Noticias del mercado

-

21:00

DJIA 17307.10 -267.65 -1.52%, NASDAQ 4952.75 -92.42 -1.83%, S&P 500 2018.72 -33.51 -1.63%

-

18:50

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes are moving to worst week in a month as oil falls. All three major indexes fell more than 1,5% on Friday and were on track for their worst weekly performance in a month as growing oversupply concerns dragged down crude oil prices to their 7-year lows.

The International Energy Agency said it sees the oil glut worsening in 2016 as demand slows and OPEC shows no signs of slowing production. The steep drop in oil prices adds to investor uncertainty as the U.S. Federal Reserve prepares to raise interest rates for the first time since June 2006 at its meeting next week.

All Dow stocks in negative area (30 of 30). Top looser - E. I. du Pont de Nemours and Company (DD, -5.61%).

All S&P index sectors also in negative area. Top looser - Basic Materials (-3.4%).

At the moment:

Dow 17206.00 -280.00 -1.60%

S&P 500 2007.75 -33.25 -1.63%

Nasdaq 100 4548.00 -90.25 -1.95%

Oil 35.68 -1.08 -2.94%

Gold 1075.00 +3.00 +0.28%

U.S. 10yr 2.16 -0.08

-

18:02

European stocks closed: FTSE 5952.78 -135.27 -2.22%, DAX 10340.06 -258.87 -2.44%, CAC 40 4549.56 -85.50 -1.84%

-

17:59

European stocks close: stocks closed lower as oil prices continued to decline

Stock indices closed lower as oil prices continued to decline. Oil prices dropped as the International Energy Agency (IEA) said that the global oil oversupply could rise next year.

The European Central Bank (ECB) Executive Board member Peter Praet said in an interview with German Handelsblatt published on Thursday that the central bank's stimulus measures were working.

"It's working very well. In fact we were pleased to see how strongly our monetary policy has improved credit conditions. The impact on inflation however seems to be taking longer," he said.

Praet pointed out that the ECB is ready to add further stimulus measures if needed.

The European Central Bank (ECB) Executive Board member Benoit Coeure said on Friday that the main risk to inflation in the Eurozone "is now off the table".

"The biggest risk to inflation is now off the table: that was the risk of deflation, self-reinforcing deflationary expectations, what we call the de-anchoring of inflationary expectations," he said.

Meanwhile, the economic data from Eurozone was mixed. Destatis released its final consumer price data for Germany on Friday. German final consumer price index were up 0.1% in November, in line with the preliminary estimate, after a flat reading in October.

On a yearly basis, German final consumer price index rose to 0.4% in November from 0.3% in October, in line with the preliminary estimate.

The increase was partly driven by a slower decline in energy prices and higher food prices, which dropped 7.5% year-on-year in November, while food prices climbed 2.3%.

Consumer prices excluding energy increased 1.3% year-on-year in November.

The Bank of France released its current account data on Friday. France's current account deficit was €1.4 billion in October, down from a surplus of €0.3 billion in September. September's figure was revised down from a surplus of €0.5 billion.

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. rose 0.2% in October, after a 0.2% drop in September.

New housing activity jumped 1.5% in October, while all new work rose 1.2%.

Repair and maintenance work slid 1.5% in October.

On a yearly basis, construction output climbed 1.0% in October, after a 0.3% decrease in September.

The Bank of England (BoE) released its quarterly survey on Friday. Consumer inflation expectations for the coming year in the UK remained unchanged at 2.0% in December.

Inflation expectations for coming two years in the U.K. climbed to 2.9% in December from 2.8% in August.

The consumer price inflation in the U.K. was -0.1% in October, below the central bank's 2% target.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,952.78 -135.27 -2.22 %

