Noticias del mercado

-

22:08

U.S. stocks closed

U.S. stocks rose for the first time in four days, while the dollar strengthened amid a recommendation to buy the currency a week before the Federal Reserve is anticipated to raise interest rates. Crude oil fell for a fifth day.

The Standard & Poor's 500 Index almost erased a 1 percent gain in the final 90 minutes of the session, with the advance stalling at the gauge's average price for the past 200 days. The gain is the first since a three-day slide erased 2 percent after last week's payrolls data hardened the consensus on Wall Street for a Fed rate hike. The dollar hovered near the highest in a decade as Citigroup Inc. called the greenback "attractive." Crude sank below $37 a barrel to settle at a six-year low.

The Fed meeting is expected to confirm that Chair Janet Yellen believes the world's biggest economy is strong enough to cope with the first increase in borrowing costs since 2006. Still, investors are caught between optimism about U.S, growth and concern that a slowdown in China and the consequent tumble in commodities will damp global growth prospects. Oil's slump since OPEC's decision to effectively abandon its production target has unsettled global financial markets.

The S&P 500 rose 0.3 percent at 4 p.m. in New York, ending just below its 50-day moving average. The gauge is little changed for the year after closing 3.7 percent away from its all-time high set in May. It climbed within 1.4 percent of the record last week.

Energy shares paced gains, rising 0.8 percent even as crude extended losses. Industrial shares climbed as airlines led gains. Materials producers fell 0.8 percent for the biggest contribution to losses, as DuPont Co. and Dow Chemical Co. gave back some of Wednesday's gains.

A report tomorrow on retail sales and producer prices will probably show stronger growth for November, according to economists surveyed by Bloomberg. The data aren't expected to impact the Fed's decision, with traders pricing in an 80 percent chance that the rates will rise on Dec. 16.

The Stoxx Europe 600 Index fell 0.3 percent for a third day of losses as a rally in commodity producers failed to lift sentiment. The region's shares earlier extended their lowest levels since Oct. 21 as most industry groups declined.

-

21:00

DJIA 17657.36 165.06 0.94%, NASDAQ 5065.90 43.03 0.86%, S&P 500 2062.94 15.32 0.75%

-

18:55

WSE: Session Results

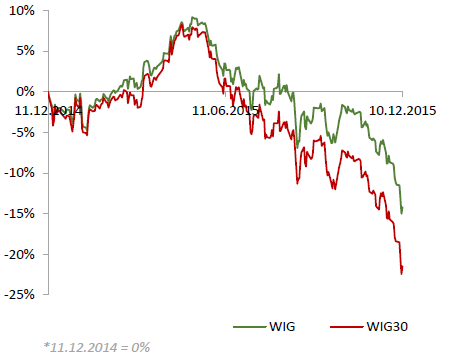

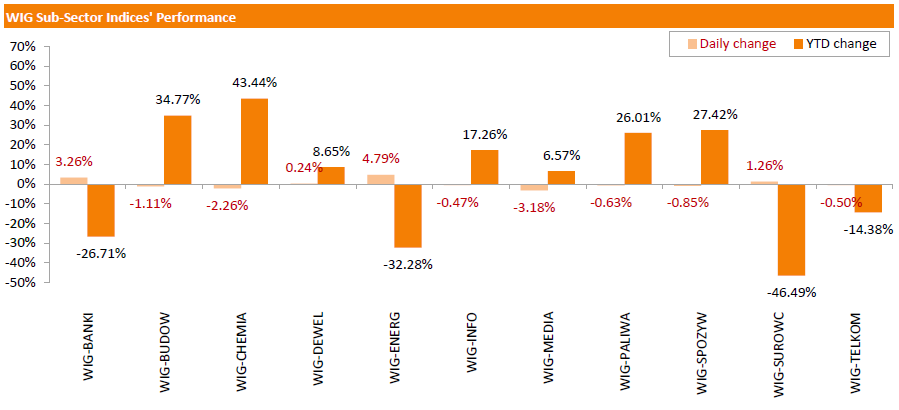

Polish equity market rebounded on Thursday. The broad market measure, the WIG Index, added 0.95%. Sector performance in the WIG Index was mixed. The beaten-down utilities (+4.79%) and banking (+3.26%) sectors performed best within the Index, while media sector (-3.18%) lagged behind.

