Noticias del mercado

-

17:46

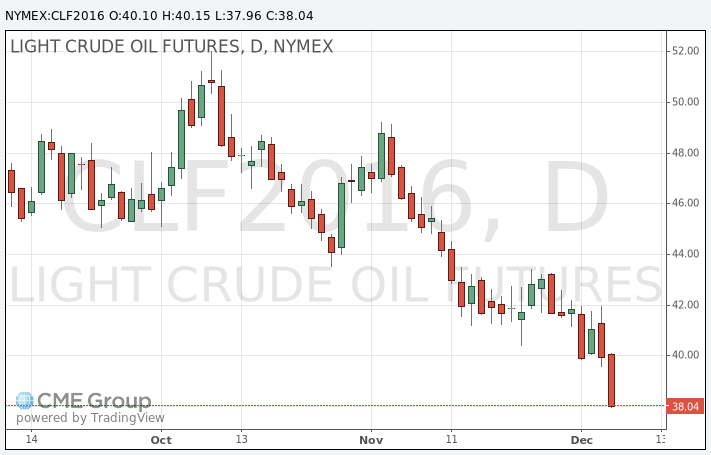

Oil prices decline on the results of the OPEC’s meeting

Oil prices dropped on the results of the Organization of Petroleum-Exporting Countries' (OPEC) meeting. The meeting ended without any agreement to cut oil output on Friday. OPEC President Emmanuel Ibe Kachikwu, Nigeria's Minister of State for Petroleum Resources, said on Friday that the OPEC decided to keep its output limit unchanged and to monitor closely market developments in the coming months.

OPEC Secretary-General Abdalla El-Badri said on Friday that the OPEC postponed its decision until the next OPEC meeting, which is scheduled to be on June 02, 2016.

OPEC's oil output is about 31.5 million barrels a day.

Market participants also eyed the rig count data. Oil driller Baker Hughes said on Monday that the international rig count for November 2015 fell to 1,109 from 1,111 in October 2015.

The average U.S. rig number for November 2015 declined to 760 from the 791 in October 2015.

The worldwide rig count for November 2015 decreased to 2,047 from the 2,086 in October 2015.

WTI crude oil for January delivery fell to $37.91 a barrel on the New York Mercantile Exchange.

Brent crude oil for January declined to $41.46 a barrel on ICE Futures Europe.

-

17:20

Gold price declines on the U.S. labour market data

Gold price declined on Friday's better-than-expected labour market data from the U.S. According to the U.S. Labor Department, the U.S. economy added 211,000 jobs in November, exceeding expectations for a rise of 200,000 jobs, after a gain of 298,000 jobs in October. October's figure was revised up from a rise of 271,000 jobs. The U.S. unemployment rate remained unchanged at 5.0% in November, in line with expectations.

The U.S. data added to speculation that the Fed will start raising its interest rate this month.

February futures for gold on the COMEX today fell to 1073.10 dollars per ounce.

-

14:17

Baker Hughes: the international rig count declines to 1,109 in November

Oil driller Baker Hughes said on Monday that the international rig count for November 2015 fell to 1,109 from 1,111 in October 2015.

The average U.S. rig number for November 2015 declined to 760 from the 791 in October 2015.

The worldwide rig count for November 2015 decreased to 2,047 from the 2,086 in October 2015.

-

10:50

OPEC’s meeting end without any agreement to cut oil output

The Organization of the Petroleum Exporting Countries' (OPEC) on Friday ended without any agreement to cut oil output. OPEC President Emmanuel Ibe Kachikwu, Nigeria's Minister of State for Petroleum Resources, said on Friday that the OPEC decided to keep its output limit unchanged and to monitor closely market developments in the coming months.

OPEC Secretary-General Abdalla El-Badri said on Friday that the OPEC postponed its decision until the next OPEC meeting, which is scheduled to be on June 02, 2016.

OPEC's oil output is about 31.5 million barrels a day.

-

10:12

The number of active U.S. rigs falls by 10 rigs to 545 last week

The oil driller Baker Hughes reported on Friday that the number of active U.S. rigs declined by 10 rigs to 545 this week. It was the lowest level since June 4, 2010.

The gas rig count increased by 3 to 292.

Combined oil and gas rigs declined by 7 to 737.

-

07:55

Oil dropped after OPEC meeting

West Texas Intermediate futures for January delivery fell to $39.61 (-0.90%), while Brent crude declined to $42.76 (-0.56%) after OPEC, led by Saudi Arabia, decided to maintain high output levels despite falling prices and calls for a cut from poorer member countries including Venezuela, Ecuador and Algeria.

Now investors are focused on the upcoming Federal Reserve meeting scheduled for December 15-16. Strong jobs data released on Friday intensified expectations for a rate hike in the U.S. Meanwhile data on China's economy due this week are likely to drive prices in the near-term.

-

07:24

Gold near three-week high

Gold is currently at $1,084.90 (+0.07%) after jumping to a three-week high on short-covering in the previous session amid strong U.S. jobs data.

The U.S. Department of Labor reported on Friday that the U.S. economy created 211,000 jobs in November compared to expectations for a 200,000 gain. The unemployment rate remained at 5% in line with expectations. The Federal Reserve is now widely expected to raise interest rates later this month.

Normally a strong payrolls report would have weighed on bullion, however last Friday investors covered their short positions preparing for better investment opportunities.

-

00:33

Commodities. Daily history for Dec 4’2015:

(raw materials / closing price /% change)

Oil 40.14 +0.43%

Gold 1,085.80 +0.16%

-