Noticias del mercado

-

22:27

U.S. stocks closed

U.S. stocks joined a selloff in global equities, while currencies of commodity-producing nations tumbled as fresh signs of weakness in China's economy rekindled concern that a slowdown there could spread.

The Standard & Poor's 500 Index fell for the fourth time in five days as crude extended losses at a six-year low. Emerging-market shares also declined as a slump in Chinese trade intensified concern over the scope of the economy's weakness. Iron ore fell to an historic low. Oil's slide drove a rally in long-term government bonds from the U.S. to Germany one week before the Federal Reserve is predicted to raise interest rates.

Chinese exports fell for a firth month, while imports capped a record 13th month of declines in November, rekindling concerns over Asia's largest economy akin to those that precipitated the summer rout on global financial markets. Oil's selloff is clouding the prospects for recoveries in the U.S. and Europe as capital spending wanes and inflation holds below central-bank targets, with the Fed poised to raise rates for the first time in a decade at its meeting next week.

The S&P 500 fell 0.7 percent to 2,063.59 as of 4 p.m. in New York. The index has lost 0.8 percent in December, with its only gain in the month a 2.1 percent rally on Friday. The S&P 500 is still up 10 percent from its August trough, as worries about weakness in China abated after the government took steps to boost growth and support the stock market.

Industrial companies led declines Tuesday, with Caterpillar Inc. and Boeing Co. down at least 2.3 percent. Freeport-McMoRan Inc. slid 6.8 percent to pace a drop in materials producers.

Canada's S&P/TSX Index dropped 0.9 percent to close at a two-year low, while miners led the Stoxx Europe 600 Index down 1.8 percent. Anglo American Plc plummeted 12 percent after suspending dividends for the second half of 2015 and next year. BHP Billiton Ltd. retreated 5.5 percent in London and Rio Tinto Group lost 8.4 percent.

MSCI's Asia-Pacific gauge slid 1.3 percent Tuesday as a gauge of Asian energy shares retreated 3.9 percent to the lowest level since Oct. 1. Japan's Topix index dropped 1 percent, while Australia's S&P/ASX 200 Index fell 0.9 percent, with sub-indexes of energy and raw-materials producers sliding at least 3.4 percent.