DAX 10,340.06 -258.87 -2.44 %

CAC 40 4,549.56 -85.50 -1.84 %

-

17:54

WSE: Session Results

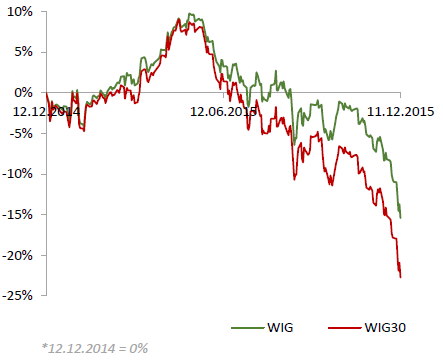

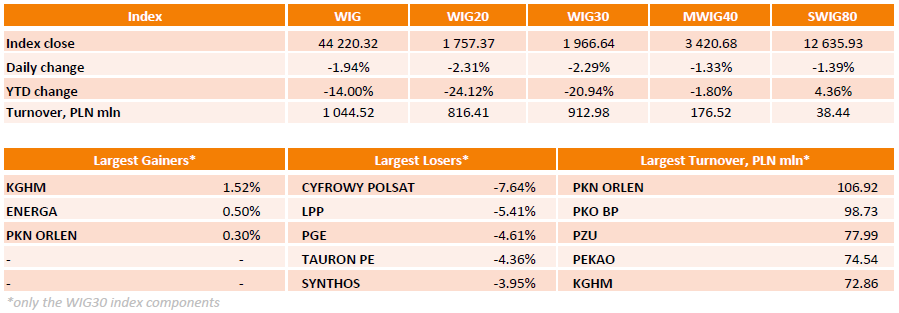

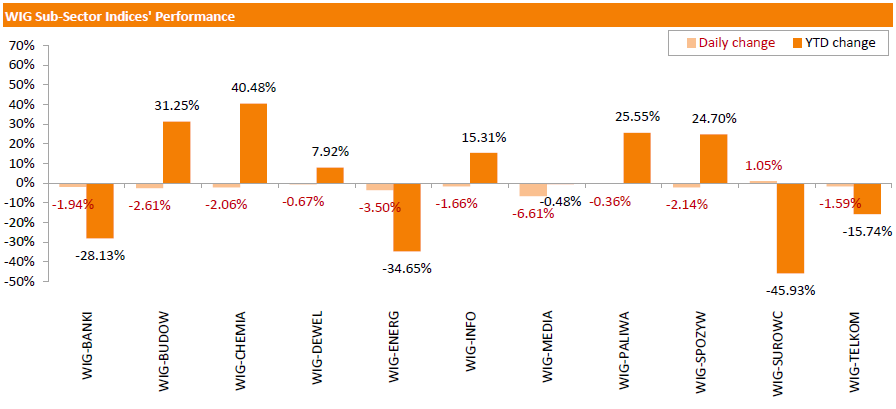

Polish equity market plunged on Friday. The broad market measure, the WIG Index, declined by 1.94%. Materials sector (+1.05%) was sole gainer within the WIG Index, while media sector (-6.61%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, fell by 2.29%. A majority of the index components recorded losses. Media group CYFROWY POLSAT (WSE: CPS) and clothing retailer LPP (WSE: LPP) topped the decliners' list, dropping 7.64% and 5.41% respectively. They were followed by gencos PGE (WSE: PGE) and TAURON PE (WSE: TPE), slumping 4.61% and 4.36% respectively. At the same time, copper producer KGHM (WSE: KGH), genco ENERGA (WSE: ENG) and oil refiner PKN ORLEN (WSE: PKN) were the only names that stepped up, returning gains of 1.52%, 0.5% and 0.3% respectively.

-

17:26

Japanese Economics Minister Akira Amari: the Bank of Japan should exclude oil prices when judging whether it has reached its 2% inflation target

Japanese Economics Minister Akira Amari said on Friday that the Bank of Japan (BoJ) should exclude oil prices when judging whether it has reached its 2% inflation target.

"If oil prices continue to decline this should be considered an unexpected event. The correct thing to do is to subtract the decline in oil prices when judging whether the BOJ has achieved its inflation target," he said.

-

17:19

International Monetary Fund Managing Director Christine Lagarde: a British exit from the European Union could weigh on the Britain’s outlook

The International Monetary Fund (IMF) Managing Director Christine Lagarde said on Friday that a British exit (Brexit) from the European Union (EU) could weigh on the Britain's outlook.

"Uncertainty associated with the outcome of the planned referendum on EU membership could weigh on the outlook," she said.

"Certainty is always better than uncertainty," the IMF managing director added.

Lagarde said that she hoped the country would stay in the EU.

-

16:50

European Central Bank Executive Board member Peter Praet: the central bank’s stimulus measures were working

The European Central Bank (ECB) Executive Board member Peter Praet said in an interview with German Handelsblatt published on Thursday that the central bank's stimulus measures were working.

"It's working very well. In fact we were pleased to see how strongly our monetary policy has improved credit conditions. The impact on inflation however seems to be taking longer," he said.