All sectors in the WIG gained, with materials (+2.77%) and chemicals (+2.63%) outperforming.

The large-cap stocks' measure, the WIG30 Index, advanced by 1.26%. In the WIG30 index, the strongest performers were banking names MBANK (WSE: MBK), BZ WBK (WSE: BZW) and ALIOR (WSE: ALR), as well as utilities names TAURON PE (WSE: TPE), ENERGA (WSE: ENG), ENEA (WSE: ENA) and PGE (WSE: PGE), jumping by 5.05%-6.19%. On the other side of the ledger, FMCG wholesaler EUROCASH (WSE: EUR) led the decliners with a 5.44% drop, followed by media and telecommunications group CYFROWY POLSAT (WSE: CPS) and chemical producer GRUPA AZOTY (WSE: ATT), plunging by 3.62% and 3.13% respectively.

-

18:18

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes slightly higer on Thursday, after three straight days of losses, as investors scoured for bargains ahead of a widely expected U.S. interest rate hike next week. Markets have had a bruising week so far as equities tracked oil prices. Brent futures are down more than 11% this month and, having dipped below $40 per barrel, there are renewed expectations it might test 2008 low.

As concerns regarding the global economy persist, all eyes will be on the Federal Reserve's meeting on Dec. 15-16, when it is expected to raise rates for the first time in nearly a decade.

Most of Dow stocks in positive area (26 of 30). Top looser - E. I. du Pont de Nemours and Company (DD, -2.08%). Top gainer - Chevron Corporation (CVX, +2.46%).

Most of S&P index sectors also in positive area. Top looser - Utilities (-1.1%). Top gainer - Healthcare (+0,5%).

At the moment:

Dow 17495.00 +120.00 +0.69%

S&P 500 2046.25 +12.00 +0.59%

Nasdaq 100 4639.00 +29.25 +0.63%

Oil 36.86 -0.30 -0.81%

Gold 1073.00 -3.50 -0.33%

U.S. 10yr 2.22 +0.02

-

18:07

European stocks close: stocks closed mixed as market participants continued to closely monitor oil prices

Stock indices closed mixed as market participants continued to closely monitor oil prices. Oil prices plunged as the Organization of the Petroleum Exporting Countries (OPEC) reported the highest oil output in November since 2009. OPEC's oil output in November rose by 230,100 barrels per day (bpd) to 31.695 million bpd from October, mainly due to higher oil output from Iraq.

Stock markets were supported by a weaker euro.

Meanwhile, the economic data from France was mixed. The French statistical office Insee its industrial production figures on Thursday. Industrial production in France rose 0.5% in October, beating expectations for a 0.1% decline, after a flat reading in September. September's figure was revised down from a 0.1% increase.

Manufacturing output fell 0.5% in October, while construction output climbed 0.5%.

Output in mining and quarrying, energy, water supply and waste management increased 5.1% in October.

On a yearly basis, the French industrial production climbed 2.3% in October, after a 0.7% gain in September.

The French consumer price inflation declined 0.2% in November, missing expectations for a flat reading, after a 0.1% rise in October.

On a yearly basis, the consumer price index was flat in November, after a 0.1% increase in October.

The Bank of England (BoE) released its interest rate decision on Thursday. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

The Bank of England's Monetary Policy Committee (MPC) released its December meeting minutes today. 8 members voted to keep the central bank's monetary policy unchanged. Ian McCafferty voted to hike interest rate.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,088.05 -38.63 -0.63 %

DAX 10,598.93 +6.44 +0.06 %

CAC 40 4,635.06 -2.39 -0.05 %

-

18:00

European Central Bank Executive Board member Yves Mersch: a majority of the Governing Council members did not want to add further stimulus measures last week

The European Central Bank (ECB) Executive Board member Yves Mersch said on Wednesday evening that a majority of the Governing Council members did not want to add further stimulus measures last week.