-

21:00

FTSE 6135.22 -88.30 -1.42%, DAX 10673.60 -212.49 -1.95%, CAC 40 4681.86 -74.55 -1.57%

-

18:34

WSE: Session Results

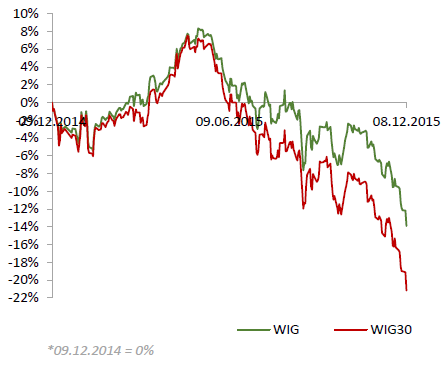

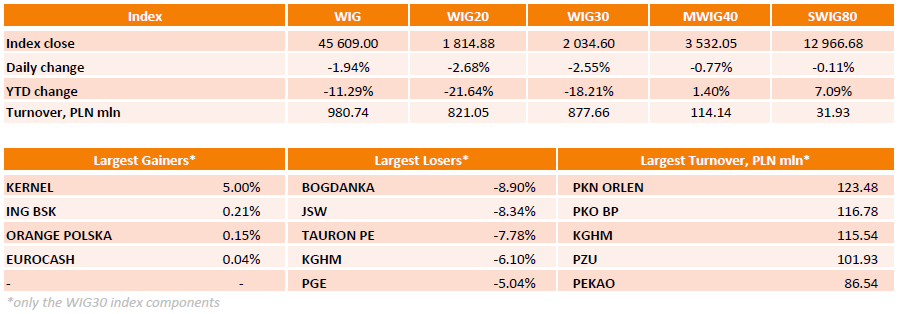

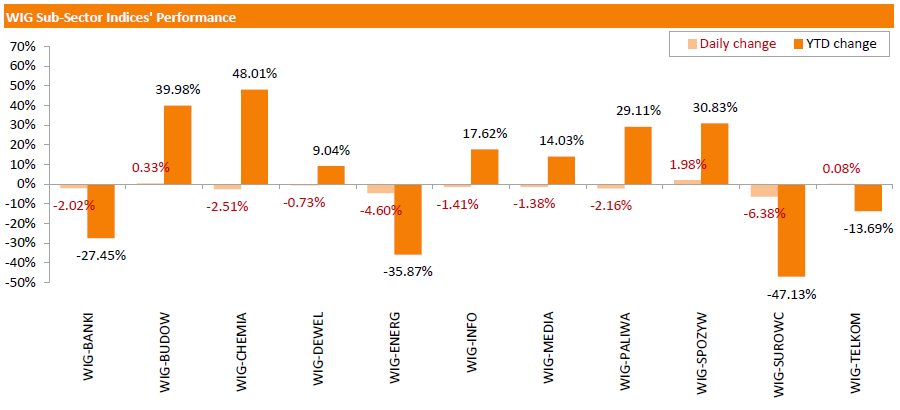

Polish equity market collapsed on Tuesday. The broad market measure, the WIG Index, fell 1.94%. Almost all sectors in the WIG generated negative returns. The exception were food industry (+1.98%), construction sector (+0.33%) and telecoms (+0.08%). At the same time, materials (-6.38%) and utilities (-4.60%) were the weakest.

The large-cap stocks' measure, the WIG30 Index, plunged by 2.55%. There were only four gainers among the index components. Agricultural name KERNEL (WSE: KER) posted the strongest advance, up 5%, rebounding after a 9% loss a day earlier. Other outperformers, namely ING BSK (WSE: ING), ORANGE POLSKA (WSE: OPL) and EUROCASH (WSE: EUR), added less than 0.25%. On the other side of the ledger, thermal coal miner BOGDANKA (WSE: LWB) was the biggest decliner, tumbling by 8.9% on concerns over cuts in coal prices in the company's contracts with its largest clients. Coking coal miner JSW (WSE: JSW) and copper producer KGHM (WSE: KGH) were also beaten down heavily, recording declines of 8.34% and 6.1% respectively, dragged down by commodities slump. Besides, utilities names TAURON PE (WSE: TPE), PGE (WSE: PGE) and ENERGA (WSE: ENG) continued to extend losses, dropping by 4.76%-7.78%.

-

18:30

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes slipped on Tuesday as oil prices steadied but remained close to their 7 year low and weak Chinese trade data reignited fears of a global economic slowdown.

Crude WTI fell below $37 per barrel and Brent below $40 for the first time since early 2009, before paring some of those losses.

Data showed China's imports fell for the 13th consecutive month, with an 8.7 percent decline in November compared with a year earlier.

Most of Dow stocks in negative area (28 of 30). Top looser - The Boeing Company (BA, -2.45%). Top gainer - NIKE, Inc. (NKE, +0.33%).

All S&P index sectors in negative area. Top looser - Financial (-4.4%).

At the moment:

Dow 17543.00 -213.00 -1.20%

S&P 500 2059.25 -21.75 -1.05%

Nasdaq 100 4679.00 -22.00 -0.47%

Oil 37.48 -0.17 -0.45%

Gold 1072.80 -2.40 -0.22%

U.S. 10yr 2.22 +0.00

-

18:00

European stocks close: stocks closed lower on the weaker-than-expected Chinese trade data

Stock indices closed lower on the weaker-than-expected Chinese trade data. The Chinese Customs Office released its trade data on Tuesday. China's trade surplus fell to $54.1 billion in November from $61.64 billion in October, missing expectations for a rise to a surplus of $63.3 billion. Exports fell at an annual rate of 6.8% in November, while imports slid at an annual rate of 8.7%, the thirteenth consecutive decline.

