Noticias del mercado

-

22:13

U.S. stocks closed

U.S. stocks headed for their lowest close in almost four weeks amid a rout in technology shares and as the selloff in commodities resumed on concern that slowing global growth will exacerbate supply gluts.

Tech companies, the market's best-performing sector over the past two months, bore the brunt of Wednesday's decline, which pushed the Standard & Poor's 500 Index toward its lowest level since Nov. 13. U.S. crude erased earlier gains, extending losses at a six-year low. The Bloomberg Dollar Spot Index sank and Treasuries fell ahead of next week's Federal Reserve meeting, while New Zealand's currency jumped after the central bank cut interest rates, but said it expects to achieve its inflation goal within current settings.

The selloff in commodities has clouded prospects for recoveries in the U.S. and Europe as capital spending from oil producers and miners wanes at the same time as China's economy shows few signs of firming. The raw materials slide has also kept inflation below central-bank targets one week before the Fed is expected to boost borrowing costs for the first time in a decade. This has exacerbated the divergence in monetary policy globally with officials from Europe to Japan still favoring stimulus measures.

The S&P 500 fell 0.7 percent as of 3:42 p.m. in New York, erasing an earlier advance of 0.8 percent. The gauge plunged through its average price for the past 50 days for the first time in two months, while a Goldman Sachs Group Inc. index of stocks with the highest short interest tumbled for a sixth day.

The technology-heavy Nasdaq 100 Index retreated 1.6 percent, as Apple Inc. slid 2.3 percent. Costco Wholesale Corp. sank 5.2 percent, the most in three years, after the largest warehouse-club chain in the U.S. reported below-estimate earnings.

DuPont Co. jumped 11 percent and Dow Chemical Co. rallied 12 percent as people familiar with the matter said a deal could be announced as soon as this week. Raw-materials producers, a group that includes the two chemical companies, rallied 3 percent for the best performance in the S&P 500.

West Texas Intermediate crude fell another 0.9 percent to $37.16 a barrel in New York as investors discounted a decline in U.S. oil inventories. Supplies fell by 3.57 million barrels last week, the U.S. Energy Information Administration reported Wednesday. Stockpiles along the Gulf Coast tumbled 7.3 million barrels, the biggest drop since December 2012.

Oil is still trading near levels last seen during the global financial crisis as Saudi Arabia leads the Organization of Petroleum Exporting Countries in maintaining output and defending market share against higher-cost producers, fueling a record supply glut.

Gold futures fluctuated near $1,076.50 an ounce, while contracts on copper advanced 0.7 percent.

