Noticias del mercado

-

22:20

U.S. stocks closed

U.S. stocks retreated as tumbling oil prices weighed on energy and raw-material companies, sparking a selloff after equities posted their biggest one-day gain in three months.

The S&P 500 fell 0.7 percent to 2,077.15 at 4 p.m. in New York, trimming an earlier drop of as much as 1.2 percent, after jumping 2.1 percent on Friday.

Crude prices extended losses after falling 2.7 percent Friday amid speculation a record global glut will be prolonged as the Organization of Petroleum Exporting Countries effectively abandoned its long-time strategy of limiting production to control prices. West Texas Intermediate futures fell 5.8 percent Monday to $37.65 a barrel, the lowest close since February 2009.

Oil's plunge of more than 40 percent in the past year has hampered recoveries in the U.S. and Europe as capital spending has waned and inflation has remained below central-bank targets.

U.S. stocks are coming off their most volatile week since the summer as investors were faced with releases from the Labor Department, the European Central Bank and speeches by Federal Reserve Chair Janet Yellen. The S&P 500's rally on Friday left it little changed for a second straight week after a report showed U.S. employers added more jobs than forecast in November, increasing speculation that the economy is strong enough to withstand higher borrowing costs -- something that Yellen has signaled.

Rate Bets

Traders are pricing in a 78 percent chance of liftoff before the Fed's interest-rate decision on Dec. 16. Investors will have little data this week to assess the strength of the economy. Reports on retail sales, a measure of producer prices and the University of Michigan's preliminary consumer sentiment index are due, though not until the end of the week.

The selloff in equities today extended a stretch of whipsaw trading to a fifth day. The main U.S. equity index moved at least 1 percent in the previous four days, the longest stretch since August, kicking off what is usually the second-best month of the year. The S&P 500 has not had back-to-back gains in more than a month.

-

21:00

DJIA 17680.14 -167.49 -0.94%, NASDAQ 5086.46 -55.81 -1.09%, S&P 500 2070.23 -21.46 -1.03%

-

18:08

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes started the week in the red as energy and raw material stocks took a hit, with oil prices falling to their lowest in nearly seven years.

Brent crude prices dropped to $41.14 and U.S. WTI fell to $38.00 a barrel, after OPEC's meeting ended last week without a reference to its output ceiling. The impact of the fall in oil prices offset some of Friday's gains that were triggered by a strong jobs report. The solid November employment report showed that the economy was strong enough to absorb an interest rate hike, which is widely expected to be raised when the Federal Reserve meets on Dec 15-16.

Most of Dow stocks in negative area (24 of 30). Top looser - Chevron Corporation (CVX, -3.87%). Top gainer - Wal-Mart Stores Inc. (WMT. +1.20%).

All S&P index sectors in negative area. Top looser - Basic Materials (-4.4%).

At the moment:

Dow 17695.00 -124.00 -0.70%

S&P 500 2072.75 -15.75 -0.75%

Nasdaq 100 4691.25 -22.00 -0.47%

Oil 38.04 -1.93 -4.83%

Gold 1075.70 -8.40 -0.77%

U.S. 10yr 2.21 -0.06

-

18:01

WSE: Session Results

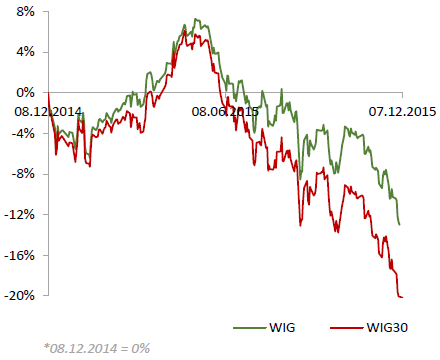

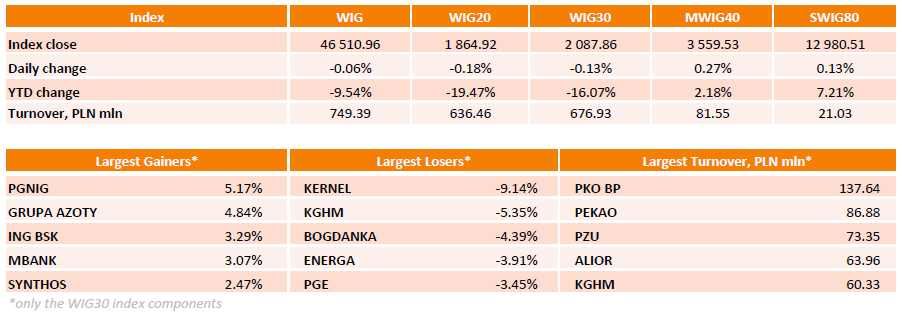

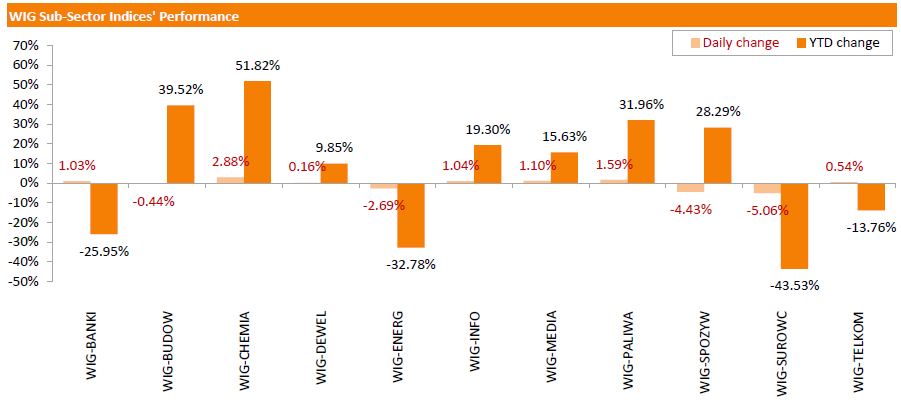

Polish equity market closed flat on Monday. The broad market benchmark, the WIG Index, inched down 0.06%. Sector-wise, materials (-5.06%) fared the worst, while chemicals (+2.88%) outperformed.

The large-cap stocks' measure, the WIG30 Index, fell by 0.13%. Within the WIG30 Index components, Ukrainian agri name KERNEL (WSE: KER) was hit the hardest, tumbling by 9.14% on the back of the news that Ukraine's Finance Ministry proposed in a new tax code to cancel the special regime for value added tax for agricultural producers and transfer all farms with an annual income of UAH 2 mln to the general taxation system. Other biggest laggards included copper producer KGHM (WSE: KGH), coal miner BOGDANKA (WSE: LWB) and two gencos ENERGA (WSE: ENG) and PGE (WSE: PGE), plunging by 3.45%-5.34%. On the other side of the ledger, oil and gas company PGNIG (WSE: PGN) and chemical producer GRUPA AZOTY (WSE: ATT) recorded the strongest daily performance, gaining 5.17% and 4.84% respectively. They were followed by banking sector names ING BSK (WSE: ING) and MBANK (WSE: MBK), advancing by 3.29% and 3.07% respectively.

-

18:01

European stocks closed: FTSE 6223.52 -14.77 -0.24%, DAX 10886.09 133.99 1.25%, CAC 40 4756.41 41.62 0.88%

-

18:00

European stocks close: stocks closed mixed as oil prices dropped

Stock indices closed mixed as oil prices dropped. Oil prices fell on the results of the Organization of Petroleum-Exporting Countries' (OPEC) meeting. The meeting ended without any agreement to cut oil output on Friday. OPEC President Emmanuel Ibe Kachikwu, Nigeria's Minister of State for Petroleum Resources, said on Friday that the OPEC decided to keep its output limit unchanged and to monitor closely market developments in the coming months.

Meanwhile, the economic data from Eurozone was positive. Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index climbed to 15.7 in December from 15.1 in November.

A reading above 0.0 indicates optimism, below indicates pessimism.

"The Eurozone outperforms other world regions as the effects of ECB's policy measures kick in. The remaining world regions depict signs of a slowdown. Japan slides back into recession. In contrast to Fed's interpretations of the state of the economy, the sentix indicator for the US economy highlights a contrary view amid the preparations for the first rate rise," Sentix said in its statement.