Meanwhile, the economic data from the Eurozone was mixed. Eurostat released its revised gross domestic product (GDP) data for the Eurozone on Tuesday. Eurozone's revised GDP rose 0.3% in third quarter, in line with the preliminary reading, after a 0.4% gain in the second quarter.

On a yearly basis, Eurozone's revised gross domestic product (GDP) increased 1.6% in third quarter, in line with the preliminary reading, after a 1.5% rise in the second quarter.

Household spending gained 0.4% in the third quarter, while gross fixed capital formation was flat.

Exports climbed by 0.2% in the third quarter, while imports rose by 0.9%.

The Bank of France cuts its growth forecast for the fourth quarter on Tuesday. The central bank expects the French economy to expand 0.3% in the fourth quarter, down from the previous estimate of a 0.4% growth.

According to the French Customs, France's trade deficit widened to €4.58 billion in October from €3.59 billion in September, missing expectations for a decline to a deficit of €3.3 billion.

The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Tuesday. Manufacturing production in the U.K. fell 0.4% in October, missing expectations for a flat reading, after a 0.9% increase in September. September's figure was revised up from a 0.8% rise.

Manufacturing output was driven by a drop in the repair and maintenance of aircraft and spacecraft, which plunged by 21.5% in October.

On a yearly basis, manufacturing production in the U.K. decreased 0.1% in October, missing forecast of a 0.1% gain, after a 0.4% drop in September. September's figure was revised up from a 0.6% decrease.

Industrial production in the U.K. climbed 0.1% in October, in line with forecasts, after a flat reading in September. September's figure was revised up from a 0.2% decline.

The increase was driven by a rise in the production of oil, water and power.

On a yearly basis, industrial production in the U.K. gained 1.7% in October, exceeding expectations for a 1.2% rise, after a 1.5% increase in September. September's figure was revised up from a 1.1% rise.

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Tuesday. The GDP estimate rose by 0.6% in three months to November, after a 0.5% growth in three months to October. The previous figure was revised down from a 0.6% growth.

"This rate of growth is consistent with the continued absorption of spare capacity in the UK economy and our own view that the Bank of England is most likely to begin to increase rates in February 2016," the NIESR said.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,135.22 -88.30 -1.42 %

DAX 10,673.6 -212.49 -1.95 %

CAC 40 4,681.86 -74.55 -1.57 %

-

18:00

European stocks closed: FTSE 6135.22 -88.30 -1.42%, DAX 10673.60 -212.49 -1.95%, CAC 40 4688.50 -67.91 -1.43%

-

17:08

Japan’s Economics Minister Akira Amari: the latest final GDP data was a positive surprise for markets

Japan's Economics Minister Akira Amari said on Tuesday that the latest final GDP data was a positive surprise for markets.

"The data was a positive surprise for markets. It's a welcome one for us too. Companies are starting to implement their capital expenditure plans," he said.

Japan's Cabinet Office released its final gross domestic product (GDP) data for Japan late Monday evening. Japan's GDP increased by 0.3% in the third quarter, beating expectations for a flat reading and up from the preliminary reading of a 0.2% decline, after a 0.3% fall in the second quarter.

On a yearly basis, Japan's economy climbed by 1.0% in the third quarter, exceeding expectations for a 0.1% gain and up from the preliminary reading of a 0.8% drop, after a 0.5% decrease in the second quarter. The second quarter's figure was revised up from a 0.7% fall.

-

17:04

National Australia Bank’s business confidence index climbs to 5 points in November

The National Australia Bank (NAB) released its business confidence index for Australia on Tuesday. The index climbed to 5 points in November from 3 points in October. October's reading was revised up from 2 points.

"This is basically another strong result for the NAB Survey, which in conjunction with signs of improvement in the labour market, means we can put more faith in the building non-mining sector recovery," NAB Group Chief Economist Alan Oster said.

The main business conditions index increased 10 points in November from 9 points in October, while employment rose to 4 points in from -1 points.