-

21:00

DJIA 17442.19 -125.81 -0.72%, NASDAQ 5005.31 -92.93 -1.82%, S&P 500 2040.90 -22.69 -1.10%

-

18:10

WSE: Session Results

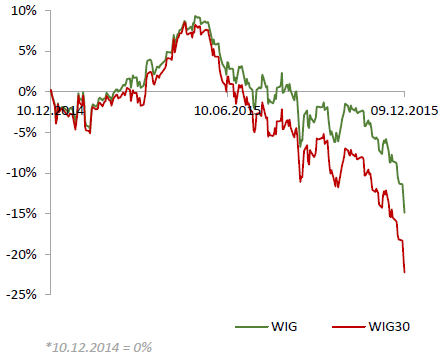

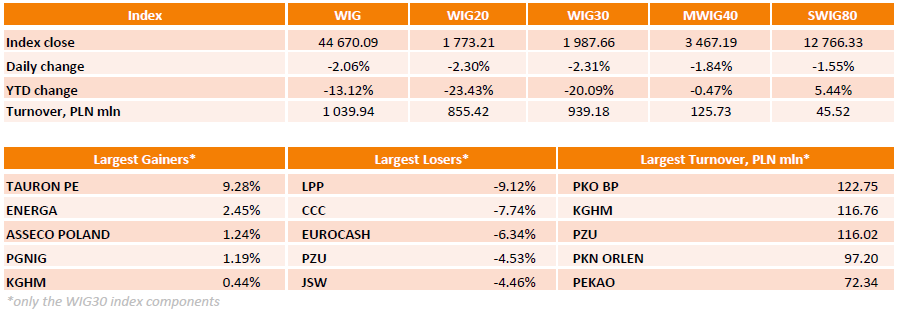

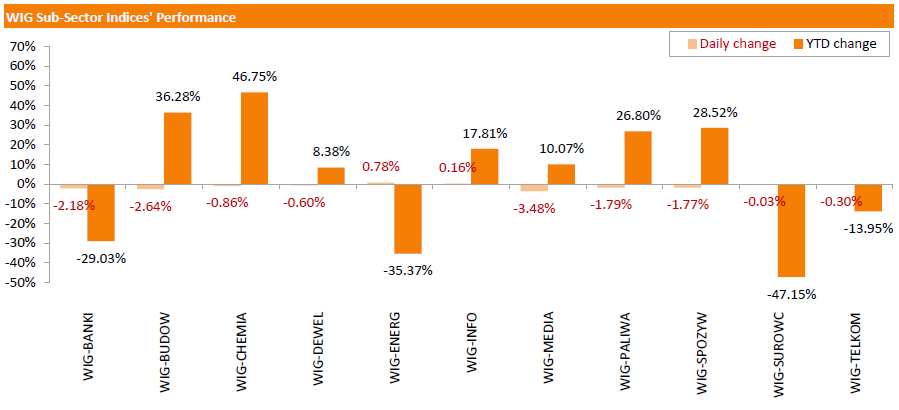

Polish equity market declined on Wednesday. The broad market measure, the WIG Index, slumped by 2.06%. Almost all sectors in the WIG generated negative returns. The exception were utilities (+0.78%) and IT-sector (+0.16%). At the same time, media sector (-3.48%) was the weakest group.

The large-cap stocks fell by 2.31%, as measured by the WIG30 Index. In the index basket, retailers LPP (WSE: LPP) and CCC (WSE: CCC) led the decliners, tumbling by 9.12% and 7.74% respectively on analyst downgrade. They were followed by FMCG wholesaler EUROCASH (WSE: EUR), insurer PZU (WSE: PZU) and coking coal miner JSW (WSE: JSW), plummeting by 6.34%, 4.53% and 4.46% respectively. On the other side of the ledger, genco TAURON PE (WSE: TPE) was the session's best performer, advancing 9.28% after the company's newly-appointed CEO announced intention to review its investment plan and possibly drop some of the projects. Other major gainers were genco ENERGA (WSE: ENG), IT-company ASSECO POLAND (WSE: ACP) and oil and gas producer PGNIG (WSE: PGN), which quotations went up by 2.45%, 1.24% and 1.19% respectively.

-

18:00

European stocks close: stocks closed lower despite the rebound in oil prices

Stock indices closed lower despite the rebound in oil prices on the U.S. crude oil inventories data. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories dropped by 3.57 million barrels to 485.9 million in the week to December 04. It was the first decline since September. Analysts had expected U.S. crude oil inventories to remain unchanged.

The European Central Bank (ECB) Governing Council member Ewald Nowotny said in Vienna on Wednesday that it was the right decision to add further stimulus measures, saying that the economic development was still weak and inflation remains well below 2% target.

Nowotny pointed out that it is analysts fault for market disappointment after the release of the ECB's monetary policy decision.

Meanwhile, the economic data from Germany was weaker than in the previous period. Destatis released its trade data for Germany on Wednesday. Germany's seasonally adjusted trade surplus increased to €20.8 billion in October from 19.2 in September.

Exports fell at a seasonally and calendar-adjusted 1.2% in October, while imports dropped 3.4%.

On a yearly basis, German exports increased 3.3% in October, while imports rose by 3.0%.

Germany's current account surplus was at €23.0 billion in October, down from €25.0 billion in September. September's figure was revised down from a surplus of €25.1 billion.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,126.68 -8.54 -0.14 %

DAX 10,592.49 -81.11 -0.76 %

CAC 40 4,637.45 -44.41 -0.95 %

-

18:00

European stocks closed: FTSE 6126.68 -8.54 -0.14%, DAX 10592.49 -81.11 -0.76%, CAC 40 4637.45 -44.41 -0.95%

-

17:24

Wall Street. Major U.S. stock-indexes mixed

Major U.S. stock-indexes rose on Wednesday as crude oil prices clawed back some of their losses and reported merger talks between Dow Chemical (DOW) and DuPont (DD) helped prop up shares of raw materials companies.