German investor confidence index increased to 22.7 in December from 20.1 in November.

Destatis released its industrial production data for Germany on Wednesday. German industrial production increased 0.2% in October, missing expectations for a 0.7% gain, after a 1.1% fall in September.

The output of capital goods increased 2.7% in October, energy output slid 5.9%, and the production in the construction sector was up 0.7%, while the production of intermediate goods dropped 1.1%.

The output of consumer goods decreased 0.1%.

German industrial production excluding energy and construction rose by 0.7% in October.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,223.52 -14.77 -0.24 %

DAX 10,886.09 +133.99 +1.25 %

CAC 40 4,756.41 +41.62 +0.88 %

-

17:31

Fitch Ratings’ Global Economic Outlook: there will be no global recession

Fitch Ratings released its Global Economic Outlook on Monday. The agency expects the global economy to expand 2.3% in 2015, 2.6% in 2016 and 2.7% in 2017. The growth in 2015 would be the weakest growth since the global financial crisis in 2009.

Fitch said that the slowdown in emerging economies weighed on the global economy "but look unlikely to spark a global recession".

"While the global growth concerns of the late summer have not gone away, emerging-market problems do not appear to be causing extreme damage to activity in the major advanced economies. China looks most likely to muddle through rather than land hard and world trade indicators have improved marginally. Policy stimulus has been stepped up in the Eurozone and China and global consumer spending growth is holding up," the agency noted.

Fitch also said that the Fed is likely to hike its interest rate this month and to raise it four times before the end of 2016.

The Bank of Japan could add further stimulus measures, according to Fitch.

-

17:13

China’s foreign-exchange reserves drop to the lowest level since February 2013

According to data released by the People's Bank of China (PBoC) on Monday, China's foreign-exchange reserves declined by $87.2 billion to $3.44 trillion in November, after a rise by $11.39 billion in October. It was the lowest level since February 2013.

It is likely that capital outflows from China continued.

The central bank also sold the U.S. dollar to support the yuan.

-

17:01

The European Central Bank will change the publication time of the euro foreign exchange reference rates

The European Central Bank (ECB) said in a statement on its website on Monday that it will change the publication time of the euro foreign exchange reference rates (ECB reference rates). ECB reference rates will be published at around 15:00 GMT.

New publication time would be effective from July 01, 2016.

The current publication time of ECB reference rates is around 13:30 GMT.

-

16:53

European Central Bank purchases €62.6 billion of public and private debt in November

The European Central Bank (ECB) purchased €62.6 billion of public and private debt under its quantitative-easing program in November, compared to €63.7 billion in October.

The ECB bought €55.1 billion of government and agency bonds in November, €6.9 billion of covered bonds, and €0.6 billion of asset-backed securities.

The ECB kept its interest rate unchanged at 0.05% on Thursday, but lowered its deposit rate to -0.3% from -0.2%. The asset-buying programme will be extended until the end of March 2017. The volume of the monthly purchases remained unchanged.

The ECB will pause its asset-buying programme between December 22 and January 1. The central bank will resume its purchases on January 04.

The central purchased €16.46 billion of government and agency bonds, €2.1 billion of covered bonds, and €0.15 billion of asset-backed securities last week.

-

16:34

U.K. manufacturers' association EEF lowers its manufacturing growth forecasts

The U.K. manufacturers' association EEF lowered its manufacturing growth forecasts on Monday. The manufacturing sector in the U.K. is expected to drop 0.1% in 2015 and to rise 0.8% in 2016.

The EEF expects the U.K. economy to expand 2.4% in 2015 and 2.1% in 2016.

The EEF said that output balance has reached the lowest level since the third quarter of 2009, while employment and investment balances were negative for the first time since the first quarter of 2010.

"The prospect of manufacturing contributing to growth in the UK economy this year has all but faded away with another disappointing set of indicators from our survey. The downbeat mood may not be universal across all industry sectors, but it certainly seems to be spreading as the challenges have mounted through this year - from the collapse in the oil price, slower world trade growth and weaker than expected construction activity," EEF Chief Economist, Lee Hopley, said.

-

16:15

Japan's leading index rises to 102.9 in October

Japan's Cabinet Office released its preliminary leading index data on Monday. The leading index increased to 102.9 in October from 101.6 in September.