-

16:44

NIESR’s gross domestic product rises by 0.6% in three months to November

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Tuesday. The GDP estimate rose by 0.6% in three months to November, after a 0.5% growth in three months to October. The previous figure was revised down from a 0.6% growth.

"This rate of growth is consistent with the continued absorption of spare capacity in the UK economy and our own view that the Bank of England is most likely to begin to increase rates in February 2016," the NIESR said.

-

16:37

Japan’s Eco Watchers' current conditions index is down to 46.1 in November

Japan's Cabinet Office released Eco Watchers' Index figures on Tuesday. Japan's economy watchers' current conditions index decreased to 46.1 in November from 48.2 in October, missing expectations for a rise to 48.6.

Japan's economy watchers' future conditions index declined to 48.2 in November from 49.1 in October.

A reading above 50 indicates optimism, while a reading below 50 indicates pessimism.

-

16:25

Job openings fall to 5.383 million in October

The U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey (JOLTS) report on Tuesday. Job openings fell to 5.383 million in October from 5.534 million in September. September's figure was revised up from 5.526 million.

The number of job openings declined for total private (4.887 million) in October from September, while the number of job openings rose for government (496,000).

The hires rate was 3.6% in October.

Total separations declined to 4.863 million in October from 4.886 million in September.

The JOLTS report is one of the Federal Reserve Chair Janet Yellen's favourite labour market indicators.

-

16:09

Japan’s current account surplus declines to ¥1,458.4 billion in October

Japan's Ministry of Finance released its current account data for Japan late Monday evening. Japan's current account surplus fell to ¥1,458.4 billion in October from ¥1,468 billion in September, missing expectations for a surplus of ¥1,659.4 billion.

Japan benefits from a weaker yen, which supports income from overseas investments.

The goods trade surplus climbed to ¥200.2 billion in October from ¥82.3 billion in September.

Exports dropped at an annual rate of 3.7% in October, while imports plunged 16.4%.

-

15:41

National Federation of Independent Business’s small-business optimism index for the U.S. declines to 94.8 in November

The National Federation of Independent Business (NFIB) released its small-business optimism index for the U.S. on Tuesday. The index decreased to 94.8 in November from 96.1 in October.

6 of 10 sub-indexes fell last month, one sub-index rose, while 3 sub-index were flat.

"Overall, the outlook remains the same with a slow 2 percent-ish growth and there is still not much pressure on prices from Main Street. All we can do at this point is hope for a more business friendly New Year," NFIB Chief Economist Bill Dunkelberg said.

-

15:35

U.S. Stocks open: Dow -1.13%, Nasdaq -1.09%, S&P -1.05%

-

15:27

Before the bell: S&P futures -1.07%, NASDAQ futures 1.08%

U.S. stock-index futures declined.

Global Stocks:

Nikkei 19,492.6 -205.55 -1.04%

Hang Seng 21,905.13 -298.09 -1.34%

Shanghai Composite 3,470.19 -66.74 -1.89%

FTSE 6,151.51 -72.01 -1.16%

CAC 4,693.08 -63.33 -1.33%

DAX 10,734.6 -151.49 -1.39%

Crude oil $36.96 (-1.83%)

Gold $1068.70 (-0.60%)

-

14:57

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Merck & Co Inc

MRK

53.58

-0.19%

0.5K

McDonald's Corp

MCD

116.00

-0.36%

2.7K

The Coca-Cola Co

KO

43.03

-0.39%

99.7K

Johnson & Johnson

JNJ

102.89

-0.42%

1.7K

Travelers Companies Inc

TRV

112.50

-0.42%

0.1K

ALTRIA GROUP INC.

MO

58.00

-0.46%

5.8K

AT&T Inc

T

34.07

-0.58%

4.1K

Wal-Mart Stores Inc

WMT

60.13

-0.61%

1.0K

Cisco Systems Inc

CSCO

27.32

-0.62%

0.1K

Pfizer Inc

PFE

32.45

-0.64%

0.9K

Verizon Communications Inc

VZ

45.74

-0.69%

0.8K

Walt Disney Co

DIS

113.02

-0.71%

1.5K

UnitedHealth Group Inc

UNH

115.05

-0.74%

0.6K

International Business Machines Co...