Crude oil prices steadied after a brutal five-day selloff, but many investors expect oil to fall below 2008 lows due to a global supply glut. Copper prices also held their ground.

Dow Chemical (DOW) and DuPont (DD.N) jumped more 10% after reports that the companies are in talks to merge.

Most of Dow stocks in positive area (23 of 30). Top looser - Apple Inc. (AAPL, -1.04%). Top gainer - E. I. du Pont de Nemours and Company (DD, +12.66%).

All S&P index sectors also in positive area. Top gainer - Basic Materials (+3,3%).

At the moment:

Dow 17705.00 +171.00 +0.98%

S&P 500 2072.25 +13.50 +0.66%

Nasdaq 100 4681.00 -6.25 -0.13%

Oil 37.93 +0.42 +1.12%

Gold 1070.30 -5.00 -0.46%

U.S. 10yr 2.26 +0.03

-

16:37

British Chambers of Commerce downgrades its U.K. GDP growth forecasts

The British Chambers of Commerce (BCC) released its U.K. GDP growth forecast on Wednesday. The U.K. economy is expected to grow at 2.4% in 2015, down from the previous forecast of a 2.6% rise, 2.5% in 2016, down from the previous forecast of a 2.7% gain, and 2.5% in 2017, down from the previous forecast of a 2.7% increase.

The downgrade was driven by weaker-than-expected trade and manufacturing activity data.

The BCC noted that the U.K. economy will be supported by the strong activity in the service sector and consumer spending.

"Official data is starting to reflect what our Quarterly Economic Survey has been showing all year - that our persistently weak trade performance and current account balance are impacting our overall growth. Similarly, the manufacturing sector has been hit badly by falling global prospects, tipping an earlier prediction of growth in 2015 to an expected contraction," John Longworth, Director General of the British Chambers of Commerce, said.

"We cannot rely so heavily on consumer spending to fuel our economy, especially when driven by increased borrowing. We have been down this path before, and know that it leaves individuals and businesses exposed when interest rates do eventually rise," he added.

-

16:24

Wholesale inventories in the U.S. falls 0.1% in October

The U.S. Commerce Department released wholesale inventories on Wednesday. Wholesale inventories in the U.S. fell 0.1% in October, missing expectations for a 0.1 gain, after a 0.w% increase in September. September's figure was revised down from a 0.5% rise.

The decline was driven by a fall in inventories of non-durable and durable goods. Inventories of non-durable goods decreased 0.1% in October, while inventories of durable goods fell 0.1%.

Wholesale sales were flat in October, after a 0.5% gain in September.

-

16:02

Ifo institute upgrades its German economic growth for 2016

The Ifo institute upgraded its German economic growth for 2016 on Wednesday. Germany's economy is expected to expand 1.7% this year, 1.9% in 2016, up from the previous estimate of 1.8%, and 1.7% in 2017.

The Ifo institute expects private consumption to remain the main driver.

"The upturn in the German economy is continuing. Private consumption continues to drive the upturn, since the income outlook of private households remains good due to further improvements in the labour market. This effect is compounded by higher, credit-financed government spending on refugees, which is creating a temporary uptick in demand at the expense of future demand," Ifo President Hans-Werner Sinn said.

Inflation is expected to be 0.3% this year, 1.0% in 2016 and 1.5% in 2017.

-

15:34

U.S. Stocks open: Dow -0.10%, Nasdaq -0.38%, S&P -0.24%

-

15:25

Before the bell: S&P futures -0.27%, NASDAQ futures -0.32%

U.S. stock-index futures slipped.

Global Stocks:

Nikkei 19,301.07 -191.53 -0.98%

Hang Seng 21,803.76 -101.37 -0.46%

Shanghai Composite 3,473.1 +3.03 +0.09%

FTSE 6,135.96 +0.74 +0.01%

CAC 4,635.56 -46.30 -0.99%

DAX 10,593.3 -80.30 -0.75%

Crude oil $37.81 (+0.80%)

Gold $1082.00 (+0.62%)

-

15:21

Home loans in Australia fall 0.5% in October

The Australian Bureau of Statistics released its home loans data on Wednesday. Home loans in Australia decreased 0.5% in October, beating expectations for a 1.0% drop, after 2.0% rise in September.