"The very large majority of the Governing Council is of the view that the measures are appropriate and that more is not needed to reach our goal," he said.

Mersch noted that the ECB is ready to add further stimulus measures to reach 2% inflation target if needed.

He pointed out that the central bank was not responsible for market disappointment after the release of the ECB's monetary policy decision.

"If we were to have gone out and said each time, that is not correct, then we wouldn't have needed to have had a Council meeting. It was correct to protect the integrity of the institution," Mersch said.

"I don't see that I contributed to any raising of expectations," he added.

Mersch also said that the downside risk to the global economy from the slowdown in China increased.

-

18:00

European stocks closed: FTSE 6088.05 -38.63 -0.63%, DAX 10598.93 6.44 0.06%, CAC 40 4635.06 -2.39 -0.05%

-

17:48

Swiss National Bank President Thomas Jordan: the Swiss franc remained overvalued

The Swiss National Bank (SNB) President Thomas Jordan said in a press conference after the release of the central bank's interest rate decision that the Swiss franc remained overvalued, and the central bank "remains active in the foreign exchange market in order to influence the exchange rate situation".

Jordan noted that the global economy expanded weaker than expected in the third quarter of 2015, due to the weak "manufacturing activity around the globe and sluggish world trade". The slowdown in the global economy weighed on the Swiss economy, he added.

-

16:51

European Central Bank Governing Council member Erki Liikanen: the ECB is ready to add further measures to boost inflation toward 2% target if needed

The European Central Bank (ECB) Governing Council member Erki Liikanen said on Thursday that the ECB is ready to add further measures to boost inflation toward 2% target if needed.

"We must be strong and ready to act, whatever happens that endangers the implementation of this target," he said.

Liikanen added that the central bank needs to continue its very accommodative monetary policy in line with the price stability target.

-

16:19

Bank of England's Monetary Policy Committee December minutes: 8-1 split to keep monetary policy unchanged

The Bank of England's Monetary Policy Committee (MPC) released its December meeting minutes on Thursday. 8 members voted to keep the central bank's monetary policy unchanged. Ian McCafferty voted to hike interest rate by 0.25%.

The consumer price inflation in the U.K. was -0.1% in October, below the central bank's 2% target. The BoE noted that inflation is expected to positive in November, to rise further as effects of low energy and food prices will dissipate and to be below 1% until the second half of next year.

"The projected return of CPI inflation to the target depends on an increase in domestic cost growth sufficient to balance the drag on prices from very subdued global inflation and past increases in the value of sterling," the BoE said.

The central bank said that the global and domestic outlook remained little changed compared to the previous month.

"There has not been much news on international activity relative to the forecasts contained in the November Report, with global growth having been stable at a rate well below historical averages. Prospects for domestic activity are also little changed on the month, with robust growth in private domestic spending continuing to counter-balance subdued demand growth overseas," the minutes said.

All MPC members agreed to hike interest rate gradually once the BoE starts raising its interest rate and "to a lower level than in recent cycles".

-

16:04

Japan’s business survey index (BSI) of manufacturers' sentiment drops to 3.8 in fourth quarter

Japan's Ministry of Finance and the Cabinet Office released its quarterly survey on late Wednesday evening. The business survey index (BSI) of manufacturers' sentiment dropped to 3.8 in fourth quarter from 11.0 in third quarter, missing expectations for a rise to 12.1.

The BSI for non-manufacturing slid to 5 in the fourth quarter from 8.9 in the third quarter.

The BSI for all industries was down to 4.6 in the fourth quarter from 9.6 in the third quarter.

The BSI for manufacturers in the first quarter of 2016 is expected to rise to 4.0, while the BSI for non-manufacturing is expected to increase to 6.4.

-

15:51

Bank of England keeps its interest rate on hold at 0.5% in December

The Bank of England (BoE) released its interest rate decision on Thursday. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

-

15:46

Greek industrial production declines 1.2% in October

The Hellenic Statistical Authority released its preliminary industrial production data for Greece on Thursday. Greek industrial production fell 1.2% in October, after a 1.8% decline in September.