Praet pointed out that the ECB is ready to add further stimulus measures if needed.

"We have clearly said that we are ready to do more, if this became necessary. The precise choice of instruments cannot be determined long in advance; it is based on the specific circumstances. The asset purchase programme is sufficiently flexible for its size, composition and duration to be adapted if necessary," he noted

-

16:36

European Central Bank Executive Board member Benoit Coeure: the main risk to inflation in the Eurozone “is now off the table”.

The European Central Bank (ECB) Executive Board member Benoit Coeure said on Friday that the main risk to inflation in the Eurozone "is now off the table".

"The biggest risk to inflation is now off the table: that was the risk of deflation, self-reinforcing deflationary expectations, what we call the de-anchoring of inflationary expectations," he said.

Coeure noted that the ECB could adjust its stimulus measures if there are risks to inflation.

He also said that the slowdown in emerging economies remains the top downside risk to the Eurozone's economy.

-

16:23

U.S. business inventories are flat in October

The U.S. Commerce Department released the business inventories data on Friday. The U.S. business inventories were flat in October, missing expectations for a 0.1% rise, after a 0.1% gain in September. September's figure was revised down from a 0.3% increase.

Retail inventories climbed 0.1% in October, wholesale inventories were down 0.1%, while manufacturing inventories fell 0.1%.

Retail sales were flat in October, while business sales dropped 0.2%.

The business inventories/sales ratio climbed to 1.38 months in October from 1.37 months in September. The business inventories /sales ratio is a measure of how long it would take to clear shelves.

-

16:15

Thomson Reuters/University of Michigan preliminary consumer sentiment index climbs to 91.8 in December

The Thomson Reuters/University of Michigan preliminary consumer sentiment index climbed to 91.8 in December from a final reading of 91.3 in November, missing expectations for an increase to 92.0.

"While the preliminary December reading was largely unchanged from last month, consumers evaluated current economic conditions more favourably and expected future prospects less favourably," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin said.

"Overall, the Sentiment Index has averaged 92.9 during 2015, the highest since 2004, with only 10 higher yearly averages in the past half century. The data continue to indicate that real consumer expenditures will grow by 2.8% in 2016 over 2015," he added.

The index of current economic conditions increased to 107.0 in December from 104.3 in November, while the index of consumer expectations fell to 82.0 from 82.9.

The one-year inflation expectations fell to 2.6% in December from 2.7% in November.

-

15:37

U.S. Stocks open: Dow -1.12%, Nasdaq -1.00%, S&P -1.02%

-

15:29

Before the bell: S&P futures -0.66%, NASDAQ futures -0.75%

U.S. stock-index futures fell.

Global Stocks:

Nikkei 19,230.48 +183.93 +0.97%

Hang Seng 21,464.05 -240.56 -1.11%

Shanghai Composite 3,435.44 -20.05 -0.58%

FTSE 6,008.86 -79.19 -1.30%

CAC 4,570.08 -64.98 -1.40%

DAX 10,418.98 -179.95 -1.70%

Crude oil $36.44 (-0.87%)

Gold $1063.70 (-0.77%)

-

15:02

U.S. producer prices climb 0.3% in November

The U.S. Commerce Department released the producer price index figures on Friday. The U.S. producer price index increased 0.3% in November, exceeding expectations for a flat reading, after a 0.4% drop in October.

A stronger U.S. dollar and weak global demand weigh on inflation.

Services prices were up 0.5% in November, while prices for goods declined 0.1%.

Food prices climbed 0.3% in November, while energy prices declined 0.6%.

On a yearly basis, the producer price index decreased 1.1% in November, beating forecasts of a 1.4% decline, after a 1.6% fall in October.

The producer price index excluding food and energy rose 0.3% in November, exceeding expectations for a 0.1% gain, after a 0.3% decrease in October.

On a yearly basis, the producer price index excluding food and energy climbed 0.5% in November, beating forecasts of a 0.2% increase, after a 0.1% rise in October.

These figures could mean that the Fed will start raising its interest rate next week.