Japan's coincident index was up to 114.3 in October from 112.3 in September. It was the highest level since January.

-

15:49

Bank of Japan Governor Haruhiko Kuroda: there is no need for the implementation of negative deposit rates in Japan

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said on Monday that there is no need for the implementation of negative deposit rates in Japan.

"Our QQE has had an intended impact on the economy and financial markets," he said.

"We don't think we should implement negative deposit interest rates," Kuroda said.

-

15:33

U.S. Stocks open: Dow -0.36%, Nasdaq -0.17%, S&P -0.33%

-

15:11

Before the bell: S&P futures -0.20%, NASDAQ futures -0.02%

U.S. stock-index futures declined.

Global Stocks:

Nikkei 19,698.15 +193.67 +0.99%

Hang Seng 22,203.22 -32.67 -0.15%

Shanghai Composite 3,536.81 +11.81 +0.34%

FTSE 6,256.63 +18.34 +0.29 %

CAC 4,779.45 +64.66 +1.37%

DAX 10,939.98 +187.88 +1.75%

Crude oil $38.86 (-2.78%)

Gold $1079.70 (-0.41%)

-

14:59

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

ALCOA INC.

AA

9.48

1.50%

140.6K

General Motors Company, NYSE

GM

36.50

0.69%

15.8K

Merck & Co Inc

MRK

53.90

0.48%

7.1K

Yandex N.V., NASDAQ

YNDX

15.85

0.38%

1.5K

E. I. du Pont de Nemours and Co

DD

67.99

0.35%

0.1K

The Coca-Cola Co

KO

43.43

0.32%

0.1K

Wal-Mart Stores Inc

WMT

59.80

0.23%

4.9K

Starbucks Corporation, NASDAQ

SBUX

61.86

0.18%

5.5K

UnitedHealth Group Inc

UNH

117.90

0.14%

0.4K

Walt Disney Co

DIS

114.40

0.14%

7.4K

Amazon.com Inc., NASDAQ

AMZN

673.60

0.14%

5.3K

Citigroup Inc., NYSE

C

55.15

0.11%

110.8K

American Express Co

AXP

71.16

0.08%

0.2K

Ford Motor Co.

F

14.21

0.07%

3.4K

Home Depot Inc

HD

134.60

0.05%

3.1K

Procter & Gamble Co

PG

77.86

0.04%

2.7K

Facebook, Inc.

FB

106.22

0.04%

80.4K

Hewlett-Packard Co.

HPQ

12.20

0.03%

10.2K

Goldman Sachs

GS

190.00

0.01%

6.5K

Boeing Co

BA

148.50

0.00%

3.1K

Johnson & Johnson

JNJ

102.95

0.00%

0.9K

Verizon Communications Inc

VZ

45.70

-0.02%

2.2K

Yahoo! Inc., NASDAQ

YHOO

34.89

-0.06%

2.0K

Visa

V

80.33

-0.09%

0.3K

International Business Machines Co...

IBM

140.30

-0.09%

0.4K

Google Inc.

GOOG

766.00

-0.11%

9.8K

Nike

NKE

131.85

-0.12%

12.4K

JPMorgan Chase and Co

JPM

67.80

-0.13%

3.1K

Apple Inc.

AAPL

118.85

-0.15%

127.9K

McDonald's Corp

MCD

116.00

-0.17%

2.7K

Cisco Systems Inc

CSCO

27.43

-0.18%

18.0K

Intel Corp

INTC

34.84

-0.27%

1K

Microsoft Corp

MSFT

55.75

-0.29%

16.4K

General Electric Co

GE

30.38

-0.36%

5.9K

Tesla Motors, Inc., NASDAQ

TSLA

229.55

-0.36%

3.1K

AT&T Inc

T

33.97

-0.41%

14.5K

ALTRIA GROUP INC.