On a yearly basis, industrial production in Greece slid at an adjusted rate of 1.9% in October, after a 2.9% rise in September. September's figure was revised up from a 2.8% gain.

Production in the manufacturing sector dropped at an annual rate of 1.3% in October, output in the mining and quarrying sector slid 12.5%, while electricity production declined by 1.1%.

-

15:38

Greek consumer prices decrease 0.8% in November

The Hellenic Statistical Authority released its consumer price inflation data for Greece on Thursday. Greek consumer prices decreased 0.8% in November, after the 0.1% drop in October.

On a yearly basis, the Greek consumer price index declined 0.7% in November, after a 0.9 fall in October. Consumer prices in Greece declined since March 2013.

Housing prices plunged at an annual rate of 4.5% in November, transport costs dropped by 4.5%, clothing and footwear prices declined 2.7%, while household equipment prices were down 1.4%.

Prices of food and non-alcoholic beverages climbed at an annual rate of 3.2% in November, while alcoholic beverages and tobacco prices increased by 1.5%.

-

15:35

U.S. Stocks open: Dow -0.05%, Nasdaq -0.05%, S&P -0.04%

-

15:27

Before the bell: S&P futures +0.28%, NASDAQ futures +0.32%

U.S. stock-index futures rose.

Global Stocks:

Nikkei 19,046.55 -254.52 -1.32%

Hang Seng 21,704.61 -99.15 -0.45%

Shanghai Composite 3,456.38 -16.06 -0.46%

FTSE 6,097.94 -28.74 -0.47%

CAC 4,631.96 -5.49 -0.12%

DAX 10,579.54 -12.95 -0.12%

Crude oil $36.72 (-1.18%)

Gold $1072.90 (-0.33%)

-

15:01

Canada’s new housing price index climbs 0.3% in October

Statistics Canada released its new housing price index on Thursday. New housing price index in Canada rose 0.3% in October, exceeding expectations of a 0.1% gain, after a 0.1% rise in September.

The increase was mainly driven by a gain in Toronto region. New home prices in Toronto and Oshawa region rose 0.5% in October.

On a yearly basis, new housing price index in Canada climbed 1.5% in October, after a 1.3% gain in September.

-

14:57

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Yandex N.V., NASDAQ

YNDX

15.13

1.54%

6.0K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

7.04

0.72%

68.6K

ALCOA INC.

AA

8.80

0.69%

21.5K

Apple Inc.

AAPL

116.19

0.49%

58.7K

Verizon Communications Inc

VZ

45.56

0.44%

0.1K

Pfizer Inc

PFE

32.40

0.34%

1.8K

AT&T Inc

T

33.68

0.33%

2.8K

Deere & Company, NYSE

DE

79.50

0.33%

0.1K

Facebook, Inc.

FB

104.89

0.28%

27.7K

General Motors Company, NYSE

GM

35.55

0.28%

2.5K

Visa

V

78.09

0.27%

7.2K

Microsoft Corp

MSFT

55.12

0.25%

27.0K

Procter & Gamble Co

PG

77.89

0.24%

2.3K

JPMorgan Chase and Co

JPM

65.60

0.21%

0.5K

Walt Disney Co

DIS

110.99

0.21%

2.7K

Intel Corp

INTC

34.88

0.20%

119.8K

Goldman Sachs

GS

181.00

0.16%

0.1K

Google Inc.

GOOG

752.60

0.13%

1.1K

Nike

NKE

129.00

0.12%

8.5K

Wal-Mart Stores Inc

WMT

59.20

0.12%

4.7K

McDonald's Corp

MCD

116.71

0.11%

0.6K

Amazon.com Inc., NASDAQ

AMZN

665.43

0.10%

10.8K

Citigroup Inc., NYSE

C

52.86

0.09%

2.1K

Twitter, Inc., NYSE

TWTR

24.33

0.08%

7.0K

Merck & Co Inc

MRK

52.82

0.00%

0.5K

The Coca-Cola Co

KO

42.66

0.00%

0.8K

Yahoo! Inc., NASDAQ

YHOO

34.40

0.00%

28.8K

International Business Machines Co...

