Noticias del mercado

-

17:47

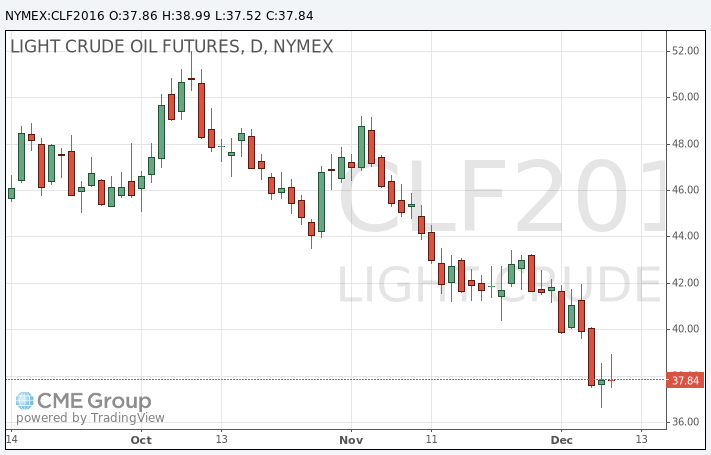

Oil prices rise on the U.S. crude oil inventories data

Oil prices rose on the U.S. crude oil inventories data. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories dropped by 3.57 million barrels to 485.9 million in the week to December 04. It was the first decline since September.

Analysts had expected U.S. crude oil inventories to remain unchanged.

Gasoline inventories increased by 786,000 barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, climbed by 423,000 million barrels.

U.S. crude oil imports increased by 274,000 barrels per day.

Refineries in the U.S. were running at 93.1% of capacity, down from 94.5% the previous week.

WTI crude oil for January delivery rose to $38.99 a barrel on the New York Mercantile Exchange.

Brent crude oil for January climbed to $41.49 a barrel on ICE Futures Europe.

-

17:32

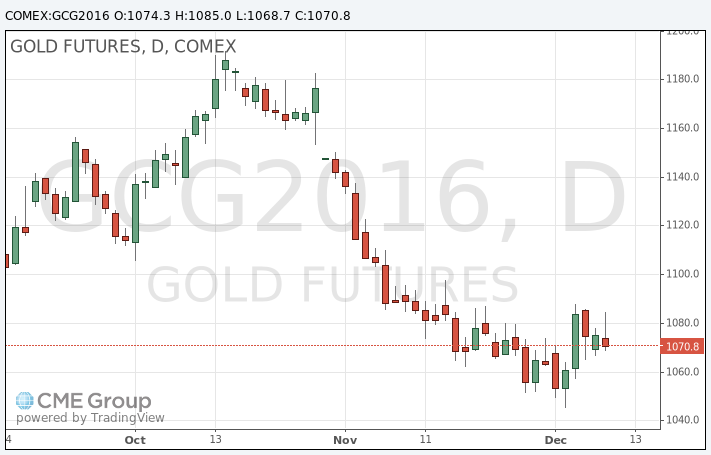

Gold price falls in the absence of key drivers

Gold price fell after an increase earlier on a weaker U.S. dollar.

Market participants are awaiting the Fed's monetary policy meeting next week. They speculate that the Fed will start raising its interest rate this month.

Gold is traded in U.S. dollars. It suffers when the U.S. dollar strengthens, becoming more expensive for holders of other currencies.

February futures for gold on the COMEX today declined to 1068.70 dollars per ounce.

-

16:45

U.S. crude inventories decline by 3.57 million barrels to 485.9 million in the week to December 04

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories dropped by 3.57 million barrels to 485.9 million in the week to December 04. It was the first decline since September.

Analysts had expected U.S. crude oil inventories to remain unchanged.

Gasoline inventories increased by 786,000 barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, climbed by 423,000 million barrels.

U.S. crude oil imports increased by 274,000 barrels per day.

Refineries in the U.S. were running at 93.1% of capacity, down from 94.5% the previous week.