IBM

138.50

-0.75%

2.4K

3M Co

MMM

156.50

-0.79%

0.2K

Intel Corp

INTC

34.71

-0.79%

0.4K

Goldman Sachs

GS

183.98

-0.81%

3.4K

Home Depot Inc

HD

132.81

-0.84%

1.9K

Google Inc.

GOOG

756.85

-0.84%

0.1K

Ford Motor Co.

F

14.00

-0.85%

20.3K

American Express Co

AXP

70.00

-0.86%

0.2K

General Electric Co

GE

30.10

-0.89%

2.0K

Nike

NKE

130.41

-0.90%

1.7K

Amazon.com Inc., NASDAQ

AMZN

663.79

-0.90%

11.4K

Boeing Co

BA

147.10

-0.91%

1K

Yahoo! Inc., NASDAQ

YHOO

34.36

-0.92%

15.5K

Microsoft Corp

MSFT

55.25

-1.00%

8.7K

Apple Inc.

AAPL

117.10

-1.00%

104.7K

FedEx Corporation, NYSE

FDX

151.00

-1.03%

0.2K

Visa

V

78.70

-1.07%

0.3K

JPMorgan Chase and Co

JPM

66.26

-1.10%

6.3K

Citigroup Inc., NYSE

C

53.79

-1.12%

4.7K

Barrick Gold Corporation, NYSE

ABX

7.60

-1.17%

1.9K

General Motors Company, NYSE

GM

35.70

-1.19%

0.7K

Hewlett-Packard Co.

HPQ

12.00

-1.23%

3.7K

Starbucks Corporation, NASDAQ

SBUX

61.11

-1.26%

8.4K

Facebook, Inc.

FB

104.11

-1.42%

76.2K

Tesla Motors, Inc., NASDAQ

TSLA

227.40

-1.61%

3.5K

Twitter, Inc., NYSE

TWTR

24.04

-1.72%

2.9K

Exxon Mobil Corp

XOM

75.35

-1.89%

7.5K

Caterpillar Inc

CAT

67.05

-1.92%

3.7K

Yandex N.V., NASDAQ

YNDX

15.00

-1.96%

6.1K

Chevron Corp

CVX

85.51

-2.03%

4.2K

ALCOA INC.

AA

8.79

-2.77%

12.4K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

7.01

-3.04%

130.7K

-

14:57

OECD’s composite leading indicator remains unchanged at 99.8 in October

The Organization for Economic Cooperation and Development (OECD) released its leading indicators on Tuesday. The composite leading indicator remained unchanged at 99.8 in October.

It signalled stable growth momentum in Canada, Italy, Japan, Germany and in the Eurozone as a whole.

The growth momentum firmed in France and India.

The index for the U.S., and the U.K. pointed to a loss in growth momentum.

The index for Russia showed signs of a weak growth momentum.

There were tentative signs of stabilisation in Brazil and China.

-

14:42

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

DuPont (DD) target raised to $80 from $72 at Argus

Amazon (AMZN) initiated with an Overweight at Keybanc/Pacific Crest

-

14:40

Building permits in Canada soar 9.1% in October

Statistics Canada released housing market data on Tuesday. Building permits in Canada jumped 9.1% in October, exceeding expectations for a 3.2% rise, after a 6.6% drop in September. September's figure was revised up from a 6.7% decrease.

The rise was driven by an increase in construction intentions in the residential sector.

Building permits for non-residential construction declined 0.2% in October, while permits in the residential sector climbed 15.5%.

-

14:25

Housing starts in Canada climb to a seasonally adjusted annualized rate of 211,916 units in November

The Canada Mortgage and Housing Corporation (CMHC) released housing starts data on Tuesday. Housing starts in Canada rose to a seasonally adjusted annualized rate of 211,916 units in November from 197,712 units in October. October's figure was revised down from 198,065 untis.

Housing starts were driven by a rise in the multi-unit segment.