IBM

136.54

-0.05%

2.7K

General Electric Co

GE

30.43

-0.13%

2.1K

Cisco Systems Inc

CSCO

26.67

-0.22%

3.7K

Tesla Motors, Inc., NASDAQ

TSLA

224.00

-0.23%

1.4K

Caterpillar Inc

CAT

65.69

-0.33%

103.3K

Exxon Mobil Corp

XOM

75.27

-0.48%

9.9K

Barrick Gold Corporation, NYSE

ABX

7.66

-0.91%

16.8K

E. I. du Pont de Nemours and Co

DD

73.68

-1.09%

1.9M

Chevron Corp

CVX

86.49

-1.27%

3.0K

-

14:55

U.S. import price index falls 0.4% in November

The U.S. Labor Department released its import and export prices data on Thursday. The U.S. import price index fell by 0.4% in November, beating expectations for a 0.7% decrease, after a 0.3% decline in October. October's figure was revised up from a 0.5% drop.

The decline was mainly driven by lower prices for fuel imports, which slid 2.5% in November.

A strong U.S. currency lowers the price of imported goods.

U.S. export prices declined by 0.6% in November, after a 0.2% fall in October.

-

14:47

Initial jobless claims rise to 282,000 in the week ending December 05

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending December 05 in the U.S. rose by 13,000 to 282,000 from 269,000 in the previous week. Analysts had expected jobless claims to remain unchanged at 269,000.

Jobless claims remained below 300,000 the 40th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims increased by 82,000 to 2,243,000 in the week ended November 28.

-

14:44

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Yahoo! (YHOO) target raised to $45 from $40 at Sun Trust Rbsn Humphrey

Freeport-McMoRan Copper & Gold (FCX) target lowered to $8 from $10 at FBR Capital

-

14:41

Canadian capacity utilisation rate is up to 82.0% in the third quarter

Statistics Canada released its capacity utilisation rate on Thursday. Canadian capacity utilisation rate climbed to 82.0% in the third quarter from 81.4% in the second quarter. The second quarter's figure was revised up from 81.3%.

The increase was mainly driven by a fall in the mining, quarrying, and oil and gas extraction and manufacturing industries. The capacity utilisation rate in the mining, quarrying, and oil and gas extraction industry rose to 76.9% in the third quarter from 74.4% in the second quarter, while the capacity utilisation rate in the manufacturing industry climbed to 83.1% from 82.4%.

The capacity utilization rate was up in 14 of the 21 major categories in the manufacturing sector in the third quarter.

-

14:21

Greek unemployment rate declines to 24.6% in September

The Hellenic Statistical Authority released its unemployment data on Thursday. The seasonally adjusted unemployment rate in Greece declined to 24.6% in September from 24.7% in August. August's figure was revised up from 24.6%.

The number of unemployed fell by 2,429 persons compared with August 2015.

The youth unemployment rate was 49.5% in September.

-

12:00

European stock markets mid session: stocks traded mixed as market participants continued to closely monitor oil prices

Stock indices traded mixed as market participants continued to closely monitor oil prices.

Stock markets were supported by a weaker euro, which declined after the Swiss National Bank's (SNB) interest rate decision. The central bank kept the rates on sight deposits at minus 0.75% and said that the bank will remain active in the forex market if needed.

Meanwhile, the economic data from France was mixed. The French statistical office Insee its industrial production figures on Thursday. Industrial production in France rose 0.5% in October, beating expectations for a 0.1% decline, after a flat reading in September. September's figure was revised down from a 0.1% increase.

Manufacturing output fell 0.5% in October, while construction output climbed 0.5%.

Output in mining and quarrying, energy, water supply and waste management increased 5.1% in October.

On a yearly basis, the French industrial production climbed 2.3% in October, after a 0.7% gain in September.

