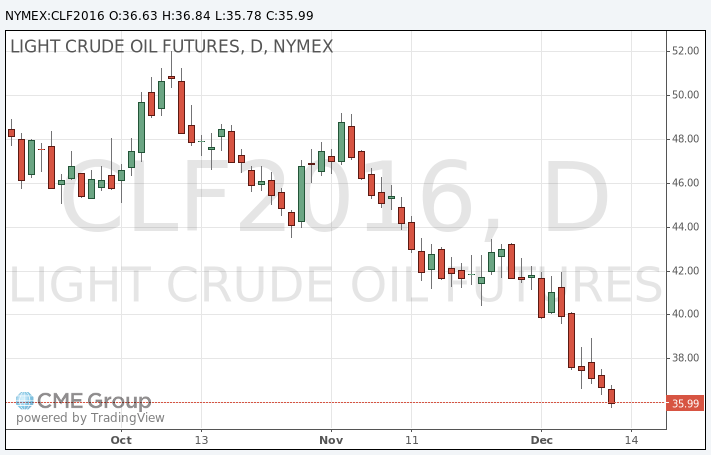

Oil prices slide as the International Energy Agency says that the global oil oversupply could rise next year

Oil prices continued to decline as the International Energy Agency (IEA) said that the global oil oversupply could rise next year.

"Consumption is likely to have peaked in the third quarter and demand growth is expected to slow to a still-healthy 1.2 mb/d in 2016, as support from sharply falling oil prices begins to fade," the IEA pointed out.

The IEA said in its monthly report on Friday that the low prices led to a lower supply from non-OPEC countries.

"Lower prices are clearly taking a toll on non-OPEC supply, with annual growth shrinking below 0.3 million barrels per day (bpd) in November from 2.2 million bpd at the start of the year," the agency noted.

The IEA expects the non-OPEC supply to fall 0.6 million bpd in 2016.

"As companies make further spending cuts in reaction to sub-$50/bbl oil, the impact on supplies - both from non-OPEC and OPEC - will be even more pronounced in the longer term," the agency.

WTI crude oil for January delivery slid to $35.78 a barrel on the New York Mercantile Exchange.

Brent crude oil for January dropped to $38.67 a barrel on ICE Futures Europe.

-

17:31

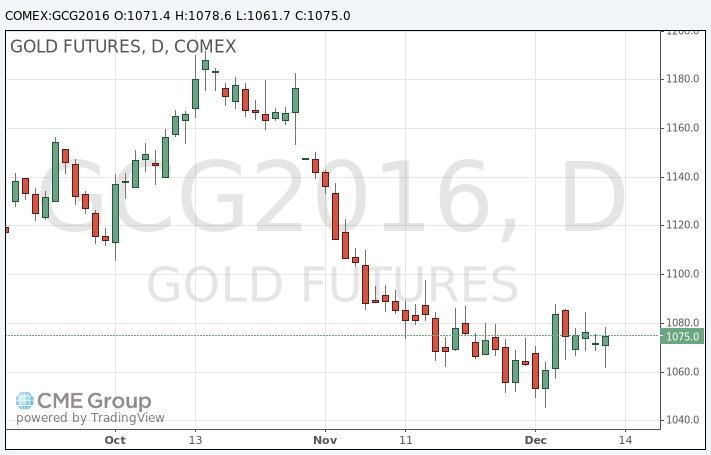

Gold rises on a weaker U.S. dollar

Gold price increased on a weaker U.S. dollar. The U.S. dollar declined against other currencies after the release of the U.S. economic data. The U.S. Commerce Department released the producer price index figures on Friday. The U.S. producer price index increased 0.3% in November, exceeding expectations for a flat reading, after a 0.4% drop in October.

A stronger U.S. dollar and weak global demand weigh on inflation.

On a yearly basis, the producer price index decreased 1.1% in November, beating forecasts of a 1.4% decline, after a 1.6% fall in October.

The producer price index excluding food and energy rose 0.3% in November, exceeding expectations for a 0.1% gain, after a 0.3% decrease in October.