-

10:43

Chinese consumer price index rises at annual rate of 1.5% in November

The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Wednesday. The Chinese consumer price index (CPI) rose at annual rate of 1.5% in November, exceeding expectations for a 1.4% increase, after a 1.3% gain in October.

Food prices rose at an annual rate of 2.3% in November, while non-food prices increased 1.1%.

On a monthly basis, consumer price inflation was flat in November, after a 0.3% fall in October.

The Chinese producer price index (PPI) dropped 5.9% in November, in line with expectations, after a 5.9% decline in October.

-

10:34

The U.S. Energy Information Administration: oil output in the U.S. fell by 60,000 barrels per day in November

According to data from the U.S. Energy Information Administration (EIA), oil output in the U.S. fell by 60,000 barrels per day (bpd) in November to 9.17 million bpd. The decline in oil production was driven by a drop in the number of rigs.

The EIA expects the U.S. oil output to be 9.33 million bpd in 2015 and 8.76 million bpd in 2016.

-

10:11

Fitch Ratings expects Brent crude to be about $55 in 2016 and $65 a barrel in 2017

Fitch Ratings released its oil price forecasts on Tuesday. The agency expects Brent crude to be about $55 in 2016 and $65 a barrel in 2017.

Fitch noted that low prices will continue to weigh on the sovereign credit ratings of major exporters in 2016.

"Vulnerability varies but the impact could be felt through negative sovereign rating actions," the agency noted.

-

08:12

Oil prices advanced

West Texas Intermediate futures for January delivery advanced to $38.25 (+1.97%), while Brent crude rose to $40.85 (+1.47%).

WTI prices were supported by an unexpected 1.9-million-barrel fall in U.S. crude inventories as estimated by industry group the American Petroleum Institute. Analysts had expected a gain of 252,000 barrels. The Energy Information Administration will release official data later today. Meanwhile analysts said that Brent prices rose mostly due to short-covering, but fundamentals remained bearish (sluggish demand, ample supplies and a strong dollar).

-

07:36

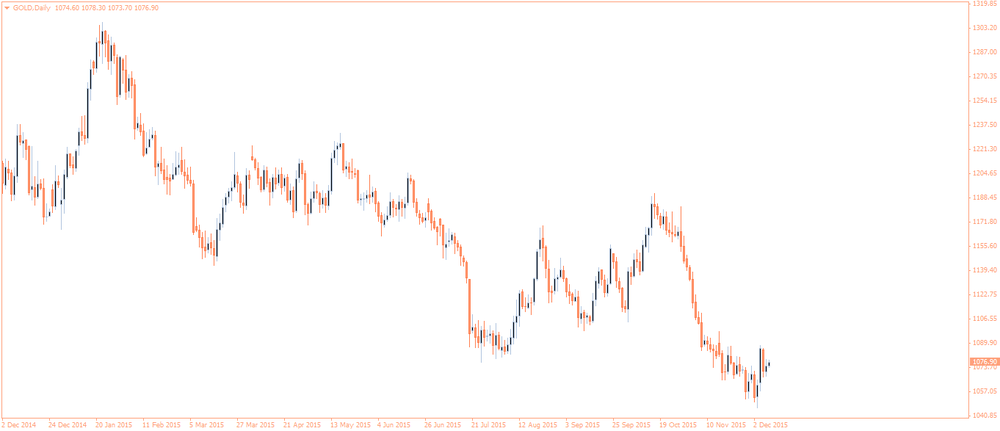

Gold slightly higher

Gold is currently at $1,076.20 (+0.08%) amid a softer dollar. Nevertheless investors are preparing for the looming Federal Open Markets Committee meeting on December 15-16. The central bank of the U.S. is widely expected to raise rates at this meeting. Higher rates increase the opportunity cost of holding the non-interest paying precious metal and reduce demand for it. That's why bullion's gains are limited

Generally weak commodity prices, particularly crude oil, weigh on gold as well.

-

01:04

Commodities. Daily history for Dec 8’2015:

(raw materials / closing price /% change)

Oil 37.85 +0.91%

Gold 1,074.10 -0.11%

-