The French consumer price inflation declined 0.2% in November, missing expectations for a flat reading, after a 0.1% rise in October.

On a yearly basis, the consumer price index was flat in November, after a 0.1% increase in October.

The U.K. stock index FTSE traded lower ahead the Bank of England's interest rate decision, which is scheduled to be released at 12:00 GMT. Analysts expect the central bank to keep its monetary policy unchanged.

Current figures:

Name Price Change Change %

FTSE 100 6,112.59 -14.09 -0.23 %

DAX 10,633.23 +40.74 +0.38 %

CAC 40 4,657.9 +20.45 +0.44 %

-

11:50

French non-farm employment is flat in the third quarter

The French statistical office Insee released its non-farm employment data on Thursday. French non-farm employment was flat in the third quarter, after a 0.1% increase in the second quarter.

Employment excluding temporary work fell 0.1% in the third quarter.

Temporary employment rose by 3.0% in the third quarter.

Employment in the industry was down by 0.5% in the third quarter, while employment in construction declined by 0.8%.

Overall, job creation in the market services sector climbed by 0.2% in the third quarter.

-

11:40

Swiss National Bank keeps its rates steady at -0.75% in December, but it downgrades its inflation forecasts

The Swiss National Bank (SNB) released its interest rate decision on Thursday. The central bank kept the rates on sight deposits at minus 0.75% and said that the bank will remain active in the forex market if needed.

The SNB noted that the Swiss franc is still significantly overvalued.

Inflation was upgraded to -1.1% in 2015 from the previous forecast of -1.2%. The central bank expects inflation to be -0.5% in 2016, remained unchanged, and 0.3% in 2017, down from the previous forecast of 0.4%.

The downward revision was driven by "a slight deterioration in the outlook for the global economy".

The central bank noted that the Swiss economy rose slightly in the second quarter, while employment declined further.

According to the central bank, the slowdown in the global economy weighs on the economy in Switzerland.

The SNB expects the Swiss economy to expand "just under" 1% in 2015 and about 1.5% in 2016.

-

11:25

French consumer price inflation declines 0.2% in November

The French statistical office Insee released its consumer price inflation for France on Thursday. The French consumer price inflation declined 0.2% in November, missing expectations for a flat reading, after a 0.1% rise in October.

On a yearly basis, the consumer price index was flat in November, after a 0.1% increase in October.

Fresh food prices rose 5.4% year-on-year in November, while petroleum products prices dropped by 11.9%.

-

11:18

French industrial production rises 0.5% in October

The French statistical office Insee its industrial production figures on Thursday. Industrial production in France rose 0.5% in October, beating expectations for a 0.1% decline, after a flat reading in September. September's figure was revised down from a 0.1% increase.

Manufacturing output fell 0.5% in October, while construction output climbed 0.5%.

Output in mining and quarrying, energy, water supply and waste management increased 5.1% in October.

On a yearly basis, the French industrial production climbed 2.3% in October, after a 0.7% gain in September.

-

11:03

U.K. trade deficit in goods widens to £11.83 billion in October

The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Thursday. The U.K. trade deficit in goods widened to £11.83 billion in October from £8.80 billion in September.

Exports of goods dropped 2.7% in October, while imports climbed 8.2%.

A strong pound and the weak global economy weigh on exports.

The total trade deficit, including services, widened to £4.14 billion in October from £1.07 billion in September. September's figure was revised up from a deficit of £1.35 billion.

-

10:52

Reserve Bank of New Zealand lowers its interest rate to 2.50%

The Reserve Bank of New Zealand (RBNZ) on Wednesday lowered its interest rate to 2.50% from 2.75%. The RBNZ Graeme Wheeler said on Wednesday that New Zealand's economy softened in 2015, "due mainly to lower terms of trade".

He noted that consumer price inflation in New Zealand is below the 1 to 3% target range, mainly due to the stronger New Zealand dollar and low global oil prices. The RBNZ governor expects that inflation will return inside the target range.