On a yearly basis, the producer price index excluding food and energy climbed 0.5% in November, beating forecasts of a 0.2% increase, after a 0.1% rise in October.

The U.S. Commerce Department released the retail sales data on Friday. The U.S. retail sales climbed 0.2% in November, missing expectations for a 0.3% increase, after a 0.1% gain in October.

The lower increase was mainly driven by a fall in automobiles purchases. Sales at auto dealerships declined 0.4% in November.

Retail sales excluding automobiles increased 0.4% in November, beating forecasts of a 0.3% gain, after a 0.1% rise in October. October's figure was revised down from a 0.2% increase.

Market participants are awaiting the Fed's monetary policy meeting next week. They speculate that the Fed will start raising its interest rate this month.

Gold is traded in U.S. dollars. It suffers when the U.S. dollar strengthens, becoming more expensive for holders of other currencies.

February futures for gold on the COMEX today rose to 1078.60 dollars per ounce.

-

14:48

U.S. retail sales increase 0.2% in November

The U.S. Commerce Department released the retail sales data on Friday. The U.S. retail sales climbed 0.2% in November, missing expectations for a 0.3% increase, after a 0.1% gain in October.

The lower increase was mainly driven by a fall in automobiles purchases. Sales at auto dealerships declined 0.4% in November.

Retail sales excluding automobiles increased 0.4% in November, beating forecasts of a 0.3% gain, after a 0.1% rise in October. October's figure was revised down from a 0.2% increase.

Sales at building material and garden equipment stores fell 0.3% in November, while sales at furniture stores decreased 0.3%.

Sales at clothing retailers climbed 0.8% in November, while sales at service stations dropped 0.8%.

These figures could be strong enough for the Fed's interest rate hike next week.

-

07:23

Oil prices fell

West Texas Intermediate futures for January delivery declined to $36.51 (-0.68%), while Brent crude fell to $39.46 (-0.68%) amid unfavorable fundamentals.

Market participants expect the current supply glut to continue in 2016 keeping prices under pressure and limiting gains. OPEC produces crude oil at record levels, while demand is relatively weak. In addition to this analysts note that demand might be traditionally lower in the next quarter.

Investors are also waiting for the Federal Reserve's meeting scheduled for next week. The central bank of the U.S. is likely to raise its interest rates for the first time in nearly a decade. This would boost the greenback making the dollar-denominated crude more expensive for customers using other currencies.

-

07:07

Gold edged down

Gold declined to $1,068.30 (-0.35%) as investors prepared for an imminent U.S. rate hike. The central bank of the U.S. is widely expected to raise rates in December. Higher rates increase the opportunity cost of holding the non-interest paying precious metal and reduce demand for it. Bullion is on track to post the seventh weekly decline.

Generally weak commodity prices, particularly crude oil, weigh on gold as well. Weakness in oil could raise deflation fears, while gold is normally used to protect funds against inflation.

Assets in SPDR Gold Trust, the biggest gold exchange traded fund, are at their lowest since September 2008, while options data suggest that investors are ready for the price to decline to $1,000 an ounce.

-

01:02

Stocks. Daily history for Sep Dec 10’2015:

(index / closing price / change items /% change)

Nikkei 225 19,046.55 -254.52 -1.32 %

Hang Seng 21,704.61 -99.15 -0.45 %

Shanghai Composite 3,456.38 -16.06 -0.46 %

FTSE 100 6,088.05 -38.63 -0.63 %

CAC 40 4,635.06 -2.39 -0.05 %

Xetra DAX 10,598.93 +6.44 +0.06 %

S&P 500 2,052.23 +4.61 +0.23 %

NASDAQ Composite 5,045.17 +22.31 +0.44 %

Dow Jones 17,574.75 +82.45 +0.47 %

-

01:02

Commodities. Daily history for Dec 10’2015:

(raw materials / closing price /% change)

Oil 36.58 -0.49%

Gold 1,071.00 -0.09%

-