The value of owner occupied loans rose at a seasonally adjusted 0.1% in October, investment lending dropped 6.1%, while the number of loans for the construction of dwellings fell 0.4%.

-

14:57

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

E. I. du Pont de Nemours and Co

DD

72.50

8.86%

495.5K

Yahoo! Inc., NASDAQ

YHOO

35.50

1.87%

241.8K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

6.85

1.63%

130.2K

Barrick Gold Corporation, NYSE

ABX

7.62

1.33%

15.0K

ALCOA INC.

AA

8.63

1.29%

38.3K

Intel Corp

INTC

34.90

0.43%

23.5K

AT&T Inc

T

33.96

0.32%

1.3K

Tesla Motors, Inc., NASDAQ

TSLA

227.29

0.25%

1.6K

Chevron Corp

CVX

86.65

0.24%

0.8K

Exxon Mobil Corp

XOM

74.75

0.16%

4.7K

ALTRIA GROUP INC.

MO

58.30

0.12%

1.9K

Walt Disney Co

DIS

112.60

0.11%

4.8K

Amazon.com Inc., NASDAQ

AMZN

678.01

0.10%

9.9K

Facebook, Inc.

FB

106.60

0.10%

61.6K

Hewlett-Packard Co.

HPQ

12.20

0.08%

3.1K

Yandex N.V., NASDAQ

YNDX

15.07

0.07%

6.0K

Merck & Co Inc

MRK

53.50

0.06%

0.3K

General Motors Company, NYSE

GM

35.50

0.06%

0.1K

HONEYWELL INTERNATIONAL INC.

HON

102.66

0.00%

0.2K

Pfizer Inc

PFE

32.52

-0.03%

0.1K

Goldman Sachs

GS

182.81

-0.06%

0.1K

FedEx Corporation, NYSE

FDX

148.30

-0.06%

0.1K

Citigroup Inc., NYSE

C

53.35

-0.07%

2.4K

Ford Motor Co.

F

13.96

-0.07%

4.5K

Boeing Co

BA

144.85

-0.10%

0.4K

General Electric Co

GE

30.16

-0.10%

30.1K

3M Co

MMM

156.56

-0.15%

0.3K

Twitter, Inc., NYSE

TWTR

24.95

-0.16%

10.9K

JPMorgan Chase and Co

JPM

65.85

-0.17%

0.7K

Wal-Mart Stores Inc

WMT

59.50

-0.18%

2.5K

Verizon Communications Inc

VZ

45.60

-0.22%

0.3K

American Express Co

AXP

69.75

-0.23%

0.1K

Home Depot Inc

HD

133.46

-0.28%

1.9K

Apple Inc.

AAPL

117.89

-0.29%

49.0K

Procter & Gamble Co

PG

77.51

-0.31%

1.2K

Microsoft Corp

MSFT

55.60

-0.34%

6.1K

Starbucks Corporation, NASDAQ

SBUX

61.92

-0.39%

5.4K

Visa

V

78.75

-0.40%

0.1K

Johnson & Johnson

JNJ

102.00

-0.41%

0.8K

Nike

NKE

131.01

-0.52%

1.8K

United Technologies Corp

UTX

93.70

-0.56%

7.0K

International Business Machines Co...

IBM

137.25

-0.58%

1.5K

Caterpillar Inc

CAT

66.00

-0.81%

20.4K

-

14:52

Upgrades and downgrades before the market open

Upgrades:

Intel (INTC) upgraded to Buy from Neutral at Nomura

Downgrades:

Other:

Yahoo! (YHOO) target raised to $44 from $39 at FBR Capital

Amazon (AMZN) target raised to $850 from $700 at Nomura

-

14:38

European Central Bank Governing Council member Ewald Nowotny: it was the right decision to add further stimulus measures

The European Central Bank (ECB) Governing Council member Ewald Nowotny said in Vienna on Wednesday that it was the right decision to add further stimulus measures, saying that the economic development was still weak and inflation remains well below 2% target.