Wheeler said that the central bank plans to achieve the inflation target without any further interest rate cuts, "although the Bank will reduce rates if circumstances warrant".

-

10:46

Australia's unemployment rate falls to 5.8% in November

The Australian Bureau of Statistics released its labour market data on Thursday. Australia's unemployment rate dropped to 5.8% in November from 5.9% in October. Analysts had expected the unemployment rate to rise to 6.0%.

The number of employed people in Australia rose by 71,400 in November, beating forecast of a decline by 10,000, after an increase by 56,100 in October. October's figure was revised down from a rise by 58,600.

Full-time employment rose by 41,600 in November, while part-time employment climbed by 29,700.

The participation rate increased to 65.3% in November from 65.0% in October.

-

10:34

Japan's Finance Ministry plans to issue more 40-year government bonds

Japan's Finance Ministry plans to issue more 40-year government bonds. Issuances of 40-year bonds should rise by 20% in fiscal year 2016 to a record of around 2.4 trillion yen ($19.3 billion). Interest rates on these bonds are around 1.5%.

-

10:23

Bank of Portugal cuts its growth forecasts

The Bank of Portugal cut its growth forecasts on Wednesday. The economy in Portugal is expected to expand 1.6% in 2015, down from the previous estimate of 1.7%, 1.7% in 2016, down from the previous estimate of 1.9%, and 1.8% in 2017, down from the previous estimate of 2.0%.

The central bank noted that the weak global economy global trade flows are the main risk factors.

There is an uncertainty on new budget as the new government didn't publish its budget plan.

Inflation is expected to 0.6% this year and 1.1% next year.

-

10:13

Germany is likely to post small budget deficit in 2016

German Finance Ministry officials said on Wednesday that the country is likely to post small budget deficit in 2016 due to higher costs for refugees. Germany expects a budget surplus of 0.75% of gross domestic product (GDP) this year.

The Finance Ministry didn't provide any forecasts for the deficit.

-

07:22

Global Stocks: U.S. stock indices fell

U.S. stock indices fell on Wednesday amid persistent declines in oil prices.

The Dow Jones Industrial Average fell 75.70 points, or 0.43%, to 17,492.30. The S&P 500 lost 15.97 points, or 0.8%, to 2,047.62. The Nasdaq Composite declined 75.38 points, or 1.5% to 5,022.87.

The S&P and the Dow are down 0.6% and 1.9% respectively for the year.

The Wall Street Journal reported that DuPont and Dow Chemical are ready to finalize a merger deal worth around $120 billion. The result might be announced in the coming days. This news supported commodity companies.

This morning in Asia Hong Kong Hang Seng edged down 0.01%, or 2.90, to 21,800.86. China Shanghai Composite Index climbed 0.28%, or 9.65, to 3.482.09. The Nikkei fell 1.37%, or 263.58, to 19,037.49.

Asian indices traded mixed. Chinese stocks advanced on news that in March 2016 Chinese authorities would introduce new rules for initial public offering listings. Over 600 companies are waiting for permission to go public.

Japanese stocks declined. A stronger yen weighed on major exporters.

-

03:04

Nikkei 225 19,108.56 -192.51 -1.00 %, Hang Seng 21,812.99 +9.23 +0.04 %, Shanghai Composite 3,471.14 -1.30 -0.04 %

-

00:30

Stocks. Daily history for Sep Dec 9’2015:

(index / closing price / change items /% change)

S&P/ASX 200 5,080.45 -28.15 -0.55%

TOPIX 1,555.58 -13.15 -0.84%

SHANGHAI COMP 3,473.1 +3.03 +0.09%

HANG SENG 21,803.76 -101.37 -0.46%

FTSE 100 6,126.68 -8.54 -0.14 %

CAC 40 4,637.45 -44.41 -0.95 %

Xetra DAX 10,592.49 -81.11 -0.76 %

S&P 500 2,047.62 -15.97 -0.77 %

NASDAQ Composite 5,022.87 -75.38 -1.48 %

Dow Jones 17,492.3 -75.70 -0.43 %

-