"Rising single home prices continue to support demand for multiples, which are poised to reach the largest proportion of total urban starts since 1971. However, inventory management is necessary to make sure that these units do not remain unsold upon completion," the CMHC's Chief Economist Bob Dugan said.

-

12:07

China's trade surplus declines to $54.1 billion in November

The Chinese Customs Office released its trade data on Tuesday. China's trade surplus fell to $54.1 billion in November from $61.64 billion in October, missing expectations for a rise to a surplus of $63.3 billion.

Exports fell at an annual rate of 6.8% in November, while imports slid at an annual rate of 8.7%, the thirteenth consecutive decline.

-

12:00

European stock markets mid session: stocks traded lower on the weaker-than-expected Chinese trade data

Stock indices traded lower on the weaker-than-expected Chinese trade data. The Chinese Customs Office released its trade data on Tuesday. China's trade surplus fell to $54.1 billion in November from $61.64 billion in October, missing expectations for a rise to a surplus of $63.3 billion. Exports fell at an annual rate of 6.8% in November, while imports slid at an annual rate of 8.7%, the thirteenth consecutive decline.

Meanwhile, the economic data from the Eurozone was mixed. Eurostat released its revised gross domestic product (GDP) data for the Eurozone on Tuesday. Eurozone's revised GDP rose 0.3% in third quarter, in line with the preliminary reading, after a 0.4% gain in the second quarter.

On a yearly basis, Eurozone's revised gross domestic product (GDP) increased 1.6% in third quarter, in line with the preliminary reading, after a 1.5% rise in the second quarter.

Household spending gained 0.4% in the third quarter, while gross fixed capital formation was flat.

Exports climbed by 0.2% in the third quarter, while imports rose by 0.9%.

The Bank of France cuts its growth forecast for the fourth quarter on Tuesday. The central bank expects the French economy to expand 0.3% in the fourth quarter, down from the previous estimate of a 0.4% growth.

According to the French Customs, France's trade deficit widened to €4.58 billion in October from €3.59 billion in September, missing expectations for a decline to a deficit of €3.3 billion.

The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Tuesday. Manufacturing production in the U.K. fell 0.4% in October, missing expectations for a flat reading, after a 0.9% increase in September. September's figure was revised up from a 0.8% rise.

Manufacturing output was driven by a drop in the repair and maintenance of aircraft and spacecraft, which plunged by 21.5% in October.

On a yearly basis, manufacturing production in the U.K. decreased 0.1% in October, missing forecast of a 0.1% gain, after a 0.4% drop in September. September's figure was revised up from a 0.6% decrease.

Industrial production in the U.K. climbed 0.1% in October, in line with forecasts, after a flat reading in September. September's figure was revised up from a 0.2% decline.

The increase was driven by a rise in the production of oil, water and power.

On a yearly basis, industrial production in the U.K. gained 1.7% in October, exceeding expectations for a 1.2% rise, after a 1.5% increase in September. September's figure was revised up from a 1.1% rise.

Current figures:

Name Price Change Change %

FTSE 100 6,190 -33.52 -0.54 %

DAX 10,833.72 -52.37 -0.48 %

CAC 40 4,736.56 -19.85 -0.42 %

-

11:52

Bank of France cuts its growth forecast for the fourth quarter

The Bank of France cuts its growth forecast for the fourth quarter on Tuesday. The central bank expects the French economy to expand 0.3% in the fourth quarter, down from the previous estimate of a 0.4% growth.

The manufacturing business confidence index fell to 98 in November from 99 in October.

The services business sentiment index declined to 96 in November from 97 in October.

The construction business sentiment index remained unchanged at 96 in November.

The Bank of France noted that the terror attacks in Paris continued to weigh on the economy.

-

11:43

House prices in the U.K. decline 0.2% in November

Halifax released its house prices data for the U.K. on Tuesday. House prices in the U.K. decreased 0.2% in November, missing expectations for a 0.3% gain, after a 1.0% rise in October. October's figure was revised down from a 1.1% increase.