Nowotny pointed out that it is analysts fault for market disappointment after the release of the ECB's monetary policy decision.

"I think it was really a massive failure of market analysts. I do not think that the communication policy of the ECB sent the wrong signal," he said.

-

14:21

Core machinery orders in Japan jump 10.7% in October

Japan's Cabinet Office released its core machinery orders data on late Tuesday evening. Core machinery orders in Japan jumped 10.7% in October, beating expectations for a 1.5% fall, after a 7.5% rise in September.

On a yearly basis, core machinery orders climbed 10.3% in October, beating expectations for a 1.4% increase, after a 1.7% drop in September.

This data indicates that capital spending in Japan improved, and it could mean that the Bank of Japan may not expand its quantitative easing.

The total number of machinery orders soared 20.9% in October from a month earlier.

Orders from non-manufacturers jumped 10.7% in October, while orders from manufacturers were up 14.5%.

-

12:00

European stock markets mid session: stocks traded lower as commodity shares fell

Stock indices traded lower as commodity shares fell.

Meanwhile, the economic data from Germany was weaker than in the previous period. Destatis released its trade data for Germany on Wednesday. Germany's seasonally adjusted trade surplus increased to €20.8 billion in October from 19.2 in September.

Exports fell at a seasonally and calendar-adjusted 1.2% in October, while imports dropped 3.4%.

On a yearly basis, German exports increased 3.3% in October, while imports rose by 3.0%.

Germany's current account surplus was at €23.0 billion in October, down from €25.0 billion in September. September's figure was revised down from a surplus of €25.1 billion.

Current figures:

Name Price Change Change %

FTSE 100 6,117.75 -17.47 -0.28 %

DAX 10,607.38 -66.22 -0.62 %

CAC 40 4,647.13 -34.73 -0.74 %

-

11:45

Westpac’ consumer confidence index for Australia declines 0.8% in November

Westpac Bank released its consumer confidence index for Australia on late Tuesday evening. The index fell 0.8% in December, after a 3.9% gain in November.

The index was mainly driven by a drop in a future economic conditions (next 5 years) sub-index.

"The Index has held on to most of the gains from last month's surprise 4% lift and is 10.7% above its levels this time last year. There have only been two months since January 2014 with higher index readings," Westpac Chief Economist Bill Evans said.

"The Reserve Bank Board next meets on February 2. We expect the Board will decide to hold rates steady pending further evidence on the labour market; commodity prices; the Australian dollar; and inflation. Westpac has long held the view that the RBA will be on hold throughout 2016 with the risk to any move being clearly to the downside," he noted.

-

11:32

Swiss unemployment rate remains unchanged at a seasonally adjusted 3.4% in November

The Swiss State Secretariat for Economic Affairs released its unemployment data for Switzerland on Wednesday. The Swiss unemployment rate remained at a seasonally adjusted 3.4% in November.

On a seasonally unadjusted basis, the unemployment rate in Switzerland increased to 3.4 in November from 3.3% in October. Analysts had expected the unemployment rate to remain unchanged at 3.3%.

The number of unemployed people in Switzerland rose by 6,874 to 148,143 in November from a month earlier.

The youth unemployment rate was down to 3.3% in November from 3.5% in October.

-

11:22

Germany’s labour costs per hour worked are flat in the third quarter

The German statistical office Destatis relased its labour costs data for the third quarter on Wednesday. Labour costs per hour worked were flat in the third quarter on a seasonally and calendar adjusted basis, after a 0.6% increase in the second quarter.

On a yearly basis, labour costs per hour worked increased 2.4% in the third quarter on a calendar adjusted basis, after a 3.0% gain in the second quarter.

The costs of gross earnings climbed a calendar adjusted 2.3% year-on-year in the third quarter, while non-wage costs were up 2.5%.

-

10:58

Germany's seasonally adjusted trade surplus increases to €20.8 billion in October

Destatis released its trade data for Germany on Wednesday. Germany's seasonally adjusted trade surplus increased to €20.8 billion in October from 19.2 in September.

Exports fell at a seasonally and calendar-adjusted 1.2% in October, while imports dropped 3.4%.

On a yearly basis, German exports increased 3.3% in October, while imports rose by 3.0%.