-

15:00

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Goldman Sachs

GS

180.50

-0.88%

3.3K

Twitter, Inc., NYSE

TWTR

26.28

1.43%

139.8K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

7.38

0.27%

54.3K

Home Depot Inc

HD

132.54

0.00%

57.1K

UnitedHealth Group Inc

UNH

116.21

0.00%

29.8K

United Technologies Corp

UTX

93.80

-0.07%

0.8K

Pfizer Inc

PFE

32.25

-0.34%

7.6K

American Express Co

AXP

69.75

-0.51%

0.2K

Wal-Mart Stores Inc

WMT

59.25

-0.52%

1.2K

Johnson & Johnson

JNJ

102.09

-0.54%

0.1K

International Paper Company

IP

38.55

-0.54%

33.1K

HONEYWELL INTERNATIONAL INC.

HON

101.16

-0.59%

0.1K

The Coca-Cola Co

KO

42.50

-0.61%

1.5K

AT&T Inc

T

33.46

-0.62%

13.4K

Boeing Co

BA

145.50

-0.62%

0.1K

Nike

NKE

127.75

-0.69%

1.3K

Merck & Co Inc

MRK

52.85

-0.71%

4.4K

Google Inc.

GOOG

744.12

-0.71%

6.7K

International Business Machines Co...

IBM

135.75

-0.75%

1.7K

ALTRIA GROUP INC.

MO

56.75

-0.75%

1.7K

Microsoft Corp

MSFT

54.85

-0.76%

49.6K

ALCOA INC.

AA

9.10

-0.76%

11.8K

Visa

V

77.52

-0.77%

2.1K

Facebook, Inc.

FB

104.61

-0.77%

81.4K

Intel Corp

INTC

34.50

-0.78%

0.1K

Walt Disney Co

DIS

109.90

-0.78%

14.5K

Barrick Gold Corporation, NYSE

ABX

7.60

-0.78%

2.8K

Cisco Systems Inc

CSCO

26.55

-0.82%

45.3K

General Electric Co

GE

30.40

-0.82%

29.9K

Verizon Communications Inc

VZ

44.95

-0.82%

67.5K

FedEx Corporation, NYSE

FDX

147.23

-0.85%

0.6K

Exxon Mobil Corp

XOM

75.03

-0.87%

11.4K

Tesla Motors, Inc., NASDAQ

TSLA

225.00

-0.91%

8.3K

Apple Inc.

AAPL

115.10

-0.92%

310.1K

JPMorgan Chase and Co

JPM

65.00

-0.93%

2.4K

Ford Motor Co.

F

13.83

-0.93%

0.2K

Caterpillar Inc

CAT

65.75

-0.95%

9.1K

Chevron Corp

CVX

88.42

-0.99%

3.5K

Amazon.com Inc., NASDAQ

AMZN

655.70

-1.00%

20.0K

Starbucks Corporation, NASDAQ

SBUX

61.25

-1.00%

0.9K

McDonald's Corp

MCD

116.01

-1.02%

1.2K

Citigroup Inc., NYSE

C

52.10

-1.04%

9.2K

Yahoo! Inc., NASDAQ

YHOO

34.27

-1.04%

2.6K

Yandex N.V., NASDAQ

YNDX

15.05

-1.57%

5.0K

E. I. du Pont de Nemours and Co

DD

70.75

-5.10%

250.7K

-

14:56

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Apple (AAPL) initiated with an Outperform at BMO Capital

HP Inc. (HPQ) initiated with a Market Perform at BMO Capital

Twitter (TWTR) initiated with a Underperform at Credit Agricole

-

14:48

U.S. retail sales increase 0.2% in November

The U.S. Commerce Department released the retail sales data on Friday. The U.S. retail sales climbed 0.2% in November, missing expectations for a 0.3% increase, after a 0.1% gain in October.

The lower increase was mainly driven by a fall in automobiles purchases. Sales at auto dealerships declined 0.4% in November.

Retail sales excluding automobiles increased 0.4% in November, beating forecasts of a 0.3% gain, after a 0.1% rise in October. October's figure was revised down from a 0.2% increase.

Sales at building material and garden equipment stores fell 0.3% in November, while sales at furniture stores decreased 0.3%.

Sales at clothing retailers climbed 0.8% in November, while sales at service stations dropped 0.8%.

These figures could be strong enough for the Fed's interest rate hike next week.

-

14:21

Business NZ performance of manufacturing index for New Zealand rises to 54.7 in November

According to the Business NZ Survey published on late Thursday evening, the Business NZ performance of manufacturing index (PMI) for New Zealand rose to 54.7 in November to 53.2 in October. October's figure was revised down from 53.3.