On a yearly basis, house prices climbed 9.0% in the three months to November, after a 9.7% increase in the three months to October.

"Solid economic growth, rising real earnings and falls in already very low mortgage rates have combined to stimulate housing demand this year. The increasingly acute imbalance between supply and demand is causing prices to rise at a robust pace. A situation that is unlikely to reverse significantly in the short-term," Halifax's housing economist Martin Ellis said.

-

11:37

France's trade deficit widens to €4.58 billion in October

According to the French Customs, France's trade deficit widened to €4.58 billion in October from €3.59 billion in September, missing expectations for a decline to a deficit of €3.3 billion. September's figure was revised down from a deficit of €3.38 billion.

Exports fell 0.1% in October, while imports climbed 2.3%.

On a yearly basis, exports rose 1.8% in October, while imports declined 1.0%.

-

11:32

Eurozone's revised GDP climbs 0.3% in third quarter

Eurostat released its revised gross domestic product (GDP) data for the Eurozone on Tuesday. Eurozone's revised GDP rose 0.3% in third quarter, in line with the preliminary reading, after a 0.4% gain in the second quarter.

On a yearly basis, Eurozone's revised gross domestic product (GDP) increased 1.6% in third quarter, in line with the preliminary reading, after a 1.5% rise in the second quarter.

Household spending gained 0.4% in the third quarter, while gross fixed capital formation was flat.

Exports climbed by 0.2% in the third quarter, while imports rose by 0.9%.

-

11:26

U.K. manufacturing production falls 0.4% in October, while industrial production climbs 0.1%

The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Tuesday. Manufacturing production in the U.K. fell 0.4% in October, missing expectations for a flat reading, after a 0.9% increase in September. September's figure was revised up from a 0.8% rise.

Manufacturing output was driven by a drop in the repair and maintenance of aircraft and spacecraft, which plunged by 21.5% in October.

On a yearly basis, manufacturing production in the U.K. decreased 0.1% in October, missing forecast of a 0.1% gain, after a 0.4% drop in September. September's figure was revised up from a 0.6% decrease.

Industrial production in the U.K. climbed 0.1% in October, in line with forecasts, after a flat reading in September. September's figure was revised up from a 0.2% decline.

The increase was driven by a rise in the production of oil, water and power.

On a yearly basis, industrial production in the U.K. gained 1.7% in October, exceeding expectations for a 1.2% rise, after a 1.5% increase in September. September's figure was revised up from a 1.1% rise.

-

10:59

St. Louis Fed President James Bullard: the Fed will focus on inflation once it starts raising its interest rate

St. Louis Fed President James Bullard said on Monday that the Fed will focus on inflation once it starts raising its interest rate.

He noted that inaccurate Fed forecasts of growth, employment and inflation led to the delay of an interest rate hike by the Fed.

"Negative surprises with respect to real GDP growth and inflation carried more weight during this period than the positive surprises on labour market performance," Bullard said.

-

10:49

Bank lending in Japan increases 2.3% year-on-year in November

The Bank of Japan released its bank lending data on Tuesday. Bank lending in Japan increased 2.3% year-on-year in November.

Lending excluding trusts climbed 2.3%, lending from trusts rose 2.2%, while lending from foreign banks was up 0.1%.

-

10:36

Japan’s final GDP rises 0.3% in the third quarter

Japan's Cabinet Office released its final gross domestic product (GDP) data for Japan late Monday evening. Japan's GDP increased by 0.3% in the third quarter, beating expectations for a flat reading and up from the preliminary reading of a 0.2% decline, after a 0.3% fall in the second quarter.

Business investment rose 0.6% in the third quarter, up from a preliminary reading of a 1.3% drop, while household spending increase 0.4%, down from a preliminary reading of a 0.5% gain.

On a yearly basis, Japan's economy climbed by 1.0% in the third quarter, exceeding expectations for a 0.1% gain and up from the preliminary reading of a 0.8% drop, after a 0.5% decrease in the second quarter. The second quarter's figure was revised up from a 0.7% fall.

