Noticias del mercado

-

17:41

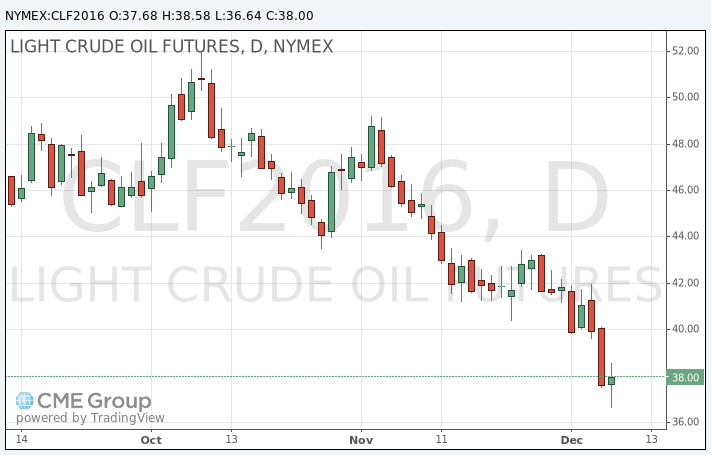

Oil prices rise after hitting 7-year lows on concerns over the global oil oversupply

Oil prices pared some losses after hitting 7-year lows on concerns over the global oil oversupply.

Market participants are awaiting the release of U.S. crude oil inventories data. The American Petroleum Institute (API) is scheduled to release its U.S. oil inventories data later in the day, and U.S. oil inventories data from the U.S. Energy Information Administration is expected on Wednesday.

The weaker-than-expected Chinese economic data also weighed on oil prices. The Chinese Customs Office released its trade data on Tuesday. China's trade surplus fell to $54.1 billion in November from $61.64 billion in October, missing expectations for a rise to a surplus of $63.3 billion. Exports fell at an annual rate of 6.8% in November, while imports slid at an annual rate of 8.7%, the thirteenth consecutive decline.

WTI crude oil for January delivery rose to $38.58 a barrel on the New York Mercantile Exchange.

Brent crude oil for January climbed to $41.27 a barrel on ICE Futures Europe.

-

17:25

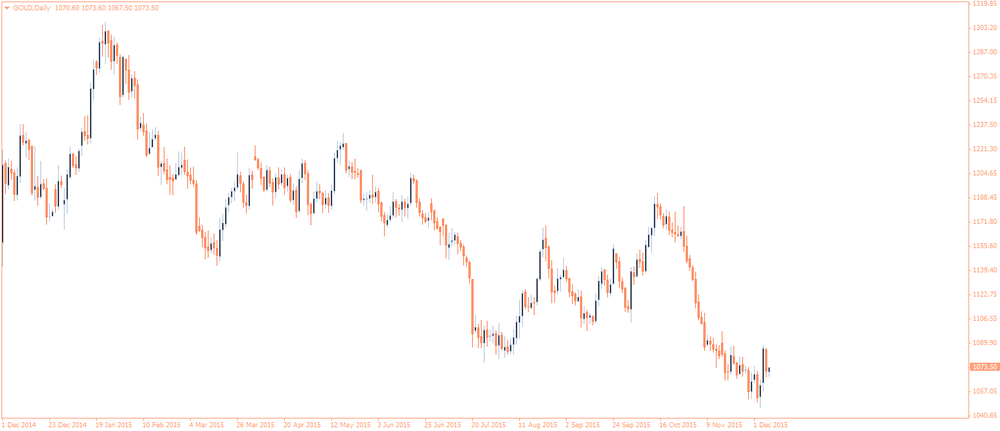

Gold price rises as market participants are awaiting the Fed’s meeting next week

Gold price increased as market participants are awaiting the Fed's monetary policy meeting next week. Market participants speculate that the Fed will start raising its interest rate this month.

Gold is traded in U.S. dollars. It suffers when the U.S. dollar strengthens, becoming more expensive for holders of other currencies.

February futures for gold on the COMEX today rose to 1078.40 dollars per ounce.

-

12:07

China's trade surplus declines to $54.1 billion in November

The Chinese Customs Office released its trade data on Tuesday. China's trade surplus fell to $54.1 billion in November from $61.64 billion in October, missing expectations for a rise to a surplus of $63.3 billion.

Exports fell at an annual rate of 6.8% in November, while imports slid at an annual rate of 8.7%, the thirteenth consecutive decline.

-

08:16

Oil dropped after OPEC meeting

West Texas Intermediate futures for January delivery is currently at $37.70 (+0.13%), while Brent crude is at $40.94 (+0.52%). Prices climbed slightly after heavy losses in the previous session, but remained under pressure amid persistent global supply glut. Concerns over excessive supplies rose after OPEC failed to come up with a plan to support prices at the cartel's meeting on December 4. OPEC was expected to stick to its current strategy and maintain output; however both types of crude still fell as investors prepared for a longer period of low prices.

Investors are waiting for the upcoming Federal Reserve meeting scheduled for December 15-16. Strong jobs data released on Friday intensified expectations for a rate hike in the U.S. Higher rates would boost the dollar and make the dollar-denominated commodity more expensive for customers using other currencies. This could suggest softer prices.

-

07:45

Gold retreated

Gold is currently at $1,072.00 (-0.30%). Bullion gave up Friday's gains as investors prepared for the looming Federal Open Market Committee meeting on December 15-16. The central bank of the U.S. is widely expected to raise rates at this meeting. Higher rates increase the opportunity cost of holding the non-interest paying precious metal and reduce demand for it.

The People's Bank of China added 20.8 tonnes of gold to its reserves in November. However these purchases failed to support prices.

-

00:30

Commodities. Daily history for Dec 7’2015:

(raw materials / closing price /% change)

Oil 37.63 -0.05%

Gold 1,070.70 -0.42%

-