A reading above 50 indicates expansion in the manufacturing sector.

The rise was mainly driven by a faster expansion in new orders and employment.

"New orders (57.8) was at its highest level since June, as was employment (53.7). Also, the proportion of positive comments for November (68.6%) was a healthy pick up from both October (61.8%) and September (58.7%). A number of comments centred on seasonal factors at play, although others mentioned good customer demand, both domestically and offshore," Business NZ's executive director for manufacturing, Catherine Beard, said.

-

12:02

European stock markets mid session: stocks traded lower on falling oil prices

Stock indices traded lower on falling oil prices. Oil prices remain under pressure due to concerns over the global oil oversupply.

Meanwhile, the economic data from Eurozone was mixed. Destatis released its final consumer price data for Germany on Friday. German final consumer price index were up 0.1% in November, in line with the preliminary estimate, after a flat reading in October.

On a yearly basis, German final consumer price index rose to 0.4% in November from 0.3% in October, in line with the preliminary estimate.

The increase was partly driven by a slower decline in energy prices and higher food prices, which dropped 7.5% year-on-year in November, while food prices climbed 2.3%.

Consumer prices excluding energy increased 1.3% year-on-year in November.

The Bank of France released its current account data on Friday. France's current account deficit was €1.4 billion in October, down from a surplus of €0.3 billion in September. September's figure was revised down from a surplus of €0.5 billion.

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. rose 0.2% in October, after a 0.2% drop in September.

New housing activity jumped 1.5% in October, while all new work rose 1.2%.

Repair and maintenance work slid 1.5% in October.

On a yearly basis, construction output climbed 1.0% in October, after a 0.3% decrease in September.

The Bank of England (BoE) released its quarterly survey on Friday. Consumer inflation expectations for the coming year in the UK remained unchanged at 2.0% in December.

Inflation expectations for coming two years in the U.K. climbed to 2.9% in December from 2.8% in August.

The consumer price inflation in the U.K. was -0.1% in October, below the central bank's 2% target.

Current figures:

Name Price Change Change %

FTSE 100 6,042.47 -45.58 -0.75 %

DAX 10,466.28 -132.65 -1.25 %

CAC 40 4,593.19 -41.87 -0.90 %

-

11:56

European Central Bank: banks borrowed €18.3 billion in loans

The European Central Bank (ECB) said on Friday that banks borrowed €18.3 billion in loans, the so-called TLTROs, compared to the previous allotment of €15.6 billion.

The ECB is offering banks the loans as part of its stimulus measures to spur Eurozone's economy and to boost inflation to its 2% target.

The ECB said there were 55 bidders for this week's TLTROs.

-

11:50

Consumer inflation expectations for the coming year in the UK remain unchanged at 2.0% in December

The Bank of England (BoE) released its quarterly survey on Friday. Consumer inflation expectations for the coming year in the UK remained unchanged at 2.0% in December.

Inflation expectations for coming two years in the U.K. climbed to 2.9% in December from 2.8% in August.

The consumer price inflation in the U.K. was -0.1% in October, below the central bank's 2% target.

-

11:42

Industrial production in Italy increases 0.5% in October

The Italian statistical office Istat released its industrial production data on Friday. Industrial production in Italy increased at a seasonally-adjusted rate of 0.5% in October, after a 0.2% rise in September.

Output of consumer goods climbed 1.6% in October, output of intermediate goods were up 0.9%, output of investment goods rose 0.6%, while output of energy dropped 0.7%.

On a yearly basis, industrial production in Italy jumped at a seasonally-adjusted rate of 2.9% in October, after a 1.8% increase in September.

Output of capital goods jumped 4.8% year-on-year in October, while output of intermediate goods climbed 2.4%.

-

11:25

UK’s construction output rises 0.2% in October

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. rose 0.2% in October, after a 0.2% drop in September.

New housing activity jumped 1.5% in October, while all new work rose 1.2%.

Repair and maintenance work slid 1.5% in October.

On a yearly basis, construction output climbed 1.0% in October, after a 0.3% decrease in September.

Construction makes up around 6% of UK's economy.

-

11:03

France’s current account deficit is €1.4 billion in October

The Bank of France released its current account data on Friday. France's current account deficit was €1.4 billion in October, down from a surplus of €0.3 billion in September. September's figure was revised down from a surplus of €0.5 billion.