-

10:24

Consumer credit in the U.S. increases by $15.98 billion in October

The Fed released its consumer credits figures on Monday. Consumer credit in the U.S. rose by $15.98 billion in October, missing expectations for a $20.7 billion increase, after a $28.57 billion gain September. September's figure was revised down from a $28.92 billion rise.

The increase was driven by gains in non-revolving credit. Revolving credit climbed by $0.18 billion in October, while non-revolving credit jumped by $15.8 billion.

-

10:12

The Conference Board’s Employment Trends Index (ETI) for the U.S. declines to 128.69 in November

The Conference Board released its Employment Trends Index (ETI) for the U.S on Monday. The index declined to 128.69 in November from 129.75 in October.

Five of the eight components decreased.

"Despite the strong numbers on job creation in the past few months, the Employment Trends Index posted the largest one month decline since the Great Recession, with five of the eight components contributing negatively to the index. While two of the components - initial claims for unemployment and our forecast of job openings - suggest modest adverse developments, their levels are still healthy. However, the past month's weakness in consumer confidence in job growth and the slowdown in temporary help needs careful watching. Overall, there is reason for caution to not linearly extrapolate the current strong growth into 2016," Managing Director of Macroeconomic and Labour Market Research at The Conference Board, Gad Levanon, said.

-

07:15

Global Stocks: U.S. stock indices fell

U.S. stock indices fell on Monday with energy companies leading declines as crude oil prices plunged.

The Dow Jones Industrial Average fell 117.12 points, or 0.7%, to 17,730.51. The S&P 500 lost 14.62 points, or 0.7%, to 2,077.07 (its energy sector fell 3.6%). The Nasdaq Composite declined 40.46 points, or 0.8% to 5,101.81.

According to the Federal Reserve Americans borrowed less in October. These data suggest that consumers were cautious ahead of the holiday season. Consumer credit rose by 5.5% in October compared to a 9.9% rise in September and a 5.1% gain in August.

Atlanta Federal Reserve Bank President Dennis Lockhart said in an interview with the Wall Street Journal published on Monday he was "ready for a decision to lift off." He added that Fed's economic targets, which determine the right time to raise rates, "have been substantially met". Most market participants expect the Federal Open Market Committee to raise rates later this month.

This morning in Asia Hong Kong Hang Seng fell 1.56%, or 346.32, to 21,856.90. China Shanghai Composite Index lost 0.92%, or 32.62, to 3.504.31. The Nikkei tumbled 1.01%, or 198.07, to 19,500.08.

Asian indices retreated amid declines in oil prices.

Japanese stocks climbed at the beginning of the session on revised GDP data, but followed the general trend and declined later. The Economic and Social Research Institute reported that the country's GDP rose by 0.3% q/q in the third quarter compared to -0.2% reported previously. The GDP rose by 1.0% on an annualized basis in line with expectations.

Chinese stocks were also weighed by the country's trade balance data. The trading surplus contracted to $54.1 billion in November from $61.64 billion reported previously. Economists had expected a surplus of $62.8 billion. Exports fell by 6.8% y/y, while imports declined by 8.7%. Economists had expected imports to fall by 12.6%.

-

03:04

Nikkei 225 19,542.28 -155.87 -0.79 %, Hang Seng 21,951.48 -251.74 -1.13 %, Shanghai Composite 3,514.33 -22.60 -0.64 %

-

00:30

Stocks. Daily history for Sep Dec 7’2015:

(index / closing price / change items /% change)

Nikkei 225 19,698.15 +193.67 +0.99 %

Hang Seng 22,203.22 -32.67 -0.15 %

Shanghai Composite 3,536.81 +11.81 +0.34 %

FTSE 100 6,223.52 -14.77 -0.24 %

CAC 40 4,756.41 +41.62 +0.88 %

Xetra DAX 10,886.09 +133.99 +1.25 %

S&P 500 2,077.07 -14.62 -0.70 %

NASDAQ Composite 5,101.81 -40.46 -0.79 %

Dow Jones 17,730.51 -117.12 -0.66 %

-