Germany's current account surplus was at €23.0 billion in October, down from €25.0 billion in September. September's figure was revised down from a surplus of €25.1 billion.

-

10:43

Chinese consumer price index rises at annual rate of 1.5% in November

The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Wednesday. The Chinese consumer price index (CPI) rose at annual rate of 1.5% in November, exceeding expectations for a 1.4% increase, after a 1.3% gain in October.

Food prices rose at an annual rate of 2.3% in November, while non-food prices increased 1.1%.

On a monthly basis, consumer price inflation was flat in November, after a 0.3% fall in October.

The Chinese producer price index (PPI) dropped 5.9% in November, in line with expectations, after a 5.9% decline in October.

-

10:21

Bank of Canada Governor Stephen Poloz: the Canadian economy will continue to recover in 2016

The Bank of Canada (BoC) Governor Stephen Poloz said in a speech on Tuesday that the Canadian economy will continue to recover in 2016.

""I think we've got all the ingredients of a recovery in place. It's being masked right now, to some degree, by the declines especially in the energy sector, but also in other resource areas," he said.

Poloz pointed out that the BoC could use negative interest rates in the event of a crisis.

"We don't need unconventional policies now, and we don't expect to use them. However, it's prudent to be prepared for every eventuality," the BoC governor noted.

"Regardless of the situation, the Bank will keep its primary focus on achieving the inflation target," he added.

-

07:18

Global Stocks: U.S. stock indices fell

U.S. stock indices fell on Tuesday. Oil prices have stabilized, but remained close to a seven-month low. Weak trade data from China intensified concerns about the global economy.

The Dow Jones Industrial Average fell 162.51 points, or 0.9%, to 17,568.00. The S&P 500 lost 13.48 points, or 0.7%, to 2,063.59 (its materials and energy sectors fell 1.9% and 1.5% respectively). The Nasdaq Composite declined 3.57 points, or less than 0.1% to 5,098.24.

The National Federation of Independent Business reported that small business confidence declined in the U.S. in November amid concerns over sales and profit growth. The corresponding index fell to 94.8 in November against 96.1 in October. The expectations for higher sales declined to -1.0% from 4.0% in October, and economy outlook came in at -7.0% compared to -4.0%.

Meanwhile the index of economic optimism in the U.S. calculated by Investor's Business Daily and TechnoMetrica Institute of Policy and Politics climbed to 47.2 in December from 45.5 in November. The latest reading is 0.7 point below the twelve-month average. A reading above 50 suggests optimism, while a reading below 50 points to pessimism.

This morning in Asia Hong Kong Hang Seng fell 0.43%, or 93.60, to 21,811.53. China Shanghai Composite Index climbed 0.19%, or 6.68, to 3.476.75. The Nikkei fell 1.09%, or 213.00, to 19,279.60.

Asian indices mostly retreated following declines in U.S. markets. Low oil prices also weighed on stocks.

The National Bureau of Statistics of China reported that the consumer price index rose by 1.5% y/y in November compared to +1.3% in October. Analysts had expected prices to grow by 1.4% y/y. The index gained mostly due to higher food prices. Faster price growth in China suggests that the government's actions start to influence the economy.

Meanwhile the producer price index fell by 5.9% y/y in November. The index has been falling for over three years.

-

03:03

Nikkei 225 19,413.64 -78.96 -0.41 %, Hang Seng 21,827.13 -78.00 -0.36 %, Shanghai Composite 3,462.09 -7.98 -0.23 %

-

01:04

Stocks. Daily history for Sep Dec 8’2015:

(index / closing price / change items /% change)

Nikkei 225 19,492.6 -205.55 -1.04 %

Hang Seng 21,905.13 -298.09 -1.34 %

Shanghai Composite 3,470.19 -66.74 -1.89 %

FTSE 100 6,135.22 -88.30 -1.42 %

CAC 40 4,681.86 -74.55 -1.57 %

Xetra DAX 10,673.6 -212.49 -1.95 %

S&P 500 2,063.59 -13.48 -0.65 %

NASDAQ Composite 5,098.24 -3.57 -0.07 %

Dow Jones 17,568 -162.51 -0.92 %

-