The trade goods deficit widened to €3.0 billion in October from €1.9 billion in September, while the surplus on services fell to €1.1 billion from €1.8 billion.

The surplus on financial account climbed to €18.4 billion in October from €10.3 billion in September.

-

10:49

German wholesale prices fall 0.2% in November

The German statistical office Destatis released its wholesale prices for Germany on Friday. German wholesale prices fell 0.2% in November, after a 0.4% decrease in October.

On a yearly basis, wholesale prices in Germany dropped 1.1% in November, after a 1.6% decline in October. Wholesale prices have been declining since July 2013.

The fall was mainly driven by a 13.3% drop in solid fuels and related products.

-

10:40

German final consumer price inflation rises 0.1% in November

Destatis released its final consumer price data for Germany on Friday. German final consumer price index were up 0.1% in November, in line with the preliminary estimate, after a flat reading in October.

On a yearly basis, German final consumer price index rose to 0.4% in November from 0.3% in October, in line with the preliminary estimate.

The increase was partly driven by a slower decline in energy prices and higher food prices, which dropped 7.5% year-on-year in November, while food prices climbed 2.3%.

Consumer prices excluding energy increased 1.3% year-on-year in November.

-

10:22

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy rise to 40.1 in in the week ended December 06

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy increased to 40.1 in in the week ended December 06 from 39.6 the prior week. The increase was driven by a more favourable assessment of the measure of views of the economy and buying climate.

The measure of views of the economy rose to 31.7 from 30.6.

The buying climate climbed to 35.3 from 34.5.

The personal finances index fell to 53.4 from 53.7.

-

10:09

U.S. budget deficit rises by $65.0 billion in November

The U.S. Treasury Department released its federal budget data on Thursday. The budget deficit increased by $65.0 billion in November, beating expectations for a rise by $68.0 billion, after a $136.0 billion growth in October.

The budget deficit rose due to a rise in spending in Social Security, Medicare and defence. Social Security spending climbed 4%, Medicare spending jumped 9%, while spending on defence increased 2% from last year.

In the first two months of the fiscal year 2016, which ends at September next year, the budget deficit totalled $201.1 billion, 12.6% higher than a year ago.

-

06:51

Global Stocks: U.S. stock indices posted modest gains

U.S. stock indices posted modest gains on Thursday after three days of declines. Investors were cautious ahead of the Federal Reserve meeting scheduled for the next week.

The Dow Jones Industrial Average rose 82.45 points, or 0.5%, to 17,574.75. The S&P 500 climbed 4.61 points, or 0.2%, to 2,045.23 (eight out of its 10 sectors rose; utilities and materials sectors declined 1.7% and 0.8% respectively). The Nasdaq Composite gained 22.31 points, or 0.4%, to 5,045.17.

The U.S. Department of Labor reported that the number of initial unemployment claims rose by 13,000 to 282,000 on a seasonally adjusted basis in the week ending December 5. The reading was above forecast for 269,000 new claims, but still below a key 300,000 level. This is the highest reading since the beginning of July. Last week's data were not revised.

This morning in Asia Hong Kong Hang Seng fell 0.68%, or 147.13, to 21,557.48. China Shanghai Composite Index lost 0.95%, or 32.67, to 3.422.83. The Nikkei rose 0.89%, or 170.04, to 19,216.59.

Asian indices traded mixed. Chinese stocks fell as investors were cautious ahead of series of economic reports due on Saturday (industrial production, fixed asset investment and retail sales).

Stocks of Japanese exporters including Toyota, Honda and Canon advanced.

-

03:19

Nikkei 225 19,272 +225.45 +1.18 %, Hang Seng 21,613.01 -91.60 -0.42 %, Shanghai Composite 3,436.81 -18.69 -0.54 %

-

01:02

Stocks. Daily history for Sep Dec 10’2015:

(index / closing price / change items /% change)

Nikkei 225 19,046.55 -254.52 -1.32 %

Hang Seng 21,704.61 -99.15 -0.45 %

Shanghai Composite 3,456.38 -16.06 -0.46 %

FTSE 100 6,088.05 -38.63 -0.63 %

CAC 40 4,635.06 -2.39 -0.05 %

Xetra DAX 10,598.93 +6.44 +0.06 %

S&P 500 2,052.23 +4.61 +0.23 %

NASDAQ Composite 5,045.17 +22.31 +0.44 %

Dow Jones 17,574.75 +82.45 +0.47 %

-