MO

58.01

-0.85%

0.2K

Twitter, Inc., NYSE

TWTR

24.80

-0.88%

40.3K

Caterpillar Inc

CAT

69.33

-0.93%

3.3K

FedEx Corporation, NYSE

FDX

154.00

-0.95%

1.2K

Exxon Mobil Corp

XOM

77.64

-1.55%

17.9K

Chevron Corp

CVX

88.22

-1.66%

0.2K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

7.69

-2.04%

7.1K

Barrick Gold Corporation, NYSE

ABX

7.92

-2.10%

18.1K

-

14:59

Atlanta Fed President Dennis Lockhart: financial markets are prepared for an interest rate hike by the Fed

Atlanta Fed President Dennis Lockhart said in an interview with CNBC on Monday that financial markets are prepared for an interest rate hike by the Fed.

He also said that he expects the gradual interest rate hikes once the Fed starts raising its interest rate.

Lockhart noted that diverging monetary policies of the European Central Bank and the Fed priced-in in the foreign exchange market.

Lockhart is a voting member of the Federal Open Market Committee (FOMC) this year.

-

14:44

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Home Depot (HD) target raised to $148 from $133 at Telsey Advisory Group

-

12:00

European stock markets mid session: stocks traded higher on a weaker euro

Stock indices traded higher on a weaker euro. The euro declined against the U.S. dollar, which was supported by Friday's better-than-expected labour market data from the U.S. The U.S. data added to speculation that the Fed will start raising its interest rate this month.

Meanwhile, the economic data from Eurozone was positive. Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index climbed to 15.7 in December from 15.1 in November.

A reading above 0.0 indicates optimism, below indicates pessimism.

"The Eurozone outperforms other world regions as the effects of ECB's policy measures kick in. The remaining world regions depict signs of a slowdown. Japan slides back into recession. In contrast to Fed's interpretations of the state of the economy, the sentix indicator for the US economy highlights a contrary view amid the preparations for the first rate rise," Sentix said in its statement.

German investor confidence index increased to 22.7 in December from 20.1 in November.

Destatis released its industrial production data for Germany on Wednesday. German industrial production increased 0.2% in October, missing expectations for a 0.7% gain, after a 1.1% fall in September.

The output of capital goods increased 2.7% in October, energy output slid 5.9%, and the production in the construction sector was up 0.7%, while the production of intermediate goods dropped 1.1%.

The output of consumer goods decreased 0.1%.

German industrial production excluding energy and construction rose by 0.7% in October.

Current figures:

Name Price Change Change %

FTSE 100 6,274.04 +35.75 +0.57 %

DAX 10,966.18 +214.08 +1.99 %

CAC 40 4,798.91 +84.12 +1.78 %

-

11:47

Ai Group/HIA Australian Performance of Construction Index is down to 50.7 in November

The Australian Industry Group (AiG) released its construction data for Australia on late Sunday evening. The Ai Group/HIA Australian Performance of Construction Index fell to 50.7 in November from 52.1 in October.

A reading above 50 indicates expansion in the sector.

The decline was mainly driven by a drop in house building and commercial and engineering construction.

"The continuing boom in apartment building saw a slight lift in the overall construction sector in November despite falls in house building and commercial and engineering construction," Ai Group Head of Policy, Peter Burn, said.

-

11:38

German industrial production rises 0.2% in October

Destatis released its industrial production data for Germany on Wednesday. German industrial production increased 0.2% in October, missing expectations for a 0.7% gain, after a 1.1% fall in September.

The output of capital goods increased 2.7% in October, energy output slid 5.9%, and the production in the construction sector was up 0.7%, while the production of intermediate goods dropped 1.1%.

The output of consumer goods decreased 0.1%.

German industrial production excluding energy and construction rose by 0.7% in October.

-

11:20

Sentix investor confidence index for the Eurozone is up to 15.7 in December

Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index climbed to 15.7 in December from 15.1 in November.

A reading above 0.0 indicates optimism, below indicates pessimism.

"The Eurozone outperforms other world regions as the effects of ECB's policy measures kick in. The remaining world regions depict signs of a slowdown. Japan slides back into recession. In contrast to Fed's interpretations of the state of the economy, the sentix indicator for the US economy highlights a contrary view amid the preparations for the first rate rise," Sentix said in its statement.

The current conditions index dropped to 13.5 in December from 16.0 in November.

The expectations index jumped to 18.0 in December from 14.3 in November.

German investor confidence index increased to 22.7 in December from 20.1 in November.

-

11:07

European Central Bank President Mario Draghi: the ECB is ready to add further stimulus measures to reach 2% inflation target if needed

The European Central Bank (ECB) President Mario Draghi said in a speech in New York on Friday that the ECB is ready to add further stimulus measures to reach 2% inflation target if needed.

"There is no doubt that if we had to intensify the use of our instruments to ensure that we achieve our price stability mandate, we would. There cannot be any limit to how far we are willing to deploy our instruments, within our mandate, and to achieve our mandate," he said.

"I can say therefore with confidence - and without any complacency - that we will secure the return of inflation to 2% without undue delay, because we are currently deploying tools that we believe will achieve this, and because we can, in any case, deploy our tools further if that proves necessary," Draghi added.

-

10:59

European Central Bank Governing Council member Jan Smets believes new stimulus measure by the ECB will help to reach 2% inflation target

The European Central Bank (ECB) Governing Council member Jan Smets said on Friday that he believes new stimulus measure by the ECB will help to reach 2% inflation target.

"I'm really confident that with these measures taken, we drastically increase the probability of a complete return to what we consider to be price stability," he said.

Smets noted that there were signs of the economic recovery in the Eurozone.

-

10:35

Bank of Japan board member Takehiro Sato: the effect of the central bank’s stimulus measures declined

The Bank of Japan (BoJ) board member Takehiro Sato said on Monday that the effect of the central bank's stimulus measures declined.

"Monetary easing effects appear cumulatively in theory, but in terms of positive effects and side effects, it is likely that the easing effects have been diminishing," he said.

Sato noted that the central bank cannot purchase government debt indefinitely at its current pace.

-

10:23

Greek parliament approves 2016 budget

The Greek parliament approved 2016 budget on Sunday. The vote for the budget was 153-145.

The Greek government will cut public spending by €5.7 billion.

The government forecasts a budget deficit of 2.1% of GDP next year.

-

07:05

Global Stocks: U.S. stock indices advanced

U.S. stock indices rose on Friday as stronger-than-expected jobs data supported expectations of an interest rate hike later in December. Nevertheless stocks of energy companies fell amid declines in oil prices after OPEC decided to maintain output. Some analysts also said stocks were partly supported by speculation that a selloff in the previous session might have been excessive.

The Dow Jones Industrial Average rose 369.96 points, or 2.1%, to 17,847.63 (+0.3% over the week). The S&P 500 rallied 41.97 points, or 2.05%, to 2,091.60 (flat over the week). The Nasdaq Composite gained 104.74 points, or 2.1% to 5,142.27 (+0.3% over the week).

The U.S. Department of Labor reported on Friday that the U.S. economy created 211,000 jobs in November compared to expectations for a 200,000 gain. October data were revised up. The unemployment rate remained at 5% in line with expectations.

This morning in Asia Hong Kong Hang Seng rose 0.28%, or 61.66, to 22,297.55. China Shanghai Composite Index climbed 0.17%, or 5.84, to 3.530.83. The Nikkei jumped 1.18%, or 230.53, to 19,735.01.

Asian indices traded higher on gains in U.S. equities. Chinese markets are preparing for important data this week such as inflation, industrial production and retail sales.

A weaker yen supported stocks of Japanese exporters.

-

03:36

Nikkei 225 19,796.65 +292.17 +1.50 %, Hang Seng 22,312.9 +77.01 +0.35 %, Shanghai Composite 3,538.55 +13.56 +0.38 %

-

00:32

Stocks. Daily history for Sep Dec 4’2015:

(index / closing price / change items /% change)

Nikkei 225 19,504.48 -435.42 -2.18 %

Hang Seng 22,235.89 -181.12 -0.81 %

Shanghai Composite 3,525.4 -59.42 -1.66 %

FTSE 100 6,238.29 -36.71 -0.59 %

CAC 40 4,714.79 -15.42 -0.33 %

Xetra DAX 10,752.1 -37.14 -0.34 %

S&P 500 2,091.69 +42.07 +2.05 %

NASDAQ Composite 5,142.27 +104.74 +2.08 %

Dow Jones 17,847.63 +369.96 +2.12 %

-